1. Ascertaining the amount due to the retiring or deceased partner, New profit sharing ratio, Gaining ratio,

Reconstitution of the partnership firm can also take place on the retirement of the partner or death of the partner. Here, the existing partnership deed comes to an end a new partnership deed comes into existence where the remaining partners continue to do the business but on different terms and conditions. In both cases, i.e. on retirement or death of a partner, it is required to determine the sum due to the retiring partner or to the legal representatives of the deceased partner.

Retirement of a Partner:

A partner may retire from the partnership firm:

- with the consent of all other partners;

or - in case of retirement at will i.e. (partnership at will);

or - by giving notice in writing to all other partners by the retiring partner.

On retirement, the old partnership comes to an end arid a new one between the remaining partner1 comes into existence. However the partnership firm as such continues.

Ascertaining the Amount due to Retiring Partner

In order to ascertain the amount due to the retiring partner, we have to calculate the following things

- Credit Balance of his Capital Account;

- Credit Balance of his Current Account (if any);

- His share of goodwill, accumulated profits, reserves etc.;

- His share in the profit on revaluation of assets and liabilities;

- His share of profit, interest on capital up to the date of retirement;

- Any salary/commission due to him.

The following deductions (if any) is made from his share:

- Debit balance of the his-current account (if any);

- His share of Goodwill to be written off, accumulated losses;

- His share of loss on revaluation of assets and liabilities;

- His share of loss, drawing and interest on drawings up to the date of retirement.

The various accounting aspects involved in retirement or death are as follows:

- New profit sharing ratio

- Gaining ratio

- Goodwill Treatment

- Accumulated profit and losses -Distribution

- Profit and Loss till the date of retirement or death

- Adjustment of Capital

- Settlement of the amount due to retired /deceased partner.

New Profit Sharing Ratio:

The new profit sharing ratio is the ratio in which the remaining partners will share future profits after the retirement or death of any partners. In other words, the new profit sharing ratio of each remaining partner will be the sum total of his old share of profits in the firm and the portion of the retiring partner’s share of the profit acquired.

New Share of Partner = Old share + Acquired share from retiring/deceased partner.

(a) Nothing is mentioned about the new profit sharing ratio at the time of retirement:

If nothing is stated about the future ratio of the remaining partner, then their old ratio is considered as their new ratio. In other words, in the absence of any information regarding the profit-sharing ratio in which the remaining partner acquires the share of the retiring/deceased partner, then it is assumed that they will acquire it in the old profit-sharing ratio and so the share the future profits in their old ratio.

For example, Kapil, Anu and Priti are partners in a firm sharing profits and losses in the ratio of 5: 3: 2. If Anu retires, then the new profit sharing ratio of Kapil and Priti will be 5: 2.

(b) Remaining partners acquire the share of retiring/deceased partner in the specified ratio:

If the remaining partners acquire the share of the retiring/deceased partner in a specified ratio, other than their old ratio, then there is a need to compute a new profit sharing ratio among them. The new profit sharing ratio is equal to the sum total of their old ratio and the share acquired from the retiring/deceased partner.

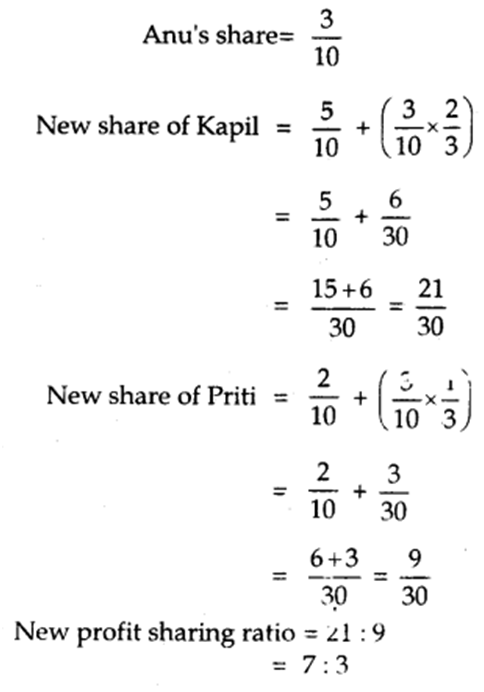

For example, Kapil, Anu and Priti are partners in a firm sharing profits and losses in the ratio of 5: 3: 2. If Anu retires from the firm and her share was acquired by Kapil and Priti in the ratio of 2: 1. In that case, the new share of profit will be calculated as follows: New share of remaining partner = Old share + Acquired share from the outgoing partner.

(c) Remaining partners may agree on a particular new profit sharing ratio:

If the remaining partners decide on a particular profit sharing ratio to share the future profits of the firm, in such a case the ratio so specified will be the new profit sharing ratio.

Gaining Ratio:

The ratio in which the continuing partners acquire the share of the retiring /deceased partner is called the gaining ratio.

(a) If nothing is mentioned in the agreement: If nothing is mentioned in the agreement about the gaining ratio, then it is assumed that the remaining partners acquire the share of the retiring/deceased partner in their old profit sharing ratio. In that case, the gaining ratio of the remaining partners will be the same as their old profit sharing ratio and there is no need to compute the gaining ratio.

(b) If a new profit sharing ratio is given: If the new profit sharing ratio is given of the remaining partners then we have to compute the gaining ratio. In this case, the gaining ratio is calculated by deducting the old ratio from the new ratio.

Gaining ratio = New ratio – Old ratio

For example X, Y and Z are partners in a firm, sharing profits and losses in ratio of 5:3:2. Y retires from the firm and X and Z decide to share future profits and losses in the ratio of 7: 5

The gaining ratio will be calculated as follows:

1. Ascertaining the amount due to the retiring or deceased partner, New profit sharing ratio, Gaining ratio,

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

CHAPTER-4

Reconstitution of a Partnership Firm – Retirement/Death of a Partner

Ascertaining the Amount Due to Retiring/ Deceased Partner

You have learnt that retirement or death of a partner also leads to reconstitution of a partnership firm. On the retirement or death of a partner, the existing partnership deed comes to an end, and in its place, a new partnership deed needs to be framed whereby, the remaining partners continue to do their business on changed terms and conditions.

There is not much difference in the accounting treatment at the time of retirement or in the event of death. In both the cases, we are required to determine the sum due to the retiring partner (in case of retirement) and to the legal representatives (in case of deceased partner) after making necessary adjustments in respect of goodwill, revaluation of a assets and liabilities and transfer of accumulated profits and losses. In addition, we may also have to compute the new profit sharing’s ratio among the remaining partners and so also their gaining ratio, This covers all these aspects in detail.

The sum due to the retiring partner (in case of retirement) and to the legal representatives/ executors (in case of death) includes:

(i) credit balance of his capital account;

(ii) credit balance of his current account (if any); (iii) his share of goodwill;

(iv) his share of accumulated profits (reserves);

(v) his share in the gain of revaluation of assets and liabilities;

(vi) his share of profits up to the date of retirement/death;

(vii) interest on his capital, if involved, up to the date of retirement/death; and

(viii) salary/commission, if any, due to him up to the date of retirement/death.

The following deductions, if any, may have to be made from his share:

(i) debit balance of his current account (if any);

(ii) his share of goodwill to be written off, if necessary;

(iii) his share of accumulated losses;

(iv) his share of loss on revaluation of assets and liabilities;

(v) his share of loss up to the date of retirement/death;

(vi) his drawings up to the date of retirement/death;

(vii) interest on drawings, if involved, up to the date of retirement/death.

Thus, similar to admission, the various accounting aspects involved on retirement or death of a partner are as follows:

1. Ascertainment of new profit sharing ratio and gaining ratio;

2. Treatment of goodwill;

3. Revaluation of assets and liabilities;

4. Adjustment in respect of unrecorded assets and liabilities;

5. Distribution of accumulated profits and losses;

6. Ascertainment of share of profit or loss up to the date of retirement/death;

7. Adjustment of capital, if required;

8. Settlement of the amounts due to retired/deceased partner;

New Profit Sharing Ratio

New profit sharing ratio is the ratio in which the remaining partners will share future profits after the retirement or death of any partner. The new share of each of the remaining partner will consist of his own share in the firm plus the share acquired from the retiring deceased partner.

Consider the following situations :

(a) normally, the continuing partners acquire the share of retiring or deceased partners in the old profit sharing ratio, and there is no need to compute the new profit sharing ratio among them, as it will be same as the old profit sharing ratio among them. In fact, in the absence of any information regarding profit sharing ratio in which the remaining partners acquire the share of retiring/deceased partner, it is assumed that they will acquire it in the old profit sharing ratio and so share the future profits in their old ratio. For example, Asha, Deepti and Nisha are partners in a firm sharing profits and losses in the ratio of 3:2:1. If Deepti retires, the new profit sharing ratio between Asha and Nisha will be 3:1, unless they decide otherwise.

(b) The continuing partners may acquire the share in the profits of the retiring/deceased partner in a proportion other than their old ratio, In that case, there is need to compute the new profit sharing ratio among them. For example: Naveen, Suresh and Tarun are partners sharing profits and losses in the ratio of 5:3:2. Suresh retires from the firm and his share was required by Naveen and Tarun in the ratio 2:1.

In such a case, the new share of profit will be calculated as follows:

New share of Continuing Partner = Old Share + Acquired share from the Outgoing Partner

Gaining Ratio 2 : 1

Share acquired by Naveen

=2/3 of 3/10

= 2/3 × 3/10 = 1/5 or 2/10

Share acquired by Tarun

= 1/3 of 3/10

= 1/3 × 3/10 = 3/30 or 1/10

Share of Naveen

= 5/10 + 2/10 = 7/10

Share of Tarun

= 2/10 + 1/10 = 3/10

Thus, the new profit sharing ratio of Naveen and Tarun will be = 7 : 3.

(c) The contributing partners may agree on a specified new profit sharing ratio: In that case the ratio so specified will be the new profit sharing ratio.

Gaining Ratio

The ratio in which the continuing partners have acquired the share from the retiring/deceased partner is called the gaining ratio. Normally, the continuing partners acquire the share of retiring/deceased partner in their old profit sharing ratio, In that case, the gaining ratio of the remaining partners will be the same as their old profit sharing ratio among them and there is no need to compute the gaining ratio, Alternatively, proportion in which they acquire the share of the retiring/deceased partner may be duly spacified. In that case, again, there is no need to calculate the gaining ratio as it will be the ratio in which they have acquired the share of profit from the retiring deceased partner.

The problem of calculating gaining ratio arises primarily when the new profit sharing ratio of the continuing partners is specified. In such a situation, the gaining ratio should be calculated by, deducting the old share of each continuing partners from his new share i.e., new profit share minus old profit share, i.e., new profit share minus old profit share. For example, Amit, Dinesh and Gagan are partners sharing profits in the ratio of 5:3:2. Dinesh retires. Amit and Gagan decide to share the profits of the new firm in

the ratio of 3:2.

The gaining ratio will be calculated as follows :

Amit’s Gaining Share = 3/5 − 5/10 = 6 – 5/10 = 1/10

Gagan’s Gaining Share = 2/5 − 2/10 = 4 – 2/10 = 2/10

Thus, Gaining Ratio of Amit and Gagan = 1:2

This implies Amit gains 1/3 and Gagan gains 2/3 of Dinesh’s share of profit.

Gaining share of Continuing Partner = New share – Old share.

Revision 1

Madhu, Neha and Tina are partners sharing profits in the ratio of 5:3:2. Calculate new profit sharing ratio and gaining ratio if

1. Madhu retires

2. Neha retires

3. Tina retires.

Solution

Given old ratio among Madhu : Neha : Tina as 5 : 3 : 2

- If Madhu retires, new profit sharing Ratio between Neha and Tina will be Neha : Tina = 3:2 and Gaining Ratio of Neha and Tina =3:2

- If Neha retires new profit sharing Ratio between Madhu and Tina will be Madhu : Tina = 5:2 Gaining Ratio of Madhu and Tina = 5:2

- If Tina retires, new profit sharing ratio between Madhu and Neha will be: Madhu : Neha = 5:3 Gaining ratio of Madhu and Neha = 5:3

Revision 2

Alka, Harpreet and Shreya are partners sharing profits in the ratio of 3:2:1. Alka retires and her share is taken up by Harpreet and Shreya in the ratio of 3:2. Calculate the new profit sharing ratio.

Solution

Gaining Given, Ratio of Harpreet and Shreya = 3:2 = 3/5 : 2/5

Old Profit Sharing Ratio of between Alka, Harpreet and Shreya 3:2:1

= 3/6 : 2/6 : 1/6

Share acquired by Harpreet

= 3/5 of 3/6 = 9/30

Share acquired by Shreya

= 2/5 of 3/6 = 6/30

New Share = Old Share + Acquired Share

Harpreet’s New Share

= 2/6 + 9/30 = 19/30

Shreya’s New Share

= 1/6 + 6/30 = 11/30

New Profit Sharing Ratio of Harpreet and Shreya = 19:11

Revision 3

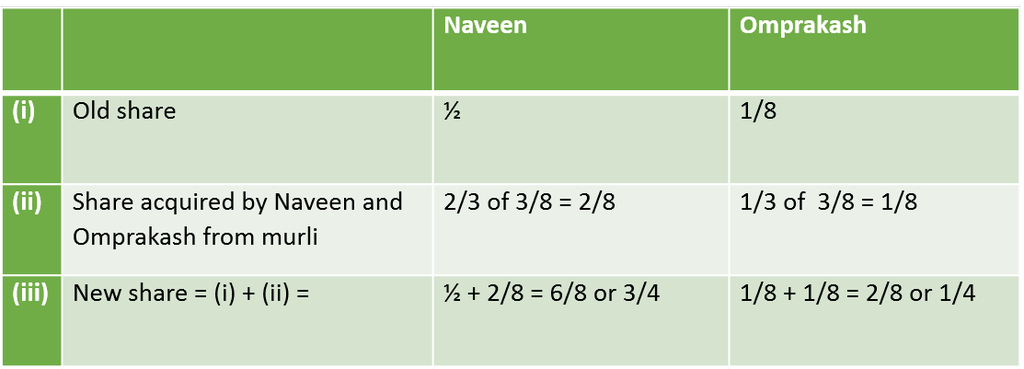

Murli, Naveen and Omprakash are partners sharing profits in the ratio of 3/8 , 1/2 and 1/8 . Murli retires and surrenders 2/3rd of his share in favour of Naveen and the remaining share in favour of Omprakash. Calculate new profit sharing and the gaining ratio of the remaining partners.

Solution

(i) Old Share = Naveen ½ and Omprakash 1/8

(ii) Share Acquired by Naveen from Murli

= 2/3 of 3/8 = 2/8

(iii) Share Acquired by Omprakash from Murli

= 1/3 of 3/8 = 1/8

(iv) New Share for Naveen

= (i) + (ii) = ½ + 2/8 = 6/8 or 3/4

(v) New Share for Omprakash

= (i) + (iii) = 1/8 + 1/8 = 2/8 or 1/4

Thus, the New profit sharing Ratio = ¾ : ¼ or 3:1

and the Gaining Ratio = 2/8 : 1/8 or 2 : 1

Revision 4

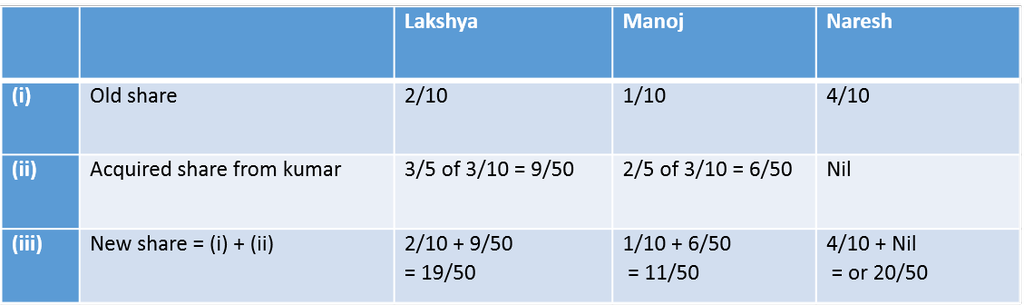

Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3 : 2 : 1 : 4. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of 3:2. Calculate new profit sharing ratio and gaining ratio of the remaining partners.

Solution

Thus, the new profit sharing ratio = ¾ : ¼ or 3 : 1 and the Gaining ratio = 2/8 : 1/8 or 2 : 1 {as calculated in (ii)}.

Revision 4

Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3 : 2 : 1 : 4. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of 3:2. Calculate new profit sharing ratio and gaining ratio of the remaining partners.

Solution

The New Profit Sharing Ratio is 19 : 11 : 20

Gaining ratio is 3 : 2 : 0

Notes :

1. Since Lakshya and Manoj are acquiring Kumar’s share of profit in the ratio of 3:2, hence, the gaining ratio will be 3:2 between Lakshya and Manoj.

2. Naresh has neither sacrificed nor gained.

Revision 5

Ranjana, Sadhna and Kamana are partners sharing profits in the ratio 4:3:2. Ranjana retires; Sadhna and Kamana decided to share profits in future in the ratio of 5:3. Calculate the Gaining Ratio.

Solution

Gaining Share = New Share – Old Share

Sadhna’s Gaining Share = 5/8 – 3/9 = 45 – 24/72 = 21/72

Kamana’s Gaining Share = 3/8 – 2/9 = 27 -16 / 72 = 11/72

Gaining Ratio between Sadhna and Kamana = 21:11

2. Treatment of Goodwill

Treatment of Goodwill:

The outgoing partner is entitled to his share of goodwill at the time of retirement/death because the goodwill has been earned by the firm with the efforts of all the existing partners. Therefore, goodwill is valued as per the agreement, at the time of retirement/death.

Due to the retirement/death of any partner, the continuing partners make again because the future profit will be shared only between the continuing partners. Therefore, the continuing partners should compensate the retiring/deceased partner for his share of goodwill in the gaining ratio.

The accounting treatment for goodwill depends upon whether the goodwill already appears in the books of the firm or not.

When Goodwill does not Appear in the Books: When Goodwill does not appear in the books of the firm, there are four following ways to compensate the retiring partner:

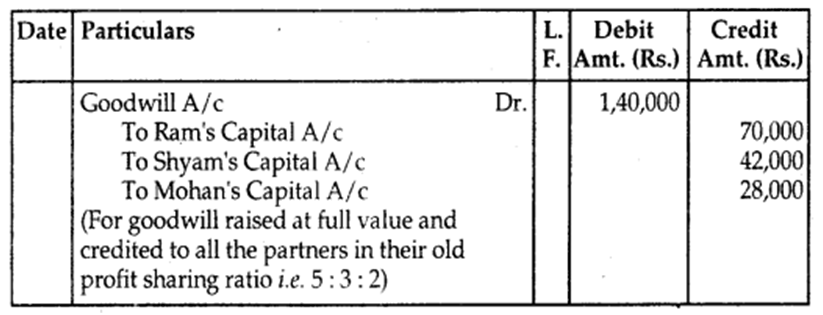

(a) Goodwill is raised at its full value and retained in the books:

Goodwill A/cDr.

To All Partner’s Capital A/c’s

(including retiring/deceased partner)

(For the goodwill raised at its full value and credited to capital A/c’s of a ’1 partners in their old profit sharing ratio)

The full value of goodwill will appear in the new balance sheet.

(b) Goodwill is raised at its full value and written off immediately:

If it is decided that the goodwill will not appear in the balance sheet of the reconstituted firm, then the following journal entries are required:

1. Goodwill A/c Dr.

To All Partner’s Capital A/c’s (For raising of Goodwill and credited to all partners capital A/c’s in their old profit sharing ratio)

2. Continuing Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For written-off goodwill between continuing partners in their new profit sharing ratio)

(c) Goodwill is raised to the extent of retired/deceased partner’s share and written off immediately:

1. Goodwill A/c Dr.

To Retiring/Deceased Partner’s Capital A/c (For the goodwill raised by share of outgoing partner)

2. Continuing Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For the goodwill written off between the continuing partners in their gaining ratio)

(d) No Goodwill account is raised at all in the firm’s books: If the outgoing partner’s share of goodwill is adjusted in the capital accounts of the continuing partners without opening a goodwill account, the following entry will be required:

Continuing Partner’s Capital A/c’s Dr.

To Outgoing Partner’s Capital A/c (For the share of outgoing partner in the goodwill adjusted through capital accounts in the gaining ratio)

The following example clears the above accounting treatment of Goodwill at the time of retirement/death:

Ram, Shyam and Mohan are partners in firm sharing profits and losses in the ratio of 5: 3: 2. Shyam retires. The goodwill of the firm is valued at Rs. 1,40,000 and the remaining partner’s Ram and Mohan continue to share profits in the ratio of 5:2. The following journal entries passed under various alternatives shall be as follows:

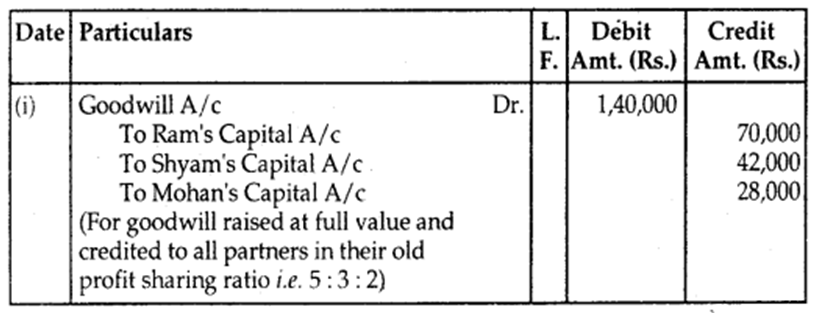

If goodwill is raised at full value and retained in books:

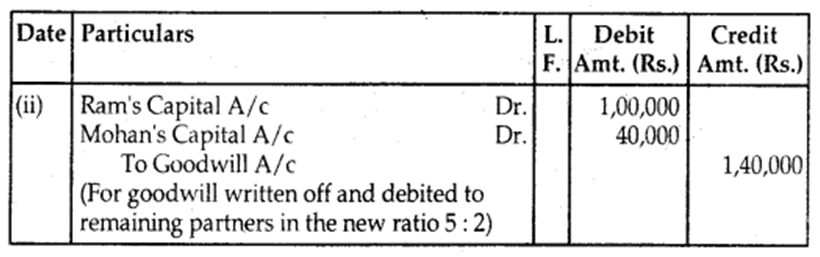

If goodwill is raised at full value and written off immediately:

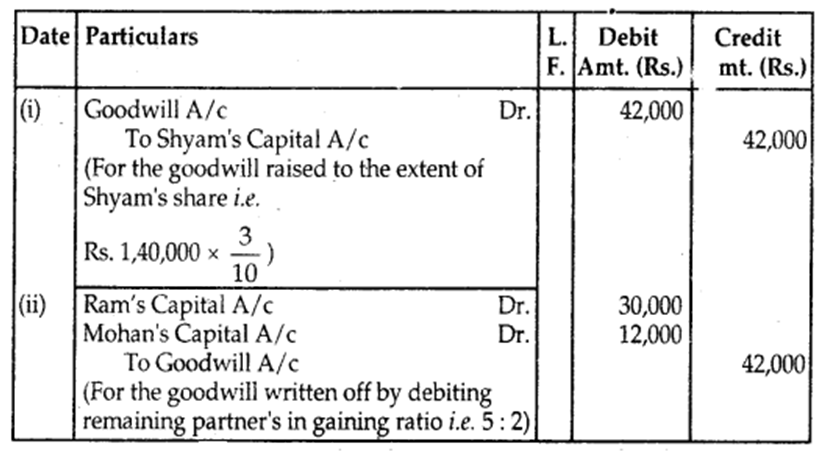

If goodwill is raised to the extent of the retiring partner’s share and written off immediately:

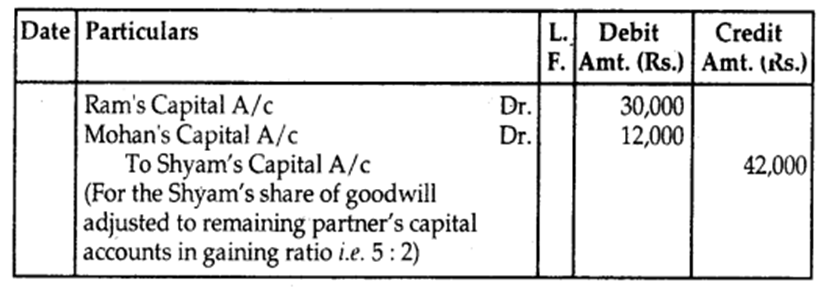

No goodwill account is raised at all in the firm’s books:

When Goodwill is already appearing in the books:

(a) If the value of goodwill appearing is equal to the current value of goodwill of the firm:

Normally, no adjustment is required if both the amounts are the same. Because goodwill stands credited in the accounts of all the partners including the retiring one.

(b) If the book value of goodwill is lower than its present value:

If the book value is less than the present value, the difference will be debited to the goodwill account and credited to the old partner’s capital accounts in their old profit sharing ratio.

Goodwill A/c Dr.

To All Partner’s Capital A/c’s (individually)

(For goodwill raised to its present value)

(c) If the book value of goodwill is more than the agreed or present value:

If the book value of goodwill is more than the present value, the difference will be debited to All partner’s capital accounts in their old profit sharing ratio and credited to the goodwill account.

All Partner’s Capital A/c’s (individually) Dr.

To Goodwill A/c

(For goodwill brought down to its present value)

Alternatively,

1. First, write off the existing goodwill that appears in the books:

All Partner’s Capital A/c’s (individually) Dr.

To Goodwill A/c

(For write-off goodwill to all partners in old profit sharing ratio)

2. Adjust retiring partner’s share of goodwill through capital A/c’s

Remaining Partner’s Capital A/c’s Dr.

To Retiring/deceased Partner’s Capital A/c

(For goodwill share of retiring/deceased partner adjusted to remaining partner’s Capital A/c’s in their gaining ratio)

Hidden Goodwill: If the firm has agreed to settle the retiring/deceased partner by paying him a lump sum, then the amount paid to him in excess of what is due to him based on the capital accounts balance after making all adjustments like accumulated profits and losses and revaluation profit or loss etc. shall be treated as his share of goodwill known as hidden goodwill.

2. Treatment of Goodwill

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Treatment of Goodwill

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement/death because the goodwill has been earned by the firm with the efforts of all the existing partners. Hence, at the time of retirement/death of a partner, goodwill is valued as per agreement among the partners the retiring/ deceased partner compensated for his share of goodwill by the continuing partners (who have gained due to acquisition of share of profit from the retiring/ deceased partner) in their gaining ratio. The accounting treatment for goodwill in such a situation depends upon whether or, not goodwill already appears in the books of the firm.

When goodwill does not appear in the books

When goodwill does not appear in the books of the firm, credit in given to the retiring partner for the share in goodwill by debiting the goodwill account to gaining partners capital accounts (individually) in their gaining ratio. The journal entry is :

Gaining Partners Capital A/c Dr. (Individually) To Retiring Partners Capital A/c

(Share in goodwill of retiring partner adjusted)

Let us take an example to understand the treatment of goodwill.

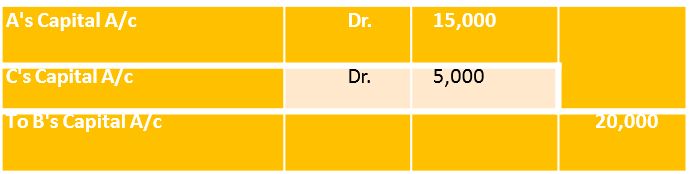

A, B and C are partners in a firm sharing profits in the ratio of 3:2:1 B retired and the value of goodwill of the firm in valued at Rs. 60,000. A and C continue the business sharing profits in the ratio of 3:1. The journal entry for adjustment of goodwill will be :

(B's share of goodwill adjusted to remaining partners' capital accounts in their gaining ratio)

It may also happen that as a result of decision on the new profit sharing ratio among the remaining partners, a continuing partner may also sacrifice a part of his share in future profits. In such a situation his capital account will also be credited along with the retiring/deceased partner’s capital account in proportion to his sacrifice and the other continuing partners’ capital accounts will be debited based on their gain in the future profit ratio.

Revision 6

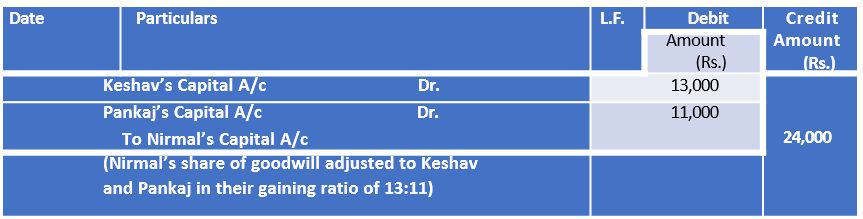

Keshav, Nirmal and Pankaj are partners sharing profits and losses in the ratio of 4 : 3 : 2. Nirmal retires and the goodwill is valued at Rs. 72,000. Keshav and Pankaj decided to share future profits and losses in the ratio of 5 : 3. Record necessary journal entries.

Solution

Journal

Working Notes

Vimal’s share of goodwill = Rs. 72,000 × 3/9 = Rs. 24,000

Calculation of Gaining Ratio

Gaining Share = New Share – Old Share

Keshav’s Gaining Share = 5/8 – 4/9 = 13/72

Pankaj’s Gaining Share = 3/8 − 2/9 = 11/72

Hence, Gaining Ratio between Keshav and Pankaj is 13:11 i.e. 13/24 : 11/24

Revision 7

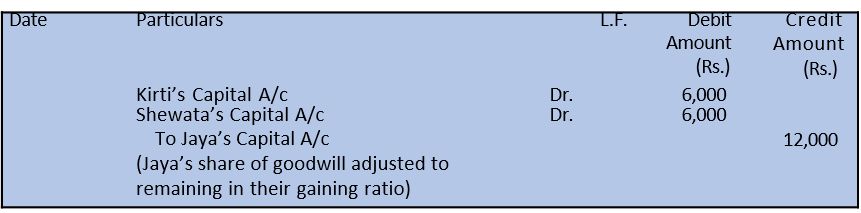

Jaya, Kirti, Ekta and Shewata are partners in a firm sharing profits and losses in the ratio of 2 : 1 : 2 : 1. On Jaya’s retirement, the goodwill of the firm is valued at Rs. 36,000. Kirti, Ekta and Shewata decided to share future profits equally. Record the necessary journal entry for the treatment of goodwill without opening ’Goodwill Account’.

Solution

Books of Kirti, Ekta and Shewata

Journal

Working Notes

1. Jaya’s Share of Goodwill

= Rs. 36,000 × 2/6 = Rs. 12,000

2. Calculation of Gaining Ratio

Gaining Share = New Share – Old Share

Kirti’s Gain = 1/3 – 1/6 = 2/6 − 1/6 = 1/6

Ekta’s Gain = 1/3 − 2/6 = 2/6 − 2/6 = 0 (Neither Gain nor Sacrifice)

Shewata’s Gain = 1/3 − 1/6 = 2/6 − 1/6 = 1/6

Hence, Gaining ratio between Kirti and Shewata 1/6 : 1/6 = 1:1

Revision 8

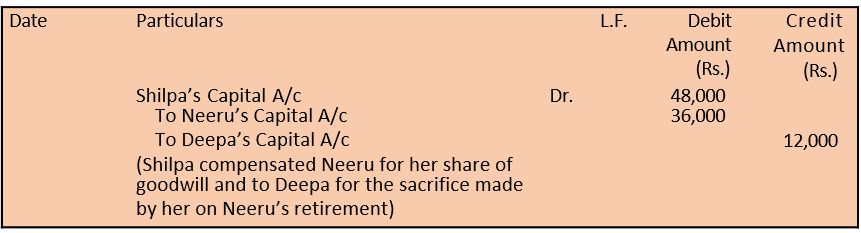

Deepa, Neeru and Shilpa were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Neeru retired and the new profit sharing ratio between Deepa and Shilpa was 2 : 3. On Neeru’s retirement, the goodwill of the firm was valued at Rs. 1,20,000. Record necessary journal entry for the treatment of goodwill on Neeru’s retirement.

Solution

Books of Deepa and Shilpa

Journal

Working Notes

1. Calculation of Gaining Ratio

Gaining Share = New Share – Old Share

Deepa’s Gaining Share = 2/5 – 5/10 = 4/10 − 5/10 = - 1/10 = (1/10) i.e., Sacrifice.

Shilpa’s Gaining Share = 3/5 − 2/10 = 6/10 – 2/10 = 4/10 i.e., Gain

2. Hence, Shilpa will compensate both Neeru (retiring partner) and Deepa (continuing partner who has sacrificed) to the extent of their sacrifice worked out as follows:

Deepa’s Sacrifice = Goodwill of the firm × Sacrificing Share

= Rs. 1,20,000 × 1/10 = Rs. 12,000

Neeru’s (Retiring Partner’s Sacrifice) = Rs. 1,20,000 × 3/10 = Rs. 36,000.

Revision 9

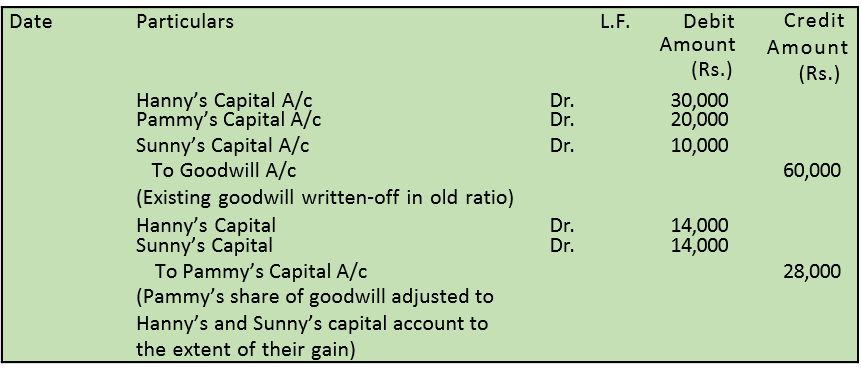

Hanny, Pammy and Sunny are partners sharing profits in the ratio of 3 : 2 : 1. Goodwill is appearing in the books at a value of Rs. 60,000. Pammy retires and at the time of Pammy’s retirement, goodwill is valued at Rs. 84,000. Hanny and Sunny decided to share future profits in the ratio of 2:1. Record the necessary journal entries.

Solution

Books of Hanny and Sunny

Journal

Working Notes

(i) Pammy’s share of current value of goodwill 1/3 of Rs. 84,000

= 1/3 × 84,000 = Rs. 28,000

(ii) Gaining Share = New Share – Old Share

Hanny’s Gaining Share = 2/3 − 3/6 = 1/6

Sunny’s Gaining Share = 1/3 – 1/6 = 1/6

This gaining Ratio of Hanny and Sunny is 1/6 : 1/6 = 1:1

Hidden Goodwill

If the firm has agreed to settle the retiring or deceased partner’s account by paying him a lump sum amount, then the amount paid to him in excess of what is due to him, based on the balance in his capital account after making necessary adjustments in respect of accumulated profits and losses and revaluation of assets and liabilities, etc., shall be treated as his share of goodwill (known as hidden goodwill).

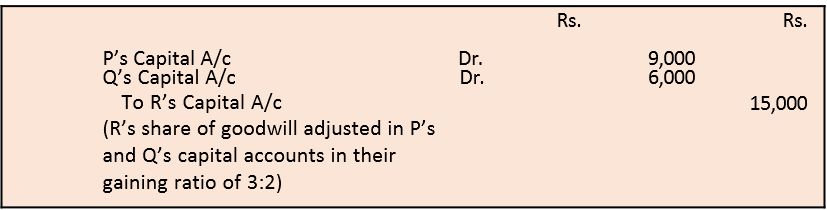

For example, P, Q and R are partners in a firm sharing profits in the ratio of 3:2:1. R retires, and the balance in his capital account after making necessary adjustments on account of reserves, revaluation of assets and liabilities workout to be Rs. 60,000, P and Q agreed to pay him Rs. 75,000 in full settlement of his claim. It implies that Rs. 15,000 is R’s share of goodwill of the firm. This will be debits to the capital accounts of P and Q in their gaining ratio (3:2 assuming no change in their own profit sharing ratio) and crediting R’s capital Account as follows:

3. Adjustment of revaluation of assets & liabilities, Adjustments of accumulated profits & losses, Adjustment of capitals

Adjustment of Revaluation of Assets and Liabilities:

The retiring /deceased partner must be given a share of all profits that have arisen till his retirement/death and is made to bear his share of losses that have occurred till that period. This necessitates the revaluation of assets and liabilities. At the time of retirement/death of a partner, there may be some assets and liabilities which may not have been shown at their present values.

Not only that, there may be some unrecorded assets and liabilities which need to be brought into books. For this purpose, a revaluation account is opened, for the revaluation of assets and liabilities on the date of retirement/death of the partner. The journal entries to be passed for this purpose are as follows:

1. For increase in the value of assets:

Asset(s) AIc (individually) Dr.

To Revaluation A/c (For increase in the value of assets)

2. For decrease in the value of assets:

Revaluation A/c Dr.

To Assets A/c’s (individually)

(For decrease in the value of assets)

3. For increase in the number of liabilities:

Revaluation A/c Dr.

To Liabilities A/c’s (individually)

(for an increase in liabilities)

4. For decrease in the number of liabilities:

Liabilities A/c’s (individually) Dr.

To Revaluation A/c (For decrease in the liabilities)

5. For an unrecorded asset:

Assets A/c Dr.

To Revaluation A/c

(For unrecorded assets brought into books)

6. For an unrecorded liability:

Revaluation A/c Dr.

To Liability A/c

(For an unrecorded liability brought into books)

7. For the sale of an unrecorded asset:

Cash A/c Dr.

To Revaluation A/c (For the sale of unrecorded assets)

8. For payment of an unrecorded liability:

Revaluation A/c Dr.

To Cash A/c

(For the payment of an unrecorded*liability)

9. For-profit on revaluation:

Revaluation A/c Dr.

To All Partner’s Capital A/c’s (individually)

(For the distribution of profit on revaluation to all partners in their old profit sharing ratio)

Or

10. For Loss on revaluation:

All Partner’s Capital A/c’s (individually) Dr.

To Revaluation A/c

(For the distribution of losses on revaluation to all partners in their old profit sharing ratio)

Reserves and Accumulated Profits and Losses:

The retiring/deceased partner is also entitled to his/her share in the accumulated profits, general reserve, workmen compensation fund 1 etc. and is also liable to share the accumulated losses.

For this purpose the following journal entries are required:

1. For Transferring accumulated profits, General Reserves etc.

To All Partner’s Capital A/c’s (individually)

(For accumulated profits are transferred to all partner’s Capital A/c’s in their old profit sharing ratio)

2. For transfer of accumulated losses:

All Partner’s Capital A/c’s (individually) Dr.

To Profit and Loss A/c To Any Accumulated Loss A/c (For accumulated losses transferred to all partner’s Capital A/c’s in their old profit sharing ratio)

Settlement of Amount Due to Retiring Partner:

The retiring partner is entitled to the amount due to him. It is settled as per the terms of the partnership deed i.e. in lump sum immediately or in various installments with or without interest as agreed or partly in cash immediately and partly in installments.

In absence of any agreement, Section 37 of the Indian Partnership Act, 1932 is applicable, according to this, the retiring partner has an option to receive either interest of 6% p.a. till the payment of his/her amount due or such share of profits which has been earned with his/her money i.e. based on the capital ratio. The necessary journal entries are as follows:

1. If payment (full) is made in cash:

Retiring Partner’s Capital A/c Dr.

To Cash/Bank A/c

(For the amount paid to retire partner)

2. If the amount due to retiring partner’s treated as a loan:

Retiring Partner’s Capital A/c Dr.

To Retiring Partner’s Loan A/c (For the amount due to retiring partner transferred to his loan account)

3. When the amount due to the retiring partner is partly paid in cash and the remaining amount treated as a loan:

Retiring Partner’s Capital A/c Dr. (Total Amount Due)

To Cash/Bank A/c. (Amount paid)

To Retiring Partner’s Loaij A/c (Amount of loan) (For the amount due to retiring, partner; partly paid in cash and remaining transferred to his loan account)

4. When the loan account is settled by paying in installments including principal and interest:

(a) For interest due on loan:

Interest on Loan A/c Dr.

To Retiring Partner’s Loan A/c

(For the interest due on the loan of the retiring partner)

(b) For payment of installment of the loan with interest:

Retiring Partner’s Loan A/c Dr.

To Cash/Bank A/c

(For the amount paid (Instalment + Interest) to retiring

partner)

These entries i.e. (a) and (b) repeated till the loan is paid off.

Adjustment of Partner’s Capital:

At the time of retirement or death of a partner, the remaining partners may decide to adjust their capital contribution in their new profit sharing ratio. The adjustment of the remaining partner’s capitals may involve any one of the following cases:

1. When the total capital of a new firm is specified.

Steps:

(a) Compute the new capital of the remaining partners by dividing total capital in their new profit-sharing ratio.

(b) Calculate the amount of adjusted old capital of the remaining partners after all adjustments regarding goodwill, accumulated profit and losses, profit or loss on revaluation etc.

(c) Find out the surplus or deficiency, as the case may be, in each

of the remaining partner’s capital accounts by comparing the new capital and the adjusted capital. ‘

(d) Adjust the surplus by paying cash to the concerned partner or by crediting his Current Account as agreed. Adjust the deficiency by asking the concerned partner to pay cash or by debiting his current account.

Journal Entries:

For excess capital withdrawn by the remaining partners:

Partner’s Capital A/c’s (individually) Dr.

To Cash/Bank A/c.

For the amount of capital to be brought in by the partners:

Cash/Bank A/c Dr.

To Partner’s Capital AJc’s (individually)

If the adjustment is made through the current account:

For excess capital:

Partner’s Capital A/c’s (individually) Dr.

To Partner’s Current A/c’s (individually)

For short capital:

Partner’s Current A/c’s /individually) Dr.

To Partner’s Capital A/c’s (individually)

2. When the total capital of the new firm is not specified:

Calculate the total capital of the new firm which will be equal to the aggregate of the adjusted old capitals of the continuing partners after all adjustments like goodwill, accumulated profits and losses, profit and losses on revaluation etc.

After calculating the total capital of the new firm, follow the same steps as discussed in case 1.

3. When the amount payable to the retiring partner will be contributed by continuing partners in such a way that their capitals are adjusted proportionately to their new profit sharing ratio:

Calculate the total capital of the reconstituted firm by adding the adjusted old capitals of remaining partners and the cash to be brought in by continuing partners in order to make payment to the retiring/ deceased partner.

Then follow the same step we discussed in case 1.

3. Adjustment of revaluation of assets & liabilities, Adjustments of accumulated profits & losses, Adjustment of capitals

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Adjustment for Revaluation of Assets and Liabilities

At the time of retirement or death of a partner there may be some assets which may not have been shown at their current values. Similarly, there may be certain liabilities which have been shown at a value different from the obligation to be met by the firm. Not only that, there may be some unrecorded assets and liabilities which need to be brought into books. As learnt in case of admission of a partner, a Revaluation Account is prepared in order to ascertain net gain (loss) on revaluation of assets and/or liabilities and bringing unrecorded items into firm’s books and the same is transferred to the capital account of all partners including retiring/deceased partners in their old profit sharing ratio. the Journal entries to be passed for this purpose are as follows:

1. For increase in the value of assets

Assets A/c’s (Individually) Dr. To Revaluation A/c

(Increase in the value of assets)

2. For decrease in the value of assets

Revaluation A/c Dr. To Assets A/c’s (Individually)

(Decrease in the value of assets)

3. For increase in the amount of liabilities

Revaluation A/c Dr. To Liabilities A/c (Individually)

(Increase in the amount of liabilities)

4. For decrease in the amount of liabilities

Liabilities A/c’s (Individually) Dr. To Revaluation A/c

(Decrease in the amount of liabilities)

5. For an unrecorded asset

Assets A/c Dr. To Revaluation A/c

(Unrecorded asset brought into book)

6. For an unrecorded liability

Revaluation A/c Dr. To Liability A/c

(Unrecorded liability brought into books)

7. For distribution of profit or loss on revaluation

Revaluation A/c Dr. To All Partners’ Capital A/c’s (Individually)

(Profit on revaluation transferred to partner’s capital)

(or)

All Partners’ Capital A/c’s (Individually) Dr.

To Revaluation A/c

(Loss on revaluation transferred to partner’s capital accounts)

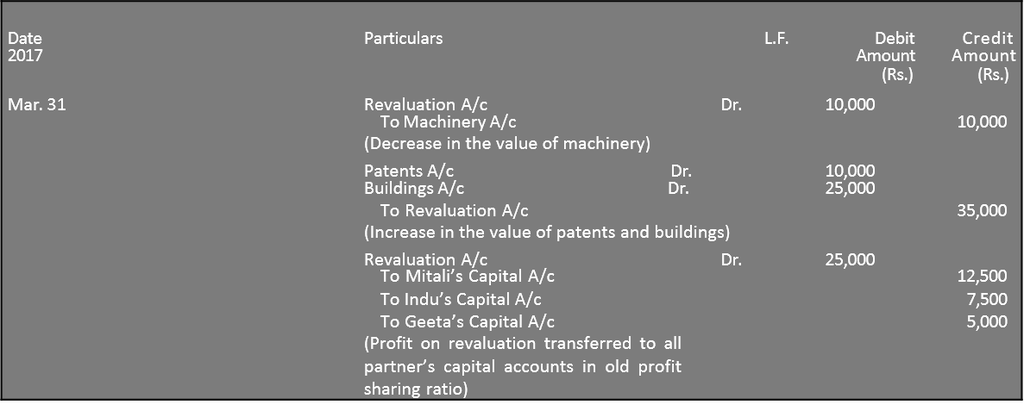

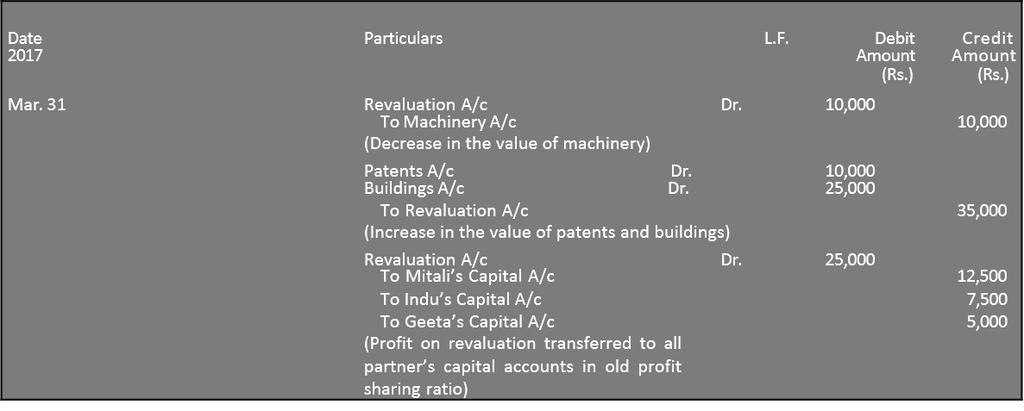

Revision 10

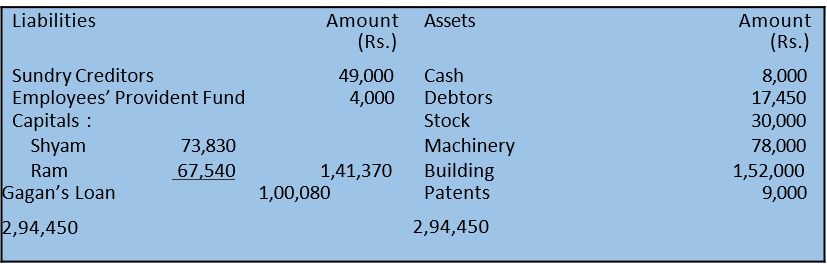

Mitali, Indu and Geeta are partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On March 31, 2017, their Balance Sheet was as under:

Geeta retires on the above date. It was agreed that Machinery be valued at Rs.1,40,000; Patents at Rs. 40,000; and Buildings at Rs. 1,25,000. Record the necessary journal entries for the above adjustmentsand prepare the Revaluation Account.

Solution

Books of Mitali and Indu

Journal

Revaluation Account

Adjustment of Accumulated Profits and Losses

Sometimes, the Balance Sheet of a firm may show accumulated profits in the form of general reserve and/on accumulated losses in the form of profit and loss account debit balance. The retiring/deceased partner is entitled to his/her share in the accumulated profits and is also liable to share the accumulated losses, if any. These accumulated profits or losses belong to all the partners and should be transferred to the capital accounts of all partners in their old profit sharing ratio. The following journal entries are recorded for the purpose.

(i) For transfer of accumulated profits (reserves),

Reserves A/c Dr. To All Partners’ Capital A/c’s (Individually)

(Reserves transferred to all partners’

capital account’s in old profit sharing ratio).

(ii) For transfer of accumulated losses

All Partners’ Capital A/c’s (Individually) Dr. To Profit and Loss A/c

(Accumulated loss transferred to all partners’

capital accounts in their old profit-sharing ratio)

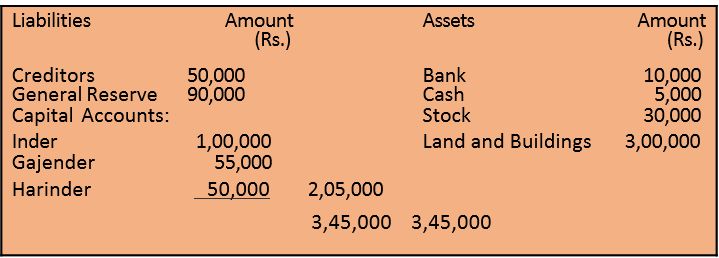

For example; Inder, Gajender and Harinder are partners sharing profits in the ratio of 3 : 2 : 1. Inder retires and the Balance Sheet of the firm on that date was as follows: Books of Inder, Gajinder and Harinder

Balance Sheet as on March 31, 2017

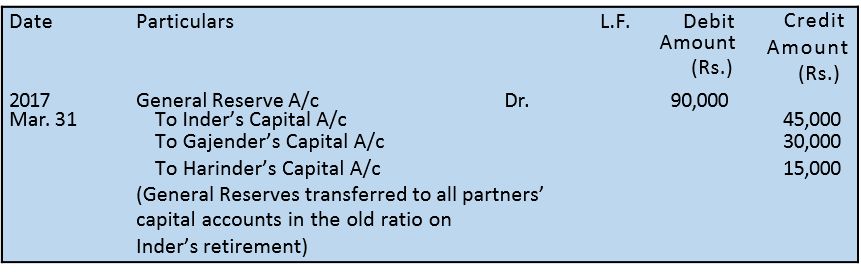

The journal entry to record the treatment of general reserve will be as follows :

Books of Gajender and Harinder

Journal

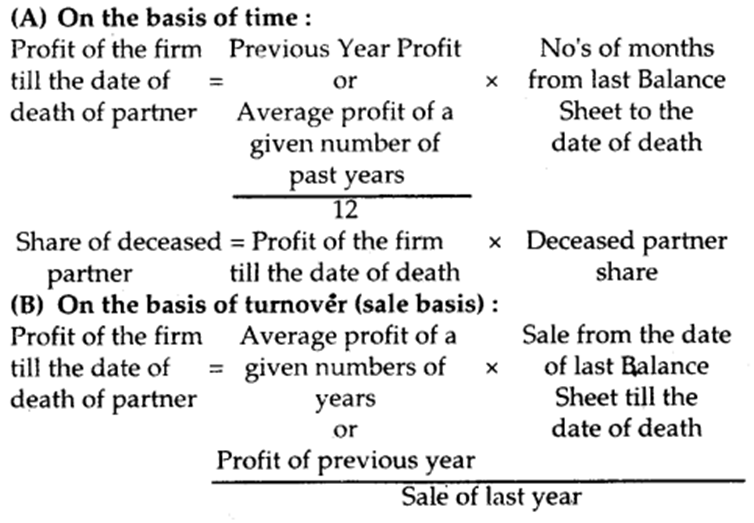

When Partner Retires in the Middle of the Year

Normally retirement of a partner takes place at the end of accounting period. But there can be a case where a partner decides to retire in the middle of the year. In such a case the claim shall include share of profit or loss, interest on capital, interest on drawings if any, from the date of last balance sheet to the date of retirement. Here, the main problem relates to the calculation of profit for the intervening period, i.e., the period from the date of last balance sheet and the date of retirement. Let us understand by way of example:

Maira, Shabnam and Vipul were partners in a firm sharing profits in the ratio of 5:4:1 profits for the year ending on March 31, 2019 was Rs. 1,00,000. Vipul decides to retire on June 30, 2019. The new profit sharing ratio of the firms is 1:1. Vipul's share of profit for the period of from April 01 to June 30, 2019 shall be calculated as:

Total profit for the year ending on 31st March, 2017 = Rs. 1,00,000

Vipul's share of profit:

Proceeding Year's × Proportionate Period × Share of Deceased Partner

= Rs. 1,00,000 × 3/12 × 4/10 = Rs. 10,000

12 10

The journal entry will be recorded as follows:

Profit & Loss Suspense A/c Dr. 10,000

To Vipul's Capital A/c 10,000

Vipul's share of profit transferred to his capital account

Alternatively, if Vipul's share of profit was to be calculated on the basis of average profits of the last three years, to which were Rs. 1,36,000 for 2016-17, Rs. 1,54,000 for 2017-18 and Rs. 1,00,000 for 2018-19, Vipul's share of profit for the period from April 7, 2019 to June 30, 2019 shall be calculated on the basis of average profit based on profits for the last year calculated as follows:

Average Profit = Total Profit/ No. of Years = ( Rs.1 ,36, 000 + Rs. 1, 54, 000 + Rs 1, 00, 000 ) / 3 = R s. 3,90,000/ 3 = Rs.1,30,000

Vipul’s share of Profit = Rs.1, 30,000

The Journal entry will be:

Profit and Loss Suspense A/c 13,000

To Vipul's Capital A/c 13,000

In case, the agreement provides, that share of profit of the retiring partner will be worked out on the basis of sales, and it is specified that the sales during the pear 2018-19 were Rs. 8,00,000 and the sales from April 1, 2017 to June 30, 2019 were Rs. 1,50,000 Vipul's share of profits for the period from April 1, 2019 shall be calculated as follows:

If sale is Rs. 80,00,000, the profit = Rs. 1,00,000

If sale is Rs. 1, the profit = 1, 00,000 / 8,00, 000

If sale is Rs. 1,50,000, the profit = 1, 00,000 / 8, 00, 000 ×1,50, 000

= Rs. 18,750

Vipul's share of profit = Rs. 7,500

Profit & Loss Suspense A/c Dr. 75,00

To Vipul's Capital A/c 75,00

For being retiring partners share of profit for the intervening period to books of account, the following journal entry is recorded.

(i) Profit & Loss Suspense A/c Dr.

To Retiring Partners Capital A/c

(Share of profit for intervening/period)

Later, Profit and Loss suspense account is closed by transferring the amount to the gaining partners capital account in their gaining ratio. The journal entry is:

(ii) Gaining Partners Capital A/c Dr. (in gaining ratio) To Profit & Loss Suspense A/c

Alternatively, the following journal entry can also be passed in place

of (i) or (ii)

Gaining Partners Capital A/c Dr. To Retiring partners Capital A/c

(Share of profit of retiring partner credited)

4. Disposal of amount due to retiring partner, Death of a partner

DISPOSAL OF AMOUNT DUE TO RETIRING PARTNER

The partner who is retiring, his or her account is settled as per the terms and conditions of the partnership deed, i.e., in lump sum instantly or in different installments, either with or without interest as consented or partly in cash directly and partially in installment at the consented intermissions. In the absenteeism of any deed, Section 37 of the Indian Partnership Act, 1932 is pertinent, which states that the partner who is retiring or moving out, has a choice to receive interest @ 6% per annum until the date of payment or such share of gains which has been earned with his or her money (i.e., which is based on the capital ratio).

Therefore, the total amount overdue to the retiring partner which is determined after all the modifications and adjustments have been made is to be compensated instantly to the retiring or an outgoing partner. In case the enterprise is not in a situation to make the payment right away, the amount that is overdue is being transferred to the retiring or outgoing Partner’s Loan A/c. The required journal entries are recorded as follows :

When a retiring partner is paid cash in full :

Retiring Partner’s Capital A/c Dr.

To Cash/Bank A/c

When retiring partner’s whole amount is treated as loan:

Retiring Partner’s Capital A/c Dr.

To Retiring Partner’s Loan A/c

When a retiring partner is partly paid in cash and the remaining amount treated as loan :

Retiring Partner’s Capital A/c Dr. (Total amount due)

To Cash/Bank A/c (Amount Paid)

To Retiring Partner’s Loan A/c (Amount of Loan)

When Loan account is settled by paying in instalments includes principal and interest :

• For interest on loan

Interest A/c Dr.

To Retiring Partner’s Loan A/c

• For payment of installment

Retiring Partner’s Loan A/c Dr.

To Cash/Bank A/c

Death of a Partner:

The accounting treatment in the event of the death of a partner is the same as that in the case of the retirement of a partner. Here, his claim is transferred to his executor’s account and settled in the same manner as that of the retired partner.

The only major difference between the retirement and death of a partner is that retirement normally takes place at the end of the accounting period whereas death may occur on any day. Therefore, in case of death, his claim shall also include his share of profit or loss, interest on capital, and interest on drawings (if any), from the beginning of the year to the date of death.

Calculation of profit for the intervening period: Share of profit of a deceased partner

Share of deceased partner = Profit of the firm till the date of death × Deceased partner share

Accounting Treatment of Outgoing Partner’s Share in Profit:

1. Through Profit and Loss Suspense Account

In case of Profit:

Profit and Loss Suspense A/c Dr.

To Deceased Partner’s Capital A/c (Share of profit for the intervening period)

In case of Loss:

Deceased Partner’s Capital A/c Dr.

To Profit and Loss Suspense A/c (Share of loss for the intervening period)

2. Through Capital Transfer In case of Profit:

Remaining Partner’s Capital A/c’s Dr.

To Deceased Partner’s Capital A/c In case of Loss:

Deceased Partner’s Capital A/c Dr.

To Remaining Partner’s Capital A/c’s The executors of deceased partner are entitled to the following:

- The credit balance of deceased partner’s capital account;

- His share of goodwill;

- His share of profit till the date of death;

- His share of profit on revaluation of assets and liabilities;

- His share of accumulated profits and reserves;

- His interest in capital if partnership deed provides till the date of death;

- His share of Joint Life Policy (if any);

- His salary and commission due (if any);

The following deduction has to be made from above.

- His drawings, interest in drawings till the date of death;

- His share of loss till the date of death;

- His share of loss on revaluation of assets and liabilities. ,

- His share of the reduction in the value of goodwill (if any).

Payment to the executors:

1. When payment is made in full Executor’s A/c Dr.

To Bank A/c.

2. When payment is made in installments The executors are entitled to interest when the payment is made in installment. If the deed is silent about this, then 6% p.a. should be given as per Section 37 of the Indian Partnership Act, 1932.

When interest is due

Interest A/c Dr.

To Executor’s A/c

When installment paid along with interest

Executor’s A/c Dr.

To Cash/Bank A/c

4. Disposal of amount due to retiring partner, Death of a partner

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Disposal of Amount Due to Retiring Partner

The outgoing partner’s account is settled as per the terms of partnership deed i.e., in lumpsum immediately or in various instalments with or without interest as agreed or partly in cash immediately and partly in instalment at the agreed intervals. In the absence of any agreement, Section 37 of the Indian Partnership Act, 1932 is applicable, which states that the outgoing partner has an option to receive either interest @ 6% p.a. till the date of payment or such share of profits which has been earned with his/her money (i.e., based on capital ratio). Hence, the total amount due to the retiring partner which is ascertained after all adjustments have been made is to be paid immediately to the retiring partner. In case the firm is not in a position to make the payment immediately, the amount due is transferred to the retiring Partner’s Loan Account, and as and when the amount is paid it is debited to his account. The necessary journal entries recorded are as follows.

1. When retiring partner is paid cash in full.

Retiring Partners’ Capital A/c Dr. To Cash/Bank A/c

2. When retiring partners’ whole amount is treated as loan.

Retiring Partners’ Capital A/c Dr. To Retiring Partners’ Loan A/c

3. When retiring partner is partly paid in cash and the remaining amount treated as loan.

Retiring Partners’ Capital A/c Dr. (Total Amount due) To Cash/Bank A/c (Amount Paid)

To Retiring Partners’ Loan A/c (Amount of Loan)

4. When Loan account is settled by paying in instalment includes principal and interest.

a) For interest on loan

Interest A/c Dr. To Retiring Partner’s Loan A/c

b) For payment of instalment

Retiring Partner’s Loan A/c Dr. To Cash/Bank A/c

Note:

4. When Loan account is settled by paying in instalment includes principal and interest.

a) For interest on loan

Interest A/c Dr. To Retiring Partner’s Loan A/c

b) For payment of instalment

Retiring Partner’s Loan A/c Dr. To Cash/Bank A/c

1. The balance of the retiring partner’s loan account is shown on the liabilities side of the Balance Sheet till the last instalment is paid to him/her.

2. Entry number (a) and (b), above will be repeated till the loan is paid off.

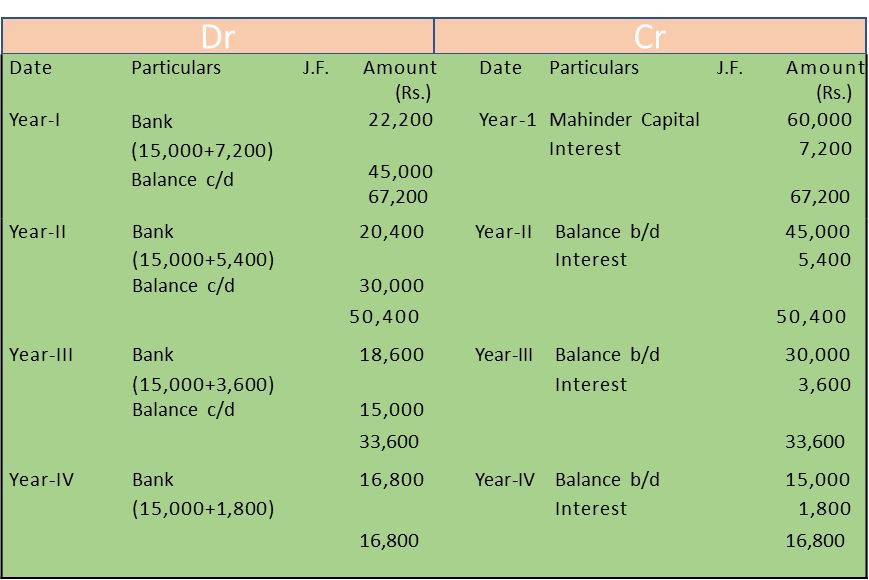

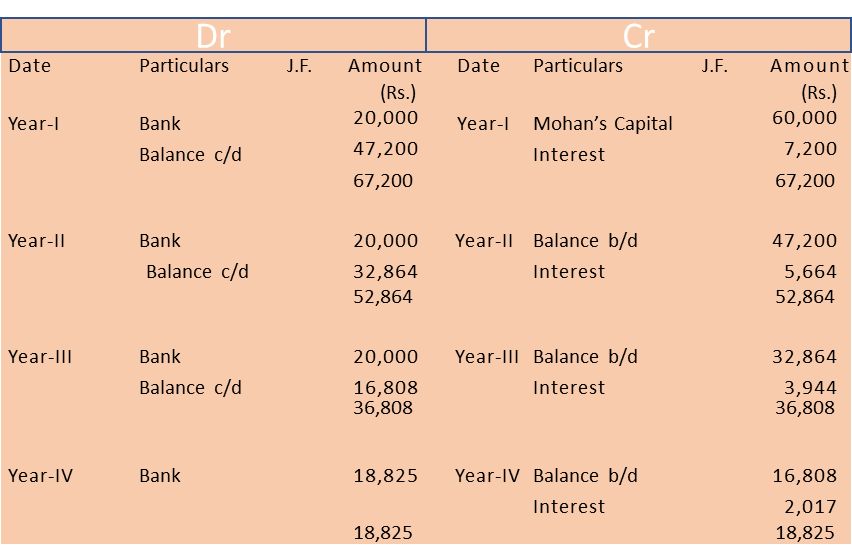

Revision 11

Amrinder, Mahinder and Joginder are partners in a firm. Mahinder retires from the firm. On his date of retirement, Rs. 60,000 becomes due to him. Amrinder and Joginder promised to pay him in instalments every year at the end of the year to which he agreed. Prepare Mahinder’s Loan Account in the following cases:

1. When payment is made four yearly instalments plus interest @ 12% p.a. on the unpaid balance.

2. When when payment is made in three yearly instalments of Rs. 20,000 including interest @ 12% p.a on the outstanding balance during the first three years and the balance including interest in the fourth year.

3. When payment is made in 4 equal yearly instalment’s including interest @ 12% p.a. on the unpaid balance.

Solution

(a) When payment is made in four yearly instalments plus interest

Books of Amrinder and Joginder

Mahinder’s Loan Account

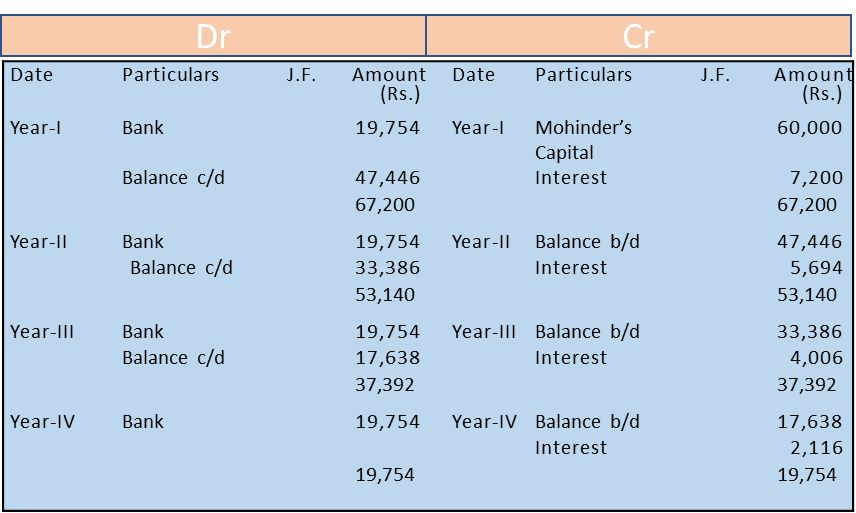

(b) When payment is made in three yearly instalments of Rs. 20,000 each including interest.

Books of Amrinder, Mahinder and Joginder

Mahinder’s Loan Account

(c) When payment is made in four equal yearly instalments including interest @12% (Annually).

Books of Amrinder and Joginder

Mahinder’s Loan Account

Note:

The annual instalment of payment in 4 years @ 12% interest works out at Rs. 19,754 (Annually of Rs. 0.329234 as per Annually Table x 60,000).

It may noted that the accounting treatment for disposal of amount due to retiring partner and deceased partner is similar with a difference that in case of death of a partner, the amount credited to him/her is transferred to his Executors’ Account and the payment has to be made to him/her. This shall be taken up later in this chapter.

Revision 12

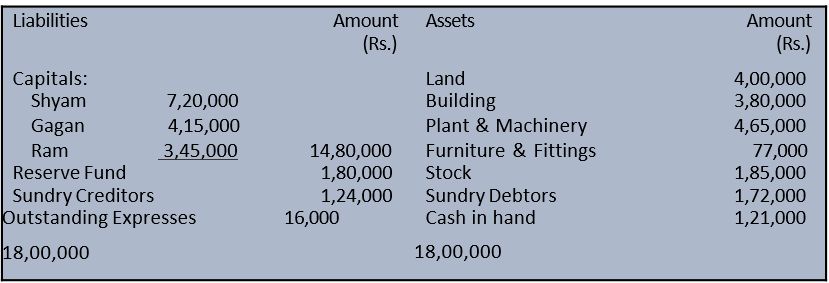

The Balance Sheet of Ashish, Suresh and Lokesh who were sharing profits in the ratio of 5 : 3 : 2, is given below as on March 31, 2017.

Balance Sheet of Ashish, Suresh and Lokesh As on March 31, 2017

Suresh retires on June 30, 2017 date and the following adjustments are agreed upon his retirement.

1. Stock was valued at Rs. 1,72,000.

2. Furniture and fittings were valued at Rs. 80,000

3. Profit share of Suresh till the date of his retirement is to be calculated on the basis of firm's last year profit which is Rs. 2,00,000.

4. An amount of Rs. 10,000 due from Mr. Deepak, a debtor, was doubtful and a provision for the same was required.

5. Goodwill of the firm was valued at Rs. 2,00,000.

6. Suresh was paid Rs. 40,000 immediately on retirement and the balance was transferred to his loan account.

7. Ashish and Lokesh were to share future profits in the ratio of 3:2.

Prepare Revaluation Account, Capital Account and Balance Sheet of the reconstituted firm.

Solution

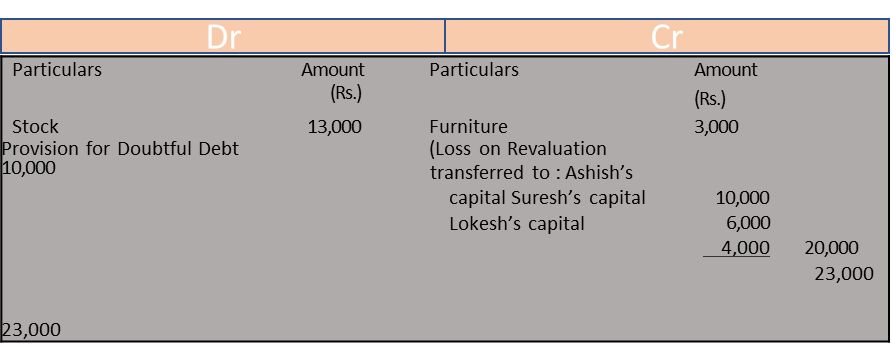

Books of Ashish, Suresh and Lokesh

Revaluation Account

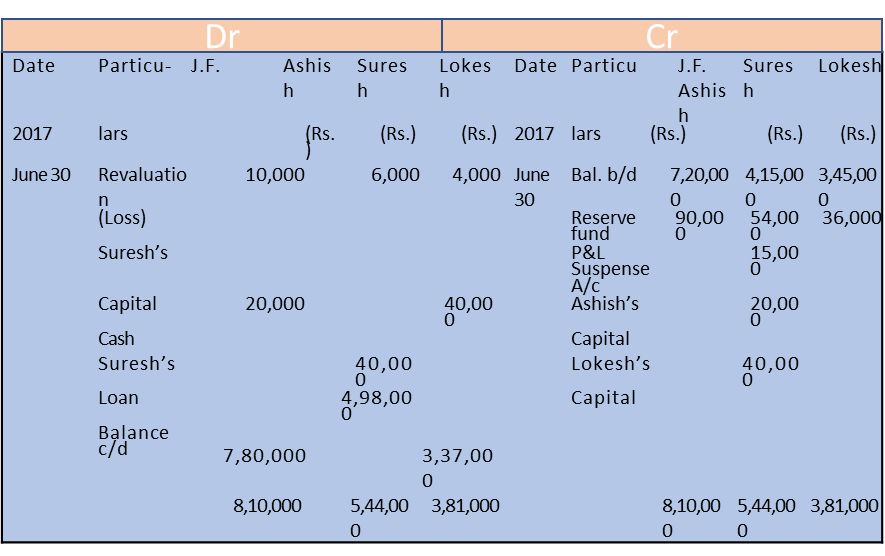

Partners’ Capital Accounts

Balance Sheet of Ashish and Lokesh as on April 01, 2017

Working Notes

1. Gaining Share = New Share – Old Share

Ashish’s Gain = 3/5 – 5/10 = 6/10 - 5/10 = 1/10

Lokesh’s Gain = 2/5 – 2/10 = 4/10 – 2/10 = 2/10

Gaining Ratio between Ashish and Lokesh = 1 : 2,

2. Suresh’s Share of Goodwill = 3/10 × Rs. 2,00,000 = Rs. 60,000

3. Suresh's share of profit = 2,00,000 × 3/13 × 3/10 = Rs. 15,000

Revision 13

Shyam, Gagan and Ram are partners sharing profit in the ratio of 2 : 2 : 1.

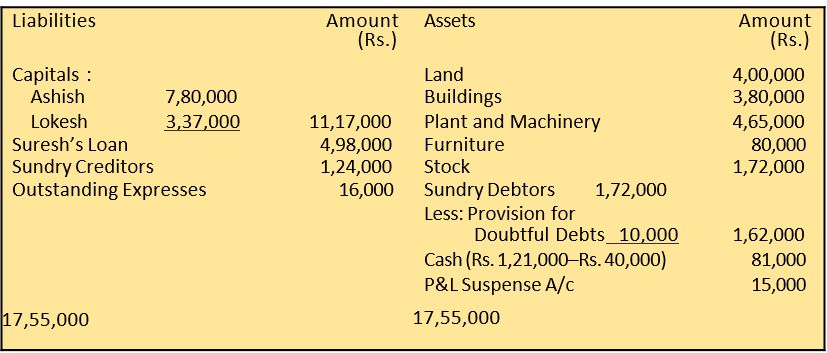

Their Balance Sheet as on March 31, 2017 are as under:

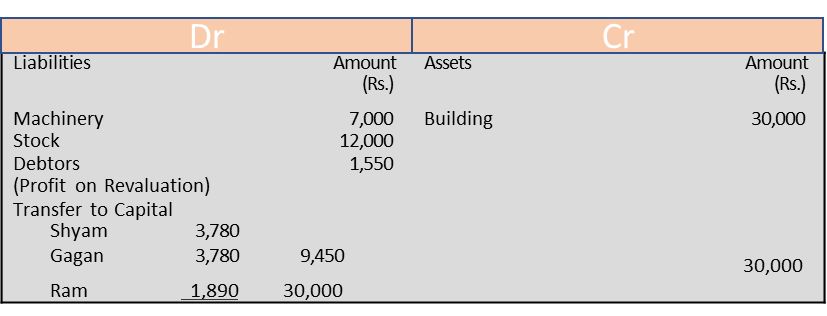

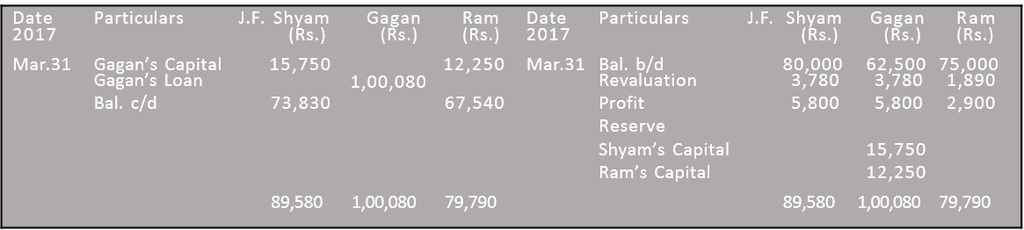

As Gagan got a very good break at an MNC, so he decided to retire on that date and it was decided that Shyam and Ram would share the future profits in the ratio of 5 : 3. Goodwill was valued at Rs. 70,000; Machinery at Rs. 78,000; Buildings at Rs. 1,52,000; stock at Rs. 30,000; and bad debts amounting to Rs. 1,550 were to be written off. Record journal entries in the books of the firm and prepare the Balance Sheet of the new firm.

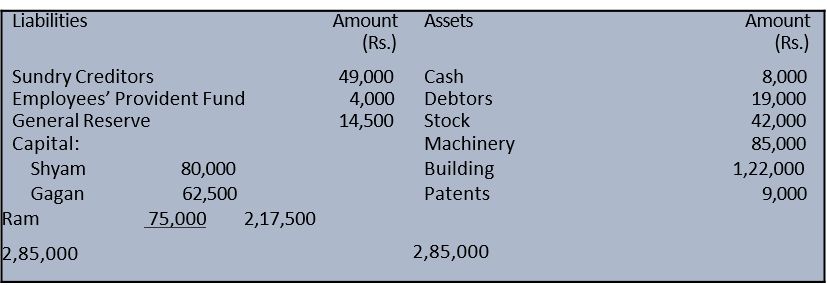

Solution

Books of Shyam, Ram and Gagan

Journal

Balance Sheet of Shyam and Ram as on March 31, 2017

Working Notes

Share Gained = New Share – Old Share

Shyam’s Gain = 5/8 – 2/5 = 25/40 – 16/40 = 9/40

Ram’s Gain = 3/8 – 1/5 = 15/40 – 8/40 = 7/40

Therefore, Gaining Ratio of Shyam and Ram = 9 : 7.

Revaluation Account

Partners’ Capital Accounts

Note: As sufficient balance is not available to pay the due amount to Gagan, the balance in his capital account is transferred to his loan account.

Adjustment of Partners’ Capitals

At the time of retirement or death of a partner, the remaining partners may decide to adjust their capital contributions in their profit sharing ratio. In such a situation, the sum of balances in the capitals of continuing partners may be treated as the total capital of the new firm, unless specified otherwise. Then, to ascertain the new capital of the continuing partners, the total capital of the firm is divided amongst the remaining partners as per the new profit sharing ratio, and the excess or deficiency of capital in the individual capital account’s may be worked out. Such excess or shortage shall be adjusted by withdrawal of contribution in cash, as the case may be, for which the following journal entries will be recorded.

(i) For excess capital withdrawn by the partner :

Partners’ Capital A/c Dr. To Cash / Bank A/c

(ii) For amount of capital to be brought in by the partner:

Cash / Bank A/c Dr. To Partners’ Capital A/c

Consider the following situations:

The adjustment of the continuing partner’s capitals may involve any one of the three ways as illustrated as follows :

1. When the capital of the new firm as decided by the partners is specified.

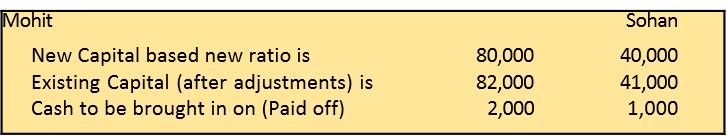

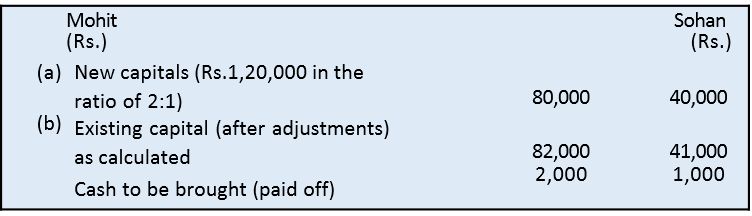

Revision 14

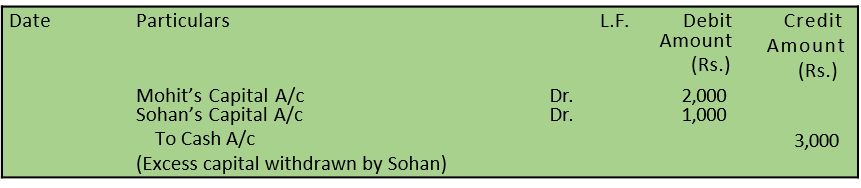

Mohit, Neeraj and Sohan are partners in a firm sharing profits in the ratio of 2 : 1 : 1. Neeraj retires and Mohit and Sohan decided that the capital of the new firm will be fixed at Rs. 1,20,000. The capital accounts of Mohit and Sohan show a credit balance of Rs. 82,000 and Rs. 41,000 respectively after making all the adjustments. Calculate the actual cash to be paid off or to be brought in by the continuing partners and pass the necessary journal entries.

Solution

The New Profit Sharing Ratio between Mohit and Sohan = 2 : 1

Books of Mohit and Sohan

Journal

2. When the total capital of new firm is not specified.

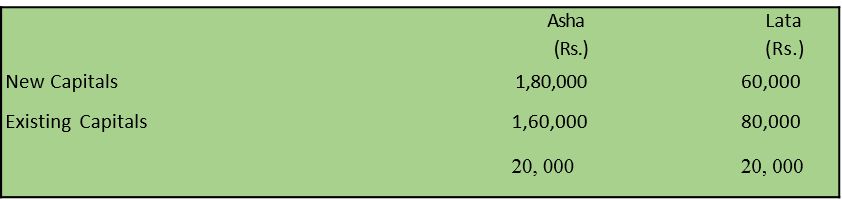

Revision 15

Asha, Deepa and Lata are partners in a firm sharing profits in the ratio of 3 : 2 : 1. Deepa retires. After making all adjustments relating to revaluation, goodwill and accumulated profit etc., the capital accounts of Asha and Lata showed a credit balance of Rs. 1,60,000 and Rs. 80,000 respectively. It was decided to adjust the capitals of Asha and Lata in their new profit sharing ratio. You are required to calculate the new capitals of the partners and record necessary journal entries for bringing in or withdrawal of the necessary amounts involved.

Solution

Calculation of new capitals of the existinging partners

Balance in Asha’s Capital (after all adjustments) = 1,60,000

Balance in Lata’s Capital = 80,000

Total Capital of the New Firm = 2,40,000

Based on the new profit sharing ratio of 3:1

Asha’s New Capital = Rs. 2,40,000 × ¾ = 1,80,000

Lata’s New Capital = Rs. 2,40,000 × ¼ = 60,000

Note :The total capital of the new firm is based on the sum of the balance in the capital accounts of the continuing partners.

Calculation of cash to be brought in or withdrawn by the continuing partners :

Cash to be brought in on (paid off)

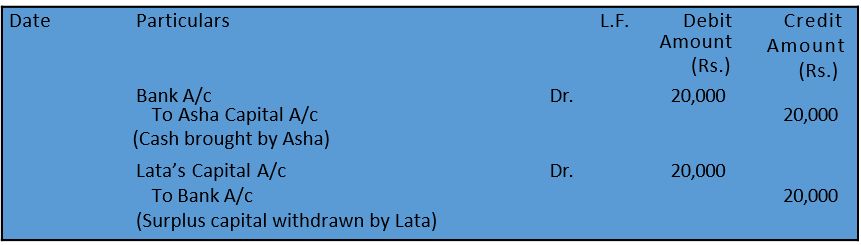

Books of Asha and Lata

Journal

3. When the amount payable to retiring partner will be contributed by continuing partners in such a way that their capitals are adjusted proportionate to their new profit sharing ratio:

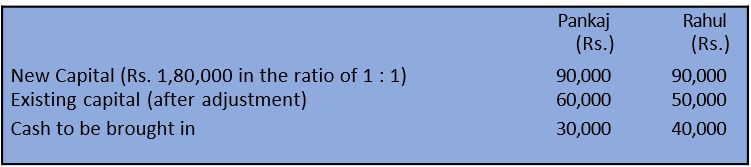

Revision 16

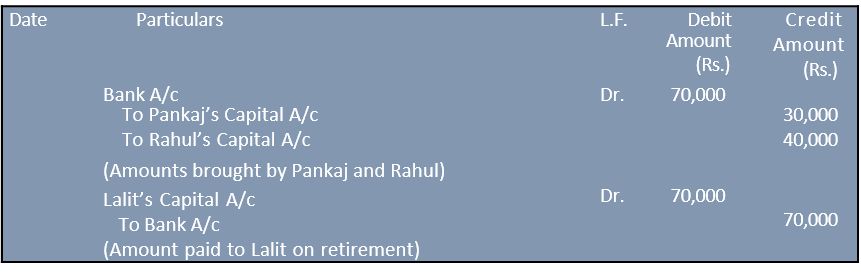

Lalit, Pankaj and Rahul are partners sharing profits in the ratio of 4 : 3 : 3. After all adjustments, on Lalit’s retirement with respect to general reserve, goodwill and revaluation etc., the balances in their capital accounts stood at Rs. 70,000, Rs. 60,000 and Rs. 50,000 respectively. It was decided that the amount payable to Lalit will be brought by Pankaj and Rahul in such a way as to make their capitals proportionate to their profit sharing ratio. Calculate the amount to be brought by Pankaj and Rahul and record necessary journal entries for the same. Also record necessary entry for payment to Lalit.

After Lalit’s retirement, the new profit sharing ratio between Pankaj and Rahul is 3 : 3, i.e. 1 : 1.

Solution

Calculation of total capital of the new firm

Balance in Pankaj’s Capital account (after adjustment) = 60,000

Balance in Rahul’s Capital account (after adjustment) = 50,000

Amount payable to Lalit (Retiring partner) = 70,000

Total capital of new firm (i) + (ii) + (iii) = 1,80,000

Calculation of new capitals of the continuing partners

Pankaj’s New Capital = Rs. 1,80,000 × ½ = Rs. 90,000

Rahul’s New Capital = Rs. 1,80,000 × ½ = Rs. 90,000

Calculation of the amounts to be brought in or withdrawn by the continuing partners

Books of Pankaj and Rahul

Journal

Revision 17

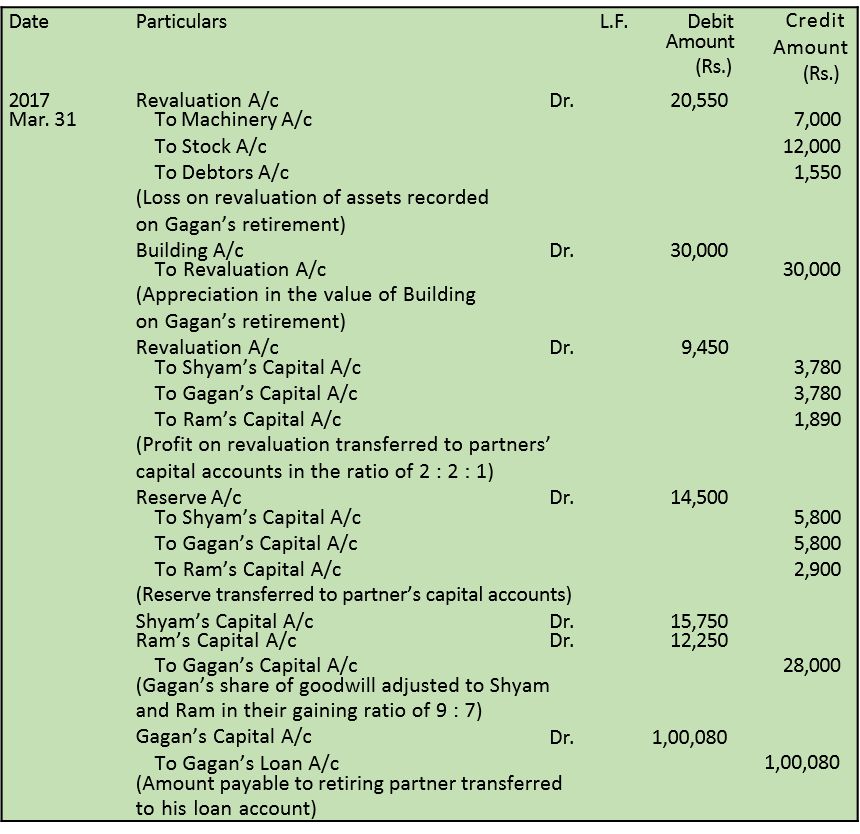

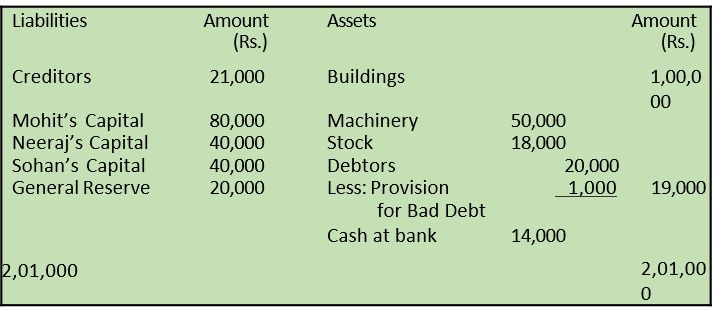

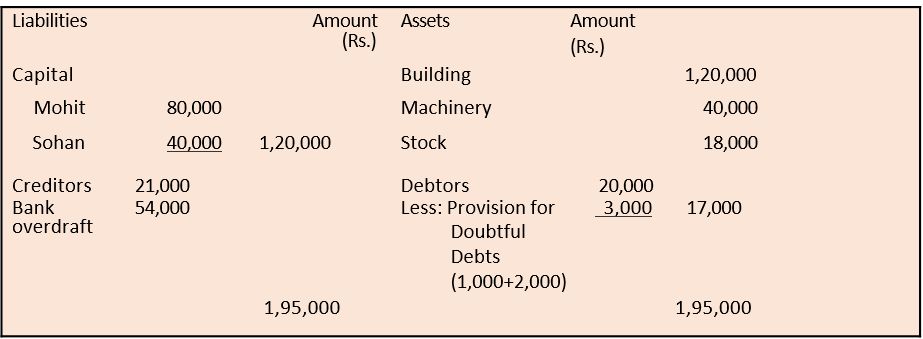

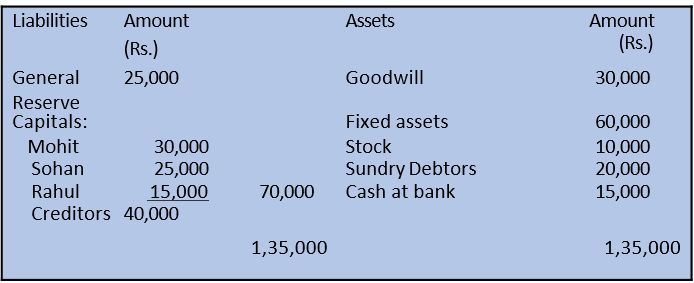

The Balance Sheet of Mohit, Neeraj and Sohan who are partners in a firm sharing profits according to their capitals as on March 31, 2017 was as under:

On that date, Neeraj decided to retire from the firm and was paid for his share in the firm subject to the following:

1. Buildings to be appreciated by 20%.

2. Provision for Bad debts to be increased to 15% on Debtors.

3. Machinery to be depreciated by 20%.

4. Goodwill of the firm is valued at Rs. 72,000 and the retiring partner’s share is adjusted through the capital accounts of remaining partners.

5. The capital of the new firm be fixed at Rs. 1,20,000.

Prepare Revaluation Account, Capital Accounts of the partners, and the Balance Sheet after retirement of B.

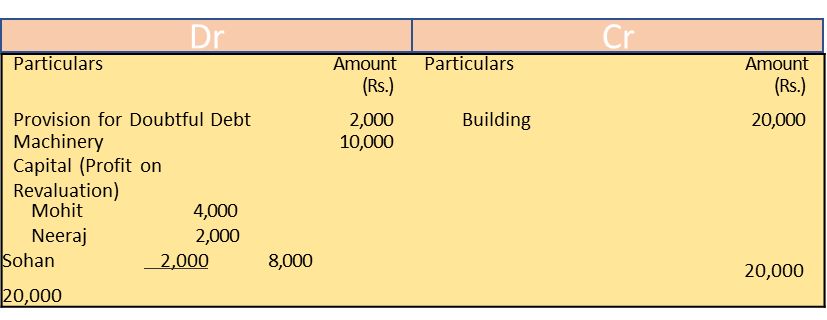

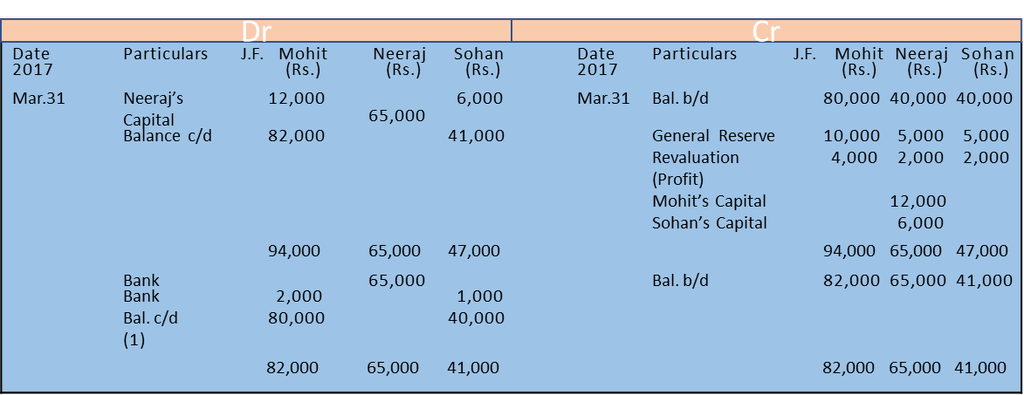

Solution

Revaluation Account

Partners’ Capital Accounts

Balance Sheet as on March 31, 2017

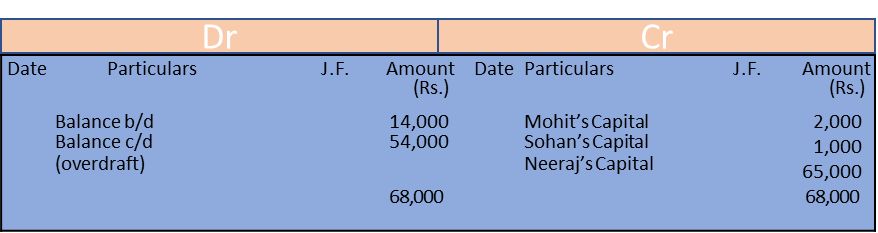

Working Notes

Bank Account

It is assumed that bank overdraft is taken to pay the retiring partners.

Cash to be brought in or withdrawn by Mohit and Sohan :

Death of a Partner

As stated earlier, the accounting treatment in the event of death of a partner is similar to that in case of retirement of a partner, and that in case of death of a partner his claim is transferred to his executors and settled in the same manner as that of the retired partner. However, there is one major difference that, while the retirement normally takes place at the end of an accounting period, the death of a partner may occur any time. Hence, in case of a partner, his claim shall also include his share of profit or loss, interest on capital, interest on drawings (if any) from the date of the last Balance Sheet to the date of his death of these, the main problem relates to the calculation of profit for the intervening period (i.e., the period from date of the last balance sheet and the date of the partner’s death. Since, it is considered cumbersome to close the books and prepare final account, for the period, the deceased partner’s share of profit may be calculated on the basis of last year’s profit (or average of past few years) or on the basis of sales.

For example, Bakul, Champak and Darshan were partners in a firm sharing profits in the ratio of 5:4:1. The profit of the firm for the year ending on March 31, 2017 was Rs.1,00,000. Champak died on June 30, 2017. Bakul and Darshan decided to share profits equally. Champak’s share of profit for the period from

April 1 to June 30, 2017, shall be calculated as follows:

Total profit for the year ending on 31st March, 2017 = Rs.1,00,000

Champak’s share of profit :

Proceeding Year’s Profit × Proportionate Period × Share of Deceased Partner

= Rs. 1,00,000 × 3/12 × 4/10 = Rs. 10,000

The journal entry will be recorded as follows :

Profit & Loss Suspense A/c Dr. 10,000

To Champak’s Capital A/c 10,000

(Champak’s share of profit transferred to his capital account)

Alternatively, if Champak’s share of profit was to be calculated on the basis of average profits of the last three years, which were Rs. 1,36,000 for 2014-15, Rs. 1,54,000 for 2015-16 and Rs. 1,00,000 for 2016-17; Champahs share of profit for the period from April 7, 2017 to June 30, 2017 shall be calculated on the basis of average profit based on profits for the last year calculation as follows:

Average Profit = Total Profit / No. of years

= Rs. 1,36,000 + Rs. 1,54,000 + Rs. 1,00,000

3

= Rs. 3,90,000

3

= Rs. 1,30,000

Champak’s share of profit = Rs. 1,30,000 × 3/12 months × 4/10 months

= Rs. 13,000

The Journal entry will be:

Profit & Loss Suspense A/c Dr. 13,000

To Champak's Capital A/c 13,000

In case, the agreement provides, that share of profit of the deceased partner will be worked out on the basis of sales, and it is specified that the sales during the year 2015-16 were Rs. 8,00,000 and the sales from April 1, 2017 to June 30, 2017 were Rs. 1,50,000 Champak’s share of profits for the period from

April 1, 2017 to June 30, 2017 shall be calculated as follows.

If sale is Rs.8,00,000, the profit = Rs.1,00,000

If sale is Rs.1, the profit = 1,00,000

8,00,000

If sale is Rs.1,50,000, the profit = 1,00,000 X 1,50,000

8,00,000

= Rs. 18,750

Champak’s share of profit = Rs. 7,500

The Journal entry will be:

Profit & Loss Suspense A/c Dr. 2,500

To Champak's Capital A/c 7,500

For being deceased partner’s share of profits for the intervening period to books of account, the following journal entry is recorded.

(i) Profit and Loss (Supense) A/c Dr.

To Deceased Partner’s Capital A/c

(Share of profit for the intervening period)

Later Profit and Loss Suspense account is closed by transferring the account to

Gaining Partners' Capital Account in their gaining ratio. The journal entry is:

(ii) Gaining Partners Capital A/c [In gaining ratio] To Profit and Loss Suspense A/c

(P&L Suspense account transferred).

Alternatively the following journal entry can also be passed in Place of (i) & (ii)

(ii) Gaining Partners' Capital A/c Dr.

To Deceased Partner Capital A/c

(share of profit of Deceased Partner credited)

Revision 18

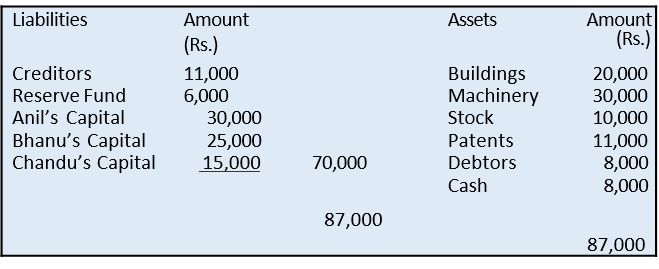

Anil, Bhanu and Chandu were partners in a firm sharing profits in the ratio of 5:3:2. On March 31, 2017, their Balance Sheet was as under:

Books of Anil, Bhanu and Chandu

Balance Sheet as on March 31, 2017

Anil died on October 1, 2017. It was agreed between his executors and the remaining partners that :

(a) Goodwill to be valued at 2 12 year’s purchase of the average profits of the previous four years which were :

Year 2013-14 – Rs.13,000, Year 2014-15 – Rs. 12,000, Year 2015-16 – Rs.20,000, Year 2016-17 – Rs.15,000

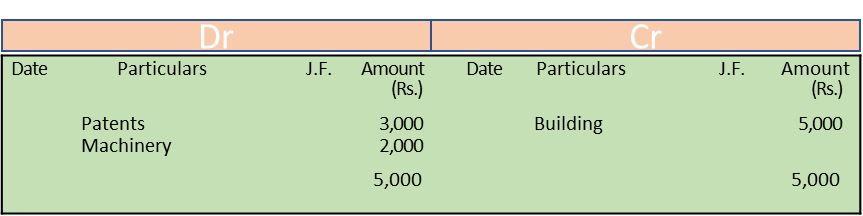

(b) Patents be valued at Rs.8,000; Machinery at Rs.28,000; and Building at Rs.25,000.

(c) Profit for the year 2017-18 be taken as having accrued at the same rate as that of the previous year.

(d) Interest on capital be provided at 10% p.a.

(e) Half of the amount due to Anil be paid immediately.

Prepare Anil’s Capital Account and Anil’s Executor’s Account as on October 1, 2017.

Solution

Books of Anil, Bhanu and Chander

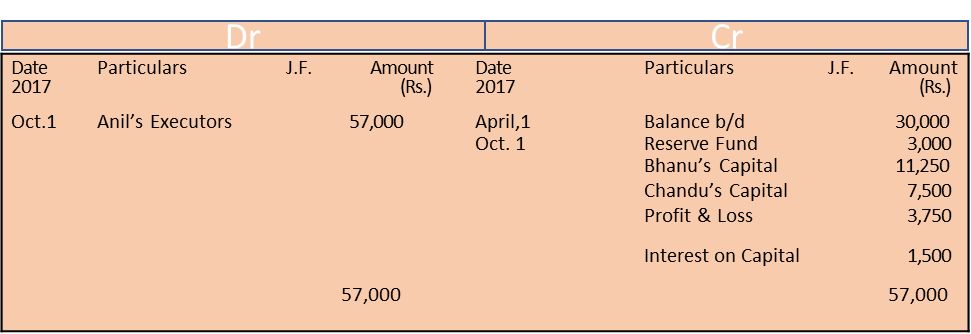

Anil’s Capital Account

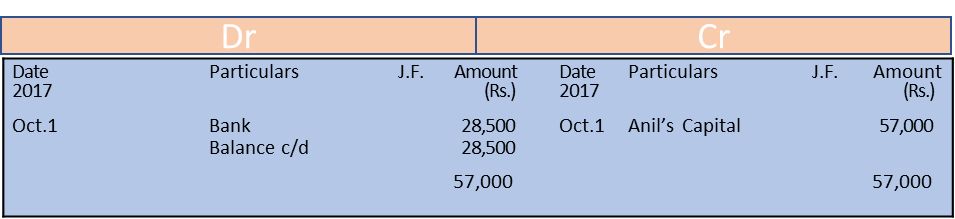

Anil’s Executor’s Account

Working Notes

Revaluation Account

Goodwill = 2½ years’ purchase × Average Profit

Average Profit = Rs. 13,000 + Rs.12,000 + Rs.20,000 + Rs.15,000

4

= Rs. 60,000

4

= Rs. 15,000

Goodwill = 5/2 × Rs. 15,000

= Rs. 37,500

Anil’s Share of Goodwill = 5/10 × Rs. 37,500

= Rs. 18,750

3. Profit from the date of last balance sheet to date of death (April 1, 2017 to October 1, 2017)

= 6 months

Profit for 6 months = Rs. 15,000 × 6/ 12 = Rs. 7,500

Anil’s share of profit = Rs. 7,500 × 5 / 10 = Rs. 3,750

4. Interest on Capital

(April 1, 2017 to October 1, 2017)

= Rs. 30,000 × 10 / 100 × 6 / 12

= Rs.1,500

Revision 19

You are given the Balance Sheet of Mohit, Sohan and Rahul who are partners sharing profits in the ratio of 2 : 2 : 1, as on March 31, 2017.

Books of Mohit, Sohan and Rahul

Balance Sheet as on March 31, 2017.

Sohan died on June 15, 2017. According to the Deed, his legal representatives are entitled to:

(a) Balance in Capital Account;

(b) Share of goodwill valued on the basis of thrice the average of the past 4 years’ profits.

(c) Share in profits up to the date of death on the basis of average profits for the past 4 years.

(d) Interest on capital account @ 12% p.a.

(e) New Profit sharing ratio of the firm will be 3:2 among Mohit and Rahul respectively.

Profits for the years ending on March 31 of 2014, 2015, 2016, 2017 respectively were Rs. 15,000, Rs. 17,000, Rs. 19,000 and Rs. 13,000.

Sohan’s legal representatives were to be paid the amount due. Mohit and Rahul continued as partner by taking over Sohan’s share equally. Work out the amount payable to Sohan’s legal representatives.

Solution

Books of Mohit, Sohan and Rahul

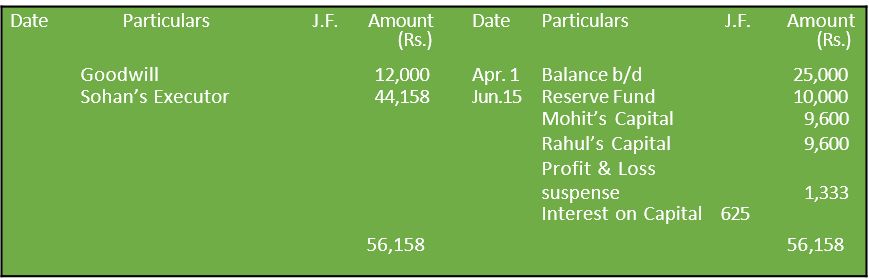

Sohan’s Capital Account

Working Notes

1. Sohan’s Share of Goodwill

= Goodwill of the Firm × 2 / 5

= Rs. 48,000 × 2 / 5 = Rs. 19,200

Goodwill of the Firm = 3 × Average Profit

= 3 × Rs. 64,000 / 4 = Rs. 48,000

2. Profit and Loss

(Share of Profit from the date of last Balance Sheet to the date of death) 2 ½ months.

= Rs. 64,000 / 4 × 2 / 5 × 2.5 / 12

= Rs. 1,333

3. Interest on Capital

= Rs. 25,000 × 12 /100 × 25/ 12 = Rs. 625

Summary

- New Profit Sharing Ratio: New profit sharing ratio is the ratio in which the remaining partner will share future profits after the retirement or death of any partner. New Share = Old Share + Acquired Share from the Outgoing partnerGaining Ratio: Gaining ratio is the ratio in which the continuing partners have acquired the share from the retiring deceased partner.

- Treatment of Goodwill: The basic rule is that gaining partner(s) shared compensate the sacrificing partner to the extent of their gain for the respective share of goodwill. If goodwill already appears in the books, it will be written off by debiting all partners’ capital account in their old profit sharing ratio.

- Revaluation of Assets and Liabilities: At the time of retirement/death of a partner, there may be some assets which may not have been shown at their current values. Similarly, there may be certain liabilities which have been shown at a value different from the obligation to be met by the firm. Besides this, there may be unrecorded assets and liabilities which have to be recorded.

- Accumulated Profits or Losses: The reserves (Accumulated profits) or losses belong to all the partners and should be transferred to capital account of all partners.

- Retiring partner/deceased partner may be paid in one lump sum or installments with interest.

- At the time of retirement/death of a partner, the remaining partner may decide to keep their capital contributions in their profit sharing ratio.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY