1. Nature of partnership, Partnership Deed, Maintenance of Partnership accounts,

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Chapter - 2

Accounting for Partnership : Basic Concepts

You have learnt about the preparation of financial statements for a sole proprietary concern. As the business expands, one needs more capital and larger number of people to manage the business and share its risks. In such a situation, people usually adopt the partnership form of organisation. Accounting for partnership firms has it’s own peculiarities, as the partnership firm comes into existence when two or more persons come together to establish business and share its profits. On many issues affecting distribution of profits, there may not be any specific agreement between the partners. In such a situation the provisions of the Indian Partnership Act 1932 apply. Similarly, calculation of interest on capital, interest on drawings and maintenance of partners capital accounts have their own peculiarities. Not only that a variety of adjustments are required on the death of a partner or when a new partner is admitted and so on. These peculiar situations need specific treatment in accounting that need to be clarified.

The present chapter discusses some basic aspects of partnership such as distribution of profit, maintenance of capital accounts, etc. The treatment of situations like admission of partner, retirement, death and dissolution have been taken up in the subsequent chapters.

Nature of Partnership

When two or more persons join hands to set up a business and share its profits and losses, they are said to be in partnership. Section 4 of the Indian Partnership Act 1932 defines partnership as the‘relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all’.

Persons who have entered into partnership with one another are individually called ‘partners’ and collectively called ‘firm’. The name under which the business is carried is called the ‘firm’s name’. A partnership firm has no separate legal entity, apart from the partners constituting it. Thus, the essential features of partnership are:

- Two or More Persons: In order to form partnership, there should be at least two persons coming together for a common goal. In other words, the minimum number of partners in a firm can be two. There is however, a limit on their maximum number. By virtue of Section 464 of the Companies Act 2013, the Central Government is empowered to prescribe maximum number of partners in a firm but the number of partners can not be more than 100. The Central government has prescribed the maximum number of partness in a firm to be 50.

- Agreement: Partnership is the result of an agreement between two or more persons to do business and share its profits and losses. The agreement becomes the basis of relationship between the partners. It is not necessary that such agreement is in written form. An oral agreement is equally valid. But in order to avoid disputes, it is preferred that the partners have a written agreement.

- Business: The agreement should be to carry on some business. Mere co- ownership of a property does not amount to partnership. For example, if Rohit and Sachin jointly purchase a plot of land, they become the joint owners of the property and not the partners. But if they are in the business of purchase and sale of land for the purpose of making profit, they will be called partners.

- Mutual Agency: The business of a partnership concern may be carried on by all the partners or any of them acting for all. This statement has two important implications. First, every partner is entitled to participate in the conduct of the affairs of its business. Second, that there exists a relationship of mutual agency between all the partners. Each partner carrying on the business is the principal as well as the agent for all the other partners. He can bind other partners by his acts and also is bound by the acts of other partners with regard to business of the firm. Relationship of mutual agency is so important that one can say that there would be no partnership, if the element of mutual agency is absent.

- Sharing of Profit: Another important element of partnership is that, the agreement between partners must be to share profits and losses of a business. Though the definition contained in the Partnership Act describes partnership as relation between people who agree to share the profits of a business, the sharing of loss is implied. Thus, sharing of profits and losses is important. If some persons join hands for the purpose of some charitable activity, it will not be termed as partnership.

- Liability of Partners: Each partner is liable jointly with all the other partners and also severally to the third party for all the acts of the firm done while he is a partner. Not only that the liability of a partner for acts of the firm is also unlimited. This implies that his private assets can also be used for paying off the firm’s debts.

Partnership Deed

Partnership comes into existence as a result of agreement among the partners. The agreement can be either oral or written. The Partnership Act does not require that the agreement must be in writing. But wherever it is in writing, the document, which contains terms of the agreement is called ‘Partnership Deed’. It generally contains the details about all the aspects affecting the relationship between the partners including the objective of business, contribution of capital by each partner, ratio in which the profits and the losses will be shared by the partners and entitlement of partners to interest on capital, interest on loan, etc.

The clauses of partnership deed can be altered with the consent of all the partners. The deed should be properly drafted and prepared as per the provisions of the ‘Stamp Act’ and preferably registered with the Registrar of Firms.

Contents of the Partnership Deed

The Partnership Deed usually contains the following details:

• Names and Addresses of the firm and its main business;

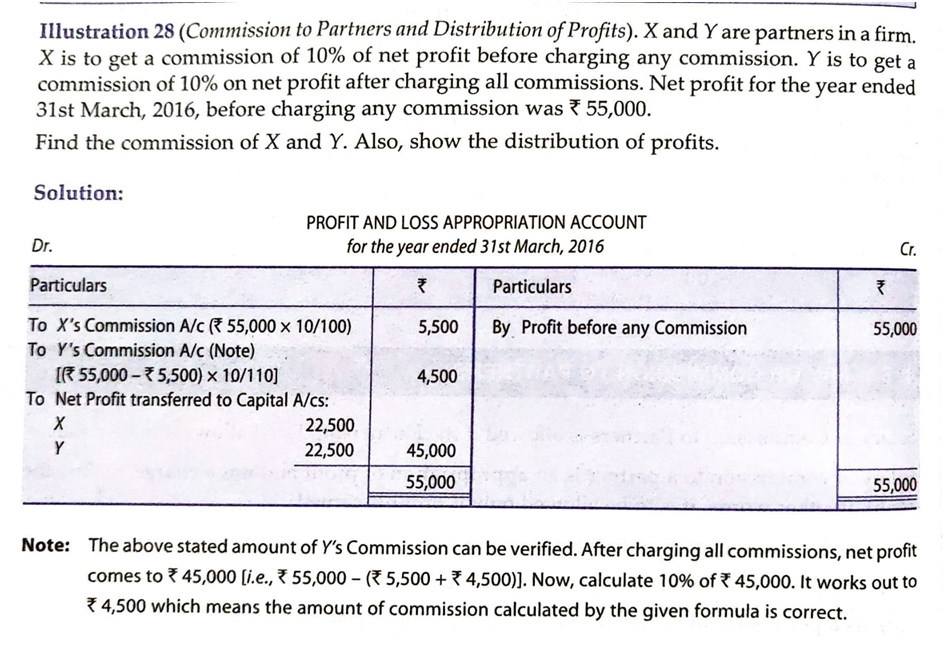

• Names and Addresses of all partners;

• Amount of capital to be contributed by each partner;

• The accounting period of the firm;

• The date of commencement of partnership;

• Rules regarding operation of Bank Accounts;

• Profit and loss sharing ratio;

• Rate of interest on capital, loan, drawings, etc;

• Mode of auditor’s appointment, if any;

• Salaries, commission, etc, if payable to any partner;

• The rights, duties and liabilities of each partner;

• Treatment of loss arising out of insolvency of one or more partners

• Settlement of accounts on dissolution of the firm;

• Method of settlement of disputes among the partners;

• Rules to be followed in case of admission, retirement, death of a partner

• Any other matter relating to the conduct of business.

Normally, the partnership deed covers all matters affecting relationship of partners amongst themselves. However, if there is no express agreement on certain matters, the provisions of the Indian Partnership Act, 1932 shall apply.

Provisions of Partnership Act Relevant for Accounting

The important provisions affecting partnership accounts are as follows:

(a) Profit Sharing Ratio: If the partnership deed is silent about the profit sharing ratio, the profits and losses of the firm are to be shared equally by partners, irrespective of their capital contribution in the firm.

(b) Interest on Capital: No partner is entitled to claim any interest on the amount of capital contributed by him in the firm as a matter of right. However, interest can be allowed when it is expressly agreed to by the partners. Thus, no interest on capital is payable if the partnership deed is silent on the issue.

(c) Interest on Drawings: No interest is to be charged on the drawings made by the partners, if there is no mention in the Deed.

(d) Interest on Loan: If any partner has advanced loan to the firm for the purpose of business, he/she shall be entitled to get an interest on the loan amount at the rate of 6 per cent per annum.

(e) Remuneration for Firm’s Work: No partner is entitled to get salary or other remuneration for taking part in the conduct of the business of the firm unless there is a provision for the same in the Partnership Deed.

Apart from the above, the Indian Partnership Act specifies that subject to contract between the partners:

(i) If a partner derives any profit for him/her self from any transaction of the firm or from the use of the property or business connection of the firm or the firm name, he/she shall account for the profit and pay it to the firm.

(ii) If a partner carries on any business of the same nature as and competing with that of the firm, he/she shall account for and pay to the firm, all profit made by him/her in that business.

Special Aspects of Partnership Accounts

Accounting treatment for partnership firm is similar to that of a sole proprietorship business with the exception of the following aspects:

• Maintenance of Partners’ Capital Accounts;

• Distribution of Profit and Loss among the partners;

• Adjustments for Wrong Appropriation of Profits in the Past;

• Reconstitution of the Partnership Firm; and

• Dissolution of Partnership Firm.

The first three aspects mentioned above have been taken up in the following sections of this chapter. The remaining aspects have been covered in the subsequent chapters.

1. Nature of partnership, Partnership Deed, Maintenance of Partnership accounts,

Meaning

Partnership business is an association between two or more persons who agree to do business & share profits & losses. The partners act as both agents & principals of the firm.

“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.” Section 4 of Indian Partnership Act, 1932.

Nature & Essential features of Partnership

Partnership is a separate business entity from the accounting viewpoint. However, from the legal viewpoint, a partnership firm is not separate from its partners. In case the business assets are not enough to meet the liabilities, the partner’s personal assets would also be liable to meet the debts.

Features

- Two or more persons – In a partnership business, the minimum number of partners is two & the maximum number of partners allowed is 50.

- Agreement – The relationship between partners is based on an agreement & that agreement is known as Partnership Deed.

- Profit-sharing – A partnership business is formed to do lawful business.

- Business of partnership can be carried on by all or any of them acting for all.

Partnership Deed

Partnership comes into existence by an oral or written agreement between the partners which contains all the terms & conditions of partnership. This agreement defines the relationship between partners. It is a legal document which is signed by all the partners. This document helps in avoiding any kind of dispute in future among the partners. This document is known as Partnership Deed.

A partnership deed, we can say, is the most important document in partnership business & it consists of the following clauses;

- Description of partners – Name, description & address of partners.

- Description of the firm – Name & address of the firm.

- Principal place of business – Address of the principal place of business

- Nature of business – What type of business is it - Trading or manufacturing? The nature of business is mentioned here.

- Commencement of Business – Date of commencement of partnership is mentioned here.

- Capital Contribution – The amount of capital to be contributed by each partner & whether the capital accounts are fixed or fluctuating.

- Interest on Capital – Rate of interest, if allowed, on capital

- Interest on Drawings – Rate of interest, if to be charged, on drawings

- Profit-Sharing Ratio – Ratio in which profits & losses are to be shared by partners.

- Interest on Loan – Rate of interest on loan given by a partner to a firm.

- Salary – Amount of salary, and commission to be paid to the partners

- Settlement of accounts – The manner in which the accounts of the partners are to be settled in case of his retirement, death or dissolution of partnership.

- Accounting period – The date on which accounts shall be closed every year.

- Rights & duties of partners – The rights & duties of partners are defined here.

- Duration of partnership – The period of partnership for which it has been started.

- Bank account operation – How shall the bank accounts be operated? Whether it shall be operated by any partner or jointly.

- Valuation of Assets – The manner in which the assets & liabilities of the firm are to be valued.

- Death of a partner – Whether the firm will continue or dissolve after the death of a partner.

- Settlement of Disputes – If there is any dispute among the partners then how it’ll be settled.

SPECIAL ASPECTS OF A PARTNERSHIP ACCOUNT

When the partnership deed is silent or does not have any clause in respect of the following matters or no partnership deed has been prepared by the partners, the following provisions of the Indian Partnership Act, 1932, shall apply:-

- Sharing of profit & losses – Profit & losses to be shared equally by all the partners.

- Interest on Capital – Interest on capital is not paid to any partner.

- Interest on Drawings – Interest on drawings is not charged to any partner.

- Interest on loan or advance/ loans by partners – Interest on loans is paid @ 6% pa. Interest is payable even if there is a loss.

- Remuneration to partners – Remuneration (salary, commission etc.) is not paid or allowed to any partner.

Some other important points:-

- A minor may be admitted for the benefit of partnership.

- A partner may retire from partnership with the consent of other partners or as per the agreement.

- Registration of firm is optional & not compulsory.

- Unless otherwise agreed by the partners, a firm is dissolved on the death of a partner.

Note – These provisions are applicable even if the partnership deed does not have a clause to this effect.

Maintenance of Partnership Accounts

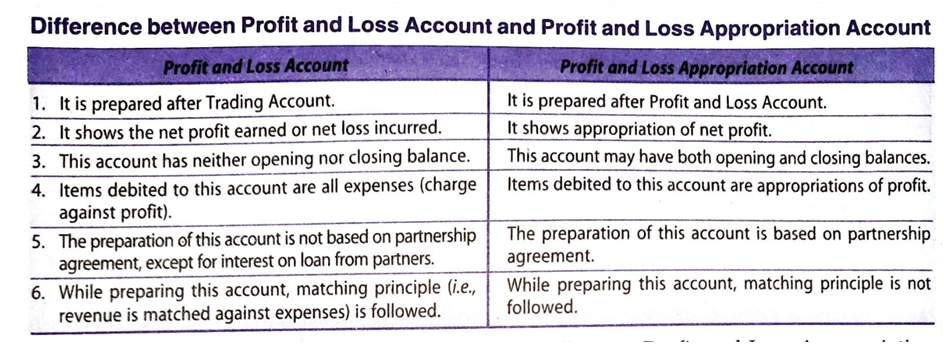

This is how partnership accounts are maintained

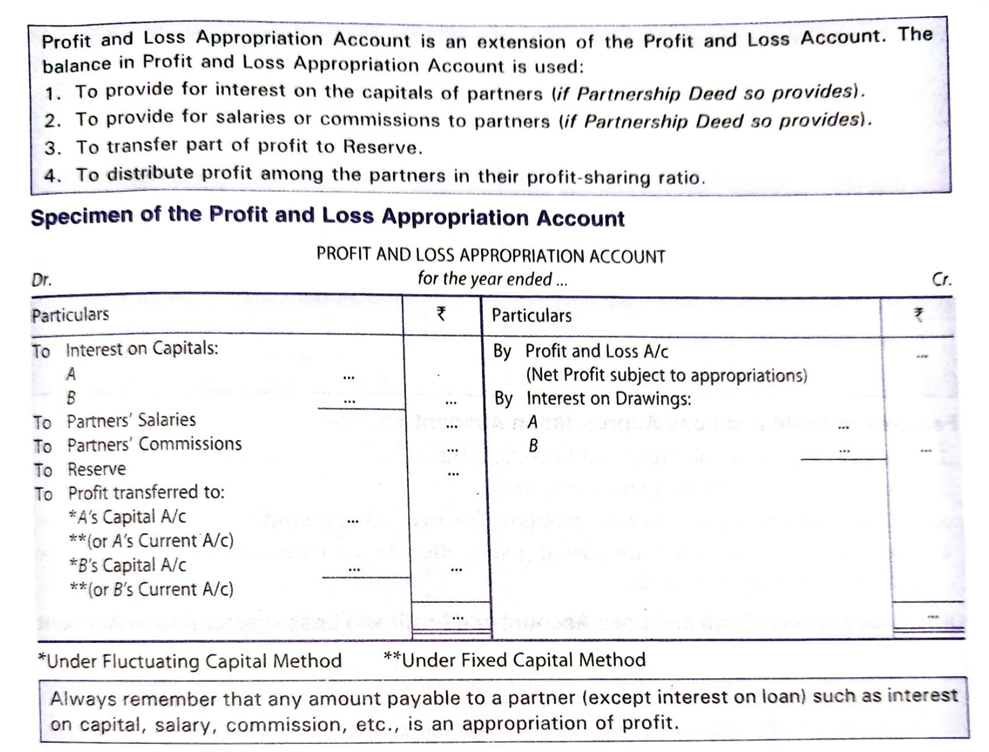

After the determination of net profit by preparing Profit & Loss A/c, we have to prepare Profit & Loss Appropriation A/c. Profit & Loss Appropriation A/c is an extension of Profit & Loss A/c. It is credited with the Net Profit taken from the Profit & Loss A/c & interest on drawings & debited with interest on capital, partner’s salaries & commissions. If the partners decide to transfer a certain part of the profit to Reserves, then it is also shown in the Dr side& the balance profit is distributed among the partners in their profit sharing ratio.

2. Maintenance of capital accounts, Distribution of profit among the partners

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Maintenance of Capital Accounts of Partners

All transactions relating to partners of the firm are recorded in the books of the firm through their capital accounts. This includes the amount of money brought in as capital, withdrawal of capital, share of profit, interest on capital, interest on drawings, partner’s salary, commission to partners, etc.

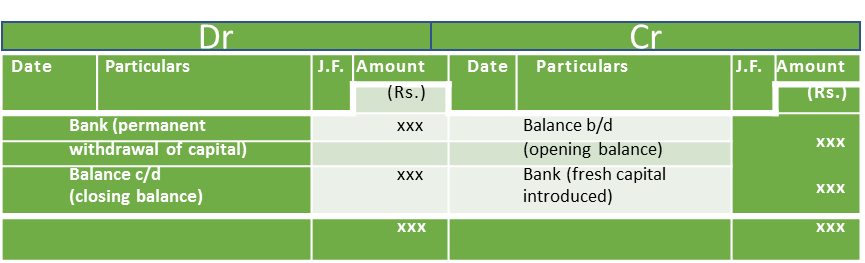

There are two methods by which the capital accounts of partners can be maintained. These are: (i) fixed capital method, and (ii) fluctuating capital method. The difference between the two lies in whether or not the transactions other than addition/withdrawal of capital are recorded in the capital accounts of the partners.

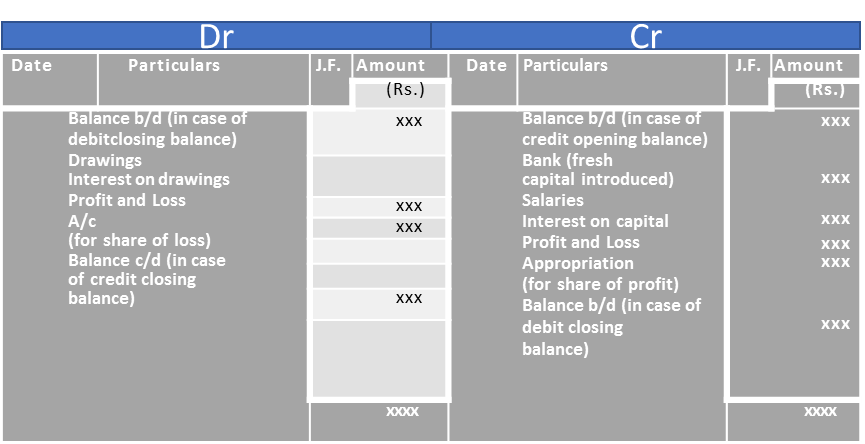

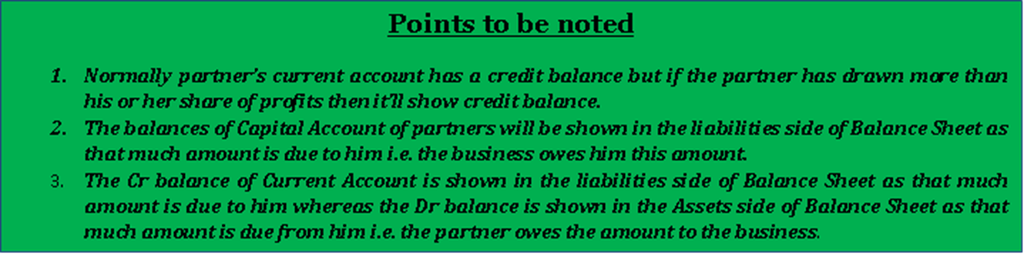

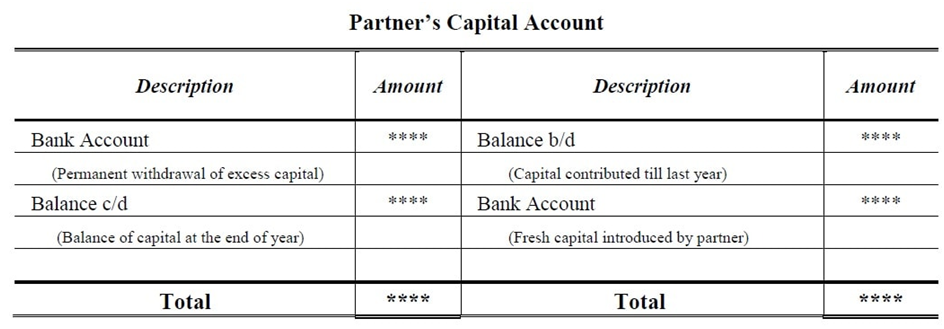

Fixed Capital Method: Under the fixed capital method, the capitals of the partners shall remain fixed unless additional capital is introduced or a part of the capital is withdrawn as per the agreement among the partners. All items like share of profit or loss, interest on capital, drawings, interest on drawings, etc. are recorded in a separate accounts, called Partner’s Current Account. The partners’ capital accounts will always show a credit balance, which shall remain the same (fixed) year after year unless there is any addition or withdrawal of capital. The partners’ current account on the other hand, may show a debit or a credit balance. Thus under this method, two accounts are maintained for each partner viz., capital account and current account, While the partners’ capital accounts shall always appear on the liabilities side in the balance sheet, the partners’ current account’s balance shall be shown on the liabilities side, if they have credit balance and on the assets side, if they have debit balance. The partner’s capital account and the current account under the fixed capital method would appear as shown below:

Partner’s Capital Account

Partner’s Current Account

Fig. 2.1: Proforma of Partner’s Capital and Current Account under Fixed Capital Method.

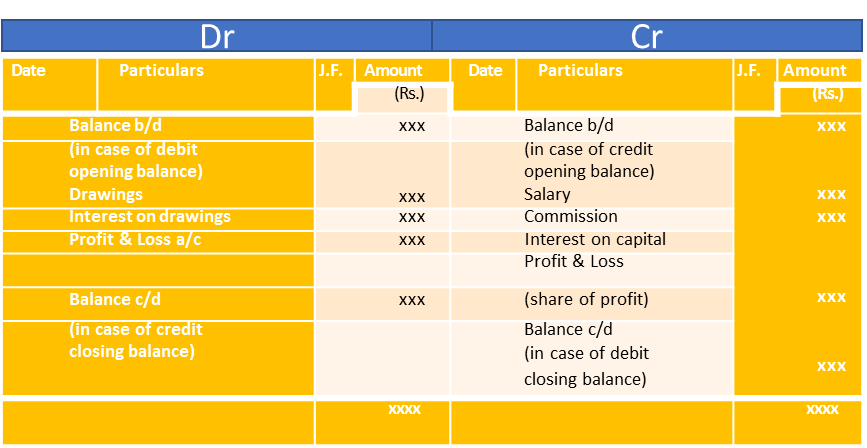

Fluctuating Capital Method: Under the fluctuating capital method, only one account, i.e. capital account is maintained for each partner. All the adjustments such as share of profit and loss, interest on capital, drawings, interest on drawings, salary or commission to partners, etc are recorded directly in the capital accounts of the partners. This makes the balance in the capital account to fluctuate from time to time. That’s the reason why this method is called fluctuating capital method. In the absence of any instruction, the capital account should be prepared by this method. The proforma of capital accounts prepared under the fluctuating capital method is given below:

Fig. 2.2: Proforma of Partner’s Capital Account under Fluctuating capital Method.

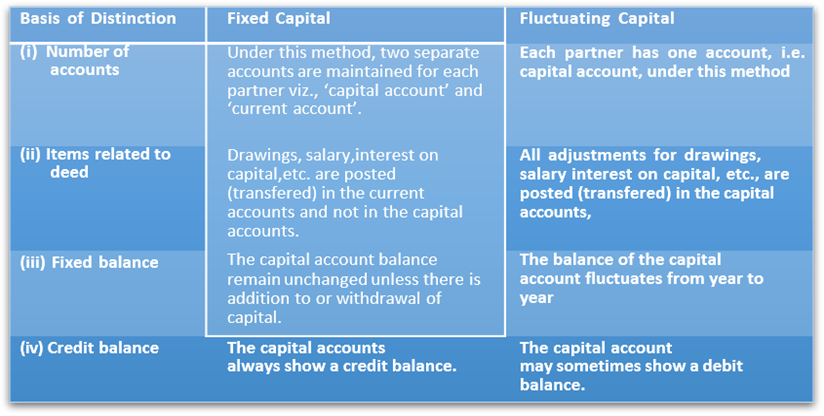

Distinction between Fixed and Fluctuating Capital Accounts

The main points of differences between the fixed and fluctuating capital methods can be summed up as follows:

Distribution of Profit among Partners

The profits and losses of the firm are distributed among the partners in an agreed ratio. However, if the partnership deed is silent, the firm’s profits and losses are to be shared equally by all the partners.

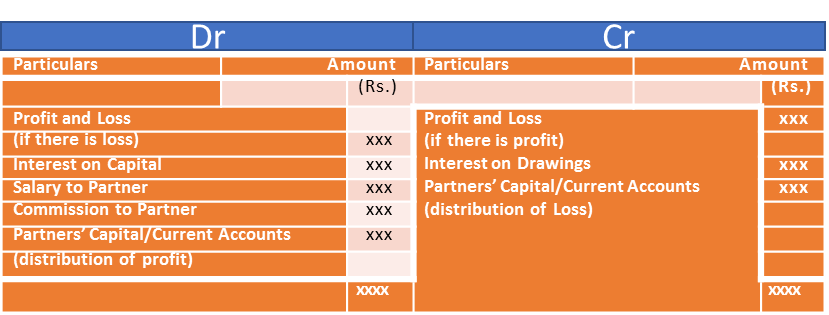

You know that in the case of sole partnership the profit or loss, as ascertained by the profit and loss account is transferred to the capital account of the proprietor. In case of partnership, however, certain adjustments such as interest on drawings, interest on capital, salary to partners, and commission to partners are required to be made. For this purpose, it is customary to prepare a Profit and Loss Appropriation Account of the firm and ascertain the final figure of profit and loss to be distributed among the partners, in their profit sharing ratio.

Profit and Loss Appropriation Account

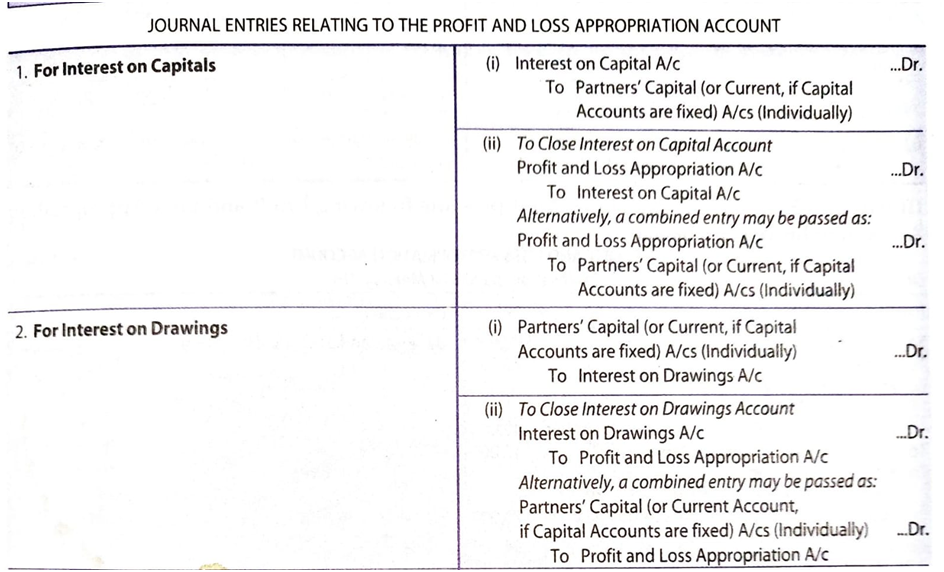

Profit and Loss Appropriation Account is merely an extension of the Profit and Loss Account of the firm. It shows how the profits are appropriated or distributed among the partners. All adjustments in respect of partner’s salary, partner’s commission, interest on capital, interest on drawings, etc. are made through this account. It starts with the net profit/net loss as per Profit and Loss Account. The journal entries for preparation of Profit and Loss Appropriation Account and making various adjustments through it are given as follows:

Journal Entries

1. Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account:

(a) If Profit and Loss Account shows a credit balance (net profit): Profit and Loss A/c Dr.

To Profit and Loss Appropriation A/c

(b) If Profit and Loss Account shows a debit balance (net loss) Profit and Loss Appropriation A/c Dr.

To Profit and Loss A/c

2. Interest on Capital:

(a) For Allowing interest on capital:

Interest on Capital A/c Dr.

To Partner’s Capital/Current A/cs (individually)

(b) For transferring interest on capital to Profit and Loss Appropriation Account: Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

3. Interest on Drawings:

(a) For charging interest on drawings to partners’ capital accounts: Partners Capital/Current A/c’s (individually) Dr.

To Interest on Drawings A/c

(b) For transferring interest on drawings to Profit and Loss Appropriation Account: Interest on Drawings A/c Dr.

To Profit and Loss Appropriation A/c

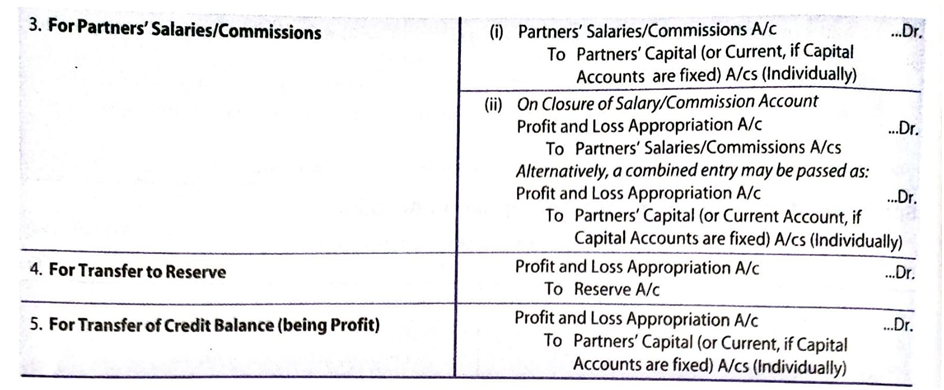

(a) For Allowing partner’s salary to partner’s capital account: Salary to Partner A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

(b) For transferring partner’s salary to Profit and Loss Appropriation Account: Profit and Loss Appropriation A/c Dr.

To Salary to Partner’s A/c

5. Partner’s Commission:

(a) For crediting commission allowed to a partner, to partner’s capital account: Commission to Partner A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

(b) For transferring commission allowed to partners to Profit and Loss Appropriation Account.

Profit and Loss Appropriation A/c Dr.

To Commission to Partners Capital/Current A/c

6. Share of Profit or Loss after appropriations:

(a) If Profit:

Profit and Loss Appropriation A/c Dr.

To Partner’s Capital/Current A/c’s (individually)

(b) If Loss:

Partner’s Capital/Current A/c (individually) To Profit and Loss Appropriation A/c

Note: In case firm suffers a loss, no interest on capital, salary, remuneration is to be allowed to partners. The Proforma of Profit and Loss Appropriation Account is given as follows:

Profit and Loss Appropriation Account

Fig. 2.3: Proforma of Profit and Loss Appropriation Account

Revision 1

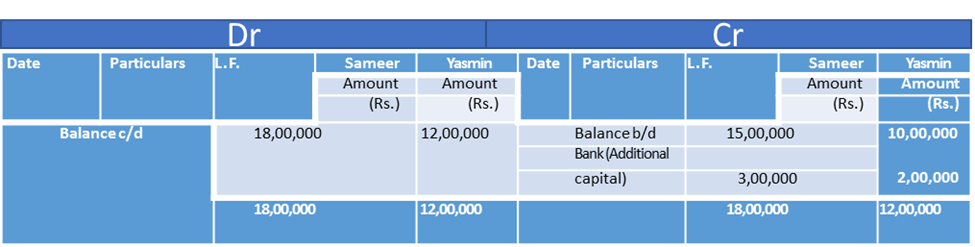

Sameer and Yasmin are partners with capitals of Rs.15,00,000 and Rs. 10,00,000 respectively. They agreed to share profits in the ratio of 3:2. Show how the following transactions will be recorded in the capital accounts of the partners in case: (i) the capitals are fixed, and (ii) the capitals are fluctuating. The books are closed on March 31, every year.

Solution

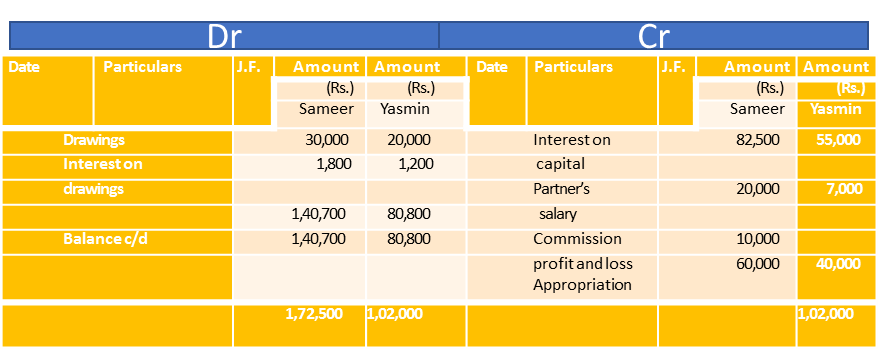

Fixed Capital Method

Partner’s Capital Accounts

Partner’s Current Accounts

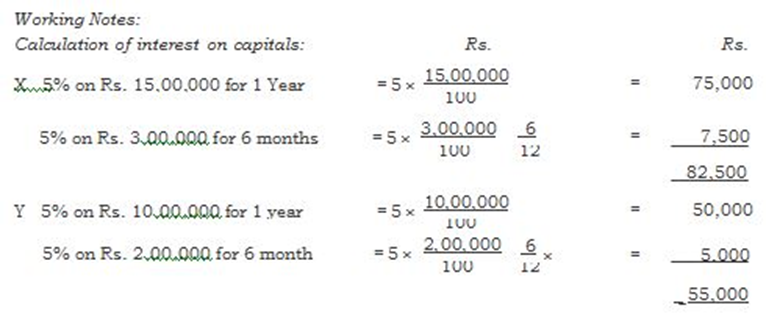

Fluctuating Capital Method

Partner’s Capital Accounts

Revision 2

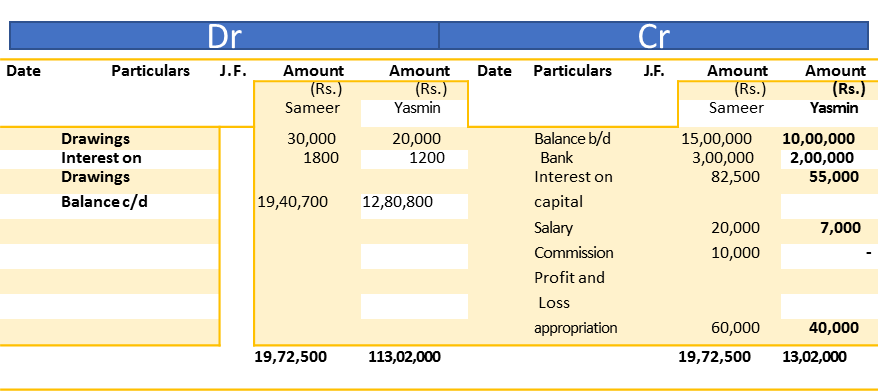

Amit, Babu and Charu set up a partnership firm on April 1, 2019. They contributed Rs. 50,000, Rs. 40,000 and Rs. 30,000, respectively as their capitals and agreed to share profits and losses in the ratio of 3 : 2 :1. Amit is to be paid a salary of Rs. 1,000 per month and Babu, a Commission of Rs. 5,000. It is also provided that interest to be allowed on capital at 6% p.a. The drawings for the year were Amit Rs. 6,000, Babu Rs. 4,000 and Charu Rs. 2,000. Interest on drawings of Rs. 270 was charged on Amit’s drawings, Rs. 180 on Babu’s drawings and Rs. 90, on Charu’s drawings. The net profit as per Profit and Loss Account for the year ending March 31, 2020 was Rs. 35,660. Prepare the Profit and Loss Appropriation Account to show the distribution of profit among the partners.

Solution

Profit and Loss Appropriation Account

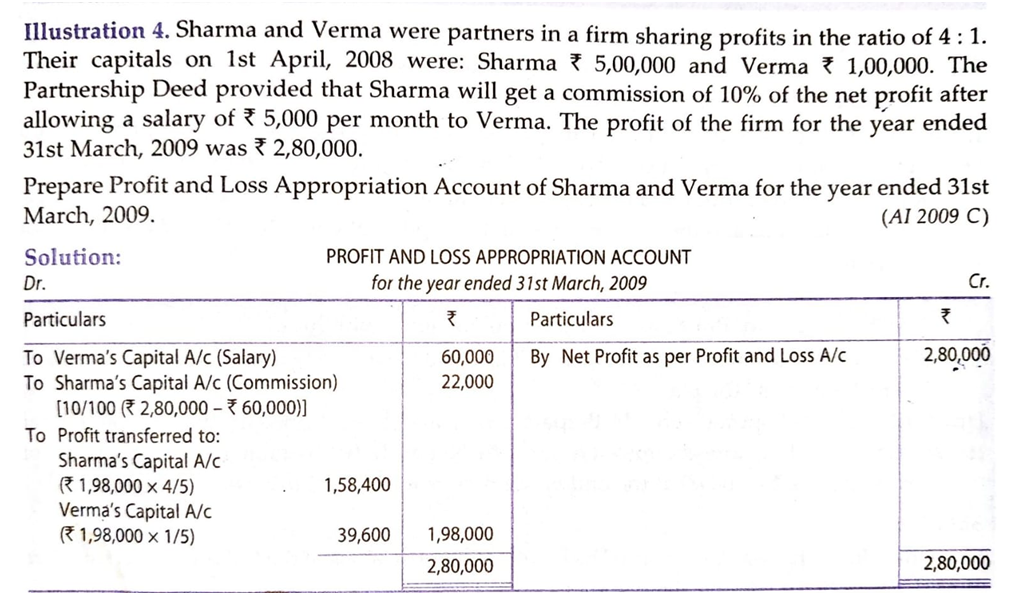

Revision 3

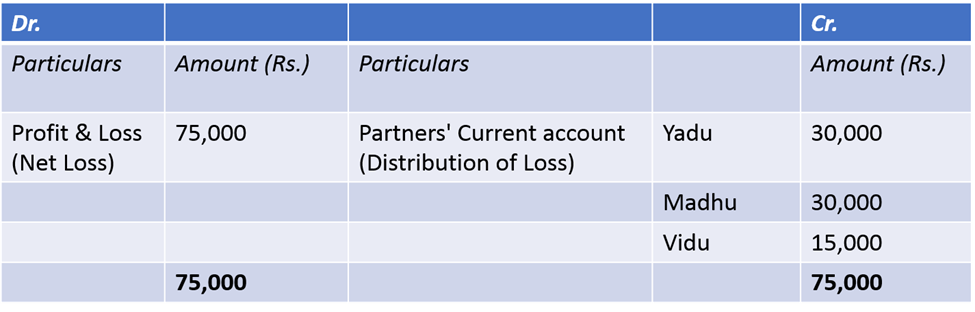

Yadu, Madhu and Vidu are partners sharing profits and losses in the ratio of 2:2:1. There fixed capitals on April 01, 2019 were; Yadu Rs. 5,00,000, Madhu Rs. 4,00,000 and Vidhu Rs. 3,50,000. As per the partnership deed, partners are entitled to interest on capital @ 5% p.a., and Yadu has to be paid a salary of Rs. 2,000 per month while Vidu would be receiving a commission of Rs. 18,000. Net loss of the firm as per profit and loss account for the year ending March 31, 2019 amounted to Rs. 75,000 on the basis of above information prepare profit and loss appropriation account. Prepare profit and loss appropriation account for the year ending March 31, 2019.

Solution

Books of Yadu, Madhu and Vidu Profit and Loss

Appropriation Account for the year ending March 31, 2019

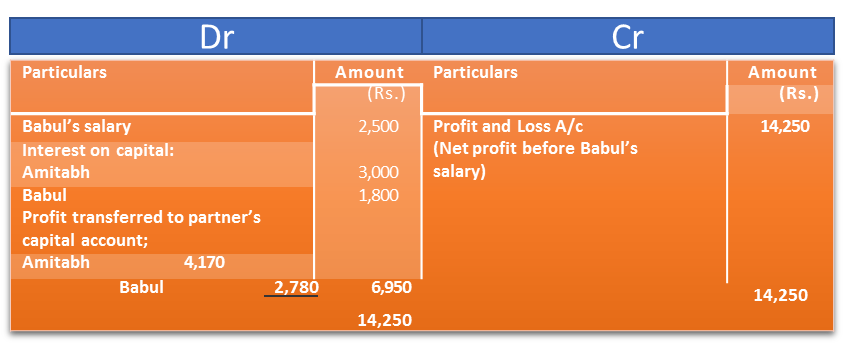

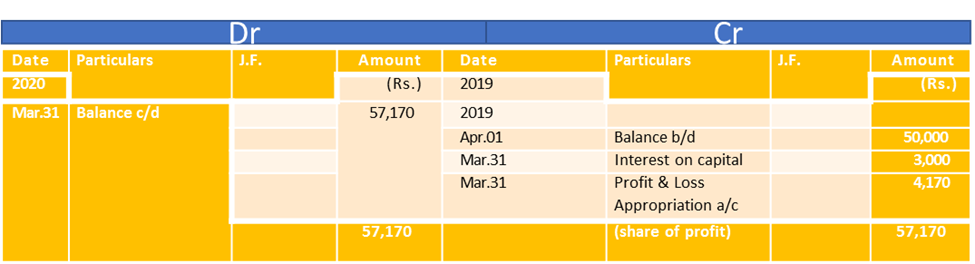

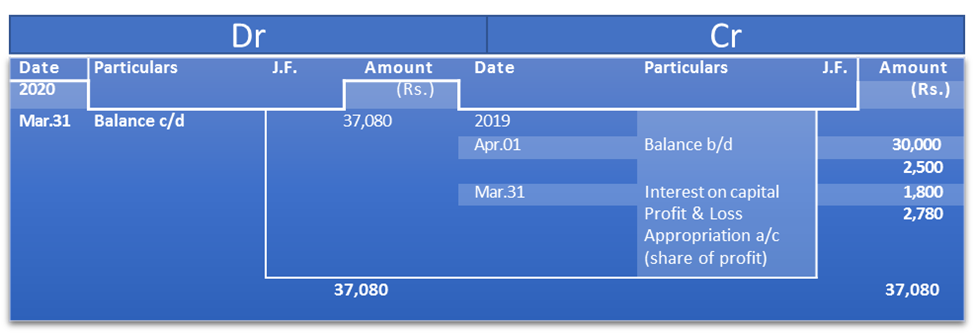

Revision 4

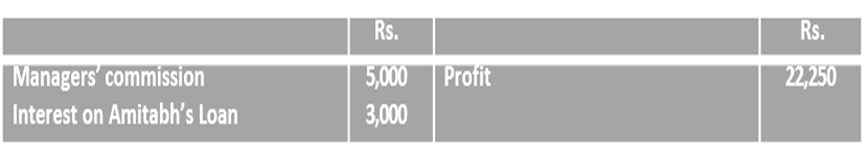

Amitabh and Babul are partners sharing profits in the ratio of 3:2, with capitals of Rs. 50,000 and Rs. 30,000 respectively. Interest on capital is agreed @ 6% p.a. Babul is to be allowed an annual salary of Rs. 2,500. Manager is to be allowed commission Rs. 5,000. Amitabh has also given a Loan on April 01, 2019 of Rs. 50,000 to the firm without any agreement. During the year 2019-20, the profits earned is Rs. 22,250. Prepare Profit and Loss Appropriation account showing the distribution of profit and the partners’ capital accounts for the year ending March 31, 2020.

Solution

Amitabh’s Capital Account

Babul’s Capital Account

Working Notes:

Profit and Loss Account

Interest on Capital

No interest is allowed on partners’ capitals unless it is expressly agreed among the partners. When the Deed specifically provides for it, interest on capital is credited to the partners at the agreed rate with reference to the time period for which the capital remained in business during a financial year. Interest on capital is generally provided for in two situations: (i) when the partners contribute unequal amounts of capitals but share profits equally, and (ii) where the capital contribution is same but profit sharing is unequal. Interest on capital is calculated with due allowance for any addition or withdrawal of capital during the accounting period. For example, Mohini, Rashmi and Navin entered into partnership, bringing in Rs. 3,00,000, Rs. 2,00,000 and Rs. 1,00,000 respectively into the business. They decided to share profits and losses equally and agreed that interest on capital will be provided to the partners @10 per cent per annum. There was no addition or withdrawal of capital by any partner during the year. The interest on capital works out to Rs. 30,000 (10% on 30,000) for Mohini, Rs. 20,000 (10% on 2,00,000) for Rashmi, and Rs.10,000 (10% on 1,00,000) for Navin.

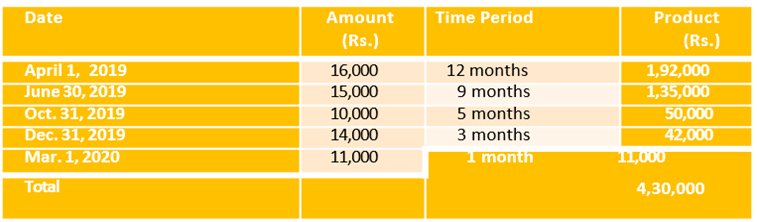

Take another case of Mansoor and Reshma who are partners in a firm and their capital accounts showed the balance of Rs. 2,00,000 and Rs. 1,50,000 respectively on April 1, 2019. Mansoor introduced additional capital of Rs. 1,00,000 on August 1, 2019 and Reshma brought in further capital of Rs. 1,50,000 on October 1, 2019. Interest is to be allowed @ 6% p.a. on the capitals. It shall be worked as follows:

Rs. 2,00,000 × 6/100 + Rs. 1,00,000 × 6/100 × 8

For Mansoor

= Rs. 12,000 + Rs. 4,000 = Rs. 16,000

For Reshma

= Rs. 1,50,000 × 6/100 + Rs. 1,50,000 × 6/100 × 6/12

= Rs. 9,000+Rs. 4,500= Rs. 13,500

When there are both addition and withdrawal of capital by the partners during a financial year, the interest on capital is calculated as follows:

(i) On the opening balance of the capital accounts of partners, interest is calculated for the whole year;

(ii) On the additional capital brought in by any partner during the year, interest is

calculated from the date of introduction of additional capital to the last day of the financial year.

(iii) In case of withdrawal of capital, interest on capital will be calculated as:

On opening capital from the beginning of the year till date of capital withdrawn and then on the reduced capital for the remaining time period. Alternatively, it can be calculated with respect of amount remained in business for the relevant period.

Revision 5

Saloni and Srishti are partners in a firm. Their capital accounts as on April 01. 2019 showed a balance of Rs. 2,00,000 and Rs. 3,00,000 respectively. On July 01, 2019, Saloni introduced additional capital of Rs. 50,000 and Srishti, Rs. 60,000. On October 01 Saloni withdrew Rs.

30,000, and on January 01, 2020 Srishti withdraw, Rs. 15,000 from their capitals. Interest is allowed @ 8% p.a. Calculate interest payable on capital to both the partners during the financial year 2019–2020.

Solution

Statement Showing Calculation of Interest on Capital :

For Saloni

(Rs.)

Interest on Rs. 2,00,000 for 3 months = Rs.2, 00, 000 × 8 × 3/100 × 12 = 4,000

Add : Interest on Rs. 2,50,000 for 3 months = Rs.2, 50, 000 × 8 × 3/100 × 12 = 5, 000

Add : Interest on Rs. 2,20,000 for 6 months = Rs.2, 20, 000 × 6/12 × 8/100 = 8,800

Total - 17,800

For Srishti

(Rs.)

Interest on Rs. 3,00,000 for 3 months = Rs.3, 00, 000 × 3/12 × 8/100 = 6,000

Add : Interest on Rs. 3,60,000 for 6 months = Rs.3, 60, 000 × 8/100 × 6/12 = 14, 400

Add : Interest on Rs. 2,20,000 for 3 months = Rs.3, 45, 000 × 8/100 × 3/12 = 300

Sometimes opening capitals of partners may not be given. In such a situation before calculation of interest on capital the opening capitals will have to be worked out with the help of partners’ closing capitals by marking necessary adjustments for the additions and withdrawal of capital, drawings, share of profit or loss, if already shown in the capital accounts the partners.

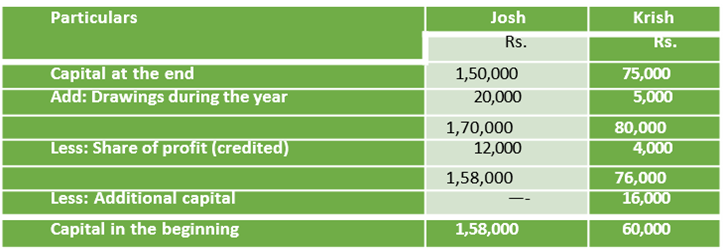

Revision 6

Josh and Krish are partners sharing profits and losses in the ratio of 3:1. Their capitals at the end of the financial year 2015-2016 were Rs. 1,50,000 and Rs. 75,000. During the year 2015-2016, Josh’s drawings were Rs. 20,000 and the drawings of Krish were Rs. 5,000, which had been duly debited to partner’s capital accounts. Profit before charging interest on capital for the year was Rs. 16,000. The same had also been debited in their profit sharing ratio. Krish had brought additional capital of Rs. 16,000 on October 1, 2015. Calculate interest on capital @ 12% p.a. for the year 2015-2016.

Solution

Statement Showing Calculation of Capital at the Beginning

Interest on capital will be as 18,960 (12% of Rs. 1,58,000) for Josh and Rs. 960 for krish calculated as follows:

(Rs. 60,000 × 12/ 100) + ( Rs. 16,000 × 12/100 × 6/12) = Rs. 7,200 + Rs. 960 = Rs. 8,160.

As clarified earlier, the interest on capital is allowed only when the firm has earned profit during the accounting year. Hence, no interest will be allowed during the year the firm has incurred net loss and if in a year, the profit of the firm is less than the amount due to the partners as interest on capital, the payment of interest will be restricted to the amount of profits. In that case, the profit will be effectively distributed in the ratio of interest on capital of each partner.

Revision 7

Anupam and Abhishek are partners sharing profits and losses in the ratio of 3 : 2. Their capital accounts showed balances of Rs. 1,50,000 and Rs. 2,00,000 respectively on April 01, 2019. Show the calculation of interest on capital for the year ending December 31, 2020 in each of the following alternatives:

(a) If the partnership deed is silent as to the payment of interest on capital and the profit for the year is Rs. 50,000;

(b) If partnership deed provides for interest on capital @ 8% p.a. and the

firm incurred a loss of Rs. 10,000 during the year;

(c) If partnership deed provides for interest on capital @ 8% p.a. and the firm earned a profit of Rs. 50,000 during the year;

(d) If the partnership deed provides for interest on capital @ 8% p.a. and the firm earned a profit of Rs. 14,000 during the year.

Solution

(a) In the absence of a specific provision in the Deed, no interest will be paid on the capital to the partners. The whole amount of profit will however be distributed among the partners in their profit sharing ratio.

(b) As the firm has incurred losses during the accounting year, no interest on capital

will be allowed to any partner. The firm’s loss will however be shared by the partners in their profit sharing ratio.

Rs.

(c) Interest to Anupam @ 8% on Rs. 1,50,000 = 12,000

Interest to Abhishek @ 8% on Rs. 2,00,000 = 16,000

= 28,000

As the profit is sufficient to pay interest at agreed rate, the whole amount of interest on capital shall be allowed and the remaining profit amounting to Rs. 22,000 (Rs. 50,000 – Rs. 28,000) shall be shared by the partners in their profit sharing ratio.

(d) As the profit for the year is Rs. 14,000, which is less than the amount of interest on capital due to partners, i.e. Rs. 28,000 (Rs. 12,000 for Anupam and Rs. 16,000 for Abhishek), interest will be paid to the extent of available profit i.e., Rs. 14,000. Anupam and Abhishek will be credited with Rs. 6,000 and Rs. 8,000, respectively. Effectively this amounts to sharing the firm’s profit in the ratio of interest on capital, i.e., 3:4.

Interest on Drawings

The partnership agreement may also provide for charging of interest on money withdrawn out of the firm by the partners for their personal use. As stated earlier, no interest is charged on the drawings if there is no express agreement among the partners about it. However if the partnership deed so provides for it, the interest is charged at an agreed rate, for the period for which drawings have been made. Remained outstanding from the partners during an accounting year. Charging interest on drawings discourages excessive amounts of drawings by the partners. The calculation of interest on drawings under different situations is shown as here under.

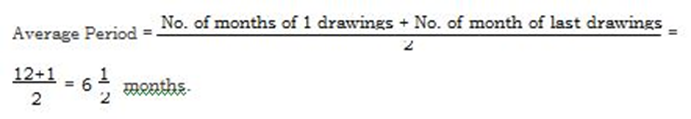

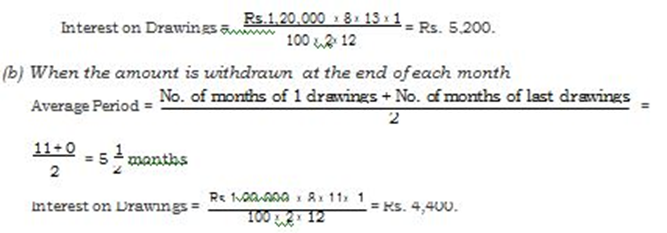

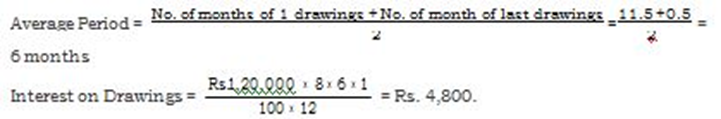

When Fixed Amounts was Withdrawn Every Month

Many a time, a fixed amount of money is withdrawn by the partners, at equal time interval, say each month or each quarter. While calculating the time period, attention must be paid to whether the fixed amount was withdrawn at the beginning (first day) of the month, middle of the month or at the end (last day) of the month. If withdrawn on the first day of every month, interest on total amount will be calculated for 6½ months; if withdrawn at the end at every month, it will be calculated for 5½ months, and if withdrawn during the middle of the month, it will be calculated for 6 months.

Suppose, Aashish withdrew Rs. 10,000 per month from the firm for his personal use during the year ending March 31, 2017. The calculation of average period and the interest on drawings, in different situations would be as follows:

(a) When the amount is withdrawn at the beginning of each month:

(c) When money is withdrawn in the middle of the month

When money is withdrawn in the middle of the month, nothing is added or deduced from the total period.

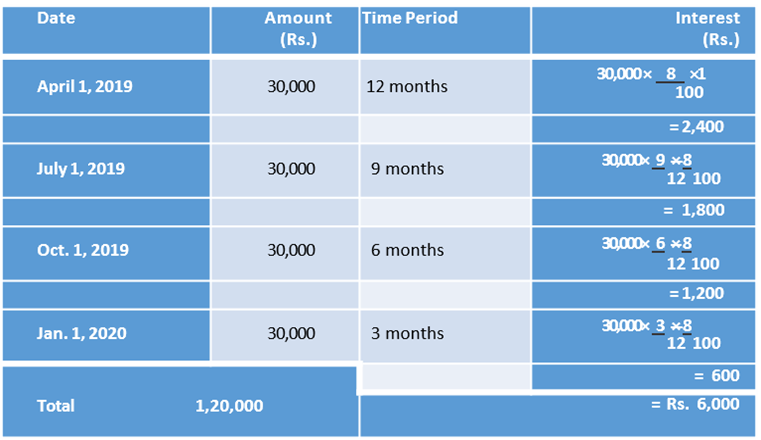

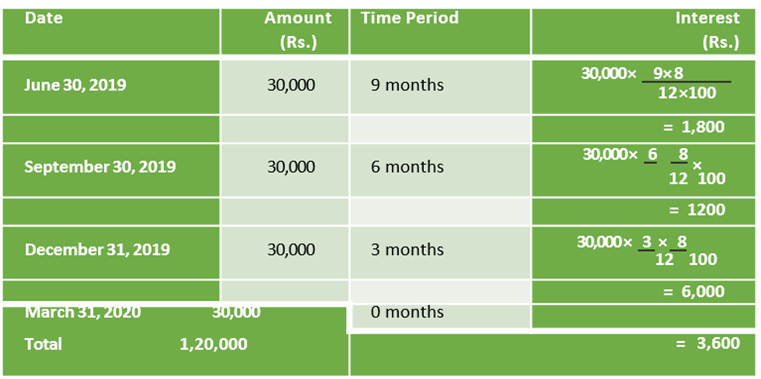

When Fixed Amount is withdrawn Quarterly

Suppose Satish and Tilak are partners in a firm, sharing profits and losses equally. During financial year 2016–2017, Satish withdrew Rs. 30,000 quarterly. If interest is to be charged on drawings @ 8% per annum, the calculation of average period and interest on drawings will be as follows:

(a) If the amount is withdrawn at the beginning of each quarter

Statement Showing Calculation of Interest on Drawings

Rs. 1,20,000 × 8/100 × 15/2 × 1/12 = Rs 6, 000

(b) If the amount is withdrawn at the end of each quarter

Statement Showing Calculation of Interest on Drawings

Alternatively, the interest can be calculated on the total amount withdrawn during the accounting year, i.e., Rs. 1,20,000 for a period of 4½ months

(9 + 6 + 3 + 0)/4 months as follows: = Rs. 1,20,000 × 8/100 × 9/2 × 1/12 = 3, 600.

When Varying Amounts are Withdrawn at Different Intervals

When the partners withdraw different amounts of money at different time intervals, the interest is calculated using the product method. Under the product method, for each withdrawal, the money withdrawn is multiplied by the period (usually expressed in months) for which it remained withdrawn during the financial year. The period is calculated from the date of the withdrawal to the last day of the accounting year. The products so calculated are totalled on the total of the products interest at the specified rate is calculated as under:

Total of products × Rate × 1/12

For example, Shahnaz withdrew the following amounts from her firm, for personal use during the year ending March 31, 2017. Calculate interest on drawings by product method, if the rate of interest to be charged is 7 per cent per annum

Calculation of interest on drawings will be as follows:

Interest = Sum of Products × Rate × 1/12 = 4, 50, 000 × 7/100 × 1/12 = 30100/12 = Rs 2, 508 (approx).

Revision 8

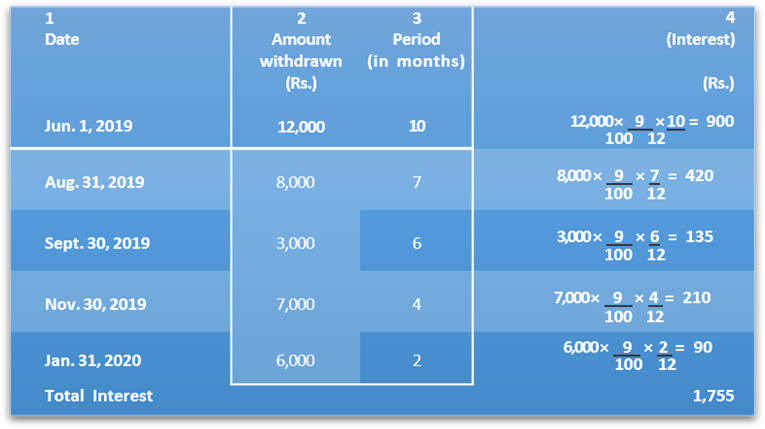

John Ibrahm, a partner in Modern Tours and Travels withdrew money during the year ending March 31, 2020 from his capital account, for his personal use. Calculate interest in drawings in each of the following alternative situations, if rate of interest is 9 per cent per annum.

(a) If he withdrew Rs. 3,000 per month at the beginning of the month.

(b) If an amount of Rs. 3,000 per month was withdrawn by him at the end of each month.

(c) If the amounts withdrawn were : Rs. 12,000 on June 01, 2019, Rs. 8,000; on August 31, 2019, Rs. 3,000; on September 30, 2019, Rs. 7,000, on November 30, 2019, and Rs. 6,000 on January 31, 2020.

Solution

(a) As a fixed amount of Rs. 3,000 per month is withdrawn at the beginning of the month, interest on drawings will be calculated for an average period of

(b) As the fixed amount of Rs. 3,000 per month is withdrawn at the end of each month, interest on drawings will be calculated for an average period of

= Rs.36,000 ×9 ×11×1 = Rs. 1,485

100×2×12

(c) Statements showing Calculation of Interest on Drawings

Revision 9

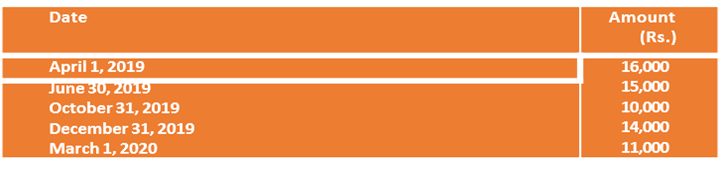

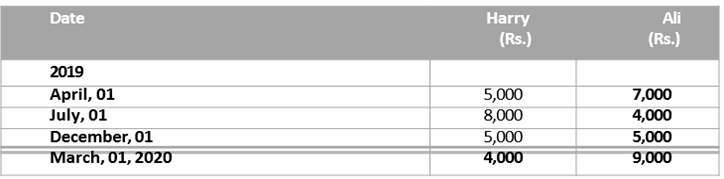

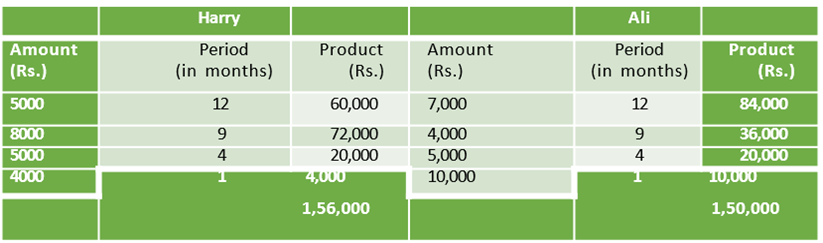

Manu, Harry and Ali are partners in a firm sharing profits and losses equally. Harry and Ali withdrew the following amounts from the firm, for their personal use during 2019-2020.

Calculate interest on drawings if the rate of interest to be charged is 10 per cent, and the books are closed on December 31 every year.

Statement Showing Calculation of Interest on Drawings

Amount of Interest

Mannu = Rs 1,56,000 x 10 x 1/100 x 12 = Rs 1, 300

Ali = Rs 1, 50, 000 x 10 x 1/ 100 x 12 = Rs 1, 250

When Dates of Withdrawal are not specified

Rs 60, 000 x 8 x 6/100 x 12 = Rs 2, 400

Rs 60, 000 × 8 × 6/100 × 12 = Rs 2, 400

2. Maintenance of capital accounts, Distribution of profit among the partners

MAINTENANCE OF CAPITAL ACCOUNTS& DISTRIBUTION OF PROFITS AMONG THE PARTNERS

To record the changes in Capital A/c of each partner, we prepare individual capital accounts for each partner. The capital accounts of partners can be maintained in two methods :

Fixed Capital Method

Fluctuating Capital Method

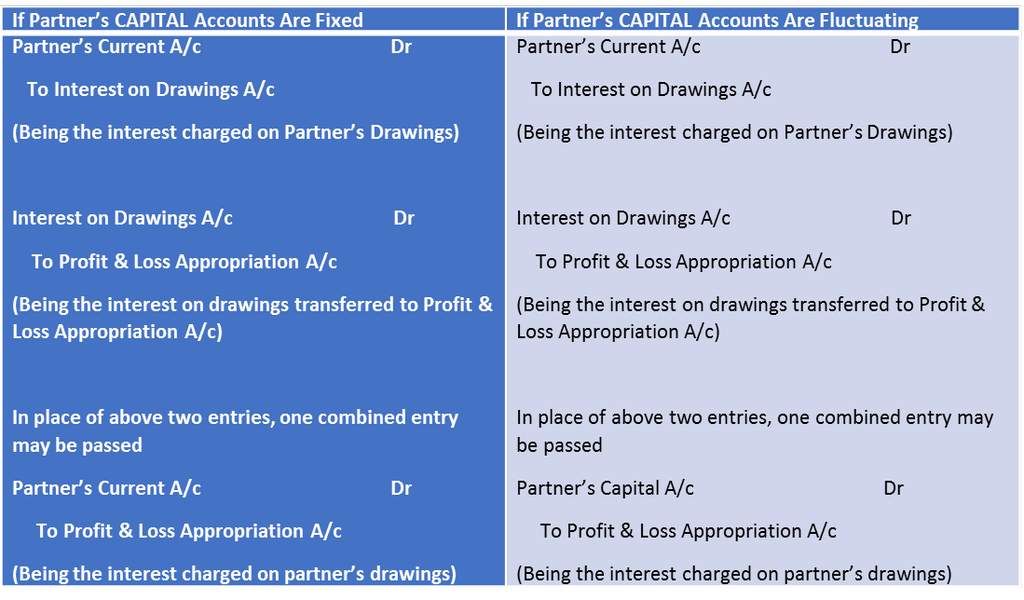

- Fixed Capital Method – In this method, the capital A/c of partners remains unaltered or fixed. When this method is followed, two accounts i.e. Capital A/c & Current A/c for each partner are maintained.

- Capital A/c – The capital account remains unaltered i.e. fixed unless additional capital is introduced or withdrawal is made from the existing capital. If there is no fresh capital introduced or any withdrawals, the capital account of the partner show the same balance year after year.

- Current A/c – It is prepared to record transactions other than introduction & withdrawal of capital such as interest on capital, interest on drawings, salary or commission to a partner, and share of profits/losses. The balance of current account always keeps fluctuating because of these adjustments.

Current A/c is debited with;

- Drawings made by partner

- Interest on drawings

- Share of loss

- Transfer of amount to any capital account permanently

Current A/c is credited with;

- Interest on capital

- Salary or commission

- Share of profits

- Transfer of any amount from capital account permanently

- Fluctuating Capital A/c – Under Fluctuating Capital method, only one account namely Capital A/c is maintained for each partner. All the transactions of a partner like salary, commissions, interest on capital are recorded in this account. As a result of this, the capital a/c fluctuates with every transaction. The debit balance of capital account is shown in the liabilities side & the credit balance is shown in the asset side.

INTEREST ON DRAWNGS

- Drawings refers to the amount withdrawn by the owner in cash or in kind.

- Interest on drawings is charged only when it is mentioned in the partnership deed.

- When it is charged, it is debited to Profit & Loss Appropriation A/c.

- It is either debited to Partner’s Capital A/c or Current A/c depending on whether Fixed Capital or Fluctuating Capital method is being followed

INTEREST ON DRAWINGS : - HOW IT IS CALCULATED?

- The computation of Interest on Drawings depends upon various factors like when the amount is withdrawn & the time period for which it remains withdrawn etc.

- So, the situations can be as follows;

- Fixed amount is withdrawn at the BEGINNING of every Month

If a partner withdraws fixed amount in the beginning of every month, interest is charged on the whole amount for 6 ½ months

Interest on Drawings = Total Drawings X Rate of Interest X 6 ½ 100 12

6 ½ months = Average Period

Average Period Formula = Time left after first drawings + Time left after last drawings 2

- Average period should be used only when the amount of Drawings is uniform & the time interval between the two consecutive drawings is also uniform.

- Fixed amount is withdrawn at the END of every Month.

If a partner withdraws a fixed amount at the end of every month, interest is charged for 5 ½ months.

Interest on Drawings = Total Drawings X Rate of Interest X 5 ½ 100 12

- Fixed amount is withdrawn in the MIDDLE of every Month

Interest on Drawings = Total Drawings X Rate of Interest X 6 100 12

- Fixed amount is withdrawn at the BEGINNING of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 7 ½ 100 12

- Fixed amount is withdrawn in the MIDDLE of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 6 100 12

- Fixed amount is withdrawn at the END of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 4 ½ 100 12

- Fixed amount is withdrawn during 6 MONTHS

- At the BEGINNING OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3 ½

100 12

- In the MIDDLE OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3

100 12

- At the END OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3 ½

100 12

- If Unequal amount is withdrawn at DIFFERENT DATES, interest on drawings is calculated on the basis of the Simple Method or Product Method

Interest on Drawings = Total of Product X Rate of Interest x 1 or 1 100 12 365

- When the date of withdrawal IS NOT GIVEN, the interest on drawings is calculated for six months on an average basis.

- When Rate of Interest is given without the word PER ANNUM, interest is charged without considering the time factor

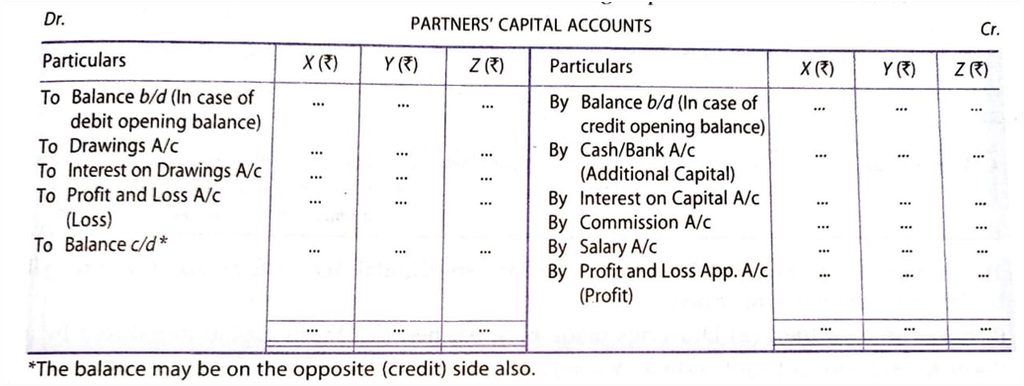

Journal Entries to Record Interest on Drawings

Salary or Commission to Partners

- Salary or commission to partners is paid only when it is allowed in Partnership Deed

- It is an appropriation of profit & not charge against the profit so it should be allowed only when profit is earned

- Commission may be allowed to the partners either

- As a percentage of profit before charging such commission

Net Profit (before Commission) x Rate of commission

100

or

- As a percentage of profit after charging such commission

Net profit (before commission) x Rate of Commission

100+Rate of Commission

Accounting Treatment:-

Partner’s Salaries/ Commission A/c Dr

To Partner’s Current A/c (When capitals are fixed)

To Partner’s Capital A/c (When capitals are fluctuating)

Profit & Loss Appropriation A/c Dr

To Partner’s salaries/commission A/c

Interest on Partner’s Loan to the Firm

- If a partner apart from investing share capital, advances any loan to the firm then he is entitled to receive interest even in the absence of an agreement/deed.

- In the absence of an agreement/deed, the minimum rate of interest on loan to be paid to the partner is 6% p.a.

- Interest on loan is a charge against profit & it is transferred to the debit of Profit/Loss A/c & not to the debit of Profit/Loss Appropriation A/c

- Journal Entries

- Interest on partner’s loan A/c Dr

To Partner’s Loan A/c

- Profit & Loss A/c Dr

To Interest on partner’s loan A/c

3. Guarantee of profit to a partner, Past adjustments, Final accounts

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Guarantee of Profit to a Partner

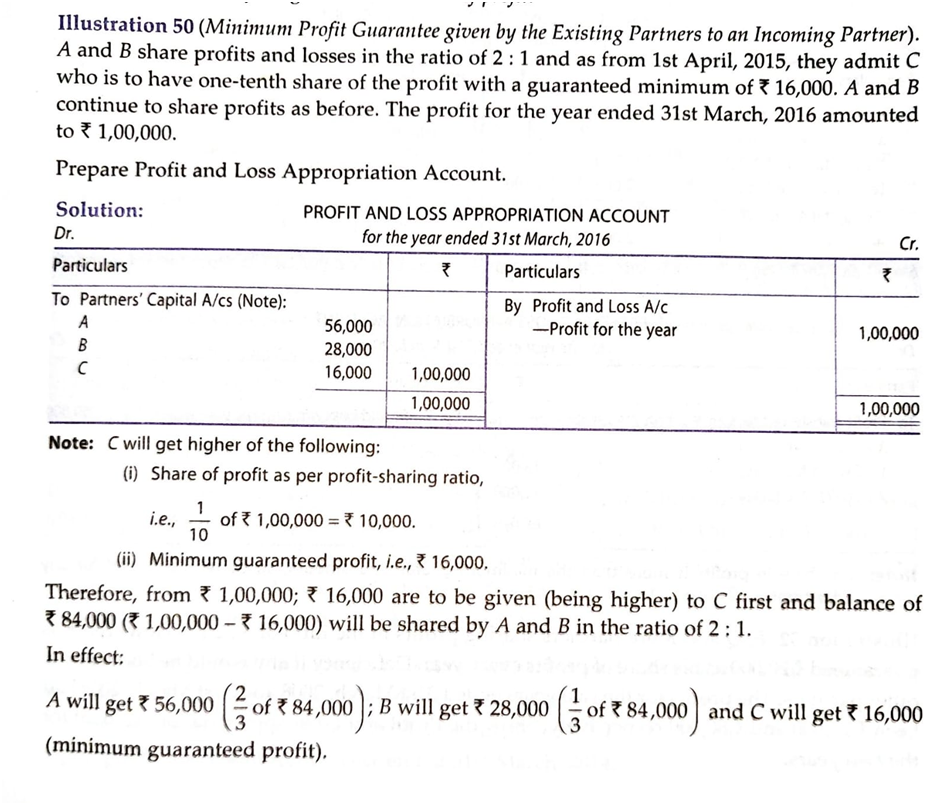

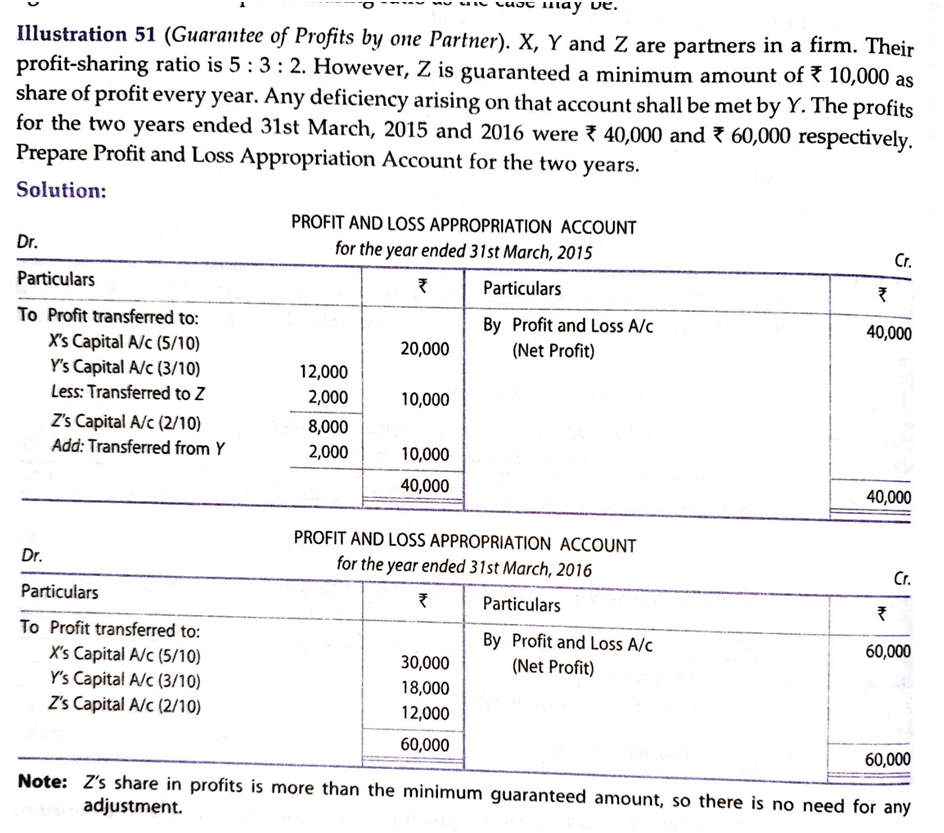

Sometimes a partner is admitted into the firm with a guarantee of certain minimum amount by way of his share of profits of the firm. Such assurance may be given by all the old partners in a certain ratio or by any of the old partners, individually to the new partner. The minimum guaranteed amount shall be paid to such new partner when his share of profit as per the profit sharing ratio is less than the guarnteed amount. For example, Madhulika and Rakshita, who are partners in a firm decide to admit Kanishka into their firm, giving her the guarantee of a minimum of Rs.25,000 as her share in firm’s profits. The firm earned a profit of Rs.1,20,000 during the year and the agreed profit sharing ratio between the partners is decided as 2:3:1. As per this ratio, Madhulika’s share in profit comes to Rs.40,000 (2/6 of Rs. 1,20,000); Rakshita, Rs. 60,000 (3/6 of Rs. 1,20,000) and Kanishka Rs. 20,000 (1/6 of Rs. 1,20,000). The share of Kanishka works out to be Rs.5,000 short of the guaranteed amount. This shall be borne by the guaranteeing partners Madhulika and Rakshita in their profit sharing ratio, which in this case is 2:3, Madhulika’s share in the deficiency comes to Rs.2,000 (2/5 of Rs. 5,000), and that of Rakshita Rs.3,000. The total profit of the firm will be distributed among the partners as follows Madhulika will get Rs.38,000 (her share 40,000 minus share in deficiency Rs.2,000); Rakshita Rs.57,000 (60,000–3,000) and Kanishka Rs. 25,000 (Rs. 20,000 + Rs. 2,000 + Rs. 3,000).

If only one partner gives the guarantee, say in the above case, only Rakshita gives the guarantee, the whole amount of deficiency (Rs.5,000) will be borne by her only. In that case profit distribution will be Madhulika Rs.40,000, Rakshita Rs. 55,000 (60,000–5,000) and Kanishka Rs. 25,000 (Rs. 20,000 + Rs. 5,000).

Revision 10

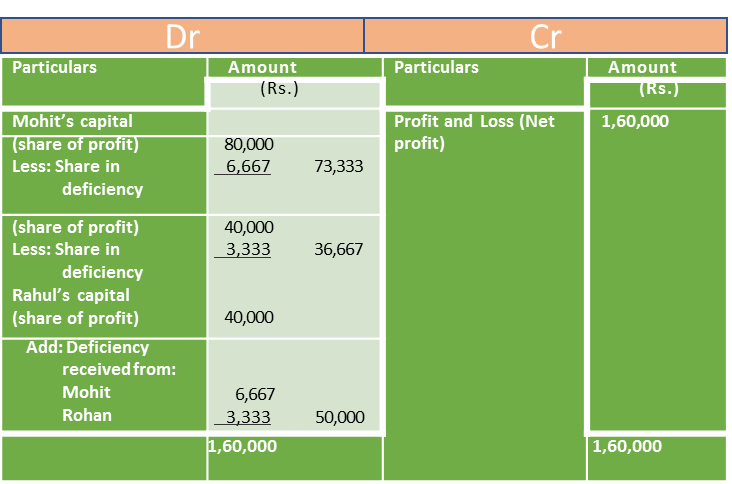

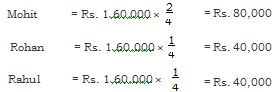

Mohit and Rohan share profits and losses in the ratio of 2:1. They admit Rahul as partner with 1/4 share in profits with a guarantee that his share of profit shall be at least Rs. 50,000. The net profit of the firm for the year ending March 31, 2015 was Rs. 1,60,000. Prepare Profit and Loss Appropriation Account.

Solution

Books of Mohit, Rohit and Rahul Profit and Loss Appropriation Account for the year ending .....

Working Notes:

The new profit sharing ratio after admission of Rahul comes to 2:1:1. As per this ratio the share of partners in the profit comes to:

But, since Rahul has been given a guarantee of minimum of Rs. 50,000 as his share of profit. The deficiency of Rs. 10,000 (Rs. 50,000 – Rs. 40,000) shall be borne by Mohit and Rohan in the ratio in which they share profits and losses between themselves, viz. 2:1 as follows:

Mohit’s share in deficiency comes to 2/3 × Rs. 10,000 = Rs. 6,667

The new partner Rahul’s share is 1/4 The remaining profit is 1 – 1/4 = 3/4, to be shared between Mohit and Rohan in the ratio of 2:1.

Mohit’s new share = 3/4 × 2/3 = 2/4

Rohan’s new share = 3/4 × 1/3 = 1/4

Thus, New profit sharing ratio comes to be 2/4 : 1/4 : 1/4 or 2 : 1: 1

Revision 11

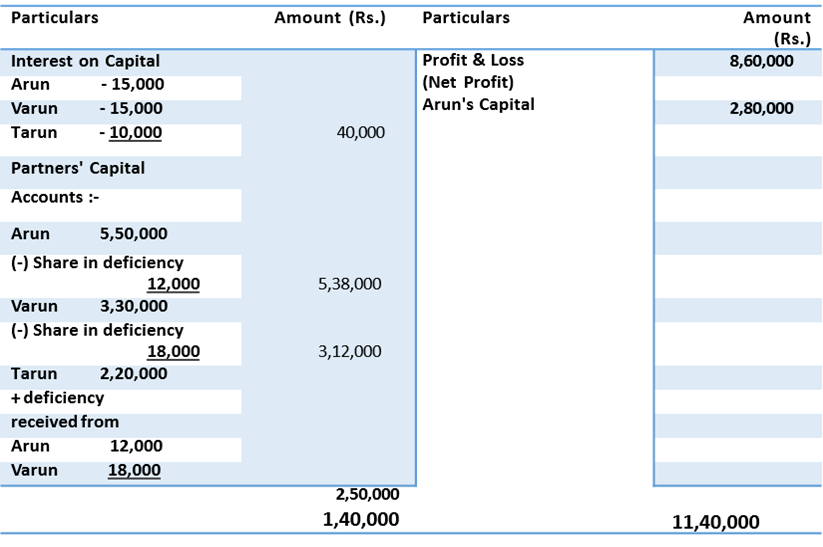

(i) Arun, Varun and Tarun were partners of a law firm sharing profits in the ratio of 5:3:2. Their partnership deed provided the following: (i) Interest on partners' capital @ 5% p.a.

(ii) Arun guaranteed that he would earn a minimum annual fee of Rs.6,00,000 for the firm.

(iii) Tarun was guaranteed a profit of Rs. 2,50,000 (excluding interest on capital) and any deficiency on account of this was to be borne by Arun and Varun in the ratio of 2:3.

During the year ending March 31, 2019, Arun earned a fee of Rs. 3,20,000 and net profits earned by the firm were Rs. 8,60,000. Partner's capital on April 01, 2018 were Arun - Rs. 30,00,000; Varun - Rs. 3,00,000 and Tarun- Rs. 2,00,000.

Prepare Profit and Loss Appropriation account and show your workings clearly.

Solution

Books of Arun, Varun and Tarun Profit and Loss Appropriation Account for the year ending March 31, 2019

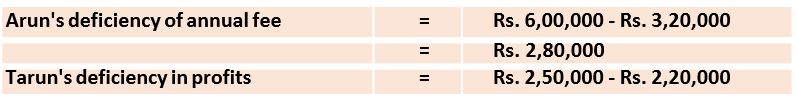

Working Notes :-

Rs. 30,000 to be borne by Arun & Varun in the ratio of 2:3 i.e. Rs. 12,000

and Rs. 18,000 respectively.

Revision 12

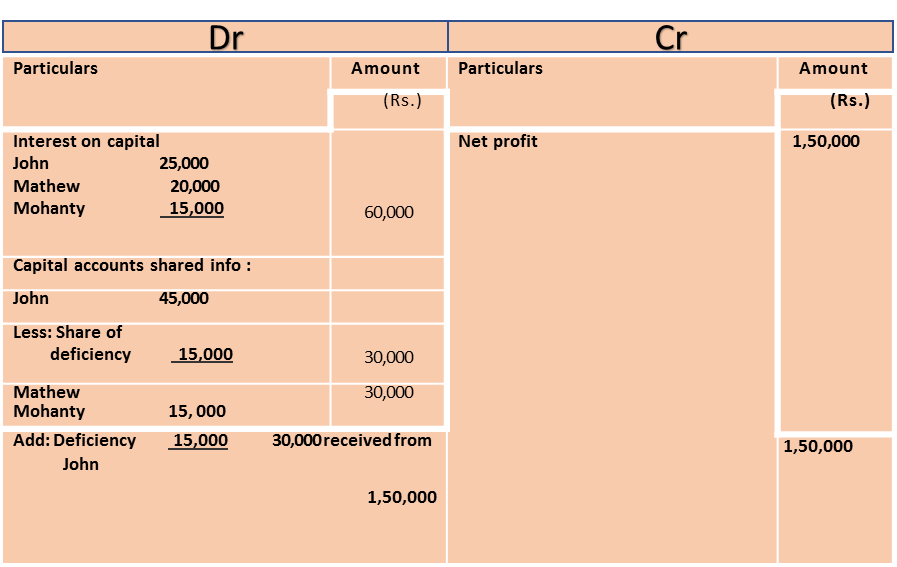

John and Mathew share profits and losses in the ratio of 3:2. They admit Mohanty into their firm to 1/6 share in profits. John personally guaranteed that Mohanty’s share of profit, after charging interest on capital @ 10 per cent per annum would not be less than Rs. 30,000 in any year. The capital provided was as follows: John Rs. 2,50,000, Mathew Rs. 2,00,000 and Mohanty Rs. 1,50,000. The profit for the year ending March 31,2015 amounted to Rs. 1,50,000 before providing interest on capital. Show the Profit & Loss Appropriation Account if new profit sharing ratio is 3:2:1.

Solution

Books of John and Mathew

Profit and Loss Appropriation Account for the year ending....

Working Notes:

Profit after interest on capital is Rs. 90,000, which is to be distributed in the ratio of 3:2:1 as follows: John gets Rs. 45,000 (3/6 × Rs. 90,000), Mathew Rs. 30,000, Mohanty Rs. 15,000. Deficiency of Mohanty from the guaranteed profit of Rs. 15,000 will be borne by John. John will therefore get Rs. 45,000 – Rs. 15,000 = Rs. 30,000, Mathew Rs. 30,000 and Mohanty Rs. 30,000.

Revision 13

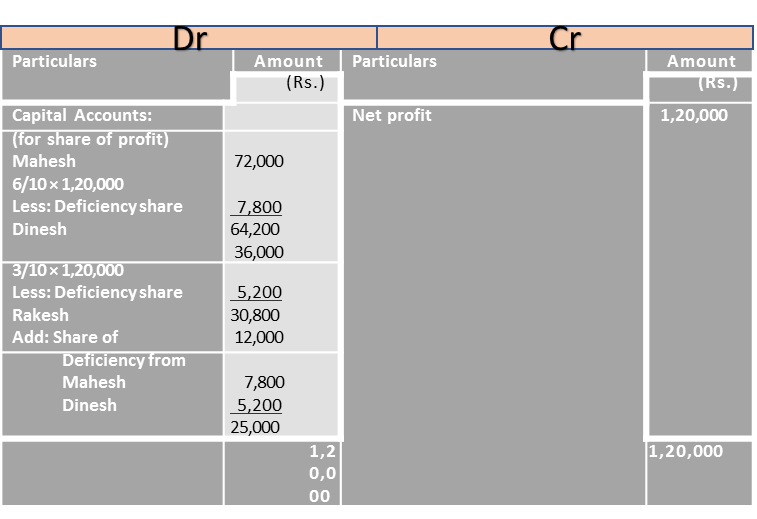

Mahesh and Dinesh share profits and losses in the ratio of 2:1. From January 01, 2014 they admit Rakesh into their firm who is to be given a share of 1/10 of the profits with a guaranteed minimum of Rs. 25,000. Mahesh and Dinesh continue to share profits as before but agree to bear any deficiency on account of guarantee to Rakesh in the ratio of 3:2 respectively. The profits of the firm for the year ending December 31, 2015 amounted to Rs. 1,20,000. Prepare Profit and Loss Appropriation Account.

Books of Mahesh and Dinesh Profit and Loss

Appropriation Account for the year ending .....

New profit sharing Ratio will be calculated as follows:

Rakesh to share 1/10 of the profit. The remaining profit 9/10 will be shared by Mahesh and Dinesh in the ratio of 2:1.

Mahesh’s share in profit will be 2/3 × 9/10 = 3/10

Dinesh’s share will be 1/3 × 9/10 = 3/10

The New ratio becomes 3/5 : 3/10 : 1/10 or 6:3:1

Mahesh’s share in profit = 1,20,000 × 6/10 = Rs. 72,000,

Dinesh’s share in profit = Rs. 36,000,

Rakesh’s share in profit = Rs. 12,000.

Mahesh will bear 3/5 of 13,000, i.e. Rs. 7,800 and Rakesh, 2/5 of Rs. 13,000, i.e. Rs. 5,200.

Thus, the profits of the firm will be shared as follows.

Mahesh will get Rs. 72,000 – Rs. 7,800 = Rs. 64,200.

Dinesh will get Rs. 36,000 – Rs. 5,200 = Rs. 30,800

Rakesh will get Rs. 12,000 + Rs. 7,800 + Rs. 5,200 = Rs. 25,000

Past Adjustments

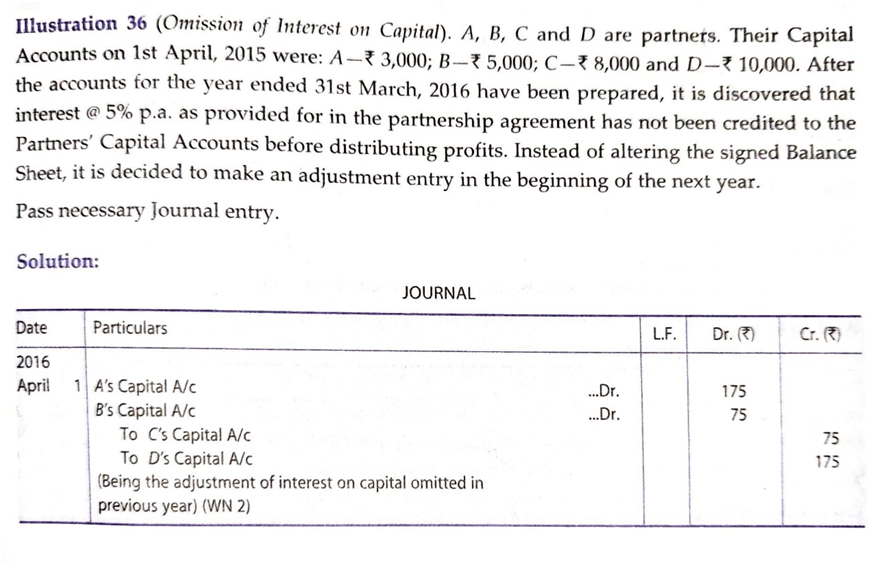

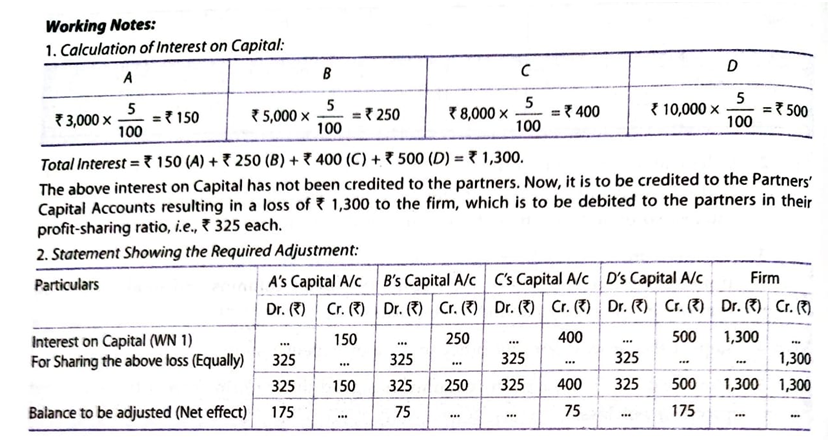

Sometimes a few omissions or errors in the recording of transactions or the preparation of summary statements are found after the final accounts have been prepared and the profits distributed among the partners. The omission may be in respect of interest on capitals, interest on drawings, interest on partners’ loan, partner’s salary, partner’s commission or outstanding expenses. There may also be some changes in the provisions of partnership deed or system of accounting having impact with retrospective effect. All these acts of omission and commission need adjustments for correction of their impact. Instead of altering old accounts, necessary adjustments can be made either; (a) through ‘Profit and Loss Adjustment Account’, or (b) directly in the capital accounts of the concerned partners. This is explained with the help of following example.

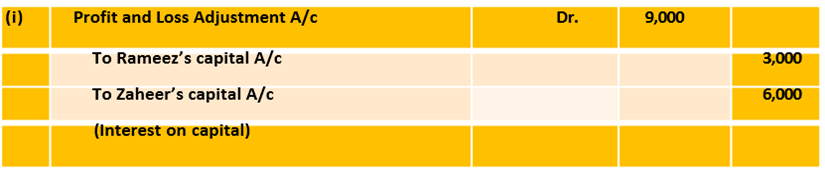

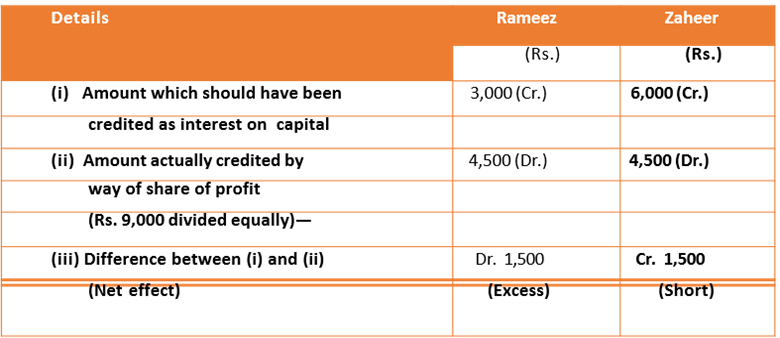

Rameez and Zaheer are equal partners. Their capitals as on April 01, 2015 were Rs. 50,000 and Rs. 1,00,000 respectively. After the accounts for the financial year ending March 31, 2016 have been prepared, it is discovered that interest at the rate of 6 per cent per annum, as provided in the partnership deed has not been credited to the partners’ capital accounts before distribution of profit. In this case, the interest on capital not credited to the partners’ capital accounts works out to be Rs. 3000 (6/100 × Rs. 50,000) for Rameez and Rs. 6,000 (6/100 × Rs. 1,00,000) for Zaheer. Had the interest on capital been duly provided, the firm’s profit would have reduced by Rs. 9,000. By this omission, the whole amount of profit as per Profit and Loss Account (without adjustment of Rs. 9,000) has been distributed among the partners in their profit sharing ratio, and the amounts of interest on capital have not been credited to their capital accounts. This error can be rectified in any of the following ways;

(a) Through Profit and Loss Adjustment Account

(b) Directly in Partners’ Capital Accounts

For direct adjustment in partners’ capital accounts first a statement to ascertain the net effect of omission on partners’ capital accounts will be worked out as follows and then the adjustment entries can be recorded.

Statement Showing Net Effect of Omitting Interest on Capital

The statement shows that Rameez has got excess credit of Rs. 1,500 while Zaheer’s account has been credited less by Rs. 1,500. In order to rectify the error Rameez’s capital account should be debited and that of Zaheer, credited with Rs. 1,500 by passing the following journal entry;

journal entry.

Rameez’s Capital A/c Dr. 1,500

To Zaheer’s Capital A/c 1,500 (Adjustment for omission of interest on capital)

Revision 14

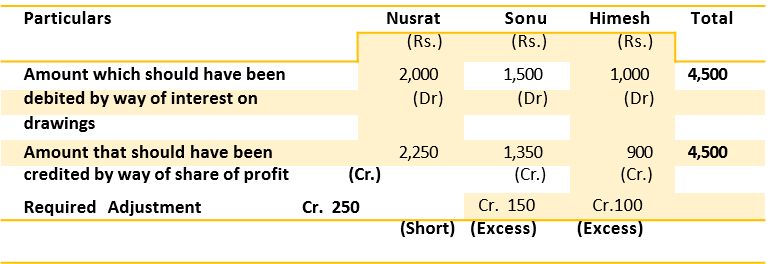

Nusrat, Sonu and Himesh are partners sharing profits and losses in the ratio of 5 : 3 : 2. The partnership deed provides for charging interest on drawing’s @ 10% p.a. The drawings of Nusrat, Sonu and Himesh during the year ending March 31, 2015 amounted to Rs. 20,000, Rs. 15,000 and Rs. 10,000 respectively. After the final accounts have been prepared, it was discovered that interest on drawings has not been taken into consideration. Give necessary adjusting journal entry.

Statement showing Net Effect of Omitting Interest on Drawings

Journal Entry for adjustment of interest on drawings would be:

Summary

1. Definition of partnership and its essential features: Partnership is defined as “Relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all”. The essential features of partnership are : (i) To form a partnership, there must be at least two persons; (ii) It is created by an agreement; (iii) The agreement should be for carrying on some legal business; (iv) sharing of profits and losses; and (v) relationship of mutual agency among the partners.

2. Meaning and contents of partnership deed: A document which contains the terms of partnership as agreed among the partners is called ‘Partnership Deed’. It usually contains information about all aspects affecting relationship between partners, including objective of business, contribution of capital by each partner, ratio in which profit and losses will be shared by the partners, entitlement of partners to interest on capital, interest on loan and the rules to be followed in case of admission, retirement, death, dissolution, etc.

3. Provisions of Partnership Act 1932 applicable to accounting: If partnership deed is silent in respect of certain aspects, the relevant provisions of the Indian Partnership Act, 1932 become applicable. According to the Partnership Act, the partners share profits equally, no partner is entitled to remuneration, no interest on capital is allowed and no interest on drawings is charged. However, if any partner has given some loan to the firm, he is entitled to interest on such amount @ 6% per annum.

4. Preparation of capital accounts under fixed and fluctuating capital methods: All transactions relating to partners are recorded in their respective capital accounts in the books of the firm. There can be two methods of maintaining Capital Accounts. These are; (i) fluctuating capital method, (ii) fixed capital method. Under fluctuating capital method, all the transactions relating to a partner are directly recorded in the capital account. Under fixed capital method, however the amount of capital remains fixed, the transactions like interest on capital, drawings, interest on drawings, salary, commission, share of profit or loss are recorded in a separate account called ‘Partner’s Current Account’.

5. Distribution of profit and loss: The distribution of profits among the partners is shown through a Profit and Loss Appropriation Account, which is merely an extension of the Profit and Loss Account. It is usually debited with interest on capital and salary/commission allowed to the partners, and credited with net profit as per Profit and Loss Account and the interest on drawings. The balance being profit or loss is distributed among the partners in the profit sharing ratio and transferred to their respective capital accounts.

6. 6. Treatment of guarantee of minimum profit to a partner: Sometimes, a partner may be guaranteed a minimum amount by way of his share in profits. If, in any year, the share of profits as calculated according to his profit sharing ratio is less than the guaranteed amount, the deficiency is made good by the guaranteeing partners’ in the agreed ratio which usually is the profit sharing ratio. If, however, such guarantee has been given by any of them, he or they alone shall bear the amount of deficiency.

7. Treatment of past adjustments: If, after the final accounts have been prepared, some omission or commissions are noticed say in respect of the interest on capital, interest on drawings, partner’s salary, commission, etc. necessary adjustments can be made in the partner’s capital accounts through the Profit and Loss Adjustment Account, to rectify the same.

8. Preparation of final accounts of a partnership firm: There is not much difference in the final accounts of a sole proprietary concern and that of a partnership firm except that in case of a partnership firm an additional account called Profit and Loss Appropriation Account is prepared to show distribution of profit and loss among the partners.

3. Guarantee of profit to a partner, Past adjustments, Final accounts

Guarantee of Profit

- In some cases, a partner may be admitted in the firm on a guarantee in respect of his minimum profit from the business.

- Such a guarantee may be given to an existing partner as well.

- Such a guarantee to the incoming partner is given ;

- All the old partners in agreed ratio

- Some of the old partners

When all the partners guarantee that one of the partners shall be given a minimum amount of profit, the following amounts have to be calculated separately

- Share of profit as per profit sharing ratio

- Minimum Guaranteed Profit

- The minimum of the above two is given to that partner & the balance of profit (i.e. total profit – profit given to the guaranteed partner) is shared by the remaining partners in the profit-sharing ratio.

- If the partner’s actual share of profit turns out to be more than the guaranteed profit then in that case the partner will be given the actual amount instead of the guaranteed amount.

- When one or more than one partner guarantees a minimum profit, the adjustment is made through the partner’s capital accounts. The following steps are followed;

- Distribute the profit among the partners in their profit sharing ratio

- If the share of the guaranteed profit of the partner falls short of the minimum amount then the difference is deducted from the original share of profit of the partners who guarantee & it is added with the original share of profit of the guaranteed partner.

- When two or more partners give guarantee, the shortfall is shared by them in the agreed ratio or in their profit-sharing ration as the case may be.

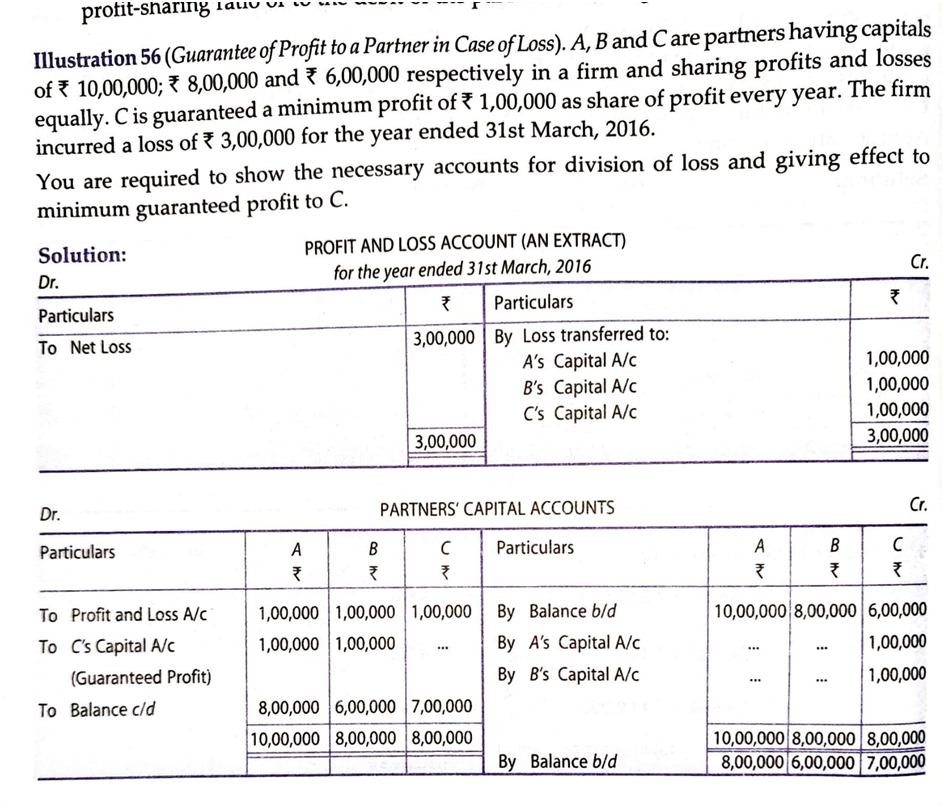

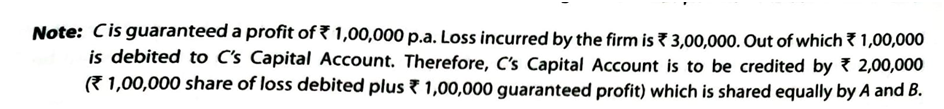

- Accounting Treatment of Guarantee of Profit in case of Loss

- Sometimes it is possible that the firm has incurred losses but the guaranteed profit is to be paid to the partner who has been guaranteed minimum profit. In such a case, the adjustment has to be made through partner’s capital A/c in the following manner;

- Distribute the loss among the partners in their profit sharing ratio

- Capital A/c of the guaranteed partner is credited with guaranteed minimum profit plus the amount of loss. This amount is debited to remaining partners in their profit sharing ratio or to the debit of the partner who has guaranteed minimum profit.

Past Adjustments

Sometimes, after the final accounts of a firm have been closed, it is found that certain matters have been left out by mistake. In such cases, instead of altering the final accounts which have already been closed, the firm rectifies the error or omission by passing an adjustment entry in the beginning of the financial year. Such adjustments are called past adjustments as they relate to the past.

Steps to pass adjusting journal entry:

Step 1 Calculate the amount already recorded.

Step 2 Calculate the amount which should have been recorded.

Step 3 Calculate the difference between Step 1 and Step 2.

Step 4 Find out the partner who received excess and the partner who received short.

Step 5 Pass the adjusting journal entry by debiting the partner who received excess and by crediting the partner who received short.

PREPARATION OF FINAL ACCOUNTS OF PARTNERSHIP FIRM

Final accounts of a partnership firm are prepared in the usual way in which they are prepared for a sole proprietorship concern except that the profits in the partnership have to be distributed among the various partners according to the terms of the partnership contract and the amount of profit may be arrived at after making adjustments for interest on capital, interest on drawings, salaries to partners, etc. for this another account “Profit & Loss Appropriation Account” is prepared after preparing Profit & Loss Account.

The final accounts prepared by partnership firms are:

a) Manufacturing account – if manufacturing activity is carried on

b) Trading and profit and loss account – to ascertain profitability

c) Profit and loss appropriation account – to show the disposal of profits and surplus

d) Balance sheet – to ascertain the financial status.

Vision classes

Vision classes