Treatment of Goodwill:

The outgoing partner is entitled to his share of goodwill at the time of retirement/death because the goodwill has been earned by the firm with the efforts of all the existing partners. Therefore, goodwill is valued as per the agreement, at the time of retirement/death.

Due to the retirement/death of any partner, the continuing partners make again because the future profit will be shared only between the continuing partners. Therefore, the continuing partners should compensate the retiring/deceased partner for his share of goodwill in the gaining ratio.

The accounting treatment for goodwill depends upon whether the goodwill already appears in the books of the firm or not.

When Goodwill does not Appear in the Books: When Goodwill does not appear in the books of the firm, there are four following ways to compensate the retiring partner:

(a) Goodwill is raised at its full value and retained in the books:

Goodwill A/cDr.

To All Partner’s Capital A/c’s

(including retiring/deceased partner)

(For the goodwill raised at its full value and credited to capital A/c’s of a ’1 partners in their old profit sharing ratio)

The full value of goodwill will appear in the new balance sheet.

(b) Goodwill is raised at its full value and written off immediately:

If it is decided that the goodwill will not appear in the balance sheet of the reconstituted firm, then the following journal entries are required:

1. Goodwill A/c Dr.

To All Partner’s Capital A/c’s (For raising of Goodwill and credited to all partners capital A/c’s in their old profit sharing ratio)

2. Continuing Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For written-off goodwill between continuing partners in their new profit sharing ratio)

(c) Goodwill is raised to the extent of retired/deceased partner’s share and written off immediately:

1. Goodwill A/c Dr.

To Retiring/Deceased Partner’s Capital A/c (For the goodwill raised by share of outgoing partner)

2. Continuing Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For the goodwill written off between the continuing partners in their gaining ratio)

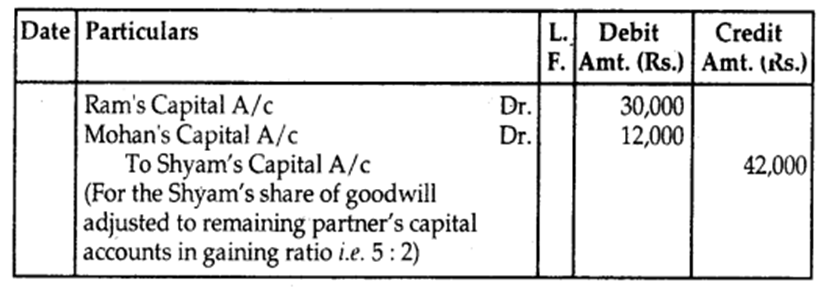

(d) No Goodwill account is raised at all in the firm’s books: If the outgoing partner’s share of goodwill is adjusted in the capital accounts of the continuing partners without opening a goodwill account, the following entry will be required:

Continuing Partner’s Capital A/c’s Dr.

To Outgoing Partner’s Capital A/c (For the share of outgoing partner in the goodwill adjusted through capital accounts in the gaining ratio)

The following example clears the above accounting treatment of Goodwill at the time of retirement/death:

Ram, Shyam and Mohan are partners in firm sharing profits and losses in the ratio of 5: 3: 2. Shyam retires. The goodwill of the firm is valued at Rs. 1,40,000 and the remaining partner’s Ram and Mohan continue to share profits in the ratio of 5:2. The following journal entries passed under various alternatives shall be as follows:

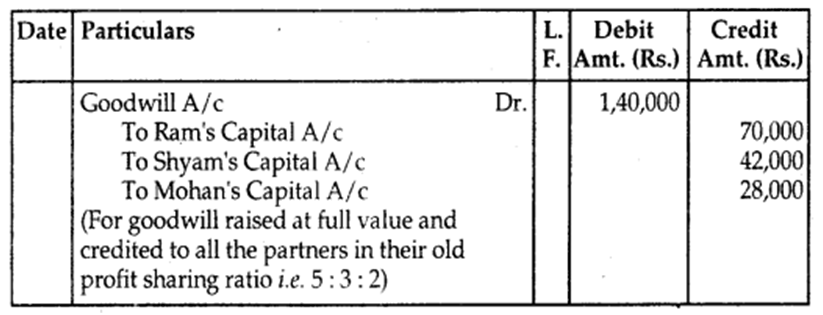

If goodwill is raised at full value and retained in books:

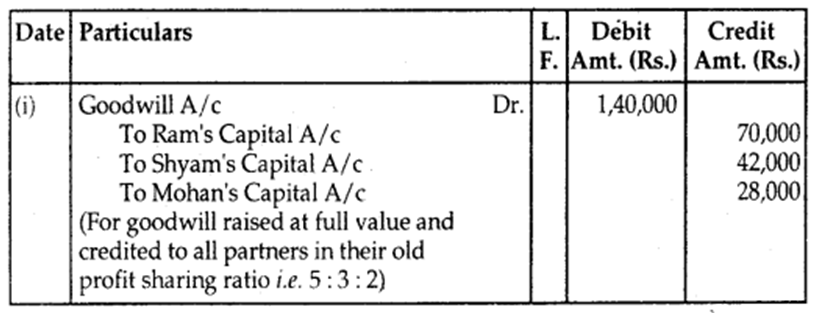

If goodwill is raised at full value and written off immediately:

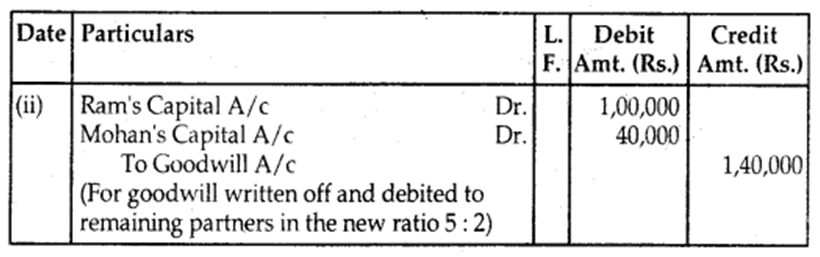

If goodwill is raised to the extent of the retiring partner’s share and written off immediately:

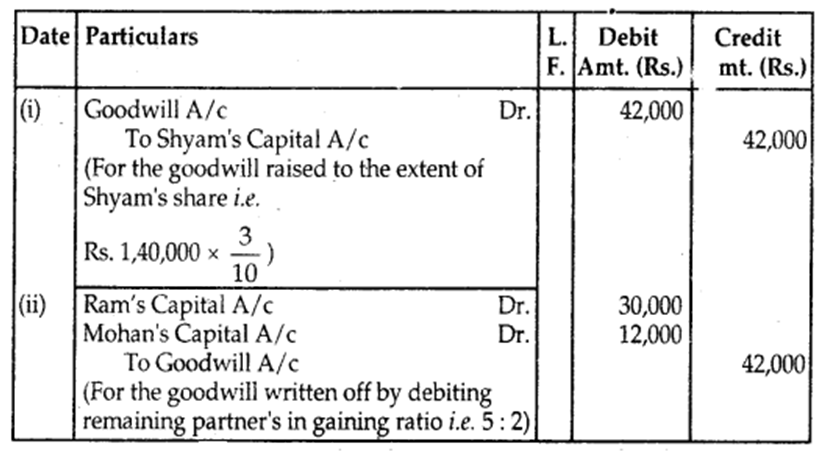

No goodwill account is raised at all in the firm’s books:

When Goodwill is already appearing in the books:

(a) If the value of goodwill appearing is equal to the current value of goodwill of the firm:

Normally, no adjustment is required if both the amounts are the same. Because goodwill stands credited in the accounts of all the partners including the retiring one.

(b) If the book value of goodwill is lower than its present value:

If the book value is less than the present value, the difference will be debited to the goodwill account and credited to the old partner’s capital accounts in their old profit sharing ratio.

Goodwill A/c Dr.

To All Partner’s Capital A/c’s (individually)

(For goodwill raised to its present value)

(c) If the book value of goodwill is more than the agreed or present value:

If the book value of goodwill is more than the present value, the difference will be debited to All partner’s capital accounts in their old profit sharing ratio and credited to the goodwill account.

All Partner’s Capital A/c’s (individually) Dr.

To Goodwill A/c

(For goodwill brought down to its present value)

Alternatively,

1. First, write off the existing goodwill that appears in the books:

All Partner’s Capital A/c’s (individually) Dr.

To Goodwill A/c

(For write-off goodwill to all partners in old profit sharing ratio)

2. Adjust retiring partner’s share of goodwill through capital A/c’s

Remaining Partner’s Capital A/c’s Dr.

To Retiring/deceased Partner’s Capital A/c

(For goodwill share of retiring/deceased partner adjusted to remaining partner’s Capital A/c’s in their gaining ratio)

Hidden Goodwill: If the firm has agreed to settle the retiring/deceased partner by paying him a lump sum, then the amount paid to him in excess of what is due to him based on the capital accounts balance after making all adjustments like accumulated profits and losses and revaluation profit or loss etc. shall be treated as his share of goodwill known as hidden goodwill.

Vision classes

Vision classes