Adjustment for Accumulated (Undistributed) Profits and Losses:

1. For Undistributed Profits, Reserves etc.

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

General Reserves A/c Dr.

Reserve fund A/c Dr.

Profit and Loss A/c Dr.

Workmen’s Compensation Fund A/c Dr.

To Old Partner’s Capital A/c’s

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

2. For Undistributed Losses:

Old Partner’s Capital A/c’s Dr.

To Profit and Loss A/c

(For distribution of accumulated losses to old partners in old profit sharing ratio)

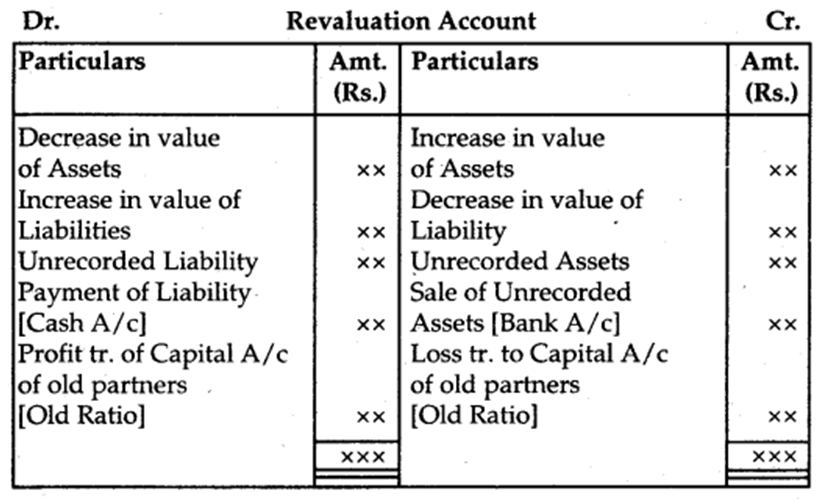

Revaluation of Assets and Reassessment of Liabilities: Revaluation of Assets and Reassessment of Liabilities is done with the help of ‘Revaluation Account’ or ‘Profit and Loss Adjustment Account’.

The journal entries recorded for revaluation of assets and reassessment of liabilities are the following:

1. For increase in the value of an Assets

Assets A/c Dr.

To Revaluation A/c (Gain)

2. For decrease in the value of an Assets

Revaluation A/c Dr.

To Assets A/c (Loss)

3. For appreciation in the amount of Liability

Revaluation A/c Dr.

To Liability A/c (Loss)

4. For reduction in the amount of a Liability

Liability A/c Dr.

To Revaluation A/c (Gain)

5. For recording an unrecorded Assets

Unrecorded Assets A/c Dr.

To Revaluation A/c (Gain)

6. For recording an unrecorded Liability

Revaluation A/c Dr.

To Unrecorded Liability A/c (Loss)

7. For the sale of unrecorded Assets

Cash A/c or Bank A/c Dr.

To Revaluation A/c (Gain)

8. For payment of unrecorded Liability

Revaluation A/c Dr.

To Cash A/c or Bank A/c (Loss)

9. For transfer of gain on Revaluation if the credit balance

Revaluation A/c Dr.

To Old Partner’s Capital A/c’s (Old Ratio)

10. For transfer of loss on Revaluation if debit balance

Old Partner’s Capital A/c’s Dr.

To Revaluation A/c (Old Ratio)

Adjustment of Capitals:

1. When the new partner brings in proportionate capital OR On the basis of the old partner’s capital.

(a) Calculate the adjusted capital of old partners (after all adjustments)

(b) Total capital of the firm

= Combined Adjusted Capital × Reciprocal proportion of the share of old partners

(c) New Partner’s Capital

= Total Capital × Proportion of share of a new partner.

2. On the basis of the new partner’s capital:

(a) Total Capital of the firm = New Partner’s Capital × Reciprocal proportion of his share.

(b) Distribute Total Capital in New Profit Sharing Ratio.

(c) Calculate adjusted capital of old partners.

(d) Calculate the difference between New Capital and Adjusted Capital.

- If the debit side of the Capital Account is bigger then it means he has excess capital

Partner’s ( capital Accounts Dr.

To Cash A /c or Bank A/c or Current A/c - If the credit side is bigger then it means that he has short capital

Cash A/c or Bank A/c or Current A/c Dr.

To Partner’s Capital A/c’s

Change in Profit Sharing Ratio among the Existing Partners:

Sometimes the existing partners of the firm may decide to change their profit-sharing ratio. In such a case, some partners will gain in future profits and some will lose. Here the gaining partners should compensate the losing partners unless otherwise agreed upon. In such a situation, first of all, the loss and gain in the value of goodwill (if any) will have to adjust.

1. Goodwill A/c Dr.

To Partner’s Capital A/c’s (For raising the amount of Goodwill in old ratio)

2. Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For writing off the amount of Goodwill in New Profit sharing ratio)

Alternatively:

Gaining Partner’s Capital A/c’s Dr.

To Losing Partner’s Capital A/c’s (For adjustment due to change in profit sharing ratio)

Accounting Treatment of Goodwill

In case of change in profit sharing ratio, the gaining partner must components the sacrificing partner by paying the proportionate amount of goodwill.

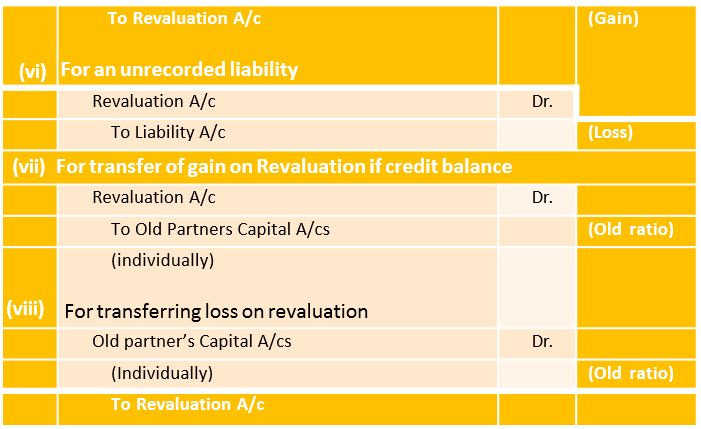

Note :(i) Increase in the value of an Asset and decrease in the value of a liability result in profit.

Assets A/cDr.

To Revaluation

(ii) Decrease in the value of any asset and increase in the value of liability gives loss.

Revaluation A/cDr.

To Assets A/c

(iii) For an increase in the value of liabilities.

Revaluation A/cDr.

To Liabilities A/c

(Increase in value of Liability)

(iv) For a decrease in the value of Liabilities

Liabilities A/cDr.

To Revaluation A/c

(Decrease in the value of Liabilities)

(v) When the Revaluation account shows profit

Revaluation A/cDr.

To Partner’s Capital A/c

(Profit credited to Partner’s Capital A/c in old ratio)

(vi) In case of Revaluation Loss

Partner’s Capital A/c’sDr.

To Revaluation A/c

(Loss debited to Partner’s Capital A/cs in old ratio)

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Adjustment for Accumulated Profits and Losses And Revaluation of Assets and Reassessment of Liabilities

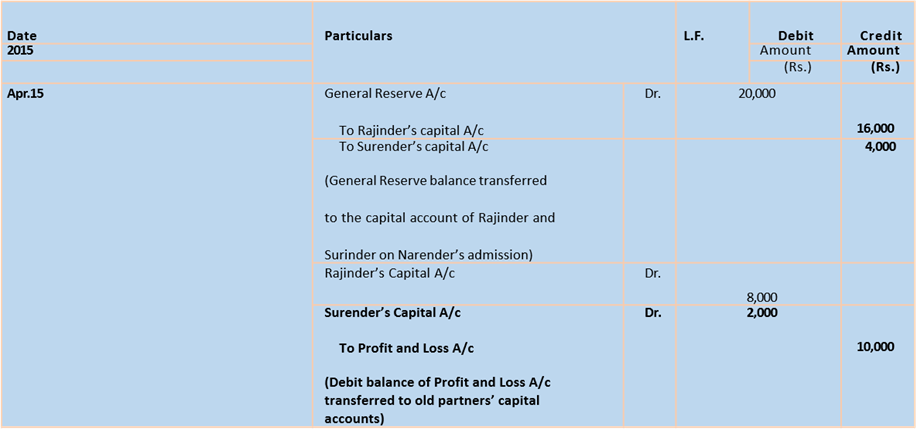

Sometimes a firm may have accumulated profits not yet transferred to capital accounts of the partners. These are usually in the form of general reserve, reserve and/or Profit and Loss Account. The new partner is not entitled to have any share in such accumulated profits. These are distributed among the partners by transferring it to their capital current accounts in old profit sharing ratio. Similarly, if there are some accumulated losses in the form of a debit balance of profit and loss account and/or deferred revenue expenditure appearing in the balance sheet of the firm. It should be transferred to the old partners’ capital accounts (see Revision 23).

Revision 23

Rajinder and Surinder are partners in a firm sharing profits in the ratio of 4:1. On April 15, 2017 they admit Narender as a new partner. On that date there was a balance of Rs. 20,000 in general reserve and a debit balance of Rs. 10,000 in the profit and loss account of the firm. Pass necessary journal entries regarding adjustment of a accumulate a profit or loss.

Solution

Books of Rajinder, Surinder and Narender Journal

At the time of admission of a new partner, it is always desirable to ascertain whether the assets of the firm are shown in books at their current values. In case the assets are overstated or understated, these are revalued. Similarly, a reassessment of the liabilities is also done so that these are brought in the books at their correct values. At times there may also be some unrecorded assets and liabilities of the firm. These also have to be brought into the books of the firm. For this purpose the firm has to prepare the Revaluation Account. The gain or loss on revaluation of each asset and liability is transferred to this account and finally its balance is transferred to the capital accounts of the old partners in their old profit sharing ratio. In other words, the revaluation account is credited with increase in the value of each asset and decrease in its liabilities because it is a gain and is debited with decrease in the value of assets and increase in its liabilities is debited to revaluation account because it is a loss. Similarly unrecorded assets are credited and unrecorded liabilities are debited to the revaluation account. If the revaluation account finally shows a credit balance then it indicates net gain and if there is a debit balance then it indicates net loss. Which will be transferred to the capital accounts of the old partners in old ratio.

The journal entries recorded for revaluation of assets and reassessment of liabilities are as follows:

(i) For increase in the value of an asset

Asset A/c Dr.

To Revaluation A/c (Gain)

(ii) For reduction in the value of an asset

Revaluation A/c Dr.

To Asset A/c (Loss)

(iii) For appreciation in the amount of a liability

Revaluation A/c Dr.

To Liability A/c (Loss)

(iv) For reduction in the amount of a liability

Liability A/c Dr.

To Revaluation A/c (Gain)

(v) For an unrecorded asset

Asset A/c Dr.

Note: Entries (i), (ii), (iii) and (iv) are recorded only with the amount increase and decrease in the value of assets and liabilities.

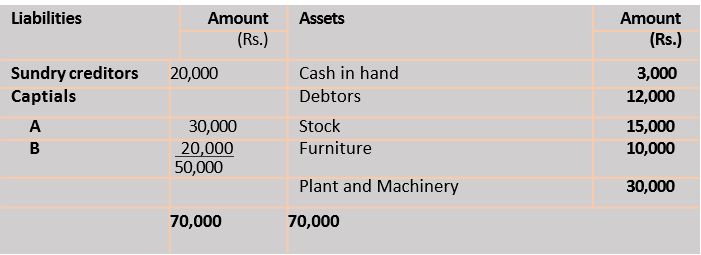

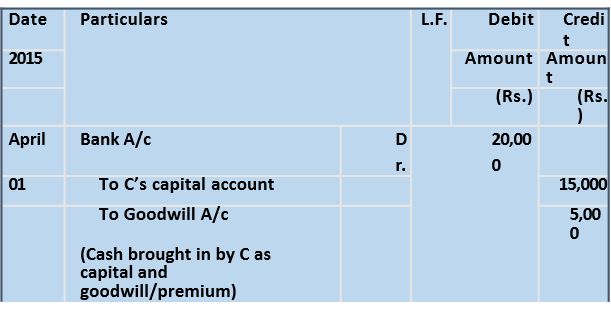

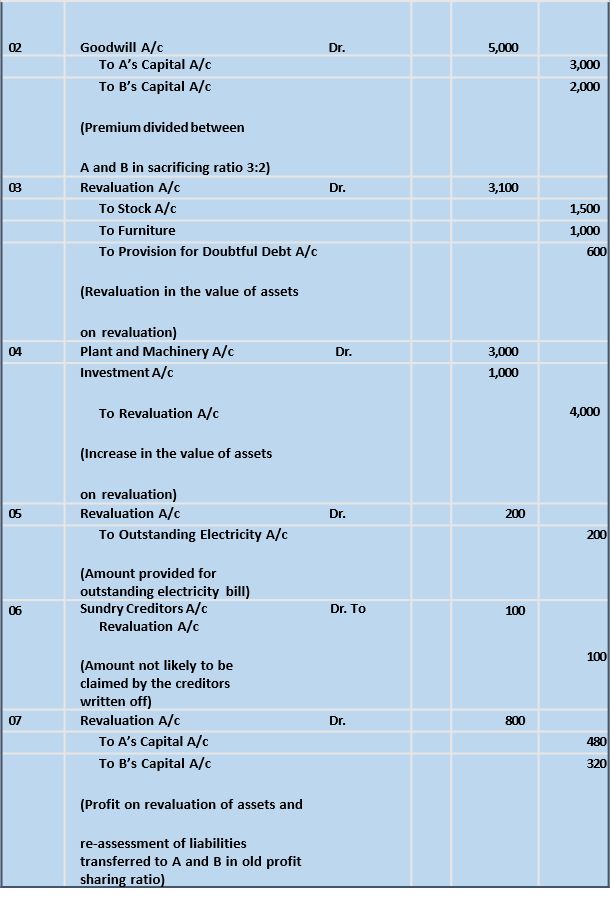

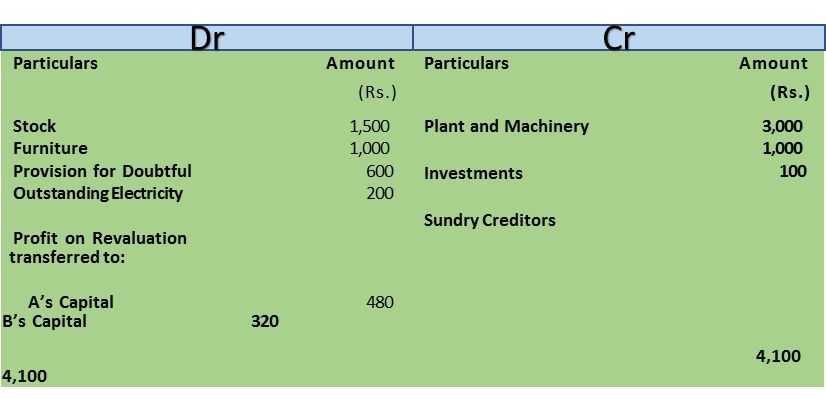

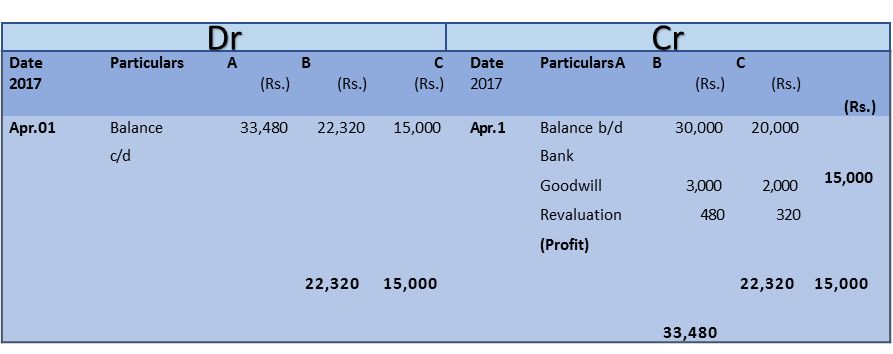

Revision 24

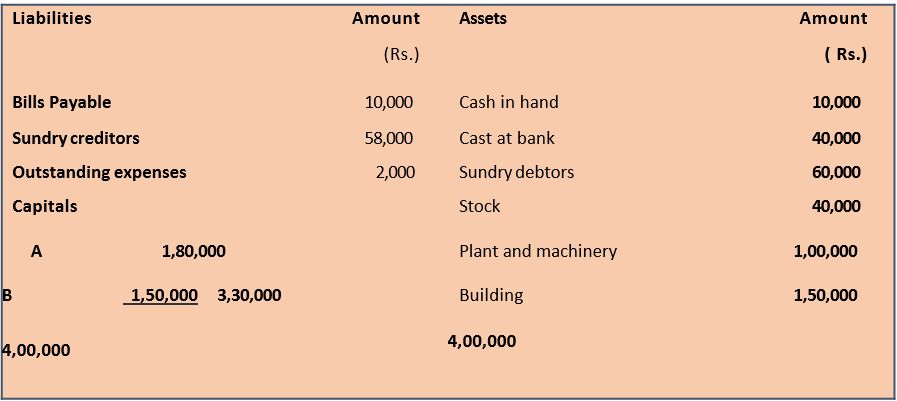

Following in Balance Sheet of A and B who share profits in the ratio of 3:2.

Balance Sheet of A and B as on April 1, 2015

On that date C is admitted into the partnership on the following terms:

- C is to bring in Rs. 15,000 as capital and Rs. 5,000 as premium for goodwill for 1/6 share.

- The value of stock is reduced by 10% while plant and machinery is appreciated by 10%.

- Furniture is revalued at Rs. 9,000.

- A provision for doubtful debts is to be created on sundry debtors at 5% and Rs. 200 is to be provided for an electricity bill.

- Investment worth Rs. 1,000 (not mentioned in the balance sheet) is to be taken into account.

- A creditor of Rs. 100 is not likely to claim his money and is to be written off.Record journal entries and prepare revaluation account and capital account of partners.

Books of A, B and C Journal

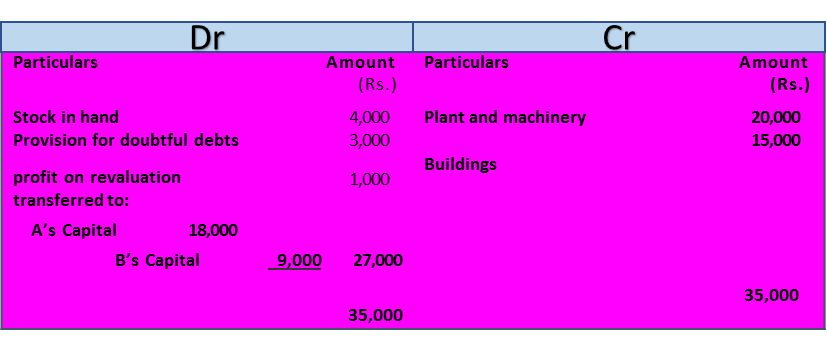

Revaluation Account

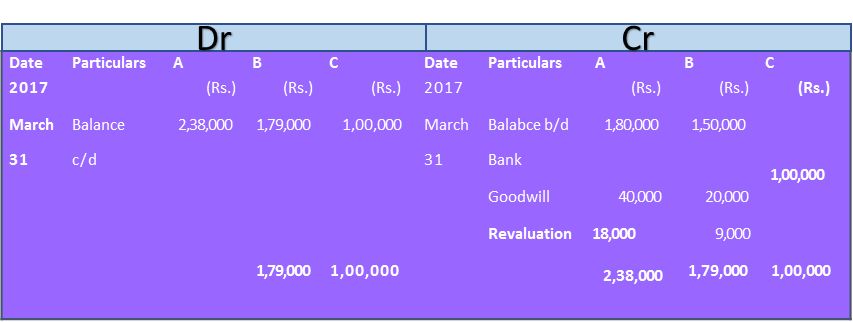

Partner’s Capital Accounts

Revision 25

Given below is the Balance Sheet of A and B, who are carrying on partnership business as on March 31,2017. A and B share profits in the ratio of 2:1.

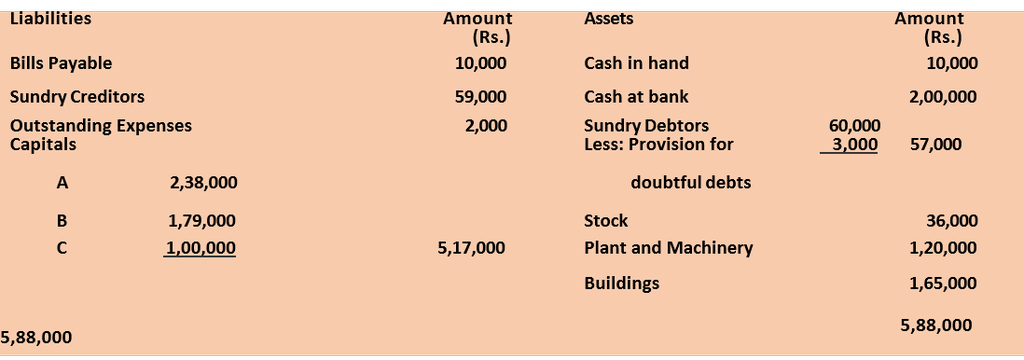

Balance Sheet of A and B as at March 31, 2017

C is admitted as a partner on the date of the balance sheet on the following terms:

1. C will bring in Rs 1,00,000 as his capital and Rs 60,000 as his share of

goodwill for 1/4 share in profits.

2. Plant is to be appreciated to Rs 1,20,000 and the value of buildings is to appreciated by 10%.

3. Stock is found overvalued by Rs 4,000.

4. A provision for doubtful debts is to be created at 5% of debtors.

5. Creditors were unrecorded to the extend of Rs 1,000.

Record revaluation Account, partners’ capital accounts, and the Balance Sheet of the constituted firm after admission of the new partner.

Solution

Books of A and B Revaluation Account

Balance Sheet of A, B and C as on April 01, 2016

Adjustment of Capitals

Sometimes, at the time of admission, the partners agree that their capitals should also be adjusted so as to be proportionate to their profit sharing ratio. In such a situation, if the capital of the new partner is given, the same can be used as a base for calculating the new capitals of the old partners. The capitals thus ascertained should be compared with their old capitals after all adjustments relating to goodwill reserves and revaluation of assets and liabilities, etc. have been made; and then the partner whose capital falls short, will bring in the necessary amount to cover the shortage and the partner who has a surplus, will withdraw the excess amount of capital. (See Revision 26)

Revision 26

A and B are partners sharing profits in the ratio of 2:1. C is admitted into the firm for 1/4 share of profits. C brings in Rs. 20,000 in respect of his capital. The capitals of old partners A and B, after all adjustments relating to goodwill, revaluation of assets and liabilities, etc., are Rs. 45,000 and Rs. 15,000 respectively. It is agreed that partners’ capitals should be according to the new profit sharing ratio.

Determine the new capitals of A and B and record the necessary journal entries assuming that the partner whose capital falls short, brings in the amount of deficiency and the partner who has an excess, withdraws the excess amount.

Solution

Calculation of new profit sharing ratio: Assuming the new partner C quires his share from A and B in their old profit sharing ratio, i.e 2:1.

C’s Share = ¼

Remaining Shares = 1- ¼ - ¾

A’s New Share = ¾ × 2/3 – 6/12

B’s New Share = ¾ × 1/5 – 3/12

C’s New Share = ¼ × 3/5 – 3/12

Thus, new profit sharing ratio between A,B and C is 6:3:3 or 2:1:1.

Required Capital of A and B

C’s capital (who has 1/4 share in profits) is Rs. 20,000. B’s new share in profits

1/4. Hence his capital will also be Rs. 20,000. A’s new share is 2/4 which is double of C’s share. Hence his capital will be Rs. 40,000.

Alternatively, based on C’s capital, the total capital of the firm works out at Rs. 80,000 (4/1 × Rs.20,000). Hence, based on their share in profits, the capital of A and B will be:

A’s capital = 2/4 of 80, 000 = Rs 40, 000

B’s capital = ¼ of 80, 000 = Rs 20,000

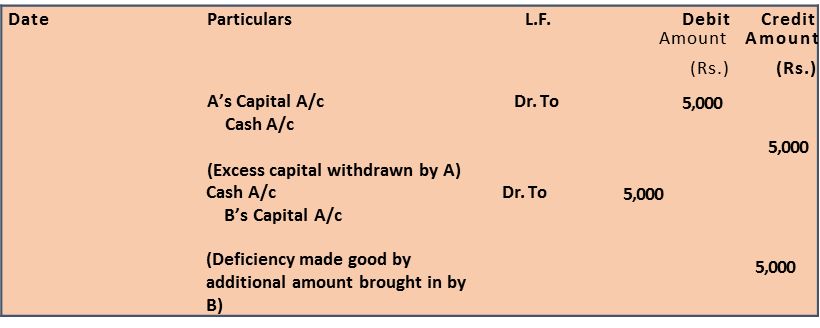

The capital of A and B after all adjustments have been made, are Rs. 45,000 and Rs. 15,000 respectively. Hence, A will withdraw Rs. 5,000 (Rs. 45,000– Rs.40,000) from the firm whereas B will contribute additional amount of Rs. 5,000 (Rs. 20,000–Rs.15,000). The journal entries will be :

Sometimes, the total capital of the firm may clearly be specified and it is agreed that the capital of each partner should be proportionate to his share in profits. In such a situation each partner’s capital (including the new partner’s capital to be brought by him) is calculated on the basis of his share in profits. By bringing in additional amount or withdrawal of excess amount, the final capital of each partner can be brought up to the required level. It may be noted that subject to agreement among the partners, surplus or deficiency in each old partners’ capital accounts can also be taken care of simply by transfer to their respective current accounts. (See Revision 27)

Revision 27

A, B and C are partners in a firm sharing profits the ratio of 3:2:1. D is admitted into the firm for 1/4 share in profits, which he gets as 1/8 from A and 1/8 from B. The total capital of the firm is agreed upon as Rs. 1,20,000 and D is to bring in cash equivalent to 1/4 of this amount as his capital. The capitals of other partners are also to be adjusted in the ratio of their respective shares in profits. The capitals of A, B and C after all adjustments are Rs. 40,000, Rs. 35,000 and Rs. 30,000 respectively. Calculate the new capitals of A,B and C, and record the necessary journal entries.

Solution

Calculation of new profit sharing ratio:

A = ½ - 1/8 = 3/8

B = 1/3 – 1/8 = 5/24

C will continue to get 1/6 as his share in the profits.

Thus, the new profit sharing ratio between A,B,C and D will be:

3/8 : 5/24 : 1/6 or 9/24 : 5/ 24 : 4/24 : 6/24 or 9 : 5 : 4 : 6

Required capitals of all partners:

A’s Capital = Rs. 1,20,000 = 9/24 = Rs 45, 000

B’s Capital = Rs. 1,20,000 × 5/24 = Rs 25, 000

C’s Capital = Rs. 1,20,000 × 4/24 = Rs 20, 000

D’s Capital = Rs. 1,20,000 × 6/24 = Rs 30, 000

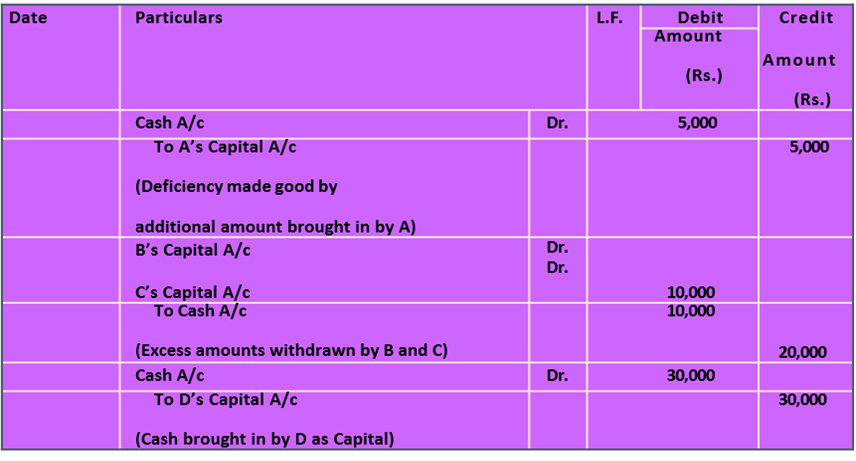

Hence, A will bring in Rs. 5,000 (Rs. 45,000 – Rs. 40,000), B will withdraw

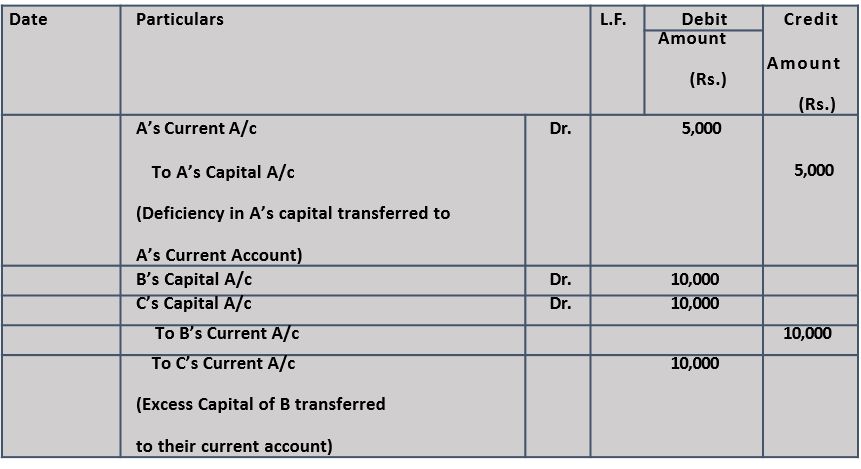

Rs. 10,000 (Rs. 35,000 – Rs. 25,000), C will withdraw Rs. 10,000 (Rs. 30,000– Rs, 20,000) and D will bring in Rs. 30,000. Alternatively, the current accounts can be opened and the amounts to be brought in or withdrawn by A, B and C will be transferred to their respective current accounts subject to the agreement among the partners. The journal entries in this regard will be recorded as follows:

Books of A, B, C and D Journal

Alternatively, for entries (2) and (3) above shall be

Books of A, B, C and D Journal

Revision 28

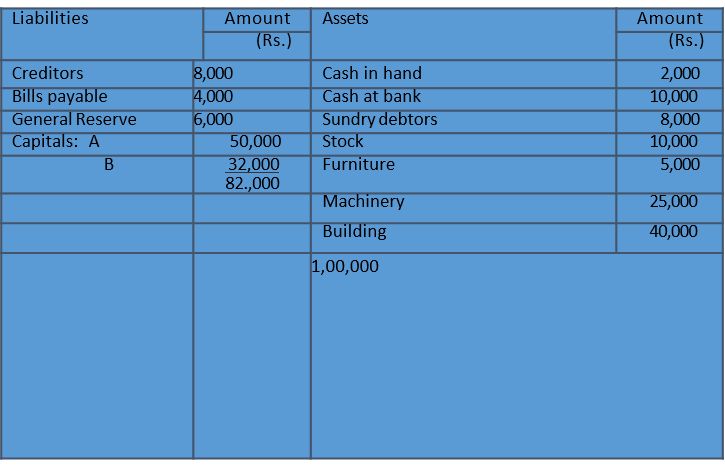

A and B are partners in a firm sharing profits in the ratio 2:1. C is admitted into the firm with 1/4 share in profits. He will bring in Rs. 30,000 as capital and capitals of A and B are to be adjusted in the profit sharing ratio. The Balance Sheet of A and B as on March 31, 2017 (before C’s admission) was as under:

Balance Sheet of A and B as at March 31,2017

Other terms of agreement are as under:

1. C will bring in Rs. 12,000 as his share of goodwill.

2. Building was valued at Rs. 45,000 and Machinery at Rs. 23,000.

3. A provision for bad debts is to be created @ 6% on debtors.

4. The capital accounts of A and B are to be adjusted by opening current accounts.

Record necessary journal entries, show necessary ledger accounts and prepare fund’s Balance Sheet after C’s admission.

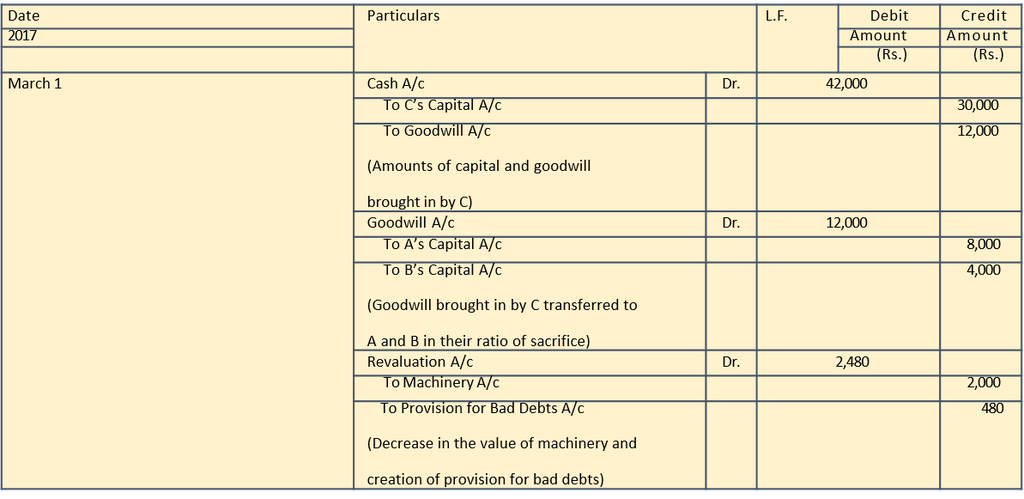

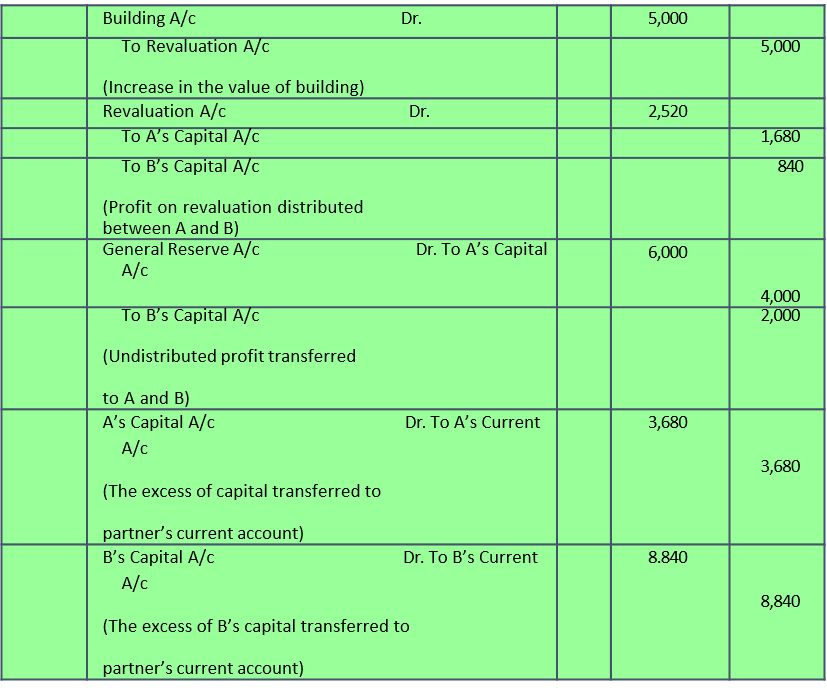

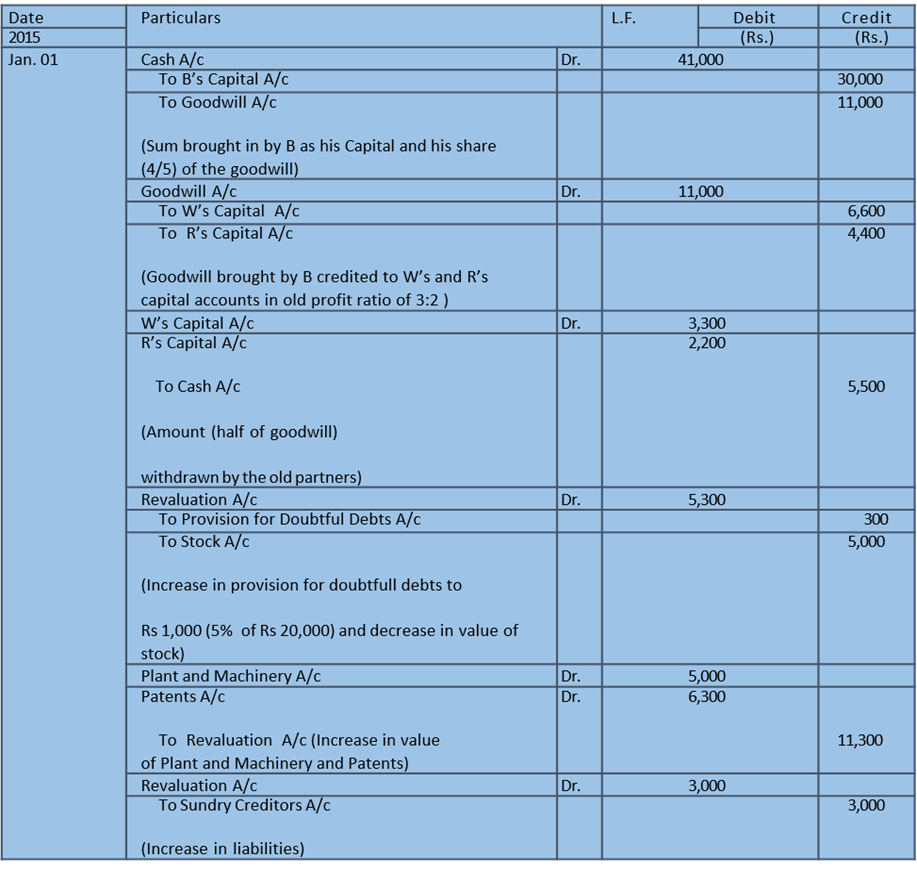

Books of A, B and C Journal

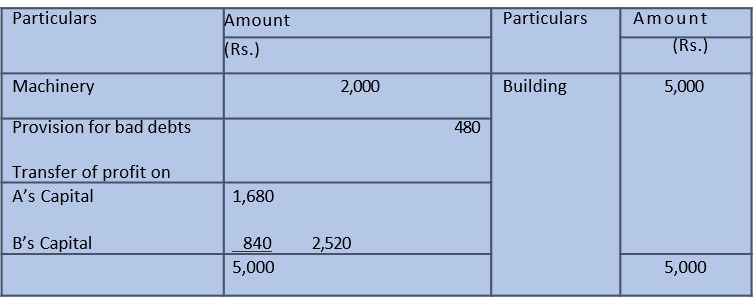

Revaluation Account

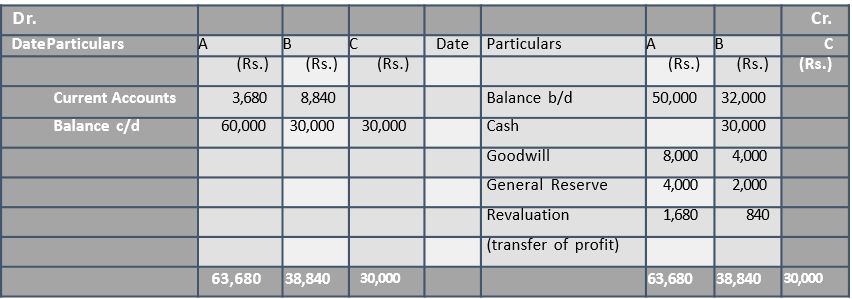

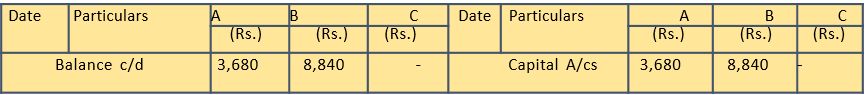

Partners’ Capital Accounts

Partners’ Current Accounts

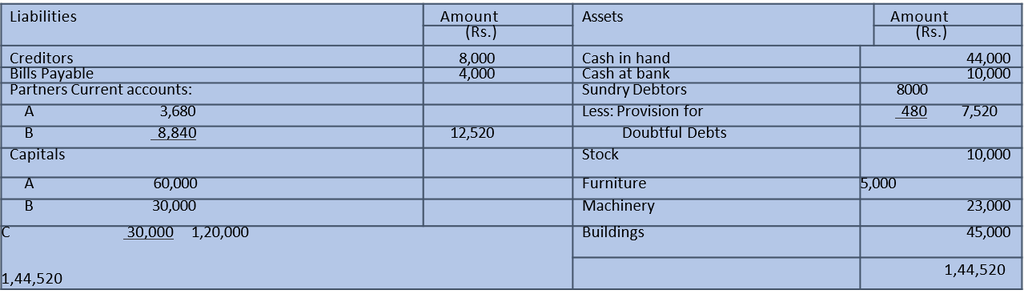

Balance Sheet of A, B and C as on March 31, 2017

Notes

Since nothing is given as to how C acquired his share from A and B. It is assumed that A

and B, between themselves continue to share the profit in the old ratio of 2:1.

C’s Share of Profits = ¼

Remaining Share = 1 – ¼ = ¾

A’s New Share = 2/3 of ¾ = 6/12 = ½

B’s New Share = 1/3 of ¾ = 3/12 = ¼

Thus, new profit sharing ratio between A, B and C is 2:1:1

New Capitals of A and B

C’s capital is Rs 30,000 and his share of profits is 1/4. Based on C’s capital, the total capital of the firm will work out at Rs 1,20,000 (4/1 × 30,000) and the respective capitals of A and B will be as follows :

A’s Capital = 2/4 of 1, 20, 000 = Rs 60, 000

B’s Capital = ¼ of 1, 20, 000 = Rs 30, 000

Revision 29

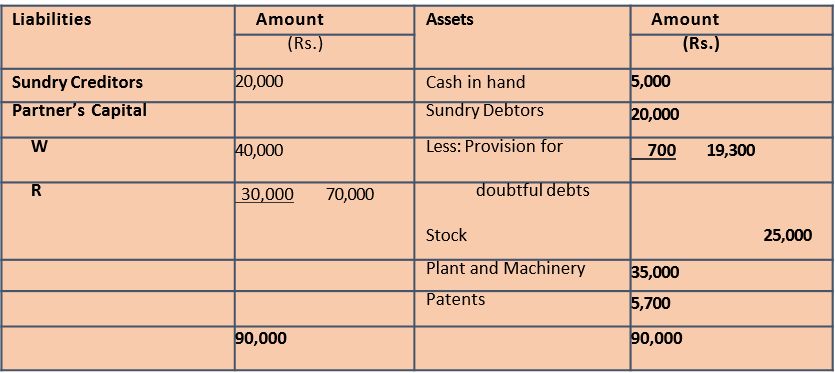

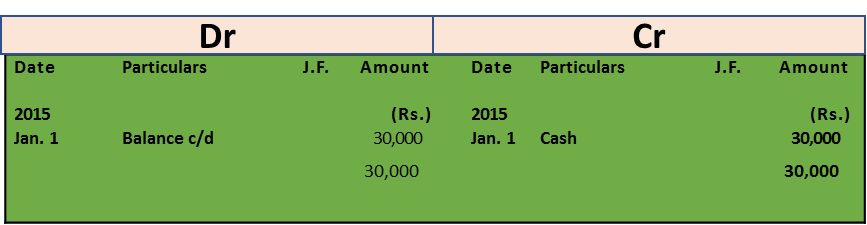

The Balance Sheet of W and R who shared profits in the ratio of 3 : 2 was as follows on January. 01, 2015.

Balance Sheet of W and R as on Jan. 01, 2015

On this date B was admitted as a partner on the following conditions:

1. He was to get 4/15 share of profit.

2. He had to bring in Rs 30,000 as his capital.

3. He would pay cash for goodwill which would be based on 2 ½ years purchase of the profits of the past four years.

4. W and R would withdraw half the amount of goodwill premium brought by B.

5. The assets would be revalued as: Sundry Debtors at book value less a provision of 5%; Stock at Rs 20,000; Plant and Machinery at Rs 40,000; and Patents at Rs 12,000.

6. Liabilities were valued at Rs 23,000, one bill for goods purchased having been omitted from books.

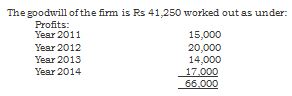

7. Profit for the past four years were :

2011 15,000 2013 14,000

2012 20,000 2014 17,000

Give necessary journal entries and ledger accounts to record the above, and prepare the Balance Sheet after B’s admission.

Solution

Average Profits = Rs 66, 000/4 = Rs 16, 500

Goodwill at 2 ½ Years purchase = Rs .16,500 × 5/2 = Rs 41, 250

B’s share of goodwill = Rs. 41,250 × 4/15 = Rs 11, 000

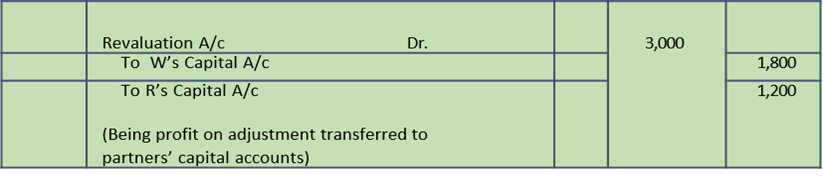

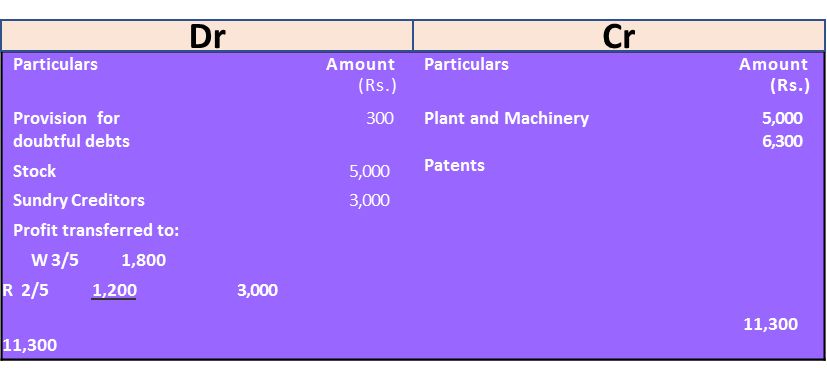

Cash Account

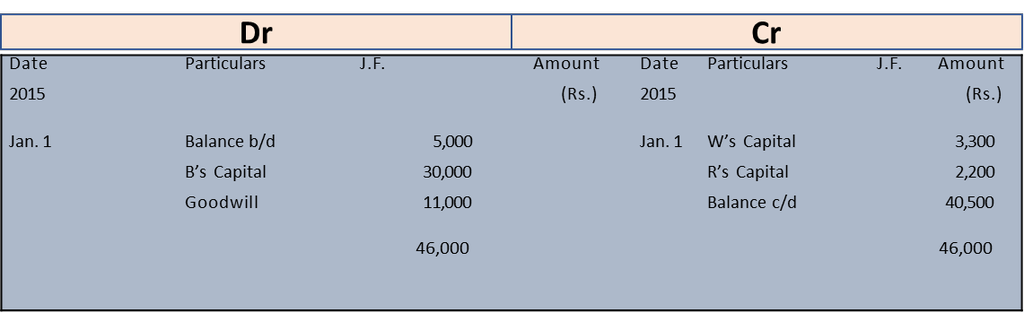

B’s Capital Account

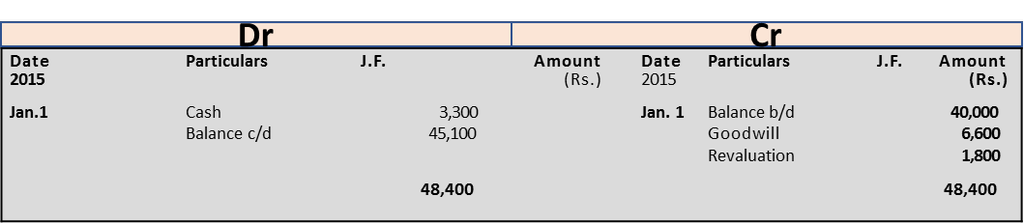

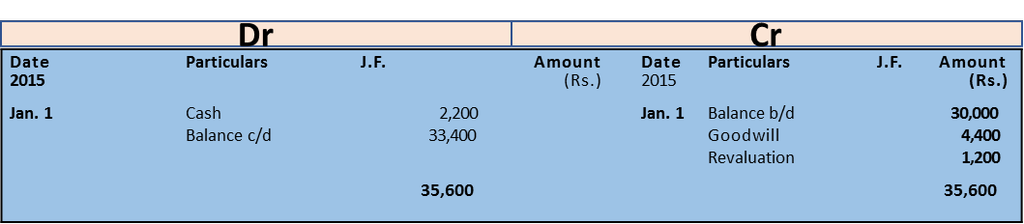

W’s Capital Account

R’s Capital Account

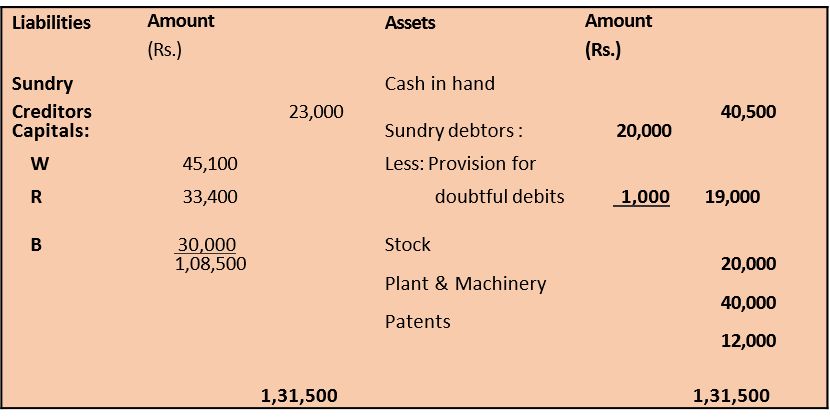

Balance Sheet of W, R and B as on January 01, 2015

The new profit sharing ratio will be:

W = (1- 4/15 ) × 3/5 = 11/15 × 3/5 = 33/75

R = ( 1 – 4/15 ) × 2/5 = 11/15 × 2/5 = 22/ 75

B = 4/15 = 20/75

The new ratio is 33 : 22 : 20.

Change in Profit Sharing Ratio among the Existing Partners

Sometimes, the partners of a firm decide to change their existing profit sharing ratio without any admission or retirement of a partner. This results in a gain of additional share in future profits of the firm for some partners while a loss of a part thereof for other partners. For example, A, B and C are partners in a firm

sharing profits in the ratios of 8:5:3 It is felt that A will no more be able to actively participate in the affairs of the firm. Hence, with effect from April 1, 2007, they decided that, in future they will share the profits in the ratio of 5:6:5. This result in A losing 3/16 (8/16 – 5/16) share in profits while B and C gaining 1/16 (6/16 – 5/16) and 2/16 (5/16 – 3/16). In such a situation, the loss and gain in the value of goodwill (if any) will have to be adjusted. This is done by crediting sacrificing partner's and debiting gaining partner's with appropriate amounts, as is explained earlier in the context of the admission of a new partners.

Any change, in the profit sharing ratio, like admission of partner, may also involve adjustments in respect of revaluation of assets and liabilities, transfer of accumulated profit and losses to partners' capital accounts in the old profit sharing ratio and adjustment of partners' capitals, if specified, so as to make them proportionate to the new profit sharing ratio. All this is done in the same way as in case of admission of a partner.

Revision 30

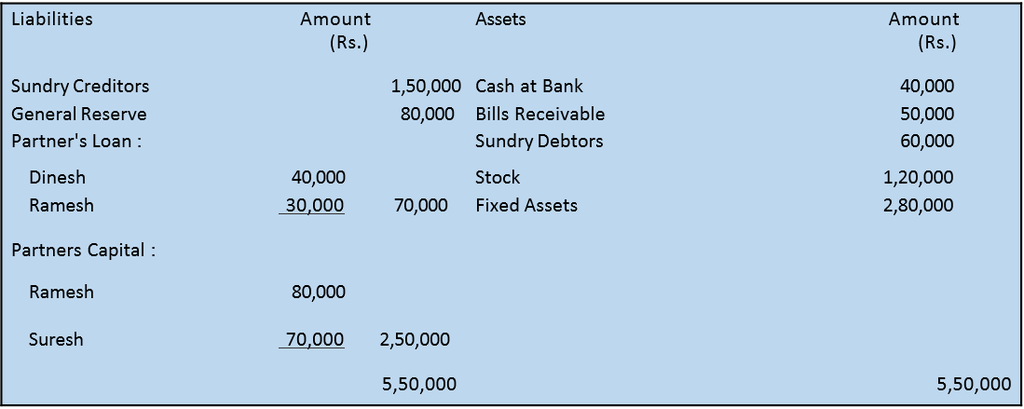

Dinesh, Ramesh and Suresh are partners in a firm sharing profits and losses in the ratio of 3:3:2. They decided to share the profits equally w.e.f. April 1, 2015. Their Balance Sheet as on March 31, 2016 was as follows :

It was also decide that :

- The fixed assets should be valued at Rs. 3,31,000.

- A provisions of 5% on sundry debtors be made doubtful debts.

- The goodwill of the firm at this date be valued at

years purchase of the average net profits of last, five years which were Rs. 14,000; Rs. 17,000; Rs. 20,000; Rs. 22,000 and Rs. 27,000 respectively.

years purchase of the average net profits of last, five years which were Rs. 14,000; Rs. 17,000; Rs. 20,000; Rs. 22,000 and Rs. 27,000 respectively. - The value of stock be reduced to Rs. 1,12,000.

- Goodwill was not to appear in the books. Pass the necessary journal entries and prepare the revised Balance sheet of the firm.

Solution

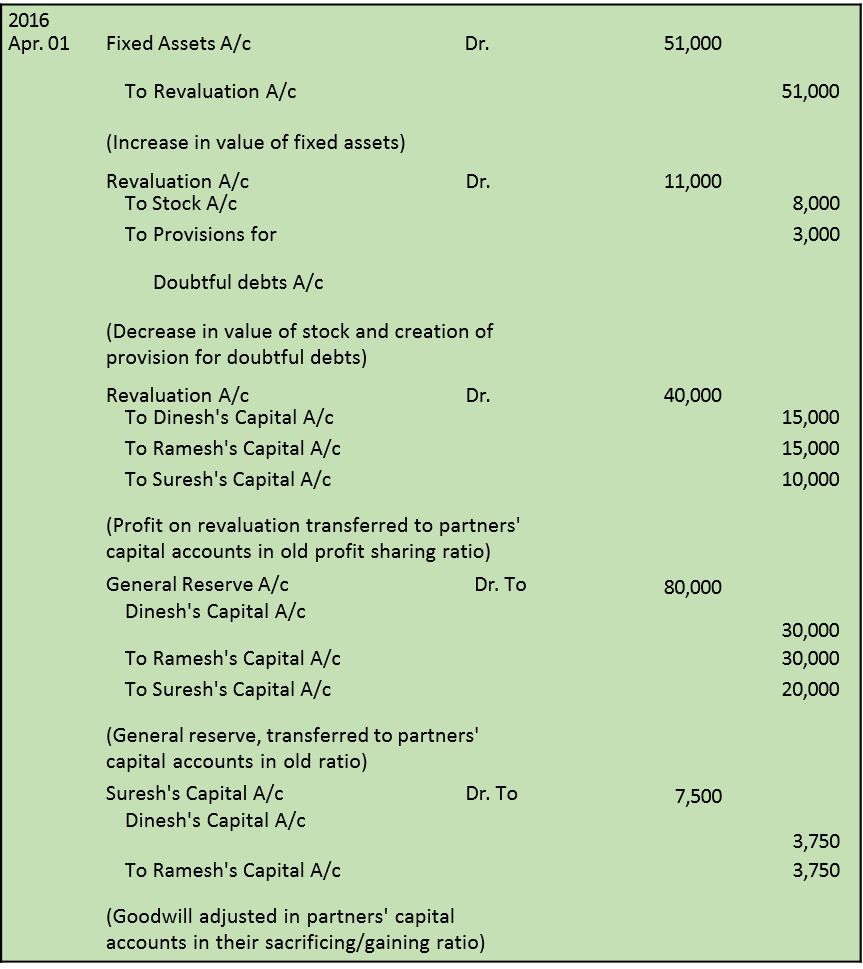

Books of Dinesh, Ramesh and Suresh Journal

Working Notes:

1. Gain or sacrifice of partners

2. Goodwill

Total Profits : Rs. 14,000 + Rs. 17,000 + Rs. 20,000 + Rs. 22,000 + Rs. 27,000

= Rs. 1,00,000

Average Profits = Rs. 1,00,000/5 = Rs. 20,000

Goodwill = Rs. 20,000 × ![]() = Rs 90, 000

= Rs 90, 000

Suresh in expected to bring in Rs. 7,500

as he gain 2/24 shares in profits.

Dinesh in expected to receive Rs. 3,750

as he sacrifices 1/24 share in profits

Ramesh is expected to receive Rs. 3,750

as he sacrifices 1/24 share in profits

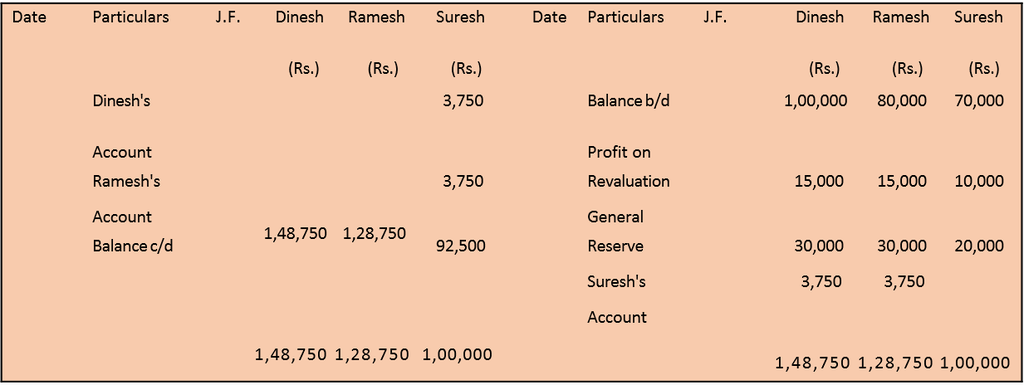

3. capital Accounts

![]() Balance Sheet as on April 01, 2015

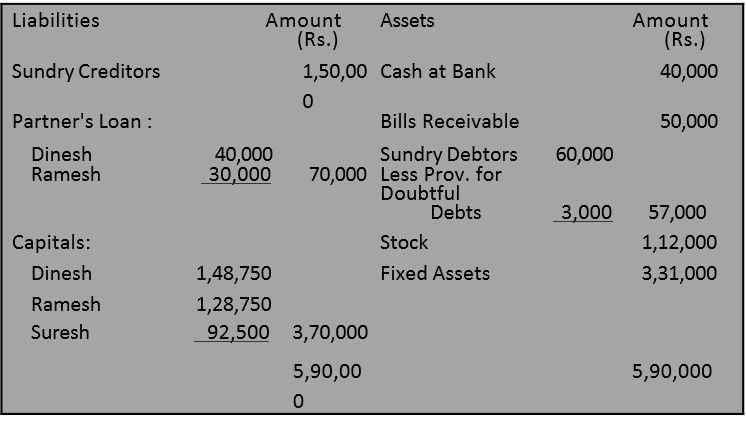

Balance Sheet as on April 01, 2015

Summary

1. Matters requiring adjustments at the time of admission of a partner: Various matters which need adjustments in the books of firm at the time of admission of a new partner are : goodwill, revaluation of assets and liabilities, reserves and other accumulated profits and losses and the capitals of the old partners’ (if agreed).

2.Determining the new profit sharing ratio and calculating sacrificing ratio: The new partner acquires his share in profits from the old partners’. This reduces the old partners’ share in profits. Hence, the problem of determining the new profit sharing ratio simply involves the determination of old partners’ new share in the profits of the reconstituted firm. Given the new partners’ share in profits and the ratio, in which he acquires it from the old partners, the new share of each old partner shall be worked out by deducting his share of sacrifice from his old share in profits. The ratio in which the old partners have agreed to sacrifice their shares in profit in favour of the new partner is called the sacrificing ratio. It is usually same as the old profit sharing ratio. However, based on the agreement it can be different also.

3. Treatment of Goodwill: Goodwill is an intangible asset and belonges to its owner at a point of time. On the admission of a new partner the goodwill of the firm belongs to the old partners. It means that on the admission of a new partner some adjustments must be made into the capital accounts of the old partners for goodwill so that the new partner will not acquire a share in that profit which the firm earns because of its goodwill earned before admission without making any payment for the same. The amount that the new partner pays for goodwill is called goodwill. From accounting point of view the firm may have to face different situations for the treatment of goodwill at the time of admission of a partner. The amount of premium brought in by the new partner is shared by old partners in the ratio of sacrifice. In case the new partner fails to bring his share of premium for goodwill in cash than the capital account of the new partner is debited for his share of premium of goodwill and the old partners capital accounts are credited in their sacrificing ratio.

4. Adjustments for Revaluation of Assets and Reassessment of Liabilities: If, at the time of admission of a partner, the assets and liabilities are revalued or some asset or liability is found unrecorded, necessary adjustments are made through the Revaluatiion Account. Any gain or loss arising from such exercise shall be distributed among the old partner’s in their old profit sharing ratio.

5. Adjustment for reserves and accumulated profits/losses: If, at the time of admission of a partner, any reserve and accumulated profits or losses exist in books of the firm, these should be transferred to old partner’s capital/current accounts in their old profit sharing ratio.

6. Determining/Adjusting partners’ capital: If agreed, the partner’s capital may be adjusted so as to be proportionate to their new profit sharing ratio. In that case, the new partner’s capital is normally used as a base for determining the new capitals of the old partners and necessary adjustment made through case or by transfer to partner’s current accounts. Other basis also may be available for determining capitals of the partners after admissioin of the new partner like sharing the total capital to be in the firm immeidately after admission of the new partner.

7. Change in profit sharing ratio: Sometimes the partners of a firm may agree to change their existing profit sharing ratio. With a result, some partners will gain in future profits while others will lose. In such a situation, the partner who gain by change in profit effecting amounts to one partner buying the share of profit from another partner. Apart from the payment for compensation, the change in profit sharing ratio also necessitates adjustment in partners’ capital accounts with respect to undistributed profits and reserves, revaluation of assets and reassessment of liabilities.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY