Reconstitution of the partnership firm can also take place on the retirement of the partner or death of the partner. Here, the existing partnership deed comes to an end a new partnership deed comes into existence where the remaining partners continue to do the business but on different terms and conditions. In both cases, i.e. on retirement or death of a partner, it is required to determine the sum due to the retiring partner or to the legal representatives of the deceased partner.

Retirement of a Partner:

A partner may retire from the partnership firm:

- with the consent of all other partners;

or - in case of retirement at will i.e. (partnership at will);

or - by giving notice in writing to all other partners by the retiring partner.

On retirement, the old partnership comes to an end arid a new one between the remaining partner1 comes into existence. However the partnership firm as such continues.

Ascertaining the Amount due to Retiring Partner

In order to ascertain the amount due to the retiring partner, we have to calculate the following things

- Credit Balance of his Capital Account;

- Credit Balance of his Current Account (if any);

- His share of goodwill, accumulated profits, reserves etc.;

- His share in the profit on revaluation of assets and liabilities;

- His share of profit, interest on capital up to the date of retirement;

- Any salary/commission due to him.

The following deductions (if any) is made from his share:

- Debit balance of the his-current account (if any);

- His share of Goodwill to be written off, accumulated losses;

- His share of loss on revaluation of assets and liabilities;

- His share of loss, drawing and interest on drawings up to the date of retirement.

The various accounting aspects involved in retirement or death are as follows:

- New profit sharing ratio

- Gaining ratio

- Goodwill Treatment

- Accumulated profit and losses -Distribution

- Profit and Loss till the date of retirement or death

- Adjustment of Capital

- Settlement of the amount due to retired /deceased partner.

New Profit Sharing Ratio:

The new profit sharing ratio is the ratio in which the remaining partners will share future profits after the retirement or death of any partners. In other words, the new profit sharing ratio of each remaining partner will be the sum total of his old share of profits in the firm and the portion of the retiring partner’s share of the profit acquired.

New Share of Partner = Old share + Acquired share from retiring/deceased partner.

(a) Nothing is mentioned about the new profit sharing ratio at the time of retirement:

If nothing is stated about the future ratio of the remaining partner, then their old ratio is considered as their new ratio. In other words, in the absence of any information regarding the profit-sharing ratio in which the remaining partner acquires the share of the retiring/deceased partner, then it is assumed that they will acquire it in the old profit-sharing ratio and so the share the future profits in their old ratio.

For example, Kapil, Anu and Priti are partners in a firm sharing profits and losses in the ratio of 5: 3: 2. If Anu retires, then the new profit sharing ratio of Kapil and Priti will be 5: 2.

(b) Remaining partners acquire the share of retiring/deceased partner in the specified ratio:

If the remaining partners acquire the share of the retiring/deceased partner in a specified ratio, other than their old ratio, then there is a need to compute a new profit sharing ratio among them. The new profit sharing ratio is equal to the sum total of their old ratio and the share acquired from the retiring/deceased partner.

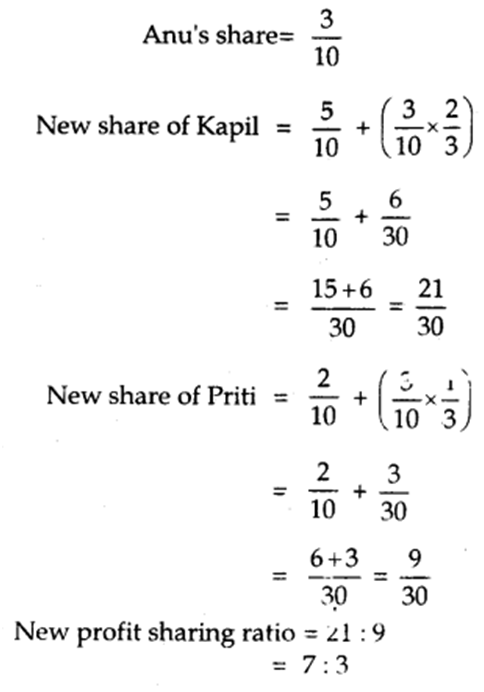

For example, Kapil, Anu and Priti are partners in a firm sharing profits and losses in the ratio of 5: 3: 2. If Anu retires from the firm and her share was acquired by Kapil and Priti in the ratio of 2: 1. In that case, the new share of profit will be calculated as follows: New share of remaining partner = Old share + Acquired share from the outgoing partner.

(c) Remaining partners may agree on a particular new profit sharing ratio:

If the remaining partners decide on a particular profit sharing ratio to share the future profits of the firm, in such a case the ratio so specified will be the new profit sharing ratio.

Gaining Ratio:

The ratio in which the continuing partners acquire the share of the retiring /deceased partner is called the gaining ratio.

(a) If nothing is mentioned in the agreement: If nothing is mentioned in the agreement about the gaining ratio, then it is assumed that the remaining partners acquire the share of the retiring/deceased partner in their old profit sharing ratio. In that case, the gaining ratio of the remaining partners will be the same as their old profit sharing ratio and there is no need to compute the gaining ratio.

(b) If a new profit sharing ratio is given: If the new profit sharing ratio is given of the remaining partners then we have to compute the gaining ratio. In this case, the gaining ratio is calculated by deducting the old ratio from the new ratio.

Gaining ratio = New ratio – Old ratio

For example X, Y and Z are partners in a firm, sharing profits and losses in ratio of 5:3:2. Y retires from the firm and X and Z decide to share future profits and losses in the ratio of 7: 5

The gaining ratio will be calculated as follows:

Vision classes

Vision classes