- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Guarantee of Profit to a Partner

Sometimes a partner is admitted into the firm with a guarantee of certain minimum amount by way of his share of profits of the firm. Such assurance may be given by all the old partners in a certain ratio or by any of the old partners, individually to the new partner. The minimum guaranteed amount shall be paid to such new partner when his share of profit as per the profit sharing ratio is less than the guarnteed amount. For example, Madhulika and Rakshita, who are partners in a firm decide to admit Kanishka into their firm, giving her the guarantee of a minimum of Rs.25,000 as her share in firm’s profits. The firm earned a profit of Rs.1,20,000 during the year and the agreed profit sharing ratio between the partners is decided as 2:3:1. As per this ratio, Madhulika’s share in profit comes to Rs.40,000 (2/6 of Rs. 1,20,000); Rakshita, Rs. 60,000 (3/6 of Rs. 1,20,000) and Kanishka Rs. 20,000 (1/6 of Rs. 1,20,000). The share of Kanishka works out to be Rs.5,000 short of the guaranteed amount. This shall be borne by the guaranteeing partners Madhulika and Rakshita in their profit sharing ratio, which in this case is 2:3, Madhulika’s share in the deficiency comes to Rs.2,000 (2/5 of Rs. 5,000), and that of Rakshita Rs.3,000. The total profit of the firm will be distributed among the partners as follows Madhulika will get Rs.38,000 (her share 40,000 minus share in deficiency Rs.2,000); Rakshita Rs.57,000 (60,000–3,000) and Kanishka Rs. 25,000 (Rs. 20,000 + Rs. 2,000 + Rs. 3,000).

If only one partner gives the guarantee, say in the above case, only Rakshita gives the guarantee, the whole amount of deficiency (Rs.5,000) will be borne by her only. In that case profit distribution will be Madhulika Rs.40,000, Rakshita Rs. 55,000 (60,000–5,000) and Kanishka Rs. 25,000 (Rs. 20,000 + Rs. 5,000).

Revision 10

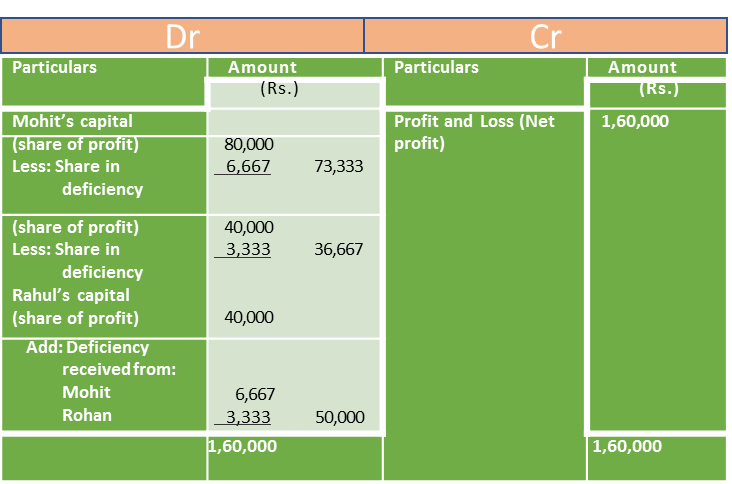

Mohit and Rohan share profits and losses in the ratio of 2:1. They admit Rahul as partner with 1/4 share in profits with a guarantee that his share of profit shall be at least Rs. 50,000. The net profit of the firm for the year ending March 31, 2015 was Rs. 1,60,000. Prepare Profit and Loss Appropriation Account.

Solution

Books of Mohit, Rohit and Rahul Profit and Loss Appropriation Account for the year ending .....

Working Notes:

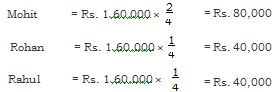

The new profit sharing ratio after admission of Rahul comes to 2:1:1. As per this ratio the share of partners in the profit comes to:

But, since Rahul has been given a guarantee of minimum of Rs. 50,000 as his share of profit. The deficiency of Rs. 10,000 (Rs. 50,000 – Rs. 40,000) shall be borne by Mohit and Rohan in the ratio in which they share profits and losses between themselves, viz. 2:1 as follows:

Mohit’s share in deficiency comes to 2/3 × Rs. 10,000 = Rs. 6,667

The new partner Rahul’s share is 1/4 The remaining profit is 1 – 1/4 = 3/4, to be shared between Mohit and Rohan in the ratio of 2:1.

Mohit’s new share = 3/4 × 2/3 = 2/4

Rohan’s new share = 3/4 × 1/3 = 1/4

Thus, New profit sharing ratio comes to be 2/4 : 1/4 : 1/4 or 2 : 1: 1

Revision 11

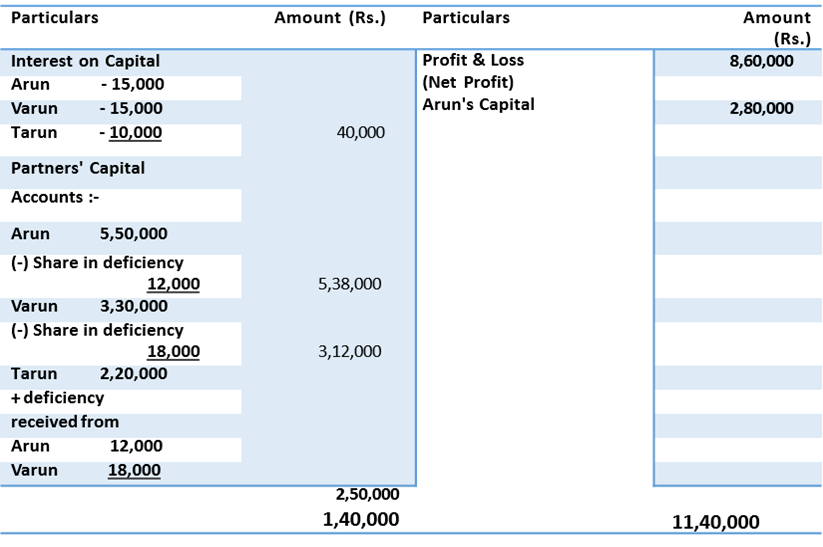

(i) Arun, Varun and Tarun were partners of a law firm sharing profits in the ratio of 5:3:2. Their partnership deed provided the following: (i) Interest on partners' capital @ 5% p.a.

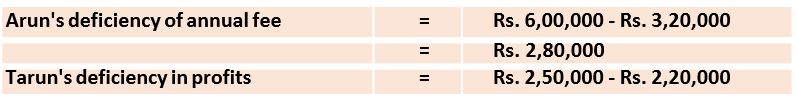

(ii) Arun guaranteed that he would earn a minimum annual fee of Rs.6,00,000 for the firm.

(iii) Tarun was guaranteed a profit of Rs. 2,50,000 (excluding interest on capital) and any deficiency on account of this was to be borne by Arun and Varun in the ratio of 2:3.

During the year ending March 31, 2019, Arun earned a fee of Rs. 3,20,000 and net profits earned by the firm were Rs. 8,60,000. Partner's capital on April 01, 2018 were Arun - Rs. 30,00,000; Varun - Rs. 3,00,000 and Tarun- Rs. 2,00,000.

Prepare Profit and Loss Appropriation account and show your workings clearly.

Solution

Books of Arun, Varun and Tarun Profit and Loss Appropriation Account for the year ending March 31, 2019

Working Notes :-

Rs. 30,000 to be borne by Arun & Varun in the ratio of 2:3 i.e. Rs. 12,000

and Rs. 18,000 respectively.

Revision 12

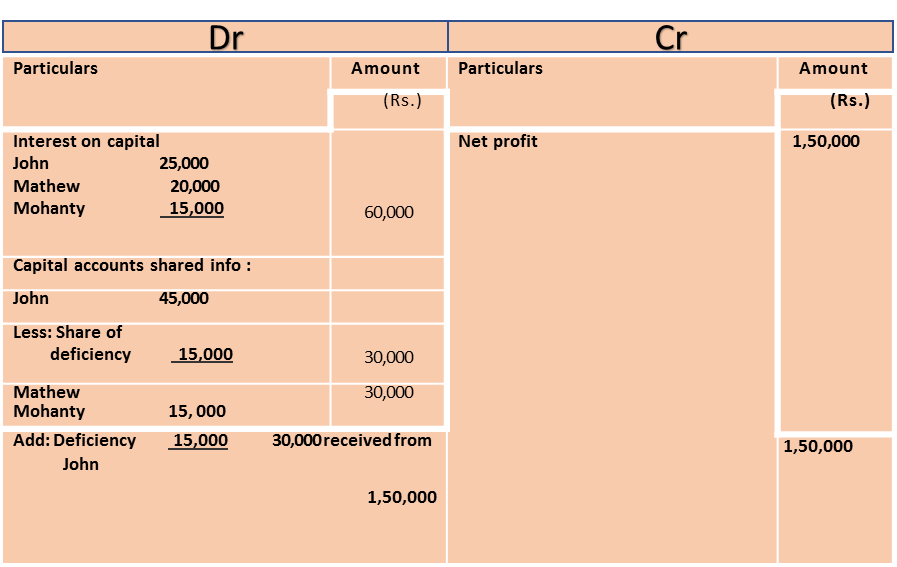

John and Mathew share profits and losses in the ratio of 3:2. They admit Mohanty into their firm to 1/6 share in profits. John personally guaranteed that Mohanty’s share of profit, after charging interest on capital @ 10 per cent per annum would not be less than Rs. 30,000 in any year. The capital provided was as follows: John Rs. 2,50,000, Mathew Rs. 2,00,000 and Mohanty Rs. 1,50,000. The profit for the year ending March 31,2015 amounted to Rs. 1,50,000 before providing interest on capital. Show the Profit & Loss Appropriation Account if new profit sharing ratio is 3:2:1.

Solution

Books of John and Mathew

Profit and Loss Appropriation Account for the year ending....

Working Notes:

Profit after interest on capital is Rs. 90,000, which is to be distributed in the ratio of 3:2:1 as follows: John gets Rs. 45,000 (3/6 × Rs. 90,000), Mathew Rs. 30,000, Mohanty Rs. 15,000. Deficiency of Mohanty from the guaranteed profit of Rs. 15,000 will be borne by John. John will therefore get Rs. 45,000 – Rs. 15,000 = Rs. 30,000, Mathew Rs. 30,000 and Mohanty Rs. 30,000.

Revision 13

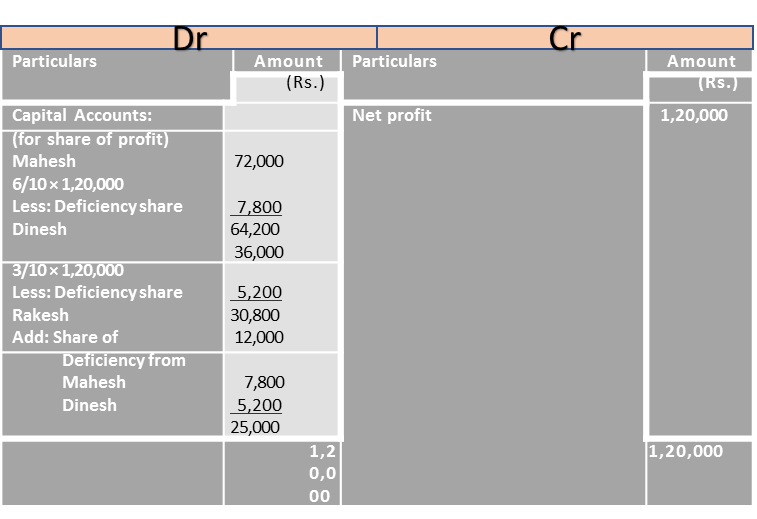

Mahesh and Dinesh share profits and losses in the ratio of 2:1. From January 01, 2014 they admit Rakesh into their firm who is to be given a share of 1/10 of the profits with a guaranteed minimum of Rs. 25,000. Mahesh and Dinesh continue to share profits as before but agree to bear any deficiency on account of guarantee to Rakesh in the ratio of 3:2 respectively. The profits of the firm for the year ending December 31, 2015 amounted to Rs. 1,20,000. Prepare Profit and Loss Appropriation Account.

Books of Mahesh and Dinesh Profit and Loss

Appropriation Account for the year ending .....

New profit sharing Ratio will be calculated as follows:

Rakesh to share 1/10 of the profit. The remaining profit 9/10 will be shared by Mahesh and Dinesh in the ratio of 2:1.

Mahesh’s share in profit will be 2/3 × 9/10 = 3/10

Dinesh’s share will be 1/3 × 9/10 = 3/10

The New ratio becomes 3/5 : 3/10 : 1/10 or 6:3:1

Mahesh’s share in profit = 1,20,000 × 6/10 = Rs. 72,000,

Dinesh’s share in profit = Rs. 36,000,

Rakesh’s share in profit = Rs. 12,000.

Mahesh will bear 3/5 of 13,000, i.e. Rs. 7,800 and Rakesh, 2/5 of Rs. 13,000, i.e. Rs. 5,200.

Thus, the profits of the firm will be shared as follows.

Mahesh will get Rs. 72,000 – Rs. 7,800 = Rs. 64,200.

Dinesh will get Rs. 36,000 – Rs. 5,200 = Rs. 30,800

Rakesh will get Rs. 12,000 + Rs. 7,800 + Rs. 5,200 = Rs. 25,000

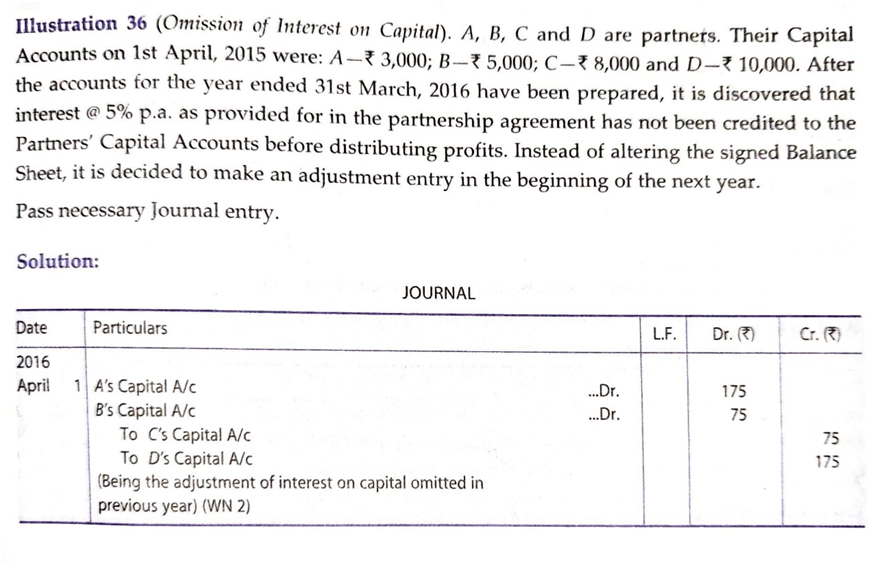

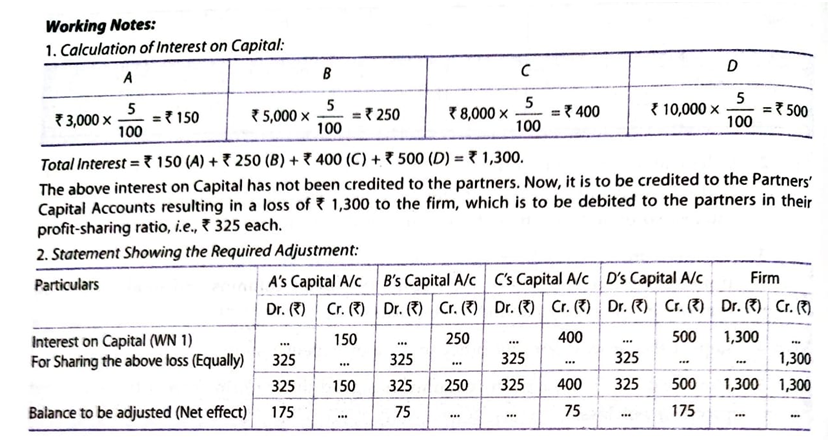

Past Adjustments

Sometimes a few omissions or errors in the recording of transactions or the preparation of summary statements are found after the final accounts have been prepared and the profits distributed among the partners. The omission may be in respect of interest on capitals, interest on drawings, interest on partners’ loan, partner’s salary, partner’s commission or outstanding expenses. There may also be some changes in the provisions of partnership deed or system of accounting having impact with retrospective effect. All these acts of omission and commission need adjustments for correction of their impact. Instead of altering old accounts, necessary adjustments can be made either; (a) through ‘Profit and Loss Adjustment Account’, or (b) directly in the capital accounts of the concerned partners. This is explained with the help of following example.

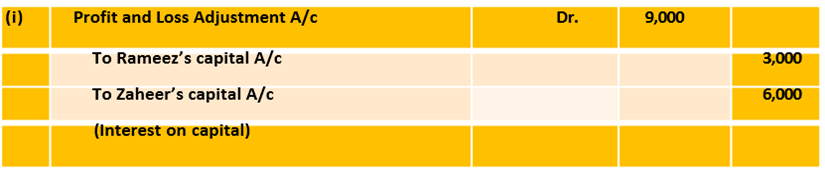

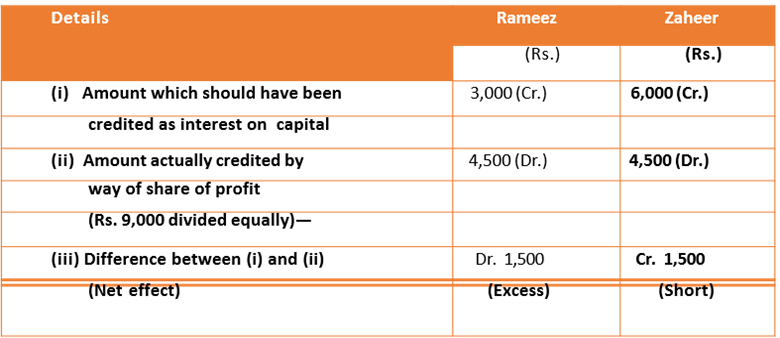

Rameez and Zaheer are equal partners. Their capitals as on April 01, 2015 were Rs. 50,000 and Rs. 1,00,000 respectively. After the accounts for the financial year ending March 31, 2016 have been prepared, it is discovered that interest at the rate of 6 per cent per annum, as provided in the partnership deed has not been credited to the partners’ capital accounts before distribution of profit. In this case, the interest on capital not credited to the partners’ capital accounts works out to be Rs. 3000 (6/100 × Rs. 50,000) for Rameez and Rs. 6,000 (6/100 × Rs. 1,00,000) for Zaheer. Had the interest on capital been duly provided, the firm’s profit would have reduced by Rs. 9,000. By this omission, the whole amount of profit as per Profit and Loss Account (without adjustment of Rs. 9,000) has been distributed among the partners in their profit sharing ratio, and the amounts of interest on capital have not been credited to their capital accounts. This error can be rectified in any of the following ways;

(a) Through Profit and Loss Adjustment Account

(b) Directly in Partners’ Capital Accounts

For direct adjustment in partners’ capital accounts first a statement to ascertain the net effect of omission on partners’ capital accounts will be worked out as follows and then the adjustment entries can be recorded.

Statement Showing Net Effect of Omitting Interest on Capital

The statement shows that Rameez has got excess credit of Rs. 1,500 while Zaheer’s account has been credited less by Rs. 1,500. In order to rectify the error Rameez’s capital account should be debited and that of Zaheer, credited with Rs. 1,500 by passing the following journal entry;

journal entry.

Rameez’s Capital A/c Dr. 1,500

To Zaheer’s Capital A/c 1,500 (Adjustment for omission of interest on capital)

Revision 14

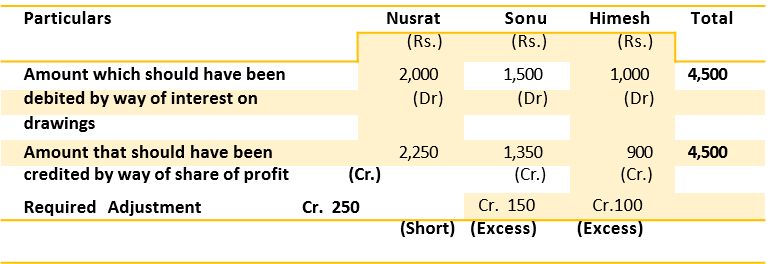

Nusrat, Sonu and Himesh are partners sharing profits and losses in the ratio of 5 : 3 : 2. The partnership deed provides for charging interest on drawing’s @ 10% p.a. The drawings of Nusrat, Sonu and Himesh during the year ending March 31, 2015 amounted to Rs. 20,000, Rs. 15,000 and Rs. 10,000 respectively. After the final accounts have been prepared, it was discovered that interest on drawings has not been taken into consideration. Give necessary adjusting journal entry.

Statement showing Net Effect of Omitting Interest on Drawings

Journal Entry for adjustment of interest on drawings would be:

Summary

1. Definition of partnership and its essential features: Partnership is defined as “Relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all”. The essential features of partnership are : (i) To form a partnership, there must be at least two persons; (ii) It is created by an agreement; (iii) The agreement should be for carrying on some legal business; (iv) sharing of profits and losses; and (v) relationship of mutual agency among the partners.

2. Meaning and contents of partnership deed: A document which contains the terms of partnership as agreed among the partners is called ‘Partnership Deed’. It usually contains information about all aspects affecting relationship between partners, including objective of business, contribution of capital by each partner, ratio in which profit and losses will be shared by the partners, entitlement of partners to interest on capital, interest on loan and the rules to be followed in case of admission, retirement, death, dissolution, etc.

3. Provisions of Partnership Act 1932 applicable to accounting: If partnership deed is silent in respect of certain aspects, the relevant provisions of the Indian Partnership Act, 1932 become applicable. According to the Partnership Act, the partners share profits equally, no partner is entitled to remuneration, no interest on capital is allowed and no interest on drawings is charged. However, if any partner has given some loan to the firm, he is entitled to interest on such amount @ 6% per annum.

4. Preparation of capital accounts under fixed and fluctuating capital methods: All transactions relating to partners are recorded in their respective capital accounts in the books of the firm. There can be two methods of maintaining Capital Accounts. These are; (i) fluctuating capital method, (ii) fixed capital method. Under fluctuating capital method, all the transactions relating to a partner are directly recorded in the capital account. Under fixed capital method, however the amount of capital remains fixed, the transactions like interest on capital, drawings, interest on drawings, salary, commission, share of profit or loss are recorded in a separate account called ‘Partner’s Current Account’.

5. Distribution of profit and loss: The distribution of profits among the partners is shown through a Profit and Loss Appropriation Account, which is merely an extension of the Profit and Loss Account. It is usually debited with interest on capital and salary/commission allowed to the partners, and credited with net profit as per Profit and Loss Account and the interest on drawings. The balance being profit or loss is distributed among the partners in the profit sharing ratio and transferred to their respective capital accounts.

6. 6. Treatment of guarantee of minimum profit to a partner: Sometimes, a partner may be guaranteed a minimum amount by way of his share in profits. If, in any year, the share of profits as calculated according to his profit sharing ratio is less than the guaranteed amount, the deficiency is made good by the guaranteeing partners’ in the agreed ratio which usually is the profit sharing ratio. If, however, such guarantee has been given by any of them, he or they alone shall bear the amount of deficiency.

7. Treatment of past adjustments: If, after the final accounts have been prepared, some omission or commissions are noticed say in respect of the interest on capital, interest on drawings, partner’s salary, commission, etc. necessary adjustments can be made in the partner’s capital accounts through the Profit and Loss Adjustment Account, to rectify the same.

8. Preparation of final accounts of a partnership firm: There is not much difference in the final accounts of a sole proprietary concern and that of a partnership firm except that in case of a partnership firm an additional account called Profit and Loss Appropriation Account is prepared to show distribution of profit and loss among the partners.

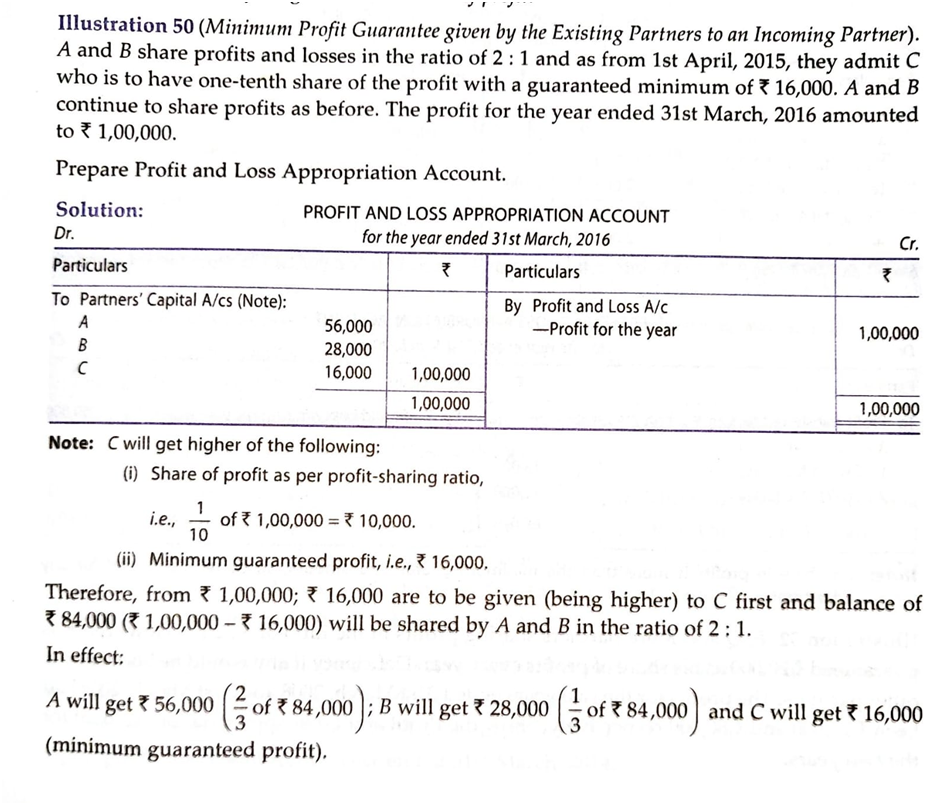

Guarantee of Profit

- In some cases, a partner may be admitted in the firm on a guarantee in respect of his minimum profit from the business.

- Such a guarantee may be given to an existing partner as well.

- Such a guarantee to the incoming partner is given ;

- All the old partners in agreed ratio

- Some of the old partners

When all the partners guarantee that one of the partners shall be given a minimum amount of profit, the following amounts have to be calculated separately

- Share of profit as per profit sharing ratio

- Minimum Guaranteed Profit

- The minimum of the above two is given to that partner & the balance of profit (i.e. total profit – profit given to the guaranteed partner) is shared by the remaining partners in the profit-sharing ratio.

- If the partner’s actual share of profit turns out to be more than the guaranteed profit then in that case the partner will be given the actual amount instead of the guaranteed amount.

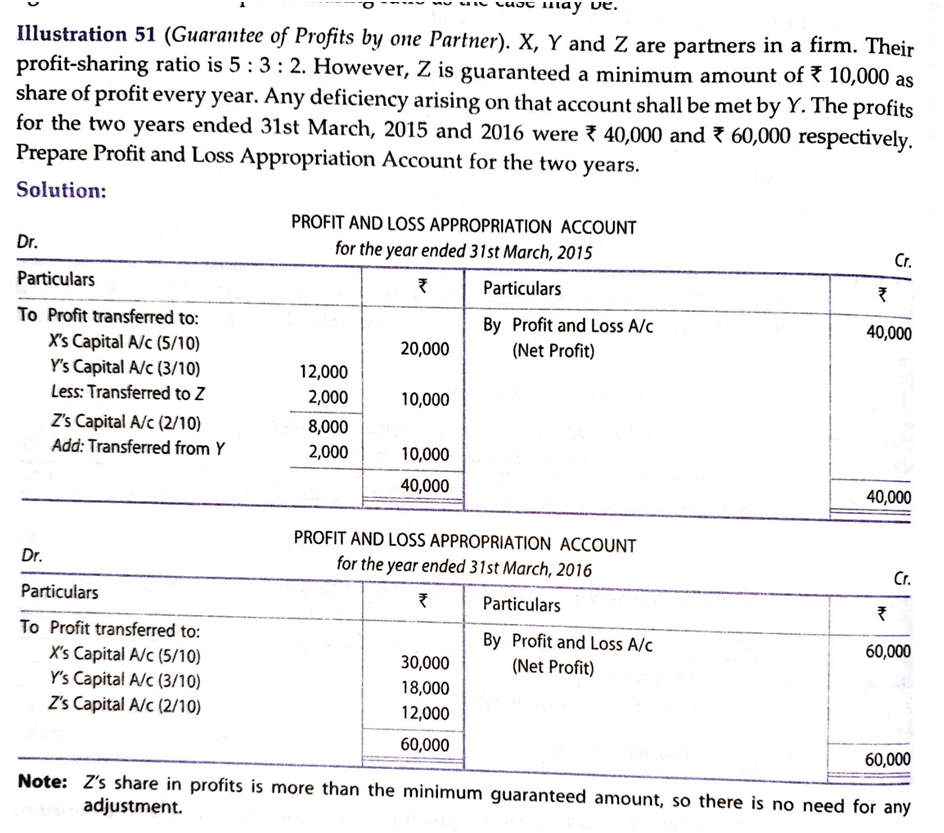

- When one or more than one partner guarantees a minimum profit, the adjustment is made through the partner’s capital accounts. The following steps are followed;

- Distribute the profit among the partners in their profit sharing ratio

- If the share of the guaranteed profit of the partner falls short of the minimum amount then the difference is deducted from the original share of profit of the partners who guarantee & it is added with the original share of profit of the guaranteed partner.

- When two or more partners give guarantee, the shortfall is shared by them in the agreed ratio or in their profit-sharing ration as the case may be.

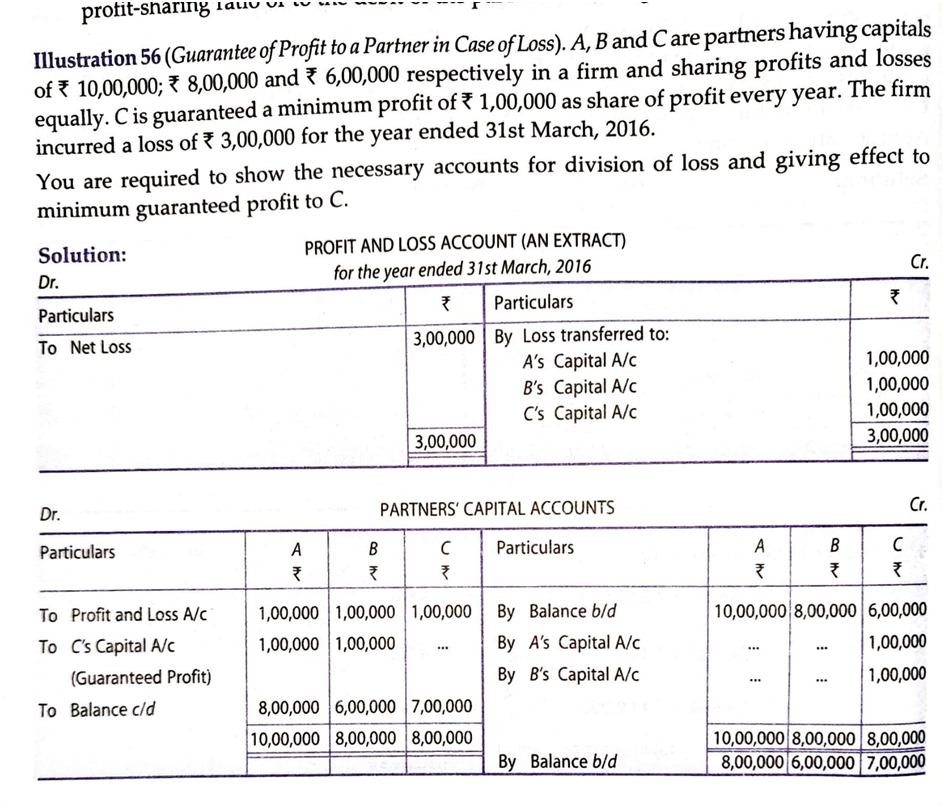

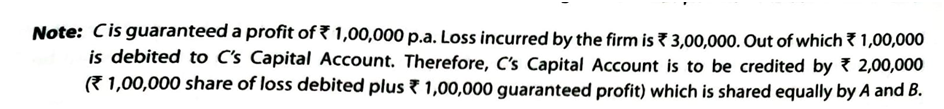

- Accounting Treatment of Guarantee of Profit in case of Loss

- Sometimes it is possible that the firm has incurred losses but the guaranteed profit is to be paid to the partner who has been guaranteed minimum profit. In such a case, the adjustment has to be made through partner’s capital A/c in the following manner;

- Distribute the loss among the partners in their profit sharing ratio

- Capital A/c of the guaranteed partner is credited with guaranteed minimum profit plus the amount of loss. This amount is debited to remaining partners in their profit sharing ratio or to the debit of the partner who has guaranteed minimum profit.

Past Adjustments

Sometimes, after the final accounts of a firm have been closed, it is found that certain matters have been left out by mistake. In such cases, instead of altering the final accounts which have already been closed, the firm rectifies the error or omission by passing an adjustment entry in the beginning of the financial year. Such adjustments are called past adjustments as they relate to the past.

Steps to pass adjusting journal entry:

Step 1 Calculate the amount already recorded.

Step 2 Calculate the amount which should have been recorded.

Step 3 Calculate the difference between Step 1 and Step 2.

Step 4 Find out the partner who received excess and the partner who received short.

Step 5 Pass the adjusting journal entry by debiting the partner who received excess and by crediting the partner who received short.

PREPARATION OF FINAL ACCOUNTS OF PARTNERSHIP FIRM

Final accounts of a partnership firm are prepared in the usual way in which they are prepared for a sole proprietorship concern except that the profits in the partnership have to be distributed among the various partners according to the terms of the partnership contract and the amount of profit may be arrived at after making adjustments for interest on capital, interest on drawings, salaries to partners, etc. for this another account “Profit & Loss Appropriation Account” is prepared after preparing Profit & Loss Account.

The final accounts prepared by partnership firms are:

a) Manufacturing account – if manufacturing activity is carried on

b) Trading and profit and loss account – to ascertain profitability

c) Profit and loss appropriation account – to show the disposal of profits and surplus

d) Balance sheet – to ascertain the financial status.

Vision classes

Vision classes