- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

CHAPTER-4

Reconstitution of a Partnership Firm – Retirement/Death of a Partner

Ascertaining the Amount Due to Retiring/ Deceased Partner

You have learnt that retirement or death of a partner also leads to reconstitution of a partnership firm. On the retirement or death of a partner, the existing partnership deed comes to an end, and in its place, a new partnership deed needs to be framed whereby, the remaining partners continue to do their business on changed terms and conditions.

There is not much difference in the accounting treatment at the time of retirement or in the event of death. In both the cases, we are required to determine the sum due to the retiring partner (in case of retirement) and to the legal representatives (in case of deceased partner) after making necessary adjustments in respect of goodwill, revaluation of a assets and liabilities and transfer of accumulated profits and losses. In addition, we may also have to compute the new profit sharing’s ratio among the remaining partners and so also their gaining ratio, This covers all these aspects in detail.

The sum due to the retiring partner (in case of retirement) and to the legal representatives/ executors (in case of death) includes:

(i) credit balance of his capital account;

(ii) credit balance of his current account (if any); (iii) his share of goodwill;

(iv) his share of accumulated profits (reserves);

(v) his share in the gain of revaluation of assets and liabilities;

(vi) his share of profits up to the date of retirement/death;

(vii) interest on his capital, if involved, up to the date of retirement/death; and

(viii) salary/commission, if any, due to him up to the date of retirement/death.

The following deductions, if any, may have to be made from his share:

(i) debit balance of his current account (if any);

(ii) his share of goodwill to be written off, if necessary;

(iii) his share of accumulated losses;

(iv) his share of loss on revaluation of assets and liabilities;

(v) his share of loss up to the date of retirement/death;

(vi) his drawings up to the date of retirement/death;

(vii) interest on drawings, if involved, up to the date of retirement/death.

Thus, similar to admission, the various accounting aspects involved on retirement or death of a partner are as follows:

1. Ascertainment of new profit sharing ratio and gaining ratio;

2. Treatment of goodwill;

3. Revaluation of assets and liabilities;

4. Adjustment in respect of unrecorded assets and liabilities;

5. Distribution of accumulated profits and losses;

6. Ascertainment of share of profit or loss up to the date of retirement/death;

7. Adjustment of capital, if required;

8. Settlement of the amounts due to retired/deceased partner;

New Profit Sharing Ratio

New profit sharing ratio is the ratio in which the remaining partners will share future profits after the retirement or death of any partner. The new share of each of the remaining partner will consist of his own share in the firm plus the share acquired from the retiring deceased partner.

Consider the following situations :

(a) normally, the continuing partners acquire the share of retiring or deceased partners in the old profit sharing ratio, and there is no need to compute the new profit sharing ratio among them, as it will be same as the old profit sharing ratio among them. In fact, in the absence of any information regarding profit sharing ratio in which the remaining partners acquire the share of retiring/deceased partner, it is assumed that they will acquire it in the old profit sharing ratio and so share the future profits in their old ratio. For example, Asha, Deepti and Nisha are partners in a firm sharing profits and losses in the ratio of 3:2:1. If Deepti retires, the new profit sharing ratio between Asha and Nisha will be 3:1, unless they decide otherwise.

(b) The continuing partners may acquire the share in the profits of the retiring/deceased partner in a proportion other than their old ratio, In that case, there is need to compute the new profit sharing ratio among them. For example: Naveen, Suresh and Tarun are partners sharing profits and losses in the ratio of 5:3:2. Suresh retires from the firm and his share was required by Naveen and Tarun in the ratio 2:1.

In such a case, the new share of profit will be calculated as follows:

New share of Continuing Partner = Old Share + Acquired share from the Outgoing Partner

Gaining Ratio 2 : 1

Share acquired by Naveen

=2/3 of 3/10

= 2/3 × 3/10 = 1/5 or 2/10

Share acquired by Tarun

= 1/3 of 3/10

= 1/3 × 3/10 = 3/30 or 1/10

Share of Naveen

= 5/10 + 2/10 = 7/10

Share of Tarun

= 2/10 + 1/10 = 3/10

Thus, the new profit sharing ratio of Naveen and Tarun will be = 7 : 3.

(c) The contributing partners may agree on a specified new profit sharing ratio: In that case the ratio so specified will be the new profit sharing ratio.

Gaining Ratio

The ratio in which the continuing partners have acquired the share from the retiring/deceased partner is called the gaining ratio. Normally, the continuing partners acquire the share of retiring/deceased partner in their old profit sharing ratio, In that case, the gaining ratio of the remaining partners will be the same as their old profit sharing ratio among them and there is no need to compute the gaining ratio, Alternatively, proportion in which they acquire the share of the retiring/deceased partner may be duly spacified. In that case, again, there is no need to calculate the gaining ratio as it will be the ratio in which they have acquired the share of profit from the retiring deceased partner.

The problem of calculating gaining ratio arises primarily when the new profit sharing ratio of the continuing partners is specified. In such a situation, the gaining ratio should be calculated by, deducting the old share of each continuing partners from his new share i.e., new profit share minus old profit share, i.e., new profit share minus old profit share. For example, Amit, Dinesh and Gagan are partners sharing profits in the ratio of 5:3:2. Dinesh retires. Amit and Gagan decide to share the profits of the new firm in

the ratio of 3:2.

The gaining ratio will be calculated as follows :

Amit’s Gaining Share = 3/5 − 5/10 = 6 – 5/10 = 1/10

Gagan’s Gaining Share = 2/5 − 2/10 = 4 – 2/10 = 2/10

Thus, Gaining Ratio of Amit and Gagan = 1:2

This implies Amit gains 1/3 and Gagan gains 2/3 of Dinesh’s share of profit.

Gaining share of Continuing Partner = New share – Old share.

Revision 1

Madhu, Neha and Tina are partners sharing profits in the ratio of 5:3:2. Calculate new profit sharing ratio and gaining ratio if

1. Madhu retires

2. Neha retires

3. Tina retires.

Solution

Given old ratio among Madhu : Neha : Tina as 5 : 3 : 2

- If Madhu retires, new profit sharing Ratio between Neha and Tina will be Neha : Tina = 3:2 and Gaining Ratio of Neha and Tina =3:2

- If Neha retires new profit sharing Ratio between Madhu and Tina will be Madhu : Tina = 5:2 Gaining Ratio of Madhu and Tina = 5:2

- If Tina retires, new profit sharing ratio between Madhu and Neha will be: Madhu : Neha = 5:3 Gaining ratio of Madhu and Neha = 5:3

Revision 2

Alka, Harpreet and Shreya are partners sharing profits in the ratio of 3:2:1. Alka retires and her share is taken up by Harpreet and Shreya in the ratio of 3:2. Calculate the new profit sharing ratio.

Solution

Gaining Given, Ratio of Harpreet and Shreya = 3:2 = 3/5 : 2/5

Old Profit Sharing Ratio of between Alka, Harpreet and Shreya 3:2:1

= 3/6 : 2/6 : 1/6

Share acquired by Harpreet

= 3/5 of 3/6 = 9/30

Share acquired by Shreya

= 2/5 of 3/6 = 6/30

New Share = Old Share + Acquired Share

Harpreet’s New Share

= 2/6 + 9/30 = 19/30

Shreya’s New Share

= 1/6 + 6/30 = 11/30

New Profit Sharing Ratio of Harpreet and Shreya = 19:11

Revision 3

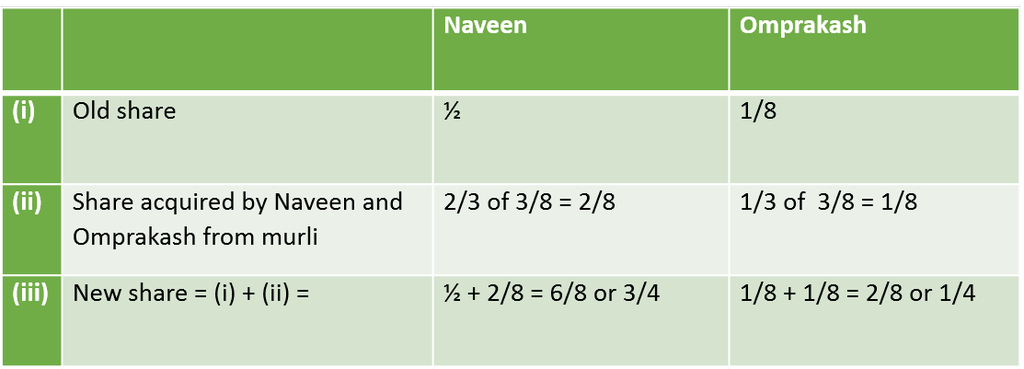

Murli, Naveen and Omprakash are partners sharing profits in the ratio of 3/8 , 1/2 and 1/8 . Murli retires and surrenders 2/3rd of his share in favour of Naveen and the remaining share in favour of Omprakash. Calculate new profit sharing and the gaining ratio of the remaining partners.

Solution

(i) Old Share = Naveen ½ and Omprakash 1/8

(ii) Share Acquired by Naveen from Murli

= 2/3 of 3/8 = 2/8

(iii) Share Acquired by Omprakash from Murli

= 1/3 of 3/8 = 1/8

(iv) New Share for Naveen

= (i) + (ii) = ½ + 2/8 = 6/8 or 3/4

(v) New Share for Omprakash

= (i) + (iii) = 1/8 + 1/8 = 2/8 or 1/4

Thus, the New profit sharing Ratio = ¾ : ¼ or 3:1

and the Gaining Ratio = 2/8 : 1/8 or 2 : 1

Revision 4

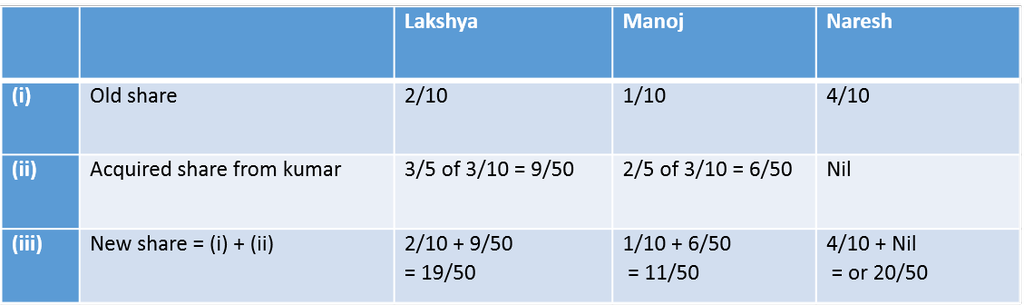

Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3 : 2 : 1 : 4. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of 3:2. Calculate new profit sharing ratio and gaining ratio of the remaining partners.

Solution

Thus, the new profit sharing ratio = ¾ : ¼ or 3 : 1 and the Gaining ratio = 2/8 : 1/8 or 2 : 1 {as calculated in (ii)}.

Revision 4

Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3 : 2 : 1 : 4. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of 3:2. Calculate new profit sharing ratio and gaining ratio of the remaining partners.

Solution

The New Profit Sharing Ratio is 19 : 11 : 20

Gaining ratio is 3 : 2 : 0

Notes :

1. Since Lakshya and Manoj are acquiring Kumar’s share of profit in the ratio of 3:2, hence, the gaining ratio will be 3:2 between Lakshya and Manoj.

2. Naresh has neither sacrificed nor gained.

Revision 5

Ranjana, Sadhna and Kamana are partners sharing profits in the ratio 4:3:2. Ranjana retires; Sadhna and Kamana decided to share profits in future in the ratio of 5:3. Calculate the Gaining Ratio.

Solution

Gaining Share = New Share – Old Share

Sadhna’s Gaining Share = 5/8 – 3/9 = 45 – 24/72 = 21/72

Kamana’s Gaining Share = 3/8 – 2/9 = 27 -16 / 72 = 11/72

Gaining Ratio between Sadhna and Kamana = 21:11

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY