DISPOSAL OF AMOUNT DUE TO RETIRING PARTNER

The partner who is retiring, his or her account is settled as per the terms and conditions of the partnership deed, i.e., in lump sum instantly or in different installments, either with or without interest as consented or partly in cash directly and partially in installment at the consented intermissions. In the absenteeism of any deed, Section 37 of the Indian Partnership Act, 1932 is pertinent, which states that the partner who is retiring or moving out, has a choice to receive interest @ 6% per annum until the date of payment or such share of gains which has been earned with his or her money (i.e., which is based on the capital ratio).

Therefore, the total amount overdue to the retiring partner which is determined after all the modifications and adjustments have been made is to be compensated instantly to the retiring or an outgoing partner. In case the enterprise is not in a situation to make the payment right away, the amount that is overdue is being transferred to the retiring or outgoing Partner’s Loan A/c. The required journal entries are recorded as follows :

When a retiring partner is paid cash in full :

Retiring Partner’s Capital A/c Dr.

To Cash/Bank A/c

When retiring partner’s whole amount is treated as loan:

Retiring Partner’s Capital A/c Dr.

To Retiring Partner’s Loan A/c

When a retiring partner is partly paid in cash and the remaining amount treated as loan :

Retiring Partner’s Capital A/c Dr. (Total amount due)

To Cash/Bank A/c (Amount Paid)

To Retiring Partner’s Loan A/c (Amount of Loan)

When Loan account is settled by paying in instalments includes principal and interest :

• For interest on loan

Interest A/c Dr.

To Retiring Partner’s Loan A/c

• For payment of installment

Retiring Partner’s Loan A/c Dr.

To Cash/Bank A/c

Death of a Partner:

The accounting treatment in the event of the death of a partner is the same as that in the case of the retirement of a partner. Here, his claim is transferred to his executor’s account and settled in the same manner as that of the retired partner.

The only major difference between the retirement and death of a partner is that retirement normally takes place at the end of the accounting period whereas death may occur on any day. Therefore, in case of death, his claim shall also include his share of profit or loss, interest on capital, and interest on drawings (if any), from the beginning of the year to the date of death.

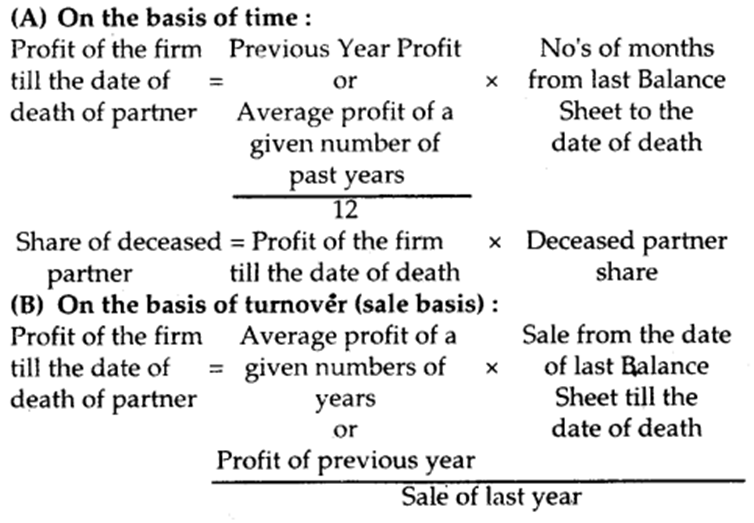

Calculation of profit for the intervening period: Share of profit of a deceased partner

Share of deceased partner = Profit of the firm till the date of death × Deceased partner share

Accounting Treatment of Outgoing Partner’s Share in Profit:

1. Through Profit and Loss Suspense Account

In case of Profit:

Profit and Loss Suspense A/c Dr.

To Deceased Partner’s Capital A/c (Share of profit for the intervening period)

In case of Loss:

Deceased Partner’s Capital A/c Dr.

To Profit and Loss Suspense A/c (Share of loss for the intervening period)

2. Through Capital Transfer In case of Profit:

Remaining Partner’s Capital A/c’s Dr.

To Deceased Partner’s Capital A/c In case of Loss:

Deceased Partner’s Capital A/c Dr.

To Remaining Partner’s Capital A/c’s The executors of deceased partner are entitled to the following:

- The credit balance of deceased partner’s capital account;

- His share of goodwill;

- His share of profit till the date of death;

- His share of profit on revaluation of assets and liabilities;

- His share of accumulated profits and reserves;

- His interest in capital if partnership deed provides till the date of death;

- His share of Joint Life Policy (if any);

- His salary and commission due (if any);

The following deduction has to be made from above.

- His drawings, interest in drawings till the date of death;

- His share of loss till the date of death;

- His share of loss on revaluation of assets and liabilities. ,

- His share of the reduction in the value of goodwill (if any).

Payment to the executors:

1. When payment is made in full Executor’s A/c Dr.

To Bank A/c.

2. When payment is made in installments The executors are entitled to interest when the payment is made in installment. If the deed is silent about this, then 6% p.a. should be given as per Section 37 of the Indian Partnership Act, 1932.

When interest is due

Interest A/c Dr.

To Executor’s A/c

When installment paid along with interest

Executor’s A/c Dr.

To Cash/Bank A/c

Vision classes

Vision classes