- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Adjustment for Revaluation of Assets and Liabilities

At the time of retirement or death of a partner there may be some assets which may not have been shown at their current values. Similarly, there may be certain liabilities which have been shown at a value different from the obligation to be met by the firm. Not only that, there may be some unrecorded assets and liabilities which need to be brought into books. As learnt in case of admission of a partner, a Revaluation Account is prepared in order to ascertain net gain (loss) on revaluation of assets and/or liabilities and bringing unrecorded items into firm’s books and the same is transferred to the capital account of all partners including retiring/deceased partners in their old profit sharing ratio. the Journal entries to be passed for this purpose are as follows:

1. For increase in the value of assets

Assets A/c’s (Individually) Dr. To Revaluation A/c

(Increase in the value of assets)

2. For decrease in the value of assets

Revaluation A/c Dr. To Assets A/c’s (Individually)

(Decrease in the value of assets)

3. For increase in the amount of liabilities

Revaluation A/c Dr. To Liabilities A/c (Individually)

(Increase in the amount of liabilities)

4. For decrease in the amount of liabilities

Liabilities A/c’s (Individually) Dr. To Revaluation A/c

(Decrease in the amount of liabilities)

5. For an unrecorded asset

Assets A/c Dr. To Revaluation A/c

(Unrecorded asset brought into book)

6. For an unrecorded liability

Revaluation A/c Dr. To Liability A/c

(Unrecorded liability brought into books)

7. For distribution of profit or loss on revaluation

Revaluation A/c Dr. To All Partners’ Capital A/c’s (Individually)

(Profit on revaluation transferred to partner’s capital)

(or)

All Partners’ Capital A/c’s (Individually) Dr.

To Revaluation A/c

(Loss on revaluation transferred to partner’s capital accounts)

Revision 10

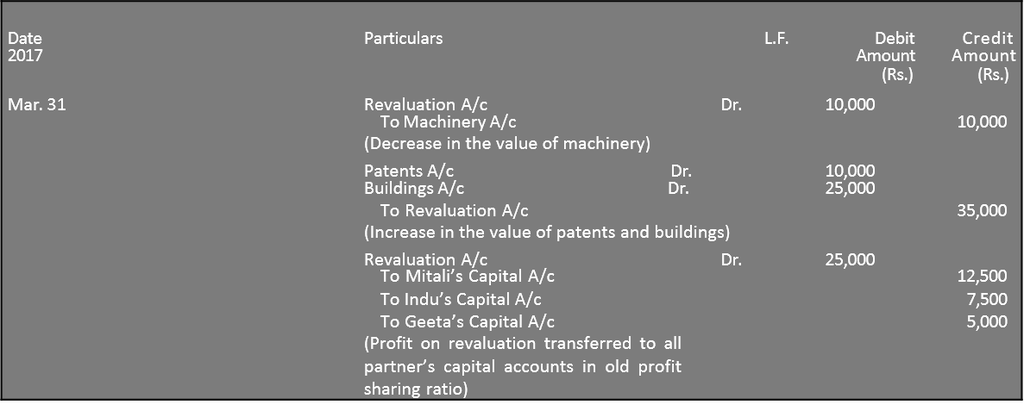

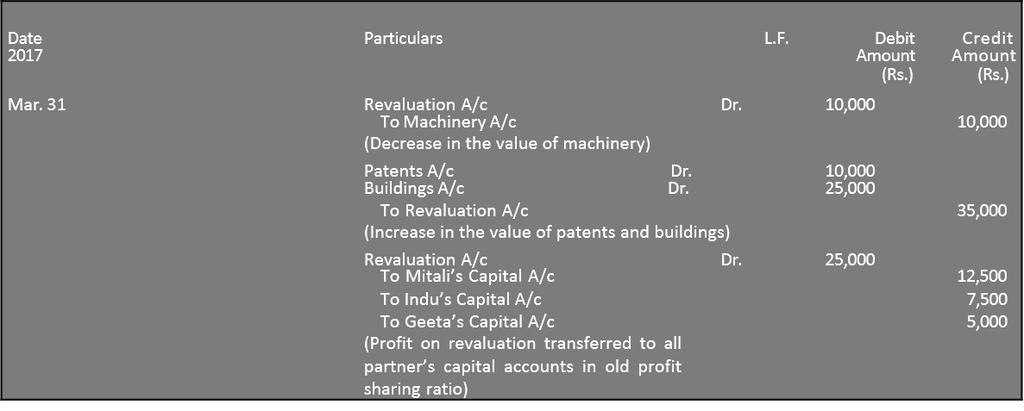

Mitali, Indu and Geeta are partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On March 31, 2017, their Balance Sheet was as under:

Geeta retires on the above date. It was agreed that Machinery be valued at Rs.1,40,000; Patents at Rs. 40,000; and Buildings at Rs. 1,25,000. Record the necessary journal entries for the above adjustmentsand prepare the Revaluation Account.

Solution

Books of Mitali and Indu

Journal

Revaluation Account

Adjustment of Accumulated Profits and Losses

Sometimes, the Balance Sheet of a firm may show accumulated profits in the form of general reserve and/on accumulated losses in the form of profit and loss account debit balance. The retiring/deceased partner is entitled to his/her share in the accumulated profits and is also liable to share the accumulated losses, if any. These accumulated profits or losses belong to all the partners and should be transferred to the capital accounts of all partners in their old profit sharing ratio. The following journal entries are recorded for the purpose.

(i) For transfer of accumulated profits (reserves),

Reserves A/c Dr. To All Partners’ Capital A/c’s (Individually)

(Reserves transferred to all partners’

capital account’s in old profit sharing ratio).

(ii) For transfer of accumulated losses

All Partners’ Capital A/c’s (Individually) Dr. To Profit and Loss A/c

(Accumulated loss transferred to all partners’

capital accounts in their old profit-sharing ratio)

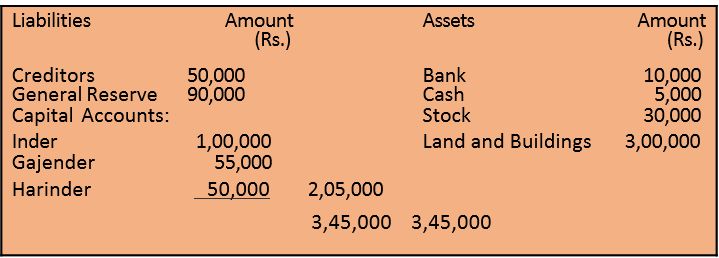

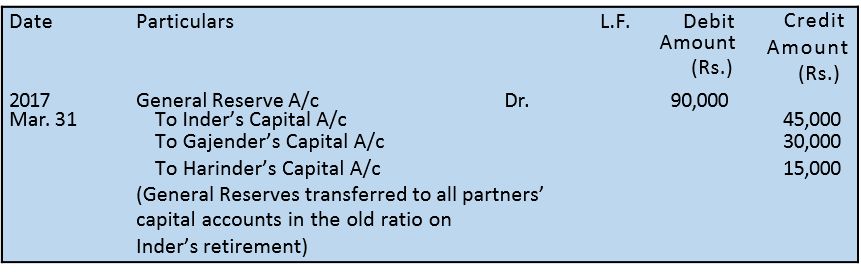

For example; Inder, Gajender and Harinder are partners sharing profits in the ratio of 3 : 2 : 1. Inder retires and the Balance Sheet of the firm on that date was as follows: Books of Inder, Gajinder and Harinder

Balance Sheet as on March 31, 2017

The journal entry to record the treatment of general reserve will be as follows :

Books of Gajender and Harinder

Journal

When Partner Retires in the Middle of the Year

Normally retirement of a partner takes place at the end of accounting period. But there can be a case where a partner decides to retire in the middle of the year. In such a case the claim shall include share of profit or loss, interest on capital, interest on drawings if any, from the date of last balance sheet to the date of retirement. Here, the main problem relates to the calculation of profit for the intervening period, i.e., the period from the date of last balance sheet and the date of retirement. Let us understand by way of example:

Maira, Shabnam and Vipul were partners in a firm sharing profits in the ratio of 5:4:1 profits for the year ending on March 31, 2019 was Rs. 1,00,000. Vipul decides to retire on June 30, 2019. The new profit sharing ratio of the firms is 1:1. Vipul's share of profit for the period of from April 01 to June 30, 2019 shall be calculated as:

Total profit for the year ending on 31st March, 2017 = Rs. 1,00,000

Vipul's share of profit:

Proceeding Year's × Proportionate Period × Share of Deceased Partner

= Rs. 1,00,000 × 3/12 × 4/10 = Rs. 10,000

12 10

The journal entry will be recorded as follows:

Profit & Loss Suspense A/c Dr. 10,000

To Vipul's Capital A/c 10,000

Vipul's share of profit transferred to his capital account

Alternatively, if Vipul's share of profit was to be calculated on the basis of average profits of the last three years, to which were Rs. 1,36,000 for 2016-17, Rs. 1,54,000 for 2017-18 and Rs. 1,00,000 for 2018-19, Vipul's share of profit for the period from April 7, 2019 to June 30, 2019 shall be calculated on the basis of average profit based on profits for the last year calculated as follows:

Average Profit = Total Profit/ No. of Years = ( Rs.1 ,36, 000 + Rs. 1, 54, 000 + Rs 1, 00, 000 ) / 3 = R s. 3,90,000/ 3 = Rs.1,30,000

Vipul’s share of Profit = Rs.1, 30,000

The Journal entry will be:

Profit and Loss Suspense A/c 13,000

To Vipul's Capital A/c 13,000

In case, the agreement provides, that share of profit of the retiring partner will be worked out on the basis of sales, and it is specified that the sales during the pear 2018-19 were Rs. 8,00,000 and the sales from April 1, 2017 to June 30, 2019 were Rs. 1,50,000 Vipul's share of profits for the period from April 1, 2019 shall be calculated as follows:

If sale is Rs. 80,00,000, the profit = Rs. 1,00,000

If sale is Rs. 1, the profit = 1, 00,000 / 8,00, 000

If sale is Rs. 1,50,000, the profit = 1, 00,000 / 8, 00, 000 ×1,50, 000

= Rs. 18,750

Vipul's share of profit = Rs. 7,500

Profit & Loss Suspense A/c Dr. 75,00

To Vipul's Capital A/c 75,00

For being retiring partners share of profit for the intervening period to books of account, the following journal entry is recorded.

(i) Profit & Loss Suspense A/c Dr.

To Retiring Partners Capital A/c

(Share of profit for intervening/period)

Later, Profit and Loss suspense account is closed by transferring the amount to the gaining partners capital account in their gaining ratio. The journal entry is:

(ii) Gaining Partners Capital A/c Dr. (in gaining ratio) To Profit & Loss Suspense A/c

Alternatively, the following journal entry can also be passed in place

of (i) or (ii)

Gaining Partners Capital A/c Dr. To Retiring partners Capital A/c

(Share of profit of retiring partner credited)

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY