- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 12

- Subject

- Accountancy

Accounting Records of Not-for-Profit Organisations

As stated earlier, normally such organisations are not engaged in any trading or business activities. The main sources of their income are subscriptions from members, donations, financial assistance from government and income from investments. Most of their transactions are in cash or through the bank. These institutions are required by law to keep proper accounting records and keep proper control over the utilization of their funds. This is why they usually keep a cash book in which all receipts and payments are duly recorded. They also maintain a ledger containing the accounts of all incomes, expenses, assets and liabilities which facilitates the preparation of financial statements at the end of the accounting period. In addition, they are required to maintain a stock register to keep complete record of all fixed assets and the consumables.

They do not maintain any capital account. Instead they maintain capital fund which is also called general fund that goes on accumulating due to surpluses generated, life membership fee, etc., received from year to year. In fact, a proper system of accounting is desirable to avoid or minimise the chances of misappropriations or embezzlement of the funds contributed by the members and other donors.

Final Accounts or Financial Statements

The Not-for-Profit Organisations are also required to prepare financial statements at the end of the each accounting period. Although these organisations are non-profit making entities and they are not required to make Trading and Profit & Loss Account but it is necessary to know whether the income during the year was sufficient to meet the expenses or not. Not only that they have to provide the necessary financial information to members, donors, and contributors and also to the Registrar of Societies. For this purpose, they have to prepare their final accounts at the end of the accounting period and the general principles of accounting are fully applicable in their preparation as stated earlier, the final accounts of a ‘not-for-profit organization’ consist of the following:

a. Receipt and Payment Account

b. Income and Expenditure Account

c. Balance Sheet.

The Receipt and Payment Account is the summary of cash and bank transactions which helps in the preparation of Income and Expenditure Account and the Balance Sheet. Besides, it is a legal requirement as the Receipts and Payments Account has also to be submitted to the Registrar of Societies along with the Income and Expenditure Account, and the Balance Sheet.

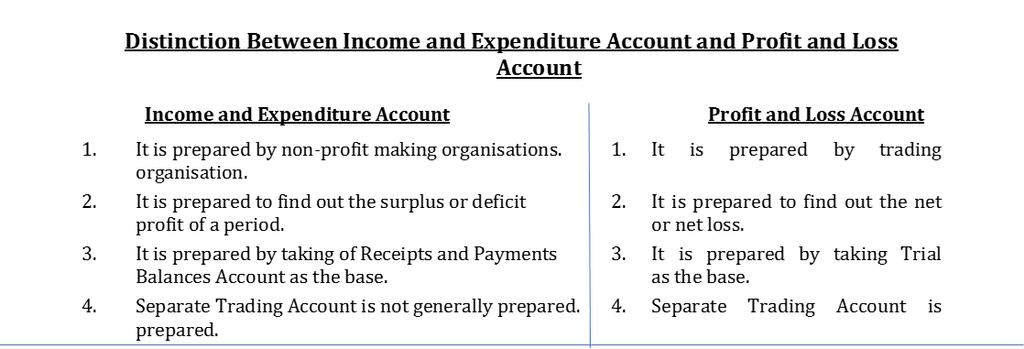

Income and Expenditure Account is akin to Profit and Loss Account. The Not-for-Profit Organisations usually prepare the Income and Expenditure Account and a Balance Sheet with the help of Receipt and Payment Account. However, this does not imply that they do not make a trial balance. In order to check the accuracy of the ledger accounts, they also prepare a trial balance which facilitates the preparation of accurate Receipt and Payment Account as well as the Income and Expenditure Account and the Balance Sheet.

In fact, if an organisation has followed the double entry system they must prepare a trial balance for checking the accuracy of the ledger accounts and it will also facilitate the preparation of Receipt and Payment account. Income and Expenditure Account and the Balance Sheet.

Receipt and Payment Account

It is prepared at the end of the accounting year on the basis of cash receipts and cash payments recorded in the cash book. It is a summary of cash and bank transactions under various heads. For example, subscriptions received from the members on different dates which appear on the debit side of the cash book, shall be shown on the receipts side of the Receipt and Payment Account as one item with its total amount. Similarly, salary, rent, electricity charges paid from time to time as recorded on the credit side of the cash book but the total salary paid, total rent paid, total electricity charges paid during the year appear on the payment side of the Receipt and Payment Account. Thus, Receipt and Payment Account gives summarized picture of various receipts and payments, irrespective of whether they pertain to the current period, previous period or succeeding period or whether they are of capital or revenue nature. It may be noted that this account does not show any non cash item like depreciation. The opening balance in Receipt and Payment Account represents cash in hand/cash at bank which is shown on its receipts side and the closing balance of this account represents cash in hand and bank balance as at the end of the year, which appear on the credit side of the Receipt and Payment Account. However, if it is bank overdraft at the end it shall be shown on its debit side as the last item. Let us look at the cash book of Golden Cricket Club given in the example to show how the total amount of each item of receipt and payment has been worked out.

Example 1

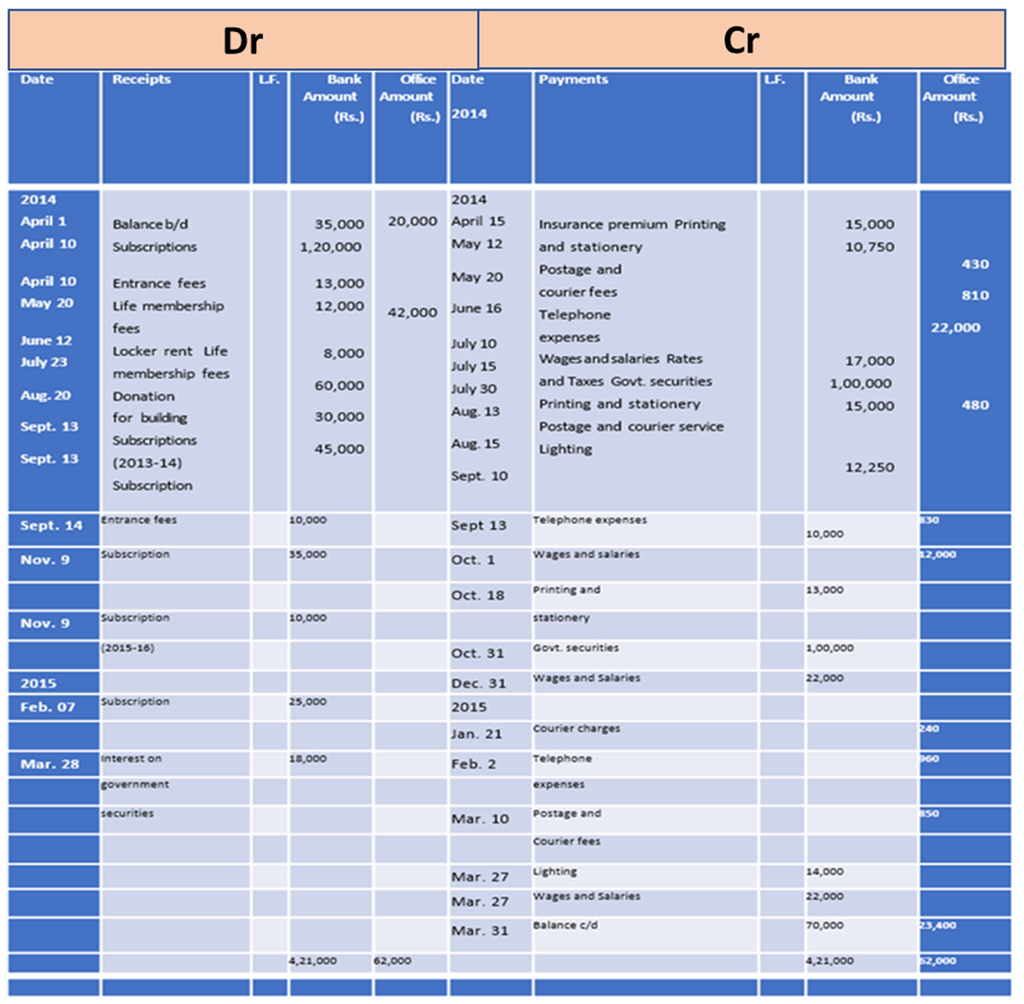

Golden Cricket Club Cash Book (Columnar)

Part A

Item wise Aggregation of various Receipts :

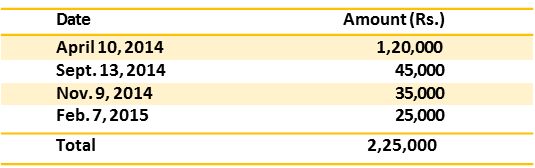

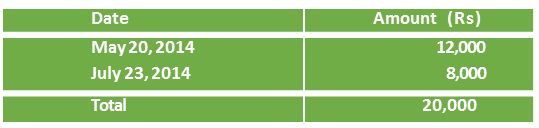

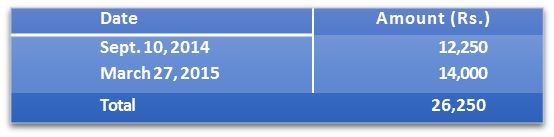

Subscriptions (2014–2015)

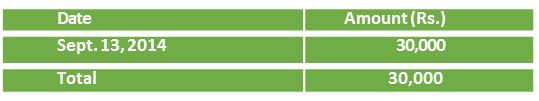

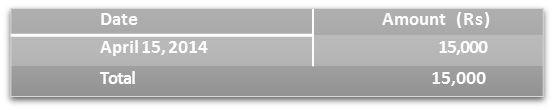

Subscriptions (2013–14)

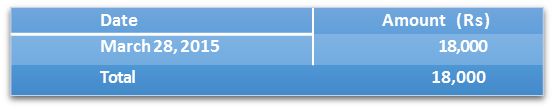

Subscription (2015–16)

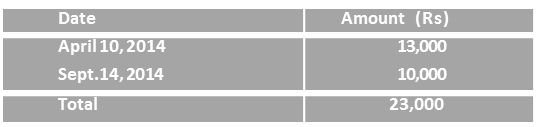

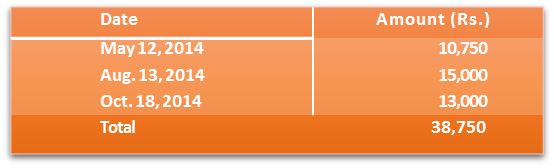

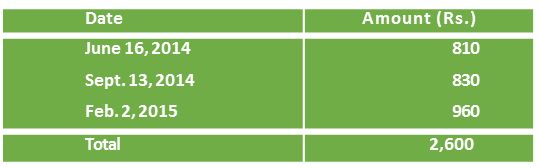

Entrance Fees

Locker Rent

Life Membership fee

Donation for Buildings

Interest on Government securities

Part B

Item wise Aggregation of various Payments

Insurance Premium

Printing and Stationery

Lighting

Telephone Expenses

Rates and Taxes

Government Securities

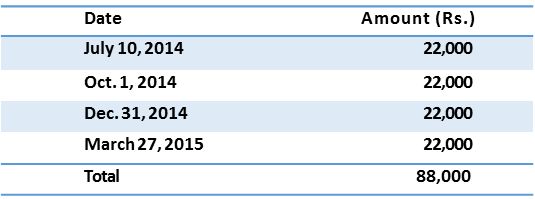

Wages and Salaries

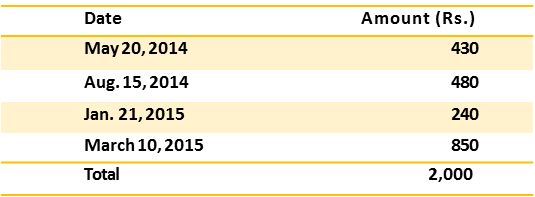

Postage and Courier Service

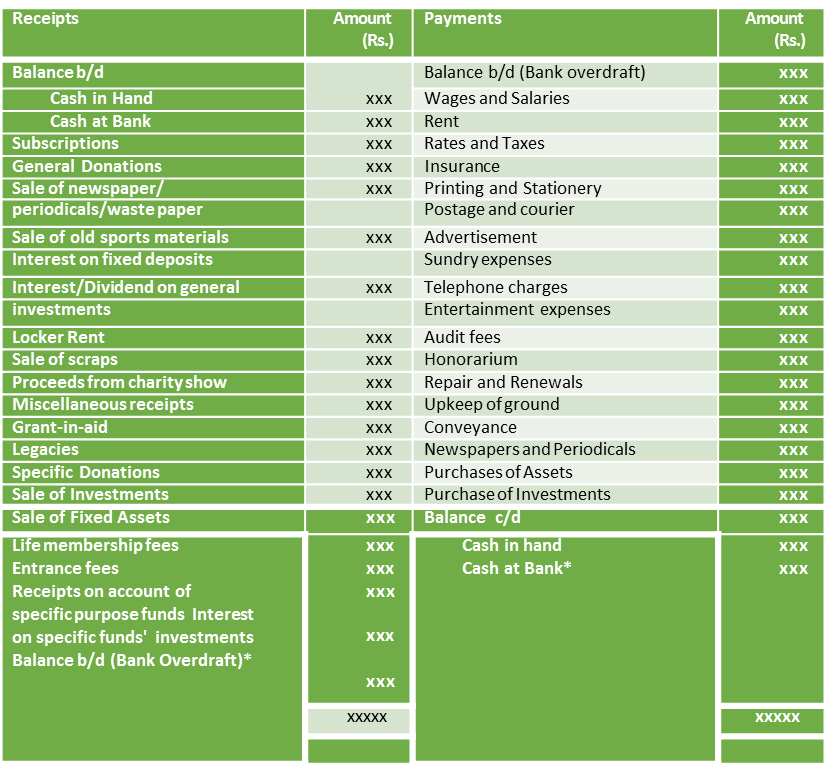

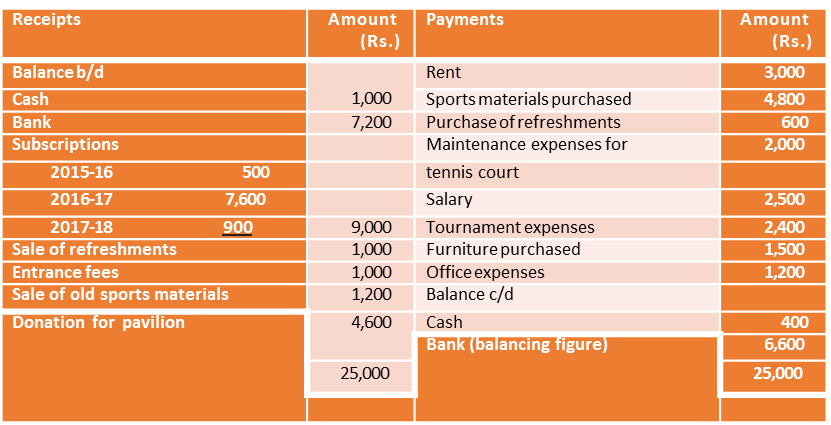

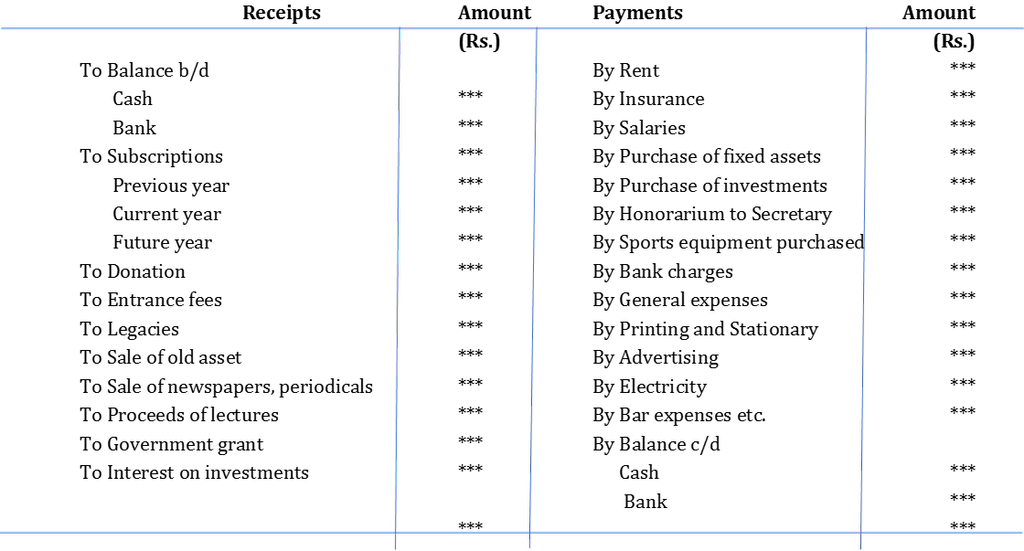

The above data can also be shown in the form of the respective accounts in the ledger. A detailed illustrative list of items of receipts and payments is given in figure 1.

Figure 1

Receipt and Payment Account is given below:

Receipt and Payment Account for the year ending ————

Fig. 1.1: Format of Receipt and Payment Account

There will be either of the two amounts i.e., each at bank or bank overdraft, not both.

It may be noted that the receipts side of the Receipt and Payment Account gives a list of revenue receipts (for past, current and future periods) as well as capital receipts. Similarly, the payments side of the Receipts and Payments Account lists the Revenue Payments (for past, current and future periods) as well as Capital Payments.

Features

-

- It is a summary of the cash book. Its form is identical with that of simple cash book (without discount and bank columns) with debit and credit sides. Receipts are recorded on the debit side while payments are entered on the credit side.

- It shows the total amounts of all receipts and payments irrespective of the period to which they pertain . For example, in the Receipt and Payment account for the year ending on March 31, 2016, we record the total subscriptions received during 2015–16 including the amounts related to the years 2014–2015 and 2016-2017. Similarly, taxes paid during 2015–16 even if they relate to the years 2014–15 and 2016–2017.

- It includes all receipts and payments whether they are of capital nature or of revenue nature.

- No distinction is made in receipts/payments made in cash or through bank. With the exception of the opening and closing balances, the total amount of each receipt and payment is shown in this account.

- No non-cash items such as depreciation outstanding expenses accrued income, etc. are shown in this account.

- It begins with opening balance of cash in hand and cash at bank (or bank overdraft) and closes with the year end balance of cash in hand/ cash at bank or bank overdraft. In fact, the closing balance in this account (difference between the total amount of receipts and payments) which is usually a debit balance reflects cash in hand and cash at bank unless there is a bank overdraft.

Steps in the Preparation of Receipt and Payment Account

- Take the opening balances of cash in hand and cash at bank and enter them on the debit side. In case there is bank overdraft at the begining of the year, enter the same on the credit side of this account.

- Show the total amounts of all receipts on its debit side irrespective of their nature (whether capital or revenue) and whether they pertain to past, current and future periods.

- Show the total amounts of all payments on its credit side irrespective of their nature (whether capital or revenue) and whether they pertain to past, current and future periods.

- None of the receivable income and payable expense is to be entered in this account as they do not involve inflow or outflow of cash.

- Find out the difference between the total of debit side and the total of credit side of the account and enter the same on the credit side as the closing balance of cash/bank. In case, however, the total of the credit side is more than that of the total of the debit side, show the difference on the debit as bank overdraft and close the account.

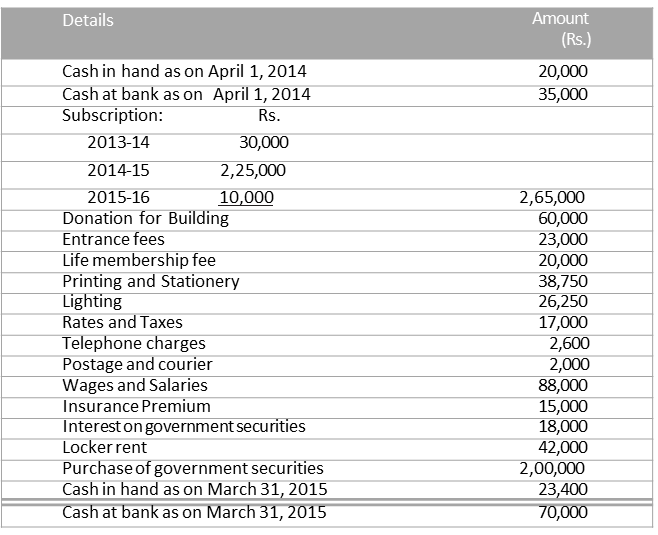

From the following information based on the data assimilated from the cash book given in example 1, at page 4, the Receipt and Payment Account of Golden Cricket Club for the year ended on March 31, 2015 will be prepared as follows:

Summary of Cash Book

Receipt and Payment Account for the year ending March 31, 2015

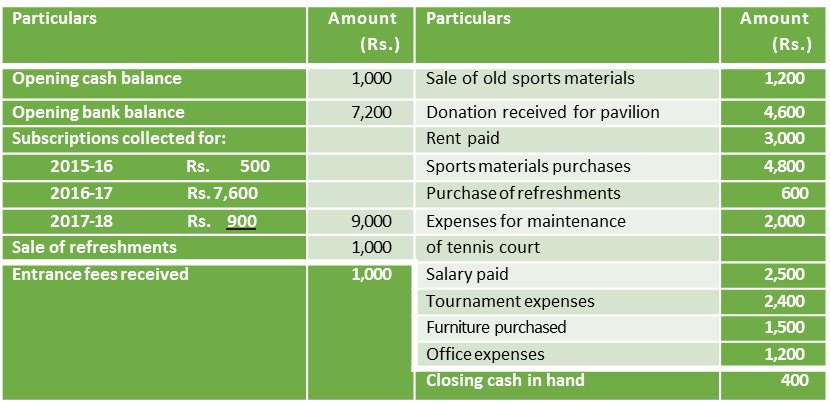

Revision 1

From the following particulars relating to Silver Point, prepare a Receipt and Payment account for the year ending March 31, 2017.

Solution

Books of Silver Point Receipt and Payment Account for the year ending March 31, 2017

financial statements of non-profit making organizations

Like trading organizations, non-profit making organizations also prepare their financial statements at the end of each accounting period. Their financial statements comprise the following:

1. Receipts and Payments Account (Cash Book)

2. Income and Expenditure Account (Profit & Loss A/c)

3. Balance Sheet.

1. Receipts and Payments ACCOUNT:

The following points are noteworthy relating to Receipts and Payments A/C:

a. Receipts and Payments Account is a summary of cash transactions.

b. It shows the opening and closing balance of cash and bank, receipts and payments (both cash and cheque) and the closing cash and bank balance at the end of the accounting period.

c. The left-hand side records all receipts and the right-hand side all payments (whether revenue or capital or relating to current years past or future accounting years).

d. It shows a classified summary of cash transactions during a given period.

For example, fees may be received from the members of a club on different dates and appear on different pages of the Cash Book as it is a chronological record. But the total fees received during the accounting period is shown in the Receipts and Payments Account.

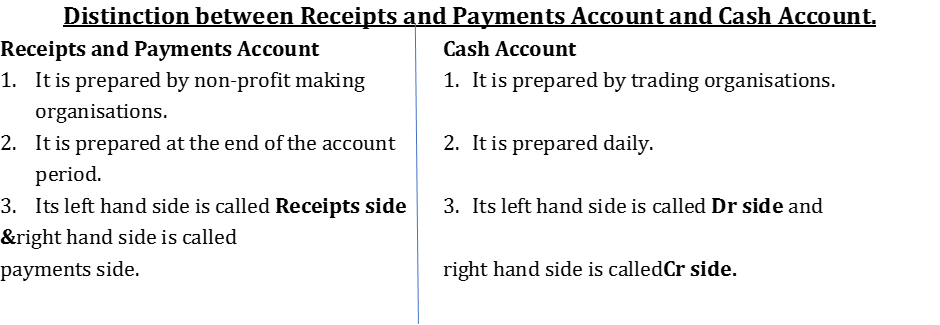

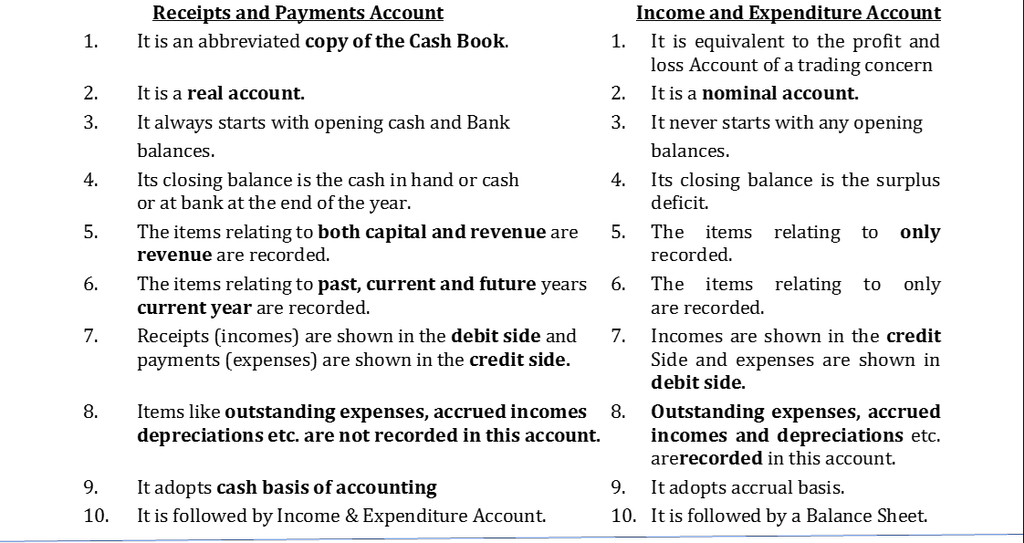

Keypoints OF RECEIPTS and Payments Account

1. It is similar to a Cash Book of a trading concern.

2. It is a real account. Receipts are recorded on the receipt side and payments are recorded on the payment side.

3. It starts with the opening cash and bank balance and closes with the closing cash and bank balance.

4. Both cash and bank transactions are merged in the same column.

5. All types of receipts are recorded on its receipts side irrespective of the nature of receipts (i.e. both capital and revenue receipts and receipts relating to past, present and future years).

6. All types of payments are recorded on the credit side irrespective of the nature of payments (i.e. both capital and revenue payments and payments relating to past, present and future years).

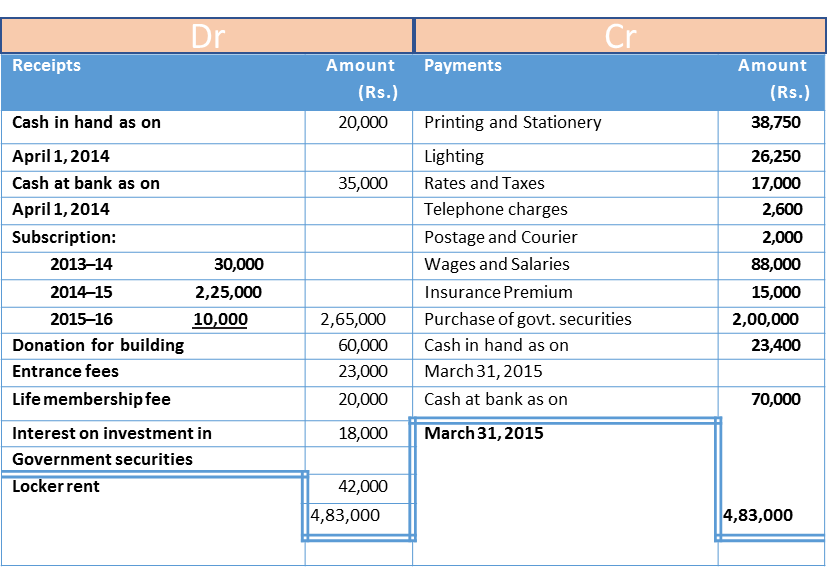

Format of Receipts and Payments Account:

Name of the Non-Profit Making Organisation:-

Receipts and Payments Account for the year ended **********

Income and Expenditure Account

Important Facts about Income & Expenditure A/C:

- Income and Expenditure Account is similar to Profit and Loss Account of a trading concern

- Since non-profit making organizations do not operate on profit objectives, income and Expenditure Account is prepared instead of preparing Profit and Loss Account.

- On the debit side, it shows all revenue expenses relating to the current year whether paid or not.

- On the credit side, it shows all revenue incomes and gains relating to the current year whether received or not.

- It is a nominal account and its preparation procedure is the same as that of a Profit and Loss Account of a trading concern.

- The balancing figure of this account is called surplus/excess of income over expenditure or deficit/excess of expenditure over income.

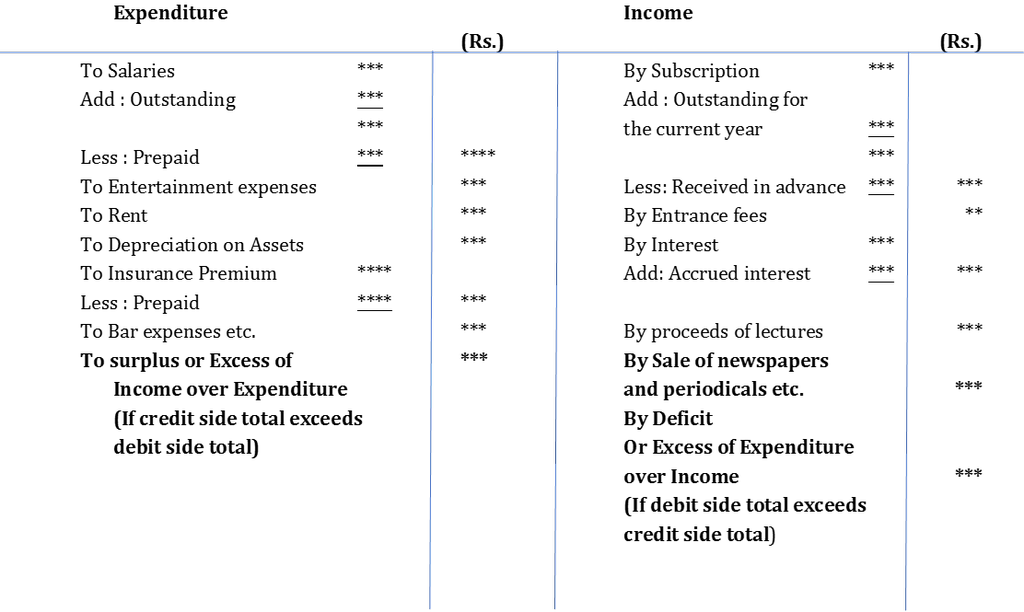

Key points of Income and Expenditure Account

1. It is similar to the Profit and Loss Account of a trading concern.

2. It is a nominal account. Expenses and losses are recorded on the debit side and incomes and gains are recorded on the credit side. The expenses are matched with revenues of the concerned period.

3. All revenue incomes relating to the current year whether received or due are recorded on the credit side.

4. All revenue expenses relating to the current year whether paid or outstanding are recorded on the debit side.

5. Capital expenditures and capital receipts are not recorded in this account.

6. It records both cash and non-cash items such as depreciation.

Format of Income and Expenditure Account

(Name of the Non-Profit Making Organisation)

Income and Expenditure Account

For the year ended on *********

3. Balance Sheet

The balance sheet of a non-profit making organization is prepared on the same line as that of a trading concern. Assets including accrued income and prepaid expenses are shown on the assets side and the liabilities side shows all liabilities including outstanding expenses. Capital Fund (same as Capital Account in case of trading concerns) appears on the liabilities side. The surplus during the period is added to the Capital Fund and the deficit is subtracted.

Note: When no information regarding Capital Fund is available, it can be ascertained by preparing the Balance Sheet at the beginning of the year i.e. Opening Balance Sheet.

Vision classes

Vision classes