CIRCULAR FLOW OF INCOME - GENERAL

Circular Flow of Income

INTRODUCTION

The term macro is derived from the Greek word ‘makro’, which means “large”. It is a branch of economics concerned with the description and explanation of economic processes involving aggregates.

- An aggregate is a collection of economic subjects that have some characteristics in common.

- Macroeconomics emerged after the publication of John Maynard Keynes' book, ‘The Theory of Employment, Interest, and Money’ in 1936. This branch investigates the economic relationships or issues that affect an economy as a whole, such as saving and total consumption.

- Macroeconomics is the part of economic theory that studies the economy as a whole, such as national income, aggregate employment, general price level, aggregate consumption, aggregate investment, etc. Its main instruments are aggregate demand and aggregate supply. It is also called the ‘Income Theory’ or ‘Employment Theory’

- Macroeconomics is concerned with economic problems at the level of an economy as a whole. Structure of Macroeconomics implies study of different sectors of the economy.

- Producer sector engaged in the production of goods and services.

- Household sector engaged in the consumption of goods and services.

- Note: Households are taken as the owners of factors of production.

- The government sector engaged in activities like taxation and subsidies

- Rest of the world sector engaged in exports and imports.

- Financial sector (or financial system) engaged in the activity of borrowing and lending.

CIRCULAR FLOW OF INCOME

It refers to the cycle of generation of income in the production process, its distribution between the factor of production namely Land, Labour, Capital and Enterprise and finally, its circulation from households to firms in the form of consumption expenditure on goods and services produced by them.

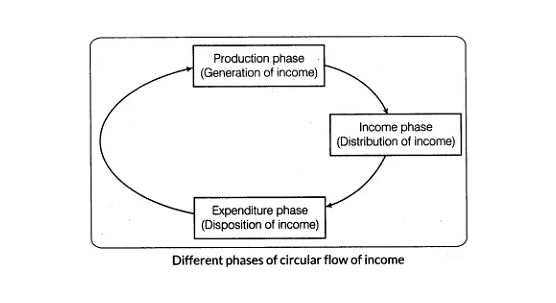

Phase in Circular Flow of Income

- Generation Phase: In this phase, the firm produces goods & services using factors of production (Land, Labour, capital and Enterprise).

- Distribution Phase: In the Second Phase, the firms make factor payments (Rent, wages, Interest & Profit) to the household for providing factor services.

- Disposition Phase: In this phase, the households spend the amount/income received by factors of production in purchasing good and services produced by firms.

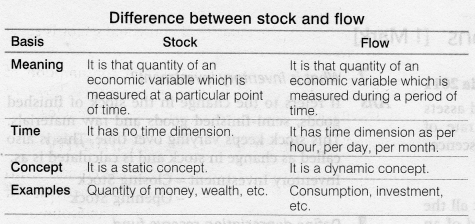

STOCK:

- Stock variable refers to that variable; which is measured at a particular point of time.

- It is static in nature, i.e., it does not change.

- There is no time dimension in stock variables.

- For eg. Distance, Amount of Money, National Wealth, National Capital, Money Supply, Water in Tank etc.

FLOW:

- Flow variable refers to that variable; which is measured over a period. The ‘period of time’ could be a day, a week, a year etc.

- It is dynamic in nature i.e. it can be changed.

- There is time dimension in flow variables

- For example, Speed, Spending of Money, Water in River, Exports, Imports, etc.

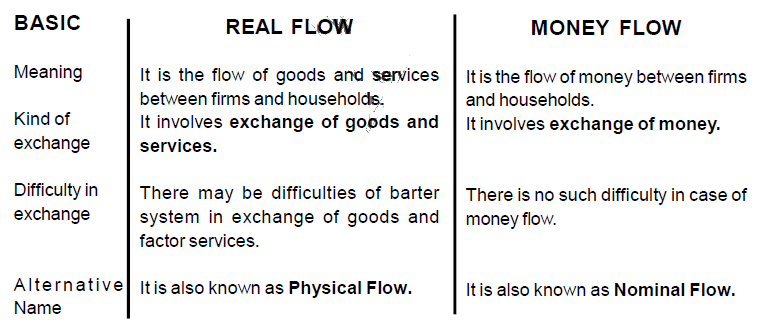

REAL & CASH FLOW

TYPES OF CIRCULAR FLOW

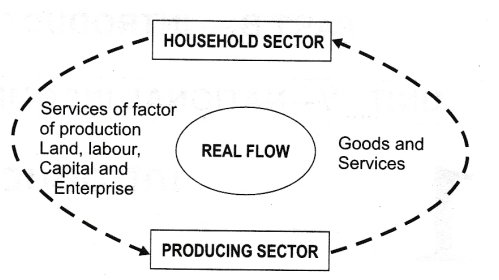

Real Flow: It refers to the flow of factor services (land, labour, capital, and enterprise) from household to firms and the corresponding flow of goods and services from firms to households. It is also known as ‘Physical Flow’.

As seen in the above diagram, the households sector provides factor services to the producing sector i.e. firm which, in turn, provide goods and services to them as a reward for their productive services.

Real flow determines the magnitude of growth process in an economy. For example, when more factor services are offered to firms, then volume of production will be more and it speeds up the process of economic growth.

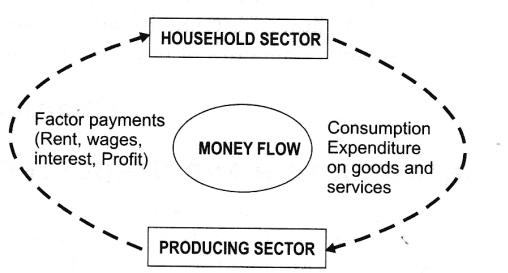

Money Flow: It refers to the flow of factor payments (Rent, wages, interest, and profit) from firms to households for providing factor services and corresponding flow of consumption expenditure from households to firm for purchase of goods and services produced by firm. It is also known as ‘Nominal flow’.

As seen in the above diagram, the producing sector makes factor payments to households for their factor services and households spend this income on purchase of goods and services produced by the firm.

CIRCULAR FLOW OF INCOME - TWO SECTOR ECONOMY MODEL

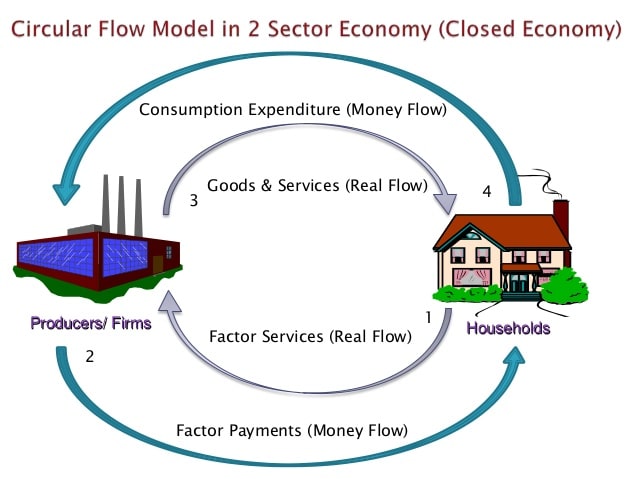

CIRCULAR FLOW IN A SIMPLE ECONOMY (TWO-SECTOR ECONOMY)

In a simple two-sector economy, there exist only two sectors i.e. household and firms, where households are the owners of factors of production (Land, Labour, Capital, and Enterprise) and consumers of goods & services. Firms produce goods and services and sell them to households.

In order to make our analysis simple, we can make some assumptions:-

- Only two sectors in an economy are there i.e. Households and firms. It means there is no government and foreign sector.

- Households provide factor services to firms only and firms hire factor services from household only.

- The amount received by the household from the firm for providing factor services is used entirely on consumption.

This brings us to the following conclusion.

- There are no savings in the economy, i.e. neither the household saves from their incomes, not the firm saves from their profits.

- In the given diagram, it can be seen that households are providing factor services in exchange for factor payment and firms are providing goods & services to households in exchange for consumption expenditure.

- Total Production = Total Consumption

- Factor Payment = Factor Income

- Consumption Expenditure = Factor Income

- Real Flow = Money Flow

Note: In a circular flow of income, production generates factor income, which is converted into expenditure. This flow of income continues, as production is a continuous activity due to never-ending human wants. It makes the flow of income circular.

Synonyms/Similar terms of this chapter

- Generation Phase - Production Phase

- Distribution Phase - Income Phase

- Disposition Phase - Expenditure Phase

- Real Flow – Physical Flow

- Money Flow – Nominal Flow

DOMESTIC TERRITORY, RESIDENTSHIP, CITIZENSHIP

DOMESTIC TERRITORY

In layman’s language, domestic territory means the political frontiers of a country. However, for national income accounting, it is used in a wider sense.

Definition: Domestic Territory is geographical territory administered by a government within which persons, goods and capital circular freely.

Let us first see what IS not included in a domestic territory:

The domestic territory DOES NOT include-

- Embassies, consulates and military establishment of a foreign country, for example- the American embassy in India is the domestic territory of America and not India

- An international organization like UNO, WHO located within the geographical boundaries of a country

What all is included?

Ship and aircraft owned and operated by normal residents between two countries.

- For example- Planes operated by Air India between London and Paris are part of the domestic territory of India. Similarly, planes operated by Singapore Airways between Indian and Japan are a part of domestic territory of Singapore.

Fishing Vessels, oil and natural gas rigs and floating platforms operated by the residents of a country in the international waters where they have exclusive rights of operation.

- For example, fishing boats operated by Indian anglers in international waters of Indian Ocean will be considered a part of domestic territory of India.

Embassies, consulates and military establishments of country located abroad.

- For example- Indian Embassy in Japan is a part of the domestic territory of India.

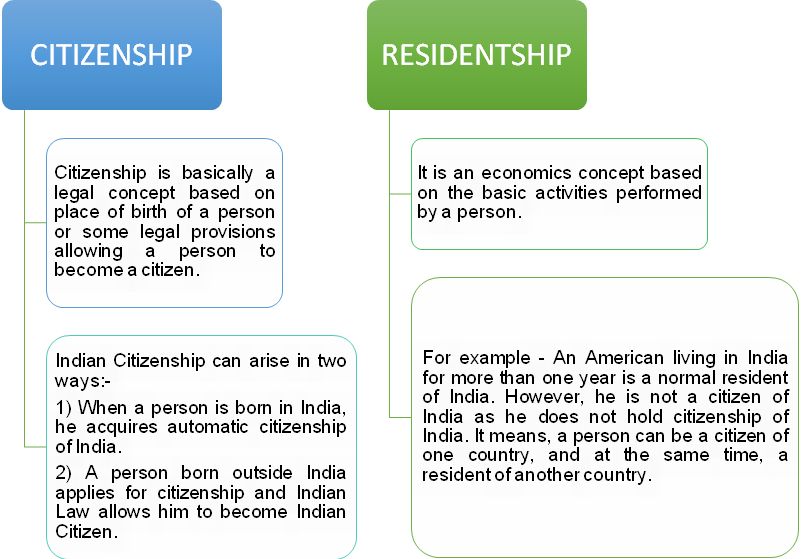

NORMAL RESIDENTS

Definition: Normal Residents of a country refers to an individual or institution who ordinarily resides in the country and whose centre of economic interest also lies in that country.

‘Centre of Economic Interest’ implies:

- The resident lives or is located within the domestic Territory.

- The resident carries out basic economic activities of earning, spending, and accumulation from that location.

Following are not included in Normal residents:-

- Foreign Tourists & Visitors

- Foreign staff of Embassies, officials, diplomats and members of the armed forces.

- International Organization like WHO, UNO etc.

- Employers of International Organizations.

- Crewmembers of foreign vessels, commercial travellers and seasonal workers, provided their stay is less than one year.

- Border workers, who cross borders on a regular basis to work in other countries.

CITIZENSHIP AND RESIDENTSHIP

FINAL GOODS & INTERMEDIATE GOODS

TYPES OF GOODS

Final Goods: Final goods refer to those goods, which are used either for consumption or for investment.

For example,

- Goods purchased by consumer households as they are meant for final consumption.

- Goods purchased by firm for capital formation or investment like machinery purchased by a firm.

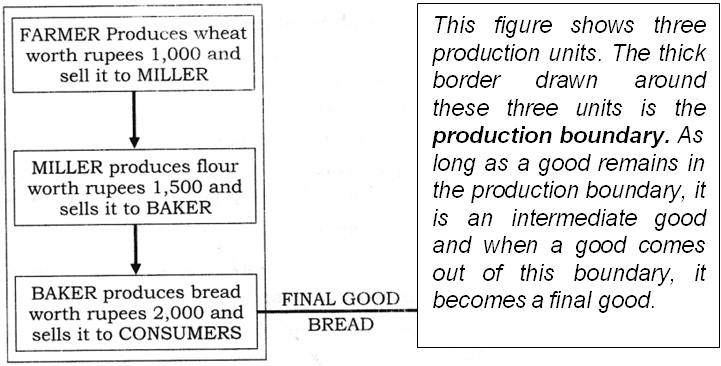

Intermediate Goods: Intermediate goods refer to those goods which are used either for resale or for further production in the same year.

For example,

- Goods purchased for resale like milk purchased by a dairy shop.

- Goods used for further production like milk used for making sweets.

NOTE: The distinction between intermediate goods and final goods is made based on the use of product and not on the basis of product itself. For example, sugar is an intermediate good when it is used by sweet shop for making sweets. However, if consumers use it, then it becomes a final good.

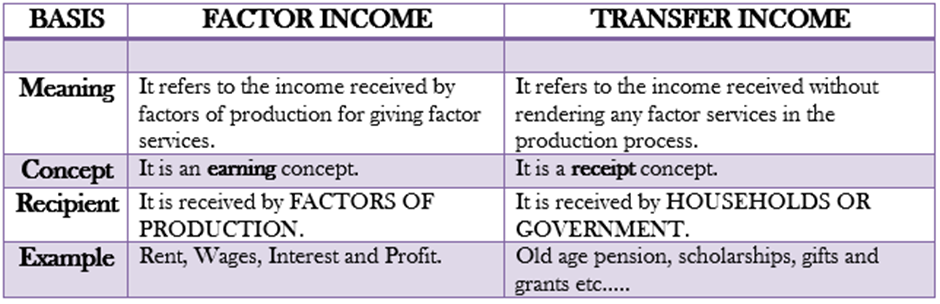

FACTOR INCOME & TRANSFER INCOME

FACTOR INCOME AND TRANSFER INCOME

Factor Income:

Definition: It refers to income received by factor of production (labour, Land, Capital and Enterprise) for rendering factor services in the production process.

- Factor Incomes of normal residents of a country is included in the National Income.

- For example-Rent, Wages, Interest and Profit.

Transfer Income:

Definition: Transfer Income refers to income received without rendering any productive service in return.

- It is unilateral (One-sided) concept.

- As there is no production of goods or services, it is not included in National Income.

- For example- Old age pension, pocket money, unemployment allowance, scholarship etc.

Note: Taxes received by the government are the transfer incomes of the government as they are received without providing any productive service in return. Similarly, subsidies paid by the government are transfer payments of the government.

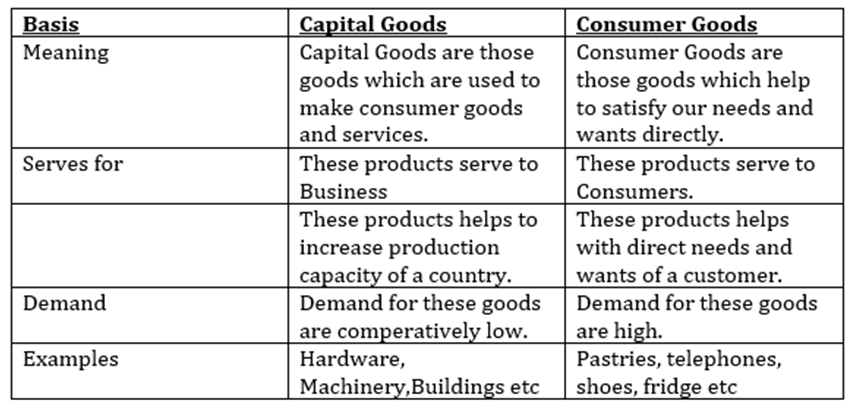

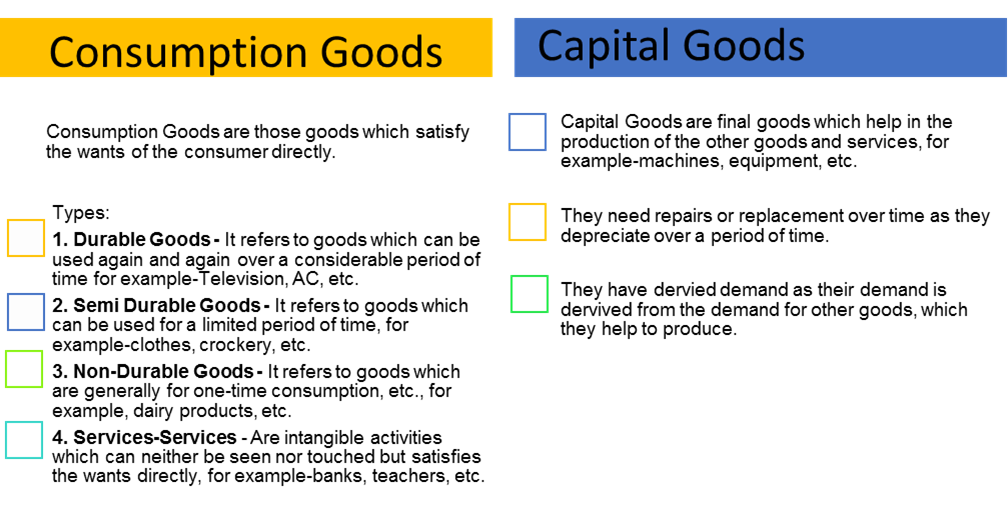

CONSUMPTION GOODS & CAPITAL GOODS

Final Goods can be further classified into two groups:

- Consumption Goods

- Capital Goods

NATIONAL INCOME AGGREGATES

INTRODUCTION

In an economy, different productive units produce various goods and services during a period of one year. Such goods and services cannot be added together in terms of quantity. Therefore, these are expressed in terms of money.

GROSS AND NET

- Gross means the value of product including depreciation.

- Net means the value of product excluding depreciation.

- The difference between these two terms is depreciation.

- Where depreciation is the expected decrease in the value of fixed capital assets due to its general use.

It is the result of production process.

Gross = Net + Depreciation Net = Gross – Depreciation

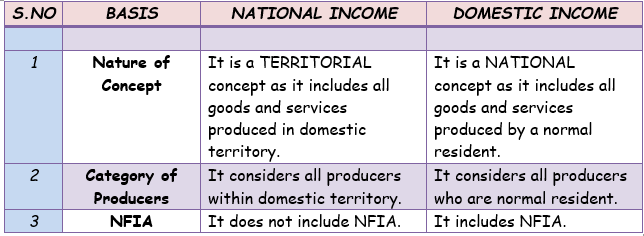

NATIONAL INCOME AND DOMESTIC INCOME

National Income refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

Domestic Income refers to a total factor income earned by the factor of production within the domestic territory of a country during an accounting year.

The difference between these two incomes is Net Factor Income from abroad (NFIA), which is included in National Income (NY) and excluded from Domestic Income (DY).

Where NFIA is the difference between income earned by normal residents from rest of the world and similar payments made to Non-residents within the domestic territory.

NFIA = Income earned by Residents from rest of the world (ROW) – Payments to

Non-Residents within Domestic territory.

NY = DY + NFIA DY = NY – NFIA

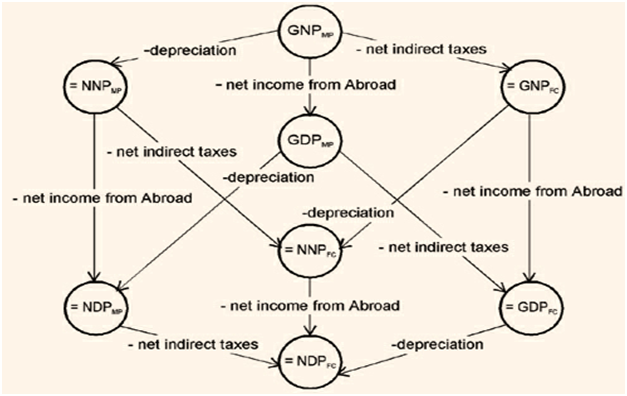

BASIC AGGREGATES OF NATIONAL INCOME

1. Gross Domestic Product at Market Price (GDPMP ):

GDPMP is defined as the gross market value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units.

- ‘Gross’ in GDPMP signifies that depreciation is included, i.e., no provision has been made for depreciation.

- ‘Domestic’ in GDPMP signifies that it includes all the final goods and services produced by all the production units located within the economic territory (irrespective of the fact whether produced by residents or non-residents).

- ‘Market Price’ in GDPMP signifies that indirect taxes are included and subsidies are excluded, i.e., it shows that Net Indirect Taxes (NIT) have been included.

- ‘Product’ in GDPMP signifies that only final goods and services have to be included and intermediate goods should not be included to avoid the double counting.

2. Gross Domestic Product at Factor Cost ( GDPFC):

GDPFC is defined as the gross factor value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units excluding Net Indirect Tax.

GDPFC = GDPMP – Net Indirect Taxes

3. Net Domestic Product at Market Price (NDPMP ).

NDPMP is defined as the net market value of all the final goods and services produced within the domestic territory of a country by its normal residents and non-residents during an accounting year.

NDPMP =GDPMP – Depreciation

4. Net Domestic Product at Factor Cost (NDPFC ).

NDPFC refers to a total factor income earned by the factor of production within the domestic territory of a country during an accounting year.

NDPFC = GDPMP – Depreciation – Net Indirect Taxes NDPFC is also known as Domestic Income or Domestic factor income.

5. Gross National Product at Market Price (GNPMP).

GNPMP refers to market value of all the final goods and services produced by the normal residents of a country during an accounting year.

GNPMP = GDPMP + Net factor income from abroad It must be noted that GNPMP can be less than GDPMP when NFIA is negative. However, GNPMP will be more than GDPMP when NFIA is positive.

6. Gross National Product at Factor Cost (GDPFC ) or Gross National Income

GNPFC refers to gross factor value of all the final goods and services produced by the normal residents of a country during an accounting year.

GDPFC = GNPMP – Net Indirect Taxes

7. Net National Product at Market Price (NNPMP ).

NNPMP refers to net market value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPMP = GNPMP – Depreciation

8. Net National Product at Factor Cost (NNPFC ) or National Income.

NNPFC refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPFC = GNPMP – Depreciation – Net Indirect Taxes It must be noted that NNPFC is also known as National Income.

RELATIONSHIP BETWEEN ALL AGGREGATES:

THREE GOLDEN RULES

INVESTMENT

Investment or capital formation refers to addition to the capital stock of an economy. For example-Construction of roads, flyovers, Building, etc.

Investment can be of two forms:

Gross Investment

- Definition: It is an addition to the stock of capital before making allowance for depreciation

Net Investment

- Definition: Net Investment is an actual addition made to the capital stock of the economy in a given period.

- Net Investment = Gross Investment- Depreciation

DEPRECIATION (Consumption of fixed capital)

Definition: It refers to a fall in the value of an asset due to normal wear and tear ,the passage of time or expected obsolescence (change in technology).

NET INDIRECT TAXES (NIT)

- NIT refers to the difference between Indirect Tax and Subsidies.

- Net Indirect Taxes (NIT) = Indirect Tax-Subsidies

Indirect Tax

Definition: Indirect Taxes refers to those taxes, which are imposed by the government on production and sale of goods and services. For example- Goods and Services Tax (GST)

Subsidies

Definition: Subsidies are the ’economic assistance’ given by the government to the firms and households, with a motive of the general welfare. For Example- Subsidy on LPG Gas Cylinders.

Factor Cost

It refers to the amount paid to factors of production for their contribution to the production process.

Market Price

It refers to the Price at which product is actually sold in the market. For example- If price of the LPG cylinder is Rs.1000 and the tax rate is 10%, the price of the cylinder becomes Rs.1100 but a subsidy of Rs.50 is provided by the government hence the final price is Rs.1050.

Here Rs.1000 is factor cost, Rs.1050 is Market Price, Rs.100 is indirect Taxes and Rs.250 is a subsidy.

NET FACTOR INCOME FROM ABROAD (NFIA)

Definition: It refers to the difference between factor income received from the rest of the world and factor income paid to the rest of the world.

NFIA = Factor Income earned from Abroad-Factor Income paid Abroad.

Significance: NFIA is significant to differentiate between ‘domestic income’ and ‘national income’.

National Income= Domestic Income + NFIA.

Components of NFIA

- Net compensation of Employees- It is the difference between income from work received by resident workers living or employed abroad for less than one year & similar payments made to non-resident workers employed domestic territory of the country.

- Net Income from Property and entrepreneurship - It refers to the difference between income from property and entrepreneurship received by residents of the country and similar payments made to Non-residents

- Net Retained earnings - It refers to the difference between retained earnings of resident’s companies located abroad and retained earnings of non-resident companies located within the domestic territory of that country.

NFIA = Net Compensation of Employees + Net Income from Property and Entrepreneurship + Net Retained earnings

Synonyms/Similar terms of this chapter

VALUE ADDED METHOD

We have learnt that production gives rise to income, income results in expenditure, which in turn, generates income again.

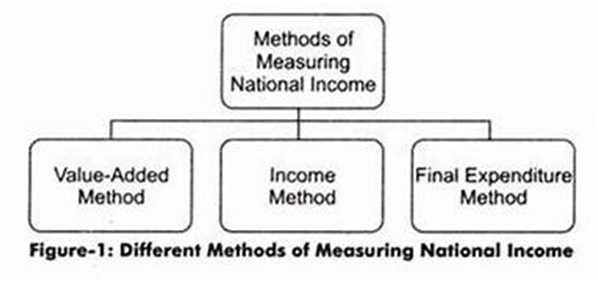

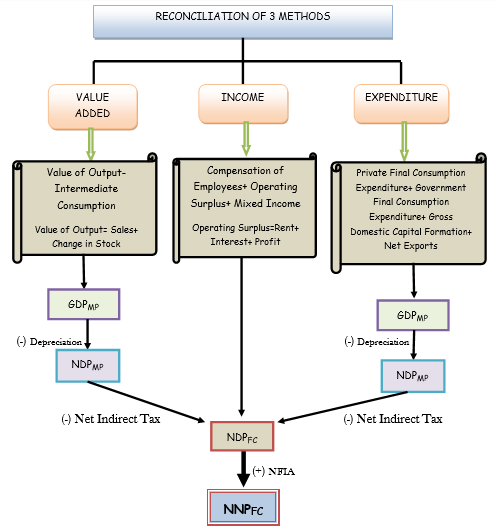

The National Income of a country can be measured in three different ways:

- Value Added Method

- Income Method

- Expenditure Method

It must be noted that all three methods give the same value of national income because they are used to measure the same physical output at three different phases.

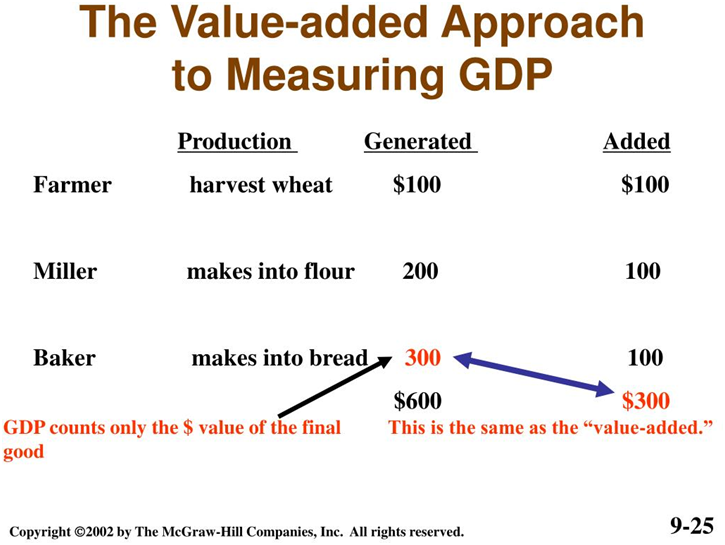

VALUE-ADDED METHOD

This method is used to measure national income in different phases of production in the circular flow. Every individual enterprise adds a certain value to the product when it purchases from some other firm as intermediate goods. When value-added by each and every firm is summed up, we get the value of national income.

- Value Added: Value added is the difference between the value of goods as they leave a stage of production and the cost of the goods as they entered that stage.

Value Added = Value of output - Intermediate consumption

For Example: Suppose a sweet shop owner buys milk worth ₹100 from the milkman. After processing the milk into sweets, he sells it for ₹250.

So, here the milk is intermediate consumption as it was used for making sweets. The sweets which are sold off are output and termed as the value of output.

The difference between this value of output and intermediate consumption is termed as ‘value-added’. Value added by each producing enterprise is known as the Gross Value Added (GVA mp).

Sum total of all GVAmp of all producing enterprises within the domestic territory of a country during one year is equal to GDPmp.

∴ ΣGVAmp = GDPmp

- If the value of intermediate consumption is given, then imports are not included separately as imports are already included in the value of intermediate consumption.

However, if domestic purchases are given, then imports will also be included.

For Example:

Case 1:

- Intermediate Consumption = ₹500

- Imports = ₹200

Here imports would not be included and the value of intermediate consumption is ₹500.

Case 2:

- Purchase of Raw Material from domestic firm=.₹700

- Imports =₹300

Here, the value of intermediate consumption = Purchase of Raw material from domestic firm + Imports =700+300

Intermediate consumption =₹1000

- Value of Output: Value of output refers to the market value of all goods and services produced during a period of one year.

How to calculate the value of output:

- When the entire output is used is sold in an accounting year then the value of output is equal to sales.

- When the entire output is not sold in an accounting year then the value of output is calculated as follows:

Value of output = Sales + change in stock

[Change in stock= Closing stock - Opening stock]

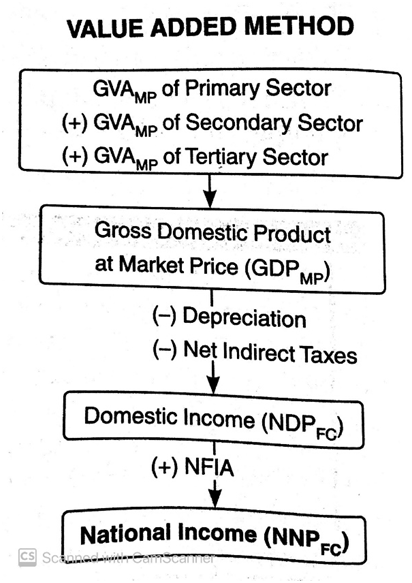

Steps to Calculate National Income by Value Added Method

Step 1- Identify and classify the production units:

The first step is to identify all the producing units into the primary, secondary and tertiary sector.

Step 2- Estimate Gross Domestic Product at Market Price:

Now gross value added to market price (GVAmp) of each sector calculated and the sum total of GVAmp of all sectors gives GDPmp i.e GDPmp= ΣGVA (of all sectors).

Step 3- Calculate Domestic Income (NDPFC)

Now, to calculate NDPFC from GDPmp, we need to subtract both depreciation as well as net indirect taxes i.e NDPFC = GDPmp – Depreciation – Net Indirect Taxes.

Step 4– Calculate National Income (NNPFC)

For calculating NNPFC from NDPFC, NFIA is to be added NNPFC= NDPFC +NFIA

Precautions of Value-Added Method

Intermediate goods are not to be included in National Income - If intermediate goods would be included in National Income it would lead to double-counting, as these are already included in final goods.

Sale and Purchase of Second Hand Goods are not included- Since these goods are already included in the year of manufacture, these are not included again. However, any brokerage or commission earned or paid is to be included while calculation.

Production of services for self-consumption (Domestic Services) are not included: Domestic services like services of Housewife, kitchen gardening etc. are not included in national income as these services never entered market place and it's difficult to find their market value.

Production of goods for self-consumption will be included - It is not included in national income as they contribute to current output. Their value is to be estimated or imputed, as they are not sold in the market.

Change in the stock of goods will be included - Net increase in the stock of inventories will be included in national income as part of capital formation.

The problem of Double Counting:

Double Counting refers to the counting of output more than once while passing through various stages of production.

While calculating national income, the only value of final goods is to be included. The problem of double counting arises when the value of intermediate goods are also included along.

How to avoid Double Counting:

Final Output Method – As per this method, the value of only the final output should be added to determine national income. For example, the value of sweets of Rs 250 sold to final customers should be taken in national income.

Value- Added Method – The value-added in every stage of production is included under this method for calculation of National Income.

INCOME METHOD

INCOME METHOD

As per this method, all the incomes that accrue to factors of production by way of wages, profits rent, interest, etc. are summed up to obtain the national income.

Components of Factor Income

The following are components of the Income Method. Sum of all the items given below is known as Domestic Income (NDP at FC)

1. Compensation of Employees (COE) –

Definition: COE is the amount paid to employees by employers for rendering productive services. It includes all the benefits received by employees from employers.

- Wages and Salaries in cash- It includes all the benefits, which are in monetary terms like wages, Salaries, bonus, commission, etc.

- Wages and Salaries in kind- it includes all the benefits in non-monetary terms like free house, car, medical facilities, etc.

- Employer’s Contribution to social security schemes – it includes contribution by an employer for social security schemas for Example- provident fund, gratuity, etc.

2. Rent and royalty-

Rent: is income from ownership of land and building. It includes both the actual rent (rent of left out land) as well as imputed rent (rent of self - occupied factors).

Royalty: refers to income received from granting leasing right of sub-soil assets. For example – Royalty from leasing of Iron mine, Gold mine, etc.

3. Interest –

Definition: Interest refers to the amount received from lending funds to a production unit. It involves both actual interest and imputed interest. For example, interest on loans taken for productive services only.

It does not include the following:

- Interest paid by the government on National Debt.

- Interest paid by consumers as such interest is paid on loans taken for consumption purposes.

- Interest paid by one firm to another firm.

4. Profits –

Definition: Profits are excess of revenues over the expenditure of any corporation. It is a residual income.

This profit earned by an entrepreneur can be used for three purposes:

- Corporate Tax – it is a tax paid by a corporate to a government on total profits. It is also known as ‘Profit Tax’ and ‘Business Tax’.

- Dividend – it is divided part of profit given to share - holders. It is also known as distributed profits.

- Retained Earnings – Out of total profit a part is distributed among shareholders and a part is retained in business in business, this is kept for future as Retained Earning. It is also known as undistributed profits, Savings of the Private sector and Reserve & Surplus.

5. Mixed Income –

Definition: It is income generated by people who are self-employed. For example- Barber, farmers, etc. or unincorporated enterprises like the retail trader, small shopkeeper.

Mixed income arises from productive services of self-employed persons, whose income includes wages, rent, interest and profit. These elements cannot be separated from each other. For Example: the income of a doctor running a clinic at his residence.

Steps of Income Method

Step-1 Identify and classify the production units.

All the producing units are classified in Primary, Secondary and tertiary sectors.

Step-2 Estimate the factor income paid by each sector.

Factor incomes paid by each factor are classified under:

- Compensation of Employees,

- Rent and Royalty

- Interest

- Profit

- Mixed income.

Step-3 Calculate Domestic Income (NDP at FC)

When all factor incomes are summed up, we get domestic income (NDP at FC) i.e. NDP at FC= Compensation of Employees + Rent and Royalty + interest +profit + mixed income of self-employed.

Step–4 Calculating National income from Domestic income.

In the final step, we need to add NFIA to domestic income to get National Income.

National Income (NNPFC) = Domestic Income (NDPFC) + NFIA.

PRECAUTIONS OF INCOME METHOD

Transfer Income – Transfer incomes are not included in National income as such incomes are not productive and there is no value addition.

Income from the sale of second-hand goods – Sale of second-hand goods are not included in national income as their sale are already recorded when these were first sold. However, commission, brokerage or any other income is to be recorded.

Income from the sale of shares, bonds and debentures are not included- Such items are not included in national income, as they do not contribute to the current flow of goods and services. However, any brokerage or commission is to be included in national income.

Windfall gains- These are gains like on lottery, horse race, etc are not included as there is no productive activity.

The imputed value of services provided by owners of production unit be the included- Imputed value of owner-occupied houses, interest on own capital, etc are included as it is a productive activity and add to flow of goods and services.

Payments out of past savings- These Payments like death duties, gift tax, interest tax, etc are not included in national income as they are paid out of past savings and do not add to the current flow of goods and services.

EXPENDITURE METHOD

EXPENDITURE METHOD

This method measures national income as the sum total of final expenditure incurred by households, business firms, governments, and foreigners.

This method is also known as ‘Income Disposable Method’.

Components of Final Expenditure:

1. Private final consumption expenditure-

As the name suggests, it is the expenditure made by households and private non –profit sharing institutions on all type of consumer goods.

It includes the following:

- Household final consumption expenditure.

- Private non-profit institutions serving household final consumption expenditure.

- Expenditure made by normal residents abroad during any tour and travel.

However, any expenditure made by foreign tourists in the domestic market would be deducted.

2. Government Final Consumption Expenditure-

It refers to expenditure made by the government on various administrative services like defence, law, and order, education, etc.

It includes the following:

- Intermediate consumption by government.

- Compensation paid by the government.

- Direct purchase from abroad for embassies and consulates located abroad.

However, it does not include the sale of goods and services produced by the general government.

3. Gross Domestic Capital Formation or Gross Investment-

Definition: It refers to the addition to the capital stock of the economy.

Following are components of GDCF:

- Gross fixed capital formation: it refers to expenditure made on purchase to a fixed asset. It includes the following Gross business fixed investment - (expenditure on new plants, machinery, equipment, etc).

- Gross Residential construction investment- (it includes expenditure on purchase of new houses by households).

- Gross public investment – (expenditure on construction of flyovers, bridges, etc by the government).

- Inventory Investment – it refers to the amount by which the firm’s inventories change during a period. it may include stock of raw material, semi-finished goods lying with producers.

It is calculated as the difference between closing stock and opening stock of the year.

- Change in Inventories = closing stock - opening stock.

- GDCF = Gross Fixed Capital Formation+ inventory Investment.

4. Net Exports:

It refers to the difference between exports and imports of a country, during a period of one year. Instead of taking Imports and exports separately, the difference between the two is taken as it is turned as Net Exports.

Net Exports=Export – Import

Steps in Calculating Net Exports

Following steps are involved in the calculation of national income by expenditure method:

Step-1 Identify the economic units incurring final expenditure-

All economic units, which incur final expenditure within the domestic territory, are classified under four groups:

- Households sector

- Govt. Sector

- Producing sector

- Rest of the world sector

Step-2 Classification of Final Expenditure –

Final expenditure by above economic units are estimated and classified under the following heads:

- Private Final Consumption Expenditure (PFCE)

- Government Final Consumption Expenditure (GFCE)

- Gross Domestic Capital Formation (GDCF)

- Net Exports (X-M)

Sum of all of the above components gives GDP.

GDP at MP = PFCE + GFCE + GDCF + (X-M)

Step-3 Calculate Domestic Income (NDPFC)-

Now to calculate NDP at FC from GDP at MP, we need to subtract depreciation and Net Indirect Taxes (NIT).

Step-4. Estimate net factor income from abroad to arrive at national income.

Finally, we add net factor income from abroad to NDPFC in order to get NNPFC (National Income).

Precautions of Expenditure Method

Expenditure on intermediate goods will not be included in national income: As intermediate goods are already included in the value of final expenditure, and if it is included again it will lead to double counting.

Transfer Payments are not included: As these payments are not connected with any productive activity, these are not added while calculating national income.

Purchase of second-hand goods will not be included: As the sale of second - hand goods are already included at the time when they were originally purchased. However, any brokerage or commission on such goods is included as it is the payment made for productive service.

Purchase of financial assets: Transactions relating shares, debentures, bonds etc. are not included, as they do not contribute to the current flow of goods and services. (Commission, brokerage on such transaction to be included)

Expenditure on own account production: Production for self - consumption, imputed value of owner occupied house, free services from general government and private non-profit institutions serving households will be included in national income since these are productive services.

TREATMENT OF DIFFERENT ITEMS IN NATIONAL INCOME

Treatments of different items in National Income

- National Income includes income earned by a normal resident of a country as a reward for their productive services in the current year.

The following items are not included while calculating national income:

Transfer Income and payments like Pension, Scholarship, gifts, etc.

Compulsory Transfer Payments like interest tax, capital gain tax, etc.

Sale and purchase of financial assets.

Windfall gains like lotteries, gambling, etc.

Non - market transactions like kitchen gardening, etc.

Intermediate consumption expenditure like the purchase of raw material by a firm, vegetables purchased by a dairy shop, etc.

Sale or purchase of second- hand goods like sale/purchase of an old house, etc.

Capital loss like the destruction of a building by earthquake or flood etc.

Capital gains like profit due to increase in the price of land, building, shares, etc.

National debt interest or interest paid by households to commercial banks.

Following items are included while calculation of National Income:

Brokerage/Commission on sale/purchase of second- hand goods.

Services provided by the owners of production units like imputed rent of owner’s occupied house interest on own capital etc.

Capital Formation (Investment) like the purchase of machinery by a firm, construction of flyover, bridges, etc.

Payment of bonus, contribution to provident fund by employer etc.

Payment of bus fare by households, examination fees paid by students, payment of telephone bills, etc.

Profit earned by an Indian company from its branches abroad, wages received by Indian employee working abroad, etc.

Free services, (Dispensary, education) by government, government expenditure on street lighting.

Interest on the loan paid by commercial banks.

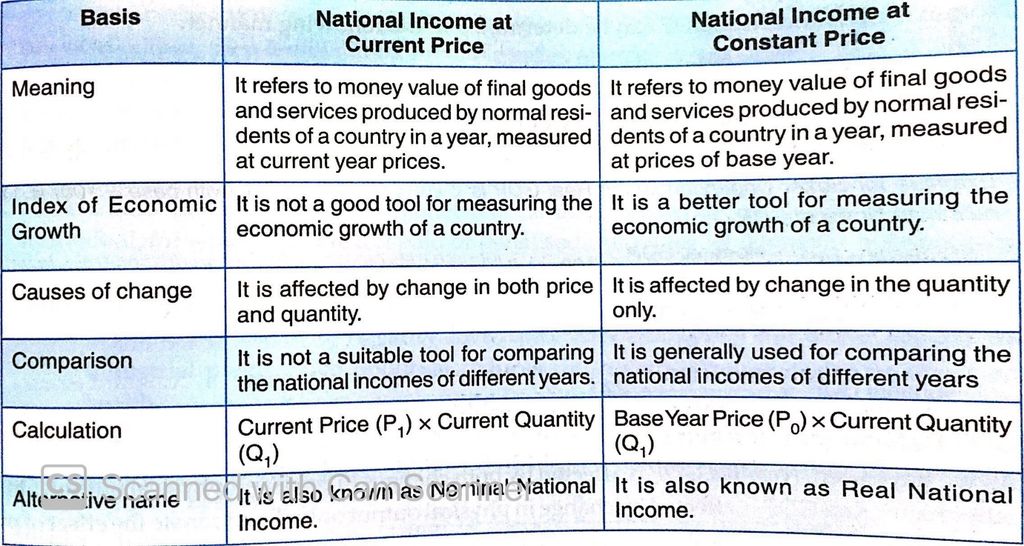

National Income at Current price and Constant price:

National Income at Current Price: It is the money value of final goods and services produced by normal residents of a country in a year, measured at prices of the current year.

It is also known as ‘Nominal National Income ’. For example – measuring India’s National Income of 2018-19 at prices of 2018-19 or measuring India’s National Income of 2017-18 at prices of 2017-18.

It does not show the true picture of the economic growth of a country as any increase in national income may be due to rise in price level without any change in physical output.

National Income at Constant Price: It is the money value of final goods and services produced by normal residents of a country in a year, measured at price of base - year. Base year is a normal year which is free from price fluctuations). Presently 2011-12 is taken as base year in India.

It is also known as ‘Real National Income’. It shows the true picture of the economic growth of a country as any increase in real national income is due to the increase in output only.

Numerical Example -

National Income at current price and at constant price.

- It can be seen that national income at current price is Rs22000 and at base price is Rs17000. The difference of Rs 5000 is not real. It does not give a true picture of economic growth as the increase is merely due to rise in prices.

Conversion of National income at current price into constant price.

- Conversion of national income at current into constant price can be done using price index, price index is an index number which shows the change in price level between two different time periods.

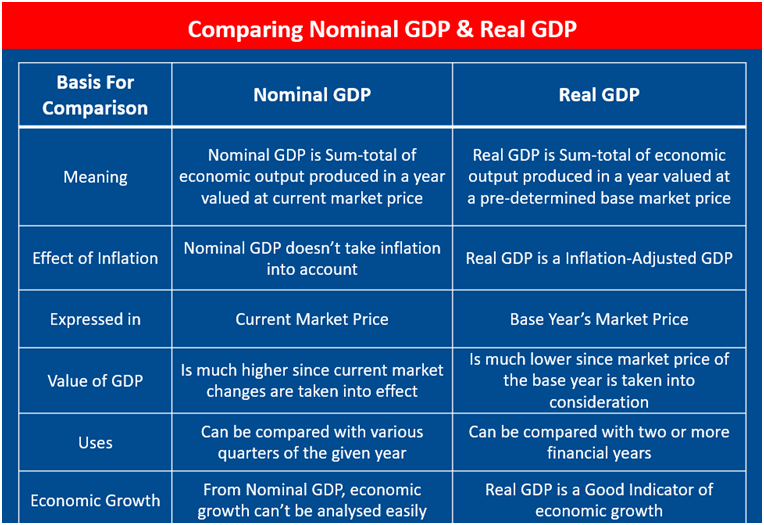

GDP DEFLATOR

Nominal GDP and Real GDP:

1. Nominal GDP or GDP at Current price – When GDP is estimated on the basis of price of the same year, it is called Nominal GDP.

2. Real GDP or GDP at Constant price – When GDP is estimated, based on the price of base year, it is called real GDP.

GDP deflator (Price Index)

Definition: GDP Deflator is one measure of overall price level. It measures the average level of prices of all the goods and services that make up GDP.

GDP Deflator or price index= Nominal GDP/Real GDP *100

Example:

If Nominal GDP is Rs 21000 Cr. and Real GDP is Rs 18000 Cr. Find GDP Deflator.

Ans: GNP Deflator = ₹116.67

Difference between Nominal GDP and Real GDP?

Which is better Nominal GDP or Real GDP?

Real GDP is better because:

- It helps in determining the effect of the increased production of goods and services as it is affected by change in physical output only. On the other hand, Nominal GDP can increase even without any increase in physical output.

- Real GDP is better measure to make periodic comparison in the physical output over different years.

- Real GDP facilitates international comparison of economic performance across the countries.

GDP and Welfare

We generally think that the increase in GDP is good. Increasing GDP is usually considered as one of the Chief goals of government's macroeconomics policy.

Because some serious problem arises when we try to use GDP as a measure of happiness or well-being, we now point out some of the limitations of GDP concept as a measure of welfare.

1. Distribution of GDP - GDP does not take into consideration the income distribution in an economy i.e. gap between rich and poor.

It may be possible that a large part of goods and services are consumed by rich. So, the welfare of the people may not rise as much as the rise in GDP.

2. Change in Price – If GDP is increasing due to increase in price rather than the increase in production, and then it will not be a reliable index of economic welfare.

3. Non-Monetary Exchange – GDP includes only those activities which are in direct monetary terms, so those activities like kitchen gardening which are non – monetary exchanges are not included in GDP due to non - availability of data. However, these activities contribute to economic welfare.

4. Externalities – Externalities refers to those harms or benefits for which a firm is not paid or penalised. It is of two types:

- Positive Externalities – These are the activities which result in benefits to others is termed as positive externalities. For example – Gurudwaras provide free langar for everyone. It increases the welfare of society.

- Negative Externalities – The activities which results in harm to others are termed as negative externalities. Smoking in public will make people smoke passively It reduces the welfare through a negative effect on health.

GDP does not take these externalities into account.

5. Rate of Population Growth – GDP also does not take into account the rate of growth of population i.e. if GDP is increasing due to increase in population. If the rate and growth of population are greater than the rate and growth of GDP, then it will decrease per - availability of goods and services which would adversely affect economic welfare.

Mayank classes

Mayank classes

PathSet Publications

PathSet Publications