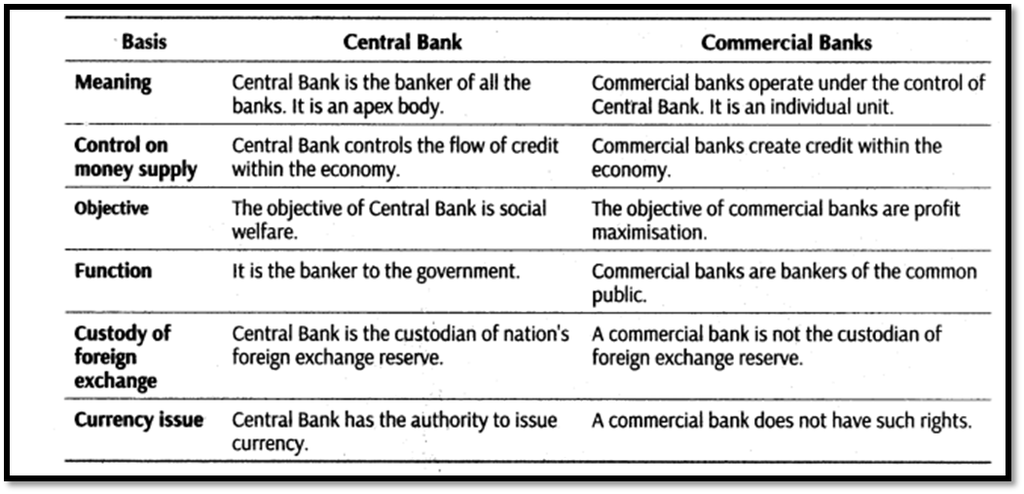

DIFFERENCE BETWEEN CENTRAL BANK AND COMMERCIAL BANK:

IMPORTANT TERMS FROM THE CHAPTER

- Commercial Bank: Commercial bank is a financial institution, which performs the functions of accepting deposits from the public and making loans and investments, with the motive of earning profit.

- Legal Reserve Ratio: It is the minimum ratio of deposits legally required to be kept by the commercial banks with themselves (Statutory Liquidity Ratio) and with the central bank, (Cash reserve Ratio).

- Money Multiplier or Credit Multiplier: When the primary cash deposit in the banking system leads to multiple expansion in the total deposits, it is known as money multiplier or credit multiplier.

- Central Bank: The central bank is the apex institution of a country’s monetary system. The design and the control of the country’s monetary policy is its main responsibility.

- Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy.

- Qualitative Instruments or Selective Tools of Monetary Policy: The instruments which are used to regulate the direction of credit is known as Qualitative Instruments.

- Bank rate: It is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan).

- Repo rate: It is the rate at which commercial bank borrow money from the central bank for short period by selling their financial securities to the central bank.

- Reverse Repo rate: It is the rate at which the central bank (RBI) borrows money from commercial bank.

- Open Market Operation: It consists of buying and selling of government securities and bonds in the open market by central bank.

- Cash Reserve Ratio: It refers to the minimum percentage of a bank’s total deposits, which it is required to keep with the central bank.

- Statutory Liquidity Ratio: It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

- Marginal requirement: Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security. Therefore, the difference between the value of security and value of loan is called marginal requirement.

- Moral suasion: It implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank.

- Selective Credit Controls (SCCs): In this method, the central bank can give directions to the commercial banks not to give credit purposes or to give more credit for particular purposes or to the priority sectors.

PathSet Publications

PathSet Publications