BARTER EXCHANGE

INTRODUCTION:

This chapter is a detailed version of barter system and its difficulties, how money has overcome its drawbacks, money supply and its measures.

BARTER SYSTEM & ITS DIFFICULTIES

Barter system

Definition: Barter system refers to exchange of goods for goods. An economy, where there is a direct barter of goods and services, is called a barter economy.

For example, wheat may be exchanged for cloth; house for horses, etc., or a teacher may be paid wheat or rice as a payment for his/her services.

Such exchange exists in the C-C Economy (commodity-to-commodity exchange economy).

Note: In C-C Economy C stands for commodity. C-C economy is the one in which commodities are exchanged for commodities. C-C exchange refers to barter system of exchange. Hence, C-C Economy is an economy dominated by barter system of exchange

Limitations of Barter Exchange:

Lack of double coincidence of wants:

- Barter is possible only if goods produced by two persons are needed by each other, thus it is double coincidence of wants.

- Double coincidence of wants means that goods in possession of two different persons must be useful and needed by each other. It is the basis of barter system, however it is rare for this to happen.

- It is difficult to find such a person every time. In barter system, exchange becomes quite limited.

Lack of store of value:

- It is very difficult to store wealth for future use.

- Most of the goods like wheat, rice, cattle etc. are likely to deteriorate with the passage of time or involve heavy cost of storage.

- Further, the transfer of goods from one place to another place involves huge transport cost.

- Transfer of immovable commodities (such as house, farm, land, etc.) becomes almost impossible.

Absence of common measure of value:

Different commodities are of different values. The value of a good or service means the amount of other goods and services it can be exchanged for in the market. There is no common measure of value under barter system.

In this situation, it is difficult to decide in what proportions are the two goods to be exchanged.

Lack of standard of deferred payment:

- In a barter economy, future payments would have to be stated in terms of specific goods or services. This leads to following problems:

- There could be disagreement regarding the quality of the goods or services to be repaid.

- There would be disagreement regarding which specific commodities would be used for repayment.

Money has overcome the drawbacks of barter system in the following ways:

Barter system makes the exchange process very difficult and highly inefficient.

(a) Medium of exchange

- Under barter system, there is lack of double coincidence of wants.

- With money as a medium exchange individuals can exchange their goods and services for money and then use this money to buy other goods and services according to their needs and conveniences.

- A buyer can buy goods through money and a seller can sell goods for money.

(b) Measure of Value

- Under barter system, there was no common measure of value. Money has also solved this difficulty.

- As Geoffrey Crowther puts it, “Money acts as a standard measure of value to which all other things can be compared.” Money measures the value of economic goods.

- Money works as a common denominator into which the values of all goods and services are expressed.

- When we express the values of a commodity in terms of money, it is called price and by knowing prices of the various commodities, it is easy to calculate exchange ratios between them.

(c) Store of value

- Under barter system, it is very difficult to store wealth for future use.

- Most of the goods are perishable and their storage requires huge space and transportation cost.

- Wealth can be conveniently stored in the form of money.

- Money can be stored without loss in value.

- Money can easily be stored for future use.

(d) Standard of deferred payments

- Under barter system, transactions on deferred payments are not possible.

- With money, the debtors make a promise that they will make payments on some future dates. In these situations, money acts as a standard of deferred payments.

- It has become possible because money has general acceptability, its value is stable, and it is durable and homogeneous.

MONEY

MONEY

Definition: Money is something which is generally acceptable as a medium of exchange and can be converted into other assets without losing its time and value

Characteristics or Features of Money:

- Durability: Money must be durable and not likely to deteriorate rapidly with

frequent handling. Currency notes and coins are being used repeatedly and shall

continue to do so for many years. - Medium of exchange: Money is the thing that acts as a medium of exchange for the sale and purchase of goods and services.

- Weight: Money must be light in weight. Paper money is better than metal coins because it is light in weight.

- Measure of value: It not only serves as medium of exchange but also acts as a measure of value. The value of all the goods and services is expressed in terms of money.

Important points about money:

- Legal definition of money: Legally, money is anything proclaimed by law as a medium of exchange. Paper notes and coins (together called currency) is money as a matter of law.

- FIAT Money: It is defined as a money which is under the ‘FIAT’ (order/authority) of the government to act as a money.

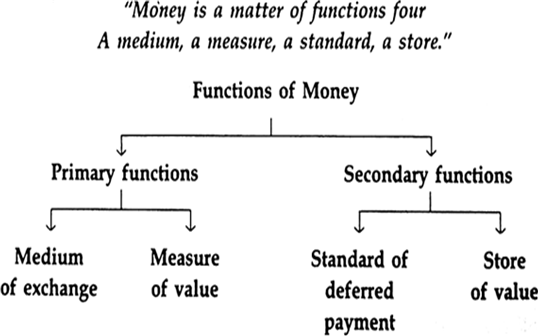

- Functional definition of money: Functional definition of money refers to money as anything that performs four basic functions. (Medium of exchange, standard unit of value, standard of deferred payments, store of value)

- Narrow definition of money: Functional definition of money is a narrow definition of money. It includes only notes, coins and demand deposits as money.

- Broad definition of money: A broad definition of money also includes time deposits/ term deposits with the banks or post offices as a component of money.

MONEY SUPPLY

Money Supply & Measures of Money Supply

- Money supply:

Definition: The volume of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

- Measures of money supply:

On the recommendation of the second working group on money supply, the RBI presented four measures of money supply in its 1977 issues of RBI Bulletin, namely M1, M2, M3 and M4.

Measures of M1 include:

- Currency notes and coins with the public (excluding cash in hand of all commercial banks) [C]

- Demand deposits of all commercial and co-operative banks excluding inter-bank deposits. (DD)

- Where demand deposits are those deposits which can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- (c) Other deposits with RBI [O.D]

M1 = C + DD + OD

Where, Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi¬government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc.

Measures of M2:

- M1 [C + DD + OD]

- Post office saving deposits

Measures of M3:

- M1

- Time deposits of all commercial and co-operative banks.

Where, Time deposits are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

Measures of M4

- M3

- Total deposits with the post office saving organization (excluding national savings certificates).

- High-powered money: High-powered money is money produced by the RBI and the government. It consists of two things: (a) currency held by the public and (b) Cash reserves with the banks.

CONCLUSION

- Barter system: Barter system of exchange is a system in which goods are exchanged for goods.

- Double coincidence of wants: It means that goods in possession of two different persons must be useful and needed by each other.

- Money: Money is something which is generally acceptable as a medium of exchange and can be converted into other assets without loosing its time and value.

- Legal definition of money: Legally, money is anything proclaimed by law as a medium of exchange. Paper notes and coins (together called currency) is money as a matter of law.

- FIAT Money: It is defined as a money which is under the ‘FIAT’ (order/authority) of the government to act as a money.

- Functional definition of money: Functional definition of money refers to money as anything that performs four basic functions. (Medium of exchange, standard unit of value, standard of deferred payments, store of value)

- Narrow definition of money: Functional definition of money is a narrow definition of money. It includes only notes, coins and demand deposits as money.

- Broad definition of money: A broad definition of money also includes time deposits/ term deposits with the banks or post offices as a component of money.

- Money Supply: The stock of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

- High-powered money: It is money produced by the RBI and the government. It consists of two things: (i) currency held by the public and (ii) Cash reserves with the banks.

- Demand deposits: These are the deposits that can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- Time deposits: These are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

- Other deposit measures of M1: Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi-government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc

MONEY SUPPLY

Money Supply & Measures of Money Supply

Money supply:

Definition: The volume of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

Measures of money supply:

On the recommendation of the second working group on money supply, the RBI presented four measures of money supply in its 1977 issues of RBI Bulletin, namely M1, M2, M3 and M4.

Measures of M1 include:

Currency notes and coins with the public (excluding cash in hand of all commercial banks) [C]

Demand deposits of all commercial and co-operative banks excluding inter-bank deposits. (DD)

Where demand deposits are those deposits which can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

(c) Other deposits with RBI [O.D]

M1 = C + DD + OD

Where, Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi¬government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc.

Measures of M2:

- M1 [C + DD + OD]

- Post office saving deposits

Measures of M3:

- M1

- Time deposits of all commercial and co-operative banks.

Where, Time deposits are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

Measures of M4:

- M3

- Total deposits with the post office saving organization (excluding national savings certificates).

- High-powered money: High-powered money is money produced by the RBI and the government. It consists of two things: (a) currency held by the public and (b) Cash reserves with the banks

CONCLUSION

- Barter system: Barter system of exchange is a system in which goods are exchanged for goods.

- Double coincidence of wants: It means that goods in possession of two different persons must be useful and needed by each other.

- Money: Money is something which is generally acceptable as a medium of exchange and can be converted into other assets without loosing its time and value.

- Legal definition of money: Legally, money is anything proclaimed by law as a medium of exchange. Paper notes and coins (together called currency) is money as a matter of law.

- FIAT Money: It is defined as a money which is under the ‘FIAT’ (order/authority) of the government to act as a money.

- Functional definition of money: Functional definition of money refers to money as anything that performs four basic functions. (Medium of exchange, standard unit of value, standard of deferred payments, store of value)

- Narrow definition of money: Functional definition of money is a narrow definition of money. It includes only notes, coins and demand deposits as money.

- Broad definition of money: A broad definition of money also includes time deposits/ term deposits with the banks or post offices as a component of money.

- Money Supply: The stock of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

- High-powered money: It is money produced by the RBI and the government. It consists of two things: (i) currency held by the public and (ii) Cash reserves with the banks.

- Demand deposits: These are the deposits that can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- Time deposits: These are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

- Other deposit measures of M1: Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi-government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc

FUNCTIONS OF MONEY

Functions of Money:

We can conclude these four functions under the following two categories:

1 - Primary function

2 - Secondary function

Primary function or Main function:

The primary function includes the most important functions of money, which it must perform in an economic system irrespective of time and place. The following two functions are included under this category.

(i) Medium of exchange

- Money when used as a medium of exchange helps to eliminate the basic limitation of barter trade, that is, the lack of double coincidence of wants.

- Individuals can exchange their goods and services for money and then can use this money to buy other goods and services according to their needs and convenience.

- Thus, the process of exchange shall have two parts: a sale and a purchase.

- The ease at which money is converted into other goods and services is called “liquidity of money”.

(ii) Measure of value /unit of account

- Another important function of money is that it serves as a common measure of value or a unit of account.

- Under barter economy, there was no common measure of value in which the values of different goods could be measured and compared with each other. Money has also solved this difficulty.

- As Geoffrey Crowther puts it, “Money acts as a standard measure of value to which all other things can be compared.” Money measures the value of economic goods.

- Money works as a common denominator into which the values of all goods and services are expressed.

- When we express the values of a commodity in terms of money, it is called price and by knowing prices of the various commodities, it is easy to calculate exchange ratios between them.

Secondary Functions:

(i) Standard of deferred payments

- Credit has become the life and blood of a modern capitalist economy.

- In millions of transactions, instant payments are not made.

- The debtors make a promise that they will make payments on some future date. In those situations, money acts as a standard of deferred payments.

- It has become possible because money has general acceptability, its value is stable, it is durable and homogeneous.

(ii) Store of value

- Wealth can be conveniently stored in the form of money. Money can be stored without loss in value.

- Savings are secured and can be used whenever there is a need.

- In this way, money acts as a bridge between the present and the future.

- Money means goods and services. Thus, money serves as a store of value.

- It is also known as asset function of money.

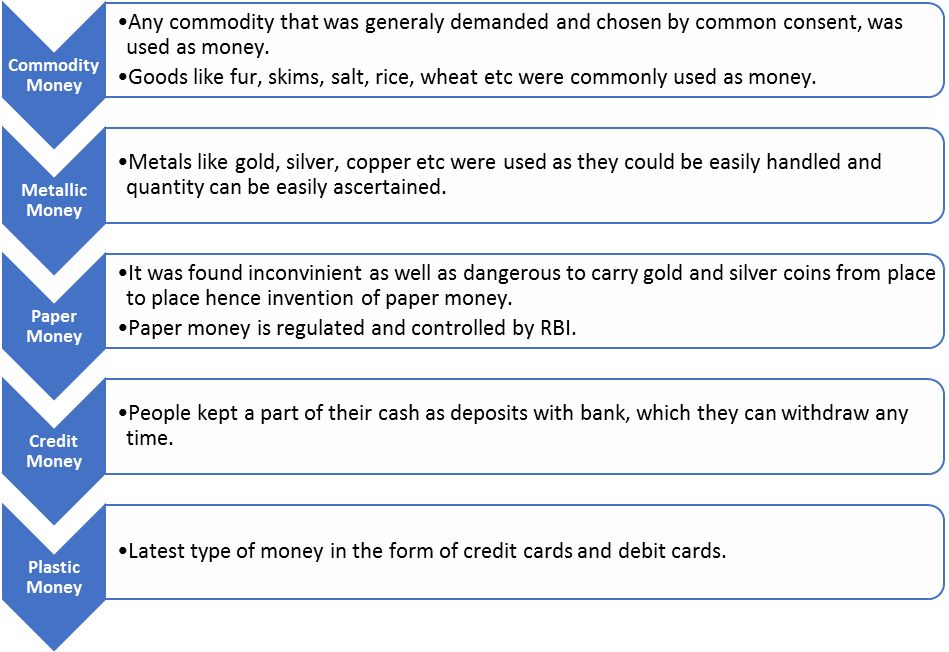

EVOLUTION OF MONEY

EVOLUTION OF MONEY

Money has evolved through different stages according to the time, place and circumstances. It developed through the following stages:

DEMAND FOR MONEY

DEMAND FOR MONEY

There are three main motives, for which money is wanted by the people:

Transaction Motive:

It refers to demand for money for conducting day-to-day transactions. This motive can be looked at from the perspective of consumers, who want income to meet their household expenditure (income motive) and from the perspective of businesspersons, who require money to carry on their business activities (business motive). The transaction motive relates to demand for money to meet the current transactions of individuals and business units.

Precautionary Motive:

It refers to the desire of people to hold cash balances for unforeseen contingencies. People wish to hold some money to provide for the risk of unforeseen events like sickness, accident, etc. The amount of money held under this motive, depends on the nature of individual and on the conditions in which he lives. The demand of money for precautionary balances is also closely related to the level of income. Higher the level of income, more will be the cash balances

Speculative Motive:

It refers to desire of the holder to keep cash balance as an alternative to financial assets like bonds. Under speculative motive, it is presumed that people can hold their wealth either in the form of bonds or in the form of cash balances. The decisions regarding holding of bonds or cash balances depend upon the expectations about changes in the rate of interest or capital value of assets (bonds) in future. The interest rate varies inversely with the market value of securities (bonds), i.e. when interest rate rises, market value of bonds falls. Hence, demand for money for speculative motive becomes less at high interest rates and becomes large at low interest rates.

COMMERCIAL BANK

COMMERCIAL BANK

A commercial bank is a kind of financial institution that carries all the operations related to deposit and withdrawal of money for the general public, providing loans for investment, and other such activities. These banks are profit-making institutions and do business only to make a profit.

The two primary characteristics of a commercial bank are lending and borrowing. The bank receives the deposits and gives money to various projects to earn interest (profit). The rate of interest that a bank offers to the depositors is known as the borrowing rate, while the rate at which a bank lends money is known as the lending rate.

Function of Commercial Bank:

The functions of commercial banks are classified into two main divisions.

(a) Primary functions

Accepts deposit: The bank takes deposits in the form of saving, current, and fixed deposits. The surplus balances collected from the firm and individuals are lent to the temporary requirements of the commercial transactions.

Provides loan and advances: Another critical function of this bank is to offer loans and advances to the enterpreneurs and business people and collect interest. For every bank, it is the primary source of making profits. In this process, a bank retains a small number of deposits as a reserve and offers (lends) the remaining amount to the borrowers in demand loans, overdraft, cash credit, short-run loans, and more such banks.

Credit cash: When a customer is provided with credit or loan, they are not provided with liquid cash. First, a bank account is opened for the customer and then the money is transferred to the account. This process allows the bank to create money.

(b) Secondary functions

Discounting bills of exchange: It is a written agreement acknowledging the amount of money to be paid against the goods purchased at a given point of time in the future. The amount can also be cleared before the quoted time through a discounting method of a commercial bank.

Overdraft facility: It is an advance given to a customer by keeping the current account to overdraw up to the given limit.

Purchasing and selling of the securities: The bank offers you with the facility of selling and buying the securities.

Locker facilities: A bank provides locker facilities to the customers to keep their valuables or documents safely. The banks charge a minimum of an annual fee for this service.

Paying and gathering the credit: It uses different instruments like a promissory note, cheques, and bill of exchange.

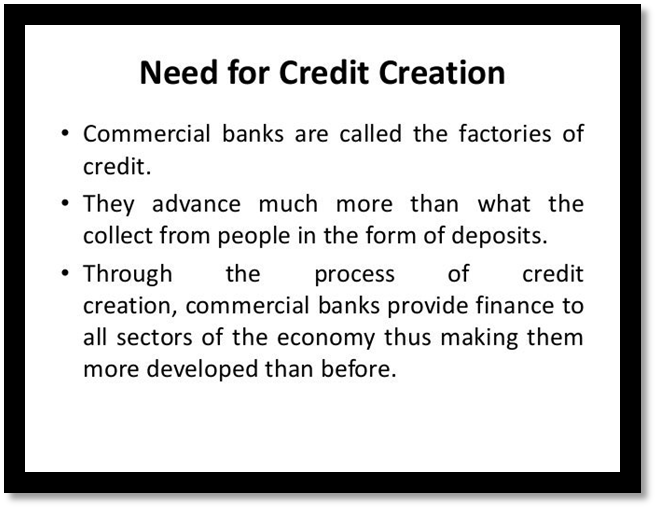

CREDIT CREATION

Money Creation / Credit Creation

Let us assume:

The entire commercial banking system is one unit. Let us call this one unit simply “banks’.

All receipts and payments in the economy are routed through the banks. One who makes payment does it by writing cheque. The one who receives payment deposits the same in his deposit account.

Suppose initially people deposit Rs.1000. The banks use this money for giving loans. But the banks cannot use the whole of deposit for this purpose. It is legally compulsory for the banks to keep a certain minimum fraction of these deposits as cash. The fraction is called the Legal Reserve Ratio (LRR). The LRR is fixed by the Central Bank. It has two components. A part of the LRR is to be kept with the Central bank and this part ratio is called the Cash Reserve Ratio (CRR). The other part is kept by the banks with themselves and is called the Statutory Liquidity Ratio.

Let us now explain the process, suppose the initial deposits in banks is Rs.1000 and the LRR is 10 percent. Further, suppose that banks keep only the minimum required, i.e., Rs.100 as cash reserve, banks are now free to lend the remainder Rs.900. Suppose they lend Rs.900. What banks do to open deposit accounts in the names of the borrowers who are free to withdraw the amount whenever they like.

Let us now suppose they withdraw the whole of amount for making payments.

Now, since all the transactions are routed through the banks, the money spent by the borrowers comes back into the banks into the deposit accounts of those who have received this payment. This increases demand deposit in banks by 900. It is 90 per cent of the initial deposit. These deposits of Rs.900 have resulted on account of loans given by the banks. In this sense the banks are responsible for money creation. With this round, increased in total deposits are now Rs.1900 (1000 + 900).

When banks receive new deposit of Rs.900, they keep 10% of it as cash reserves and use the remaining Rs.810 for giving loans. The borrowers use these loans for making payments. The money comes back into the accounts of those who have received the payments. Bank deposits again rise, but by a smaller amount of Rs.810. It is 90 per cent of the last deposit creation. The total deposits now increase to Rs.2710 (=1000 + 900 + 810). The process does not end here.

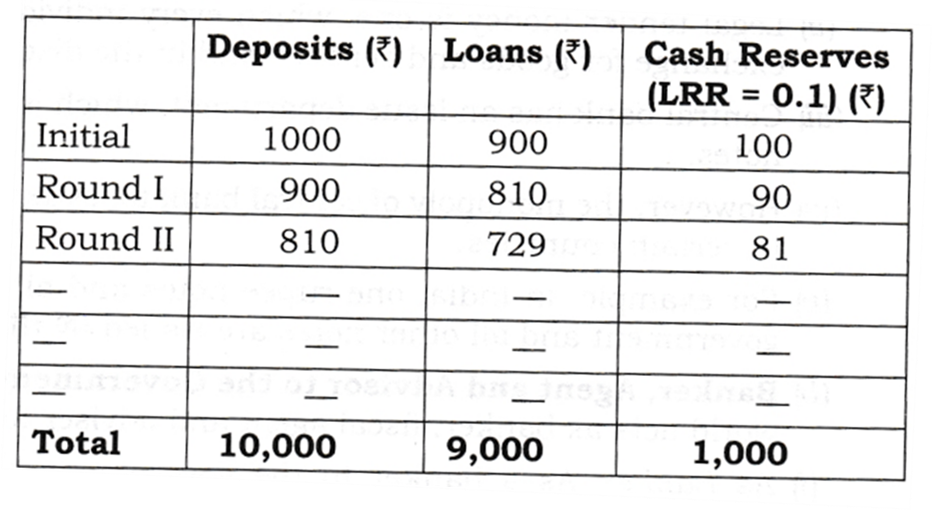

The deposit creation continues in the above manner. The deposits go on increasing round after round but Deposit Creation by Commercial Banks increases each time by only 90 per cent of the last round deposits. At the same time, cash reserves go on increasing, each time 90 per cent of the last cash reserve. The deposit creation comes to end when the total cash reserves become equal to the initial deposit. The total deposit creation comes to Rs.10000, ten times the initial deposit as shown in the table.

Deposit Creation By Commercial Banks

It can also be explained with the help of the following formula:

Money Multiplier = 1/LRR = 1/0.1 = 10

The total money creation thus,

Money creation = Initial deposit*1/LRR = 10,000

Note that lower the LRR, higher the money multiplier and more the money creation. If the LRR = 5% = 0.5, the money multiplier = 2(1/0.05). If the LRR = 20%, the money multiplier is

Banks are required to keep only a fraction of deposits as cash reserves because of the following two reasons:

First, the banking experience has revealed that not all depositors approach the banks for withdrawal of money at the same time and also that normally they withdraw a fraction of deposits.

Secondly, there is a constant flow of new deposits into the banks. Therefore to meet the daily demand for withdrawal of cash, it is sufficient for banks to keep only a fraction of deposits as a cash reserve.

When the primary cash deposit in the banking system leads to multiple expansion in the total deposits, it is known as money multiplier or credit multiplier.

CENTRAL BANK

CENTRAL BANK

Definition: The central bank is an apex body that controls, operates, regulates and directs the entire banking and monetary structure of the country.

It is known as apex as it occupies the top most position in the monetary and banking system of the country. India’s central bank is the Reserve Bank of India.

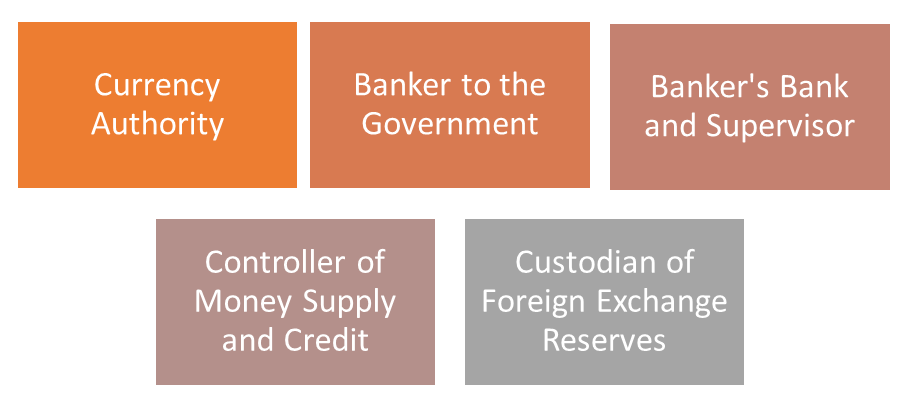

Functions of Central Bank:

1. Currency Authority:

- The central bank has the sole monopoly to issue currency notes. Commercial banks cannot issue currency notes. Currency notes issued by the central bank are the legal tender money.

- Legal tender money is one, which every individual is bound to accept by law in exchange for goods and services and in the discharge of debts.

- Central bank has an issue department, which is solely responsible for the issue of notes.

However, the monopoly of central bank to issue the currency notes may be partial in certain countries.

For example, in India, the government issues one-rupee notes and all types of coins and all other notes are issued by the Reserve Bank of India.

2. Banker to the Government:

- Central bank everywhere in the world acts as banker, fiscal agent and adviser to their respective government.

(I) As Banker:

As a banker to the government, the central bank performs same functions as performed by the commercial banks to their customers.

- It receives deposits from the government and collects cheques and drafts deposited in the government account.

- It provides cash to the government as resumed for payment of salaries and wages to their staff and other cash disbursements.

- It makes payments on behalf of the government.

- It also advances short-term loans to the government.

- It supplies foreign exchange to the government for repaying external debt or making other payments.

(ii) As Fiscal Agent:

- As a fiscal agent, it manages the public debt.

- It collects taxes and other payments on behalf of the government.

- It represents the government in the international financial institutions (such as World Bank, International Monetary Fund, etc.) and conferences.

(iii) As Adviser:

- The central bank also acts as the financial adviser to the government.

- It gives advice to the government on all financial and economic matters such as deficit financing, devaluation of currency, trade policy, foreign exchange policy, etc.

3. Banker’s Bank and Supervisor:

(a) Banker’s Bank: Central bank acts as the banker to the banks in three ways:

- Custodian of the cash reserves of the commercial banks;

- As the lender of the last resort; and

- As clearing agent.

(i) As a custodian of the cash reserves of the commercial banks, the central bank maintains the cash reserves of the commercial banks. Every commercial bank has to keep a certain percent of its cash reserves with the central bank by law.

(ii) As Lender of the Last Resort,

- As banker to the banks, the central bank acts as the lender of the last resort.

- In other words, in case the commercial banks fail to meet their financial requirements from other sources, they can, as a last resort, approach to the central bank for loans and advances.

- The central bank assists such banks through discounting of approved securities and bills of exchange.

(iii) As Clearing Agent,

- Since it is the custodian of the cash reserves of the commercial banks, the central bank can act as the clearinghouse for these banks.

- Since all banks have their accounts with the central bank, the central bank can easily settle the claims of various banks against each other simply by book entries of transfers from and to their accounts.

- This method of settling accounts is called the Clearing House Function of the central bank.

(b) Supervisor

- The Central Bank supervises, regulates and controls the commercial banks.

- The regulation of banks may be related to their licensing, branch expansion, liquidity of assets, management, amalgamation (merging of banks) and liquidation (the winding of banks).

- The control is exercised by periodic inspection of banks and the returns filed by them.

4. Controller of Money Supply and Credit:

Principal instruments of Monetary Policy or credit controls of the Central Bank of a country are broadly classified as:

- Quantitative Instruments or General Tools

- Qualitative Instruments or Selective Tools.

(a) Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy. These instruments do not direct or restrict the flow of credit to some specific sectors of the economy.

(i) Bank Rate (Discount Rate)

- Bank rate is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan). The thing, which has to be remembered, is that central bank lends to commercial banks and not to public.

- In a situation of excess demand leading to inflation,

- Central bank raises bank rate that discourages commercial banks in borrowing from central bank, as it will increase the cost of borrowing of commercial bank.

- It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

- Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

In a situation of deficient demand leading to deflation,

- Central bank decreases bank rate that encourages commercial banks in borrowing from the central bank as it will decrease the cost of borrowing of commercial bank.

- Decrease in bank rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

- Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

Thus, expenditure on investment and consumption increase, which will control the deficient demand.

(ii) Repo Rate

- Repo rate is the rate at which commercial bank borrow money from the central

- bank for short period by selling their financial securities to the central bank.

- These securities are pledged as a security for the loans.

- It is called Repurchase rate as this involves commercial bank selling securities

- to RBI to borrow the money with an agreement to repurchase them at a later

- date and at a predetermined price.

Therefore, keeping securities and borrowing is repo rate.

In a situation of excess demand leading to inflation,

- Central bank raises repo rate that discourages commercial banks in borrowing from central bank as it will increase the cost of borrowing of commercial bank.

- It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

- Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

In a situation of deficient demand leading to deflation,

- Central bank decreases Repo rate that encourages commercial banks in borrowing from central bank, as it will decrease the cost of borrowing of commercial bank.

- Decrease in Repo rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

- Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

Thus, expenditure on investment and consumption increase, which will control the deficient demand.

(iii) Reverse Repo Rate

- It is the rate at which the Central Bank (RBI) borrows money from commercial bank.

- In a situation of excess demand leading to inflation, Reverse repo rate is increased, it encourages the commercial bank to park their funds with the central bank to earn higher return on idle cash. It decreases the lending capability of commercial banks, which controls excess demand.

- In a situation of deficient demand leading to deflation, Reverse repo rate is decreased; it discourages the commercial bank to park their funds with the central bank. It increases the lending capability of commercial banks, which controls deficient demand.

(iv) Open Market Operations (OMO)

- It consists of buying and selling of government securities and bonds in the open market by Central Bank.

- In a situation of excess demand leading to inflation, central bank sells government securities and bonds to commercial bank. With the sale of these securities, the power of commercial bank of giving loans decreases, which will control excess demand.

- In a situation of deficient demand leading to deflation, central bank purchases.

- Government securities and bonds from commercial bank. With the purchase of these securities, the power of commercial bank of giving loans increases, which will control deficient demand.

(v) Varying Reserve Requirements

- Banks are obliged to maintain reserves with the central bank, which is known as legal reserve ratio. It has two components. One is the Cash Reserve Ratio or CRR and the other is the SLR or Statutory Liquidity Ratio.

- Cash Reserve Ratio: It refers to the minimum percentage of a bank’s total deposits, which it is required to keep with the central bank. Commercial banks have to keep with the central bank a certain percentage of their deposits in the form of cash reserves as a matter of law.

For example, if the minimum reserve ratio is 10% and total deposits of a certain bank is Rs. 100 crore, it will have to keep Rs. 10 crore with the Central Bank.

- In a situation of excess demand leading to inflation, Cash Reserve Ratio (CRR) is raised to 20 per cent, the bank will have to keep Rs.20 crore with the Central Bank, which will reduce the cash resources of commercial bank and reducing credit availability in the economy, which will control excess demand.

- In a situation of deficient demand leading to deflation, cash reserve ratio (CRR) falls to 5% the bank will have to keep Rs. 5 crore with the central bank, which will increase the cash resources of commercial bank and increasing credit availability in the economy, which will control deficient demand.

(vi) The Statutory Liquidity Ratio (SLR)

- It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

- In a situation of excess demand leading to inflation, the central bank increases statutory liquidity ratio (SLR), which will reduce the cash resources of commercial bank and reducing credit availability in the economy.

- In a situation of deficient demand leading to deflation, the central bank decreases statutory liquidity ratio (SLR), which will increase the cash resources of commercial bank and increases credit availability in the economy.

It may consist of:

(1) Excess reserves

(2) Unencumbered (are not acting as security for loans from the Central Bank) government and other approved securities (securities whose repayment is guaranteed by the government); and

(3) Current account balances with other banks.

(b) Qualitative Instruments or Selective Tools of Monetary Policy: These instruments are used to regulate the direction of credit. They are as under:

Imposing margin requirement on secured loans

- Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security.

- So, the difference between the value of security and value of loan is called

- marginal requirement.

- In a situation of excess demand leading to inflation, central bank raises marginal requirements. This discourages borrowing because it makes people gets less credit against their securities.

- In a situation of deficient demand leading to deflation, central bank decreases marginal requirements. This encourages borrowing because it makes people get more credit against their securities.

Moral Suasion

- Moral suasion implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank.

- In a situation of excess demand leading to inflation, it appeals for credit contraction.

- In a situation of deficient demand leading to deflation, it appeals for credit expansion.

Selective Credit Controls (SCCs)

- In this method, the central bank can give directions to the commercial banks not to give credit for certain purposes or to give more credit for particular purposes or to the priority sectors.

- In a situation of excess demand leading to inflation, the central bank introduces rationing of credit in order to prevent excessive flow of credit, particularly for speculative activities. It helps to wipe off the excess demand.

- In a situation of deficient demand leading to deflation, the central bank withdraws rationing of credit and make efforts to encourage credit.

5. Custodian of Foreign Exchange Reserves:

- The central bank also acts as the custodian of the country's stock of gold and reserves of foreign exchange. This function enables the central bank to exercise a reasonable control on foreign exchange. According to regulations of foreign exchange, all foreign exchange transactions must be routed through RBI. Centralization of foreign exchange transactions with the Reserve Bank serves two objectives:

- It helps the bank in stabilizing the external value of the currency;

- It helps in pursuing a coordinated policy towards the balance of payments situation of the country.

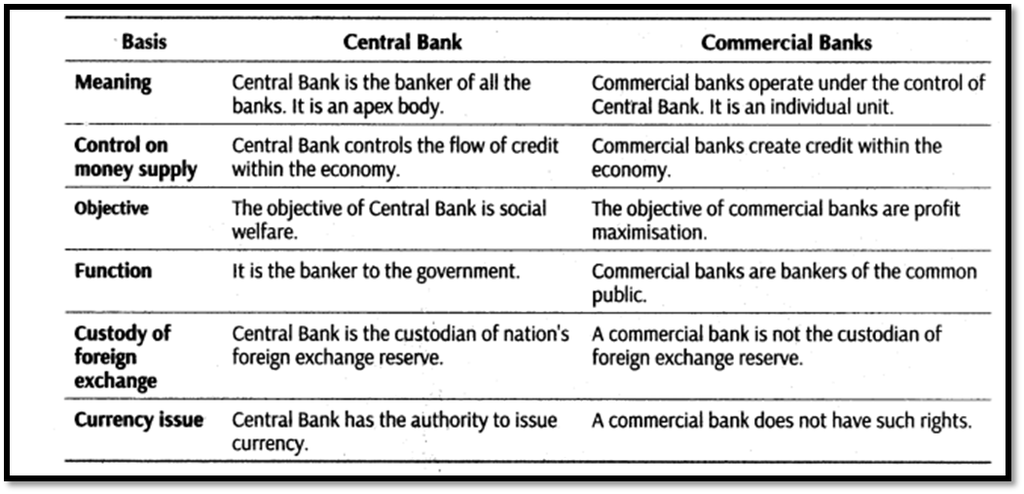

CENTRAL BANK v/s COMMERCIAL BANK

DIFFERENCE BETWEEN CENTRAL BANK AND COMMERCIAL BANK:

IMPORTANT TERMS FROM THE CHAPTER

- Commercial Bank: Commercial bank is a financial institution, which performs the functions of accepting deposits from the public and making loans and investments, with the motive of earning profit.

- Legal Reserve Ratio: It is the minimum ratio of deposits legally required to be kept by the commercial banks with themselves (Statutory Liquidity Ratio) and with the central bank, (Cash reserve Ratio).

- Money Multiplier or Credit Multiplier: When the primary cash deposit in the banking system leads to multiple expansion in the total deposits, it is known as money multiplier or credit multiplier.

- Central Bank: The central bank is the apex institution of a country’s monetary system. The design and the control of the country’s monetary policy is its main responsibility.

- Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy.

- Qualitative Instruments or Selective Tools of Monetary Policy: The instruments which are used to regulate the direction of credit is known as Qualitative Instruments.

- Bank rate: It is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan).

- Repo rate: It is the rate at which commercial bank borrow money from the central bank for short period by selling their financial securities to the central bank.

- Reverse Repo rate: It is the rate at which the central bank (RBI) borrows money from commercial bank.

- Open Market Operation: It consists of buying and selling of government securities and bonds in the open market by central bank.

- Cash Reserve Ratio: It refers to the minimum percentage of a bank’s total deposits, which it is required to keep with the central bank.

- Statutory Liquidity Ratio: It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

- Marginal requirement: Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security. Therefore, the difference between the value of security and value of loan is called marginal requirement.

- Moral suasion: It implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank.

- Selective Credit Controls (SCCs): In this method, the central bank can give directions to the commercial banks not to give credit purposes or to give more credit for particular purposes or to the priority sectors.

PathSet Publications

PathSet Publications