Money Creation / Credit Creation

Let us assume:

The entire commercial banking system is one unit. Let us call this one unit simply “banks’.

All receipts and payments in the economy are routed through the banks. One who makes payment does it by writing cheque. The one who receives payment deposits the same in his deposit account.

Suppose initially people deposit Rs.1000. The banks use this money for giving loans. But the banks cannot use the whole of deposit for this purpose. It is legally compulsory for the banks to keep a certain minimum fraction of these deposits as cash. The fraction is called the Legal Reserve Ratio (LRR). The LRR is fixed by the Central Bank. It has two components. A part of the LRR is to be kept with the Central bank and this part ratio is called the Cash Reserve Ratio (CRR). The other part is kept by the banks with themselves and is called the Statutory Liquidity Ratio.

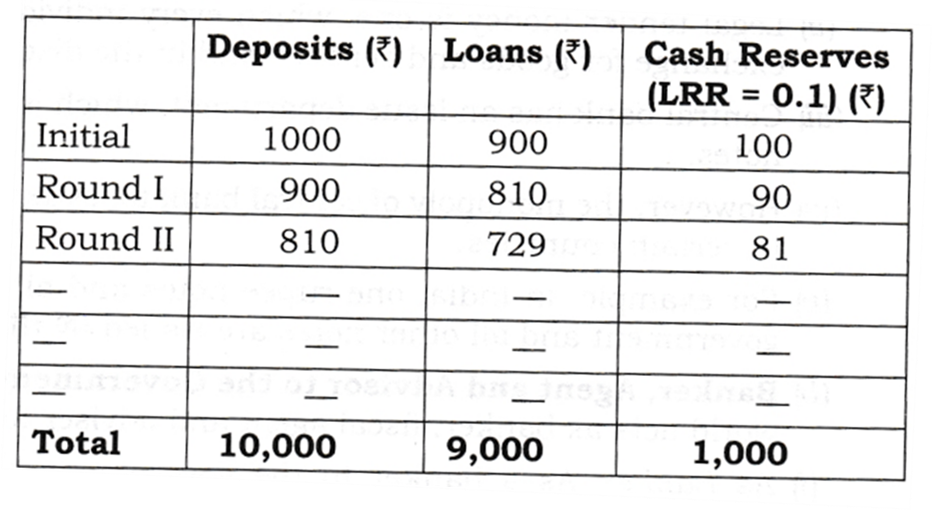

Let us now explain the process, suppose the initial deposits in banks is Rs.1000 and the LRR is 10 percent. Further, suppose that banks keep only the minimum required, i.e., Rs.100 as cash reserve, banks are now free to lend the remainder Rs.900. Suppose they lend Rs.900. What banks do to open deposit accounts in the names of the borrowers who are free to withdraw the amount whenever they like.

Let us now suppose they withdraw the whole of amount for making payments.

Now, since all the transactions are routed through the banks, the money spent by the borrowers comes back into the banks into the deposit accounts of those who have received this payment. This increases demand deposit in banks by 900. It is 90 per cent of the initial deposit. These deposits of Rs.900 have resulted on account of loans given by the banks. In this sense the banks are responsible for money creation. With this round, increased in total deposits are now Rs.1900 (1000 + 900).

When banks receive new deposit of Rs.900, they keep 10% of it as cash reserves and use the remaining Rs.810 for giving loans. The borrowers use these loans for making payments. The money comes back into the accounts of those who have received the payments. Bank deposits again rise, but by a smaller amount of Rs.810. It is 90 per cent of the last deposit creation. The total deposits now increase to Rs.2710 (=1000 + 900 + 810). The process does not end here.

The deposit creation continues in the above manner. The deposits go on increasing round after round but Deposit Creation by Commercial Banks increases each time by only 90 per cent of the last round deposits. At the same time, cash reserves go on increasing, each time 90 per cent of the last cash reserve. The deposit creation comes to end when the total cash reserves become equal to the initial deposit. The total deposit creation comes to Rs.10000, ten times the initial deposit as shown in the table.

Deposit Creation By Commercial Banks

It can also be explained with the help of the following formula:

Money Multiplier = 1/LRR = 1/0.1 = 10

The total money creation thus,

Money creation = Initial deposit*1/LRR = 10,000

Note that lower the LRR, higher the money multiplier and more the money creation. If the LRR = 5% = 0.5, the money multiplier = 2(1/0.05). If the LRR = 20%, the money multiplier is

Banks are required to keep only a fraction of deposits as cash reserves because of the following two reasons:

First, the banking experience has revealed that not all depositors approach the banks for withdrawal of money at the same time and also that normally they withdraw a fraction of deposits.

Secondly, there is a constant flow of new deposits into the banks. Therefore to meet the daily demand for withdrawal of cash, it is sufficient for banks to keep only a fraction of deposits as a cash reserve.

When the primary cash deposit in the banking system leads to multiple expansion in the total deposits, it is known as money multiplier or credit multiplier.

PathSet Publications

PathSet Publications