INVESTMENT FUNCTION

Definition: Investment refers to the expenditure incurred on the creation of New Capital Asset. For example, expenditure incurred on the purchase of machinery, building, equipment, etc.

It can be of two types:

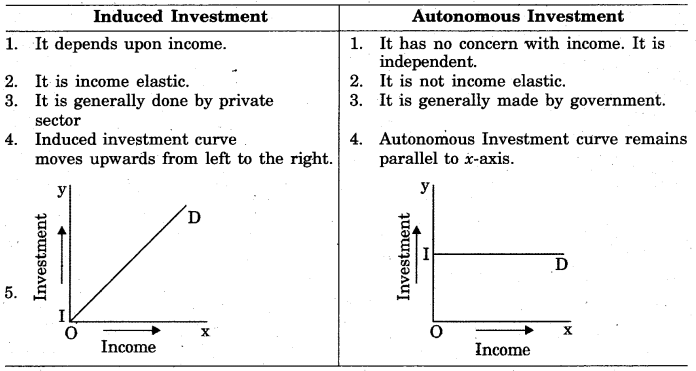

(1) Induced investment

(2) Autonomous investment

Induced Investment

Definition: Induced investment is that investment, which is directly influenced by the level of income that is it, increases with income and it falls with a fall in income. These are made for profit Motive.

Autonomous Investment

Definition: Autonomous investment refers to investment, which is not influenced by the level of income. These are not made for-profit motive.

The government on infrastructure activities generally makes these types of investments.

The level of autonomous investment depends upon social, economic and political conditions of any country hence its take it changes when there is a change in technology on the discovery of new resources or growth of population, etc.

Difference between Induced Investment & Autonomous Investment.

DETERMINANTS OF INVESTMENT

Investment in a new project depends upon two factors:

Marginal efficiency of investment

Rate of interest.

Marginal Efficiency of Investment:

Definition: Marginal efficiency of investment refers to the expected rate of return from additional investment.

It is determined by two factors:

Supply price: it happens to the cost of producing a new asset of that kind. It is the price at which the new capital can be supplied or replaced. for example, if a machine of rupees 1100000 is replaced in place of an old machine, then Rupees 1 lakh is supplied price

Protective yield: it refers to net return expected from the Capital Asset over its lifetime. For example, if the expected yield from a machine is rupees 8000 and running expenses are rupees 500 then protective Shield could be rupees 8000 - 500 is equal to Rs 7500.

In the above example, MEI will be calculated as follows:

MEI = Protective yield / Supply price * 100

MEI = 7500/100000 = 7.5%

Rate of Interest:

It refers to the cost of borrowing money for financing Investments. There exist an inverse relationship between ROI and volume of investment. At a higher ROI, investment soending will be less and vice-versa.

COMAPARISON OF MEI & ROI:

Profitability of an investment can be worked out by comparing MEI with ROI. IF MEI >ROI, investment is profitable as at this point, return from investment is more as compared to cost and if MEI<ROI, investment is not profitable as at this point return from investment is less as compared to cost.

PathSet Publications

PathSet Publications