1. Meaning of Bill of Exchange

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Chapter- 8

Bill of Exchange

Meaning of Bill of Exchange

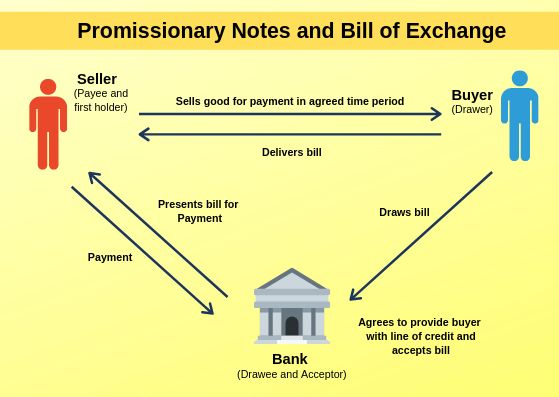

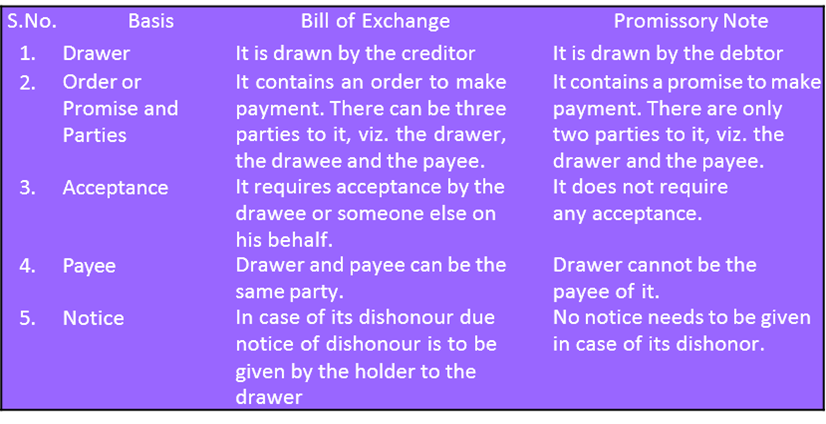

A bill of exchange is generally drawn by the creditor upon his debtor. It has to be accepted by the drawee (debtor) or someone on his behalf. It is just a dnaft till its acceptance is made. The amount mentioned in the bill of exchange is payable either on demand or on the expiry of a fixed period of time. It must be stamped as per the requirement of law.

The following features of a bill of exchange emerge out of this definition.

- A bill of exchange must be in writing.

- It is an order to make payment.

- The order to make payment is unconditional.

- The maker of the bill of exchange must sign it.

- The payment to be made must be certain.

- The date on which payment is made must also be certain.

- The bill of exchange must be payable to a certain person.

Bill of Exchange

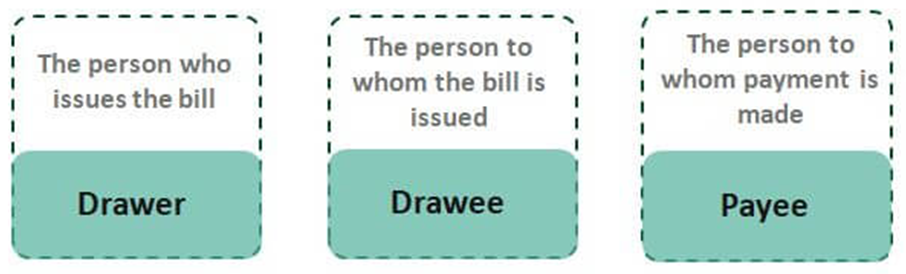

Parties to a Bill of Exchange

There are three parties to a bill of exchange:

- A seller/creditor who is entitled to receive money from the debtor can draw a bill of exchange upon the buyer/debtor. The drawer after writing the bill of exchange has to sign it as maker of the bill of exchange.

- Drawee is the purchaser or debtor of the goods upon whom the bill of exchange is drawn.

- Payee is the person to whom the payment is to be made. The drawer of the bill himself will be the payee if he keeps the bill with him till the date of its payment.

The payee may change in case, the drawer has got the bill discounted, the person who has discounted the bill will become the payee or if the bill is endorsed in favour of a creditor of the drawer, the creditor will become the payee. Normally, the drawer and the payee is the same person. Similarly, the drawee and the acceptor is normally the person.

2. Promissory Note

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Promissory Note

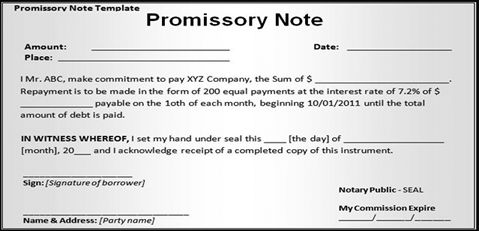

When a person gives a promise in writing to pay a certain sum of money unconditionally to a certain person or according to his order the document is called is a promissory note. A promissory note does not require any acceptance because the maker of the promissory note himself promises to make the payment.

Following features of a promissory note emerge out of the above definition:

- It must be in writing

- It must contain an unconditional promise to pay.

- The sum payable must be certain.

- It must be signed by the maker.

- The maker must sign it.

- It must be payable to a certain person.

- It should be properly stamped.

Parties to a Promissory Note

There are two parties to a promissory note.

- Maker or Drawer is the person who makes or draws the promissory note to pay a certain amount as specified in the promissory note. He is also called the promisor.

- Drawee or Payee is the person in whose favour the promissory note is drawn. He is called the promise.

Generally, the drawee is also the payee, unless, it is otherwise mentioned in the promissory note.

Distinction between a Bill of Exchange and Promissory Note

5. Accounting Treatment

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Accounting Treatment

The person who draws the bill of exchange and gets it back after its due acceptance, it is a bill receivable. For the person who accepts the bill, it is a bills payable. In case of a promissory note for the maker it is a bills payable and for the person in whose favour the promissory note is drawn it is a bills receivable. Bills receivables are assets and Bills payable are liabilities. Bills and Notes are used interchangeably.

In the Books of Drawer/Promissor

A bill receivable can be treated in the following ways by its receiver.

- He can retain it till the date of maturity, and get it collected on date of maturity directly, or get it collected through the banker.

- He can get the bill discounted from the bank.

- He can endorse the bill in favour of his Creditor.

The accounting treatment in the books of receiver under all the four alternatives is given below under the assumption that the bill is duly honoured on maturity by the acceptor.

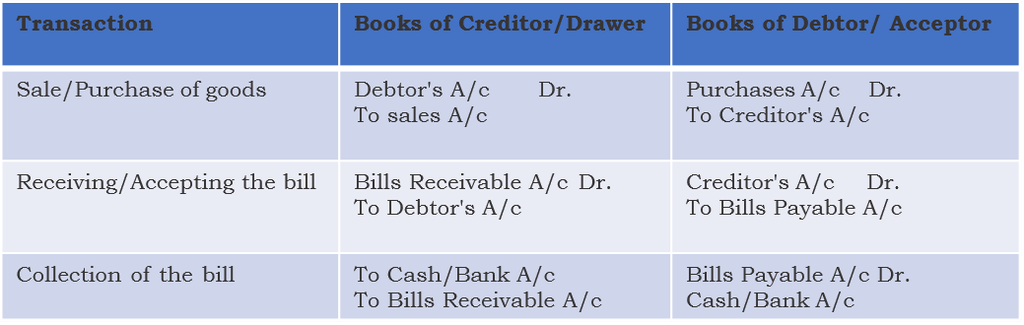

(1) When the bill of exchange is retained by the receiver with him till date of its maturity:

On receiving the bill

Bills Receivable A/c Dr. To Debtors A/c

On maturity of the bill

Cash/Bank A/c Dr. To Bills Receivable A/c

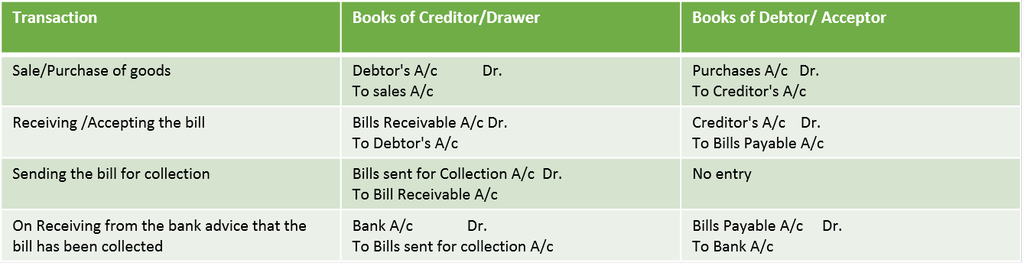

However, when the bill of exchange is retained by the receiver with him and sent to bank for collection a few days before maturity, the following two entries are recorded:

On sending the bill for collection

Bills Sent for Collection A/c Dr. To Bills Receivable A/c

On receiving the advice from the bank that the bill has been collected

Bank A/c Dr. To Bills Sent for Collection A/c

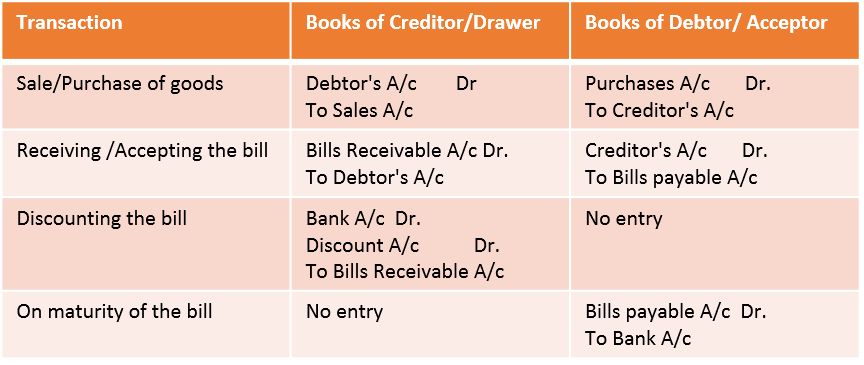

(2) When the receiver gets the bill discounted from the bank:

On receiving the bill

Bills Receivable A/c Dr. To Debtors A/c

On discounting the bill

Bank A/c Dr.

Discount A/c Dr. To Bills Receivable A/c

On Maturity

No entry is recorded because the bill becomes the property of the bank, therefore, the bank collects the amount of the bill from the acceptor and no journal entry is recorded in the books of the drawer.

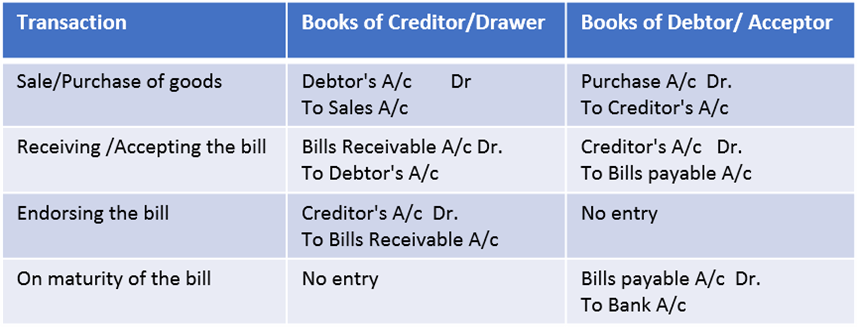

(3) When the bill is endorsed by the receiver in favour of his creditor:

On receiving the bill

Bills Receivable A/c Dr. To Debtor's A/c

On endorsing the bill

Creditor's A/c Dr. To Bills Receivable A/c

On Maturity

No entry is recorded because the bill has been transferred in favour of the creditor, therefore the creditor becomes its owner and will receive the payment on maturity. Hence, no entry is recorded in the books of drawer or endorser

In the Books of Acceptor/Promissor

The following journal entries are recorded in the books of the acceptor or promisesor :

On accepting the bill

Creditor's A/c Dr. To Bills Payable A/c

On Maturity of the bill

Bills Payable A/c Dr. To Bank A/c

1. When the drawer retains the bill with him till the date of its maturity and gets the same collected directly

2. When the bill is retained by the drawer with him and sent to bank for collection a few days before maturity

3. When the drawer gets the bill discounted from the bank

4. When the bill is endorsed by the drawer in favour of his creditor

4. Maturity, endorsement, discounting

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Maturity, endorsement, discounting

Maturity of Bill

The date on which a bill of exchange or a promissory note becomes due for payment is known as maturity of bill. If a bill dated March 05 is payable 30 days after date it, falls due on April 07, i.e., 33 days after March 05 If it were payable one month after date, the due date would be April 08, i.e., one month and 3 days after March 05.

However, where the date of maturity is a public holiday, the instrument will become due on the preceding business day. In this case if April 08, falls on a public holiday then the April 07 will be the maturity date. But when an emergent holiday is declared under the Negotiable Instruments Act 1881, by the Government of India which may happen to be the date of maturity of a bill of exchange, then the date of maturity will be the next working day immediately after the holiday.

Discounting of Bill

If the holder of the bill needs funds, he can approach the bank for encasement of the bill before the due date. The bank shall make the payment of the bill after deducting some interest (called discount in this case). This process of encashing the bill with the bank is called discounting the bill. The bank gets the amount from the drawee on the due date.

Endorsement of Bill

Any holder may transfer a bill unless its transfer is restricted, i.e., the bill has been negotiated containing words prohibiting its transfer. The bill can be initially endorsed by the drawer by putting his signatures at the back of the bill along with the name of the party to whom it is being transferred. The act of signing and transferring the bill is called endorsement.

3. Advantages of Bill

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Advantages of Bill of Exchange

- Framework for relationships: A bill of exchange represents a device, which provides a framework for enabling the credit transaction between the seller/ creditor and buyer/debtor on an agreed basis.

- Certainty of terms and conditions: The creditor knows the time when he would receive the money so also debtor is fully aware of the date by which he has to pay the money. This is due to the fact that terms and conditions of the relationships between debtor and creditor such as amount required to be paid; date of payment; interest to be paid, if any, place of payment are clearly mentioned in the bill of exchange.

- Convenient means of credit: A bill of exchange enables the buyer to buy the goods on credit and pay after the period of credit. However, the seller of goods even after extension of credit can get payment immediately either by discounting the bill with the bank or by endorsing it in favour of a third party.

- Conclusive proof: The bill of exchange is a legal evidence of a credit transaction implying thereby that during the course of trade buyer has obtained credit from the seller of the goods, therefore, he is liable to pay to the seller. In the event of refusal of making the payment, the law requires the creditor to obtain a certificate from the Notary to make it a conclusive evidence of the happening.

- Easy transferability: A debt can be settled by transferring a bill of exchange through endorsement and delivery.

6. Dishonour of Bill

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Dishonour of a Bill

When the drawee fails to make the payment on the date of maturity then it is known as Dishonour of a Bill. In this situation, liability of the acceptor is restored. Therefore, the entries made on the receipt of the bill should be reversed.

Noting Charges

A bill of exchange should be duly presented for payment on the date of its maturity. The drawee is absolved of his liability if the bill is not duly presented. Proper presentation of the bill means that it should be presented on the date of maturity to the acceptor during business working hours. To establish beyond doubt that the bill was dishonoured, despite its due presentation, it may preferably to be got noted by Notary Public. Noting authenticates the fact of dishonour. For providing this service, a fees is charged by the Notary Public which is called Noting Charges.

The following facts are generally noted by the Notary:

- Date, fact and reasons of dishonor.

- If the bill is not expressly dishonored, the reasons why he treats it as dishonored.

- The amount of noting charges.

The entries recorded for noting charges in the drawers book are as follows:

When Drawer himself pays

Drawee's A/c Dr. To Cash A/c

Where endorsee pays

Drawee's A/c Dr. To Endorsee A/c

When the bank pays on discounted bill

Drawee's A/c Dr. To Bank A/c

When the bank pays in the event of sending the bill for collection to the bank

Drawee's A/c Dr. To Bank A/c

Note - whosoever pays the noting charges, ultimately these have to be borne by the drawee. That is why the drawee is invariably debited in the drawer's books. This is because he is responsible for the dishonour of the bill and, hence, he has to bear these expenses.

For recording the noting charges in his book the drawee opens Noting Charges Acccount. He debits the Noting Charges Account and credits the Drawer's Account.

7. Renewal of Bill

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

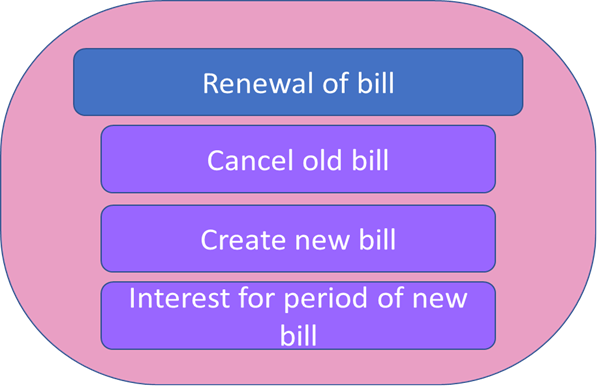

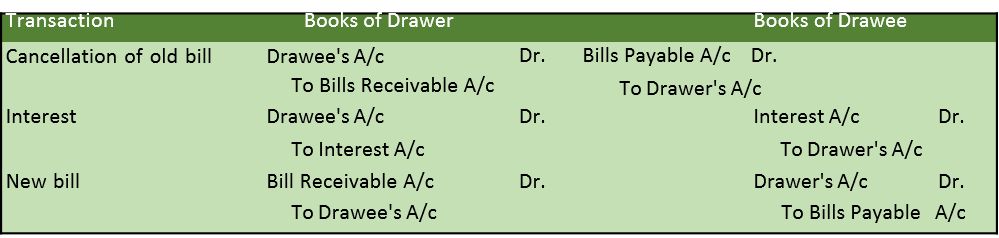

Renewal of the Bill

Sometimes, the acceptor of the bill foresees that it may be difficult to meet the obligation of the bill on maturity and may, therefore, approach the drawer with the request for extension of time for payment. If it is so, the old bill is cancelled and the fresh bill with new terms of payment is drawn and duly accepted and delivered. This is called renewal of the bill. Since the cancellation of bill is mutually agreed upon noting of the bill is not required.

The dreawee may have to pay interest to the drawer for the extended period of credit. The interest is paid in cash or may be included in the amount of the new bill. The journal entries recorded in case of renewal for the cancellation of the old bill, for interest and for the acceptance of the new bill in the books of the drawer and drawee are given below:

8. Retiring of Bill

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Retiring of the Bill

When the drawee of the bill has funds at his disposal and makes a request to the drawer or holder to accept the payment of the bill before its maturity. If the holder agrees to do so, the bill is said to have been retired. A bill of exchange is arranged to be retired before the due date by mutual understanding between the drawer and the drawee.

The retiring of a bill draws a curtain on the bill transactions before the expiry of its normal term. To encourage the retirement of the bill, the holder allows some discount called Rebate on bills for the period between date of retirement and maturity. The rebate is calculated at a certain rate of interest.

The accounting treatment on the retirement of a bill is similar to the accounting treatment when a bill is honoured by the acceptor on the due date in the ordinary course. The only difference between the two relates to the granting of rebate.

The following journal entries are recorded:

In the books of the holder

On retiring the acceptance and rebate allowed Cash A/c

Dr. Rebate on bills A/c Dr. To Bills Receivables A/c

In the books of the drawee

Bills Payable A/c Dr. Cash A/c Dr. To Rebate on Bills A/c

Vision classes

Vision classes