- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

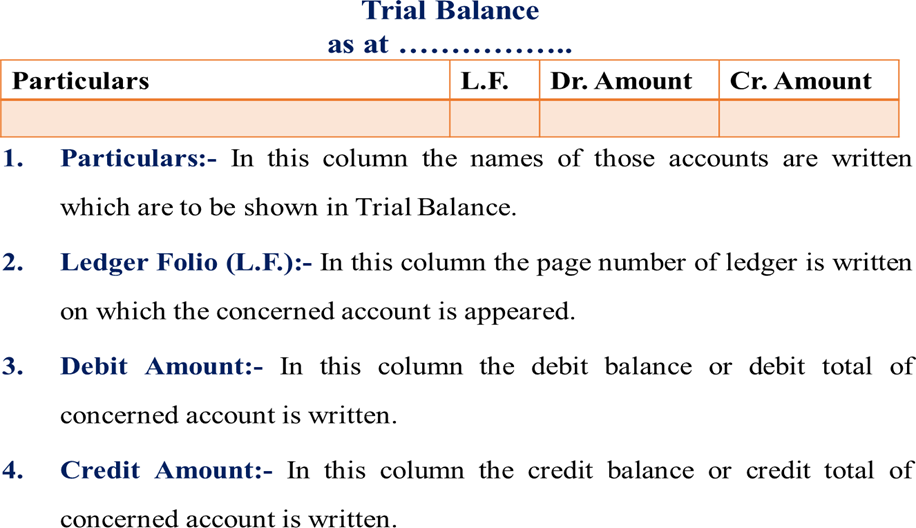

Preparation of Trial Balance

Following guidelines should be followed while preparing trial balance –

The following balances are placed on the credit column of the trial balance:

- Liabilities Income Accounts

- Capital Account

- Profits

Methods of Preparation of Trial Balance

A business organization can prepare a trial balance at any time. It can be prepared monthly, quarterly, half- yearly. It is prepared on a particular date and not for a particular period. There are three methods for preparation of trial balance.

Methods of preparation trial balance –

Balance method

Total method

Balance cum total method

Total method:-

Under this method, all the accounts having debit balances in the ledger are shown on the debit side or in debit column of trial balance and all the accounts having credit balances are shown on the credit side or in credit column of the trial balance. When an account shows no balance, i.e., the debit and credit side of an account are equal, is not shown in the trial balance.

As per latest CBSE syllabus, only Balance Method of preparing Trial Balance is prescribed.

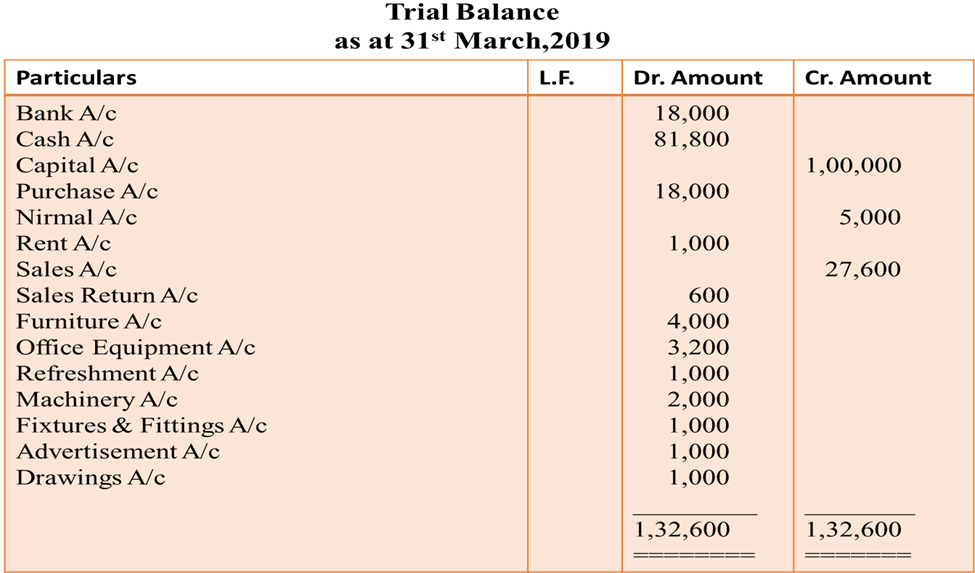

Balances Method

This is the most widely used method in practice. Under this method trial balance is prepared by showing the balances of all ledger accounts and then totalling up the debit and credit columns of the trial balance to assure their correctness. The account balances are used because the balance summarises the net effect of all transactions relating to an account and helps in preparing the financial statements. It may be noted that in trial balance, normally in place of balances in individual accounts of the debtors, a figure of sundry debtors is shown, and in place of individual accounts of creditors, a figure of sundry creditors is shown.

Totals-cum-balances Method

In this method, we combine both totals method and balances method. Under this method four columns for amount are prepared. Two columns for writing the debit and credit totals of various accounts and two columns for writing the debit and credit balances of these accounts. However, this method is also not used in practice because it is time consuming and hardly serves any additional or special purpose.

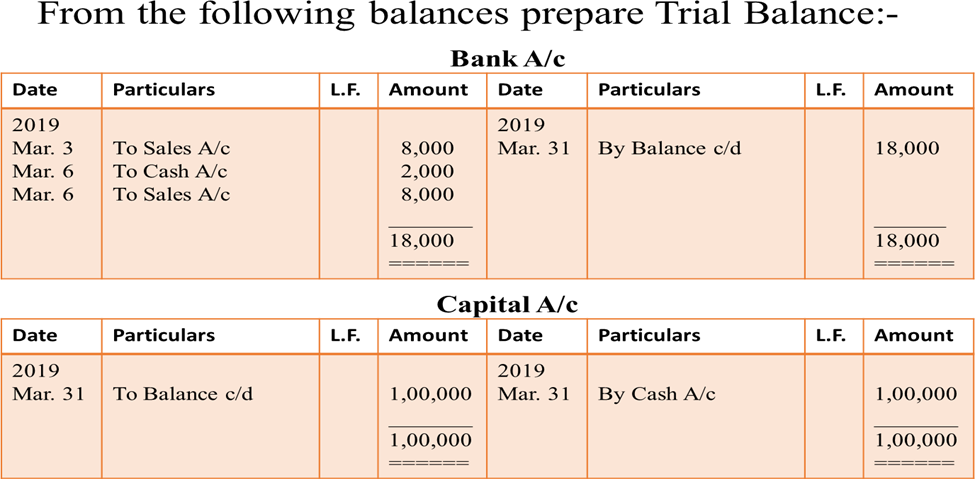

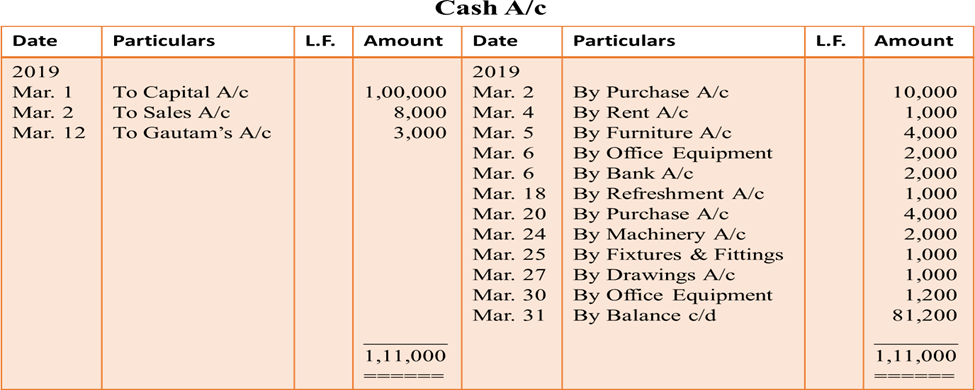

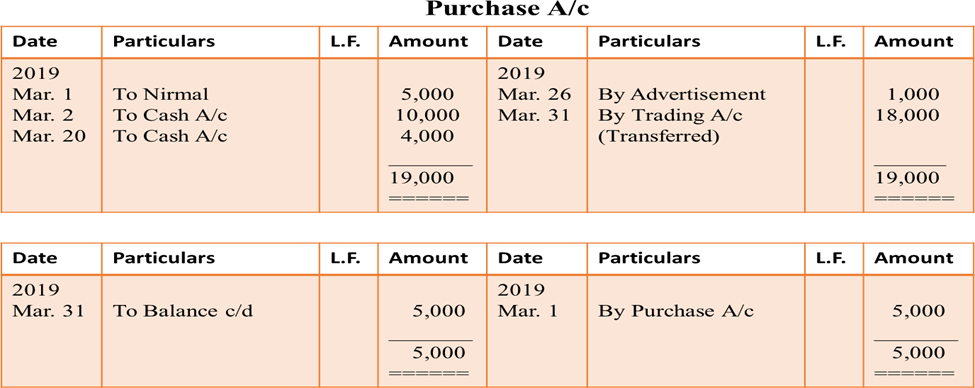

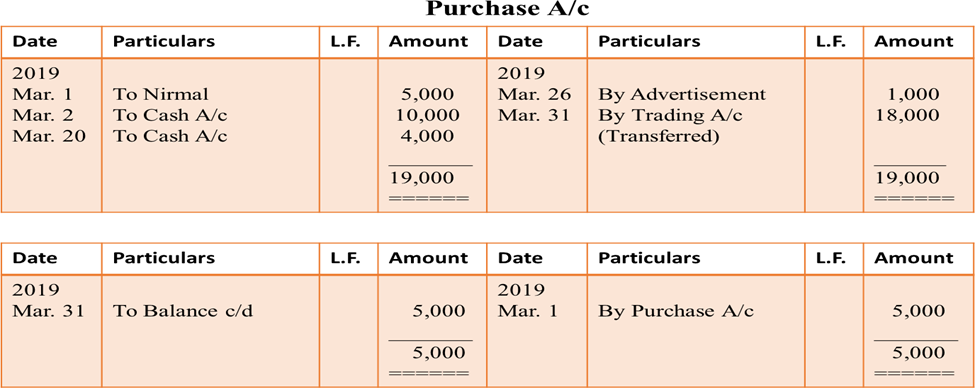

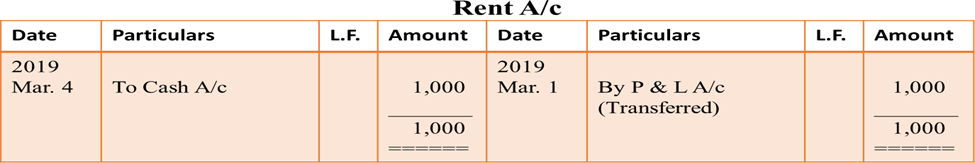

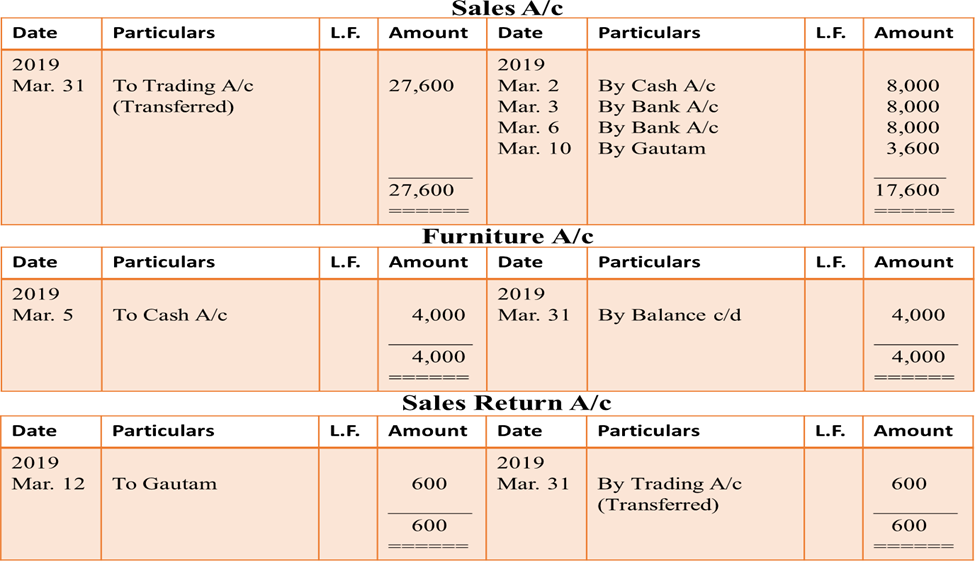

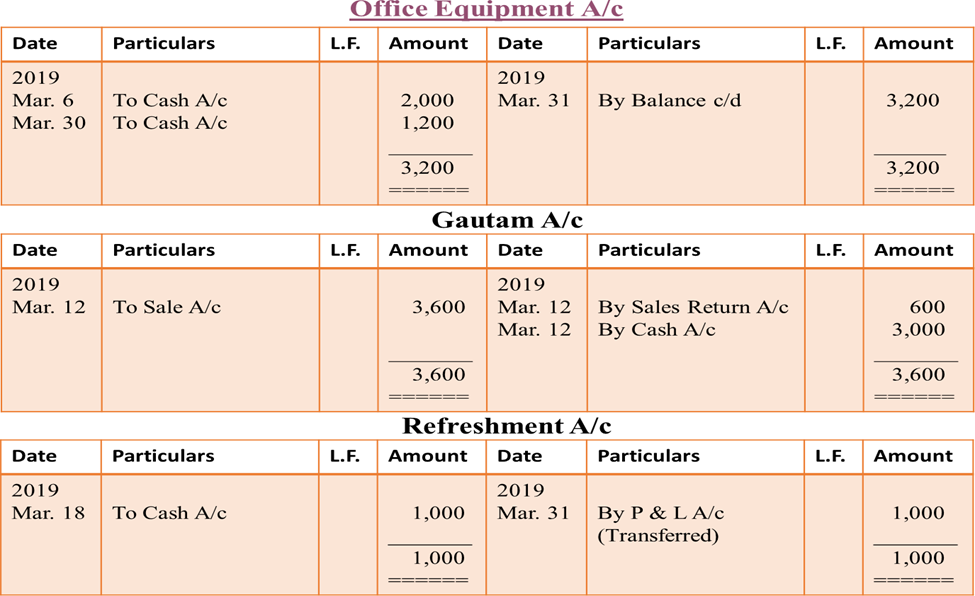

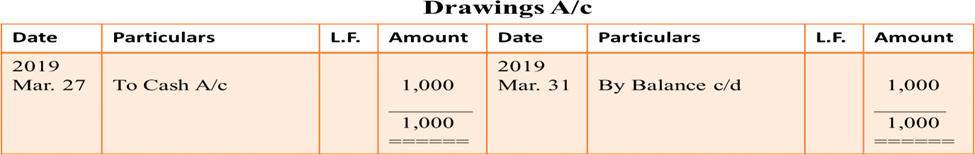

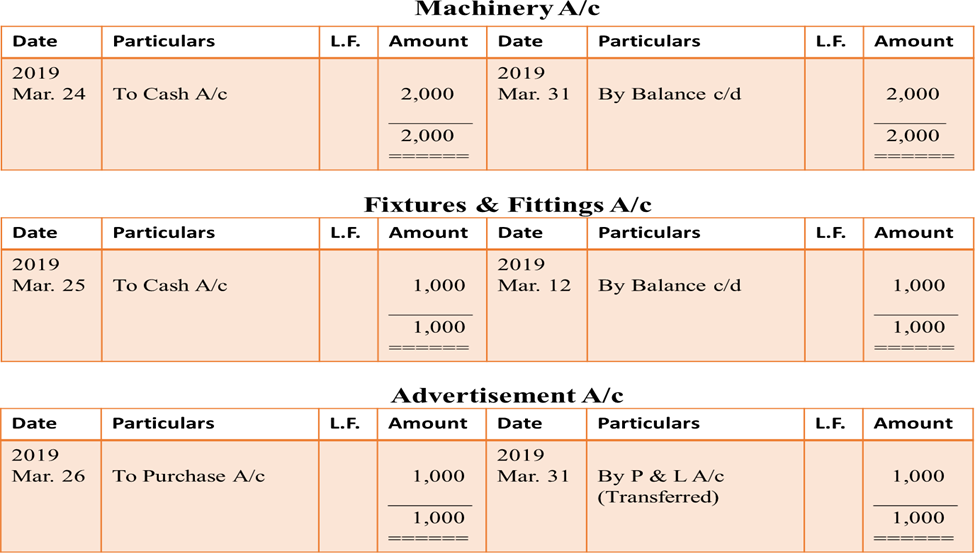

Example :-

Suspense Account

Sometimes in spite of best efforts of an accountant, all the errors are not located and Trial balance does not tally. In such a situation, to avoid the delay in the preparation of final accounts, the difference is placed to a newly opened account known as ‘Suspense Account’. If the debit side of the Trial Balance exceeds the credit side, the difference will be put on the credit side of Suspense Account and if credit side of the Trial balance exceeds the debit side, Suspense Account will be debited. After including the balance of suspense account in the Trial Balance, it will appear to be tallied. Later on, when the errors are located, they will be rectified and Suspense Account will be automatically closed.

Vision classes

Vision classes