1. Cash Book

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Chapter 4

Recording of Transactions

Cash Book

Cash book is a book in which all transactions relating to cash receipts and cash payments are recorded. It starts with the cash or bank balances at the beginning of the period. Generally, it is made on monthly basis.

This is a very popular book and is maintained by all organisations, big or small, profit or not-for- profit. It serves the purpose of both journal as well as the ledger (cash) account. It is also called the book of original entry. When a cashbook is maintained, transactions of cash are not recorded in the journal, and no separate account for cash or bank is required in the ledger.

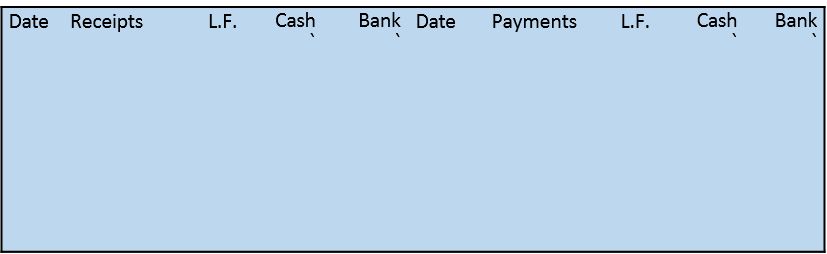

Single Column Cash Book

The single column cash book records all cash transactions of the business in a chronological order, i.e., it is a complete record of cash receipts and cash payments. When all receipts and payments are made in cash by a business organisation only, the cash book contains only one amount column on each (debit and credit) side.

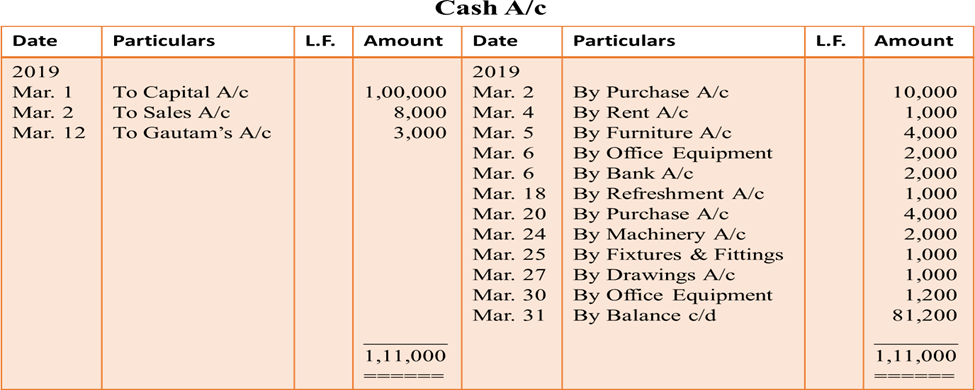

Cash book

(Format of single column cash book)

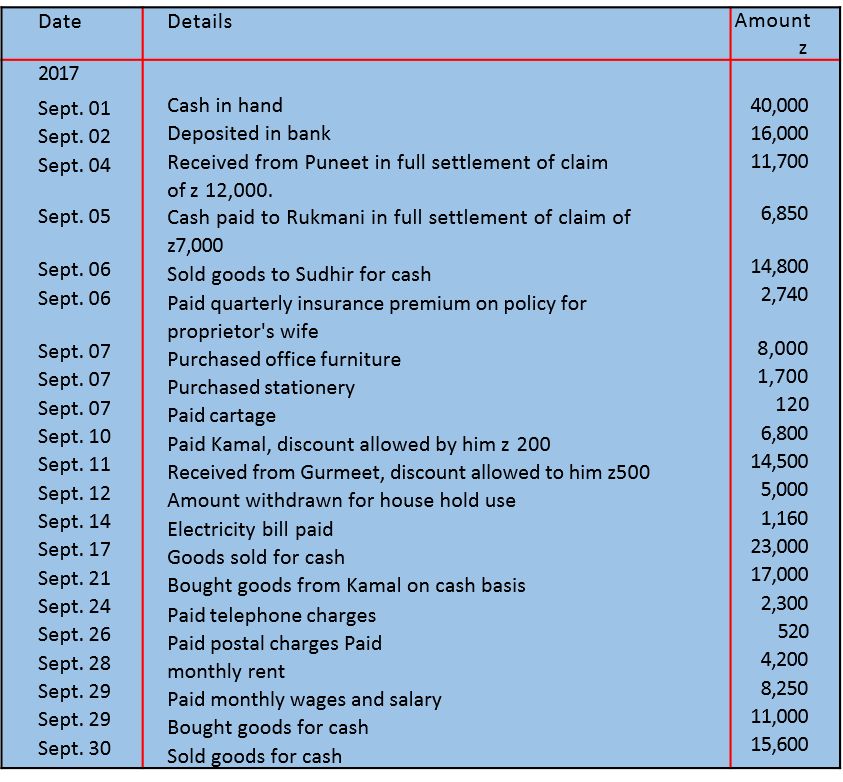

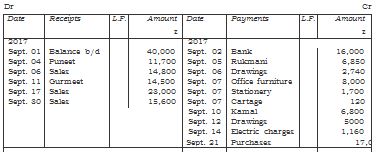

Recording of entries in the single column cash book and its balancing is illustrated by an example. Consider the following transactions of M/s Roopa Traders observe how they are recorded in a single column cash book.

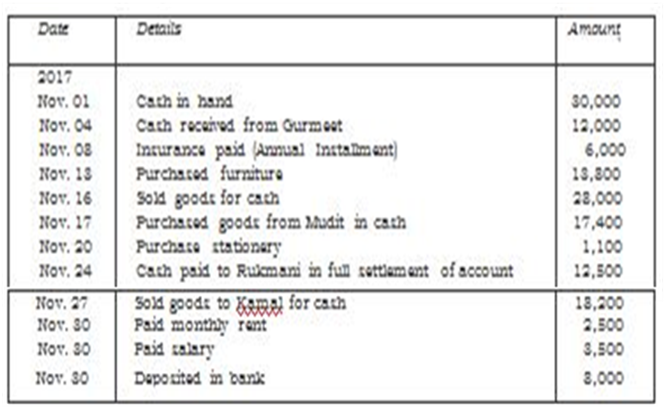

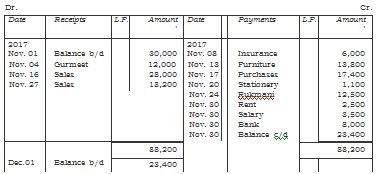

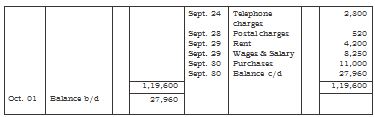

Roopa Traders Cash Book

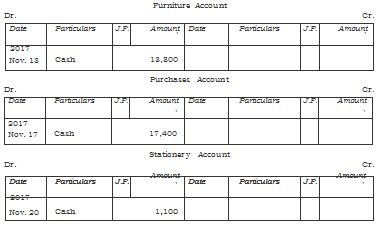

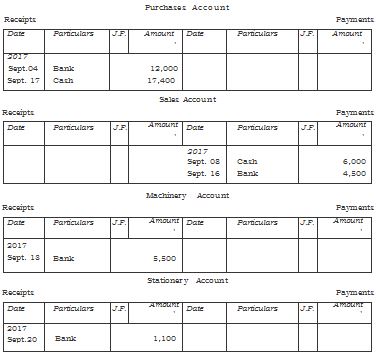

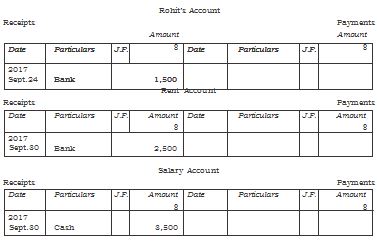

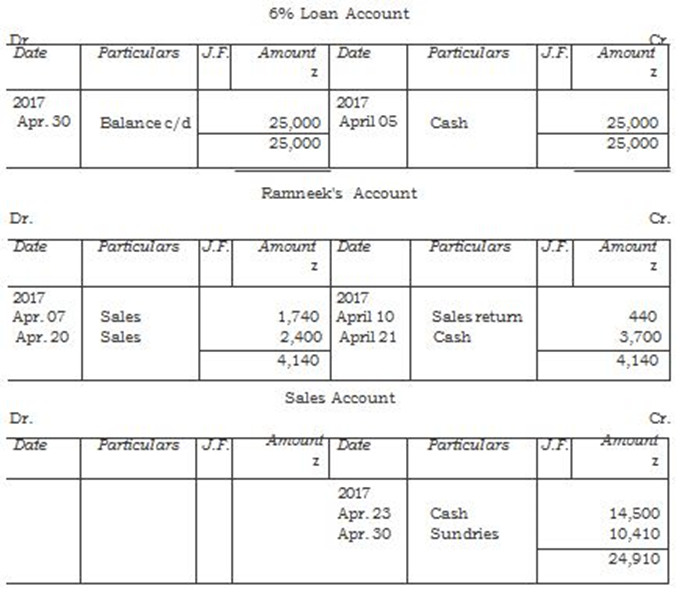

Posting of the Single Column Cash Book

The left side of the cash book shows the receipts of the cash whereas the right side of the cash book shows all the payments made in cash. The accounts appearing on then debit side for the cash book are credited in the respective ledger accounts because cash has been received in respect of them. Thus, in our example, an entry 'cash received from Gurmeet' appears on the debit side of the cash book conveys that the cash has been received from Gurmeet. Therefore, in the ledger, Gurmeet's account will be credited by writing 'Cash' in the particulars column on the credit side. Similarly, all the account names appearing on the credit side of the cash book are debited as cash/cheque has been paid in respect of them. Now, notice, how the transactions in our example are posted to the related ledger accounts:

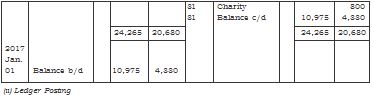

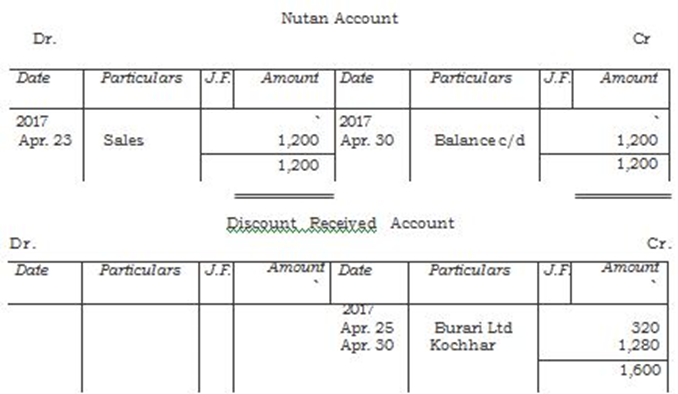

Books of Roopa Traders Gurmeet’s Account

Double Column Cash Book

In this type of cash book, there are two columns of amount on each side of the cash book. In fact, now-a-days bank transactions are very large in number. In many organisations, as far as possible, all receipts and payments are affected through bank.

A businessman generally opens a current account with a bank. Bank, do not allow any interest on the balance in current account but charge a small amount, called incidental charges, for the services rendered.

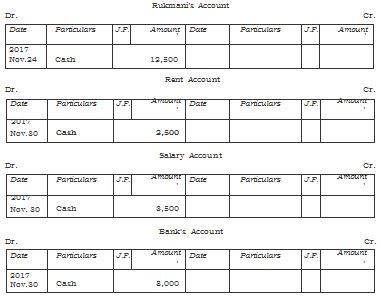

For depositing cash/cheques in the bank account, a form has to be filled, which is called a pay-in-slip. It contains a counterfoil also which is returned to the customer (depositor) with the signature of the cashier, as receipt.

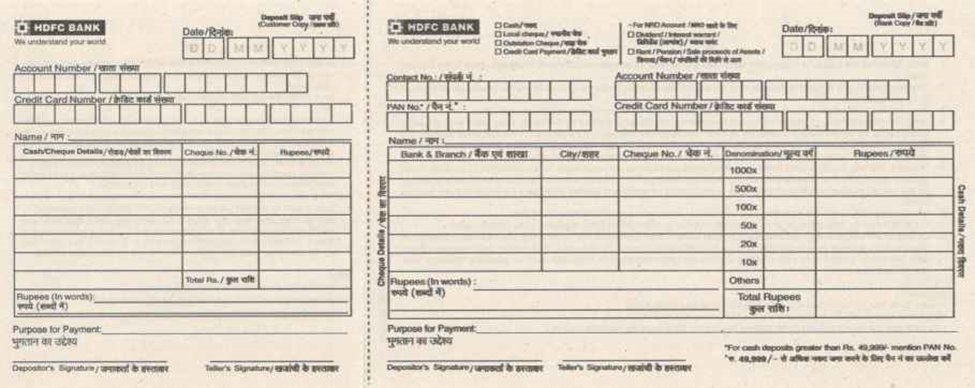

The bank issues blank cheque forms, to the account holder for withdrawing money. The depositor writes the name of the party to whom payment is to be made after the words Pay printed on the cheque. Cheque

forms have the printed word bearer, which means payment is to be made to the person whose name has been written after the words "pay" or the bearer of the cheques. When the world 'bearer' is struck off by drawing a line, the cheque becomes an order cheque. It means payment is to be made to the person whose name is written on the cheque or to his order after proper identification.

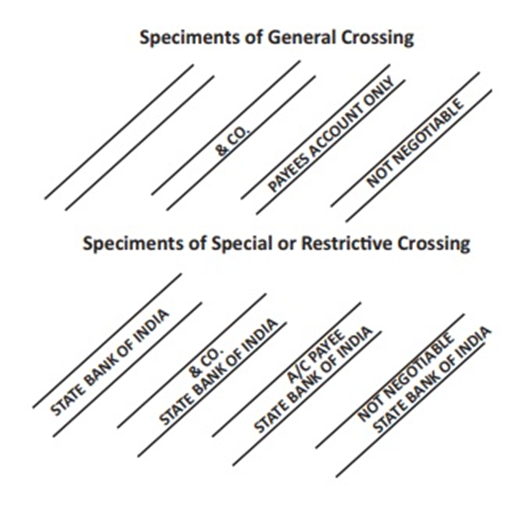

Cheques are generally crossed in practice. The payment of a crossed cheque cannot be made direct to the party on the counter. It is to be paid only through a bank. When two parallel lines are drawn across the cheque, it is said to be crossed. The various types of crossing providing different degrees of safety to the payment. In case of an A/c payee only crossing, the amount of the cheque can be deposited only in the account of the person whose name appears on the cheque. When the name of the bank is written between two parallel lines, it becomes a special crossing and the payment can be made only to the bank whose name has been written between the two lines.

Though this is rarely done, a cheque can be transferred by the payee (the person in whose favour the cheque has been drawn) to another person, if it is not crossed A/c payee only. A bearer cheque can be passed on by mere delivery. An order cheque can be transferred by endorsement and delivery. Endorsement means the writing of instructions to pay the cheque to a particular person and then singing it on the back of the cheque.

When the number of bank transactions is large; it is convenient to have a separate amount column for bank transactions in the cash book itself instead of recording them in the journal. This helps in getting information about the position of the bank account from time to time. Just like cash transactions, all payments into the bank are recorded on the left side and all withdrawals/payments through the bank are recorded on the right side. When cash is deposited in the bank or cash is withdrawn from the bank, both the entries are recorded in the cash book. This is so because both aspects of the transaction appear in the cash book itself. When cash is paid into the bank, the amount deposited is written on the left side in the bank column and at the same time the same amount is entered on the right side in the cash column. The reverse entries are recorded when cash is withdrawn from the bank for use in the office. Against such entries the word C, which stands for contra is written in the L.F. column indicating that these entries are not to be posted to the ledger account.

The bank column is balanced in the same way as the cash column. However, in the bank column, there can be credit balance also because of overdraft taken from the bank. Overdraft is a situation when cash withdrawn from the bank exceeds the amount of deposit. Entries in respect of cheques received should be made in the bank column of the cash book. When a cheque is received, it may be deposited into the bank on the same day or it may be deposited on another day. In case, it is deposited on the same day the amount is recorded in the bank column of the cash book on the receipts side. If the cheque is deposited on another day, in that case, on the date of receipt it is treated as cash received and hence recorded in the cash column on the receipts side. On the day of deposit to the bank, it is shown in the Bank Column on receipt (Dr.) side and in the Cash Column on the payment (Cr.) side. This is a contra entry.

If a cheque received from a customer is dishonoured, the bank will return the dishonoured cheque and debit the firm's account. On receipt of such cheque or intimation from the bank, the firm will make an entry on the credit side of the cash book by entering the amount of the dishonoured cheque in the bank column and the name of the customer in the particulars column. This entry will restore the position prevailing before the receipt of the cheque form the customer and its deposit in the bank. Dishonour of a cheque means return of the cheque unpaid, generally due to insufficient funds in the customer's account with the bank.

If the bank debits the firm on account of interest, commission or other charges for bank services, the entry will be made on the credit side in bank column. If the bank credits the firm's account, the entry will be made on the debit side of the cash book in the appropriate column.

Cash book

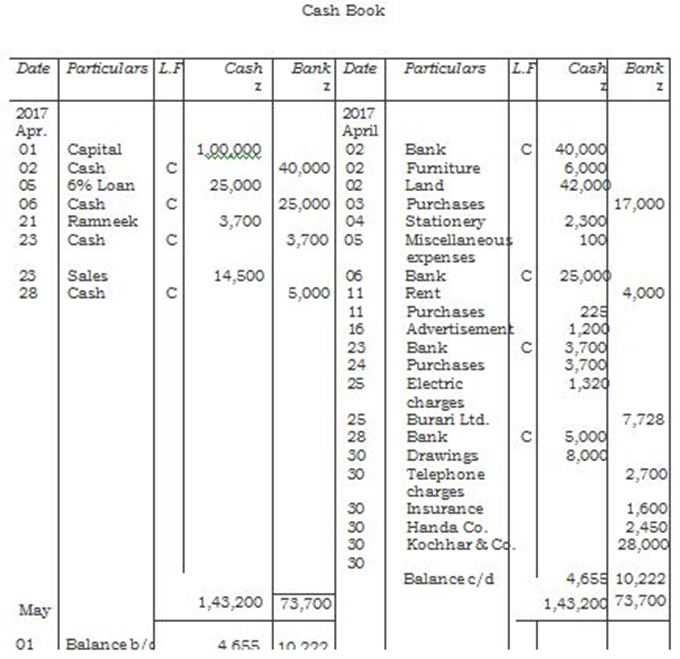

We will now learn how the transactions are recorded in the double column cash book.

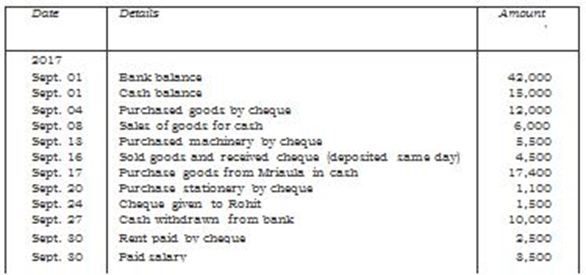

Consider the following example:

The following transactions related to M/s Tools India :

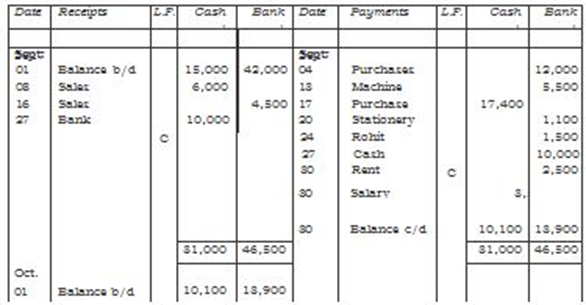

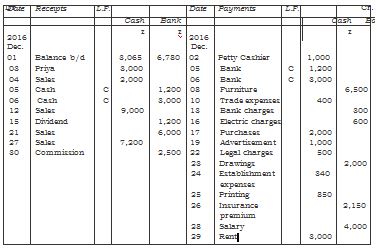

The double column cash book based upon above business transactions will prepared as follows:

Cash book

When the bank column is maintained in the cash book, the bank account also is not opened in the ledger. The bank column serves the purpose of the bank account. Entries marked C (being contra entries as explained earlier) are ignored while posting from the cash book to the ledger. These entries represent debit or credit of cash account against the bank account or vice-versa. We will now see how the transactions recorded in double column cash book are posted to the individual accounts.

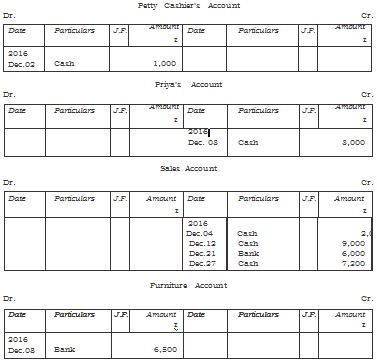

Petty Cash Book

In every organisation, a large number of small payments such as conveyance, cartage, postage, telegrams and other expenses (collectively recorded under miscellaneous expenses) are made. These are generally repetitive in nature. If all these payments are handled by the cashier and are recorded in the main cash book, the procedure is found to be very cumbersome. The cashier may be overburdened and the cash book may become very bulky. To avoid this, large organisations normally appoint one more cashier (petty cashier) and maintain a separate cash book to record these transactions. Such a cash book maintained by petty cashier is called petty cash book.

The petty cashier works on the Imprest system. Under this system, a definite sum, say 8 2,000 is given to the petty cashier at the beginning of a certain period. This amount is called imprest amount. The petty cashier goes on making all small payments out of this imprest amount and when he has spent the substantial portion of the imprest amount say 81,780, he gets reimbursement of the amount spent from the head cashier. Thus, he again has the full imprest amount in the beginning of the next period. The reimbursement may be made on a weekly, fortnightly or monthly basis, depending on the frequency of small payments. (In certain cases, the petty cash system is operated through the main cash book itself. In such instances, the petty cash book is not maintained independently.)

The petty cash book generally has a number of columns for the amount on the payment side (credit) besides the first other amount column. Each of the amount columns is allotted for items of specific payments, which are most common. The last amount column is designated as 'Miscellaneous' followed by a 'Remarks' column. In the miscellaneous column those payments are recorded for which a separate column does not exist. In the 'Remarks' the nature of payment is recorded. At the end of the period, all amount columns are totaled. The total amount column l shows the total amount spent and to be reimbursed. On the receipt (debit) side, there is only one amount column. Columns for the date, voucher number and particulars are common for both receipts and payments.

Balancing of Cash Book

On the left side, all cash transactions relating to cash receipts (debits) and on the right side all transactions relating to cash payments (credits) are entered date-wise. When a cash book is maintained, a separate cash book in the ledger is not opened. The cash book is balanced in the same way as an account in the ledger. But it may be noted that in the case of the cash book, there will always be debit balance because cash payments can never exceed cash receipts and cash in hand at the beginning of the period.

The source document for cash receipts is generally the duplicate copy of the receipt issued by the cashier. For payment, any document, invoice, bill, receipt, etc., on the basis of which payment has been made, will serve as a source document for recording transactions in the cash book. When payment has been made, all these documents, popularly known as vouchers, are given a serial number and filed in a separate file for future reference and verification.

Example 1

From the following transactions made by M/s Kuntia Traders, prepare the single column cashbook.

Solution

Books of Kuntia Traders

Cash Book

Example 2

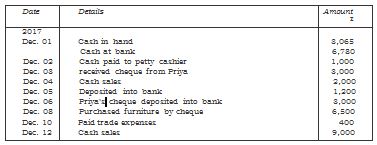

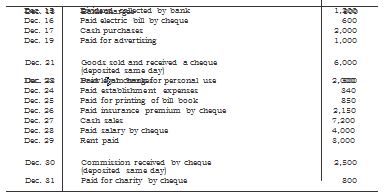

Prepare double column cash book of M/s Advance Technology Pvt. Ltd. for the month of December 2014 from the following transactions:

Solution

Books of Advance Technology

Cash Book

1. Need for reconciliation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

CHAPTER -5

Bank Reconciliation Statement

Need and importance

Definition: A schedule showing the items of difference between the bank statement and the bank column of Cash Book is known as Bank Reconciliation Statement. “A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate”.

Causes of Differences in Cash Book and pass Book

- Transactions recorded in Cash Book but not in Pass Book.

- Transactions recorded in Pass Book but not in Cash Book.

- Others transaction errors.

Transactions recorded in Cash Book but not in Pass Book

Cheques issued but not presented for payment in the bank.

- Cheques deposited or paid into the bank for collection but not yet credited by bank.

- Cheques deposited but dishonoured.

- Working Debit or credit entered.

Transactions recorded in Pass Book but not in Cash Book :-

- Interest allowed by the Bank

- Interest on overdraft, bank charges and commission etc. charges by Bank.

- Direct deposit by the customers into Bank.

- Interest, dividend etc. collected by the Bank.

- Direct payment made by the Bank on behalf of customer as per standing instruction.

Other transactions :-

- Error in totalling or balancing of Cash Book.

- Transactions recorded twice in Cash Book.

- Transactions recorded twice in Pass Book.

- Error of recording by wrong amount.

- Error of recording in wrong side like Debit instead of credit and vice-versa.

- It helps in locating and rectifying the errors or omissions committed either by the firm or by the bank.

- Customer becomes sure of the correctness of the bank balance shown by the cash book.

- Facilitates the preparation of amended or revised Cash Book.

- Reduces the chances of fraud by the staff of the firm or bank.

- Helps in keeping a track of the cheques deposited for collection.

1. Meaning of Trial Balance

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

CHAPTER 6

Trial Balance and Rectification of Errors

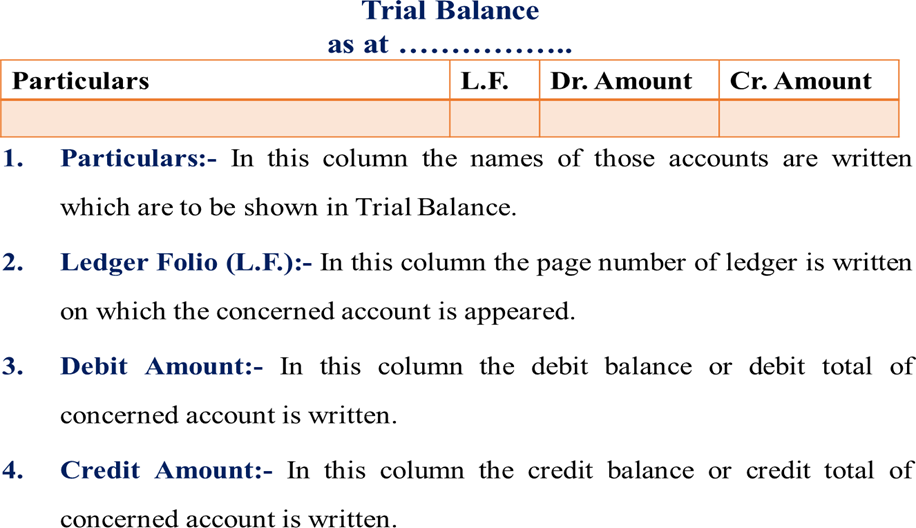

MEANING OF TRIAL BALANCE

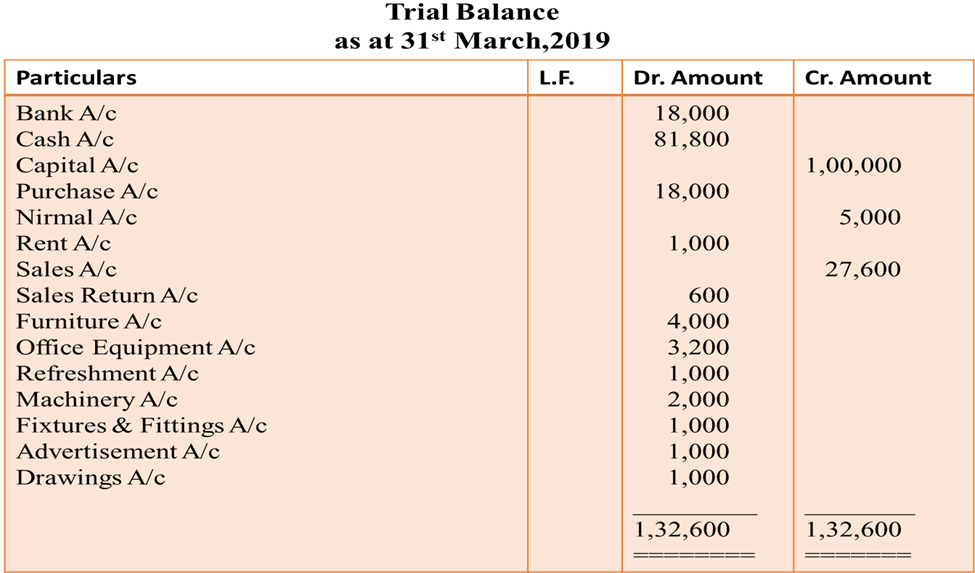

It is a statement prepared with the debit and credit balances of the ledger accounts. It also includes the balances of cash and Bank taken from the Cash Book. The total of debit and credit columns should be equal. The agreement of Trial Balance ensures arithmetical accuracy and not accounting accuracy.

“The Statement prepared with the help of ledger balances, at the end of financial year or at any other date, to find out whether debit total agrees with credit total, is called a Trial Balance.”

- William Pickles

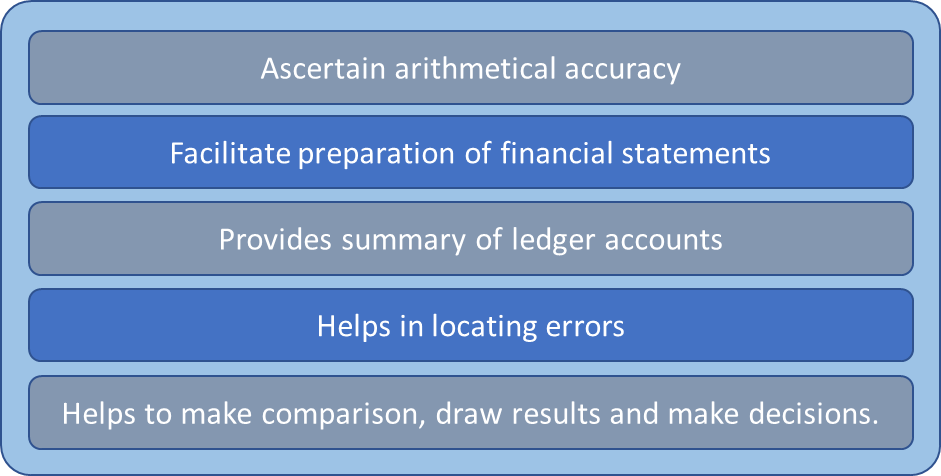

Objectives of Trial Balance

It helps in ascertaining arithmetic errors that occur while preparing accounts. Accountants can make mistakes while recording financial transactions under the double-entry bookkeeping system. When the debit and credit sides of a Trial Balance do not match, it means one of two things. One, there was an error in either recording the account balance. Or two, there is an accounting mistake made while recording the transaction in the ledgers.

It helps in preparing the financial statements of a company at the end of a financial year. The final balance of expenses and revenue accounts is taken from the Trial Balance and used in the Profit and Loss Account. Similarly, the accounts related to Assets, Liabilities and Capital gets recorded in the Balance Sheet.

- All expenses and losses have a debit balance.

- All income and gains have a credit balance.

- All assets have a debit balance.

- All liabilities have a credit balance.

- Capital has a credit balance but some time, it has a debit balance also.

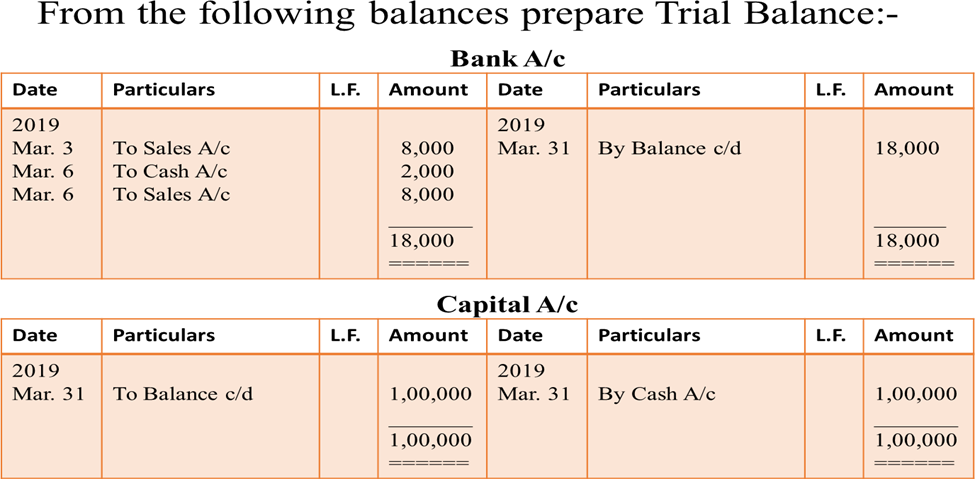

To prepare a trial balance we need the closing balances of all the ledger accounts and the cash book as well as the bank book.

So firstly every ledger account must be balanced. Balancing is the difference between the sum of all the debit entries and the sum of all the credit entries.

Then prepare a three column worksheet. One column for the account name and the corresponding columns for debit and credit balance.

Fill out the account name and the balance of such account in the appropriate debit or credit column

Then we total both the debit column and the credit column. Ideally, in a balanced error-free Trial balance these totals should be the same

Once you compare the totals and the totals are same you close the trial balance. If there is a difference we try and find and rectify errors.

Here are some cases that cause errors in the trial balance:

- A mistake in transferring the balances to the trial balance

- Error in balancing an account

- The wrong amount posted in the ledger

- Made the entry in the wrong column, debit instead of credit or vice versa

- Mistake made in the casting of the journal or subsidiary book

Rules for Preparation of Trial Balance

While preparation of trial balances we must take care of the following rules/points-

The balances of the following accounts are always found on the debit column of the trial balance

- Assets Expense Accounts

- Drawings Account

- Cash Balance

- Bank Balance

- Any losses

A Trial Balance helps in summarising the financial transactions done while running a business. It is a consolidated summary of the financial transactions that have taken place within a financial year. It can help the management in making business decisions as well.

1. Concepts, causes, need & factors

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Chapter -7

Depreciation, provisions & reserves

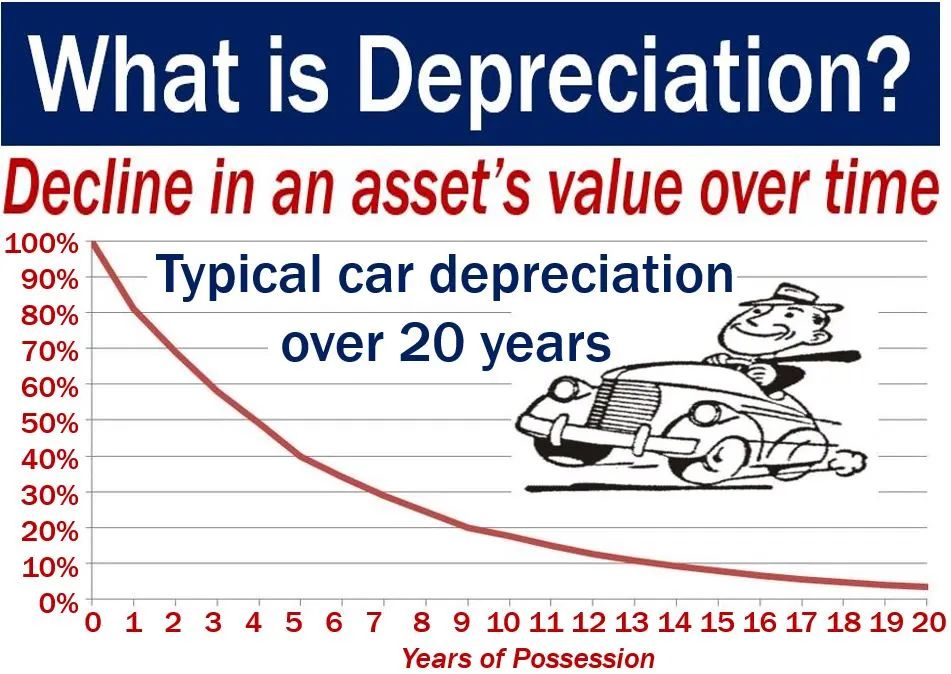

Depreciation

The fixed assets are the assets which are used in business for more than one accounting year. Fixed assets technically referred to as "depreciable assets". The term "Depreciation" means decline in the value of a fixed assets due to use, passage of time or obsolescence. We can sat, if a business enterprise procures a machine and uses it in production process then the value of machine declines with its usage. Even if the machine is not used in production process, we can not expect it to realise the same sales price due to the passage of time or arrival of a new model.

It implies that fixed assets are subject to decline in value and this decline is technically referred to as depreciation.

Depreciation is that part of the cost of a fixed asset which has expired on account of its usage and/or lapse of time. Hence, depreciation is an expired cost or expense, charged against the revenue of a given accounting period. The expired cost or loss in the value of machine on account of its use or passage of time and is referred to as 'Depreciation'. The amount of depreciation, being a charge against profit, is debited to Income Statement (Statement of Profit and Loss).

Meaning of Depreciation

It is based on the cost of assets consumed in a business and not on its market value. It may be described as a permanent, continuing and gradual shrinkage in the book value of fixed assets.

Institute of Cost and Management Accounting, London (ICMA) terminology "The depreciation is the diminution in intrinsic value of the asset due to use and/or lapse of time."

The Institute of Chartered Accountants of India (ICAI) defines depreciation as "a measure of the wearing out, consumption or other loss of value of depreciable asset arising from use, efflux ion of time or obsolescence through technology and market-change.

Depreciation has a significant effect in determining and presenting the financial position and results of operations of an enterprise. Depreciation is charged in each accounting period by reference to the extent of the depreciable amount. It should be noted that the subject matter of depreciation, or its base, are 'depreciable' assets which:

- are expected to be used during more than one accounting period.

- have a limited useful life.

- are held by an enterprise for use in production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Examples of depreciable assets - are machines, plants, furniture, buildings, computers, trucks, vans, equipments, etc. Moreover, depreciation is the allocation of 'depreciable amount', which is the "historical cost", or other amount substituted for historical cost less estimated salvage value.

Another point in the allocation of depreciable amount is the 'expected useful life' of an asset. It has been described as "either

- The period over which a depreciable asset is expected to the used by the enterprise.

- The number of production of similar units expected to be obtained from the use of the asset by the enterprise."

Features of Depreciation

1. It is decline in the book value of fixed assets.

2. It includes loss of value due to efflux ion of time, usage or obsolescence.

3. It is a continuing process.

4. It is an expired cost and hence must be deducted before calculating taxable profits. For example, if profit before depreciation and tax is f 50,000, and depreciation is f 10,000; profit before tax will be:

Profit before depreciation & tax 50,000

(-) Depreciation (10, 000)

Profit before tax 40,000

5. It is a non-cash expense. It does not involve any cash outflow. It is the process of writing-off the capital expenditure already incurred.

Depreciation and other Similar Terms

‘Depletion' and 'amortization', are also used in connection with depreciation. This has been due to the similar treatment given to them in accounting on the basis of similarity of their outcome, as they represent the expiry of the usefulness of different assets.

Depletion

The term depletion is used in the context of extraction of natural resources like mines, quarries, etc. that reduces the availability of the quantity of the material or asset. For example, if a business enterprise is into mining business and purchases a coal mine for f 10,00,000. Then the value of coal mine declines with the extraction of coal out of the mine. This decline in the value of mine is termed as depletion.

The main difference between depletion and depreciation is that the former is concerned with the exhaution of economic resources, but the latter relates to the usage of an asset. In spite of this, the result is erosion in the volume of natural resources and expiry of the service potential. Therefore, depletion and depreciation are given similar accounting treatment.

Causes of Depreciation

Wear and Tear due to Use or Passage of Time

It reduces the asset's technical capacities to serve the purpose for, which it has been meant. Another aspect of wear and tear is the physical deterioration. An asset deteriorates simply with the passage of time, even though they are not being put to any use. This happens especially when the assets are exposed to the rigours of nature like weather, winds, rains, etc.

Expiration of Legal Rights

Certain categories of assets lose their value after the agreement governing their use in business comes to an end after the expiry of pre-determined period. Examples of such assets are patents, copyrights, leases, etc. whose utility to business is extinguished immediately upon the removal of legal backing to them.

Obsolescence

Obsolescence means the fact of being "out-of-date". Obsolescence implies to an existing asset becoming out-of-date on account of the availability of better type of asset.

It arises from such factors as:

- Technological changes;

- Improvements in production methods;

- Change in market demand for the product or service output of the asset;

- Legal or other description.

Abnormal Factors

Decline in the usefulness of the asset may be caused by abnormal factors such as accidents due to fire, earthquake, floods, etc. Accidental loss is permanent but not continuing or gradual. For example, a car which has been repaired after an accident will not fetch the same price in the market even if it has not been used.

Need for Depreciation

The need for providing depreciation in accounting records arises from conceptual, legal, and practical business consideration. These considerations provide depreciation a particular significance as a business expense.

Matching of Costs and Revenue: Every asset is bound to undergo some wear and tear, and hence lose value, once it is put to use in business. Therefore, depreciation is as much the cost as any other expense incurred in the normal course of business like salary, carriage, postage and stationary, etc. It is a charge against the revenue of the corresponding period and must be deducted before arriving at net profit according to 'Generally Accepted Accounting Principles'.

Consideration of Tax: Depreciation is a deductible cost for tax purposes. However, tax rules for the calculation of depreciation amount need not necessarily be similar to current business practices,

True and Fair Financial Position: If depreciation on assets is not provided for, then the assets will be overvalued and the balance sheet will not depict the correct financial position of the business. Also, this is not permitted either by established accounting practices or by specific provisions of law.

Compliance with Law: Apart from tax regulations, there are certain specific legislations that indirectly compel some business organisations like corporate enterprises to provide depreciation on fixed assets.

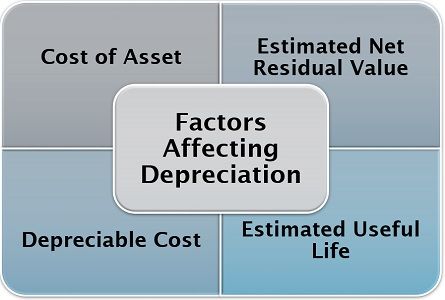

Factors Affecting the Amount of Depreciation

Cost of Asset: Cost of an asset includes invoice price and other costs, which are necessary to put the asset in use or working condition. It also includes freight and transportation cost, transit insurance, installation cost, registration cost, commission paid on purchase of asset adds items such as software, etc. In case of purchase of a second hand asset it includes initial repair cost to put the asset in workable condition.

Estimated Net Residual Value: It is the estimated net realisable value (or sale value) of the asset at the end of its useful life. It is also known as scrap value or salvage value for accounting purpose. The net residual value is calculated after deducting the expenses necessary for the disposal of the asset.

Depreciable Cost: It is the cost, which is distributed and charged as depreciation expense over the estimated useful life of the asset. It is important to mention that total amount of depreciation charged over the useful life of the asset must be equal to the depreciable cost. If total amount of depreciation charged is less than the depreciable cost then the capital expenditure is under recovered. It violates the principle of proper matching of revenue and expense.

Estimated Useful Life: It is the estimated economic or commercial life of the asset. Physical life is not important for this purpose because an asset may still exist physically but may not be capable of commercially viable production. For example, a machine is purchased and it is estimated that it can be used in production process for 5 years. After 5 years the machine may still be in good physical condition but can't be used for production profitably, i.e., if it is still used the cost of production may be very high. Therefore, the useful life of the machine is considered as 5 years irrespective of its physical life. Estimation of useful life of an asset is difficult as it depends upon several factors such as usage level of asset, maintenance of the asset, technological changes, market changes, etc. Normally, useful life is shorter than the physical life. The useful life of an asset is expressed in number of years but it can also be expressed in other units, e.g., number of units of output or number of working hours.

Useful life depends upon the following factors:

- Pre-determined by legal or contractual limits, e.g., in case of leasehold asset, the useful life is the period of lease.

- The number of shifts for which asset is to be used.

- Repair and maintenance policy of the business organization.

- Technological obsolescence.

- Innovation/improvement in production method.

- Legal or other restrictions.

1. Meaning of Bill of Exchange

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Chapter- 8

Bill of Exchange

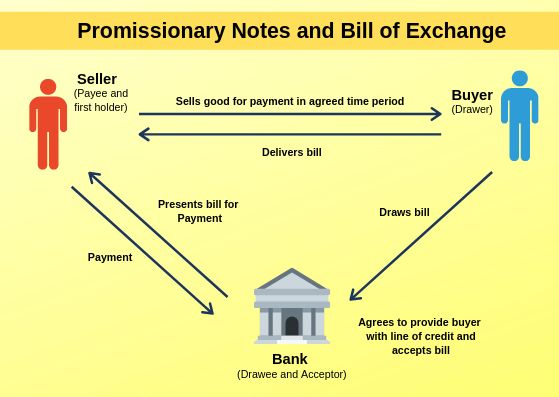

Meaning of Bill of Exchange

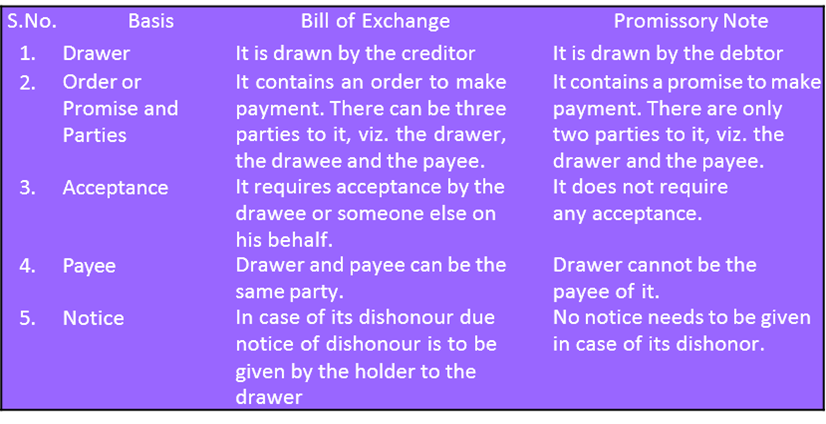

A bill of exchange is generally drawn by the creditor upon his debtor. It has to be accepted by the drawee (debtor) or someone on his behalf. It is just a dnaft till its acceptance is made. The amount mentioned in the bill of exchange is payable either on demand or on the expiry of a fixed period of time. It must be stamped as per the requirement of law.

The following features of a bill of exchange emerge out of this definition.

- A bill of exchange must be in writing.

- It is an order to make payment.

- The order to make payment is unconditional.

- The maker of the bill of exchange must sign it.

- The payment to be made must be certain.

- The date on which payment is made must also be certain.

- The bill of exchange must be payable to a certain person.

Bill of Exchange

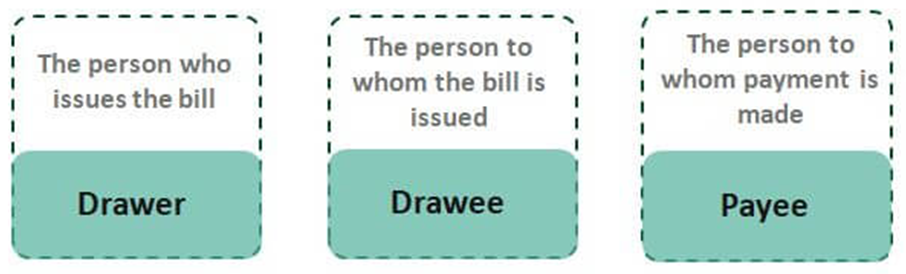

Parties to a Bill of Exchange

There are three parties to a bill of exchange:

- A seller/creditor who is entitled to receive money from the debtor can draw a bill of exchange upon the buyer/debtor. The drawer after writing the bill of exchange has to sign it as maker of the bill of exchange.

- Drawee is the purchaser or debtor of the goods upon whom the bill of exchange is drawn.

- Payee is the person to whom the payment is to be made. The drawer of the bill himself will be the payee if he keeps the bill with him till the date of its payment.

The payee may change in case, the drawer has got the bill discounted, the person who has discounted the bill will become the payee or if the bill is endorsed in favour of a creditor of the drawer, the creditor will become the payee. Normally, the drawer and the payee is the same person. Similarly, the drawee and the acceptor is normally the person.

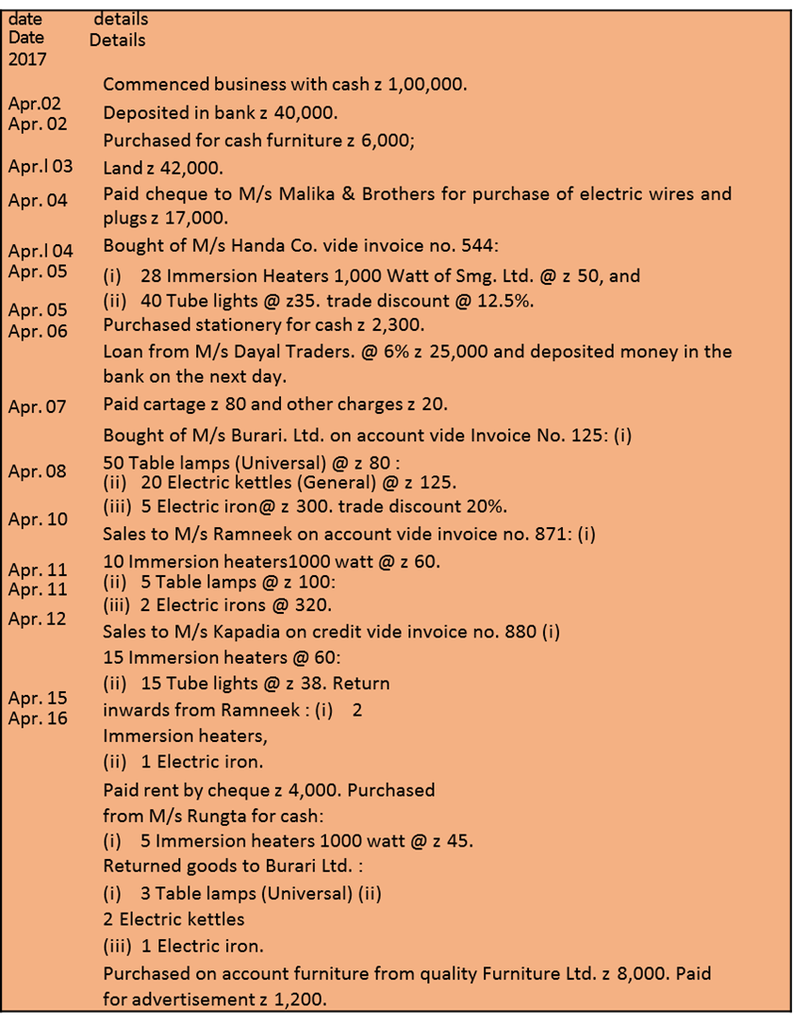

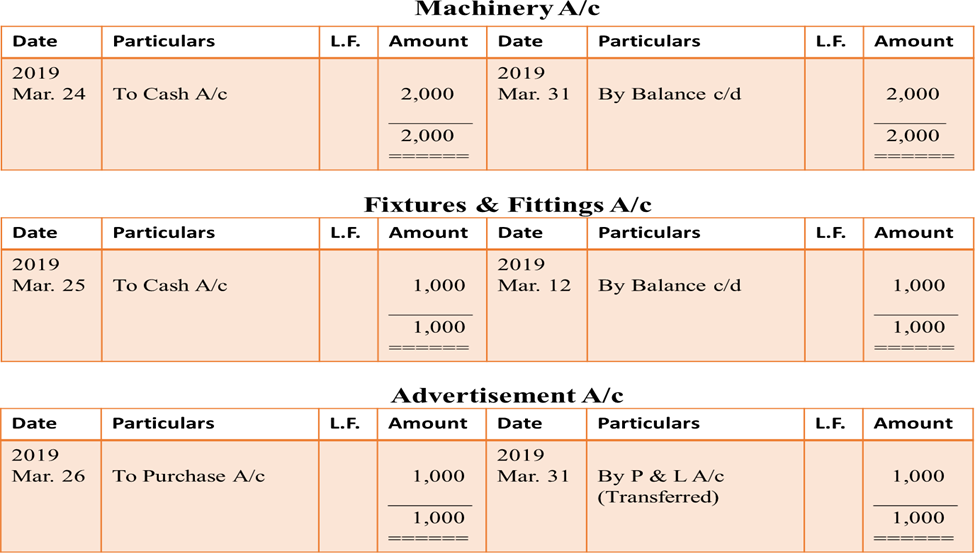

2. Purchase Book

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

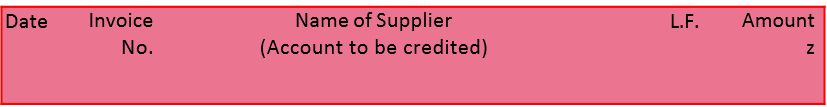

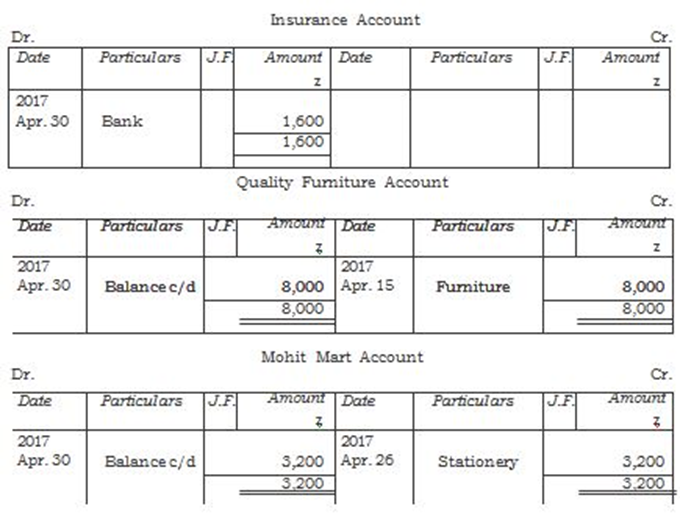

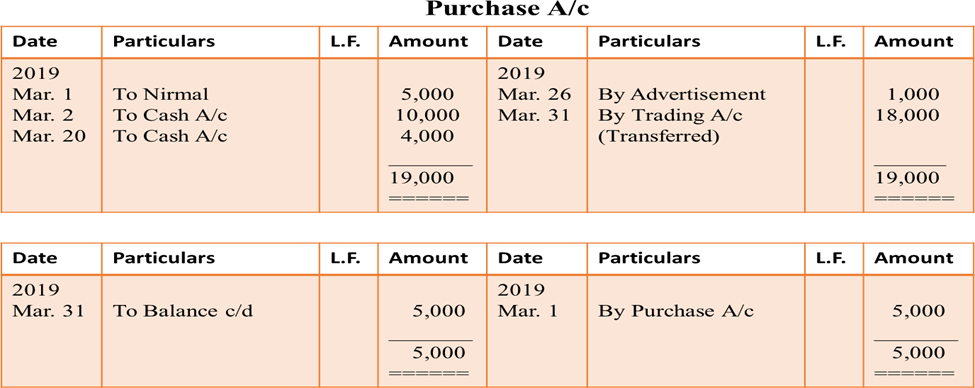

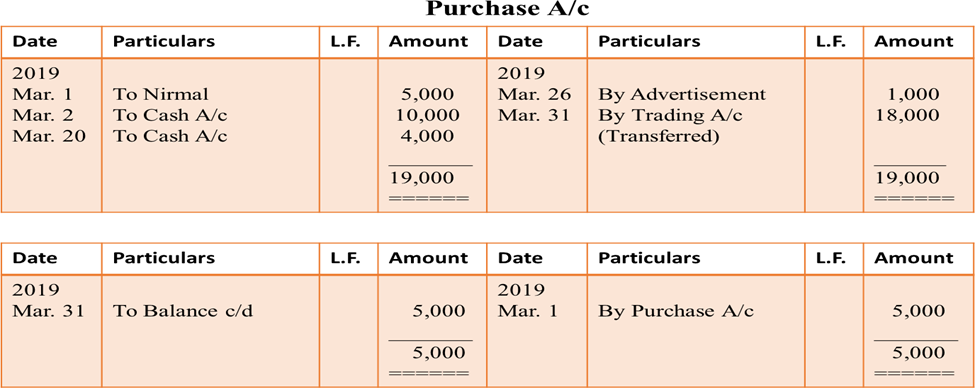

Purchase Book

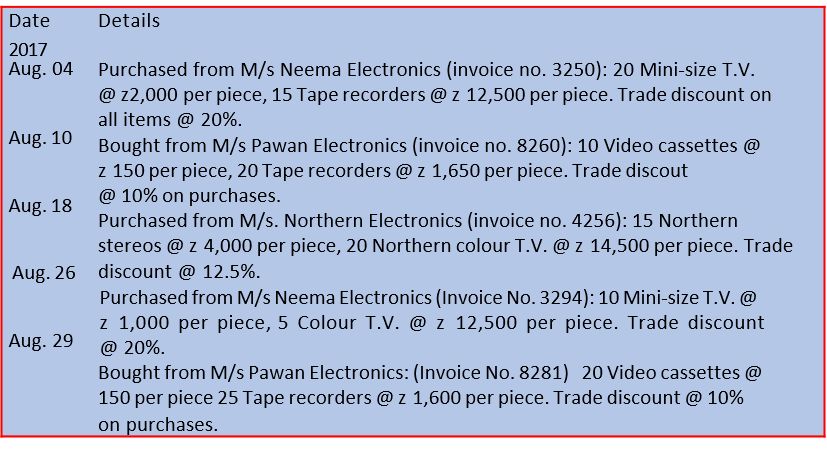

All credit purchases of goods are recorded in the purchases journal whereas cash purchases are recorded in the cash book. Other purchases such as purchases of office equipment, furniture, building, are recoded in the journal proper if purchased on credit or in the cash book if purchased for cash. The source documents for recording entries in the book are invoices or bills received by the firm from the supplies of the goods. Entries are made with the net amount of the invoice. Trade discount and other details of the invoice need not be recorded in this book. The format of the purchases journal is shown in figure 4.6.

Purchases (Journal) Book

The monthly total of the purchases book is posted to the debit of purchases account in the ledger. Individual suppliers accounts may be posted daily. Consider the following details obtained from M/s Kanika Traders and observe how the entries are recorded in the purchase journal.

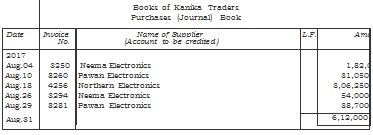

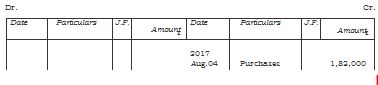

Posting from the purchases journal is done daily to their respective accounts with the relevant amounts on the credit side. The total of the purchases journal is periodically posted to the debit of the purchases account normally on the monthly basis. However, if the number of transactions is very large, this total may be done and posted at some other convenient time interval such as daily, weekly or fortnightly. The posting from the purchases journal to the ledger from is illustrated as follows:

Books of Kanika Electronics Neema Electronics

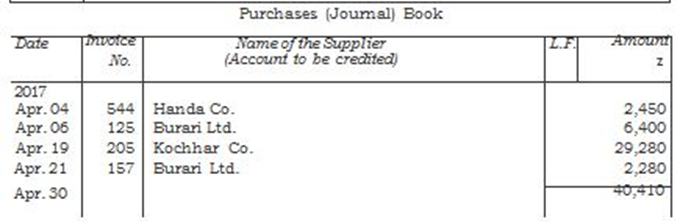

3. Purchase Return Book

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

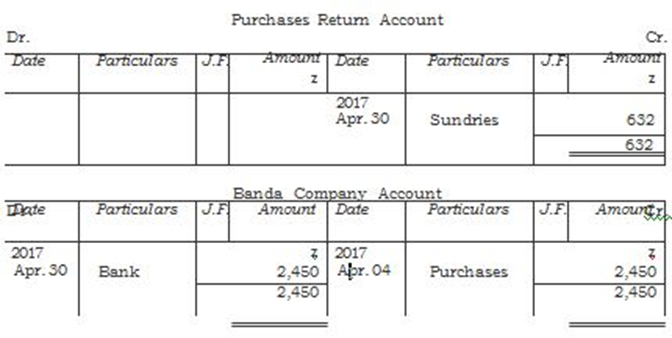

Purchase Return Book

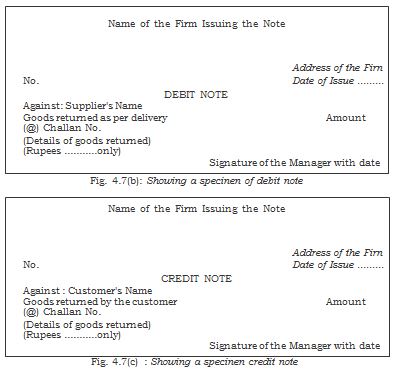

Sometimes goods purchased are returned to the supplier for various reasons such as the goods are not of the required quality, or are defective, etc. For every return, a debit note (in duplicate) is prepared and the original one is sent to the supplier for making necessary entries in his book. The supplier may also prepare a note, which is called the credit note. The source document for recording entries in the purchases return journal is generally a debit note. A debit note will contain the name of the party (to whom the goods have been returned) details of the goods returned and the reason for returning the goods. Each debit note is serially numbered and dated.

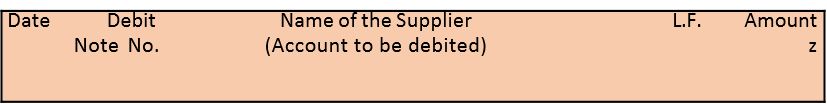

Purchases Return (Journal) Book

Debit and Credit Notes

A Debit note is a document evidencing a debit to be raised against a party for reasons other than sale on credit. On finding that goods supplied are not as per the terms of the order placed, the defective goods are returned to the supplier of the goods and a note is prepared to debit the supplier; or when an additional sum is recoverable from a customer such a note is prepared to debit the customer with the additional dues. In these two situations the note is called a debit.

On the other hand, a Credit note is prepared, when a party is to be given a credit for reasons other than credit purchase. It is a common practice to make it in red ink. When goods are received back from a customer, a credit note should be sent to him.

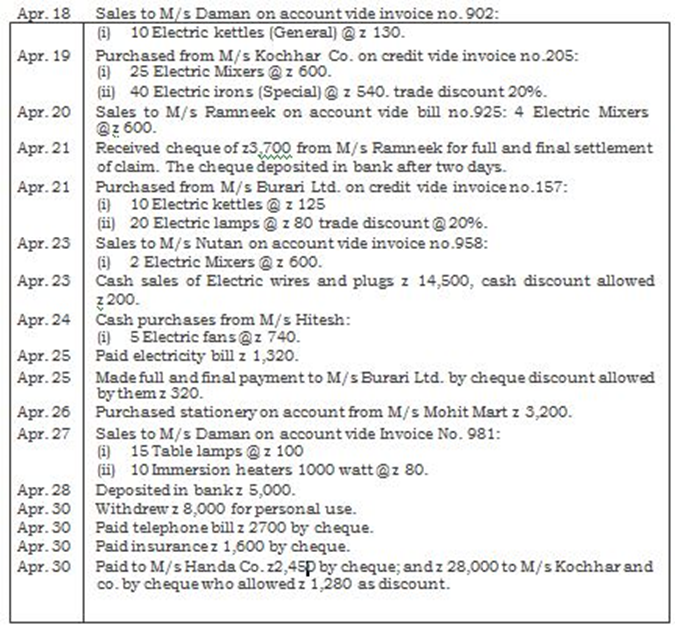

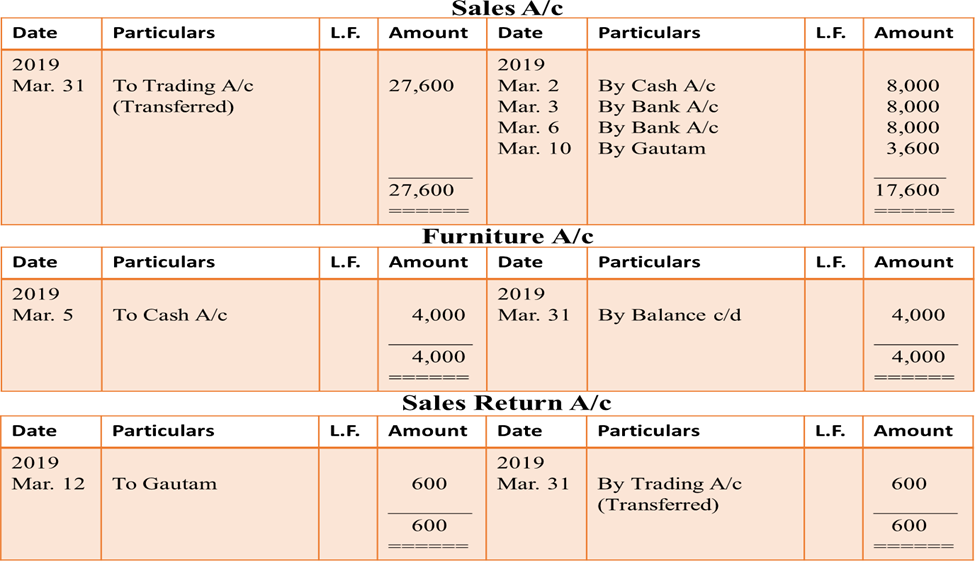

4. Sales Book

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Sales Book

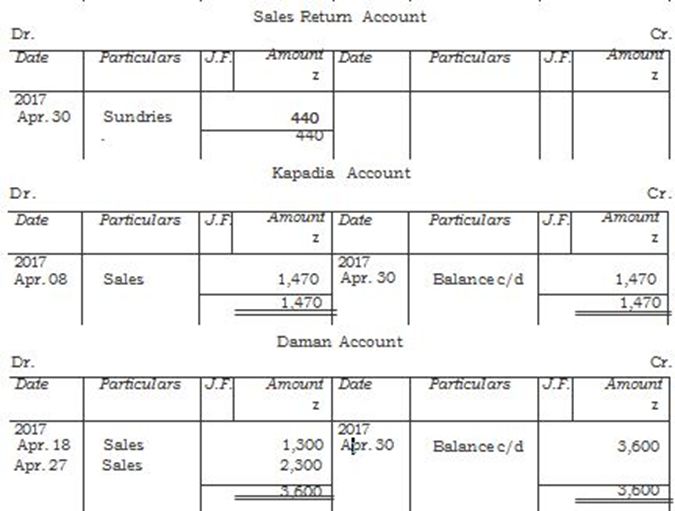

All credit sales of merchandise are recorded in the sales journal. Cash sales are recorded in the cash book. The format of the sales journal is similar to that of the purchases journal explained earlier. The source document for recording entries in the sales journal are sales invoice or bill issued by the firm to the customers. The date of sale, invoice number, name of the customer and amount of the invoice are recorded in the sales journal. Other details about the sales transaction including terms of payment are available in the invoice. In fact, two or more than two copies of a sales invoice are prepared for each sale. The book keeper makes entries in the sales journal from one copy of the sales invoice. In the sales journal, one additional column may be added to record sales tax recovered from the customer and to be paid to the government within the stipulated time. Periodically, at the end of each month the amount column is total led and posted to the credit of sales account in the ledger. Posting to the debit side of individual customer's accounts may be made daily.

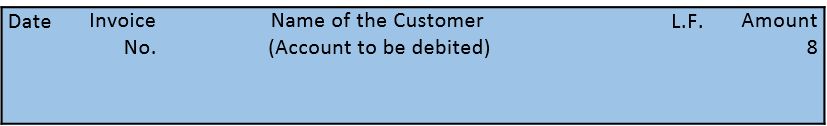

Sales (Journal) Book

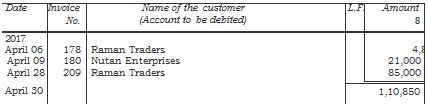

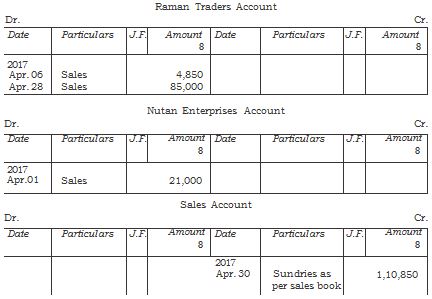

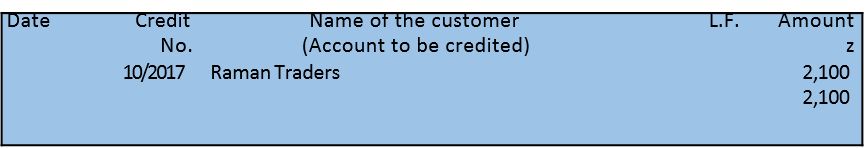

For example M/s Koina Supplies sold on credit:

(i) Two water purifiers @ 8 2,100 each and five buckets @ 8 130 each to M/s Raman Traders (Invoice no. 178 dated April 06, 2017).

(ii) Five road side containers @ 8 4,200 each to M/s Nutan enterprises (Invoice no 180 dated April 09, 2017) .

(iii) 100 big buckets @ 8 850 each to M/s Raman traders (Invoice no. 209, dated April 28, 2017).

The above stated transactions will be entered in a sales journal as follows:

Books of Koina Suppliers

Sales (Journal) Book

Posting from the sales journal are done to the debit of customer's accounts kept in the ledger. Like the purchases journal, individual customer's accounts are generally posted daily, with the amount involved. The sales journal is also totaled periodically (generally monthly), and this total is credited to sales account in the ledger. The sales (journal) book illustrated above will be posted in the related ledger account in the following manner:

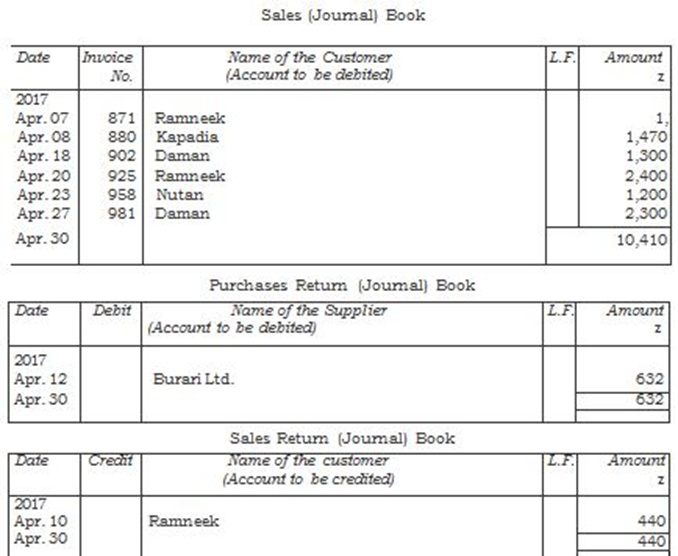

5. Sales Return Book

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Sales Return Book

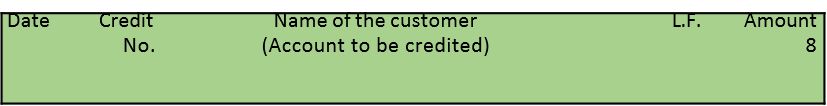

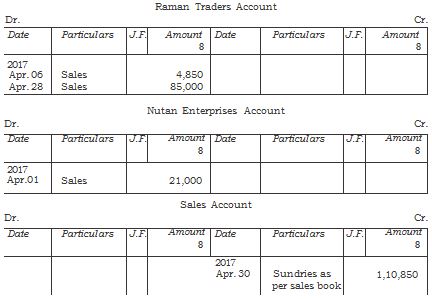

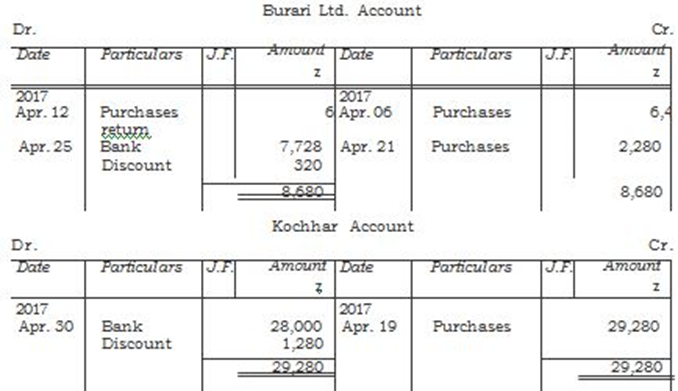

This journal is used to record return of goods by customers to them on credit. On receipt of goods from the customer, a credit note is prepared, like the debit note referred to earlier. The difference between the credit not and the debit note is that the former is prepared by the seller and the latter is prepared by the buyer. Like the debit note, the credit note is also prepared in duplicate and contains detail relating to the name of the customer, details of the merchandise received back and the amount. Each credit note is serially numbered and dated. The source document for recording entries in the sales return book is generally the credit note.

Sales Return (Journal) Book

Refer to the sales (journal) book of Koina Supplier of you will find that two water purifiers were sold to Raman Traders for z 2,100 each, out of which one purifier was returned back due to the manufacturing defect (credit note no.10/2017). In this case, the sales return (Journal) book will be prepared as follows :

Sales Return (Journal) Book

Posting to the sales return journal requires that the customer's account be credited with the amount of returns and the sales return account be debited with the periodical total in the same way as is done in case of posting from the purchases journal.

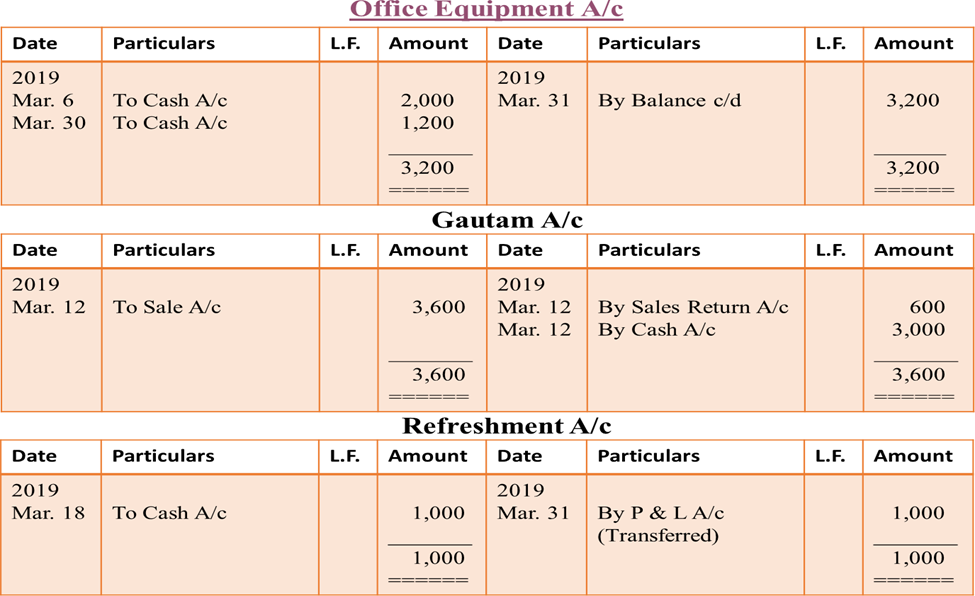

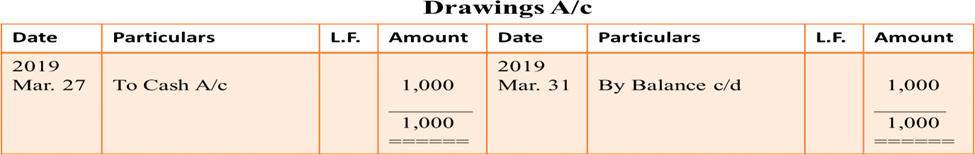

6. Journal Proper and Balancing the Accounts

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

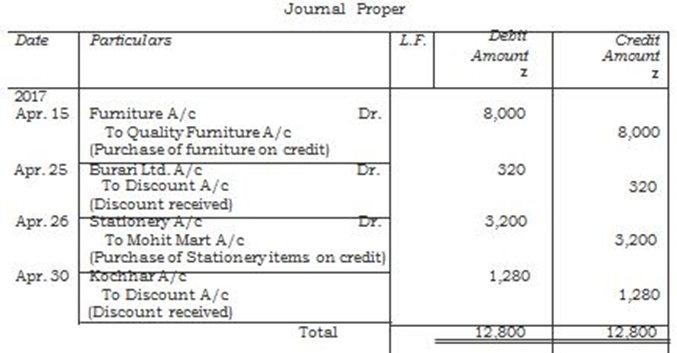

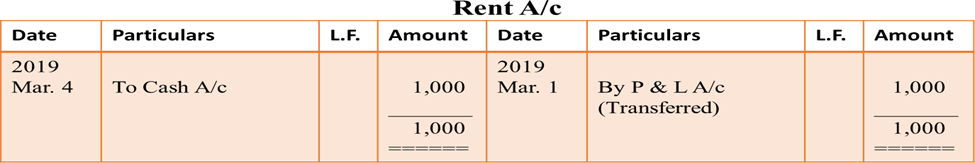

Journal Proper

A book maintained to record transactions, which do not find place in special journals, is known as Journal Proper or Journal Residual.

Following transactions are recorded in this journal:

Opening Entry: In order to open new set of books in the beginning of new accounting year and record therein opening balances of assets, liabilities and capital, the opening entry is made in the journal.

Adjustment Entries: In order to update ledger account on accrual basis, such entries are made at the end of the accounting period. Such as Rent outstanding, Prepaid insurance, Depreciation and Commission received in advance.

Rectification entries: To rectify errors in recording transactions in the books of original entry and their posting to ledger accounts this journal is used.

Transfer entries: Drawing account is transferred to capital account at the end of the accounting year. Expenses accounts and revenue accounts which are not balanced at the time of balancing are opened to record specific transactions. Accounts relating to operation of business such as Sales, Purchases, Opening Stock, Income, Gains and Expenses, etc., and drawing are closed at the end of the year and their Total/balances are transferred to Trading and Profit and Loss account by recording the journal entries. These are also called closing entries.

Other entries: In addition to the above-mentioned entries in the points number 1 to 4, recording of the following transaction is done in the journal proper :

(i) At the time of a dishonour of a cheque the entry for cancellation for discount received or discount allowed earlier.

(ii) Purchase/sale of items on credit other than goods.

(iii) Goods withdrawn by the owner for personal use.

(iv) Goods distributed as samples for sales promotion.

(v) Endorsement and dishonour of bills of exchange.

(vi) Transaction in respect of consignment and joint venture, etc.

(vii) Loss of goods by fire/theft/spoilage

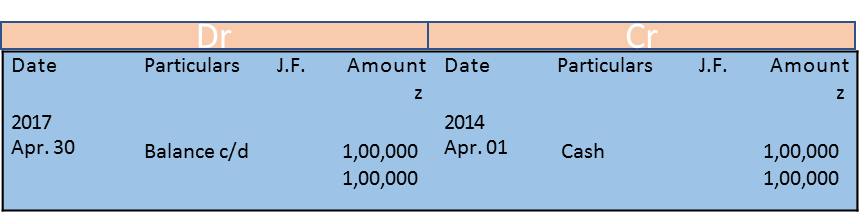

Balancing the Accounts

Accounts in the ledger are periodically balanced, generally at the end of the accounting period, with the object of ascertaining the net position of each amount. Balancing of an account means that the two sides are totaled and the difference between them is shown on the side, which is shorter in order to make their totals equal. The words 'balance c/d' are written against the amount of the difference between the two sides.

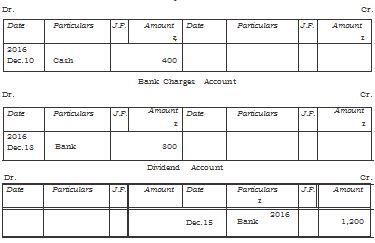

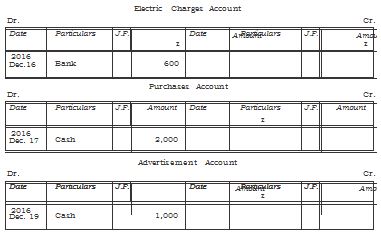

In case the debit side exceeds the credit side, the difference is written on the credit side, if the credit side exceeds the debit side, the difference between the two appears on the debit side and is called debit and credit balance respectively. The accounts of expenses losses and gains/revenues are not balanced but are closed by transferring to trading and profit and loss account. The balancing of an account is shown below with the help of an example explaining the complete process of recording the transactions, posting to ledger and balancing there of.

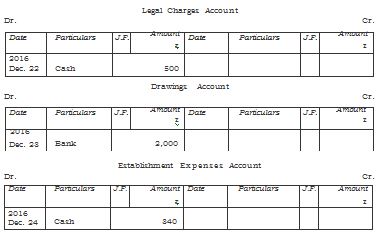

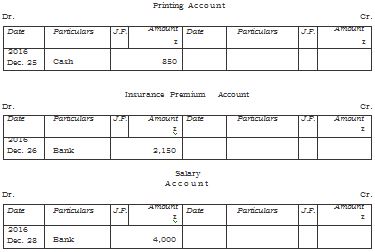

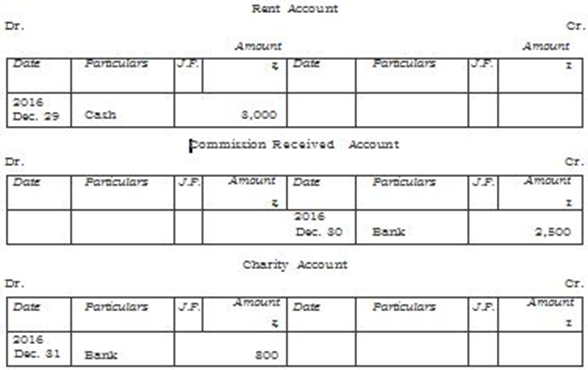

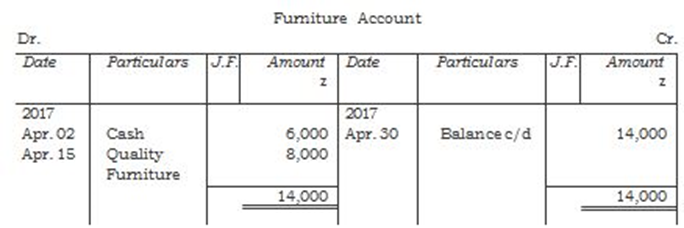

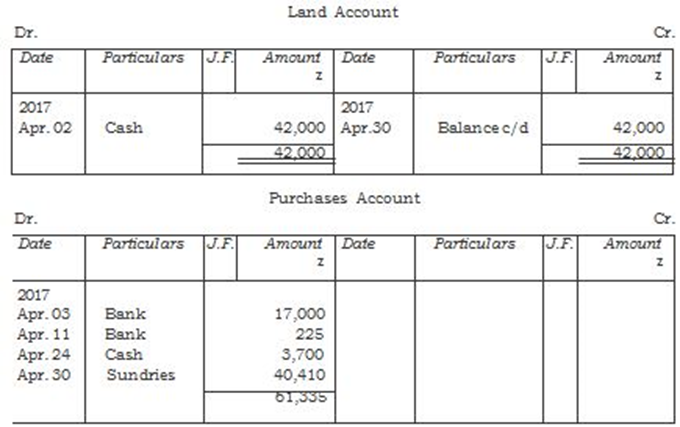

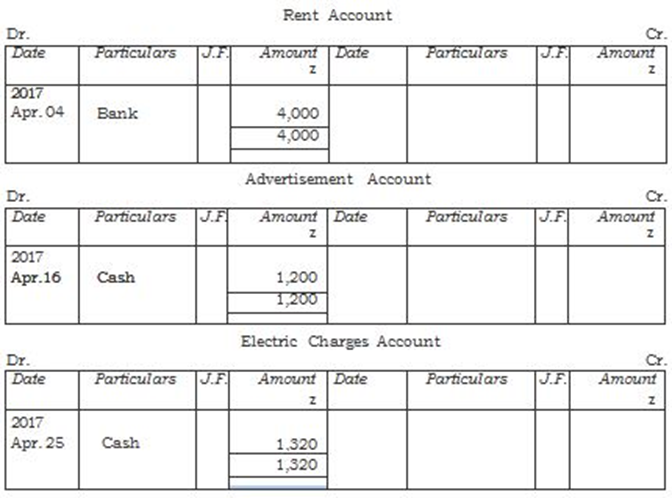

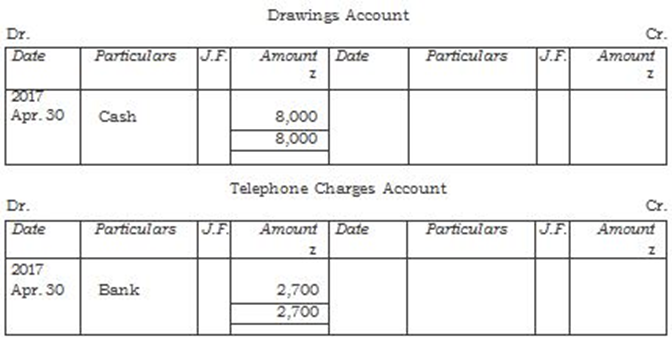

The recorded transactions will be posted in the ledger.

Capital Account

2. Preparation of Reconciliation statement

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Procedure of preparing Bank Reconciliation Statement (BRS)

A Bank Reconciliation Statement is prepared when we get the duly completed Pass Book from the Bank.

- First of all tally the Debit side entries of the cash book with the Credit side entries of the Pass Book and vice versa.

- Tick the items appearing in both the books.

- Unticked items will be the points of differences.

- A BRS is then prepared by taking either the balance as per Cash Book or Pass Book as a starting point.

Important points

- If the Starting point is Cash Book Balance then the ending point will be Pass Book Balance.

- If the starting point is Pass Book Balance then the ending point will be the Balance as per Cash Book.

- Debit Balance as per Cash Book or Credit Balance as per Pass Book, means that the firm has that much amount of deposit at the bank ->also called favourable balance -> write the amount under + items.

- Credit Balance as per Cash Book or Debit Balance as per Pass Book, means that this much amount has seen withdrawn in excess of deposit -> also called overdraft or unfavourable balance -> write the amount under items.

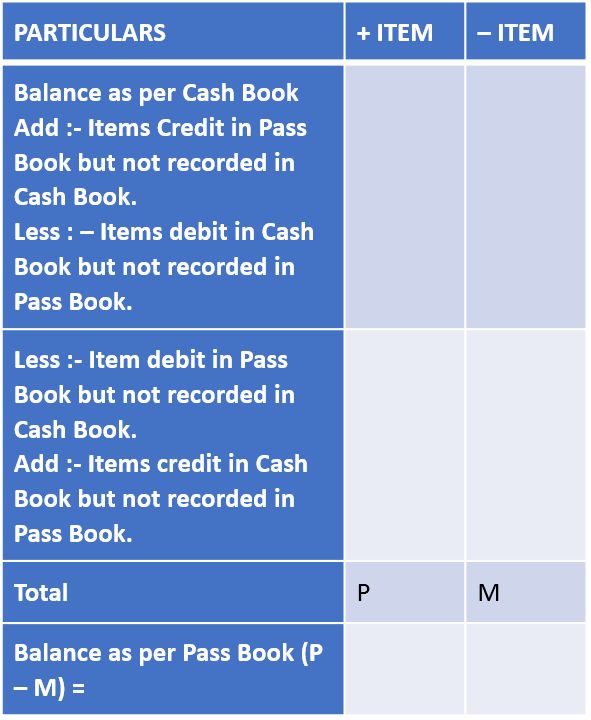

Method of preparing BRS starting with the Balance/overdraft as per Bank Column of Cash Book.

Bank Reconciliation Statement as on ………………………..

Note:

- If total of Plus (+) Items is more than the total of (-) items Difference is Credit Balance or favourable balance as per Pass Book.

- Where as if the – items total is more than the (+) items total then Difference is Debit Balance or overdraft as per Pass Book.

- If BRS is started with Balance as per Cash Book then ending point is Balance as per Pass Book and Vice-Versa.

- Debit balance of Cash Book means favourable balance or (+) Balance

- Debit balance of Pass Book means unfavourable balance or (-) balance.

- Credit balance of Pass Book means favourable balance or (+) balance

- Credit balance of Cash Book means unfavourable balance or (-) Balance.

Ready Reference Items which increase the pass Book Balance or decreases the Cash Book Balance

- Cheques issued but not yet presented.

- Credits made by the bank for Interest.

- Amount directly deposited by the customers in our bank A/c.

- Interest and dividend collected by the bank.

- Cheques paid into the bank but omitted to be recorded in the Cash – Book.

Items which decreases the pass Book Balance or increase the Cash Book Balance

- Cheques sent to the bank for collection but not yet credited by the – bank.

- Cheques paid into the bank but dishonoured.

- Direct payments made by the bank.

- Bank charges, commission etc. debited by the bank.

- Cheques issued but omitted to be recorded in the Cash Book.

READY REFERENCE

Items which increases the Cash Book Balance or decreases the Pass Book Balance

- Cheques deposited into the bank but dishonoured.

- Cheque sent for collection but not yet collected.

- Direct Payments made by the bank.

- Bank charges, commission etc.debited by the bank.

- Cheques issued but omitted to be recorded in the Cash Book.

Items which decreases the Cash Book Balance or increase the Pass Book Balance

- Cheques issued but not yet presented.

- Credits made by the bank for interest.

- Amount directly deposited by the customers into the Bank.

- Interest and dividend collected by the Bank.

- Cheques paid into the bank but omitted to be recorded in the Cash Book.

Amended Cash Book Method

Introduction: So far we have studied the preparation of Bank Reconciliation Statement simply by reconciling the causes of differences between the Cash Book and Pass Book. In actual practice adjustments are done in the Cash Book by comparing the Bank column of Cash Book with the Bank Statement and after that, B.R. Statement is prepared. It is called Amended Cash Book Method.

Procedure

- Adjusted Cash book prepared starting with the Balance of the Cash Book given in the question.

- All errors that have been committed in the Cash Book will have to be rectified by passing adjusting entries in the Cash Book.

Usual of General Errors are

- Overcasting or Undercasting of Debit/Credit Column of Cash – Book.

- Cheques deposited or Issued but omitted to be entered in the Cash Book.

- Incorrect amount (if any) entered in the Cash Book.

- Entries on the correct side or in the wrong column of Cash Book.

- Any amount recorded twice in the Cash Book.

Certain amounts for which Bank has debited our A/c will be recorded on the Credit side of Cash Book. Such items are

- Interest charged by the bank on overdraft, etc.

- Debits made by the bank for the bank charges, commission etc.

- Direct payments made by the Bank on behalf of the A/c holder.

- Cheques sent for collection but dishonoured.

Cash Book is then balanced: and the new Balance of the Cash book is taken as the starting point for preparing the B.R. Statement.

Important: It should be noted that the following items must not be recorded in the Amended Cash Book.

- Cheques deposited into the Bank but not yet credited by the Bank.

- Cheques Issued but yet not presented for payment.

- Any wrong Entry in Pass Book.

Points to Remember

- Amended or adjusted Cash Book is started with the given balance of bank as per Cash Book.

- Closing Balance of the adjusted Cash Book is the opening balance of bank Reconciliations statement.

2. Objective and Preparation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Preparation of Trial Balance

Following guidelines should be followed while preparing trial balance –

The following balances are placed on the credit column of the trial balance:

- Liabilities Income Accounts

- Capital Account

- Profits

Methods of Preparation of Trial Balance

A business organization can prepare a trial balance at any time. It can be prepared monthly, quarterly, half- yearly. It is prepared on a particular date and not for a particular period. There are three methods for preparation of trial balance.

Methods of preparation trial balance –

Balance method

Total method

Balance cum total method

Total method:-

Under this method, all the accounts having debit balances in the ledger are shown on the debit side or in debit column of trial balance and all the accounts having credit balances are shown on the credit side or in credit column of the trial balance. When an account shows no balance, i.e., the debit and credit side of an account are equal, is not shown in the trial balance.

As per latest CBSE syllabus, only Balance Method of preparing Trial Balance is prescribed.

Balances Method

This is the most widely used method in practice. Under this method trial balance is prepared by showing the balances of all ledger accounts and then totalling up the debit and credit columns of the trial balance to assure their correctness. The account balances are used because the balance summarises the net effect of all transactions relating to an account and helps in preparing the financial statements. It may be noted that in trial balance, normally in place of balances in individual accounts of the debtors, a figure of sundry debtors is shown, and in place of individual accounts of creditors, a figure of sundry creditors is shown.

Totals-cum-balances Method

In this method, we combine both totals method and balances method. Under this method four columns for amount are prepared. Two columns for writing the debit and credit totals of various accounts and two columns for writing the debit and credit balances of these accounts. However, this method is also not used in practice because it is time consuming and hardly serves any additional or special purpose.

Example :-

Suspense Account

Sometimes in spite of best efforts of an accountant, all the errors are not located and Trial balance does not tally. In such a situation, to avoid the delay in the preparation of final accounts, the difference is placed to a newly opened account known as ‘Suspense Account’. If the debit side of the Trial Balance exceeds the credit side, the difference will be put on the credit side of Suspense Account and if credit side of the Trial balance exceeds the debit side, Suspense Account will be debited. After including the balance of suspense account in the Trial Balance, it will appear to be tallied. Later on, when the errors are located, they will be rectified and Suspense Account will be automatically closed.

3. Significance of Agreement of Trial Balance

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Significance of Agreement of Trial Balance

trial balance means that both the debit and the credit entries have been made correctly for each transaction. However, as stated earlier, the agreement of trial balance is not an absolute proof of accuracy of accounting records. A tallied trial balance only proves, to a certain extent, that the posting to the ledger is arithmetically correct. But it does not guarantee that the entry itself is correct. There can be errors, which affect the equality of debits and credits, and there can be errors, which do not affect the equality of debits and credits. Some common errors include the following:

- Error in totalling of the debit and credit balances in the trial balance.

- Error in totalling of subsidiary books.

- Error in posting of the total of subsidiary books.

- Error in showing account balances in wrong column of the tiral balance, or in the wrong amount.

- Omission in showing an account balance in the trial balance.

- Error in the calculation of a ledger account balance.

- Error while posting a journal entry: a journal entry may not have been posted properly to the ledger, i.e., posting made either with wrong amount or on the wrong side of the account or in the wrong account.

- Error in recording a transaction in the journal: making a reverse entry, i.e., account to be debited is credited and amount to be credited is debited, or an entry with wrong amount.

- Error in recording a transaction in subsidiary book with wrong name or wrong amount.

2. Methods of calculating Depreciation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Methods of calculating Depreciation

The depreciation depends on depreciable amount and the method of allocation. For this, two methods are mandated by law and enforced by professional accounting practice in India. These methods are straight line method and written down value method. There are other methods such as - annuity method, depreciation fund method, insurance policy method, sum of years digit method, double declining method, etc. which may be used for determining the amount of depreciation.

The selection of an appropriate method depends upon the following:

- Type of the asset;

- Nature of the use of such asset;

- Circumstances prevailing in the business;

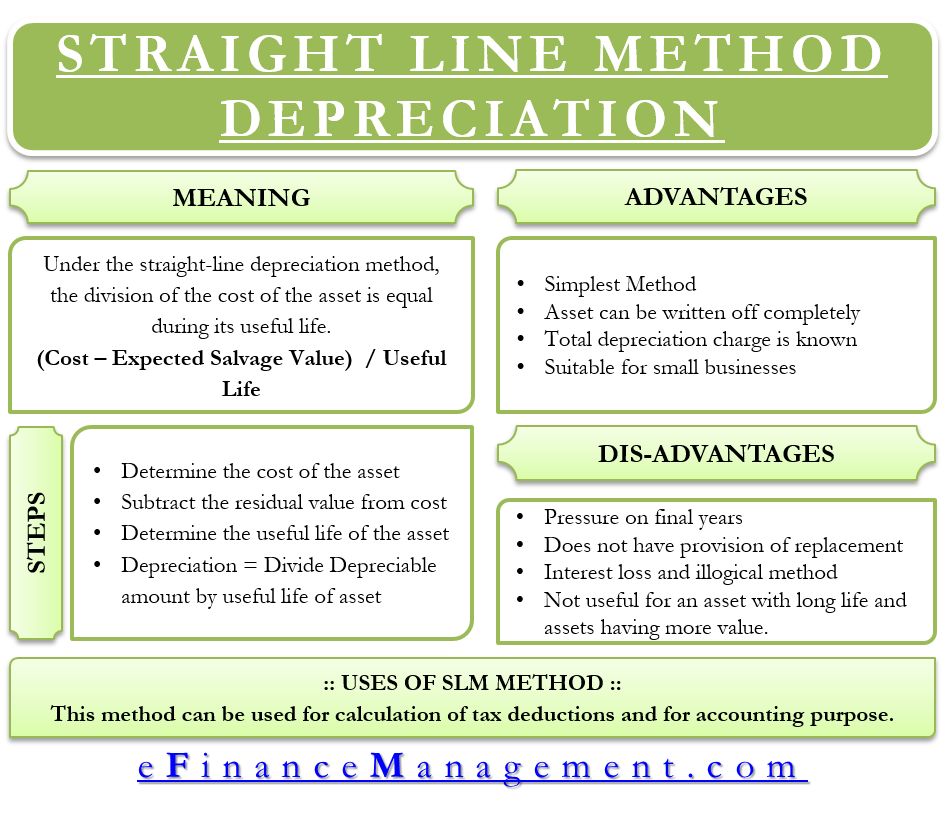

Straight Line Method

It is the widely used methods of providing depreciation. It is based on the assumption of equal usage of the asset over its entire useful life. It is called straight line for a reason that if the amount of depreciation and corresponding time period is plotted on a graph, it will result in a straight line. It is also called fixed installment method because the amount of depreciation remains constant from year to year over the useful life of the asset.

According to this method, a fixed and an equal amount is charged as depreciation in every accounting period during the lifetime of an asset. The amount annually charged as depreciation is such that it reduces the original cost of the asset to its scrap value, at the end of its useful life. This method is also known as fixed percentage on original cost method because same percentage of the original cost is written off as depreciation from year to year.

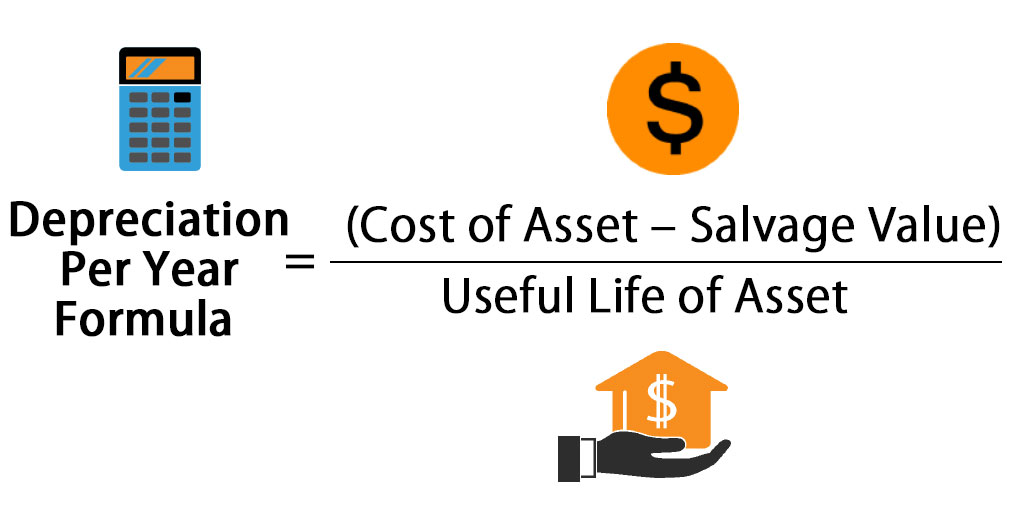

The depreciation amount is computed as -

Depreciation = ![]()

The rate of depreciation under straight line method is the percentage of the total cost of the asset to be charged as deprecation during the useful lifetime of the asset. Rate of depreciation is calculated as follows:

Rate of Depreciation =  * 100

* 100

Straight Line method has certain advantages which are –

- It is very simple, easy to understand and apply. Simplicity makes it a popular method in practice;

- Asset can be depreciated up to the net scrap value or zero value. Therefore, this method makes it possible to distribute full depreciable cost over useful life of the asset;

- Every year, same amount is charged as depreciation in profit and loss account.

- This makes comparison of profits for different years easy;

- This method is suitable for those assets whose useful life can be estimated accurately and where the use of the asset is consistent from year to year such as leasehold buildings.

There are certain limitations of straight line method which are-

- It is based on the faulty assumption of same amount of the utility of an asset in different accounting years;

- With the passage of time, work efficiency of the asset decreases and repair and maintenance expense increases. Hence, under this method, the total amount charged against profit on account of depreciation and repair taken together, will not be uniform throughout the life of the asset, rather it will keep on increasing from year to year.

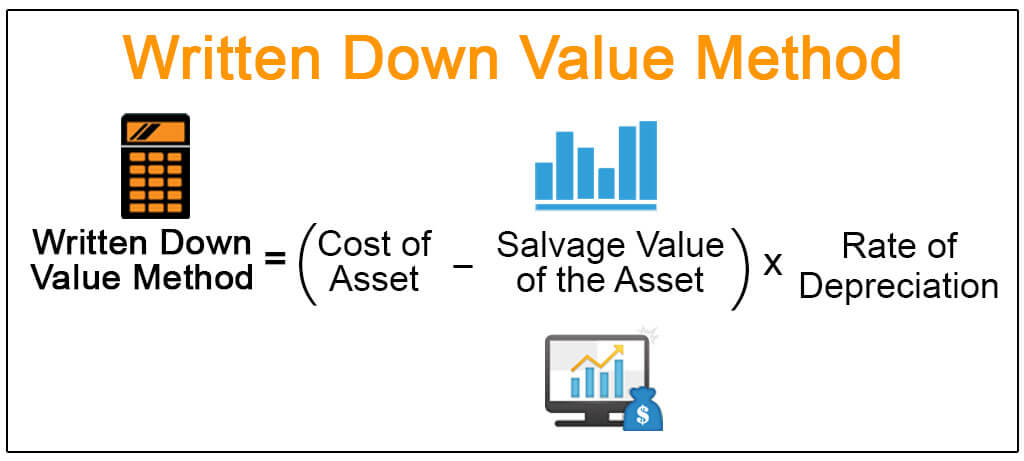

Written Down Value Method

The depreciation is charged on the book value of the asset in this method. It is also known as 'reducing balance method' because the book value keeps on reducing by the annual charge of depreciation. This method involves the application of a pre-determined proportion/percentage of the book value of the asset at the beginning of every accounting period, so as to calculate the amount of depreciation. The amount of depreciation reduces year after year.

Advantages of Written down Value Method are-

- It is based on a more realistic assumption that the benefits from asset go on diminishing (reducing) with the passage of time. Hence, it calls for proper allocation of cost because higher depreciation is charged in earlier years when asset's utility is higher as compared to later years when it becomes less effective.

- Results almost equal burden of depreciation and repair expenses taken together every year on profit and loss account.

- Income Tax Act accepts this method for tax purposes.

- As a large portion of cost is written-off in earlier years, loss due to obsolescence gets reduced.

- It is suitable for fixed assets which last for long and which require increased repair and maintenance expenses with passage of time. It can also be used where obsolescence rate is high.

Although this method is based upon a more realistic assumption it suffers from the following limitations.

- As depreciation is calculated at fixed percentage of written down value, depreciable cost of the asset cannot be fully written-off. The value of the asset can never be zero;

- It is difficult to ascertain a suitable rate of depreciation.

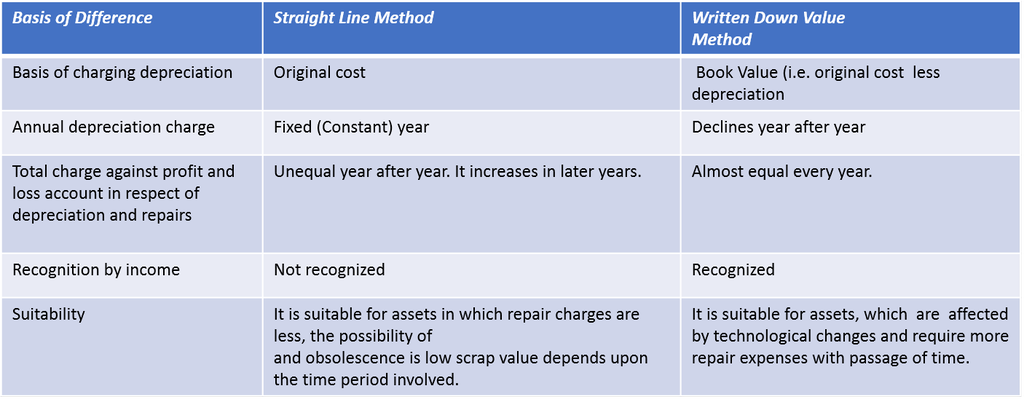

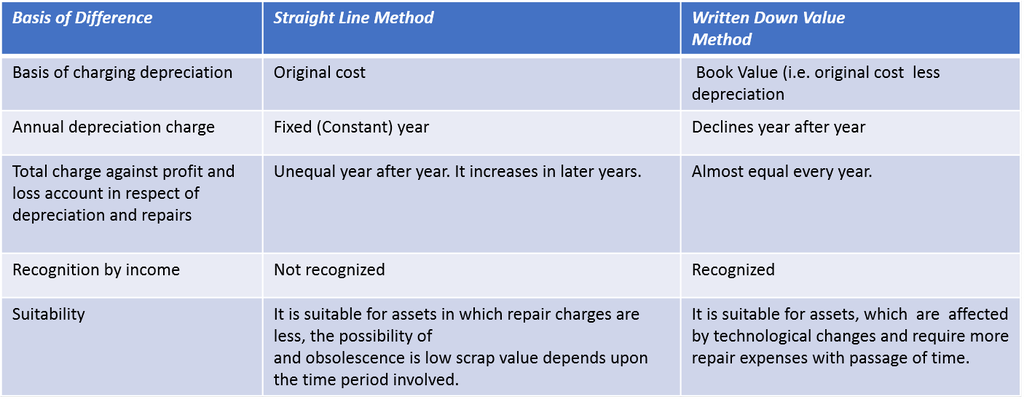

Difference between Straight Line method and Written down Value Method

3. Methods of recording Depreciation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Methods of recording Depreciation

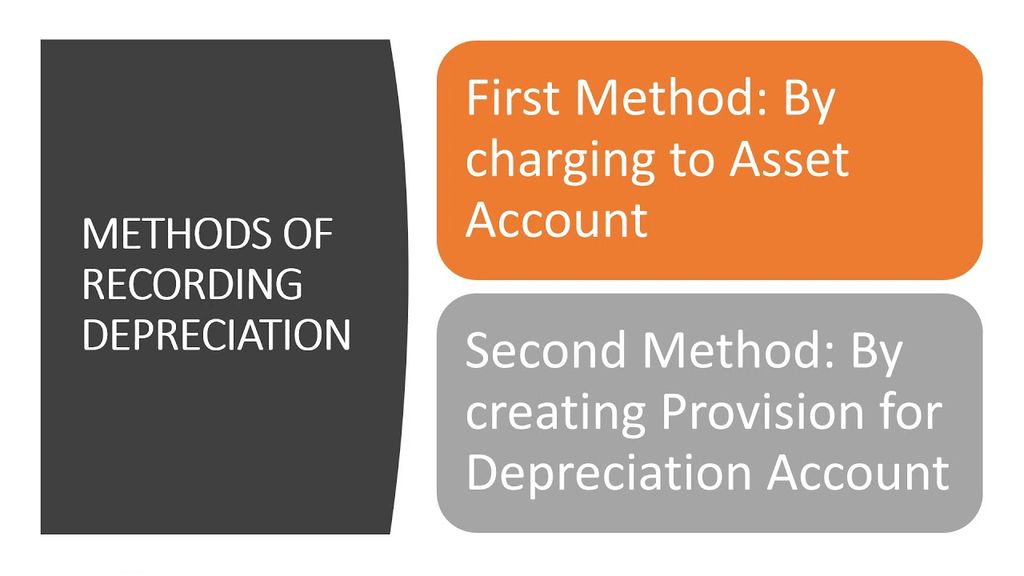

There are two types of recording depreciation on fixed assets:

Charging Depreciation to Asset account

In this method, depreciation is deducted from the depreciable cost of the asset (credited to the asset account) and charged (or debited) to profit and loss account.

Journal entries under this recording method are as follows:

For recording purchase of asset

(only in the year of purchase) Asset A/c Dr. (with the cost of asset including installation, freight, etc.)

To Bank/Vendor A/c

Following two entries are recorded at the end of every year-

(a) For deducting depreciation amount from the cost of the asset.

Depreciation A/c Dr. (with the amount of depreciation)

To Asset A/c

(b) For charging depreciation to profit and loss account.

Profit & Loss A/c Dr. (with the amount of depreciation)

To Depreciation A/c

Balance Sheet Treatment:

In this method, the fixed asset appears at its net book value (i.e. cost less depreciation charged till date) on the asset side of the balance sheet and not at its original cost (also known as historical cost).

Creating Provision for Depreciation Account/Accumulated Depreciation Account

It is use to accumulate the depreciation provided on an asset in a separate account generally called 'Provision for Depreciation' or 'Accumulated Depreciation' account. By such accumulation of depreciation the asset account need not be disturbed in any way and it continues to be shown at its original cost over the successive years of its useful life.

There are some basic characteristic of this method of recording depreciation. These are given below:

- Asset account continues to appear at its original cost year after year over its entire life;

- Depreciation is accumulated on a separate account instead of being adjusted in the asset account at the end of each accounting period.

For recording purchase of asset.

(only in the year of purchase) Asset A/c Dr. (with the cost of asset including installation, expenses etc.)

To Bank/Vendor A/c (cash/credit purchase)

Following two journal entries are recorded at the end of each year:

(a) For crediting depreciation amount to provision for depreciation account.

Depreciation A/c Dr. (with the amount of depreciation)

To Provision for depreciation A/c

(b) For charging depreciation to profit and loss account.

Profit & Loss A/c Dr. (with the amount of depreciation)

To Depreciation A/c

Balance sheet treatment

In the balance sheet, the fixed asset continues to appear at its original cost on the asset side. The depreciation charged till that date appears in the provision for depreciation account, which is shown either on the "liabilities side" of the balance sheet or by way of deduction from the original cost of the asset concerned on the asset side of the balance sheet.

Disposal of Asset

Disposal of asset can take place either at the end of its useful life or during its useful life (due to obsolescence or any other abnormal factor).

If it is sold at the end of its useful life, the amount realised on account of the sale of asset as scrap should be credited to the asset account and the balance is transferred to profit and loss account.

Use of Asset Disposal Account

Asset disposal account is designed to provide a complete and clear view of all the transactions involved in the sale of an asset under one account head. The concerned variables are the original cost of the asset, depreciation accumulated on the asset up to date, sale price of the asset, value of the parts of the asset retained for use, if any and the resultant profit or loss on disposal. The balance of this amount is transferred to the profit and loss account. This method is generally used when a part of the asset is sold and provision for depreciation account exists.

In this method, a new account titled Asset Disposal Account is opened. The original cost of the asset being sold is debited to the asset disposal account and accumulated depreciation amount appearing in provision for depreciation account relating to that asset till the date of disposal is credited to the asset disposal account. The net amount realized from the sale of the asset is also credited to this account. The balance of asset disposal account shows profit or loss which is transferred to profit and loss account. The advantage of this method is that it gives a full picture of all the transactions related to asset disposal at one place.

The journal entries required for the preparation of asset disposal account is as follows:

1. Asset Disposal A/c Dr. (with the original cost of asset, To Asset A/c being sold)

2. Provision for Depreciation A/c Dr. (with the accumulated balance in

To Asset Disposal A/c provision for depreciation account)

3. Bank A/c Dr. (with the net sales proceeds) To Asset Disposal A/c

Asset Disposal Account may ultimately show a debit or credit balance. The debit balance on the account indicates loss on disposal and would be dealt with as follows:

Profit and Loss A/c Dr. (with the amount of loss on sale) To Asset Disposal

A/c

The credit balance of the account, profit on disposal and would be closed by the following journal entry:

Asset Disposal A/c Dr. (with the amount of profit on sale) To Profit and Loss A/c

2. Promissory Note

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

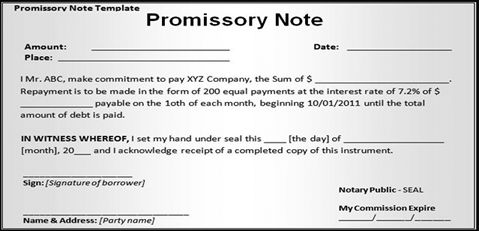

Promissory Note

When a person gives a promise in writing to pay a certain sum of money unconditionally to a certain person or according to his order the document is called is a promissory note. A promissory note does not require any acceptance because the maker of the promissory note himself promises to make the payment.

Following features of a promissory note emerge out of the above definition:

- It must be in writing

- It must contain an unconditional promise to pay.

- The sum payable must be certain.

- It must be signed by the maker.

- The maker must sign it.

- It must be payable to a certain person.

- It should be properly stamped.

Parties to a Promissory Note

There are two parties to a promissory note.

- Maker or Drawer is the person who makes or draws the promissory note to pay a certain amount as specified in the promissory note. He is also called the promisor.

- Drawee or Payee is the person in whose favour the promissory note is drawn. He is called the promise.

Generally, the drawee is also the payee, unless, it is otherwise mentioned in the promissory note.

Distinction between a Bill of Exchange and Promissory Note

4. Searching of Errors and Rectification of Errors

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Rectification of Errors

Meaning:- Trial Balance is prepared to check the arithmetical accuracy of the books of account. The two sides of the Trial Balance must be equal, i.e., the total of the debit side must be equal to total of credit side.

Disagreement of a Trial Balance means that there are errors in books of account. Some of the errors affect the agreement of the Trial Balance and are disclosed by the Trial Balance. In the same way some of the errors does not affect the agreement of Trial Balance.

Types of Errors

- Error of omission

- Error of commission

- Error of principles

- Compensating errors

Errors of Omission:-

Errors which arise due to non-recording of business transactions wholly or partially are called errors of omission. These errors usually occur when a transaction needs to be posted to the books of original entry, i.e., the journal or with regard to omission to post a transaction into the ledger.

Error of Omissions is generally of two types:-

- Error of Complete omission

- Error of Partial Omission

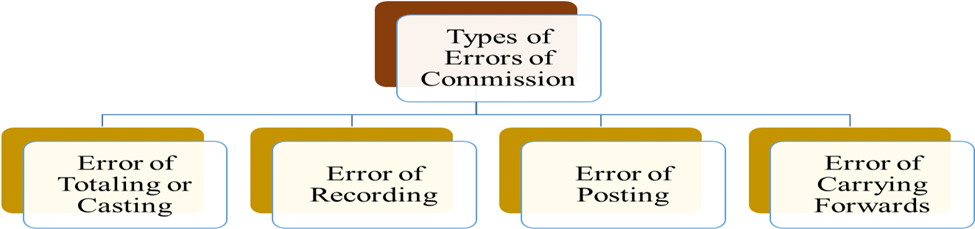

Errors of Commission:-

When an entry is incorrectly recorded either wholly or partially for reasons like posting of incorrect amount, posting to incorrect account, wrong calculation, wrong totalling, wrong casting or balancing and similar others, the error are called as errors of commission. For example, if an amount of Rs.2,500 was paid to Suresh and the cash account was correctly credited but the personal account of Suresh was debited with an amount of Rs.250.

Errors of Principle:-

These type of errors come into existence due to non-obedience of principles of accounting. They have no effect on Trial Balance because they do not occur due to faulty recording as discussed above, but due to lack of understanding of fundamental accounting principles.

For examples:-

- When purchase of an asset (machinery, building, etc.) is debited to Purchases Account and not to Asset Account.

- When expenses incurred on purchase or installation of assets are debited to expenses account and not to that particular Asset Account.

Compensating Errors:-

Errors which counter balance each other, i.e., cancel the effect of each other are called compensating errors. Such errors do not affect Trial Balance, e.g., Rs.2,000 paid to Sonika is recorded as Rs.20,000 and Rs.20,000 paid to Monika is recorded as Rs.2,000. These type of errors does not affect the trial balance.

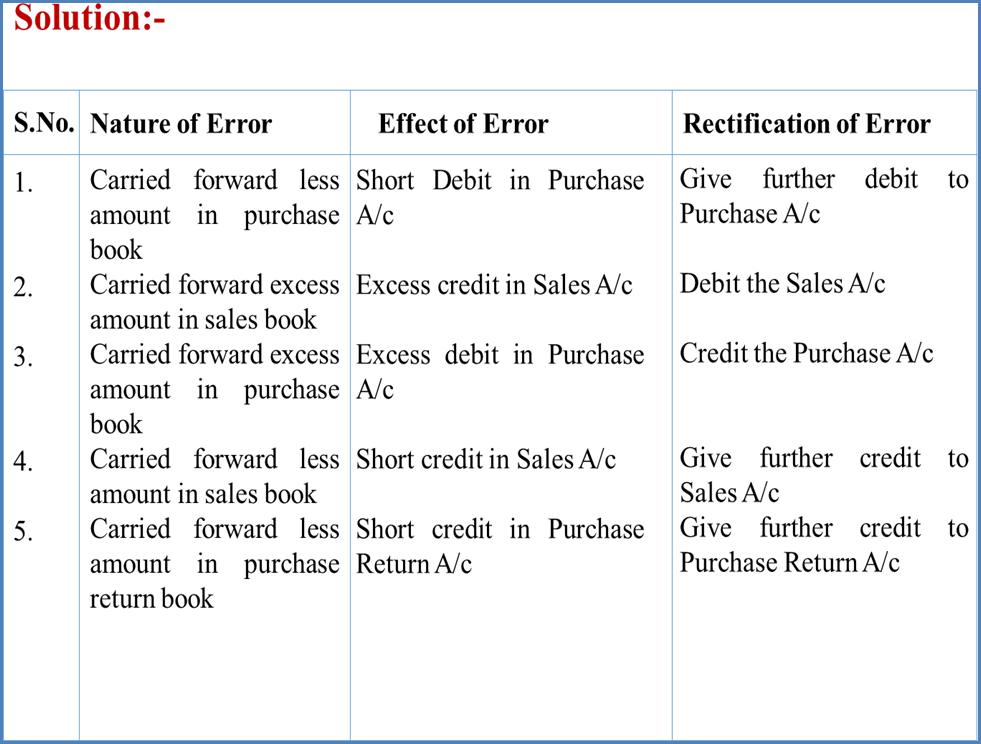

Searching of Errors on the basis of affects of Trial Balance

Errors affecting Trial Balance or One Sided Errors

One sided errors affect the Trial Balance as they affect only one account. Examples of one- sided errors are:

- Error of casting, i.e., when a subsidiary book is under cast or overcast.

- Error of carrying forward.

- Wrong totaling or wrong balancing of a ledger account.

- Error of posting to the correct account but with wrong amount.

- Error of posting to the correct account but on the wrong side.

- Error of posting to the wrong side with the wrong amount.

- Error of partial omission.

- Error of omission by posting the total of subsidiary book into the respective ledger.

- Error of omission to show an account in the trial balance.

Errors not affecting Trial Balance or Two Sided Errors

Two-sided errors do not affect the trial balance Examples of two-sided errors are:

- Errors of complete omission from posting to the account.

- Errors of posting to the wrong account but on the correct side.

- Wrong recording in the books of original entry (Subsidiary books).

- Errors of principles.

- Compensating Errors.

Effect of Errors on Final Accounts

Nominal Accounts, affect the profits and Personal and Real Accounts affect the Balance Sheet. For example, Stock Account, Purchases Account, Wages Account, Salaries Account, Commission Account, Bad Debts Account, etc., affect the Net profit because they are shown either in Trading Account or Profit and Loss Account. If any of these accounts is debited in the rectification entry, it reduces the Profit and if any of these accounts is credited then it increases the Profit.

Balances of Personal and Real Accounts form part of a Balance Sheet, so errors in such types of accounts will affect Balance Sheet only, not Profit and Loss Account.

Stages of Rectification of Errors

Rectification before the Preparation of Trial Balance: In this stage, errors are located before transferring the difference in the trial balance to Suspense Account. Rectification entries are passed concerning specific accounts.

Rectification after the Preparation of Trial Balance: In this stage, the difference in the trial balance gets transferred to Suspense Account. So, wherever applicable, suspense account is used while passing rectification entries.

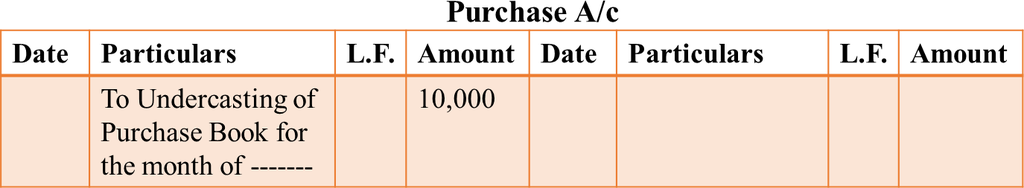

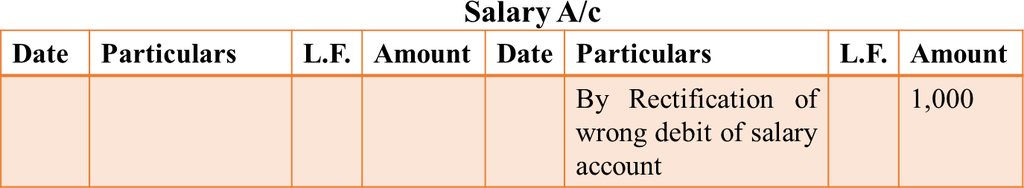

Rectification of One Sided Errors before Preparation of Trial Balance

Rectify the following transactions which were detected before preparation of Trial balance:-

- The total of purchase book has been undercast by Rs.10,000.

- Payment of salary of Rs.1,000, posted twice in salary account.

- Depreciation of Rs.2,000 on furniture written off, not recorded in depreciation account.

Solution:-

Total of purchase book undercast, it means the Purchase Account is debited short by Rs.10,000. So, we have to debit Purchase Account by Rs.10,000 to rectify the error.

Salary account is debited Rs.1,000 more, so, to rectify this error we have to credit salary account by Rs.1,000.

Depreciation on furniture Rs.2,000 not recorded in depreciation account, to rectify this error we have to record this in depreciation account on debit side.

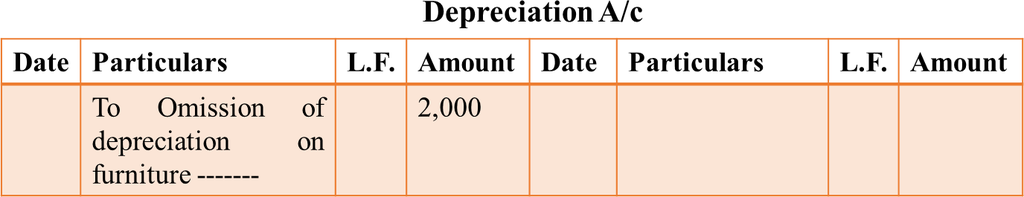

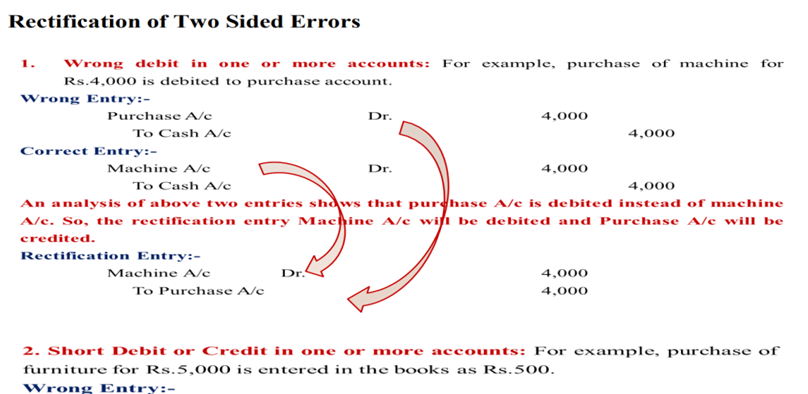

Rectification of Two Sided Errors before Preparation of Trial Balance

As these errors affect two accounts simultaneously, they are hence called two-sided errors. They have no effect on Trial Balance. These are mainly errors of recording, errors of principle, error of posting to wrong account and error of complete omission. Rectification of these errors is done with the help of journal entries.

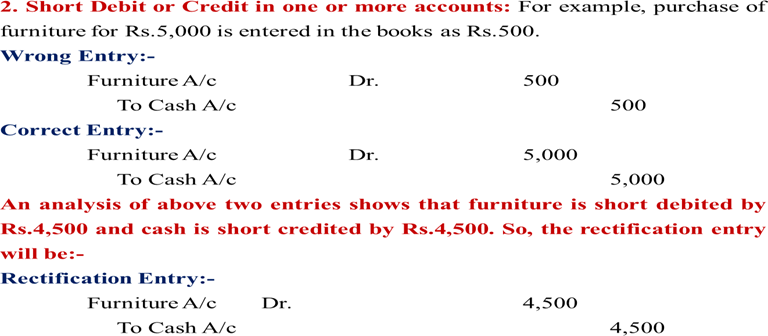

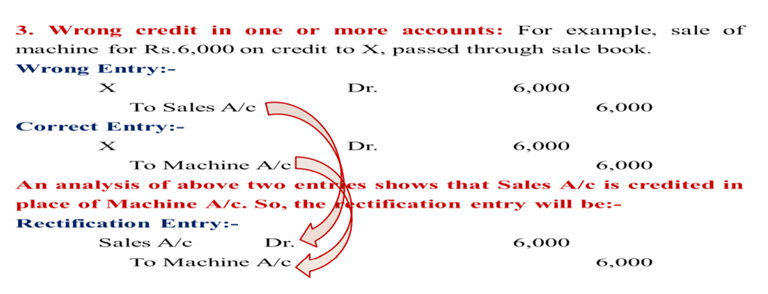

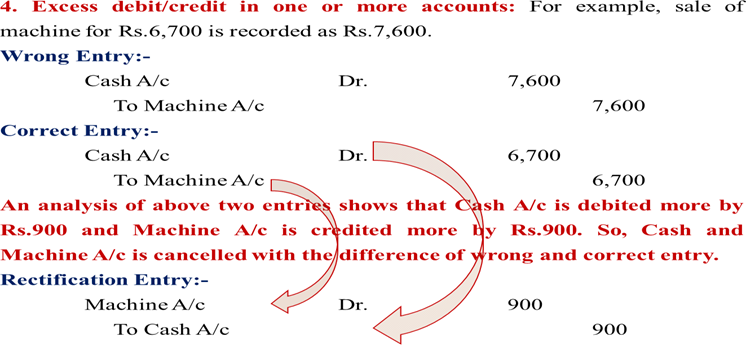

In this process of rectification, for the sake of understanding, three journal entries are passed –

the correct entry, wrong entry, and the rectifying entry.

- The correct entry denotes the journal entry which should have been recorded.

- The wrong entry signifies the incorrect entry that has actually been passed in the books.

- The rectifying entry represents the journal entry passed to rectify the error.

Rectification of Two Sided Errors

Rectification of Errors after Preparation of Trial Balance but before Preparation of Final Accounts

Sometimes error could not be found before the preparation of trial balance. Thus, in such situation the amount of difference in the Trial Balance is transferred to a newly opened account called Suspense Account. Here also two types or errors:-

- Two Sided Errors:- Rectified by passing a single journal entry without opening Suspense Account.

- One Sided Errors:- Rectified by passing a single journal entry by opening Suspense Account.

Suspense Account

When the totals of debit and credit side of Trial Balance do not agree with each other and the errors made in accounts are not detected, then the amount of difference in totals of both sides is transferred to suspense account. As the errors are rectified, the balance of suspense account goes on reducing.

The suspense account is a nominal account. The prime objective of opening this account is to balance the Trial Balance. In the financial statements, the suspense account is shown in the Balance Sheet on either the assets or liabilities side depending on the nature of its balance.

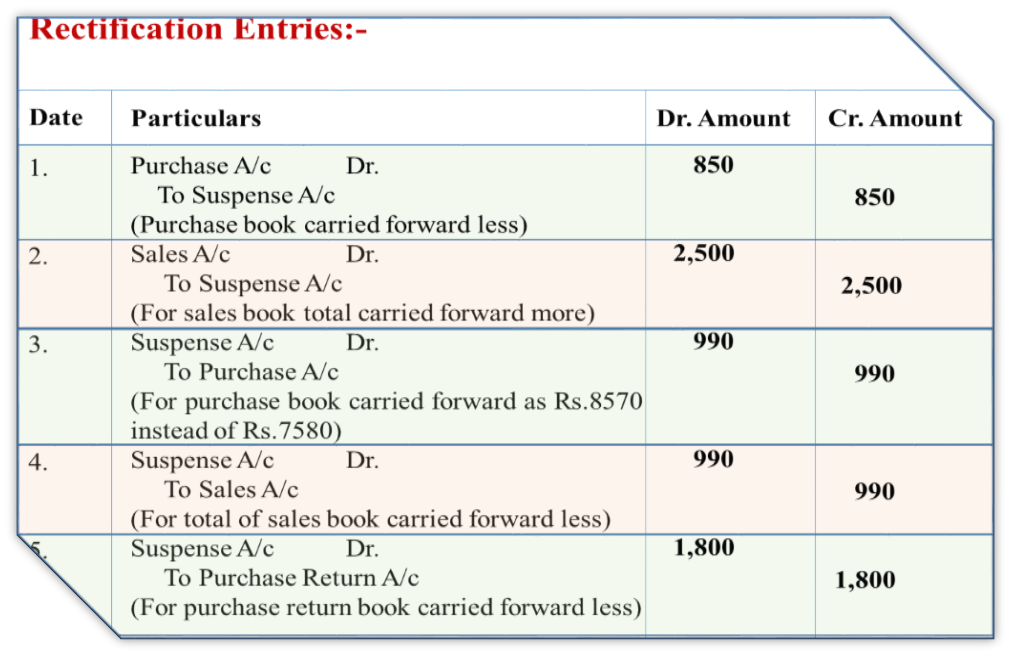

Rectification of One Sided Error after Preparation of Trial Balance

Assuming that a Suspense Account have a balance of Rs.430, correct the following errors which were discovered after the preparation of trial balance and also prepare Suspense Account:

- Purchases book is carried forward Rs.850 less.

- Sales book total is carried forward Rs.2,500 more.

- The total of Rs.7,580 in the purchases book has been carried forward as Rs.8,570.

- The total of the sales book Rs.6,550 on page 20 was carried forward to page 21 as Rs.5,560.

- Purchases return book was carried forward as Rs.3,520 instead of Rs.5,320.

4. Effect of any addition or extension of asset

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Effect of any addition or extension of asset

The amount incurred on such additions/extensions is capitalised and written off as depreciation over the life of the asset. It is important to mention here that the amount so incurred is in addition to usual repair and maintenance expenses.

The effect of any addition or extension of asset are-

- Any addition or extension, which becomes an integral part of the existing asset should be depreciated over the useful life of that asset.

- The depreciation on such addition or extension may also be provided at the rate applied to the existing asset.

- Where an addition or extension retains a separate identity and is capable of being used after the existing asset is disposed off, depreciation, should be provided independently on the basis of its own useful life.

5. Provisions

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Provisions

The traders create a Provision for Doubtful Debts to take care of expected loss at the time of realization from debtors. In a similar way, Provision for repairs and renewals may also be created to provide for expected repair and renewal of the fixed assets.

Examples of provisions are:

- Provision for depreciation;

- Provision for bad and doubtful debts;

- Provision for taxation;

- Provision for discount on debtors; and

- Provision for repairs and renewals.

Note: - The amount of provision for expense and loss is a charge against the revenue of the current period. Creation of provision ensures proper matching of revenue and expenses and hence the calculation of true profits.

Provisions are created by debiting the profit and loss account. In the balance sheet, the amount of provision may be shown either:

- By deduction from the concerned asset on the assets side.

- On the liabilities side of the balance sheet along with current liabilities, for example provision for taxes and provision for repairs and renewals.

Accounting Treatment for Provisions

The accounting treatment of all types of provisions is almost similar. Therefore, the accounting treatment is explained here taking up the case of provision for doubtful debts. When business transaction takes place on credit basis, debtors account is created and its balance is shown on the asset-side of the balance sheet.

These debtors may be of three types:

- Good Debtors are those from where collection of debt is certain.

- Bad Debts are those debtors from where collection of money is not possible and the amount of credit given is a certain loss.

- Doubtful Debts are those debtors who may pay but business firm is not sure about the collection of full amount from them.

The provision for doubtful debts is usually calculated as a certain percentage of the total amount due from sundry debtors after deducting/writing-off all known bad debts. Provision for doubtful debts is also called 'Provision for bad and doubtful debts'. It is created by debiting the amount of required provision to the profit and loss account and crediting it to provision for doubtful debts account.

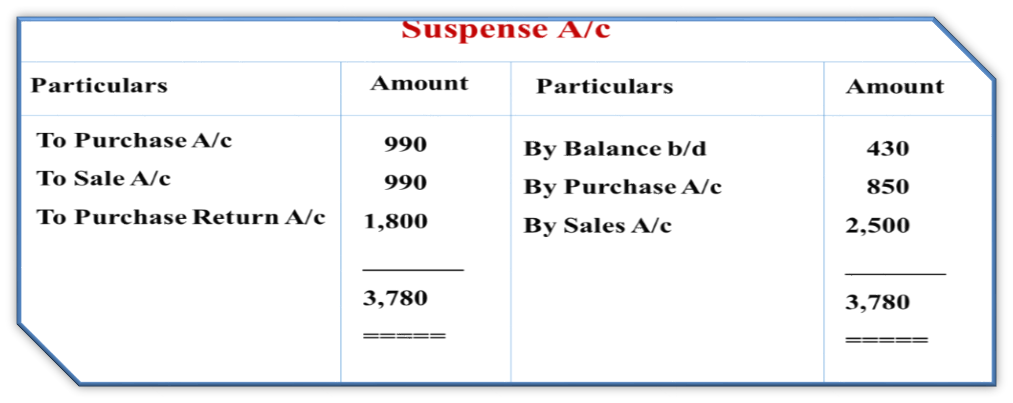

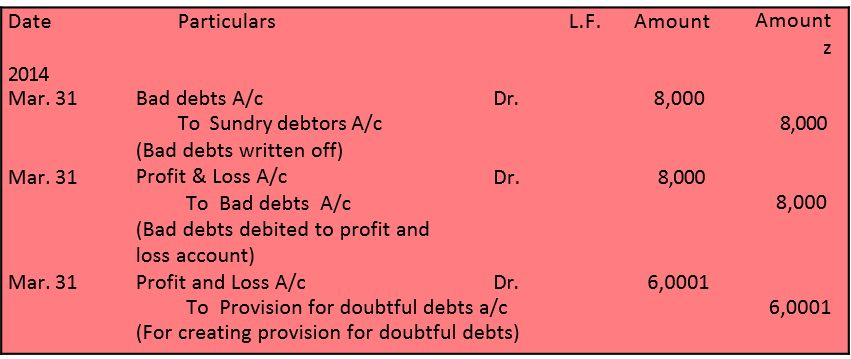

For creating a provision for doubtful debts the following journal entry is recorded:

Profit and Loss A/c Dr. (With the amount of provision) To Provision for doubtful debts A/c

This is explained with the help of the following example

Observe an extract of the trial balance -

Additional Information

1. Bad debts proved bad but not recorded amounted to z 8,000

2. Provision is to be maintained at 10% of debtors.

In order to create the provision for doubtful debts, the following journal entries will be recorded:

Journal

Working Notes

Provision for doubtful debts @10% of sundry debtors i.e.

Z 68,000 - Z 8000 = Z 60,000

Z 6000 x 10/100 = Z 6000

6. Reserves and Secret Reserves

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Reserves

Some part of profit retained in the business to provide for certain future needs like growth and expansion or to meet future contingencies such as workmen compensation. Reserve is not a charge against profit as it is not meant to cover any known liability or expected loss in future. It is shown under the head Reserves and Surpluses on the liabilities side of the balance sheet after capital.

Examples of reserves are:

- General reserve;

- Workmen compensation fund;

- Investment fluctuation fund;

- Capital reserve;

- Dividend equalization reserve;

- Reserve for redemption of debenture.

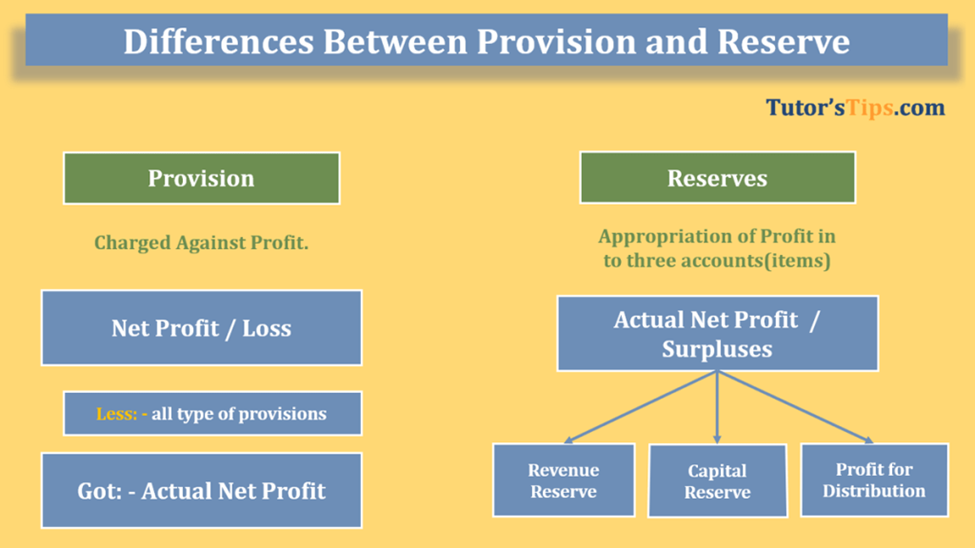

Difference between Reserve and Provision

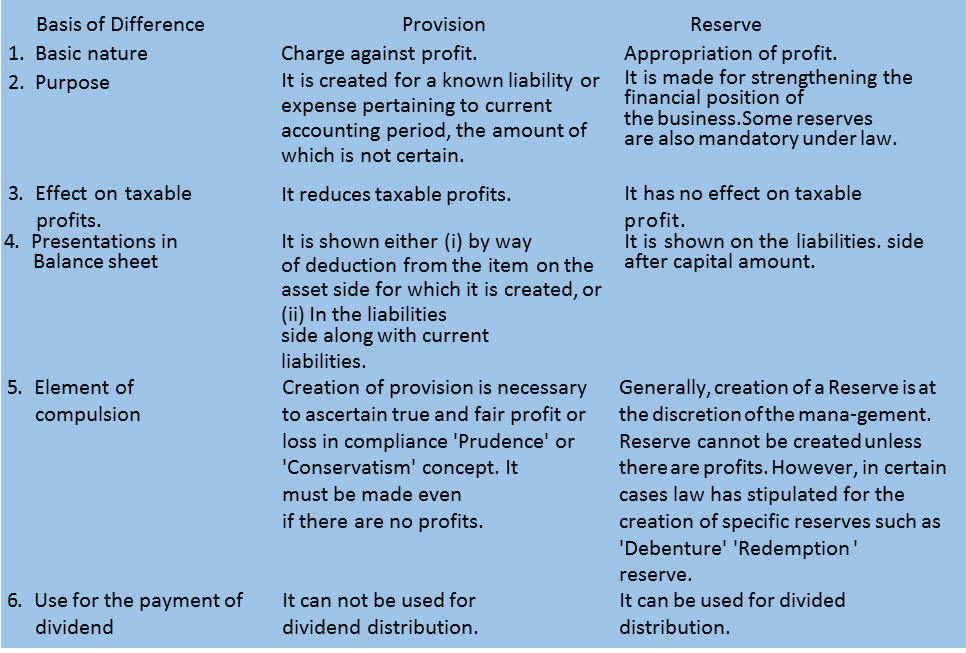

Types of Reserves

General reserve: General Reserve which is not specified. It is also termed as free reserve because the management can freely utilize it for any purpose. General reserve strengthens the financial position of the business.

Specific reserve: Specific reserve is created and utilized only for some specific purpose.

Examples of specific reserves are given below: