1. Concepts, causes, need & factors

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Chapter -7

Depreciation, provisions & reserves

Depreciation

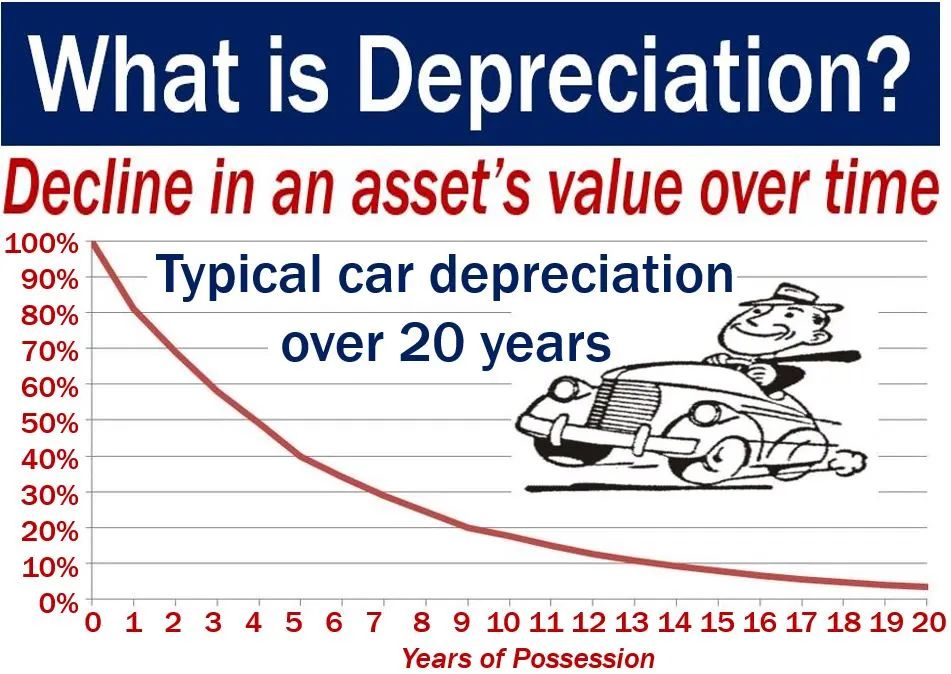

The fixed assets are the assets which are used in business for more than one accounting year. Fixed assets technically referred to as "depreciable assets". The term "Depreciation" means decline in the value of a fixed assets due to use, passage of time or obsolescence. We can sat, if a business enterprise procures a machine and uses it in production process then the value of machine declines with its usage. Even if the machine is not used in production process, we can not expect it to realise the same sales price due to the passage of time or arrival of a new model.

It implies that fixed assets are subject to decline in value and this decline is technically referred to as depreciation.

Depreciation is that part of the cost of a fixed asset which has expired on account of its usage and/or lapse of time. Hence, depreciation is an expired cost or expense, charged against the revenue of a given accounting period. The expired cost or loss in the value of machine on account of its use or passage of time and is referred to as 'Depreciation'. The amount of depreciation, being a charge against profit, is debited to Income Statement (Statement of Profit and Loss).

Meaning of Depreciation

It is based on the cost of assets consumed in a business and not on its market value. It may be described as a permanent, continuing and gradual shrinkage in the book value of fixed assets.

Institute of Cost and Management Accounting, London (ICMA) terminology "The depreciation is the diminution in intrinsic value of the asset due to use and/or lapse of time."

The Institute of Chartered Accountants of India (ICAI) defines depreciation as "a measure of the wearing out, consumption or other loss of value of depreciable asset arising from use, efflux ion of time or obsolescence through technology and market-change.

Depreciation has a significant effect in determining and presenting the financial position and results of operations of an enterprise. Depreciation is charged in each accounting period by reference to the extent of the depreciable amount. It should be noted that the subject matter of depreciation, or its base, are 'depreciable' assets which:

- are expected to be used during more than one accounting period.

- have a limited useful life.

- are held by an enterprise for use in production or supply of goods and services, for rental to others, or for administrative purposes and not for the purpose of sale in the ordinary course of business.

Examples of depreciable assets - are machines, plants, furniture, buildings, computers, trucks, vans, equipments, etc. Moreover, depreciation is the allocation of 'depreciable amount', which is the "historical cost", or other amount substituted for historical cost less estimated salvage value.

Another point in the allocation of depreciable amount is the 'expected useful life' of an asset. It has been described as "either

- The period over which a depreciable asset is expected to the used by the enterprise.

- The number of production of similar units expected to be obtained from the use of the asset by the enterprise."

Features of Depreciation

1. It is decline in the book value of fixed assets.

2. It includes loss of value due to efflux ion of time, usage or obsolescence.

3. It is a continuing process.

4. It is an expired cost and hence must be deducted before calculating taxable profits. For example, if profit before depreciation and tax is f 50,000, and depreciation is f 10,000; profit before tax will be:

Profit before depreciation & tax 50,000

(-) Depreciation (10, 000)

Profit before tax 40,000

5. It is a non-cash expense. It does not involve any cash outflow. It is the process of writing-off the capital expenditure already incurred.

Depreciation and other Similar Terms

‘Depletion' and 'amortization', are also used in connection with depreciation. This has been due to the similar treatment given to them in accounting on the basis of similarity of their outcome, as they represent the expiry of the usefulness of different assets.

Depletion

The term depletion is used in the context of extraction of natural resources like mines, quarries, etc. that reduces the availability of the quantity of the material or asset. For example, if a business enterprise is into mining business and purchases a coal mine for f 10,00,000. Then the value of coal mine declines with the extraction of coal out of the mine. This decline in the value of mine is termed as depletion.

The main difference between depletion and depreciation is that the former is concerned with the exhaution of economic resources, but the latter relates to the usage of an asset. In spite of this, the result is erosion in the volume of natural resources and expiry of the service potential. Therefore, depletion and depreciation are given similar accounting treatment.

Causes of Depreciation

Wear and Tear due to Use or Passage of Time

It reduces the asset's technical capacities to serve the purpose for, which it has been meant. Another aspect of wear and tear is the physical deterioration. An asset deteriorates simply with the passage of time, even though they are not being put to any use. This happens especially when the assets are exposed to the rigours of nature like weather, winds, rains, etc.

Expiration of Legal Rights

Certain categories of assets lose their value after the agreement governing their use in business comes to an end after the expiry of pre-determined period. Examples of such assets are patents, copyrights, leases, etc. whose utility to business is extinguished immediately upon the removal of legal backing to them.

Obsolescence

Obsolescence means the fact of being "out-of-date". Obsolescence implies to an existing asset becoming out-of-date on account of the availability of better type of asset.

It arises from such factors as:

- Technological changes;

- Improvements in production methods;

- Change in market demand for the product or service output of the asset;

- Legal or other description.

Abnormal Factors

Decline in the usefulness of the asset may be caused by abnormal factors such as accidents due to fire, earthquake, floods, etc. Accidental loss is permanent but not continuing or gradual. For example, a car which has been repaired after an accident will not fetch the same price in the market even if it has not been used.

Need for Depreciation

The need for providing depreciation in accounting records arises from conceptual, legal, and practical business consideration. These considerations provide depreciation a particular significance as a business expense.

Matching of Costs and Revenue: Every asset is bound to undergo some wear and tear, and hence lose value, once it is put to use in business. Therefore, depreciation is as much the cost as any other expense incurred in the normal course of business like salary, carriage, postage and stationary, etc. It is a charge against the revenue of the corresponding period and must be deducted before arriving at net profit according to 'Generally Accepted Accounting Principles'.

Consideration of Tax: Depreciation is a deductible cost for tax purposes. However, tax rules for the calculation of depreciation amount need not necessarily be similar to current business practices,

True and Fair Financial Position: If depreciation on assets is not provided for, then the assets will be overvalued and the balance sheet will not depict the correct financial position of the business. Also, this is not permitted either by established accounting practices or by specific provisions of law.

Compliance with Law: Apart from tax regulations, there are certain specific legislations that indirectly compel some business organisations like corporate enterprises to provide depreciation on fixed assets.

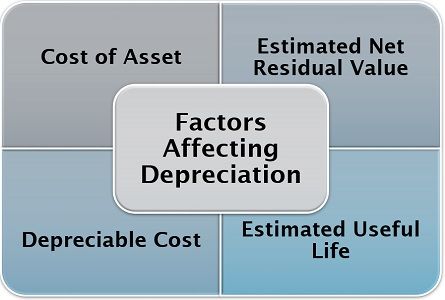

Factors Affecting the Amount of Depreciation

Cost of Asset: Cost of an asset includes invoice price and other costs, which are necessary to put the asset in use or working condition. It also includes freight and transportation cost, transit insurance, installation cost, registration cost, commission paid on purchase of asset adds items such as software, etc. In case of purchase of a second hand asset it includes initial repair cost to put the asset in workable condition.

Estimated Net Residual Value: It is the estimated net realisable value (or sale value) of the asset at the end of its useful life. It is also known as scrap value or salvage value for accounting purpose. The net residual value is calculated after deducting the expenses necessary for the disposal of the asset.

Depreciable Cost: It is the cost, which is distributed and charged as depreciation expense over the estimated useful life of the asset. It is important to mention that total amount of depreciation charged over the useful life of the asset must be equal to the depreciable cost. If total amount of depreciation charged is less than the depreciable cost then the capital expenditure is under recovered. It violates the principle of proper matching of revenue and expense.

Estimated Useful Life: It is the estimated economic or commercial life of the asset. Physical life is not important for this purpose because an asset may still exist physically but may not be capable of commercially viable production. For example, a machine is purchased and it is estimated that it can be used in production process for 5 years. After 5 years the machine may still be in good physical condition but can't be used for production profitably, i.e., if it is still used the cost of production may be very high. Therefore, the useful life of the machine is considered as 5 years irrespective of its physical life. Estimation of useful life of an asset is difficult as it depends upon several factors such as usage level of asset, maintenance of the asset, technological changes, market changes, etc. Normally, useful life is shorter than the physical life. The useful life of an asset is expressed in number of years but it can also be expressed in other units, e.g., number of units of output or number of working hours.

Useful life depends upon the following factors:

- Pre-determined by legal or contractual limits, e.g., in case of leasehold asset, the useful life is the period of lease.

- The number of shifts for which asset is to be used.

- Repair and maintenance policy of the business organization.

- Technological obsolescence.

- Innovation/improvement in production method.

- Legal or other restrictions.

2. Methods of calculating Depreciation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Methods of calculating Depreciation

The depreciation depends on depreciable amount and the method of allocation. For this, two methods are mandated by law and enforced by professional accounting practice in India. These methods are straight line method and written down value method. There are other methods such as - annuity method, depreciation fund method, insurance policy method, sum of years digit method, double declining method, etc. which may be used for determining the amount of depreciation.

The selection of an appropriate method depends upon the following:

- Type of the asset;

- Nature of the use of such asset;

- Circumstances prevailing in the business;

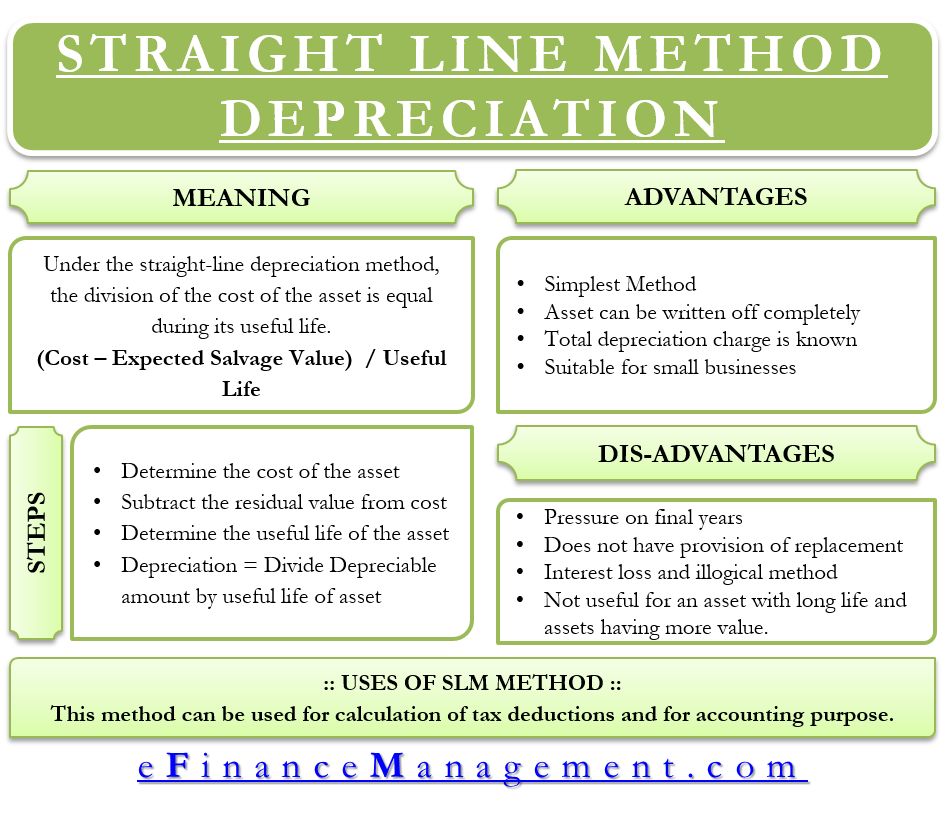

Straight Line Method

It is the widely used methods of providing depreciation. It is based on the assumption of equal usage of the asset over its entire useful life. It is called straight line for a reason that if the amount of depreciation and corresponding time period is plotted on a graph, it will result in a straight line. It is also called fixed installment method because the amount of depreciation remains constant from year to year over the useful life of the asset.

According to this method, a fixed and an equal amount is charged as depreciation in every accounting period during the lifetime of an asset. The amount annually charged as depreciation is such that it reduces the original cost of the asset to its scrap value, at the end of its useful life. This method is also known as fixed percentage on original cost method because same percentage of the original cost is written off as depreciation from year to year.

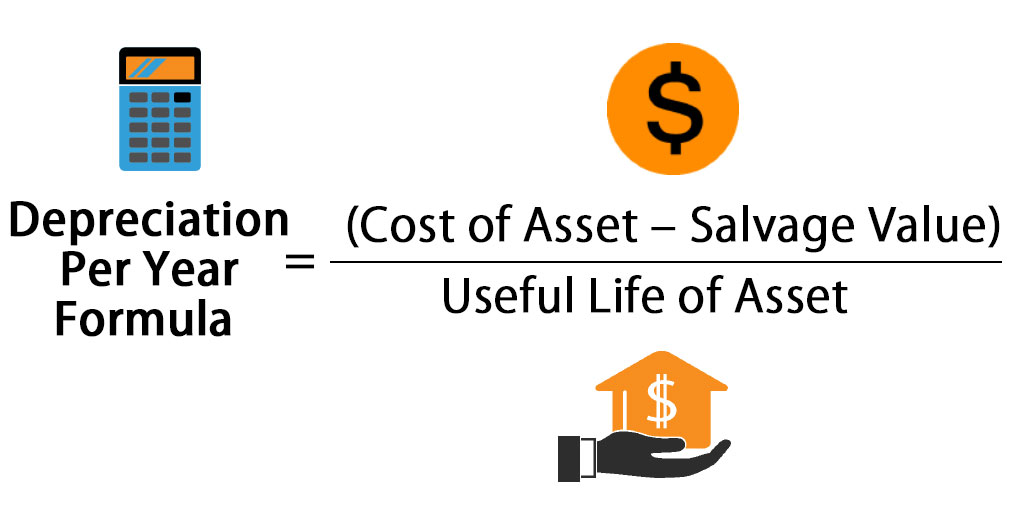

The depreciation amount is computed as -

Depreciation = ![]()

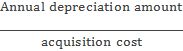

The rate of depreciation under straight line method is the percentage of the total cost of the asset to be charged as deprecation during the useful lifetime of the asset. Rate of depreciation is calculated as follows:

Rate of Depreciation =  * 100

* 100

Straight Line method has certain advantages which are –

- It is very simple, easy to understand and apply. Simplicity makes it a popular method in practice;

- Asset can be depreciated up to the net scrap value or zero value. Therefore, this method makes it possible to distribute full depreciable cost over useful life of the asset;

- Every year, same amount is charged as depreciation in profit and loss account.

- This makes comparison of profits for different years easy;

- This method is suitable for those assets whose useful life can be estimated accurately and where the use of the asset is consistent from year to year such as leasehold buildings.

There are certain limitations of straight line method which are-

- It is based on the faulty assumption of same amount of the utility of an asset in different accounting years;

- With the passage of time, work efficiency of the asset decreases and repair and maintenance expense increases. Hence, under this method, the total amount charged against profit on account of depreciation and repair taken together, will not be uniform throughout the life of the asset, rather it will keep on increasing from year to year.

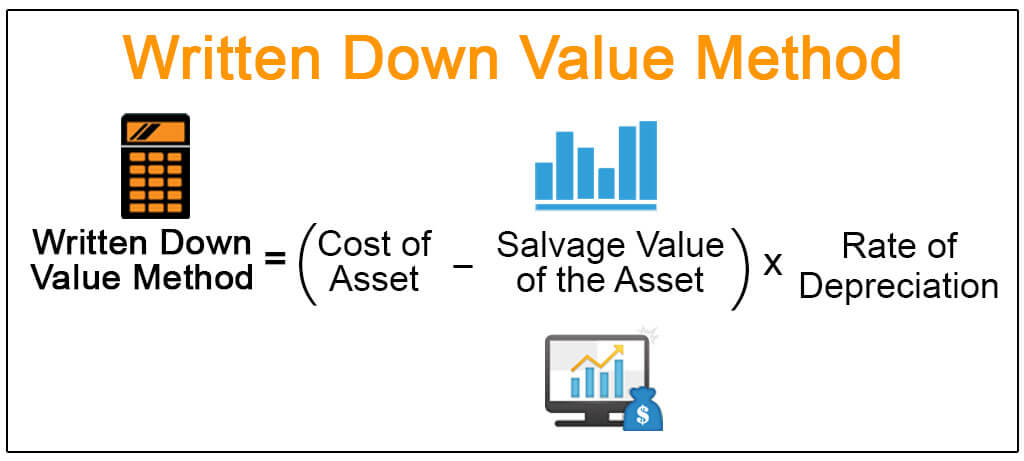

Written Down Value Method

The depreciation is charged on the book value of the asset in this method. It is also known as 'reducing balance method' because the book value keeps on reducing by the annual charge of depreciation. This method involves the application of a pre-determined proportion/percentage of the book value of the asset at the beginning of every accounting period, so as to calculate the amount of depreciation. The amount of depreciation reduces year after year.

Advantages of Written down Value Method are-

- It is based on a more realistic assumption that the benefits from asset go on diminishing (reducing) with the passage of time. Hence, it calls for proper allocation of cost because higher depreciation is charged in earlier years when asset's utility is higher as compared to later years when it becomes less effective.

- Results almost equal burden of depreciation and repair expenses taken together every year on profit and loss account.

- Income Tax Act accepts this method for tax purposes.

- As a large portion of cost is written-off in earlier years, loss due to obsolescence gets reduced.

- It is suitable for fixed assets which last for long and which require increased repair and maintenance expenses with passage of time. It can also be used where obsolescence rate is high.

Although this method is based upon a more realistic assumption it suffers from the following limitations.

- As depreciation is calculated at fixed percentage of written down value, depreciable cost of the asset cannot be fully written-off. The value of the asset can never be zero;

- It is difficult to ascertain a suitable rate of depreciation.

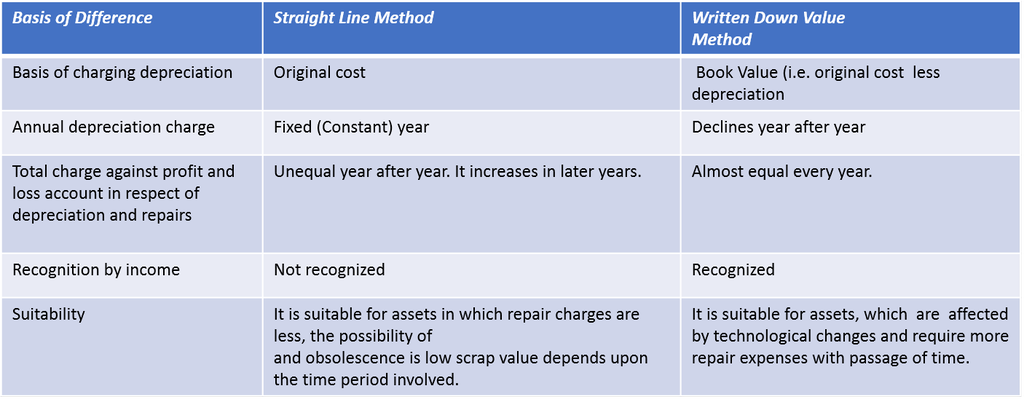

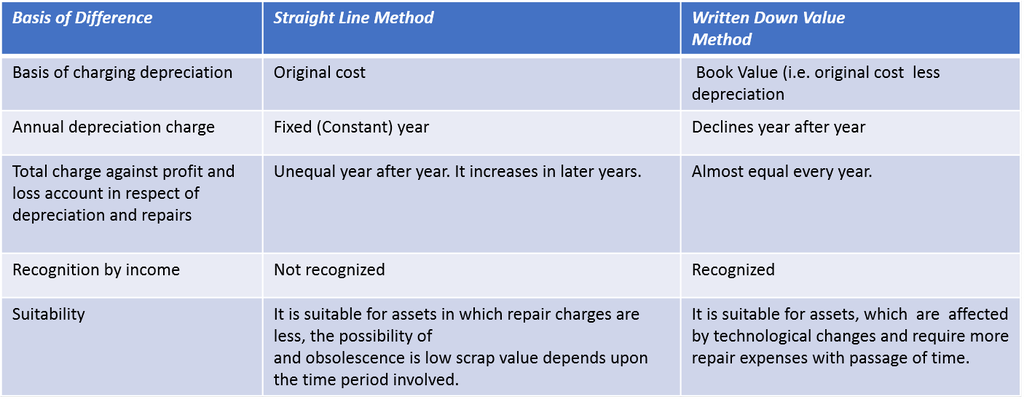

Difference between Straight Line method and Written down Value Method

3. Methods of recording Depreciation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Methods of recording Depreciation

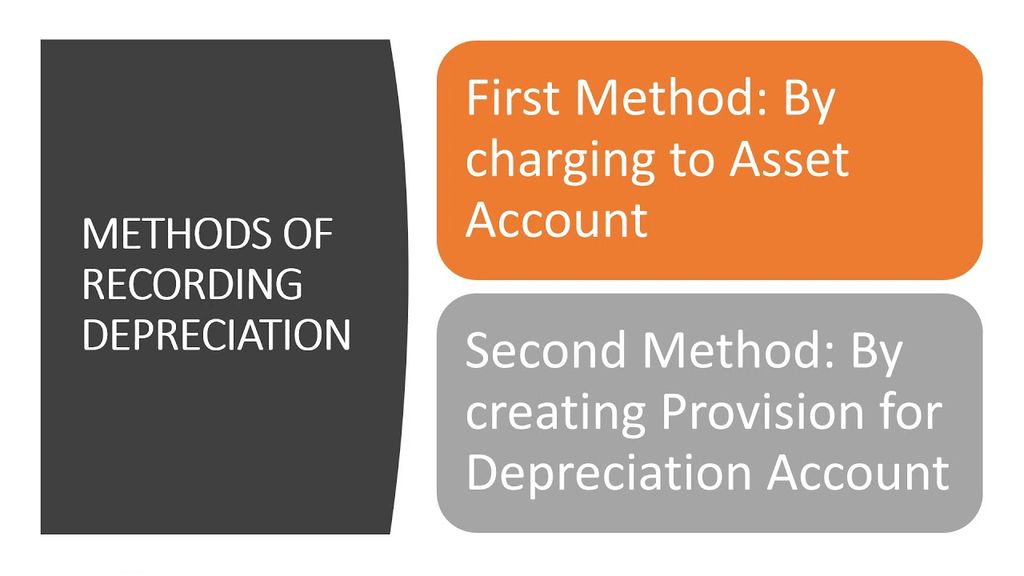

There are two types of recording depreciation on fixed assets:

Charging Depreciation to Asset account

In this method, depreciation is deducted from the depreciable cost of the asset (credited to the asset account) and charged (or debited) to profit and loss account.

Journal entries under this recording method are as follows:

For recording purchase of asset

(only in the year of purchase) Asset A/c Dr. (with the cost of asset including installation, freight, etc.)

To Bank/Vendor A/c

Following two entries are recorded at the end of every year-

(a) For deducting depreciation amount from the cost of the asset.

Depreciation A/c Dr. (with the amount of depreciation)

To Asset A/c

(b) For charging depreciation to profit and loss account.

Profit & Loss A/c Dr. (with the amount of depreciation)

To Depreciation A/c

Balance Sheet Treatment:

In this method, the fixed asset appears at its net book value (i.e. cost less depreciation charged till date) on the asset side of the balance sheet and not at its original cost (also known as historical cost).

Creating Provision for Depreciation Account/Accumulated Depreciation Account

It is use to accumulate the depreciation provided on an asset in a separate account generally called 'Provision for Depreciation' or 'Accumulated Depreciation' account. By such accumulation of depreciation the asset account need not be disturbed in any way and it continues to be shown at its original cost over the successive years of its useful life.

There are some basic characteristic of this method of recording depreciation. These are given below:

- Asset account continues to appear at its original cost year after year over its entire life;

- Depreciation is accumulated on a separate account instead of being adjusted in the asset account at the end of each accounting period.

For recording purchase of asset.

(only in the year of purchase) Asset A/c Dr. (with the cost of asset including installation, expenses etc.)

To Bank/Vendor A/c (cash/credit purchase)

Following two journal entries are recorded at the end of each year:

(a) For crediting depreciation amount to provision for depreciation account.

Depreciation A/c Dr. (with the amount of depreciation)

To Provision for depreciation A/c

(b) For charging depreciation to profit and loss account.

Profit & Loss A/c Dr. (with the amount of depreciation)

To Depreciation A/c

Balance sheet treatment

In the balance sheet, the fixed asset continues to appear at its original cost on the asset side. The depreciation charged till that date appears in the provision for depreciation account, which is shown either on the "liabilities side" of the balance sheet or by way of deduction from the original cost of the asset concerned on the asset side of the balance sheet.

Disposal of Asset

Disposal of asset can take place either at the end of its useful life or during its useful life (due to obsolescence or any other abnormal factor).

If it is sold at the end of its useful life, the amount realised on account of the sale of asset as scrap should be credited to the asset account and the balance is transferred to profit and loss account.

Use of Asset Disposal Account

Asset disposal account is designed to provide a complete and clear view of all the transactions involved in the sale of an asset under one account head. The concerned variables are the original cost of the asset, depreciation accumulated on the asset up to date, sale price of the asset, value of the parts of the asset retained for use, if any and the resultant profit or loss on disposal. The balance of this amount is transferred to the profit and loss account. This method is generally used when a part of the asset is sold and provision for depreciation account exists.

In this method, a new account titled Asset Disposal Account is opened. The original cost of the asset being sold is debited to the asset disposal account and accumulated depreciation amount appearing in provision for depreciation account relating to that asset till the date of disposal is credited to the asset disposal account. The net amount realized from the sale of the asset is also credited to this account. The balance of asset disposal account shows profit or loss which is transferred to profit and loss account. The advantage of this method is that it gives a full picture of all the transactions related to asset disposal at one place.

The journal entries required for the preparation of asset disposal account is as follows:

1. Asset Disposal A/c Dr. (with the original cost of asset, To Asset A/c being sold)

2. Provision for Depreciation A/c Dr. (with the accumulated balance in

To Asset Disposal A/c provision for depreciation account)

3. Bank A/c Dr. (with the net sales proceeds) To Asset Disposal A/c

Asset Disposal Account may ultimately show a debit or credit balance. The debit balance on the account indicates loss on disposal and would be dealt with as follows:

Profit and Loss A/c Dr. (with the amount of loss on sale) To Asset Disposal

A/c

The credit balance of the account, profit on disposal and would be closed by the following journal entry:

Asset Disposal A/c Dr. (with the amount of profit on sale) To Profit and Loss A/c

4. Effect of any addition or extension of asset

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Effect of any addition or extension of asset

The amount incurred on such additions/extensions is capitalised and written off as depreciation over the life of the asset. It is important to mention here that the amount so incurred is in addition to usual repair and maintenance expenses.

The effect of any addition or extension of asset are-

- Any addition or extension, which becomes an integral part of the existing asset should be depreciated over the useful life of that asset.

- The depreciation on such addition or extension may also be provided at the rate applied to the existing asset.

- Where an addition or extension retains a separate identity and is capable of being used after the existing asset is disposed off, depreciation, should be provided independently on the basis of its own useful life.

5. Provisions

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Provisions

The traders create a Provision for Doubtful Debts to take care of expected loss at the time of realization from debtors. In a similar way, Provision for repairs and renewals may also be created to provide for expected repair and renewal of the fixed assets.

Examples of provisions are:

- Provision for depreciation;

- Provision for bad and doubtful debts;

- Provision for taxation;

- Provision for discount on debtors; and

- Provision for repairs and renewals.

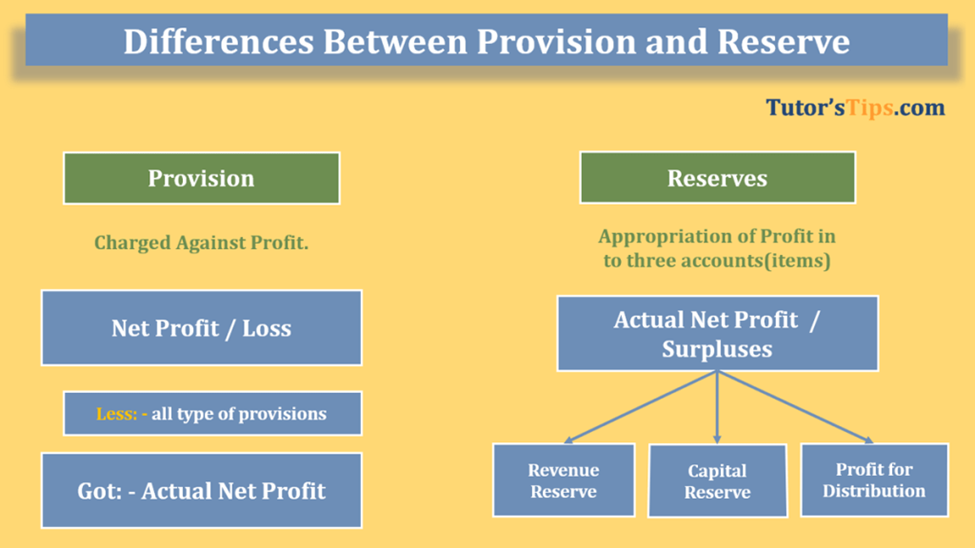

Note: - The amount of provision for expense and loss is a charge against the revenue of the current period. Creation of provision ensures proper matching of revenue and expenses and hence the calculation of true profits.

Provisions are created by debiting the profit and loss account. In the balance sheet, the amount of provision may be shown either:

- By deduction from the concerned asset on the assets side.

- On the liabilities side of the balance sheet along with current liabilities, for example provision for taxes and provision for repairs and renewals.

Accounting Treatment for Provisions

The accounting treatment of all types of provisions is almost similar. Therefore, the accounting treatment is explained here taking up the case of provision for doubtful debts. When business transaction takes place on credit basis, debtors account is created and its balance is shown on the asset-side of the balance sheet.

These debtors may be of three types:

- Good Debtors are those from where collection of debt is certain.

- Bad Debts are those debtors from where collection of money is not possible and the amount of credit given is a certain loss.

- Doubtful Debts are those debtors who may pay but business firm is not sure about the collection of full amount from them.

The provision for doubtful debts is usually calculated as a certain percentage of the total amount due from sundry debtors after deducting/writing-off all known bad debts. Provision for doubtful debts is also called 'Provision for bad and doubtful debts'. It is created by debiting the amount of required provision to the profit and loss account and crediting it to provision for doubtful debts account.

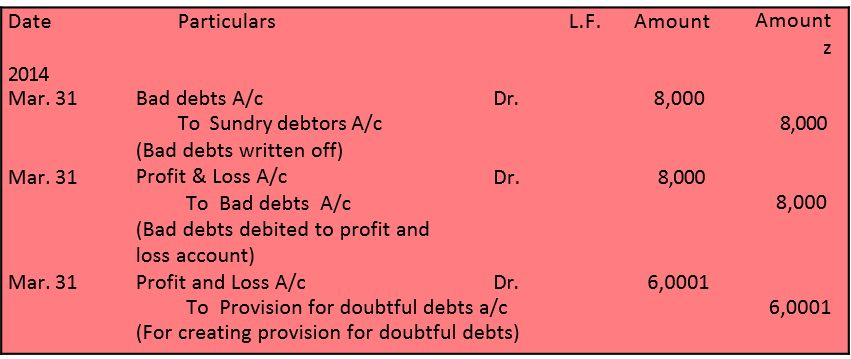

For creating a provision for doubtful debts the following journal entry is recorded:

Profit and Loss A/c Dr. (With the amount of provision) To Provision for doubtful debts A/c

This is explained with the help of the following example

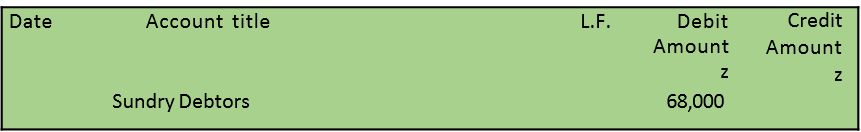

Observe an extract of the trial balance -

Additional Information

1. Bad debts proved bad but not recorded amounted to z 8,000

2. Provision is to be maintained at 10% of debtors.

In order to create the provision for doubtful debts, the following journal entries will be recorded:

Journal

Working Notes

Provision for doubtful debts @10% of sundry debtors i.e.

Z 68,000 - Z 8000 = Z 60,000

Z 6000 x 10/100 = Z 6000

6. Reserves and Secret Reserves

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Reserves

Some part of profit retained in the business to provide for certain future needs like growth and expansion or to meet future contingencies such as workmen compensation. Reserve is not a charge against profit as it is not meant to cover any known liability or expected loss in future. It is shown under the head Reserves and Surpluses on the liabilities side of the balance sheet after capital.

Examples of reserves are:

- General reserve;

- Workmen compensation fund;

- Investment fluctuation fund;

- Capital reserve;

- Dividend equalization reserve;

- Reserve for redemption of debenture.

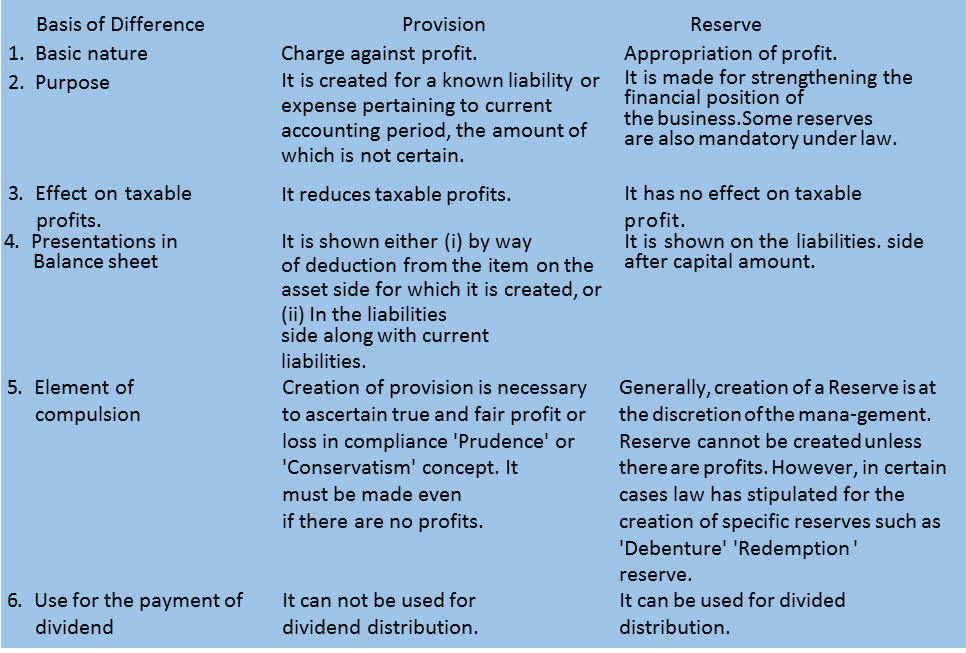

Difference between Reserve and Provision

Types of Reserves

General reserve: General Reserve which is not specified. It is also termed as free reserve because the management can freely utilize it for any purpose. General reserve strengthens the financial position of the business.

Specific reserve: Specific reserve is created and utilized only for some specific purpose.

Examples of specific reserves are given below:

- Dividend equalization reserve: This reserve is created to stabilize or maintain dividend rate. In the year of high profit, amount is transferred to Dividend Equalization reserve. In the year of low profit, this reserve amount is used to maintain the rate of dividend.

- Workmen compensation fund: It is created to provide for claims of the workers due to accident, etc.

- Investment fluctuation fund: It is created to make for decline in the value of investment due to market fluctuations.

- Debenture redemption reserve: It is created to provide funds for redemption of debentures.

Reserves are also classified as revenue and capital reserves according to the nature of the profit out of which they are created.

(a) Revenue reserves: It is created from revenue profits which arise out of the normal operating activities of the business and are otherwise freely available for distribution as dividend.

Examples of revenue reserves are:

- General reserve;

- Workmen compensation fund;

- Investment fluctuation fund;

- Dividend equalization reserve;

- Debenture redemption reserve;

(b) Capital reserves: It is created out of capital profits which do not arise from the normal operating activities. Such reserves are not available for distribution as dividend. These reserves can be used for writing off capital losses or issue of bonus shares in case of a company.

Examples of capital profits are -

- Premium on issue of shares or debenture.

- Profit on sale of fixed assets.

- Profit on redemption of debentures.

- Profit on revaluation of fixed asset & liabilities.

- Profits prior to incorporation.

- Profit on reissue of forfeited shares

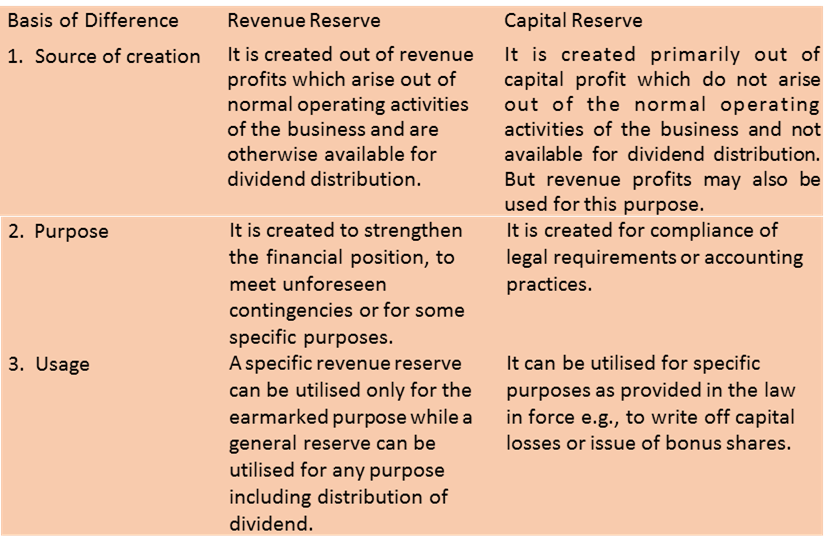

Difference between Revenue and Capital Reserve

Importance of Reserves

A business protect itself from the consequences of unknown expenses and losses, it may be required to bear in future. It may also regard it as more appropriate in certain cases to reduce the amount that can be drawn by the proprietors as profit in order to conserve business resource to meet certain significant demands in future. An example of such a demand is the much needed expansion in the scale of business operations.

The amount so set aside may be meant for the purpose of:

- Meeting a future contingency

- Strengthening the general financial position of the business;

- Redeeming a long-term liability like debentures, etc.

Secret Reserves

It does not appear in the balance sheet. It may also help to reduce the disclosed profits and also the tax liability. The secret reserve can be merged with the profits during the lean periods to show improved profits. It is termed as 'Secret Reserve', as it is not known to outside stakeholders.

Secret reserve can also be created by way of:

Undervaluation of inventories/stock.

Charging capital expenditure to profit and loss account.

Making excessive provision for doubtful debts.

Showing contingent liabilities as actual liabilities.

Vision classes

Vision classes