- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

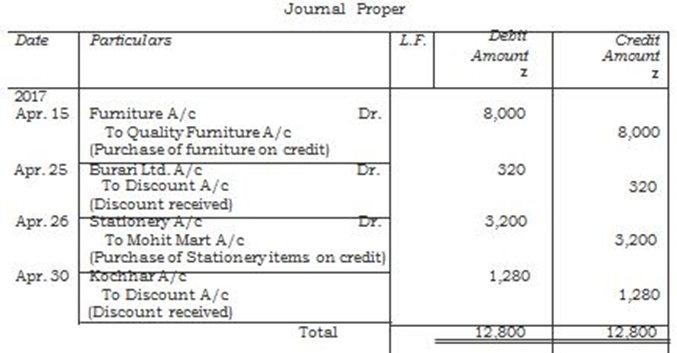

Journal Proper

A book maintained to record transactions, which do not find place in special journals, is known as Journal Proper or Journal Residual.

Following transactions are recorded in this journal:

Opening Entry: In order to open new set of books in the beginning of new accounting year and record therein opening balances of assets, liabilities and capital, the opening entry is made in the journal.

Adjustment Entries: In order to update ledger account on accrual basis, such entries are made at the end of the accounting period. Such as Rent outstanding, Prepaid insurance, Depreciation and Commission received in advance.

Rectification entries: To rectify errors in recording transactions in the books of original entry and their posting to ledger accounts this journal is used.

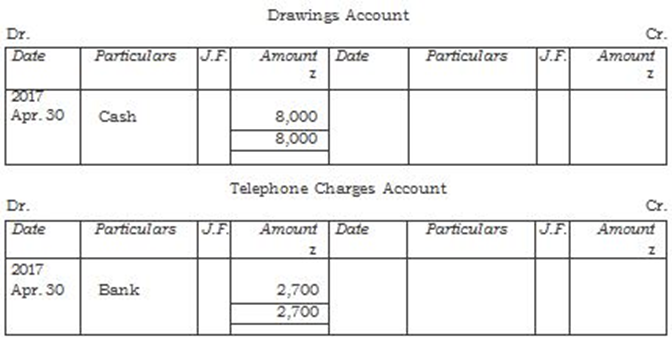

Transfer entries: Drawing account is transferred to capital account at the end of the accounting year. Expenses accounts and revenue accounts which are not balanced at the time of balancing are opened to record specific transactions. Accounts relating to operation of business such as Sales, Purchases, Opening Stock, Income, Gains and Expenses, etc., and drawing are closed at the end of the year and their Total/balances are transferred to Trading and Profit and Loss account by recording the journal entries. These are also called closing entries.

Other entries: In addition to the above-mentioned entries in the points number 1 to 4, recording of the following transaction is done in the journal proper :

(i) At the time of a dishonour of a cheque the entry for cancellation for discount received or discount allowed earlier.

(ii) Purchase/sale of items on credit other than goods.

(iii) Goods withdrawn by the owner for personal use.

(iv) Goods distributed as samples for sales promotion.

(v) Endorsement and dishonour of bills of exchange.

(vi) Transaction in respect of consignment and joint venture, etc.

(vii) Loss of goods by fire/theft/spoilage

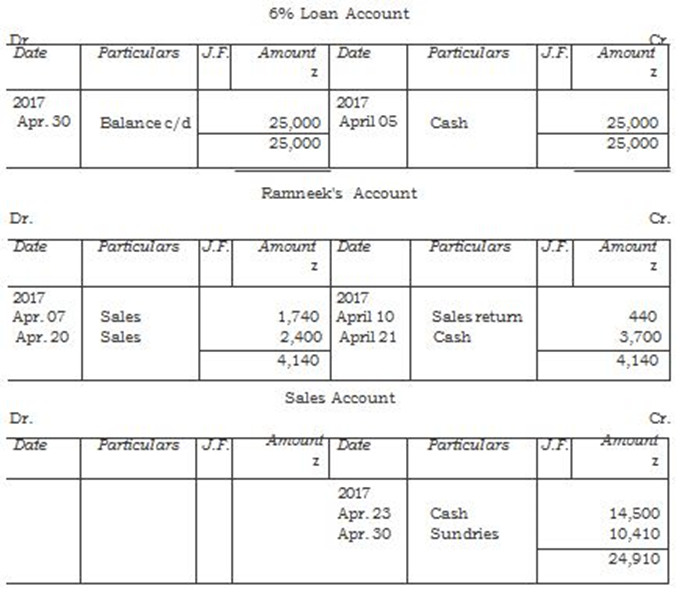

Balancing the Accounts

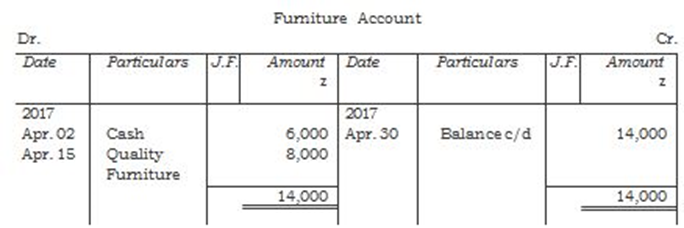

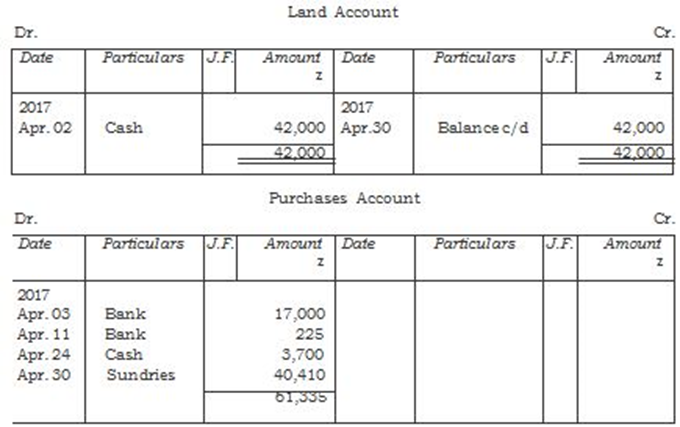

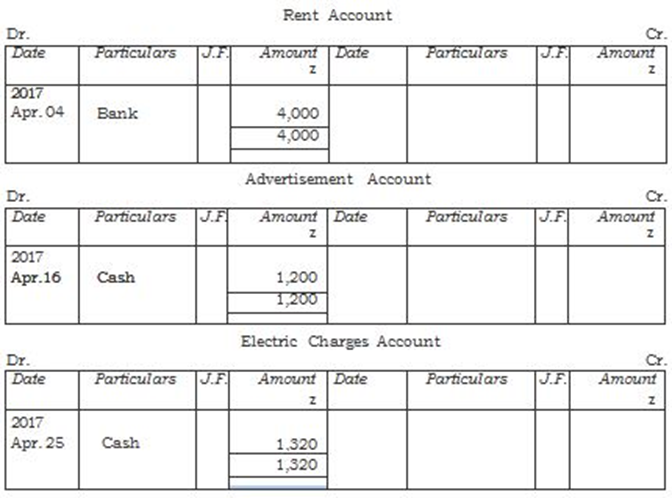

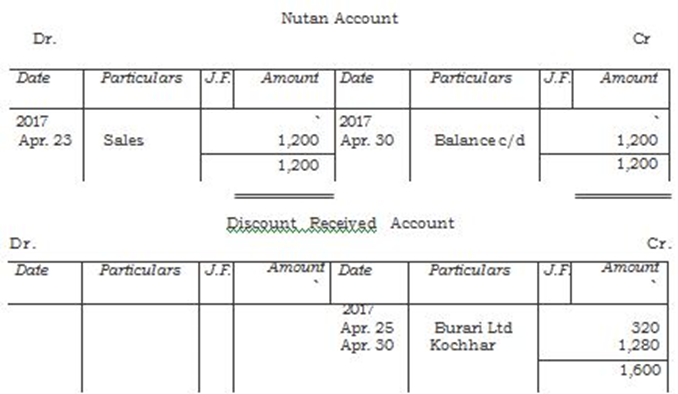

Accounts in the ledger are periodically balanced, generally at the end of the accounting period, with the object of ascertaining the net position of each amount. Balancing of an account means that the two sides are totaled and the difference between them is shown on the side, which is shorter in order to make their totals equal. The words 'balance c/d' are written against the amount of the difference between the two sides.

In case the debit side exceeds the credit side, the difference is written on the credit side, if the credit side exceeds the debit side, the difference between the two appears on the debit side and is called debit and credit balance respectively. The accounts of expenses losses and gains/revenues are not balanced but are closed by transferring to trading and profit and loss account. The balancing of an account is shown below with the help of an example explaining the complete process of recording the transactions, posting to ledger and balancing there of.

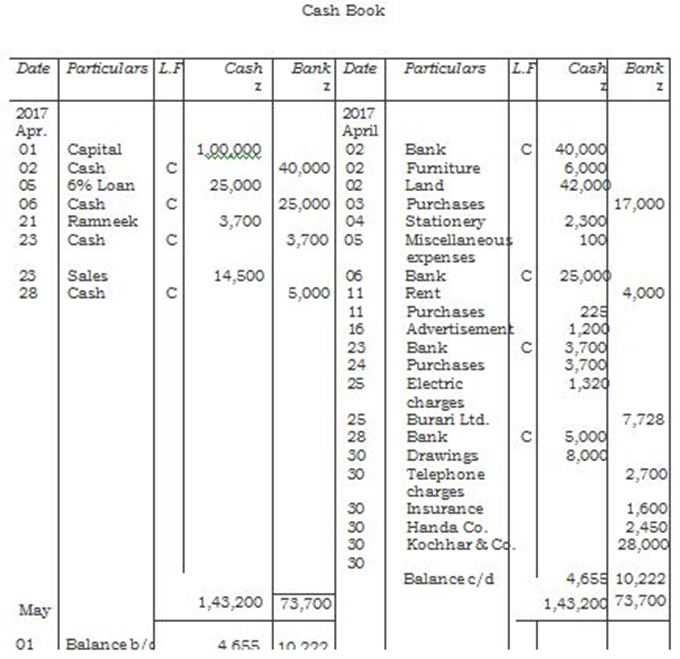

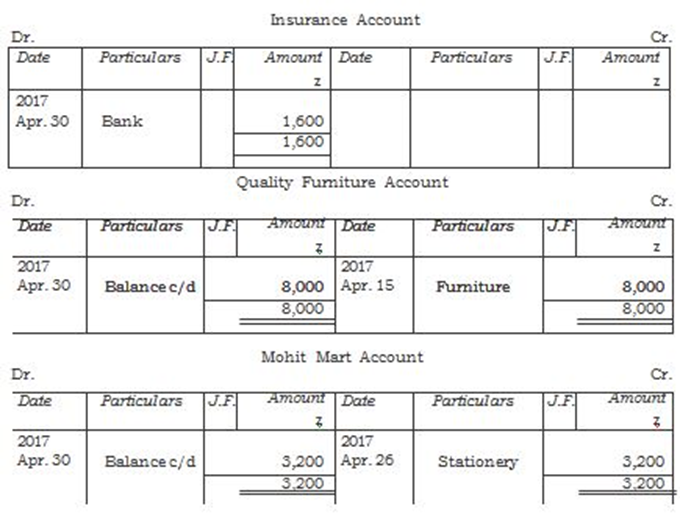

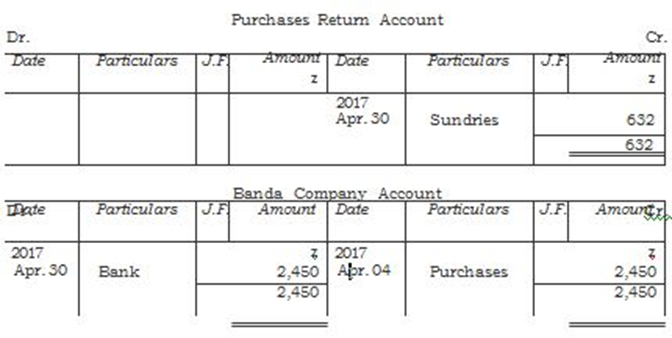

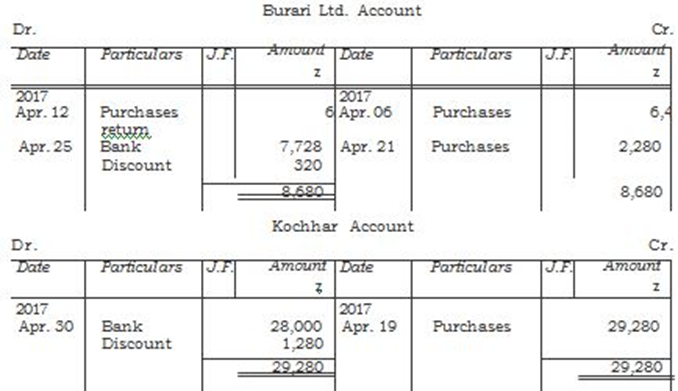

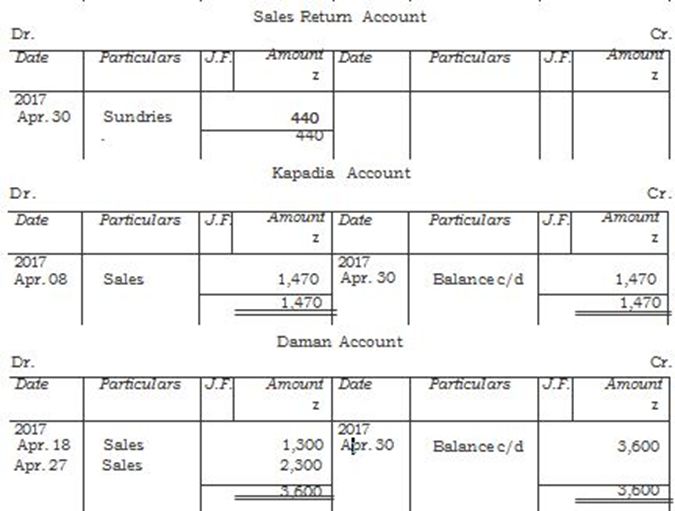

The recorded transactions will be posted in the ledger.

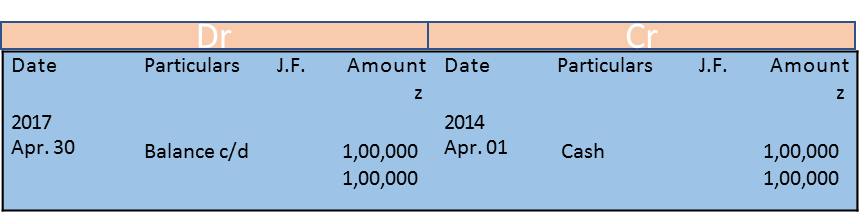

Capital Account

Vision classes

Vision classes