- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

CHAPTER 6

Trial Balance and Rectification of Errors

MEANING OF TRIAL BALANCE

It is a statement prepared with the debit and credit balances of the ledger accounts. It also includes the balances of cash and Bank taken from the Cash Book. The total of debit and credit columns should be equal. The agreement of Trial Balance ensures arithmetical accuracy and not accounting accuracy.

“The Statement prepared with the help of ledger balances, at the end of financial year or at any other date, to find out whether debit total agrees with credit total, is called a Trial Balance.”

- William Pickles

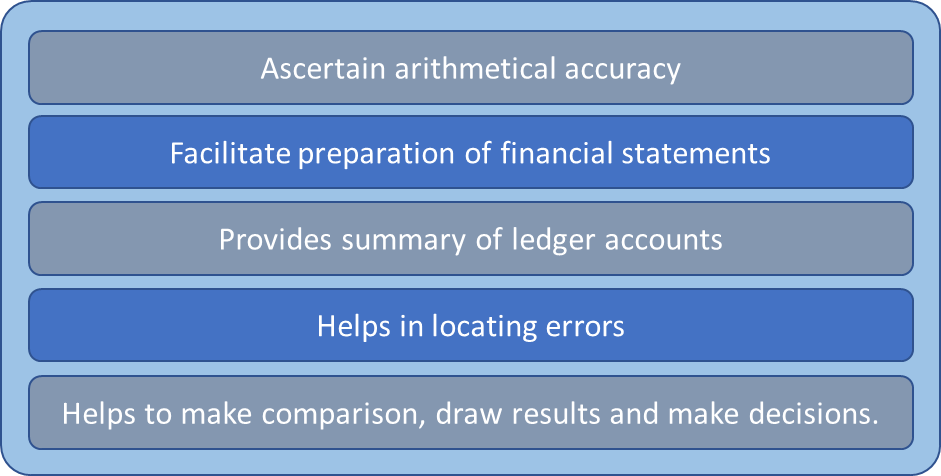

Objectives of Trial Balance

It helps in ascertaining arithmetic errors that occur while preparing accounts. Accountants can make mistakes while recording financial transactions under the double-entry bookkeeping system. When the debit and credit sides of a Trial Balance do not match, it means one of two things. One, there was an error in either recording the account balance. Or two, there is an accounting mistake made while recording the transaction in the ledgers.

It helps in preparing the financial statements of a company at the end of a financial year. The final balance of expenses and revenue accounts is taken from the Trial Balance and used in the Profit and Loss Account. Similarly, the accounts related to Assets, Liabilities and Capital gets recorded in the Balance Sheet.

- All expenses and losses have a debit balance.

- All income and gains have a credit balance.

- All assets have a debit balance.

- All liabilities have a credit balance.

- Capital has a credit balance but some time, it has a debit balance also.

To prepare a trial balance we need the closing balances of all the ledger accounts and the cash book as well as the bank book.

So firstly every ledger account must be balanced. Balancing is the difference between the sum of all the debit entries and the sum of all the credit entries.

Then prepare a three column worksheet. One column for the account name and the corresponding columns for debit and credit balance.

Fill out the account name and the balance of such account in the appropriate debit or credit column

Then we total both the debit column and the credit column. Ideally, in a balanced error-free Trial balance these totals should be the same

Once you compare the totals and the totals are same you close the trial balance. If there is a difference we try and find and rectify errors.

Here are some cases that cause errors in the trial balance:

- A mistake in transferring the balances to the trial balance

- Error in balancing an account

- The wrong amount posted in the ledger

- Made the entry in the wrong column, debit instead of credit or vice versa

- Mistake made in the casting of the journal or subsidiary book

Rules for Preparation of Trial Balance

While preparation of trial balances we must take care of the following rules/points-

The balances of the following accounts are always found on the debit column of the trial balance

- Assets Expense Accounts

- Drawings Account

- Cash Balance

- Bank Balance

- Any losses

A Trial Balance helps in summarising the financial transactions done while running a business. It is a consolidated summary of the financial transactions that have taken place within a financial year. It can help the management in making business decisions as well.

Vision classes

Vision classes