1. Meaning of Trial Balance

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

CHAPTER 6

Trial Balance and Rectification of Errors

MEANING OF TRIAL BALANCE

It is a statement prepared with the debit and credit balances of the ledger accounts. It also includes the balances of cash and Bank taken from the Cash Book. The total of debit and credit columns should be equal. The agreement of Trial Balance ensures arithmetical accuracy and not accounting accuracy.

“The Statement prepared with the help of ledger balances, at the end of financial year or at any other date, to find out whether debit total agrees with credit total, is called a Trial Balance.”

- William Pickles

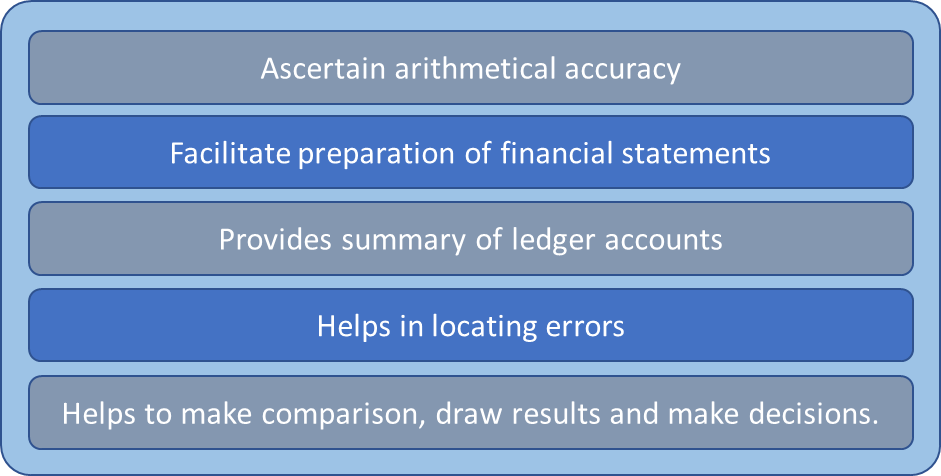

Objectives of Trial Balance

It helps in ascertaining arithmetic errors that occur while preparing accounts. Accountants can make mistakes while recording financial transactions under the double-entry bookkeeping system. When the debit and credit sides of a Trial Balance do not match, it means one of two things. One, there was an error in either recording the account balance. Or two, there is an accounting mistake made while recording the transaction in the ledgers.

It helps in preparing the financial statements of a company at the end of a financial year. The final balance of expenses and revenue accounts is taken from the Trial Balance and used in the Profit and Loss Account. Similarly, the accounts related to Assets, Liabilities and Capital gets recorded in the Balance Sheet.

- All expenses and losses have a debit balance.

- All income and gains have a credit balance.

- All assets have a debit balance.

- All liabilities have a credit balance.

- Capital has a credit balance but some time, it has a debit balance also.

To prepare a trial balance we need the closing balances of all the ledger accounts and the cash book as well as the bank book.

So firstly every ledger account must be balanced. Balancing is the difference between the sum of all the debit entries and the sum of all the credit entries.

Then prepare a three column worksheet. One column for the account name and the corresponding columns for debit and credit balance.

Fill out the account name and the balance of such account in the appropriate debit or credit column

Then we total both the debit column and the credit column. Ideally, in a balanced error-free Trial balance these totals should be the same

Once you compare the totals and the totals are same you close the trial balance. If there is a difference we try and find and rectify errors.

Here are some cases that cause errors in the trial balance:

- A mistake in transferring the balances to the trial balance

- Error in balancing an account

- The wrong amount posted in the ledger

- Made the entry in the wrong column, debit instead of credit or vice versa

- Mistake made in the casting of the journal or subsidiary book

Rules for Preparation of Trial Balance

While preparation of trial balances we must take care of the following rules/points-

The balances of the following accounts are always found on the debit column of the trial balance

- Assets Expense Accounts

- Drawings Account

- Cash Balance

- Bank Balance

- Any losses

A Trial Balance helps in summarising the financial transactions done while running a business. It is a consolidated summary of the financial transactions that have taken place within a financial year. It can help the management in making business decisions as well.

2. Objective and Preparation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

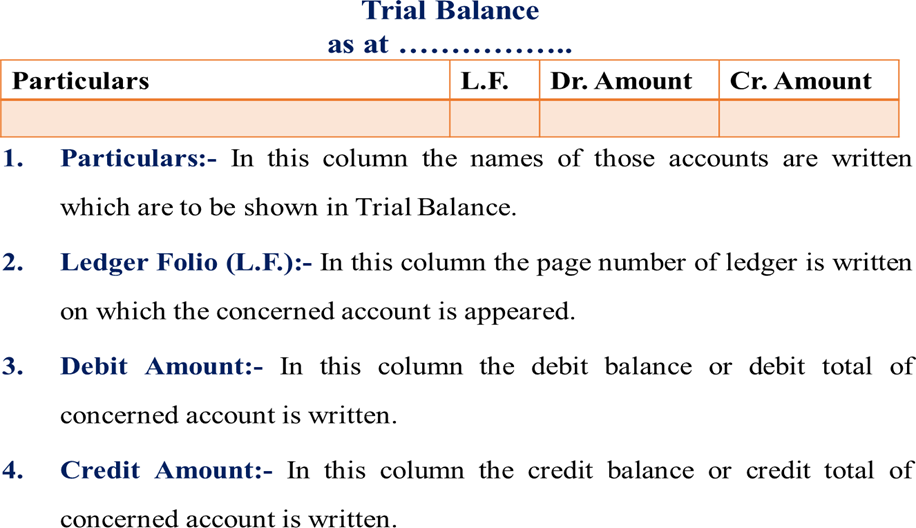

Preparation of Trial Balance

Following guidelines should be followed while preparing trial balance –

The following balances are placed on the credit column of the trial balance:

- Liabilities Income Accounts

- Capital Account

- Profits

Methods of Preparation of Trial Balance

A business organization can prepare a trial balance at any time. It can be prepared monthly, quarterly, half- yearly. It is prepared on a particular date and not for a particular period. There are three methods for preparation of trial balance.

Methods of preparation trial balance –

Balance method

Total method

Balance cum total method

Total method:-

Under this method, all the accounts having debit balances in the ledger are shown on the debit side or in debit column of trial balance and all the accounts having credit balances are shown on the credit side or in credit column of the trial balance. When an account shows no balance, i.e., the debit and credit side of an account are equal, is not shown in the trial balance.

As per latest CBSE syllabus, only Balance Method of preparing Trial Balance is prescribed.

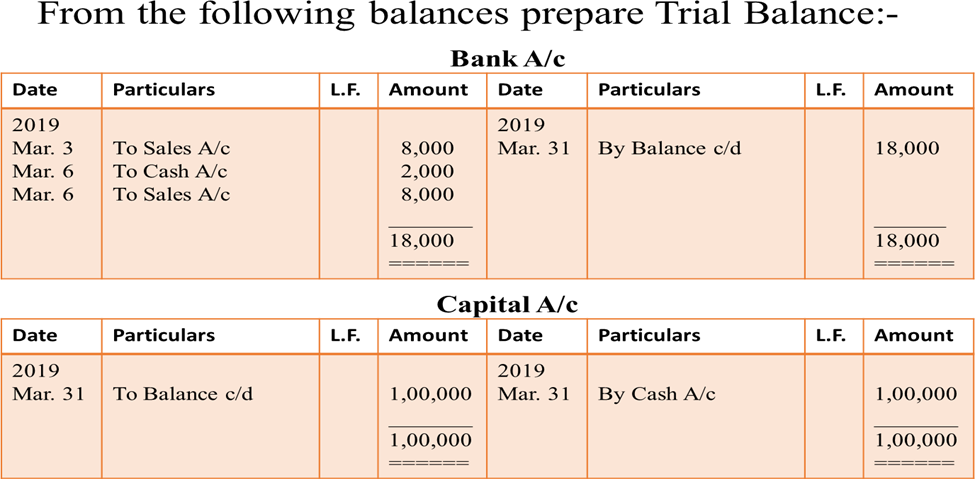

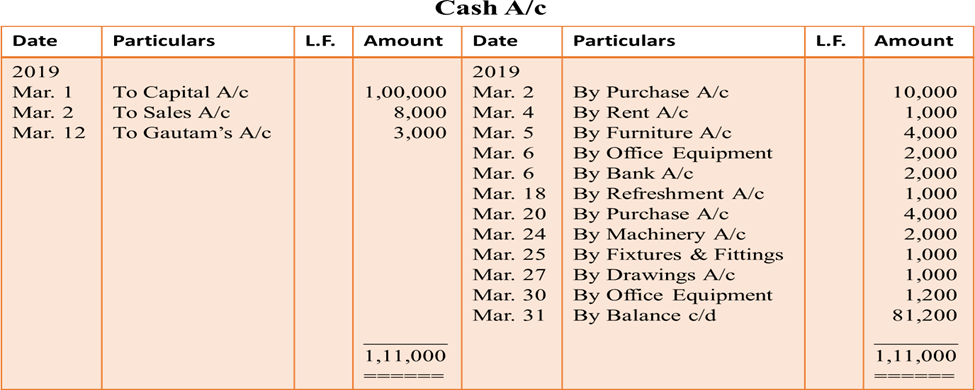

Balances Method

This is the most widely used method in practice. Under this method trial balance is prepared by showing the balances of all ledger accounts and then totalling up the debit and credit columns of the trial balance to assure their correctness. The account balances are used because the balance summarises the net effect of all transactions relating to an account and helps in preparing the financial statements. It may be noted that in trial balance, normally in place of balances in individual accounts of the debtors, a figure of sundry debtors is shown, and in place of individual accounts of creditors, a figure of sundry creditors is shown.

Totals-cum-balances Method

In this method, we combine both totals method and balances method. Under this method four columns for amount are prepared. Two columns for writing the debit and credit totals of various accounts and two columns for writing the debit and credit balances of these accounts. However, this method is also not used in practice because it is time consuming and hardly serves any additional or special purpose.

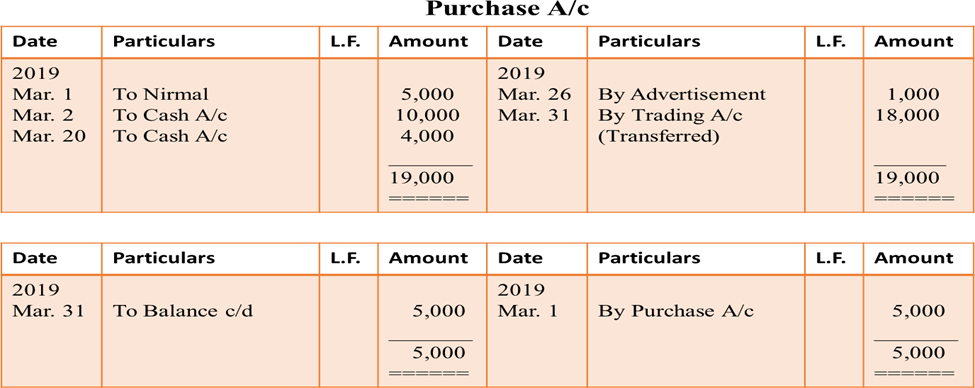

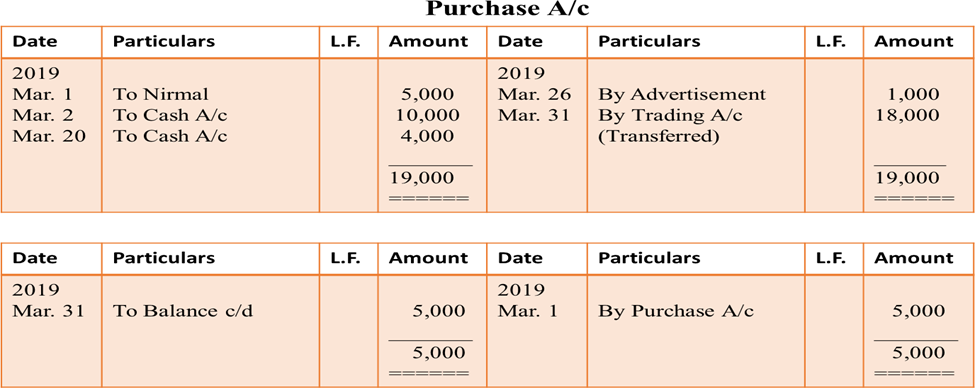

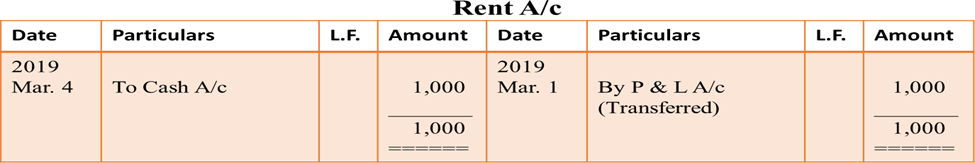

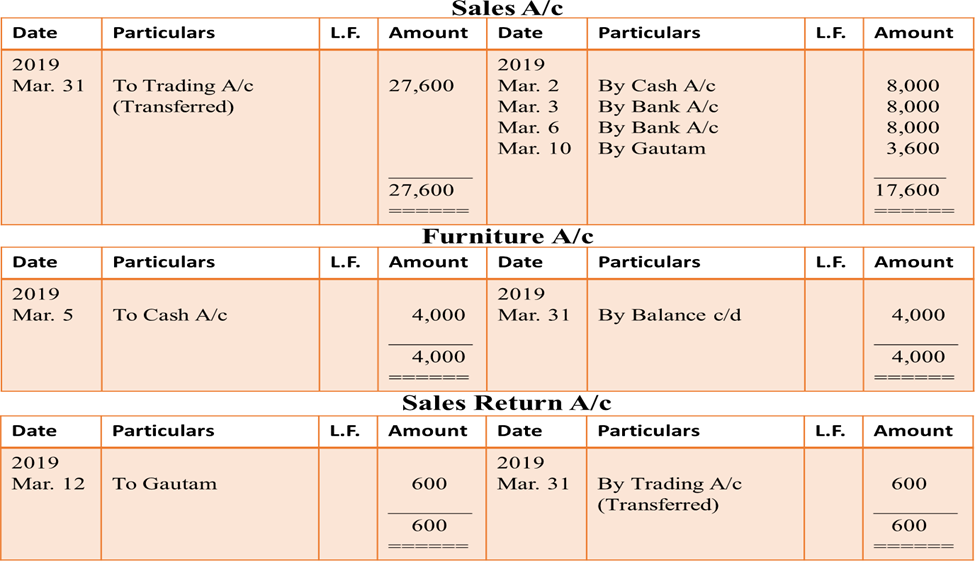

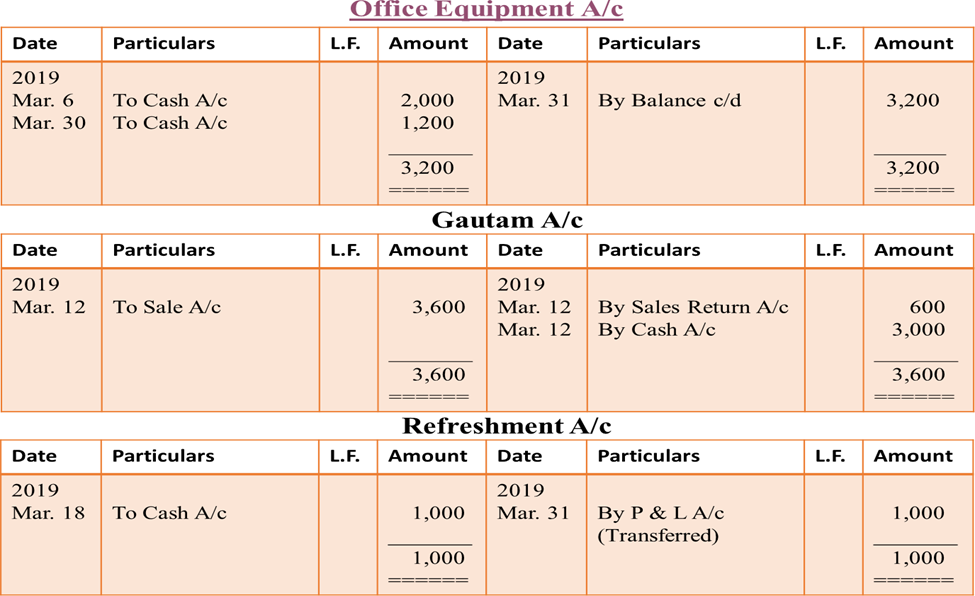

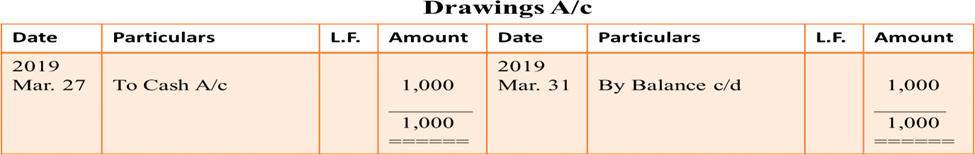

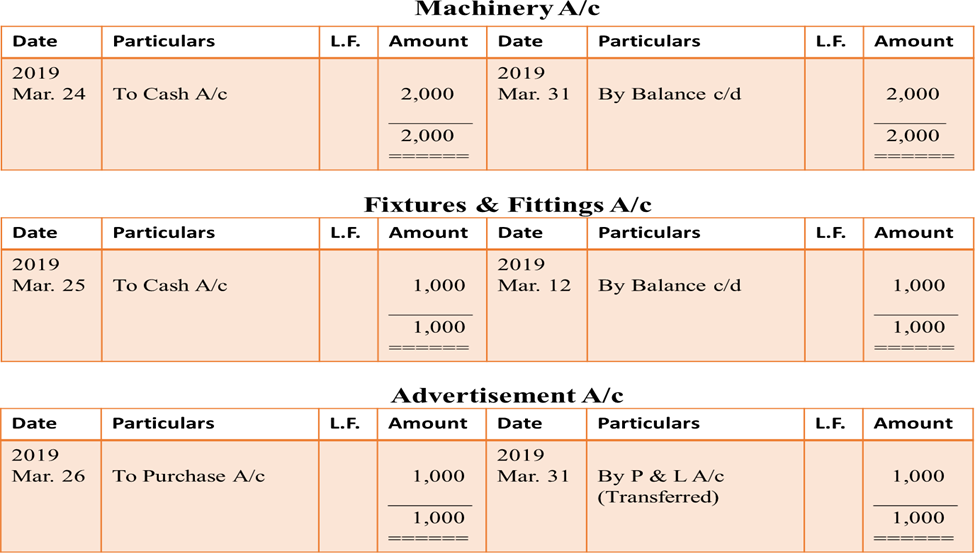

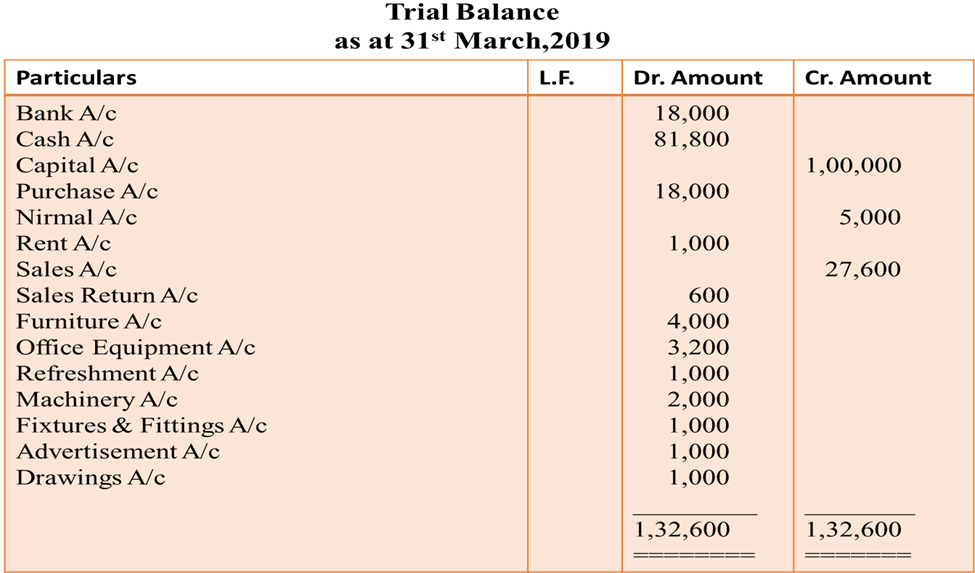

Example :-

Suspense Account

Sometimes in spite of best efforts of an accountant, all the errors are not located and Trial balance does not tally. In such a situation, to avoid the delay in the preparation of final accounts, the difference is placed to a newly opened account known as ‘Suspense Account’. If the debit side of the Trial Balance exceeds the credit side, the difference will be put on the credit side of Suspense Account and if credit side of the Trial balance exceeds the debit side, Suspense Account will be debited. After including the balance of suspense account in the Trial Balance, it will appear to be tallied. Later on, when the errors are located, they will be rectified and Suspense Account will be automatically closed.

3. Significance of Agreement of Trial Balance

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Significance of Agreement of Trial Balance

trial balance means that both the debit and the credit entries have been made correctly for each transaction. However, as stated earlier, the agreement of trial balance is not an absolute proof of accuracy of accounting records. A tallied trial balance only proves, to a certain extent, that the posting to the ledger is arithmetically correct. But it does not guarantee that the entry itself is correct. There can be errors, which affect the equality of debits and credits, and there can be errors, which do not affect the equality of debits and credits. Some common errors include the following:

- Error in totalling of the debit and credit balances in the trial balance.

- Error in totalling of subsidiary books.

- Error in posting of the total of subsidiary books.

- Error in showing account balances in wrong column of the tiral balance, or in the wrong amount.

- Omission in showing an account balance in the trial balance.

- Error in the calculation of a ledger account balance.

- Error while posting a journal entry: a journal entry may not have been posted properly to the ledger, i.e., posting made either with wrong amount or on the wrong side of the account or in the wrong account.

- Error in recording a transaction in the journal: making a reverse entry, i.e., account to be debited is credited and amount to be credited is debited, or an entry with wrong amount.

- Error in recording a transaction in subsidiary book with wrong name or wrong amount.

4. Searching of Errors and Rectification of Errors

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Rectification of Errors

Meaning:- Trial Balance is prepared to check the arithmetical accuracy of the books of account. The two sides of the Trial Balance must be equal, i.e., the total of the debit side must be equal to total of credit side.

Disagreement of a Trial Balance means that there are errors in books of account. Some of the errors affect the agreement of the Trial Balance and are disclosed by the Trial Balance. In the same way some of the errors does not affect the agreement of Trial Balance.

Types of Errors

- Error of omission

- Error of commission

- Error of principles

- Compensating errors

Errors of Omission:-

Errors which arise due to non-recording of business transactions wholly or partially are called errors of omission. These errors usually occur when a transaction needs to be posted to the books of original entry, i.e., the journal or with regard to omission to post a transaction into the ledger.

Error of Omissions is generally of two types:-

- Error of Complete omission

- Error of Partial Omission

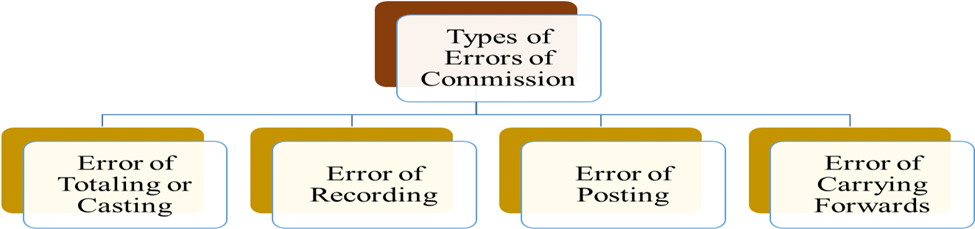

Errors of Commission:-

When an entry is incorrectly recorded either wholly or partially for reasons like posting of incorrect amount, posting to incorrect account, wrong calculation, wrong totalling, wrong casting or balancing and similar others, the error are called as errors of commission. For example, if an amount of Rs.2,500 was paid to Suresh and the cash account was correctly credited but the personal account of Suresh was debited with an amount of Rs.250.

Errors of Principle:-

These type of errors come into existence due to non-obedience of principles of accounting. They have no effect on Trial Balance because they do not occur due to faulty recording as discussed above, but due to lack of understanding of fundamental accounting principles.

For examples:-

- When purchase of an asset (machinery, building, etc.) is debited to Purchases Account and not to Asset Account.

- When expenses incurred on purchase or installation of assets are debited to expenses account and not to that particular Asset Account.

Compensating Errors:-

Errors which counter balance each other, i.e., cancel the effect of each other are called compensating errors. Such errors do not affect Trial Balance, e.g., Rs.2,000 paid to Sonika is recorded as Rs.20,000 and Rs.20,000 paid to Monika is recorded as Rs.2,000. These type of errors does not affect the trial balance.

Searching of Errors on the basis of affects of Trial Balance

Errors affecting Trial Balance or One Sided Errors

One sided errors affect the Trial Balance as they affect only one account. Examples of one- sided errors are:

- Error of casting, i.e., when a subsidiary book is under cast or overcast.

- Error of carrying forward.

- Wrong totaling or wrong balancing of a ledger account.

- Error of posting to the correct account but with wrong amount.

- Error of posting to the correct account but on the wrong side.

- Error of posting to the wrong side with the wrong amount.

- Error of partial omission.

- Error of omission by posting the total of subsidiary book into the respective ledger.

- Error of omission to show an account in the trial balance.

Errors not affecting Trial Balance or Two Sided Errors

Two-sided errors do not affect the trial balance Examples of two-sided errors are:

- Errors of complete omission from posting to the account.

- Errors of posting to the wrong account but on the correct side.

- Wrong recording in the books of original entry (Subsidiary books).

- Errors of principles.

- Compensating Errors.

Effect of Errors on Final Accounts

Nominal Accounts, affect the profits and Personal and Real Accounts affect the Balance Sheet. For example, Stock Account, Purchases Account, Wages Account, Salaries Account, Commission Account, Bad Debts Account, etc., affect the Net profit because they are shown either in Trading Account or Profit and Loss Account. If any of these accounts is debited in the rectification entry, it reduces the Profit and if any of these accounts is credited then it increases the Profit.

Balances of Personal and Real Accounts form part of a Balance Sheet, so errors in such types of accounts will affect Balance Sheet only, not Profit and Loss Account.

Stages of Rectification of Errors

Rectification before the Preparation of Trial Balance: In this stage, errors are located before transferring the difference in the trial balance to Suspense Account. Rectification entries are passed concerning specific accounts.

Rectification after the Preparation of Trial Balance: In this stage, the difference in the trial balance gets transferred to Suspense Account. So, wherever applicable, suspense account is used while passing rectification entries.

Rectification of One Sided Errors before Preparation of Trial Balance

Rectify the following transactions which were detected before preparation of Trial balance:-

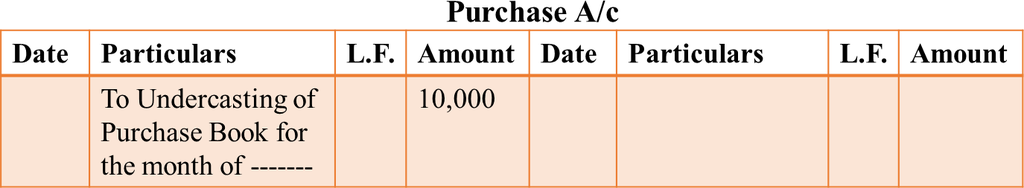

- The total of purchase book has been undercast by Rs.10,000.

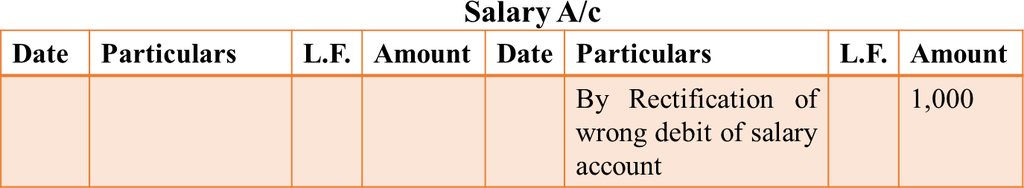

- Payment of salary of Rs.1,000, posted twice in salary account.

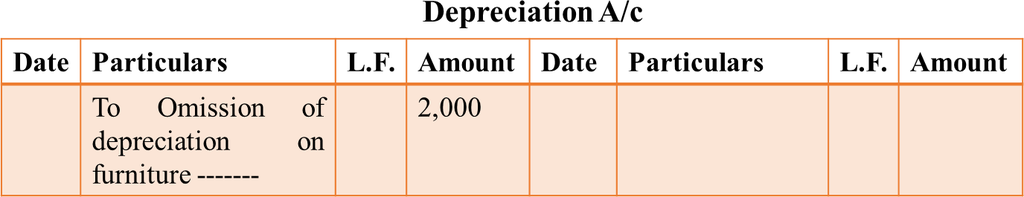

- Depreciation of Rs.2,000 on furniture written off, not recorded in depreciation account.

Solution:-

Total of purchase book undercast, it means the Purchase Account is debited short by Rs.10,000. So, we have to debit Purchase Account by Rs.10,000 to rectify the error.

Salary account is debited Rs.1,000 more, so, to rectify this error we have to credit salary account by Rs.1,000.

Depreciation on furniture Rs.2,000 not recorded in depreciation account, to rectify this error we have to record this in depreciation account on debit side.

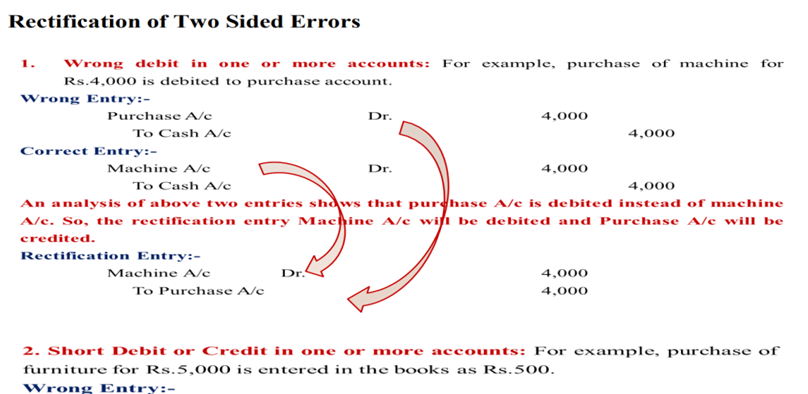

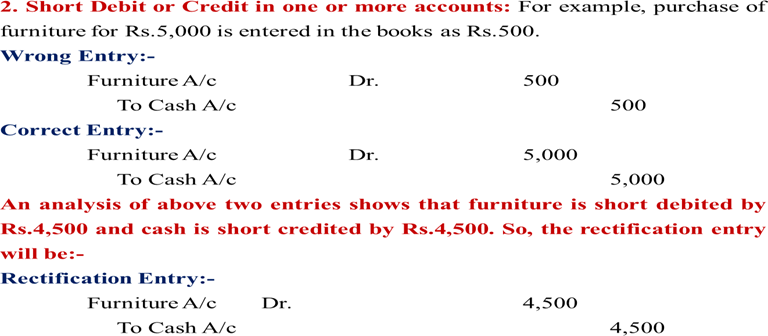

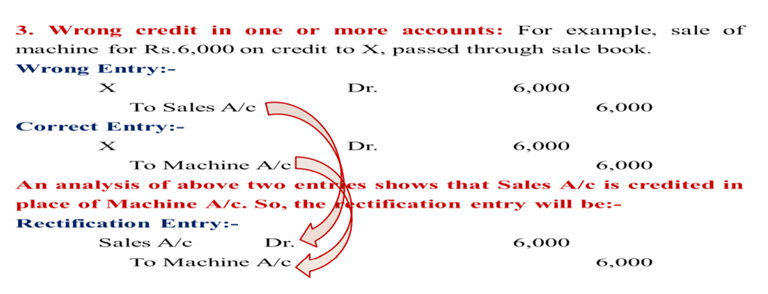

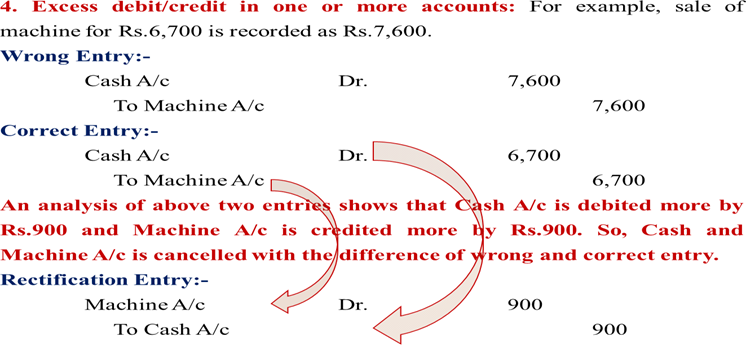

Rectification of Two Sided Errors before Preparation of Trial Balance

As these errors affect two accounts simultaneously, they are hence called two-sided errors. They have no effect on Trial Balance. These are mainly errors of recording, errors of principle, error of posting to wrong account and error of complete omission. Rectification of these errors is done with the help of journal entries.

In this process of rectification, for the sake of understanding, three journal entries are passed –

the correct entry, wrong entry, and the rectifying entry.

- The correct entry denotes the journal entry which should have been recorded.

- The wrong entry signifies the incorrect entry that has actually been passed in the books.

- The rectifying entry represents the journal entry passed to rectify the error.

Rectification of Two Sided Errors

Rectification of Errors after Preparation of Trial Balance but before Preparation of Final Accounts

Sometimes error could not be found before the preparation of trial balance. Thus, in such situation the amount of difference in the Trial Balance is transferred to a newly opened account called Suspense Account. Here also two types or errors:-

- Two Sided Errors:- Rectified by passing a single journal entry without opening Suspense Account.

- One Sided Errors:- Rectified by passing a single journal entry by opening Suspense Account.

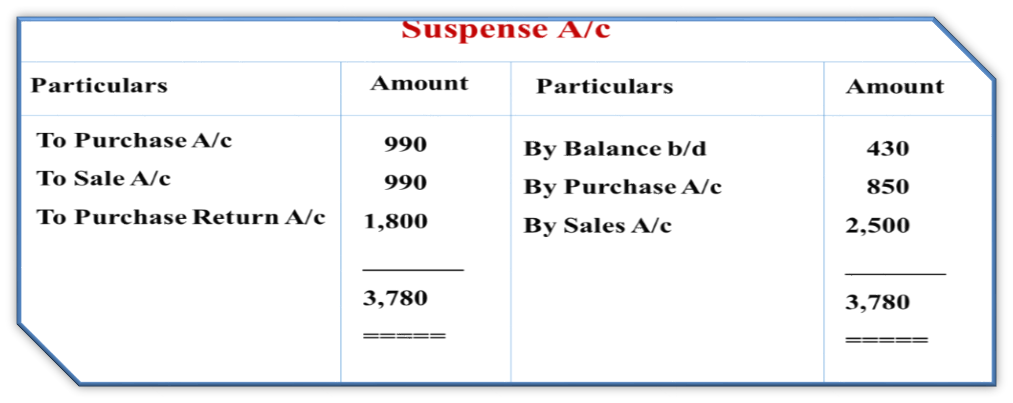

Suspense Account

When the totals of debit and credit side of Trial Balance do not agree with each other and the errors made in accounts are not detected, then the amount of difference in totals of both sides is transferred to suspense account. As the errors are rectified, the balance of suspense account goes on reducing.

The suspense account is a nominal account. The prime objective of opening this account is to balance the Trial Balance. In the financial statements, the suspense account is shown in the Balance Sheet on either the assets or liabilities side depending on the nature of its balance.

Rectification of One Sided Error after Preparation of Trial Balance

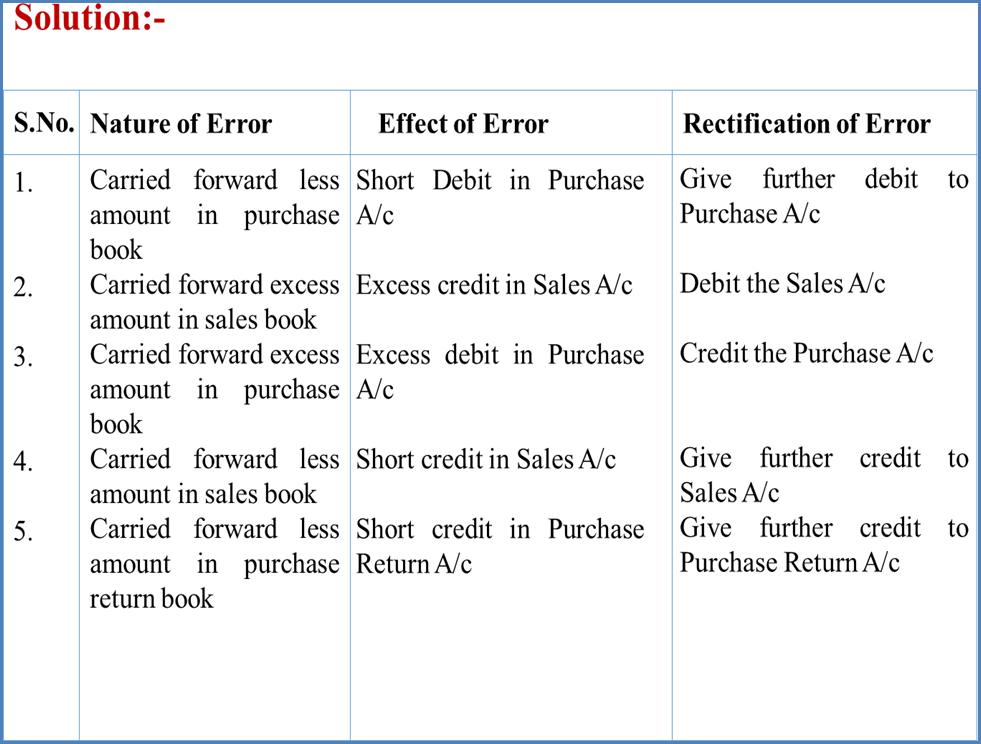

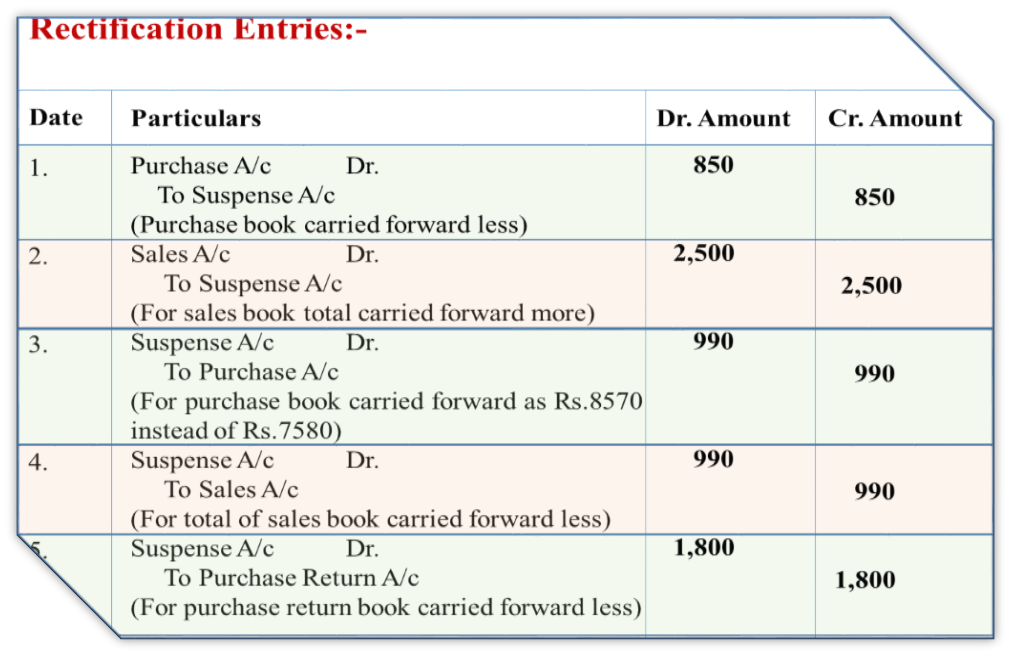

Assuming that a Suspense Account have a balance of Rs.430, correct the following errors which were discovered after the preparation of trial balance and also prepare Suspense Account:

- Purchases book is carried forward Rs.850 less.

- Sales book total is carried forward Rs.2,500 more.

- The total of Rs.7,580 in the purchases book has been carried forward as Rs.8,570.

- The total of the sales book Rs.6,550 on page 20 was carried forward to page 21 as Rs.5,560.

- Purchases return book was carried forward as Rs.3,520 instead of Rs.5,320.

Vision classes

Vision classes