1. Modes of reconstitution of a partnership firm, Admission of a new partner

(MODES OF RECONSTITUTION)

A partnership firm may go for reconstitution for various reasons such as;

- Change in the profit-sharing ratio among the Existing Partners.

- Admission of a Partner.

- The Retirement of an Existing Partner.

- Death or Insolvency of a Partner.

ADMISSION OF A PARTNER

- Admission of a partner is one of the modes of reconstitution of partnership firm because when a new partner is admitted, the existing agreement among the partners comes to an end & a new agreement comes into existence which results in change in profit sharing ratio, goodwill valuation & reassessment of assets & liabilities.

- The capital contribution of the new partner, his liabilities, and share of profits is decided upon.

- As per Section 31 of the Indian Partnership Act, the new partner shall not be admitted to the firm without the consent of all existing partners.

- After admission, the new partner gets the following two rights :

- Right to share future profits of the firm

- Right to share in the assets of the firm

- He/she also becomes liable for any liability of the business incurred after admission & any loss incurred by the firm

- The new/incoming partner receives share in future profits that is equal to the sacrifice of profit by an existing partner/partners of the firm & the same new partner has to compensate the partner/partners who are sacrificing their share in profits in his/her favor.

- Such amount paid by the incoming partner is known as Goodwill or Premium for Goodwill.

- Besides Goodwill/Premium for Goodwill, the new partner also contributes in Capital to get the rights in the assets of the firm.

Effects of Admission of Partner

- Old partnership agreement comes to an end & a new agreement is formed.

- New or incoming partner becomes entitled to the future share of profits & losses of the firm.

- New or incoming partner contributes an agreed amount of capital in the firm.

- New or incoming partner gets a right to the assets of the firm.

- Adjustments are made regarding the accumulated profits & losses

- Assets are revalued & liabilities are reassessed & the net change is adjusted in existing or old partner’s capital accounts in their old profit sharing ratio.

- Goodwill of the firm is valued in order to pay the sacrificing partner for their sacrificed share by the gaining partners through their capital accounts.

What are the adjustments required on the admission of a partner?

- Determining new profit sharing ratio

- Valuation of adjustment of goodwill

- Adjustment of profit/loss arising from revaluation of assets & reassessment of liabilities.

- Adjustments of accumulated profits, reserves & losses.

- Adjustment of capital (if agreed)

2. New profit sharing ratio, Sacrificing Ratio

Determination of New Profit Sharing Ratio

The new or incoming partner is entitled to the share of future profits & losses of the firm. Therefore, there will be a change in the existing profit sharing ratio of the old partners since the new partner will acquire his/her share from the existing share of old partners. The new or incoming partners may acquire the share from the old partner in the following ways;

- In their old profit-sharing ratio

- In a particular ratio or surrendered ratio

- In a particular fraction from some of the partners

Let us discuss in detail;

- When a new partner acquires his share from old or existing partners in their old profit sharing ratio;

In this situation, the share of the new partner is given & it is assumed that the new partner has acquired his share from old partners in their old profit sharing ratio. Old partners continue to share the balance profits & losses in their old profit-sharing ratio. Unless otherwise agreed, the profit-sharing ratio of the existing partners remains unchanged & the new profit sharing ratio is determined by deducting new or incoming partner’s share from 1 & then dividing the balance in old profit sharing ratio of the old partners.

- When share of the New partner is given & new ratio of Old Partners is also given;

In this case, the new partner’s share is deducted from 1 & the balance is divided among old partners in their new ratio. Hence, there is a new profit-sharing ratio for all the partners.

- When New or Incoming Partner acquires his share from old or existing partners in a particular ratio;

In such a case, the new or incoming partner acquires a part of share of profits from one partner & a part of share of profits from another partner. The existing partner’s share will change to the extent of share sacrificed on admission of new partner.

- When new or incoming partner acquires his shares by surrender of particular fraction of their shares by the old or existing partners;

In such a case, the shares surrendered by the old partners in favor of the new partners are added & it becomes the share of the new partner. The shares surrendered by the old partners is deducted from their respective share to determine old partner’s share in the reconstituted firm.

The Concept of Sacrificing Ratio

Sacrificing ratio can be explained as the ratio in which existing or old partners sacrifice their share of profits in favor of the new or incoming partner. It can also be defined as the ratio in which the new partner is given a share by the existing partners. This share can be given by all the partners equally or by some of the partners in agreed share. Sacrificing ratio determines the compensation that new partner should pay to the old partners for the share of profits sacrificed by them. The following can be the situations under which sacrificing ratio is determined;

- When the share of new or incoming partner is given without giving the details of the sacrifice made by the old or existing partners

In this situation, there is no change in the profit sharing ratio of old partners because it is assumed that the partners make sacrifices in their old profit sharing ratio & for that reason sacrificing ratio is always in the old profit sharing ratio.

- When the old ratio of old or existing partners & new ratio of all the partners are given

In this case, the sacrificing ratio is the difference between the old ratio & the new ratio.

- When new or incoming partner acquires the share by surrendering a particular fraction of shares by old partners

In such a case, the shares surrendered by the old partner in favor of the new partner are added & it becomes the share of the incoming or new partner. The shares so surrendered by the old partner is deducted from his old share to find out his share in the reconstituted firm.

3. Goodwill - Meaning, Nature & Valuation

Goodwill:

Goodwill is the value of the reputation of a firm. In other words, a well-established business develops the advantage of a good name, reputation and wide business connections. This helps the business to earn more profits as compared to newly set-up businesses. This advantage in monetary terms is called ‘Goodwill’ & it arises only if a firm is able to earn higher profits than normal.

“Goodwill may be said to be that element arising from the reputation, connections or other advantages possessed by a business which enable it to earn greater profits than the return normally to be expected on the capital represented by the net tangible assets employed in the business.” – Spicer and Pegler

Characteristics of Goodwill:

- Goodwill is an intangible asset

- It is a valuable asset. It helps in earning higher profits than normal.

- It is very difficult to place an exact value on goodwill. It is fluctuating from time to time due to changing circumstances of the business.

- Goodwill is an attractive force that brings in customers.

- Goodwill comes into existence due to various factors.

Factors Affecting the Value of Goodwill

1. Nature of business: Company produces high value-added products or has stable demand in the market. Such a company will have more goodwill and is able to earn more profits.

2. Location: If a business is located in a favorable place, it will attract more customers and therefore will have more goodwill.

3. Efficient Management: Efficient Management brings high productivity and costs efficiency to the business which enables it to earn higher profits and thus more goodwill.

4. Market Situation: A firm under monopoly or limited competition enjoys high profits which leads to a higher value of goodwill.

5. Special Advantages: A firm enjoys a higher value of goodwill if it has special advantages like import licenses, low rate and assured supply of power, long-term contracts for sale and for purchase, patents, trademarks etc.

6. Quality of Products: If the quality of products of the firm is good and regular, then it has more goodwill.

Valuation of Goodwill: Why is it needed?

- At the time of sale of a business;

- Change in the profit-sharing ratio amongst the existing partners;

- Admission of a new partner.

- Retirement of a partner;

- Death of a partner;

- Dissolution of a firm;

- The amalgamation of the partnership firm

Methods of Valuation of Goodwill: There are various methods for the valuation of goodwill in the partnership business. The value of goodwill may differ in different methods. Goodwill is an intangible asset, so it is very difficult to calculate its exact value. As per the money measurement concept of Accounting, anything that cannot be measured in terms of money should not be recorded in books of accounts. Therefore, it is important to convert Goodwill into monetary terms to record it in the books of accounts. The methods followed for valuing goodwill are:

- Average Profit Method

- Super Profit Method

- Capitalisation Method.

1. Average Profit Method: In this method, Goodwill is calculated on the basis of the number of past years profits. In this method, the goodwill is valued at an agreed number of years purchase of the average profits of the past few years. A number of years purchase means the period for which the business would be able to earn profit only on the basis of the Goodwill of the business.

There are two different methods of calculating average profit which are:

1. Simple average

2. Weighted average

Simple Average: In the simple average method, the goodwill is calculated by multiplying the average profit with the agreed number of years of purchase.

Step 1 – Find out normal profit by deducting abnormal gains & non-business incomes & adding abnormal losses & non-business expenses.

Step 2 – Average Profit = Total Profits/Number of years of profit & loss given

Step 3 - Goodwill = Average Profit x No. of years of purchase

Example of Simple Average Profit Method

The following illustration will help in understanding the concept of Average Profit method more clearly.

ABC & Co. has these profits in the following years

2010 – ₹5000

2011- ₹4000

2012- ₹5000

2013- ₹3000

2014- ₹5000

Calculate the goodwill at 4 years of purchase.

Solution

Average Profit = Total Profit / No.of years

= 5000+4000+5000+3000+5000

= 22000/5

= 4400

Goodwill = Average Profit x No. of years of purchase

= 4400 x 4

= 19600

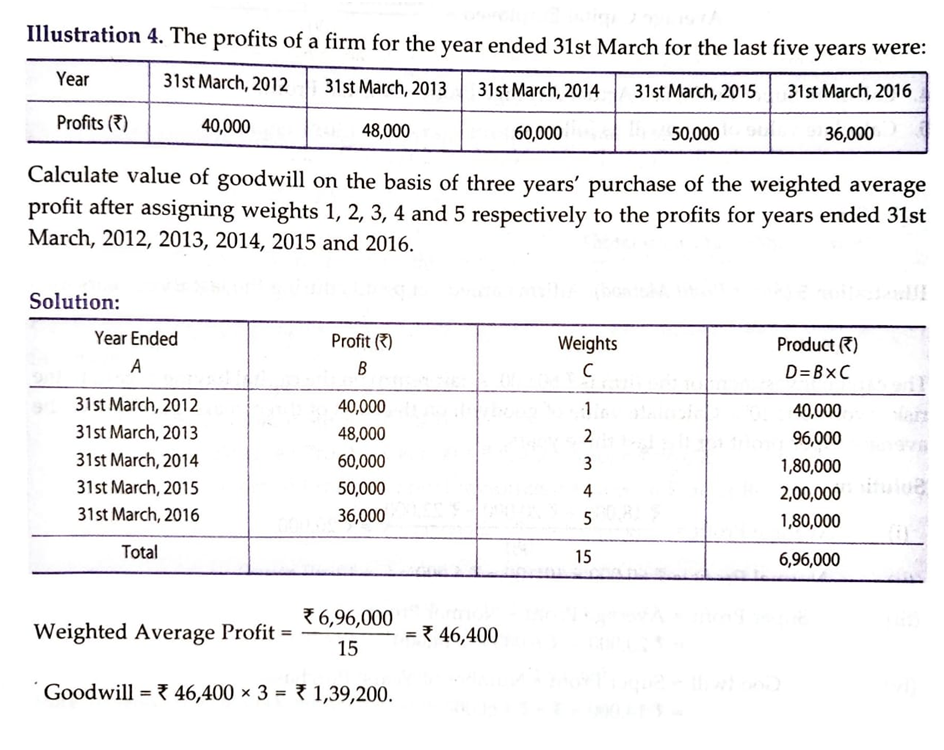

Weighted Average: In the weighted average method, weights are assigned to the profits of each year with more weightage for the recent years. The goodwill is calculated by multiplying the weighted average profit with the number of years of purchase.

Weighted Average Profit = Sum of Weighted profits / Sum of weights

Goodwill = Weighted Average Profit x No. of years of purchase

If the profits remain constant over a period of a few years then there should be equal weightage given for all the years which is the simple average method.

If the profit is fluctuating every year then the preference shifts to the weighted average method with necessary weightage given to profits obtained from recent years.

Super Profit Method: In this method, goodwill is valued on the basis of excess profits earned by a firm in comparison to average profits earned by other firms. When a similar type of business earns a return as a certain percentage of the capital employed, it is called ‘normal return’. The excess of actual profit over the normal profit is called ‘Super Profits’.

For Ex – The other firms are earning profits within @ 15% return whereas a particular firm is earning profits @ 20%. This 5% of extra return is known as Super Profit.

Steps:

- Calculate Actual Average Profit i.e. [ Total Profit No. of Years ]

- Calculate Normal Profit i.e.

= Capital Employed × Normal Rate of Return 100

[Capital Employed = Total Assets – Outside Liabilities] - Find Out Super Profits

Super Profits = Actual Average Profit – Normal Profit

4. Calculate the Value of Goodwill

= Super profit × No. of years purchased

3. Capitalisation Methods: There are two ways of finding out the value of Goodwill through this method;

(a) By capitalizing the average profits

(b) By capitalizing the super-profits.

(a) Capitalisation of Actual Average Profit Method:

- Calculate actual average profit: [ Total Profit No. of Years ]

- Capitalize the average profit on the basis of the normal rate of return:

The capitalized value of the actual average profit

= Actual Average Profit × 100 Normal Rate of Return - Find out the actual capital employed:

Actual Capital Employed = Total Assets at their current value other than [Goodwill, Fictitious assets and non-trade investments] – Outside Liabilities. - Compute the value of Goodwill:

Goodwill = Capitalised value of actual average profit – Actual Capital Employed.

(b) Capitalisation of Super Profit Method:

1. Calculate Actual Capital Employed [same as above].

2. Calculate Super Profit [same as under Super Profit Method].

3. Multiply the Super Profit by the required rate of return multiplier:

Goodwill = Super Profit × 100 Normal Rate of Return

Treatment of Goodwill:

To compensate old partners for the loss (sacrifice) of their share in profits, the incoming partner, who acquires his share of profit from the old partners brings in some additional amount termed as a share of goodwill.

Goodwill, at the time of admission, can be treated in two ways:

- Premium Method

- Revaluation Method.

1. Premium Method:

The premium method is followed when the incoming partner pays his share of goodwill in cash. From the accounting point of view, the following are the different situations related to the treatment of goodwill:

(a) Goodwill (Premium) paid privately (directly to old partners)

[No entry is required]

(b) Goodwill (Premium) brought in cash through the firm

1. Cash A/c or Bank A/c Dr.

To Goodwill A/c

(For the amount of Goodwill brought by new partner)

2. Goodwill A/c Dr.

To Old Partner’s Capital A/c

(For the amount of Goodwill distributed among the old partners in their sacrificing ratio)

Alternatively:

1. Cash A/c or Bank A/c Dr.

To New Partner’s Capital A/c (For the amount of Goodwill brought b> a new partner)

2. New Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c’s (For the amount of Goodwill distributed among the old partners in their sacrificing ratio)

3. If old partners withdrew goodwill (in full or in part) (if any)

Old Partner’s Capital A/c’s Dr.

To Cash A/c or Bank A/c

(For the amount of goodwill withdrawn by the old partners)

When goodwill already exists in books:

If the goodwill already exists in the books of firms and the incoming partner brings his share of goodwill in cash, then the goodwill appearing in the books will have to be written off.

Old Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For Goodwill written-off in old ratio)

After the admission of the partner, all partners may decide to maintain the Goodwill Account in the books of accounts.

Goodwill A/c Dr.

To All Partner’s Capital A/c’s (For Goodwill raised in the new firm after admission of a new partner in new profit sharing ratio)

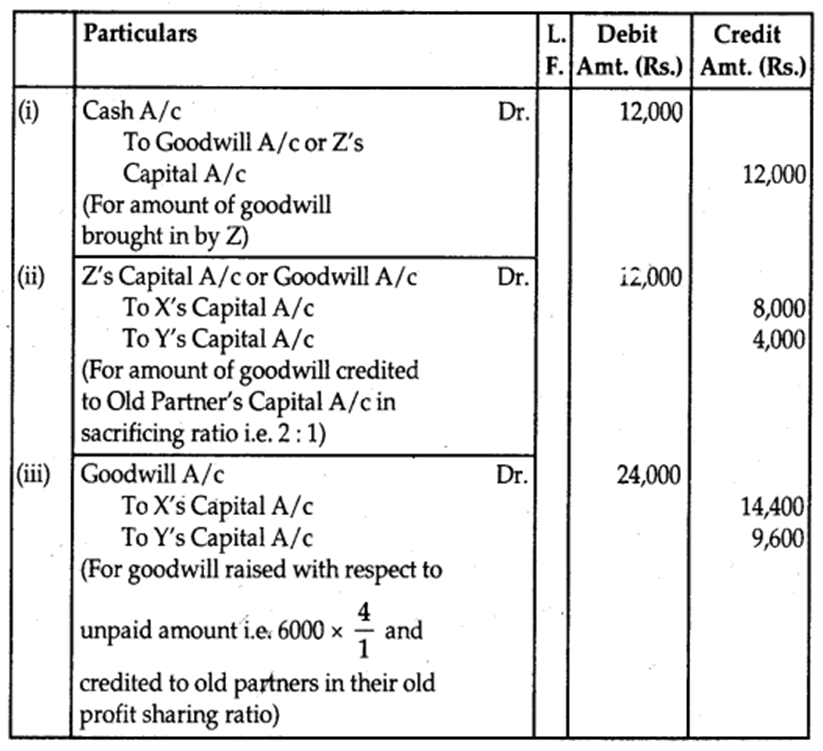

2. Revaluation Method:

If the incoming partner does not bring in his share of goodwill in cash, then this method is followed. In this case, the goodwill account is raised in the books of accounts. When goodwill account is to be raised in the books there are two possibilities:

(a) No goodwill appears in books at the time of admission.

(b) Goodwill already exists in books at the time of admission,

(a) No goodwill appears in the books:

Goodwill A/c Dr.

To Old Partner’s Capital A/c’s (For Goodwill raised at full value in the old ratio)

If the incoming partner brings in a part of his share of goodwill. In that case, after distributing the amount brought in for goodwill among the old partners in their sacrificing ratio, the goodwill account is raised in the books of accounts based on the portion of premium not brought by the incoming partner.

Example: X and Y are partners sharing profits in the ratio of 3: 2. They admit Z as a new partner. 14th share. The sacrificing ratio of X and Y is 2: 1. Z brings Rs. 12,000 as goodwill out of his share of Rs. 18,000. No goodwill account appears in the books of the firm.

Answer:

(b) When Goodwill already exists in the books

1. When the value of goodwill appearing in books is equal to the agreed value:

[No Entry is Required]

2. If the value of goodwill appearing in the books is less than the agreed value:

Goodwill A/c Dr.

To Old Partner’s Capital A/c’s (For Goodwill is raised to its agreed value)

3. If the value of goodwill appearing in the books is more than the agreed value:

Old Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For Goodwill brought down to its agreed value)

If partners, after raising Goodwill in the books and making necessary adjustments decide that the goodwill should not appear in the firm’s balance sheet, then it has to be written off.

All Partners’ Capital A/c’s Dr.

To Goodwill A/c (For Goodwill written off)

Sometimes, the partners may decide not to show goodwill accounts anywhere in books.

New Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c (For adjustment for New Partner’s Share of Goodwill)

Hidden or Inferred Goodwill:

1. To find out the total capital of the firm by new partner’s capital and his share of profit.

Example: New partner’s capital for the 14th share is Rs. 80,000, the entire capital of the new firm will be

80,000 × 41 = Rs. 3,20,000

2. To ascertain the existing total capital of the firm: We will have to ascertain the existing total capital of the new firm by adding the capital (of all partners, including new partner’s capital after adjustments, if any excluding goodwill)

If assets and liabilities are given:

Capital = Assets (at revalued figures) – Liabilities (at revalued figures)

3. Goodwill= Capital from (1) – Capital from (2)

Generally, this method is used, when the incoming partner does not bring his share of goodwill in cash. Here, we find out the total goodwill of the firm. After that, we can find out the new partner’s share of goodwill and treat accordingly.

4. Adjustments of accumulated profits & losses,

Adjustment for Accumulated (Undistributed) Profits and Losses:

1. For Undistributed Profits, Reserves etc.

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

General Reserves A/c Dr.

Reserve fund A/c Dr.

Profit and Loss A/c Dr.

Workmen’s Compensation Fund A/c Dr.

To Old Partner’s Capital A/c’s

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

2. For Undistributed Losses:

Old Partner’s Capital A/c’s Dr.

To Profit and Loss A/c

(For distribution of accumulated losses to old partners in old profit sharing ratio)

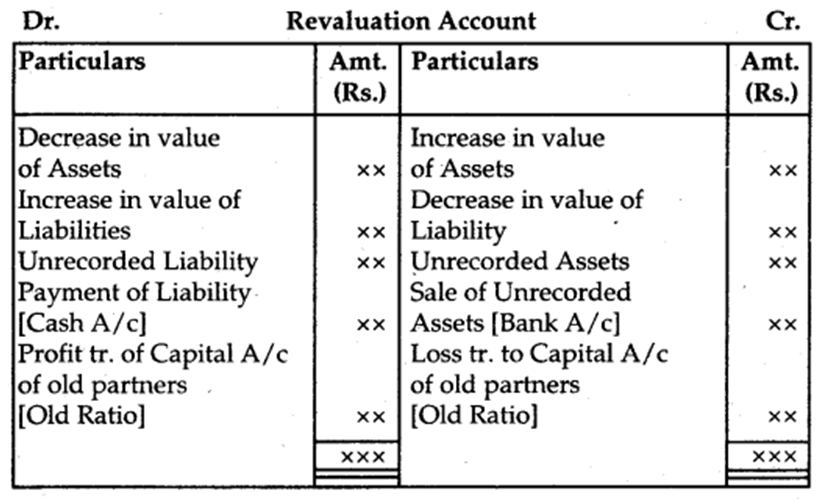

Revaluation of Assets and Reassessment of Liabilities: Revaluation of Assets and Reassessment of Liabilities is done with the help of ‘Revaluation Account’ or ‘Profit and Loss Adjustment Account’.

The journal entries recorded for revaluation of assets and reassessment of liabilities are the following:

1. For increase in the value of an Assets

Assets A/c Dr.

To Revaluation A/c (Gain)

2. For decrease in the value of an Assets

Revaluation A/c Dr.

To Assets A/c (Loss)

3. For appreciation in the amount of Liability

Revaluation A/c Dr.

To Liability A/c (Loss)

4. For reduction in the amount of a Liability

Liability A/c Dr.

To Revaluation A/c (Gain)

5. For recording an unrecorded Assets

Unrecorded Assets A/c Dr.

To Revaluation A/c (Gain)

6. For recording an unrecorded Liability

Revaluation A/c Dr.

To Unrecorded Liability A/c (Loss)

7. For the sale of unrecorded Assets

Cash A/c or Bank A/c Dr.

To Revaluation A/c (Gain)

8. For payment of unrecorded Liability

Revaluation A/c Dr.

To Cash A/c or Bank A/c (Loss)

9. For transfer of gain on Revaluation if the credit balance

Revaluation A/c Dr.

To Old Partner’s Capital A/c’s (Old Ratio)

10. For transfer of loss on Revaluation if debit balance

Old Partner’s Capital A/c’s Dr.

To Revaluation A/c (Old Ratio)

Adjustment of Capitals:

1. When the new partner brings in proportionate capital OR On the basis of the old partner’s capital.

(a) Calculate the adjusted capital of old partners (after all adjustments)

(b) Total capital of the firm

= Combined Adjusted Capital × Reciprocal proportion of the share of old partners

(c) New Partner’s Capital

= Total Capital × Proportion of share of a new partner.

2. On the basis of the new partner’s capital:

(a) Total Capital of the firm = New Partner’s Capital × Reciprocal proportion of his share.

(b) Distribute Total Capital in New Profit Sharing Ratio.

(c) Calculate adjusted capital of old partners.

(d) Calculate the difference between New Capital and Adjusted Capital.

- If the debit side of the Capital Account is bigger then it means he has excess capital

Partner’s ( capital Accounts Dr.

To Cash A /c or Bank A/c or Current A/c - If the credit side is bigger then it means that he has short capital

Cash A/c or Bank A/c or Current A/c Dr.

To Partner’s Capital A/c’s

Change in Profit Sharing Ratio among the Existing Partners:

Sometimes the existing partners of the firm may decide to change their profit-sharing ratio. In such a case, some partners will gain in future profits and some will lose. Here the gaining partners should compensate the losing partners unless otherwise agreed upon. In such a situation, first of all, the loss and gain in the value of goodwill (if any) will have to adjust.

1. Goodwill A/c Dr.

To Partner’s Capital A/c’s (For raising the amount of Goodwill in old ratio)

2. Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For writing off the amount of Goodwill in New Profit sharing ratio)

Alternatively:

Gaining Partner’s Capital A/c’s Dr.

To Losing Partner’s Capital A/c’s (For adjustment due to change in profit sharing ratio)

Accounting Treatment of Goodwill

In case of change in profit sharing ratio, the gaining partner must components the sacrificing partner by paying the proportionate amount of goodwill.

Note :(i) Increase in the value of an Asset and decrease in the value of a liability result in profit.

Assets A/cDr.

To Revaluation

(ii) Decrease in the value of any asset and increase in the value of liability gives loss.

Revaluation A/cDr.

To Assets A/c

(iii) For an increase in the value of liabilities.

Revaluation A/cDr.

To Liabilities A/c

(Increase in value of Liability)

(iv) For a decrease in the value of Liabilities

Liabilities A/cDr.

To Revaluation A/c

(Decrease in the value of Liabilities)

(v) When the Revaluation account shows profit

Revaluation A/cDr.

To Partner’s Capital A/c

(Profit credited to Partner’s Capital A/c in old ratio)

(vi) In case of Revaluation Loss

Partner’s Capital A/c’sDr.

To Revaluation A/c

(Loss debited to Partner’s Capital A/cs in old ratio)

Vision classes

Vision classes