Adjustment for Accumulated (Undistributed) Profits and Losses:

1. For Undistributed Profits, Reserves etc.

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

General Reserves A/c Dr.

Reserve fund A/c Dr.

Profit and Loss A/c Dr.

Workmen’s Compensation Fund A/c Dr.

To Old Partner’s Capital A/c’s

(For distribution of accumulated profits and reserves to old partners in old profit sharing ratio)

2. For Undistributed Losses:

Old Partner’s Capital A/c’s Dr.

To Profit and Loss A/c

(For distribution of accumulated losses to old partners in old profit sharing ratio)

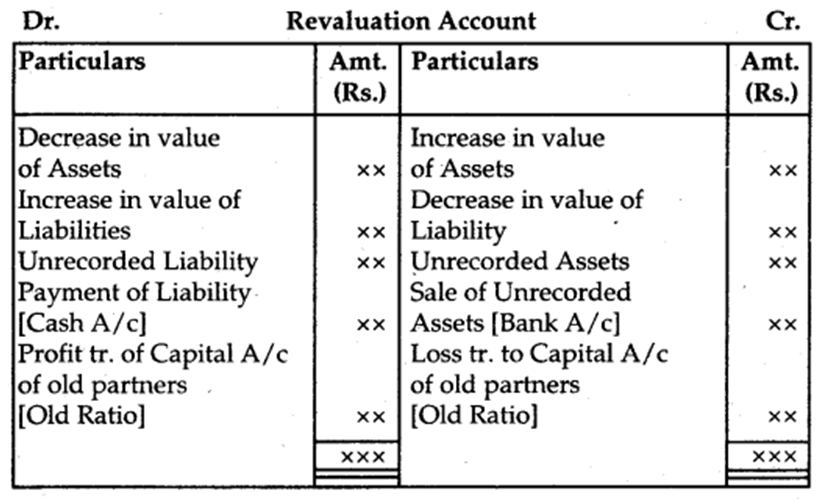

Revaluation of Assets and Reassessment of Liabilities: Revaluation of Assets and Reassessment of Liabilities is done with the help of ‘Revaluation Account’ or ‘Profit and Loss Adjustment Account’.

The journal entries recorded for revaluation of assets and reassessment of liabilities are the following:

1. For increase in the value of an Assets

Assets A/c Dr.

To Revaluation A/c (Gain)

2. For decrease in the value of an Assets

Revaluation A/c Dr.

To Assets A/c (Loss)

3. For appreciation in the amount of Liability

Revaluation A/c Dr.

To Liability A/c (Loss)

4. For reduction in the amount of a Liability

Liability A/c Dr.

To Revaluation A/c (Gain)

5. For recording an unrecorded Assets

Unrecorded Assets A/c Dr.

To Revaluation A/c (Gain)

6. For recording an unrecorded Liability

Revaluation A/c Dr.

To Unrecorded Liability A/c (Loss)

7. For the sale of unrecorded Assets

Cash A/c or Bank A/c Dr.

To Revaluation A/c (Gain)

8. For payment of unrecorded Liability

Revaluation A/c Dr.

To Cash A/c or Bank A/c (Loss)

9. For transfer of gain on Revaluation if the credit balance

Revaluation A/c Dr.

To Old Partner’s Capital A/c’s (Old Ratio)

10. For transfer of loss on Revaluation if debit balance

Old Partner’s Capital A/c’s Dr.

To Revaluation A/c (Old Ratio)

Adjustment of Capitals:

1. When the new partner brings in proportionate capital OR On the basis of the old partner’s capital.

(a) Calculate the adjusted capital of old partners (after all adjustments)

(b) Total capital of the firm

= Combined Adjusted Capital × Reciprocal proportion of the share of old partners

(c) New Partner’s Capital

= Total Capital × Proportion of share of a new partner.

2. On the basis of the new partner’s capital:

(a) Total Capital of the firm = New Partner’s Capital × Reciprocal proportion of his share.

(b) Distribute Total Capital in New Profit Sharing Ratio.

(c) Calculate adjusted capital of old partners.

(d) Calculate the difference between New Capital and Adjusted Capital.

- If the debit side of the Capital Account is bigger then it means he has excess capital

Partner’s ( capital Accounts Dr.

To Cash A /c or Bank A/c or Current A/c - If the credit side is bigger then it means that he has short capital

Cash A/c or Bank A/c or Current A/c Dr.

To Partner’s Capital A/c’s

Change in Profit Sharing Ratio among the Existing Partners:

Sometimes the existing partners of the firm may decide to change their profit-sharing ratio. In such a case, some partners will gain in future profits and some will lose. Here the gaining partners should compensate the losing partners unless otherwise agreed upon. In such a situation, first of all, the loss and gain in the value of goodwill (if any) will have to adjust.

1. Goodwill A/c Dr.

To Partner’s Capital A/c’s (For raising the amount of Goodwill in old ratio)

2. Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For writing off the amount of Goodwill in New Profit sharing ratio)

Alternatively:

Gaining Partner’s Capital A/c’s Dr.

To Losing Partner’s Capital A/c’s (For adjustment due to change in profit sharing ratio)

Accounting Treatment of Goodwill

In case of change in profit sharing ratio, the gaining partner must components the sacrificing partner by paying the proportionate amount of goodwill.

Note :(i) Increase in the value of an Asset and decrease in the value of a liability result in profit.

Assets A/cDr.

To Revaluation

(ii) Decrease in the value of any asset and increase in the value of liability gives loss.

Revaluation A/cDr.

To Assets A/c

(iii) For an increase in the value of liabilities.

Revaluation A/cDr.

To Liabilities A/c

(Increase in value of Liability)

(iv) For a decrease in the value of Liabilities

Liabilities A/cDr.

To Revaluation A/c

(Decrease in the value of Liabilities)

(v) When the Revaluation account shows profit

Revaluation A/cDr.

To Partner’s Capital A/c

(Profit credited to Partner’s Capital A/c in old ratio)

(vi) In case of Revaluation Loss

Partner’s Capital A/c’sDr.

To Revaluation A/c

(Loss debited to Partner’s Capital A/cs in old ratio)

Vision classes

Vision classes