Goodwill:

Goodwill is the value of the reputation of a firm. In other words, a well-established business develops the advantage of a good name, reputation and wide business connections. This helps the business to earn more profits as compared to newly set-up businesses. This advantage in monetary terms is called ‘Goodwill’ & it arises only if a firm is able to earn higher profits than normal.

“Goodwill may be said to be that element arising from the reputation, connections or other advantages possessed by a business which enable it to earn greater profits than the return normally to be expected on the capital represented by the net tangible assets employed in the business.” – Spicer and Pegler

Characteristics of Goodwill:

- Goodwill is an intangible asset

- It is a valuable asset. It helps in earning higher profits than normal.

- It is very difficult to place an exact value on goodwill. It is fluctuating from time to time due to changing circumstances of the business.

- Goodwill is an attractive force that brings in customers.

- Goodwill comes into existence due to various factors.

Factors Affecting the Value of Goodwill

1. Nature of business: Company produces high value-added products or has stable demand in the market. Such a company will have more goodwill and is able to earn more profits.

2. Location: If a business is located in a favorable place, it will attract more customers and therefore will have more goodwill.

3. Efficient Management: Efficient Management brings high productivity and costs efficiency to the business which enables it to earn higher profits and thus more goodwill.

4. Market Situation: A firm under monopoly or limited competition enjoys high profits which leads to a higher value of goodwill.

5. Special Advantages: A firm enjoys a higher value of goodwill if it has special advantages like import licenses, low rate and assured supply of power, long-term contracts for sale and for purchase, patents, trademarks etc.

6. Quality of Products: If the quality of products of the firm is good and regular, then it has more goodwill.

Valuation of Goodwill: Why is it needed?

- At the time of sale of a business;

- Change in the profit-sharing ratio amongst the existing partners;

- Admission of a new partner.

- Retirement of a partner;

- Death of a partner;

- Dissolution of a firm;

- The amalgamation of the partnership firm

Methods of Valuation of Goodwill: There are various methods for the valuation of goodwill in the partnership business. The value of goodwill may differ in different methods. Goodwill is an intangible asset, so it is very difficult to calculate its exact value. As per the money measurement concept of Accounting, anything that cannot be measured in terms of money should not be recorded in books of accounts. Therefore, it is important to convert Goodwill into monetary terms to record it in the books of accounts. The methods followed for valuing goodwill are:

- Average Profit Method

- Super Profit Method

- Capitalisation Method.

1. Average Profit Method: In this method, Goodwill is calculated on the basis of the number of past years profits. In this method, the goodwill is valued at an agreed number of years purchase of the average profits of the past few years. A number of years purchase means the period for which the business would be able to earn profit only on the basis of the Goodwill of the business.

There are two different methods of calculating average profit which are:

1. Simple average

2. Weighted average

Simple Average: In the simple average method, the goodwill is calculated by multiplying the average profit with the agreed number of years of purchase.

Step 1 – Find out normal profit by deducting abnormal gains & non-business incomes & adding abnormal losses & non-business expenses.

Step 2 – Average Profit = Total Profits/Number of years of profit & loss given

Step 3 - Goodwill = Average Profit x No. of years of purchase

Example of Simple Average Profit Method

The following illustration will help in understanding the concept of Average Profit method more clearly.

ABC & Co. has these profits in the following years

2010 – ₹5000

2011- ₹4000

2012- ₹5000

2013- ₹3000

2014- ₹5000

Calculate the goodwill at 4 years of purchase.

Solution

Average Profit = Total Profit / No.of years

= 5000+4000+5000+3000+5000

= 22000/5

= 4400

Goodwill = Average Profit x No. of years of purchase

= 4400 x 4

= 19600

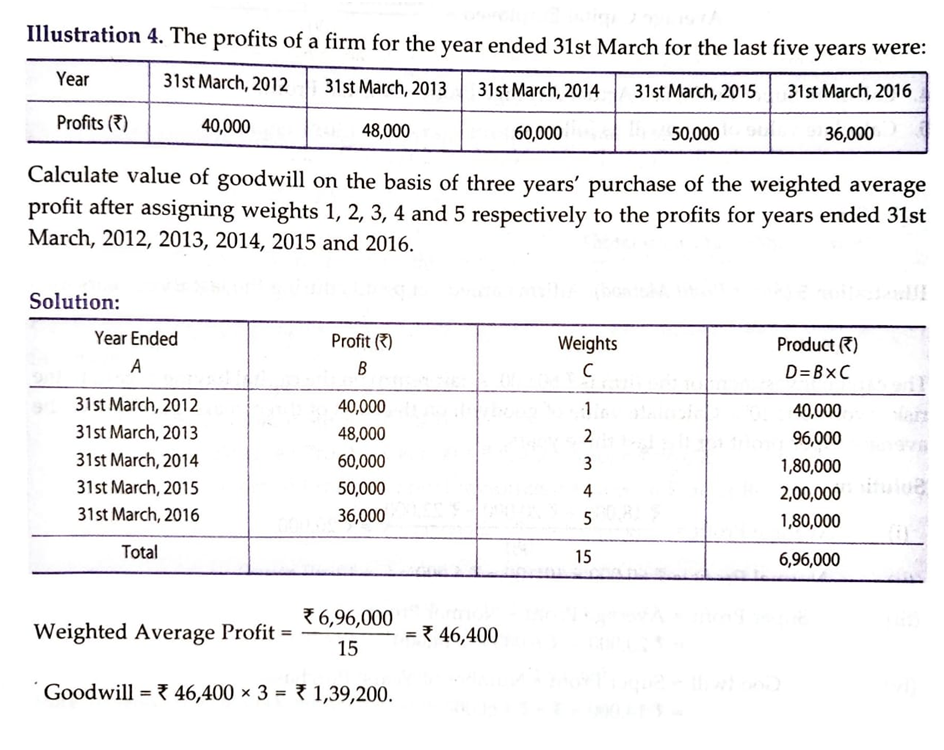

Weighted Average: In the weighted average method, weights are assigned to the profits of each year with more weightage for the recent years. The goodwill is calculated by multiplying the weighted average profit with the number of years of purchase.

Weighted Average Profit = Sum of Weighted profits / Sum of weights

Goodwill = Weighted Average Profit x No. of years of purchase

If the profits remain constant over a period of a few years then there should be equal weightage given for all the years which is the simple average method.

If the profit is fluctuating every year then the preference shifts to the weighted average method with necessary weightage given to profits obtained from recent years.

Super Profit Method: In this method, goodwill is valued on the basis of excess profits earned by a firm in comparison to average profits earned by other firms. When a similar type of business earns a return as a certain percentage of the capital employed, it is called ‘normal return’. The excess of actual profit over the normal profit is called ‘Super Profits’.

For Ex – The other firms are earning profits within @ 15% return whereas a particular firm is earning profits @ 20%. This 5% of extra return is known as Super Profit.

Steps:

- Calculate Actual Average Profit i.e. [ Total Profit No. of Years ]

- Calculate Normal Profit i.e.

= Capital Employed × Normal Rate of Return 100

[Capital Employed = Total Assets – Outside Liabilities] - Find Out Super Profits

Super Profits = Actual Average Profit – Normal Profit

4. Calculate the Value of Goodwill

= Super profit × No. of years purchased

3. Capitalisation Methods: There are two ways of finding out the value of Goodwill through this method;

(a) By capitalizing the average profits

(b) By capitalizing the super-profits.

(a) Capitalisation of Actual Average Profit Method:

- Calculate actual average profit: [ Total Profit No. of Years ]

- Capitalize the average profit on the basis of the normal rate of return:

The capitalized value of the actual average profit

= Actual Average Profit × 100 Normal Rate of Return - Find out the actual capital employed:

Actual Capital Employed = Total Assets at their current value other than [Goodwill, Fictitious assets and non-trade investments] – Outside Liabilities. - Compute the value of Goodwill:

Goodwill = Capitalised value of actual average profit – Actual Capital Employed.

(b) Capitalisation of Super Profit Method:

1. Calculate Actual Capital Employed [same as above].

2. Calculate Super Profit [same as under Super Profit Method].

3. Multiply the Super Profit by the required rate of return multiplier:

Goodwill = Super Profit × 100 Normal Rate of Return

Treatment of Goodwill:

To compensate old partners for the loss (sacrifice) of their share in profits, the incoming partner, who acquires his share of profit from the old partners brings in some additional amount termed as a share of goodwill.

Goodwill, at the time of admission, can be treated in two ways:

- Premium Method

- Revaluation Method.

1. Premium Method:

The premium method is followed when the incoming partner pays his share of goodwill in cash. From the accounting point of view, the following are the different situations related to the treatment of goodwill:

(a) Goodwill (Premium) paid privately (directly to old partners)

[No entry is required]

(b) Goodwill (Premium) brought in cash through the firm

1. Cash A/c or Bank A/c Dr.

To Goodwill A/c

(For the amount of Goodwill brought by new partner)

2. Goodwill A/c Dr.

To Old Partner’s Capital A/c

(For the amount of Goodwill distributed among the old partners in their sacrificing ratio)

Alternatively:

1. Cash A/c or Bank A/c Dr.

To New Partner’s Capital A/c (For the amount of Goodwill brought b> a new partner)

2. New Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c’s (For the amount of Goodwill distributed among the old partners in their sacrificing ratio)

3. If old partners withdrew goodwill (in full or in part) (if any)

Old Partner’s Capital A/c’s Dr.

To Cash A/c or Bank A/c

(For the amount of goodwill withdrawn by the old partners)

When goodwill already exists in books:

If the goodwill already exists in the books of firms and the incoming partner brings his share of goodwill in cash, then the goodwill appearing in the books will have to be written off.

Old Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For Goodwill written-off in old ratio)

After the admission of the partner, all partners may decide to maintain the Goodwill Account in the books of accounts.

Goodwill A/c Dr.

To All Partner’s Capital A/c’s (For Goodwill raised in the new firm after admission of a new partner in new profit sharing ratio)

2. Revaluation Method:

If the incoming partner does not bring in his share of goodwill in cash, then this method is followed. In this case, the goodwill account is raised in the books of accounts. When goodwill account is to be raised in the books there are two possibilities:

(a) No goodwill appears in books at the time of admission.

(b) Goodwill already exists in books at the time of admission,

(a) No goodwill appears in the books:

Goodwill A/c Dr.

To Old Partner’s Capital A/c’s (For Goodwill raised at full value in the old ratio)

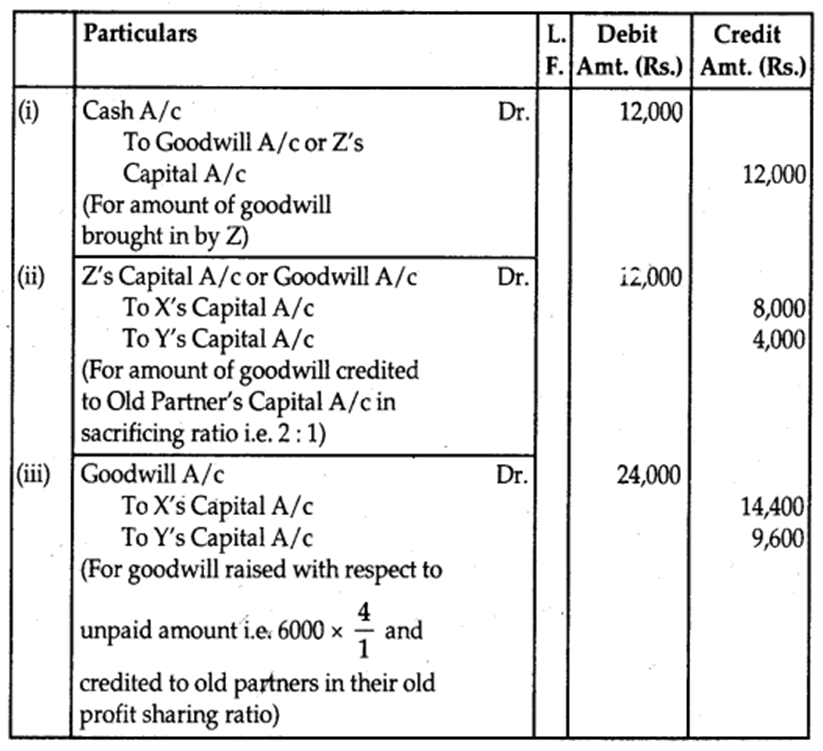

If the incoming partner brings in a part of his share of goodwill. In that case, after distributing the amount brought in for goodwill among the old partners in their sacrificing ratio, the goodwill account is raised in the books of accounts based on the portion of premium not brought by the incoming partner.

Example: X and Y are partners sharing profits in the ratio of 3: 2. They admit Z as a new partner. 14th share. The sacrificing ratio of X and Y is 2: 1. Z brings Rs. 12,000 as goodwill out of his share of Rs. 18,000. No goodwill account appears in the books of the firm.

Answer:

(b) When Goodwill already exists in the books

1. When the value of goodwill appearing in books is equal to the agreed value:

[No Entry is Required]

2. If the value of goodwill appearing in the books is less than the agreed value:

Goodwill A/c Dr.

To Old Partner’s Capital A/c’s (For Goodwill is raised to its agreed value)

3. If the value of goodwill appearing in the books is more than the agreed value:

Old Partner’s Capital A/c’s Dr.

To Goodwill A/c

(For Goodwill brought down to its agreed value)

If partners, after raising Goodwill in the books and making necessary adjustments decide that the goodwill should not appear in the firm’s balance sheet, then it has to be written off.

All Partners’ Capital A/c’s Dr.

To Goodwill A/c (For Goodwill written off)

Sometimes, the partners may decide not to show goodwill accounts anywhere in books.

New Partner’s Capital A/c Dr.

To Old Partner’s Capital A/c (For adjustment for New Partner’s Share of Goodwill)

Hidden or Inferred Goodwill:

1. To find out the total capital of the firm by new partner’s capital and his share of profit.

Example: New partner’s capital for the 14th share is Rs. 80,000, the entire capital of the new firm will be

80,000 × 41 = Rs. 3,20,000

2. To ascertain the existing total capital of the firm: We will have to ascertain the existing total capital of the new firm by adding the capital (of all partners, including new partner’s capital after adjustments, if any excluding goodwill)

If assets and liabilities are given:

Capital = Assets (at revalued figures) – Liabilities (at revalued figures)

3. Goodwill= Capital from (1) – Capital from (2)

Generally, this method is used, when the incoming partner does not bring his share of goodwill in cash. Here, we find out the total goodwill of the firm. After that, we can find out the new partner’s share of goodwill and treat accordingly.

Vision classes

Vision classes