INVESTMENT

Investment or capital formation refers to addition to the capital stock of an economy. For example-Construction of roads, flyovers, Building, etc.

Investment can be of two forms:

Gross Investment

- Definition: It is an addition to the stock of capital before making allowance for depreciation

Net Investment

- Definition: Net Investment is an actual addition made to the capital stock of the economy in a given period.

- Net Investment = Gross Investment- Depreciation

DEPRECIATION (Consumption of fixed capital)

Definition: It refers to a fall in the value of an asset due to normal wear and tear ,the passage of time or expected obsolescence (change in technology).

NET INDIRECT TAXES (NIT)

- NIT refers to the difference between Indirect Tax and Subsidies.

- Net Indirect Taxes (NIT) = Indirect Tax-Subsidies

Indirect Tax

Definition: Indirect Taxes refers to those taxes, which are imposed by the government on production and sale of goods and services. For example- Goods and Services Tax (GST)

Subsidies

Definition: Subsidies are the ’economic assistance’ given by the government to the firms and households, with a motive of the general welfare. For Example- Subsidy on LPG Gas Cylinders.

Factor Cost

It refers to the amount paid to factors of production for their contribution to the production process.

Market Price

It refers to the Price at which product is actually sold in the market. For example- If price of the LPG cylinder is Rs.1000 and the tax rate is 10%, the price of the cylinder becomes Rs.1100 but a subsidy of Rs.50 is provided by the government hence the final price is Rs.1050.

Here Rs.1000 is factor cost, Rs.1050 is Market Price, Rs.100 is indirect Taxes and Rs.250 is a subsidy.

NET FACTOR INCOME FROM ABROAD (NFIA)

Definition: It refers to the difference between factor income received from the rest of the world and factor income paid to the rest of the world.

NFIA = Factor Income earned from Abroad-Factor Income paid Abroad.

Significance: NFIA is significant to differentiate between ‘domestic income’ and ‘national income’.

National Income= Domestic Income + NFIA.

Components of NFIA

- Net compensation of Employees- It is the difference between income from work received by resident workers living or employed abroad for less than one year & similar payments made to non-resident workers employed domestic territory of the country.

- Net Income from Property and entrepreneurship - It refers to the difference between income from property and entrepreneurship received by residents of the country and similar payments made to Non-residents

- Net Retained earnings - It refers to the difference between retained earnings of resident’s companies located abroad and retained earnings of non-resident companies located within the domestic territory of that country.

NFIA = Net Compensation of Employees + Net Income from Property and Entrepreneurship + Net Retained earnings

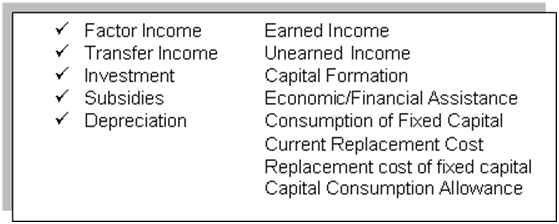

Synonyms/Similar terms of this chapter

PathSet Publications

PathSet Publications