MAINTENANCE OF CAPITAL ACCOUNTS& DISTRIBUTION OF PROFITS AMONG THE PARTNERS

To record the changes in Capital A/c of each partner, we prepare individual capital accounts for each partner. The capital accounts of partners can be maintained in two methods :

Fixed Capital Method

Fluctuating Capital Method

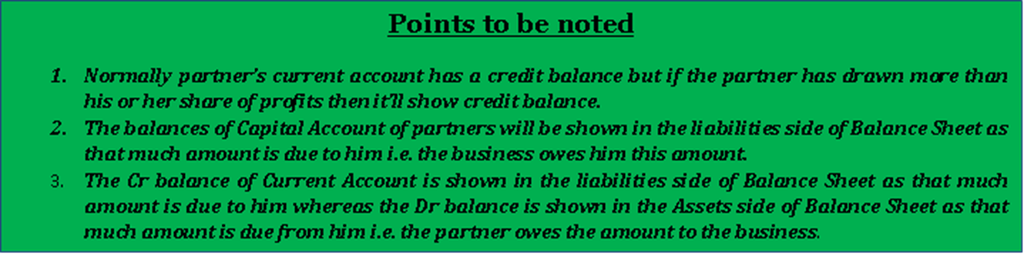

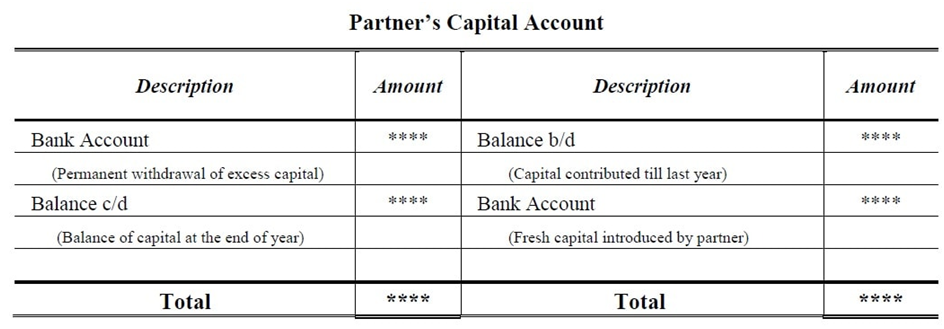

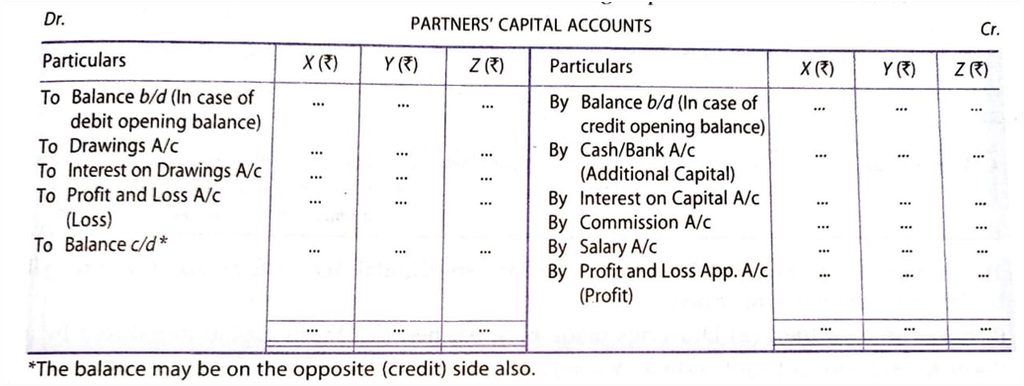

- Fixed Capital Method – In this method, the capital A/c of partners remains unaltered or fixed. When this method is followed, two accounts i.e. Capital A/c & Current A/c for each partner are maintained.

- Capital A/c – The capital account remains unaltered i.e. fixed unless additional capital is introduced or withdrawal is made from the existing capital. If there is no fresh capital introduced or any withdrawals, the capital account of the partner show the same balance year after year.

- Current A/c – It is prepared to record transactions other than introduction & withdrawal of capital such as interest on capital, interest on drawings, salary or commission to a partner, and share of profits/losses. The balance of current account always keeps fluctuating because of these adjustments.

Current A/c is debited with;

- Drawings made by partner

- Interest on drawings

- Share of loss

- Transfer of amount to any capital account permanently

Current A/c is credited with;

- Interest on capital

- Salary or commission

- Share of profits

- Transfer of any amount from capital account permanently

- Fluctuating Capital A/c – Under Fluctuating Capital method, only one account namely Capital A/c is maintained for each partner. All the transactions of a partner like salary, commissions, interest on capital are recorded in this account. As a result of this, the capital a/c fluctuates with every transaction. The debit balance of capital account is shown in the liabilities side & the credit balance is shown in the asset side.

INTEREST ON DRAWNGS

- Drawings refers to the amount withdrawn by the owner in cash or in kind.

- Interest on drawings is charged only when it is mentioned in the partnership deed.

- When it is charged, it is debited to Profit & Loss Appropriation A/c.

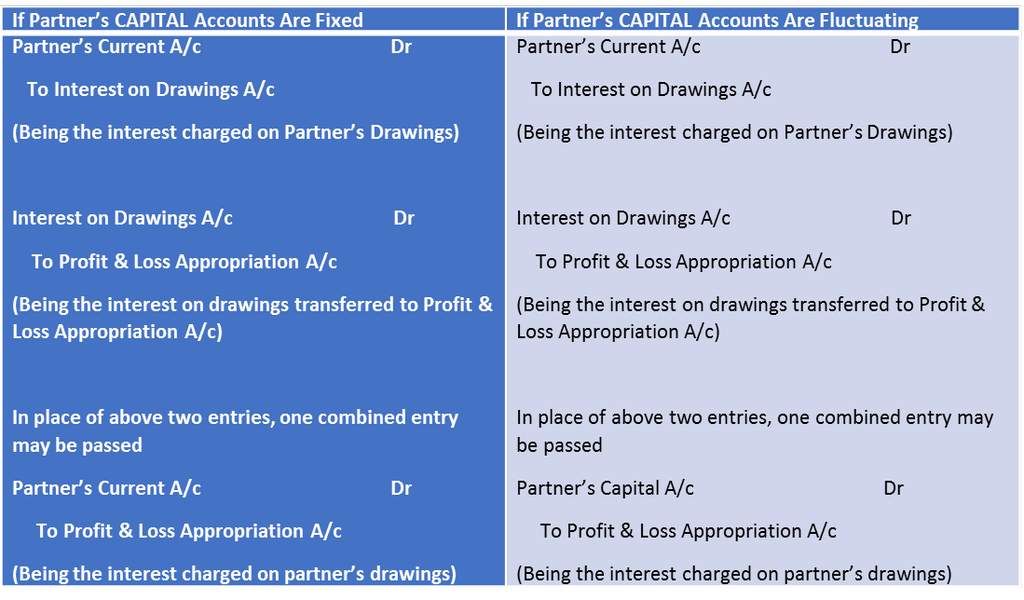

- It is either debited to Partner’s Capital A/c or Current A/c depending on whether Fixed Capital or Fluctuating Capital method is being followed

INTEREST ON DRAWINGS : - HOW IT IS CALCULATED?

- The computation of Interest on Drawings depends upon various factors like when the amount is withdrawn & the time period for which it remains withdrawn etc.

- So, the situations can be as follows;

- Fixed amount is withdrawn at the BEGINNING of every Month

If a partner withdraws fixed amount in the beginning of every month, interest is charged on the whole amount for 6 ½ months

Interest on Drawings = Total Drawings X Rate of Interest X 6 ½ 100 12

6 ½ months = Average Period

Average Period Formula = Time left after first drawings + Time left after last drawings 2

- Average period should be used only when the amount of Drawings is uniform & the time interval between the two consecutive drawings is also uniform.

- Fixed amount is withdrawn at the END of every Month.

If a partner withdraws a fixed amount at the end of every month, interest is charged for 5 ½ months.

Interest on Drawings = Total Drawings X Rate of Interest X 5 ½ 100 12

- Fixed amount is withdrawn in the MIDDLE of every Month

Interest on Drawings = Total Drawings X Rate of Interest X 6 100 12

- Fixed amount is withdrawn at the BEGINNING of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 7 ½ 100 12

- Fixed amount is withdrawn in the MIDDLE of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 6 100 12

- Fixed amount is withdrawn at the END of every QUARTER

Interest on Drawings = Total Drawings X Rate of Interest X 4 ½ 100 12

- Fixed amount is withdrawn during 6 MONTHS

- At the BEGINNING OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3 ½

100 12

- In the MIDDLE OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3

100 12

- At the END OF EACH MONTH

Interest on Drawings = Total Drawings X Rate X 3 ½

100 12

- If Unequal amount is withdrawn at DIFFERENT DATES, interest on drawings is calculated on the basis of the Simple Method or Product Method

Interest on Drawings = Total of Product X Rate of Interest x 1 or 1 100 12 365

- When the date of withdrawal IS NOT GIVEN, the interest on drawings is calculated for six months on an average basis.

- When Rate of Interest is given without the word PER ANNUM, interest is charged without considering the time factor

Journal Entries to Record Interest on Drawings

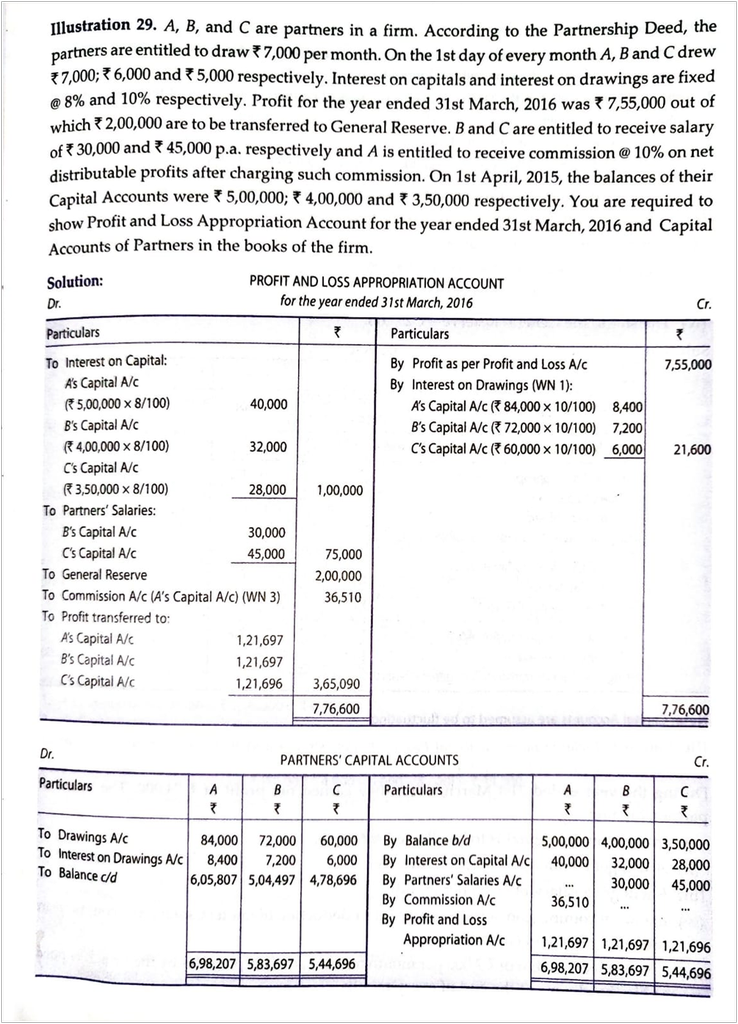

Salary or Commission to Partners

- Salary or commission to partners is paid only when it is allowed in Partnership Deed

- It is an appropriation of profit & not charge against the profit so it should be allowed only when profit is earned

- Commission may be allowed to the partners either

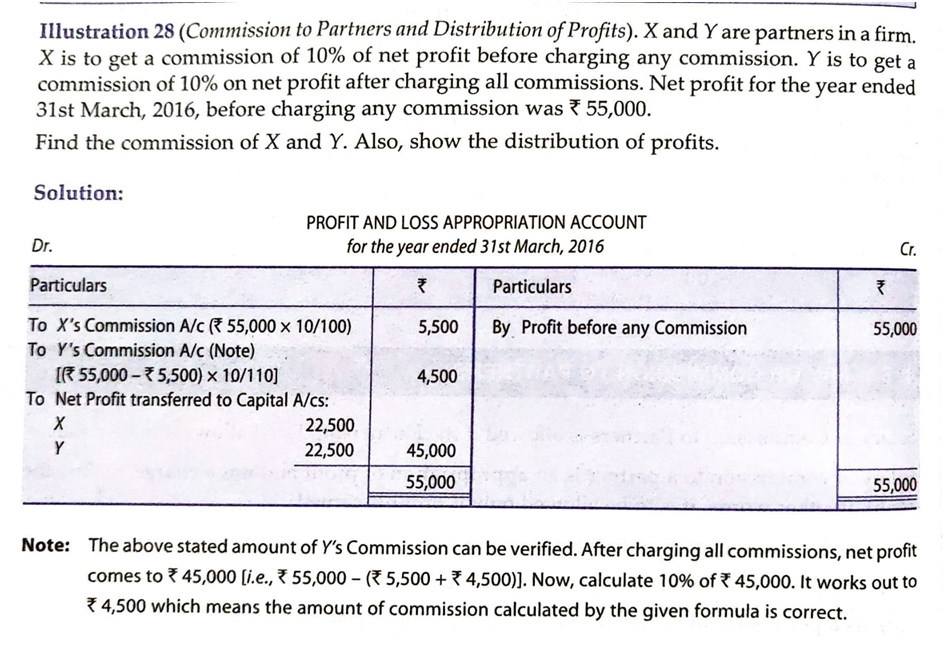

- As a percentage of profit before charging such commission

Net Profit (before Commission) x Rate of commission

100

or

- As a percentage of profit after charging such commission

Net profit (before commission) x Rate of Commission

100+Rate of Commission

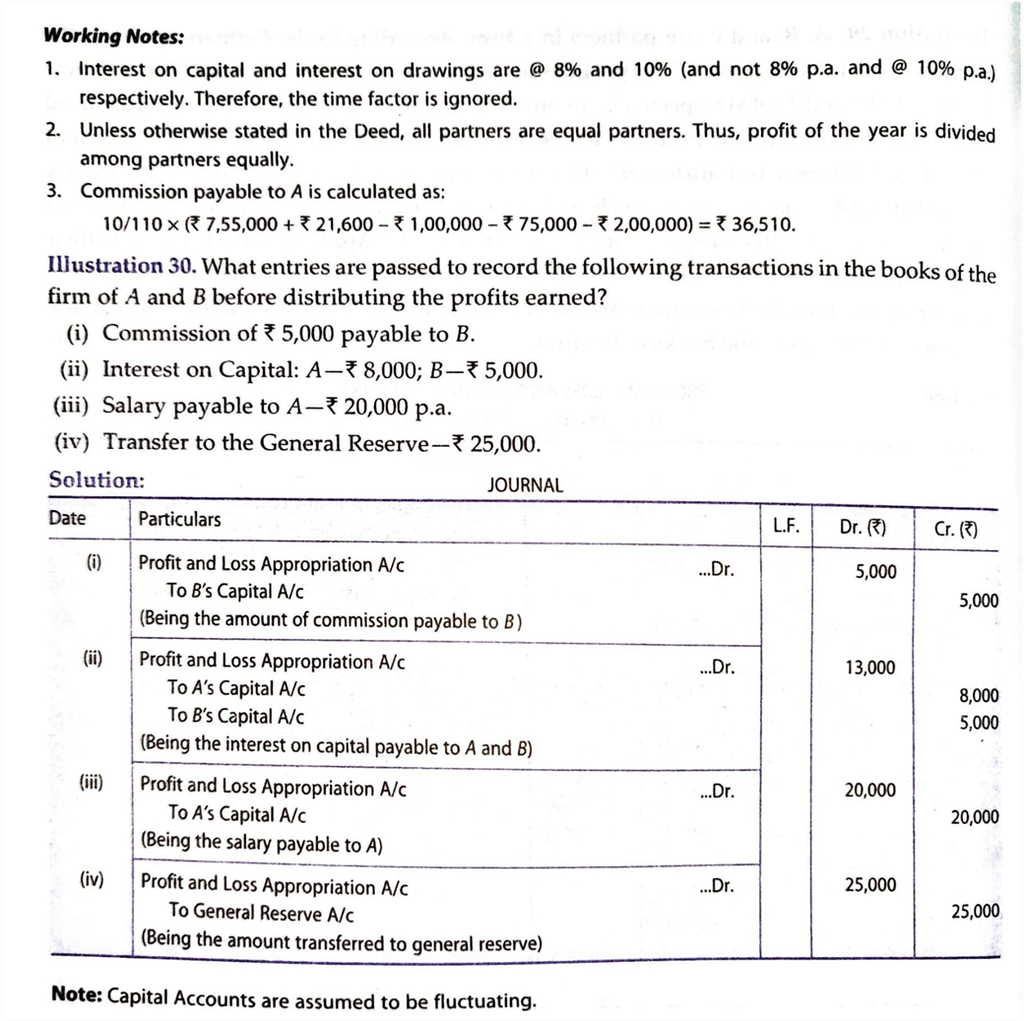

Accounting Treatment:-

Partner’s Salaries/ Commission A/c Dr

To Partner’s Current A/c (When capitals are fixed)

To Partner’s Capital A/c (When capitals are fluctuating)

Profit & Loss Appropriation A/c Dr

To Partner’s salaries/commission A/c

Interest on Partner’s Loan to the Firm

- If a partner apart from investing share capital, advances any loan to the firm then he is entitled to receive interest even in the absence of an agreement/deed.

- In the absence of an agreement/deed, the minimum rate of interest on loan to be paid to the partner is 6% p.a.

- Interest on loan is a charge against profit & it is transferred to the debit of Profit/Loss A/c & not to the debit of Profit/Loss Appropriation A/c

- Journal Entries

- Interest on partner’s loan A/c Dr

To Partner’s Loan A/c

- Profit & Loss A/c Dr

To Interest on partner’s loan A/c

Vision classes

Vision classes