- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Journal

This is the basic book of original entry. In this book, transactions are recorded in the chronological order, as and when they take place. Afterwards, transactions from this book are posted to the respective accounts. Each transaction is separately recorded after determining the particular account to be debited or credited.

Journal

The first column in a journal is Date on which the transaction took place. In the Particulars column, the account title to be debited is written on the first line beginning from the left hand corner and the word ‘Dr.’ is written at the end of the column. The account title to be credited is written on the second line leaving sufficient margin on the left side with a prefix ‘To’. Below the account titles, a brief description of the transaction is given which is called Narration. Having written the Narration a line is drawn in the Particulars column, which indicates the end of recording the specific journal entry. The column relating to Ledger Folio records the page number of the ledger book on which relevant account is appears. This column is filled up at the time of posting and not at the time of making journal entry.

The Debit amount column records the amount against the account to be debited and similarly the Credit Amount column records the amount against the account to be credited. It may be noted that, the number of transactions is very large and these are recorded in number of pages in the journal book. Hence, at the end of each page of the journal book, the amount columns are totaled and carried forward (c/f) to the next page where such amounts are recorded as brought forward (b/f) balances. The journal entry is the basic record of a business transaction. It may be simple or compound. When only two accounts are involved to record a transaction, it is called a simple journal entry.

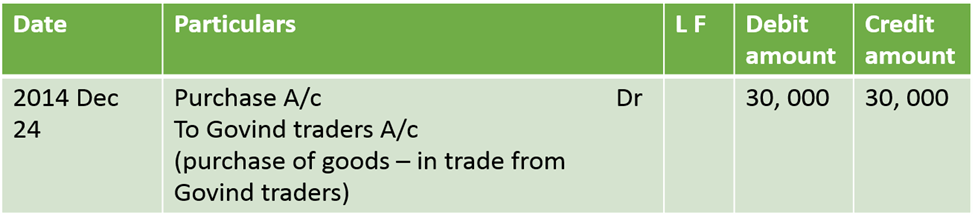

For Example, Goods Purchased on credit for Rs.30,000 from M/s Govind Traders on December 24, 2017, involves only two accounts: (a) Purchases A/c (Goods), (b)

Govind Traders A/c (Creditors). This transaction is recorded in the journal as follows:

It will be noticed that although the transaction results in an increase in stock of goods, the account debited is purchases, not goods. In fact, the goods account is divided into five accounts, viz. purchases account, sales account, purchases returns account, sales returns account, and stock account. When the number of accounts to be debited or credited is more than one, entry made for recording the transaction is called compound journal entry. That means compound journal entry involves multiple accounts.

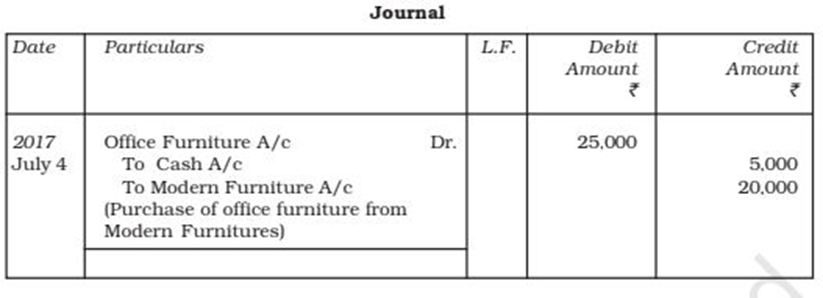

For example, Office furniture is purchased from Modern Furniture’s on July 4, 2017 for ` 25,000 and ` 5,000 is paid by cash immediately and balance of ` 20,000 is still payable. It increases furniture (assets) by ` 25,000, decreases cash (assets) by ` 5,000 and increases liability by ` 20,000.

The entry made in the journal on July 4, 2017 is:

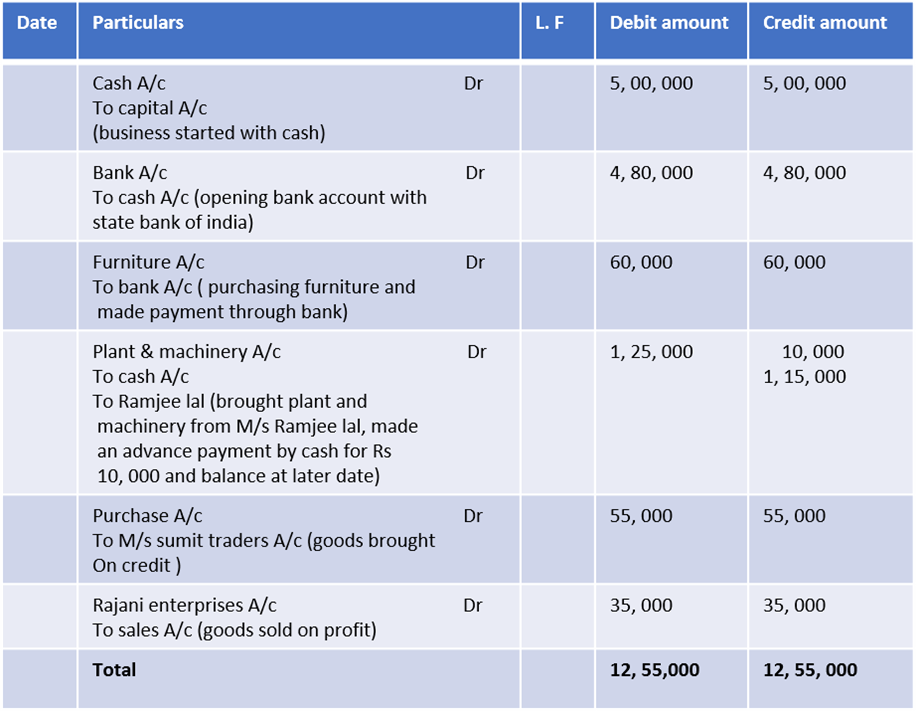

Books of Rohit Journal

The Ledger

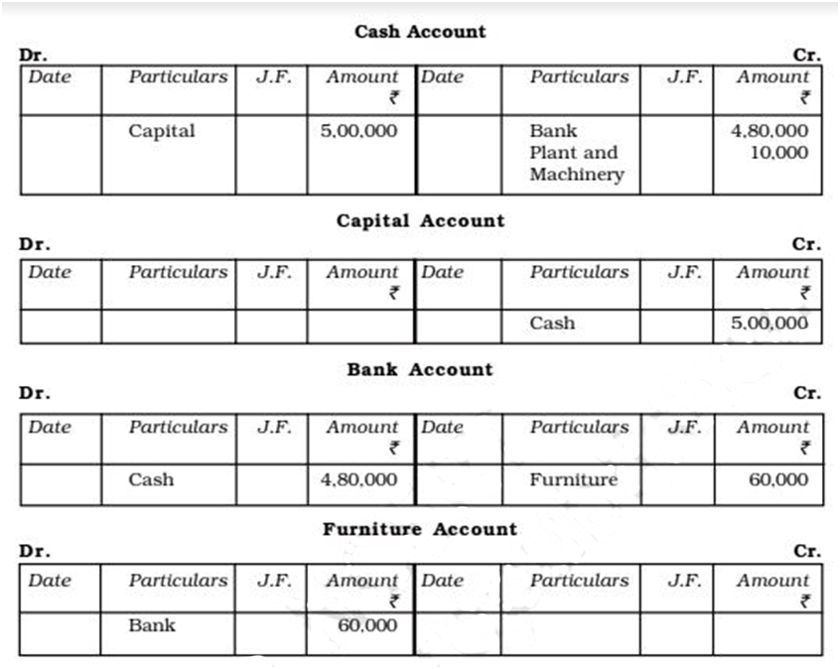

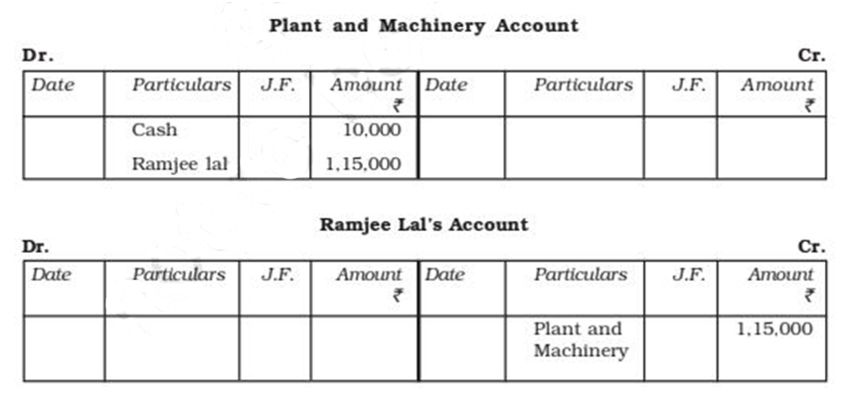

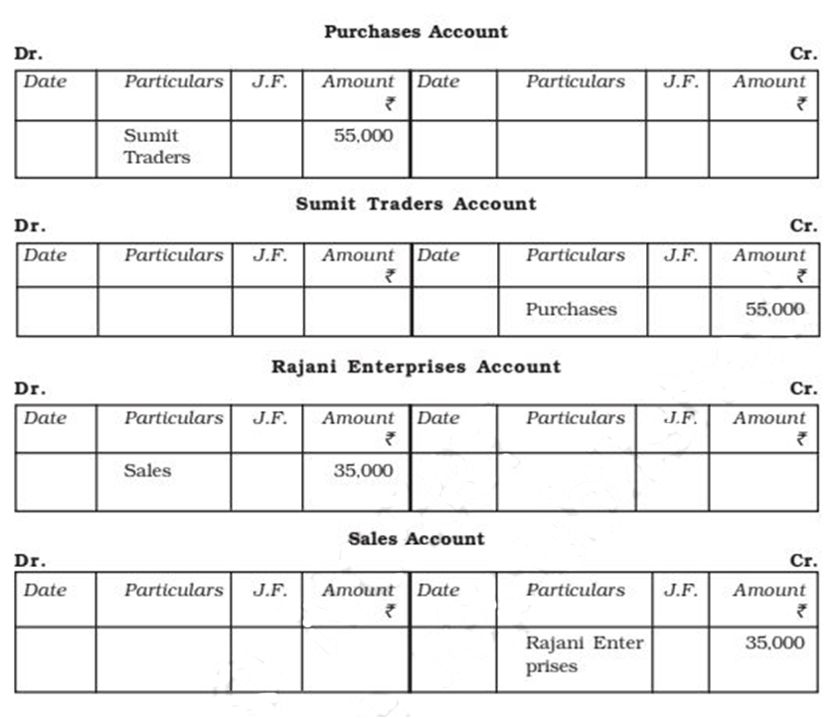

The ledger is the principal book of accounting system. It contains different accounts where transactions relating to that account are recorded. A ledger is the collection of all the accounts, debited or credited, in the journal proper and various special journal (about which you will learn in chapter 4). A ledger may be in the form of bound register, or cards, or separate sheets may be maintained in a loose leaf binder. In the ledger, each account is opened preferably on separate page or card.

A ledger is very useful and is of utmost importance in the organisation. The net result of all transactions in respect of a particular account on a given date can be ascertained only from the ledger. For example, the management on a particular date wants to know the amount due from a certain customer or the amount the firm has to pay to a particular supplier, such information can be found only in the ledger. Such information is very difficult to ascertain from the journal because the transactions are recorded in the chronological order and defies classification. For easy posting and location, accounts are opened in the ledger in some definite order. For example, they may be opened in the same order as they appear in the profit and loss account and in balance sheet. In the beginning, an index is also provided. For easy identification, in big organisations, each account is also allotted a code number.

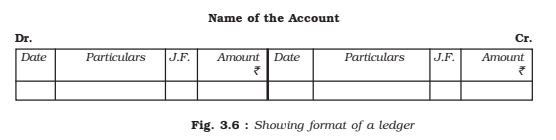

According to this format the columns will contain the information as given below: An account is debited or credited according to the rules of debit and credit already explained in respect of each category of account. Title of the account : The Name of the item is written at the top of the format as the title of the account. The title of the account ends with suffix ‘Account’. Dr./Cr. : Dr. means Debit side of the account that is left side and Cr. Means Credit side of the account, i.e. right side. Date : Year, Month and Date of transactions are posted in chronological order in this column.

Particulars : Name of the item with reference to the original book of entry is written on debit/credit side of the account.

Journal Folio : It records the page number of the original book of entry on which relevant transaction is recorded. This column is filled up at the time of posting.

Amount : This column records the amount in numerical figure, corresponding to what has been entered in the amount column of the original book of entry.

Distinction between Journal and Ledger

The Journal and the Ledger are the most important books of the double entry mechanism of accounting and are indispensable for an accounting system.

Following points of comparison are worth noting :

1. The Journal is the book of first entry (original entry); the ledger is the book of second entry.

2. The Journal is the book for chronological record; the ledger is the book for analytical record.

3. The Journal, as a book of source entry, gets greater importance as legal evidence than the ledger.

4. Transaction is the basis of classification of data within the Journal; Account is the basis of classification of data within the ledger.

5. Process of recording in the Journal is called Journalising; the process of recording in the ledger is known as Posting.

Classification of Ledger Accounts

We have seen earlier that all ledger accounts are put into five categories namely, assets, liabilities, capital, revenues/gains and expense losses. All these accounts may further be put into two groups, i.e. permanent accounts and temporary accounts. All permanent accounts are balanced and carried forward to the next accounting period. The temporary accounts are closed at the end of the accounting period by transferring them to the trading and profit and loss account.

All permanent accounts appear in the balance sheet. Thus, all assets, liabilities and capital accounts are permanent accounts and all revenue and expense accounts are temporary accounts. This classification is also relevant for preparing the financial statements.

Posting from Journal

Posting is the process of transferring the entries from the books of original entry (journal) to the ledger. In other words, posting means grouping of all the transactions in respect to a particular account at one place for meaningful conclusion and to further the accounting process. Posting from the journal is done periodically, may be, weekly or fortnightly or monthly as per the requirements and convenience of the business.

The complete process of posting from journal to ledger has been discussed below:

Step 1 : Locate in the ledger, the account to be debited as entered in the journal.

Step 2 : Enter the date of transaction in the date column on the debit side.

Step 3: In the ‘Particulars’ column write the name of the account through which it has been debited in the journal. For example, furniture sold for cash ` 34,000. Now, in cash account on the debit side in the particulars column ‘Furniture’ will be entered signifying that cash is received from the sale of furniture. In Furniture account, in the ledger on the credit side is the particulars column, the word, cash will be recorded. The same procedure is followed in respect of all the entries recorded in the journal.

Step 4 : Enter the page number of the journal in the folio column and in the journal write the page number of the ledger on which a particular account appears.

Step 5 : Enter the relevant amount in the amount column on the debit side. It may be noted that the same procedure is followed for making the entry on the credit side of that account to be credited. An account is opened only once in the ledger and all entries relating to a particular account is posted on the debit or credit side, as the case may be.

We will now see how the transactions listed to different accounts from the journal.

Vision classes

Vision classes