1. Business Transactions & source documents

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

CHAPTER -3

RECORDING OF TRANSACTIONS

BUSINESS TRANSACTION AND SOURCE DOCUMENTS

Meaning of Source document:

Business transactions are recorded in the books of accounts on the basis of some written evidence called source document.

Types of sources of documents:

1. Cash memo-when the trader sells and purchase goods for cash he gives and received cash memo.

2. Invoice and bill- when a trader sells goods on credit he prepares a sale invoice which contain of all detail of transaction.

3. Debit note-when a business return goods to supplier business prepare a debit not and send to the supplier with the return goods.

4. Credit note- when goods are received back from a customer a credit not send to him that the customer account has been credited in our books.

5. Pay in slip-this is a form available from a bank and it used to deposit money in the bank.

Meaning of Voucher

Documentary evidence in support of the transaction is known as voucher.

Type of voucher:

1. Cash voucher- Cash voucher is prepared for cash transaction i.e., cash receipt and cash payments. These are two type ;

(i) debit voucher-its prepared for cash payment

(ii) Credit voucher- its prepared for cash receipts.

2. Non –cash voucher-these vouchers are prepared for credit transactions like credit sale and purchase, depreciation, bad debts.

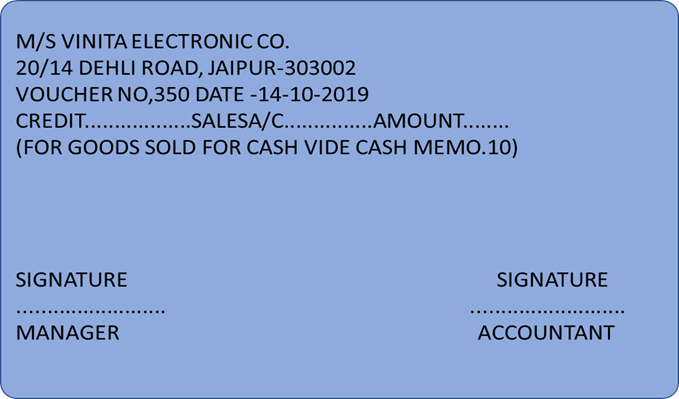

FORMATE OF CREDIT VOUCHER

2. Accounting Equation

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Accounting Equation:

The accounting equation is the basic element of the balance sheet and the primary principle of accounting. It helps the company to prepare a balance sheet and see if the entire enterprise’s asset is equal to its liabilities and stockholder equity. It is the base of the double-entry accounting system.

Double-entry accounting is a system that ensures that accounting and transaction equation should be equal as it affects both sides. Any change in the asset account, there should be a change in related liability and stockholder’s equity account. While performing journal entries accounting equation should be kept in mind.

Total Assets =Total Liabilities

OR

Total Assets = Internal Liabilities + External Liabilities

OR

Total Assets = Capital + Liabilities

Examples of accounting equation

1) Ram started business with cash rs.10000

Assets (cash+) = liabilities (capital+) +10000 = +10000

Its mean assets increase and liabilities also increase same amount so result will be same

2) mohan purchase good with cash rs.1000

Assets (stock+) asset (cash-) =liabilities +1000 -1000

3) Goods sold to shyam on credit for rs.5000

Assets (stock-) assets (debtors+) = lia. (No change)

4) Furniture purchase for cash rs.25000

Assets (furniture+) assets (cash) = lia. (No change)

5) Paid rent rs.500

Assets (cash-) = liabilities (capital-)

6) Received commission rs.400

Assets (cash+) = lia. (Capital+)

Multiple effect entries

Goods sold on credit (cost price rs.30000) for Rs. 40000

Assets (stock-) assets (debtors+) = lia. (capital+)

-30000 + 40000 = + 10000

Classification of Transactions Following are the nine basic transactions:

1. Increase in assets with corresponding increase in capital.

2. Increase in assets with corresponding increase in liabilities.

3. Decrease in assets with corresponding decrease in capital.

4. Decrease in assets with corresponding decrease in liabilities.

5. Increase and decrease in assets.

6. Increase and decrease in liabilities

7. Increase and decrease in capital

8. Increase in liabilities and decrease in capital

9. Increase in capital and decrease in liabilities.

Example :

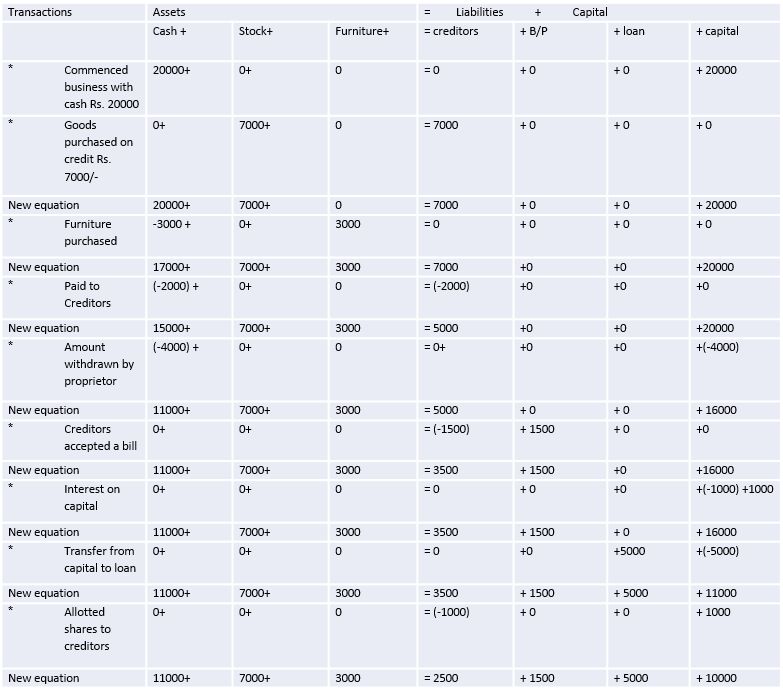

Show the effect of the following business transactions on assets, liabilities and capital through accounting equations:

1. Commenced business with cash 20,000

2. Goods purchased on credit 7,000

3. Furniture purchased 3,000

4. paid to creditors 2,000

5. Amount withdrawn by the proprietor 4,000

6. Creditors accepted a bill for payment 1,500

7. Interest on capital 1,000

8. Transfer from capital to loan 5,000

9. Allotted shares to creditors 1,000

Solution:

Important note

Assets = Liabilities +Capital

Assets are equal to the sum total of Liabilities and Capital

Question for Practice:

Prepare Accounting equation on the basis of following information:

(1) Sohan started business with cash =80,000

Machinery =10,000

And stock =10,000

(2) Interest on the above capital was allowed @10%

(3) Money withdrew from the business for his personal use10, 000

(4) Interest on drawings 500

(5) Depreciation charged on machinery 2,000

3. Using Debit & Credit

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

USING DEBIT AND CREDIT

Rules of Debit and Credit

Traditional or English Approach: This approach is based on the main principle of double entry system i.e., every debit has a credit and every credit has a debit. According to this system we should record both the aspects of a transaction whereas one aspect of a transaction will be debited and other aspect of a transaction will be credited.

(1) Personal Account: The accounts which related to an individual, firms, company, or an institution.

Personal account classified three categories:

(i) Natural person accounts -Mohan, Seeta, bank, capital, and drawing. Debtors, creditors account

(ii) Artificial personal accounts-company, firms and institutions.

(iii) Representative personal accounts- outstanding expenses, prepaid expenses, accord income and received in advance.

RULE

Debit - the receiver

Credit - the giver

(2) Real Account: The account all of those things whose value can be measure term of money like cash, goods, furniture, goodwill etc.

RULE

Debit what comes in

Credit what goes out.

(3) Nominal Account: these accounts include the account of all expenses and incomes. Like rent, salary, interest, commission, discount received/allowed etc.

RULE

Debit all expenses & losses

Credit all incomes and gains.

(2) Debit and Credit rules (Modern or American Approach)

This approach is based on the accounting equation or balance sheet. In this approach accounts are debited or credited according to the nature of an account. In a summarized way the five rules of modern approach is as follows:

1. Increase in asset will be debited and decrease will be credited.

2. Increase in the liabilities will be credited and decrease will be debited.

3. Increase in the capital will be credited and decrease will be debited.

4. Increase in the revenue or income will be credited and decrease will be debited.

5. Increase in expenses and losses will be debited and decrease will be credited.

IMPORTANT NOTE:

1. Increase in Assets/ Expenses and Losses will be debited and decrease will be credited

2. Increase in Liabilities/ capital/ Revenue or Gain will be credited and decrease will be debited

4. Books of original entry

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Books of Original Entry

When a businessman starts their company, one of the primary things they do is keep a track of their everyday transactions. These transactions are recorded on a timely basis (depending on the nature of their business) in a book before they are transferred to ledger accounts. Books of original entry are nothing but an accounting book or journal where all transactions are initially recorded. All business transactions, their details and descriptions are first recorded in the book of original entry.

Entering transactions on a regular basis in Book of original entry that carries details and evidence of business transactions before they are posted or transferred into proper ledger because, without the book of original entry being filled with evidence of business transactions, the writing of a ledger cannot be initiated.

Types of Books of Original Entry:

- General Journal - To record the transactions not recorded in special journals

- Special Journals - Special journals include further sub-journals; as given below:

- Sales journal - To record sales invoices issued by the firm when selling goods on credit

- Purchases journal - To record purchases invoices received by the business from suppliers, when buying goods on credit

- Return inwards journal - To record sales returns from customers

- Return outwards journal - To record purchases returns to suppliers

- Cash book - To record receipts or payments

Entries in the books of original entry normally consist of:

- Date of transaction

- Details relating to transactions, i.e., the second aspect of transactions, e.g., name of trade receivable in the sales journal

- Monetary amount of the transactions

- References to the relevant ledger account (often called folio)

- References to original source documents, e.g., invoice number

5. Journal and Ledger

- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Journal

This is the basic book of original entry. In this book, transactions are recorded in the chronological order, as and when they take place. Afterwards, transactions from this book are posted to the respective accounts. Each transaction is separately recorded after determining the particular account to be debited or credited.

Journal

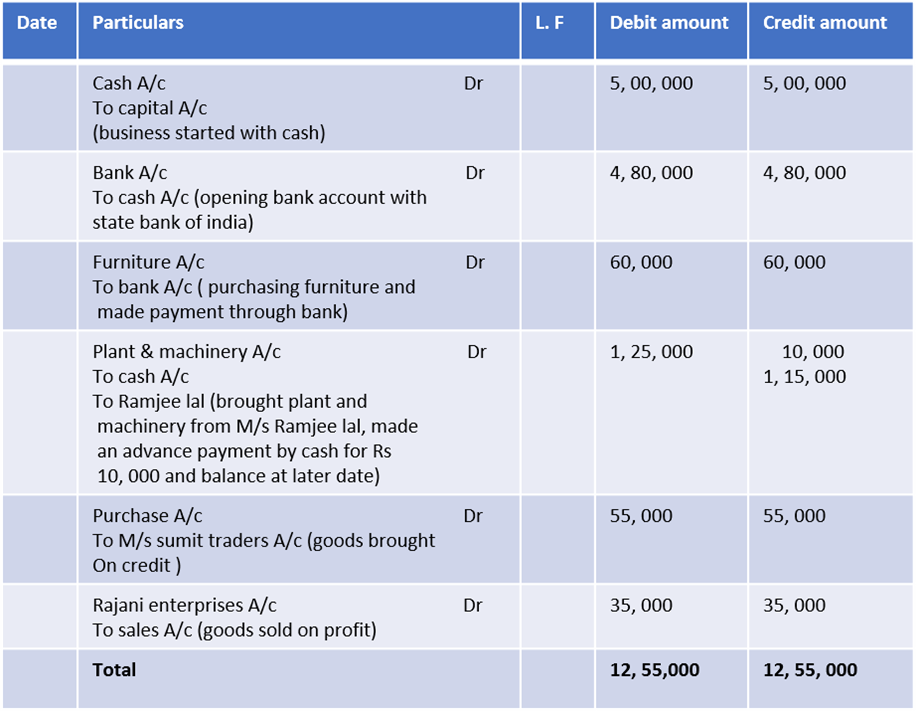

The first column in a journal is Date on which the transaction took place. In the Particulars column, the account title to be debited is written on the first line beginning from the left hand corner and the word ‘Dr.’ is written at the end of the column. The account title to be credited is written on the second line leaving sufficient margin on the left side with a prefix ‘To’. Below the account titles, a brief description of the transaction is given which is called Narration. Having written the Narration a line is drawn in the Particulars column, which indicates the end of recording the specific journal entry. The column relating to Ledger Folio records the page number of the ledger book on which relevant account is appears. This column is filled up at the time of posting and not at the time of making journal entry.

The Debit amount column records the amount against the account to be debited and similarly the Credit Amount column records the amount against the account to be credited. It may be noted that, the number of transactions is very large and these are recorded in number of pages in the journal book. Hence, at the end of each page of the journal book, the amount columns are totaled and carried forward (c/f) to the next page where such amounts are recorded as brought forward (b/f) balances. The journal entry is the basic record of a business transaction. It may be simple or compound. When only two accounts are involved to record a transaction, it is called a simple journal entry.

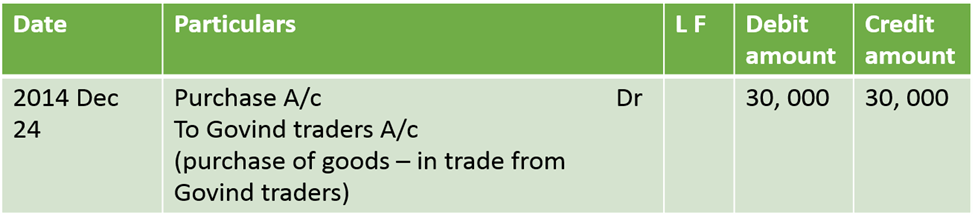

For Example, Goods Purchased on credit for Rs.30,000 from M/s Govind Traders on December 24, 2017, involves only two accounts: (a) Purchases A/c (Goods), (b)

Govind Traders A/c (Creditors). This transaction is recorded in the journal as follows:

It will be noticed that although the transaction results in an increase in stock of goods, the account debited is purchases, not goods. In fact, the goods account is divided into five accounts, viz. purchases account, sales account, purchases returns account, sales returns account, and stock account. When the number of accounts to be debited or credited is more than one, entry made for recording the transaction is called compound journal entry. That means compound journal entry involves multiple accounts.

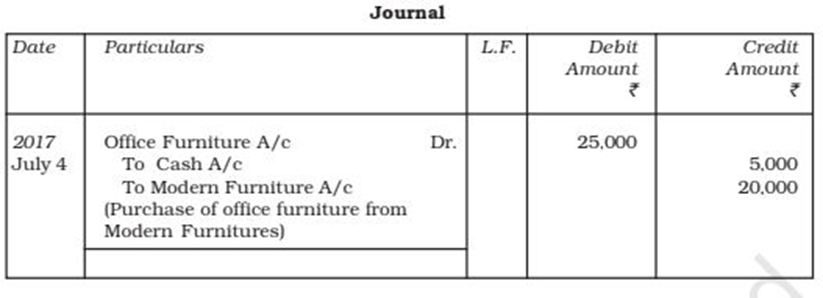

For example, Office furniture is purchased from Modern Furniture’s on July 4, 2017 for ` 25,000 and ` 5,000 is paid by cash immediately and balance of ` 20,000 is still payable. It increases furniture (assets) by ` 25,000, decreases cash (assets) by ` 5,000 and increases liability by ` 20,000.

The entry made in the journal on July 4, 2017 is:

Books of Rohit Journal

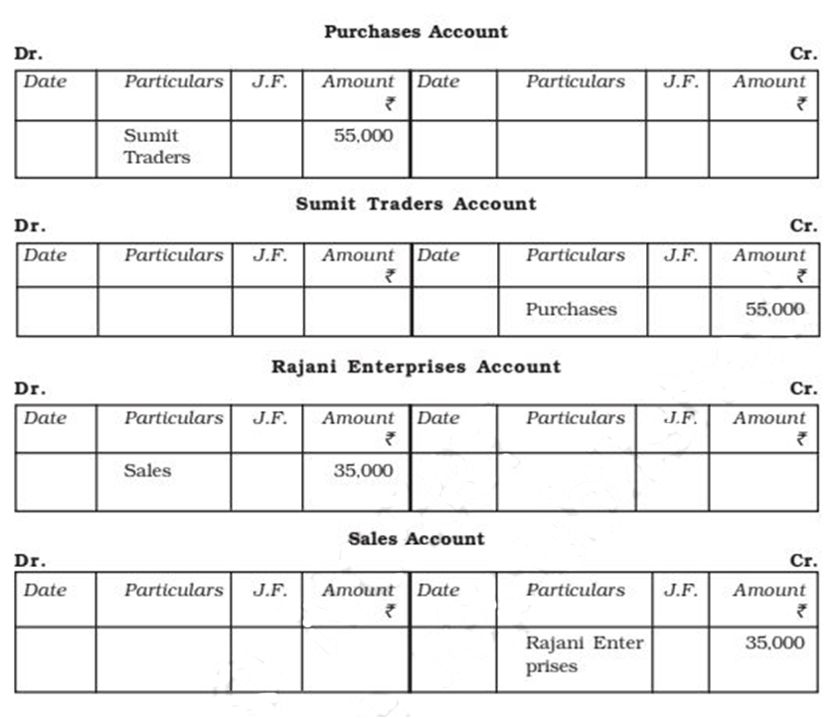

The Ledger

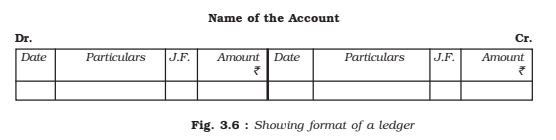

The ledger is the principal book of accounting system. It contains different accounts where transactions relating to that account are recorded. A ledger is the collection of all the accounts, debited or credited, in the journal proper and various special journal (about which you will learn in chapter 4). A ledger may be in the form of bound register, or cards, or separate sheets may be maintained in a loose leaf binder. In the ledger, each account is opened preferably on separate page or card.

A ledger is very useful and is of utmost importance in the organisation. The net result of all transactions in respect of a particular account on a given date can be ascertained only from the ledger. For example, the management on a particular date wants to know the amount due from a certain customer or the amount the firm has to pay to a particular supplier, such information can be found only in the ledger. Such information is very difficult to ascertain from the journal because the transactions are recorded in the chronological order and defies classification. For easy posting and location, accounts are opened in the ledger in some definite order. For example, they may be opened in the same order as they appear in the profit and loss account and in balance sheet. In the beginning, an index is also provided. For easy identification, in big organisations, each account is also allotted a code number.

According to this format the columns will contain the information as given below: An account is debited or credited according to the rules of debit and credit already explained in respect of each category of account. Title of the account : The Name of the item is written at the top of the format as the title of the account. The title of the account ends with suffix ‘Account’. Dr./Cr. : Dr. means Debit side of the account that is left side and Cr. Means Credit side of the account, i.e. right side. Date : Year, Month and Date of transactions are posted in chronological order in this column.

Particulars : Name of the item with reference to the original book of entry is written on debit/credit side of the account.

Journal Folio : It records the page number of the original book of entry on which relevant transaction is recorded. This column is filled up at the time of posting.

Amount : This column records the amount in numerical figure, corresponding to what has been entered in the amount column of the original book of entry.

Distinction between Journal and Ledger

The Journal and the Ledger are the most important books of the double entry mechanism of accounting and are indispensable for an accounting system.

Following points of comparison are worth noting :

1. The Journal is the book of first entry (original entry); the ledger is the book of second entry.

2. The Journal is the book for chronological record; the ledger is the book for analytical record.

3. The Journal, as a book of source entry, gets greater importance as legal evidence than the ledger.

4. Transaction is the basis of classification of data within the Journal; Account is the basis of classification of data within the ledger.

5. Process of recording in the Journal is called Journalising; the process of recording in the ledger is known as Posting.

Classification of Ledger Accounts

We have seen earlier that all ledger accounts are put into five categories namely, assets, liabilities, capital, revenues/gains and expense losses. All these accounts may further be put into two groups, i.e. permanent accounts and temporary accounts. All permanent accounts are balanced and carried forward to the next accounting period. The temporary accounts are closed at the end of the accounting period by transferring them to the trading and profit and loss account.

All permanent accounts appear in the balance sheet. Thus, all assets, liabilities and capital accounts are permanent accounts and all revenue and expense accounts are temporary accounts. This classification is also relevant for preparing the financial statements.

Posting from Journal

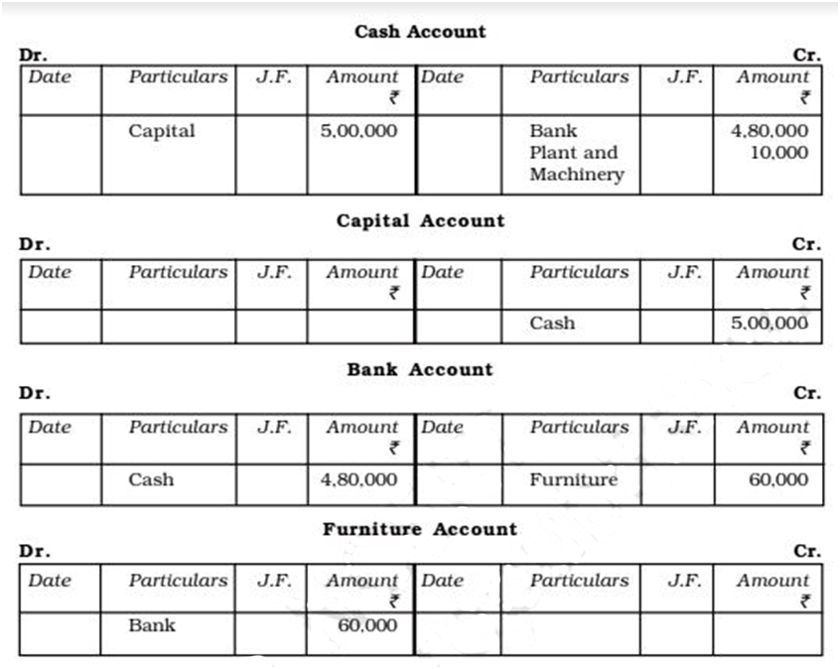

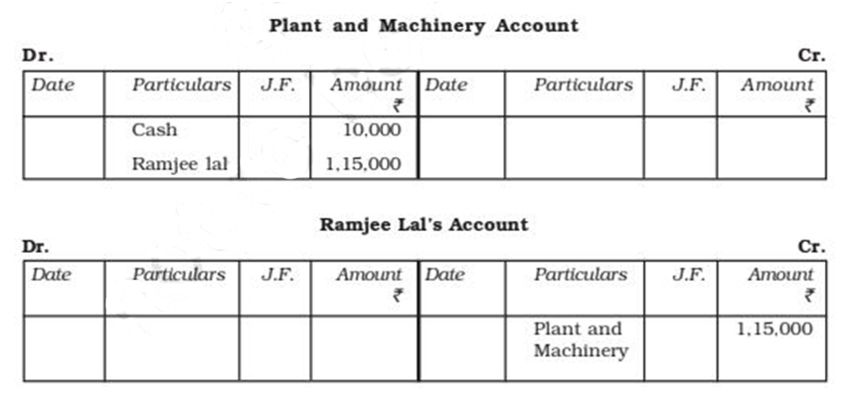

Posting is the process of transferring the entries from the books of original entry (journal) to the ledger. In other words, posting means grouping of all the transactions in respect to a particular account at one place for meaningful conclusion and to further the accounting process. Posting from the journal is done periodically, may be, weekly or fortnightly or monthly as per the requirements and convenience of the business.

The complete process of posting from journal to ledger has been discussed below:

Step 1 : Locate in the ledger, the account to be debited as entered in the journal.

Step 2 : Enter the date of transaction in the date column on the debit side.

Step 3: In the ‘Particulars’ column write the name of the account through which it has been debited in the journal. For example, furniture sold for cash ` 34,000. Now, in cash account on the debit side in the particulars column ‘Furniture’ will be entered signifying that cash is received from the sale of furniture. In Furniture account, in the ledger on the credit side is the particulars column, the word, cash will be recorded. The same procedure is followed in respect of all the entries recorded in the journal.

Step 4 : Enter the page number of the journal in the folio column and in the journal write the page number of the ledger on which a particular account appears.

Step 5 : Enter the relevant amount in the amount column on the debit side. It may be noted that the same procedure is followed for making the entry on the credit side of that account to be credited. An account is opened only once in the ledger and all entries relating to a particular account is posted on the debit or credit side, as the case may be.

We will now see how the transactions listed to different accounts from the journal.

Vision classes

Vision classes