- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Accounting Equation:

The accounting equation is the basic element of the balance sheet and the primary principle of accounting. It helps the company to prepare a balance sheet and see if the entire enterprise’s asset is equal to its liabilities and stockholder equity. It is the base of the double-entry accounting system.

Double-entry accounting is a system that ensures that accounting and transaction equation should be equal as it affects both sides. Any change in the asset account, there should be a change in related liability and stockholder’s equity account. While performing journal entries accounting equation should be kept in mind.

Total Assets =Total Liabilities

OR

Total Assets = Internal Liabilities + External Liabilities

OR

Total Assets = Capital + Liabilities

Examples of accounting equation

1) Ram started business with cash rs.10000

Assets (cash+) = liabilities (capital+) +10000 = +10000

Its mean assets increase and liabilities also increase same amount so result will be same

2) mohan purchase good with cash rs.1000

Assets (stock+) asset (cash-) =liabilities +1000 -1000

3) Goods sold to shyam on credit for rs.5000

Assets (stock-) assets (debtors+) = lia. (No change)

4) Furniture purchase for cash rs.25000

Assets (furniture+) assets (cash) = lia. (No change)

5) Paid rent rs.500

Assets (cash-) = liabilities (capital-)

6) Received commission rs.400

Assets (cash+) = lia. (Capital+)

Multiple effect entries

Goods sold on credit (cost price rs.30000) for Rs. 40000

Assets (stock-) assets (debtors+) = lia. (capital+)

-30000 + 40000 = + 10000

Classification of Transactions Following are the nine basic transactions:

1. Increase in assets with corresponding increase in capital.

2. Increase in assets with corresponding increase in liabilities.

3. Decrease in assets with corresponding decrease in capital.

4. Decrease in assets with corresponding decrease in liabilities.

5. Increase and decrease in assets.

6. Increase and decrease in liabilities

7. Increase and decrease in capital

8. Increase in liabilities and decrease in capital

9. Increase in capital and decrease in liabilities.

Example :

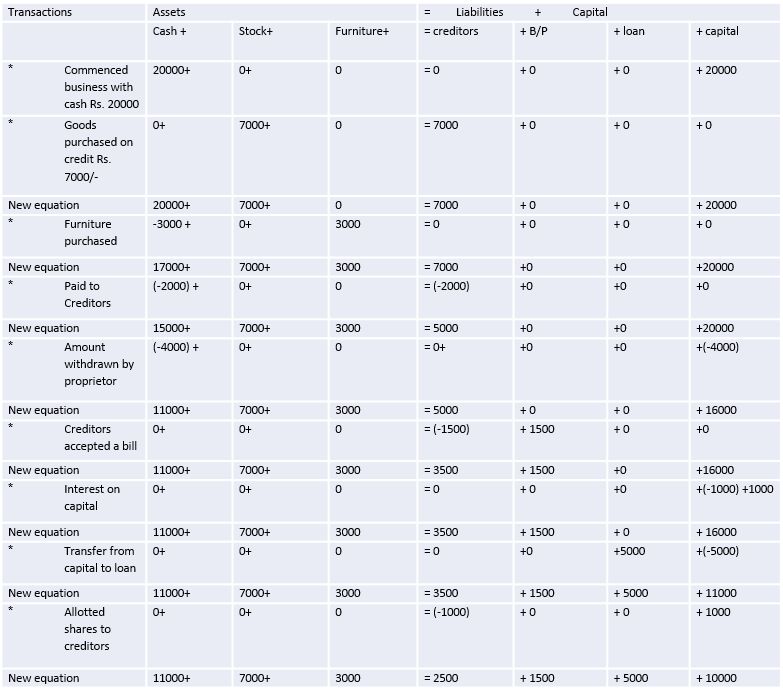

Show the effect of the following business transactions on assets, liabilities and capital through accounting equations:

1. Commenced business with cash 20,000

2. Goods purchased on credit 7,000

3. Furniture purchased 3,000

4. paid to creditors 2,000

5. Amount withdrawn by the proprietor 4,000

6. Creditors accepted a bill for payment 1,500

7. Interest on capital 1,000

8. Transfer from capital to loan 5,000

9. Allotted shares to creditors 1,000

Solution:

Important note

Assets = Liabilities +Capital

Assets are equal to the sum total of Liabilities and Capital

Question for Practice:

Prepare Accounting equation on the basis of following information:

(1) Sohan started business with cash =80,000

Machinery =10,000

And stock =10,000

(2) Interest on the above capital was allowed @10%

(3) Money withdrew from the business for his personal use10, 000

(4) Interest on drawings 500

(5) Depreciation charged on machinery 2,000

Vision classes

Vision classes