- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Accounting Treatment

The person who draws the bill of exchange and gets it back after its due acceptance, it is a bill receivable. For the person who accepts the bill, it is a bills payable. In case of a promissory note for the maker it is a bills payable and for the person in whose favour the promissory note is drawn it is a bills receivable. Bills receivables are assets and Bills payable are liabilities. Bills and Notes are used interchangeably.

In the Books of Drawer/Promissor

A bill receivable can be treated in the following ways by its receiver.

- He can retain it till the date of maturity, and get it collected on date of maturity directly, or get it collected through the banker.

- He can get the bill discounted from the bank.

- He can endorse the bill in favour of his Creditor.

The accounting treatment in the books of receiver under all the four alternatives is given below under the assumption that the bill is duly honoured on maturity by the acceptor.

(1) When the bill of exchange is retained by the receiver with him till date of its maturity:

On receiving the bill

Bills Receivable A/c Dr. To Debtors A/c

On maturity of the bill

Cash/Bank A/c Dr. To Bills Receivable A/c

However, when the bill of exchange is retained by the receiver with him and sent to bank for collection a few days before maturity, the following two entries are recorded:

On sending the bill for collection

Bills Sent for Collection A/c Dr. To Bills Receivable A/c

On receiving the advice from the bank that the bill has been collected

Bank A/c Dr. To Bills Sent for Collection A/c

(2) When the receiver gets the bill discounted from the bank:

On receiving the bill

Bills Receivable A/c Dr. To Debtors A/c

On discounting the bill

Bank A/c Dr.

Discount A/c Dr. To Bills Receivable A/c

On Maturity

No entry is recorded because the bill becomes the property of the bank, therefore, the bank collects the amount of the bill from the acceptor and no journal entry is recorded in the books of the drawer.

(3) When the bill is endorsed by the receiver in favour of his creditor:

On receiving the bill

Bills Receivable A/c Dr. To Debtor's A/c

On endorsing the bill

Creditor's A/c Dr. To Bills Receivable A/c

On Maturity

No entry is recorded because the bill has been transferred in favour of the creditor, therefore the creditor becomes its owner and will receive the payment on maturity. Hence, no entry is recorded in the books of drawer or endorser

In the Books of Acceptor/Promissor

The following journal entries are recorded in the books of the acceptor or promisesor :

On accepting the bill

Creditor's A/c Dr. To Bills Payable A/c

On Maturity of the bill

Bills Payable A/c Dr. To Bank A/c

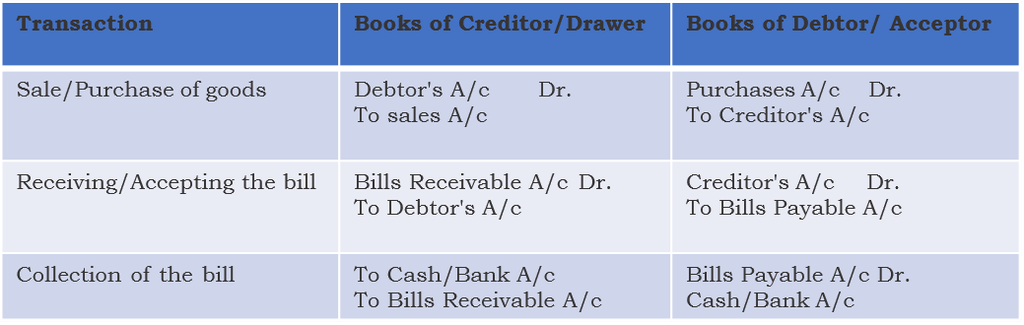

1. When the drawer retains the bill with him till the date of its maturity and gets the same collected directly

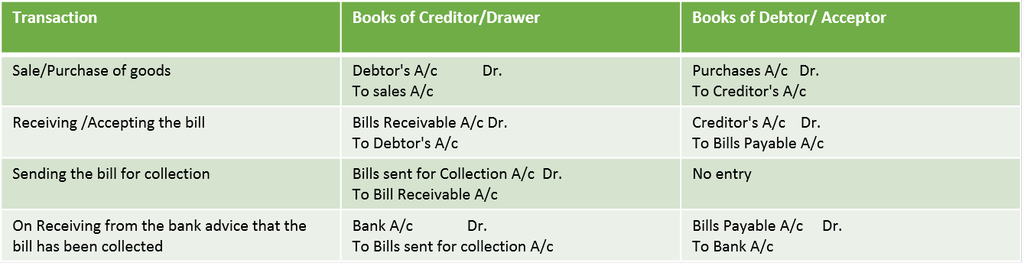

2. When the bill is retained by the drawer with him and sent to bank for collection a few days before maturity

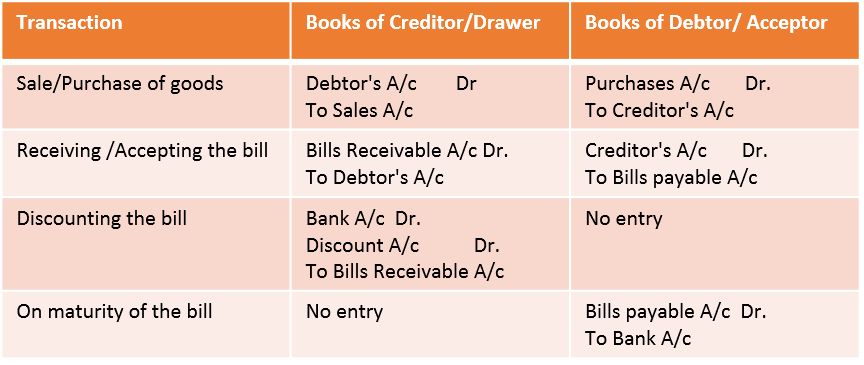

3. When the drawer gets the bill discounted from the bank

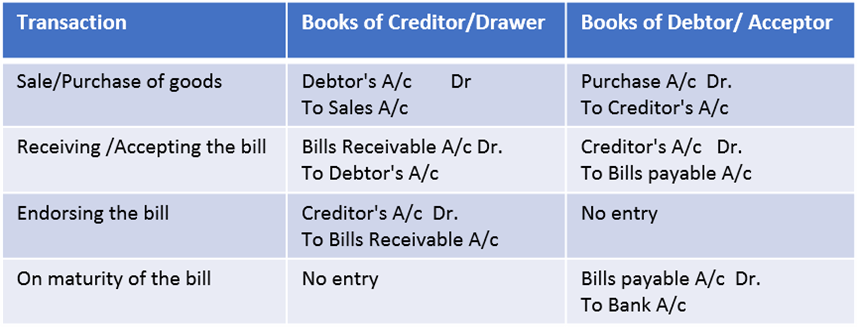

4. When the bill is endorsed by the drawer in favour of his creditor

Vision classes

Vision classes