- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

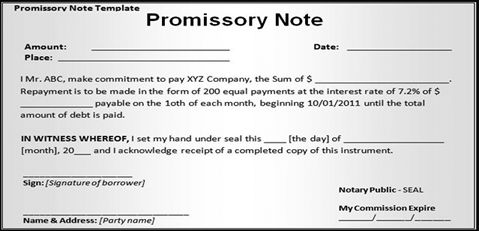

Promissory Note

When a person gives a promise in writing to pay a certain sum of money unconditionally to a certain person or according to his order the document is called is a promissory note. A promissory note does not require any acceptance because the maker of the promissory note himself promises to make the payment.

Following features of a promissory note emerge out of the above definition:

- It must be in writing

- It must contain an unconditional promise to pay.

- The sum payable must be certain.

- It must be signed by the maker.

- The maker must sign it.

- It must be payable to a certain person.

- It should be properly stamped.

Parties to a Promissory Note

There are two parties to a promissory note.

- Maker or Drawer is the person who makes or draws the promissory note to pay a certain amount as specified in the promissory note. He is also called the promisor.

- Drawee or Payee is the person in whose favour the promissory note is drawn. He is called the promise.

Generally, the drawee is also the payee, unless, it is otherwise mentioned in the promissory note.

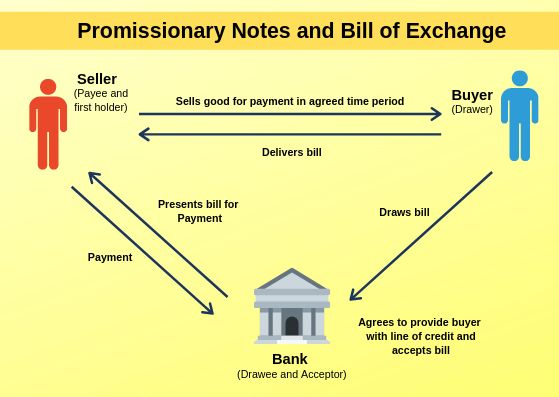

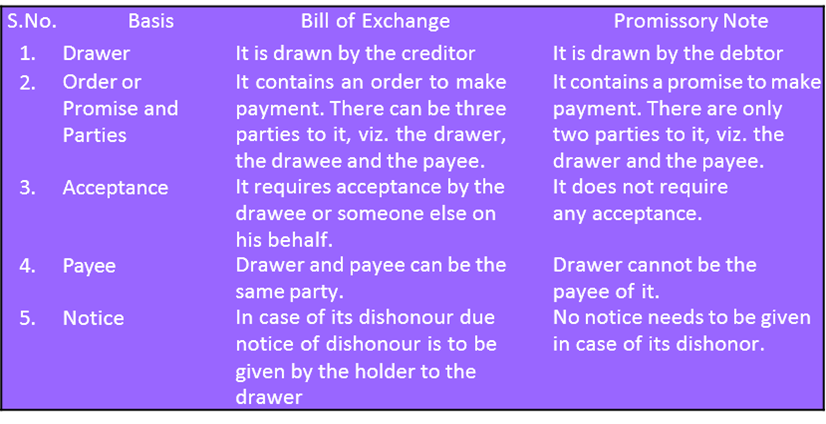

Distinction between a Bill of Exchange and Promissory Note

Vision classes

Vision classes