- Books Name

- class 8 th Mathematics Book

- Publication

- ReginaTagebücher

- Course

- CBSE Class 8

- Subject

- Mathmatics

Compound Interest

Introduction to compound interest

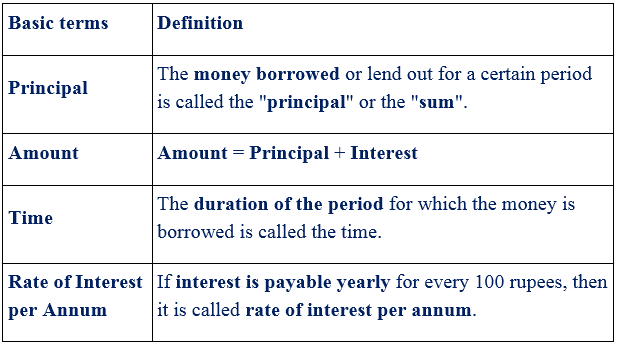

Interest:

Interest is the amount of money that is paid for the use of borrowed money.

Example:Let a person 'A' borrows some money from 'B' for a certain period of fixed time at a fixed rate, then 'A' will pay the borrowed money along with the additional money, which is called interest.

Compound Interest:

Sometimes it so happens that the borrower and the lender agree to fix up a certain unit of time, say yearly or half-yearly or quarterly, to settle the previous account.

In such cases, the amount after the first unit of time becomes the principal for the second unit, the amount after the second unit becomes the principal for the third unit and so on.

After the specified period, the difference between the amount and the money borrowed is called the compound interest for the period, which is abbreviated as C.I.

Compound Interest (C.I.) = Amount A − Principal P

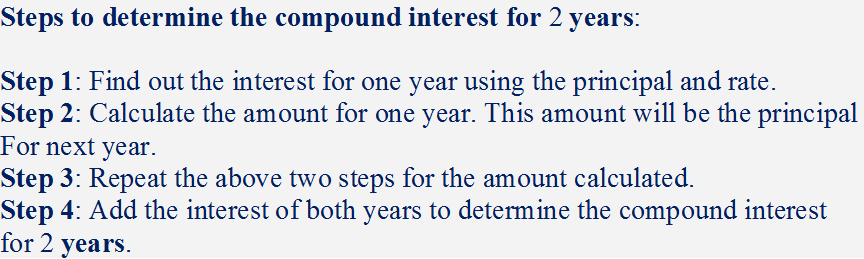

Steps to compute the compound interest

Example:

Let us assume Sheela deposited a sum of ₹ 10000 in a bank for 2 years at an interest of 4 % compounded annually. Then we will find out the compound interest (C.I) and the amount she has to pay at the end of 2 years in a couple of steps.

Step 1:Calculate the interest for the first year.

We know that the formula to calculate simple interest is given by:

I1=P1×n×r100

Here: The principal P1 = ₹10000.

The time period n = 1 year.

The rate of interest r = 4 %

Substitute the known values in the formula.

I1 = 10000⋅1⋅4100

= ₹400

Step 2: Find the amount at the end of the first year.

Amount at the end of the first year is given by the sum of the principal and the interest of the first year.

That is the amount at the end of the first year = P1+I1.

= 10000+400

= ₹10400

Here ₹10400 is the principal for the second year P2.

Step 3: Now, find the interest for the sum ₹10400.

Interest at 4 % for the second year is given by I2=P2×n×r100.

= 10400⋅1⋅4100

= ₹416.

Amount at the end of the second year is given by the sum of the principal and the interest of the second year.

That is the amount at the end of the second year = P2+I2.

= 10400+416

= ₹10816

Step 4: Calculate the compound interest for 2 years.

The compound interest is given by the sum of the interest of the first and the second year.

That is, C.I = I1+I2.

= 400+416

= ₹816.

We can also find this compound interest in the following way.

Compound interest (C.I) = Final amount A2 − Initial principal P1

= ₹10816 − ₹10000

= ₹816

Simple interest for 2 years at the rate of 4% for the principal of = ₹10000.

S.I = P×n×r100

= 10000⋅2⋅4100

= ₹800

Now, we can find the difference between the simple interest and compound interest.

S.I after 2 years with rate of 4 % = ₹800.

C.I after 2 years with rate of 4 % = ₹816.

Difference = C.I − S.I

= ₹816 − ₹800

= ₹16

It is evident that the compound interest is higher than the simple interest.

Formulae of compound interest

Type 1: General formula to find the compound interest and the amount.

The formula to calculate the amount is given by A=P(1+r100)n.

Here A is the amount,r is the rate of interest per annum, and n is the time period.

Now using this amount value, we can determine the compound interest C.I as follows:

C.I = Amount A − Principal P

We can also use the alternative formula, which is obtained by combining both the formula above.

C.I = A − P

C.I=[P(1+r/100)n]−P

Factor out P from the right-hand side of the equation.

Therefore, C.I=P[(1+r/100)n−1].

Type 2: To find the amount and the compound interest when compounded annually or half-yearly or quarterly.

Let A be the amount, P be the principal, r be the rate of interest per annum, and n be the time period.

Case 1: To find the amount and the compound interest when compounded annually.

The formula for calculating the amount when compounded annually is given by A=P(1+r100)n.

And C.I = Amount A − Principal P.

r C.I=P[(1+r100)n−1].

Case 2: To find the amount and the compound interest when compounded half-yearly.

The formula for calculating the amount when compounded half-yearly is given by A=P(1+r200)2n.

And C.I = Amount A − Principal P.

Or C.I=P[(1+r200)2n−1].

Case 3: To find the amount and the compound interest when compounded quarterly.

he formula for calculating the amount when compounded quarterly is given by A=P(1+r/400)4n.

And C.I = Amount A − Principal P.

Or C.I=P[(1+r/400)4n−1].

Type 3: To find the amount when the interest is compounded annually but the rate of interest differs year by year.

Let A be the amount, P be the principal, r1,r2,r3 be the interest rates for first, second and third consecutive years per annum and n be the time period.

Then the amount at the end of n years is given by:

A=P(1+r1/100)(1+r2/100)(1+r 3/100).......(1+rn/100)

And C.I = Amount A − Principal P.

Type 4: To find the amount when interest is compounded annually but time being a fraction.

Let A be the amount, P be the principal, r be the rate of interest per annum and n= abc years be the time period.

Then the amount at the end of n years is given by:

A=P(1+r/100)a (1+(r×b/c)/100)

And C.I = Amount A − Principal P.

Application of compound interest

1. Increase in Growth:

Type 1: Population growth after n years:

Let P be the population of a city or state at the beginning of a certain year, and the population grows at a constant rate of r% per annum.

Then, the population after n years is given by A=P(1+r/100)n.

Type 2: Population grows at different rates:

Let P be the population of a city or state at the beginning of a certain year, and the population grows at a constant rate of r1% in the first year, r2% in the second year and so on. Then, the population after n years is given by:

A=P(1+r1/100)(1+r2/100)(1+r3/100)......(1+rn/100)

2. Depreciation:

Let P be the value of the product or an article at a certain time, and the value of the product depreciates at the rate of r% per annum.

Then, the depreciated value at n years is given by A=P(1−r/100)n.

Difference between simple interest and compound interest

Simple interest means calculating the interest over the period at the rate of interest per annum and principal.

But in compound interest, the interest of the first year will be added to the principal, which is considered as the principal for the following year.

So, we can find that there is no difference in S.I and C.I for the first conversion period.

Formula to calculate the difference in 2 years:

If the principal P and the rate of interest per annum r are given, we can use the following formula to calculate the difference in the second year between the C.I and the S.I.

C.I−S.I=P(r/100)2.

Formula to calculate the difference in 3 years:

If the principal P and the rate of interest per annum r are given, we can use the following formula to calculate the difference in the third year between the C.I and the S.I.

C.I−S.I=P(r/100)2 (3+r/100).

ReginaTagebücher

ReginaTagebücher