1. Percentage practical problems

- Books Name

- class 8 th Mathematics Book

- Publication

- ReginaTagebücher

- Course

- CBSE Class 8

- Subject

- Mathmatics

Comparing Quantities

Percentage practical problems

Introduction to percentage

- The term "percent" means per hundred or for every hundred. This term has been derived from the Latin word per centum.

- The symbol (%) is used for the term percent.

Example:

13 percent is written as 13%, and it means that "13 out of 100".

Important concepts and formula to remember

Basic Concepts:

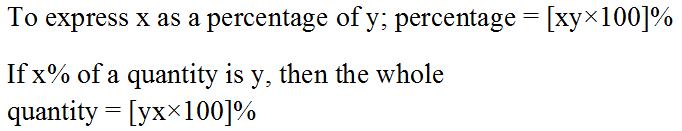

Fundamental Formulae:

1. Increase/Decrease in quantity:

(I) If quantity increases by R%, then [Where R denotes the rate of change in percentage]

New quantity = Original quantity + Increases in the quantity

= Original quantity + R% of Original quantity

= Original quantity + R100 of Original quantity

= [1+R100] Original quantity

(II) Similarly, if quantity decreases by R%, then New quantity = [100−R100] ×Original quantity

2. Population:

(I) If a population of a city increases by R% per annum, then the population after 'n' years = (1+R100)n of the original population.

Population after 'n' years = (1+R100)n×Original population

(II) Population 'n' years ago = Original population(1+R100)n

3. Rate is more/less than another:

(I) If a number x is R% more than y, then y is less than x by (R100+R×100)%

(II) If a number x is R% less than y, then y is more than x by (R100−R×100)%

4. Prices of a commodity Increase/Decrease by R %:

(I) If the price of a commodity increase by R%, then a reduction in consumption, so as not to increase the expenditure. [xy×100]%

(II) If the price of a commodity decreases by R%, then increases in consumption, so as not to increase the expenditure. [yx×100]%

If a quantity is increased or decreases by x% and another quantity is increased or decreased by y%, the percent % change on the product of both the quantity is given by require % change = R100

Note: For increasing use (+)ve sign and for decreasing use (−)ve sign.

2. Profit and loss

- Books Name

- class 8 th Mathematics Book

- Publication

- ReginaTagebücher

- Course

- CBSE Class 8

- Subject

- Mathmatics

Profit and loss

Recall: Profit and loss

1. Cost Price:

The price at which a person buys a product is called Cost Price (C.P) of that product.

2. Selling Price:

The price at which a person sells a product is called the Selling Price (S.P) of that product.

3. Profit:

When selling price of a product is higher than the cost price, profit is achieved, which is equal to the difference in selling price and the cost price.

Profit=S.P−C.P

When S.P≻C.P [When the S.P is more than the C.P, then there is a profit.]

Another synonymous term is used for profit is gain.

4. Loss:

When selling price is less than the cost price, there is a loss in the transaction, which is equal to the difference of the cost price and selling price.

Loss=C.P−S.P

When S.P≺C.P [When the S.P is less than the C.P, then there is a loss]

Important!

It is to be noted that the profit or loss is always calculated on the cost price.

Formula for profit and loss

1. To determine the percentage of profit:

% Profit = Profit/Costprice×100

2. To determine the percentage of loss:

% Loss = Loss/Costprice×100

3. To determine the selling price/cost price for profit:

- If the profit percentage and cost price is given, we can find out selling price(S.P) of that product using the below formula.

S.P=(100+Profit%)/100×C.P.

- Instead of cost price, if the selling price is given and asked to find out cost price, by slightly rearranging the formula we can determine the cost price of the product.

C.P=100/(100+Profit%)×S.P.

4. To Determine the selling price/cost price for loss:

- If the loss percentage and cost price is given, we can find out the selling price(S.P) of that product using the below formula.

S.P=(100−Loss%)/100×C.P.

- Instead of cost price, if the selling price is given and asked to find out cost price, by slightly rearranging the formula, we can determine the cost price of the product.

C.P=100/(100−Loss%)×S.P.

Introdution to discounts

To increase the sale and also to clear the old stock during the festival seasons, shopkeepers offer a certain percentage of rebates on the marked price of the articles. In other words, this rebate is known as a discount.

The reduction in market price to increase the sale or to dispose of old goods is known as the discount.

Usually, discounts are express as a percentage of the marked price. The customer or buyer pays the difference between the Marked price and the discounted price.

Thus, we have Discount=Marked Price × Rate of discount

What is marked price and selling price?

- Actually, In big shops and departmental stores, we see that every product is tagged with a card with a price written on it. The price marked on it is called the marked price.

- Based on this marked price, the shopkeeper offers a discount of a certain percentage. The price payable by the customer after deduction of discount is called the Selling price(S.P).

Therefore S.P=Marked price−Discount

Introduction to GST

Goods And Services Tax- GST

- The goods and services tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption.

- The GST is remitted by the consumers and the traders and is one of the sources of income to the government.

Key Takeaways:

- GST is an Indirect tax.

- The GST is shared by the Central and State Governments equally.

- GST is destination based Tax.

Types of GST:

- Central GST, (CGST),

- State GST (SGST),

- Integrated GST (IGST) and for union territories, there is UTGST.

Products Under GST:

- The products such as hair oil, toothpaste, soap, computers and processed food, etc., come under GST.

- All these kind of products comes under the tax slab of 5%,12%,18% and 28%.

Exempted Products On GST:

- There are also many products like eggs, honey, milk, salt, etc., which are exempted from GST.

- Products like petrol, diesel etc., do not come under GST and they are taxed separately.

Introduction to overhead expenses and successive discounts

1. Overhead Expenses

Consider a situation that you're going to shop with your father to buy articles like machinery, furniture, electronic items, etc. These products are bought with some expenses on repairs, transportation and labour charges. These expenses are included in the Cost price and which is called as Overhead expenses.

Therefore, Total cost price=Cost price + Over head expenses

2. Successive Discounts:

- In the case of Successive Discounts, the second discount is calculated on the reduced price after deducting the first discount from the marked price.

- Similarly, the third discount is calculated on the reduced price after deducting the second discounts and so on.

Example:

Consider that you're going to buy a book for ₹100 with successive discounts of 5% and 10%. Therefore the shop keeper first discount 5% of the total amount, which is as follows.

=Totalprice×5%=100×5100=5Thereducedprice=100−5= ₹95

Then this book also has a second discount of 10%. So now we have to do the percentage calculation with the amount which is reduced from the first discount, which is as follows.

=Reducedpricebyfirstdiscount×10%=95×10100=9.5Thefinalpriceofthebookaftertwosuccessivediscounts=95−9.5= ₹85.5

3. Compound Interest

- Books Name

- class 8 th Mathematics Book

- Publication

- ReginaTagebücher

- Course

- CBSE Class 8

- Subject

- Mathmatics

Compound Interest

Introduction to compound interest

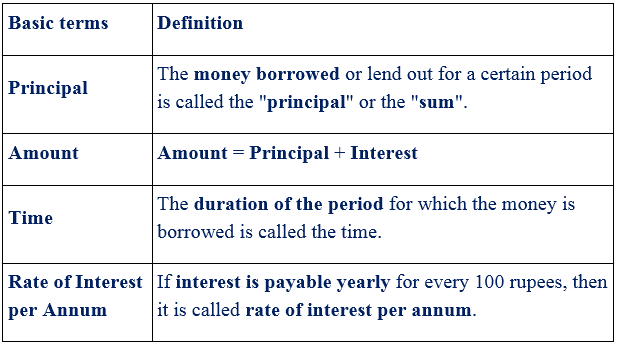

Interest:

Interest is the amount of money that is paid for the use of borrowed money.

Example:Let a person 'A' borrows some money from 'B' for a certain period of fixed time at a fixed rate, then 'A' will pay the borrowed money along with the additional money, which is called interest.

Compound Interest:

Sometimes it so happens that the borrower and the lender agree to fix up a certain unit of time, say yearly or half-yearly or quarterly, to settle the previous account.

In such cases, the amount after the first unit of time becomes the principal for the second unit, the amount after the second unit becomes the principal for the third unit and so on.

After the specified period, the difference between the amount and the money borrowed is called the compound interest for the period, which is abbreviated as C.I.

Compound Interest (C.I.) = Amount A − Principal P

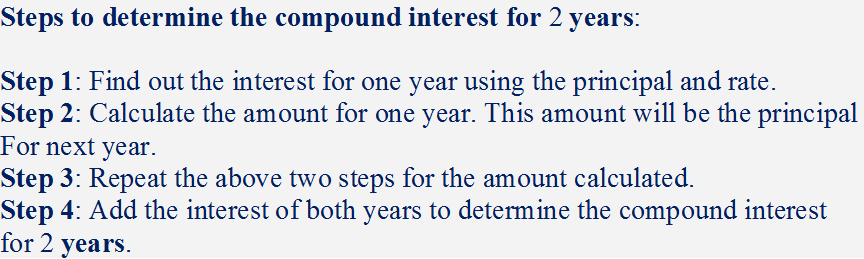

Steps to compute the compound interest

Example:

Let us assume Sheela deposited a sum of ₹ 10000 in a bank for 2 years at an interest of 4 % compounded annually. Then we will find out the compound interest (C.I) and the amount she has to pay at the end of 2 years in a couple of steps.

Step 1:Calculate the interest for the first year.

We know that the formula to calculate simple interest is given by:

I1=P1×n×r100

Here: The principal P1 = ₹10000.

The time period n = 1 year.

The rate of interest r = 4 %

Substitute the known values in the formula.

I1 = 10000⋅1⋅4100

= ₹400

Step 2: Find the amount at the end of the first year.

Amount at the end of the first year is given by the sum of the principal and the interest of the first year.

That is the amount at the end of the first year = P1+I1.

= 10000+400

= ₹10400

Here ₹10400 is the principal for the second year P2.

Step 3: Now, find the interest for the sum ₹10400.

Interest at 4 % for the second year is given by I2=P2×n×r100.

= 10400⋅1⋅4100

= ₹416.

Amount at the end of the second year is given by the sum of the principal and the interest of the second year.

That is the amount at the end of the second year = P2+I2.

= 10400+416

= ₹10816

Step 4: Calculate the compound interest for 2 years.

The compound interest is given by the sum of the interest of the first and the second year.

That is, C.I = I1+I2.

= 400+416

= ₹816.

We can also find this compound interest in the following way.

Compound interest (C.I) = Final amount A2 − Initial principal P1

= ₹10816 − ₹10000

= ₹816

Simple interest for 2 years at the rate of 4% for the principal of = ₹10000.

S.I = P×n×r100

= 10000⋅2⋅4100

= ₹800

Now, we can find the difference between the simple interest and compound interest.

S.I after 2 years with rate of 4 % = ₹800.

C.I after 2 years with rate of 4 % = ₹816.

Difference = C.I − S.I

= ₹816 − ₹800

= ₹16

It is evident that the compound interest is higher than the simple interest.

Formulae of compound interest

Type 1: General formula to find the compound interest and the amount.

The formula to calculate the amount is given by A=P(1+r100)n.

Here A is the amount,r is the rate of interest per annum, and n is the time period.

Now using this amount value, we can determine the compound interest C.I as follows:

C.I = Amount A − Principal P

We can also use the alternative formula, which is obtained by combining both the formula above.

C.I = A − P

C.I=[P(1+r/100)n]−P

Factor out P from the right-hand side of the equation.

Therefore, C.I=P[(1+r/100)n−1].

Type 2: To find the amount and the compound interest when compounded annually or half-yearly or quarterly.

Let A be the amount, P be the principal, r be the rate of interest per annum, and n be the time period.

Case 1: To find the amount and the compound interest when compounded annually.

The formula for calculating the amount when compounded annually is given by A=P(1+r100)n.

And C.I = Amount A − Principal P.

r C.I=P[(1+r100)n−1].

Case 2: To find the amount and the compound interest when compounded half-yearly.

The formula for calculating the amount when compounded half-yearly is given by A=P(1+r200)2n.

And C.I = Amount A − Principal P.

Or C.I=P[(1+r200)2n−1].

Case 3: To find the amount and the compound interest when compounded quarterly.

he formula for calculating the amount when compounded quarterly is given by A=P(1+r/400)4n.

And C.I = Amount A − Principal P.

Or C.I=P[(1+r/400)4n−1].

Type 3: To find the amount when the interest is compounded annually but the rate of interest differs year by year.

Let A be the amount, P be the principal, r1,r2,r3 be the interest rates for first, second and third consecutive years per annum and n be the time period.

Then the amount at the end of n years is given by:

A=P(1+r1/100)(1+r2/100)(1+r 3/100).......(1+rn/100)

And C.I = Amount A − Principal P.

Type 4: To find the amount when interest is compounded annually but time being a fraction.

Let A be the amount, P be the principal, r be the rate of interest per annum and n= abc years be the time period.

Then the amount at the end of n years is given by:

A=P(1+r/100)a (1+(r×b/c)/100)

And C.I = Amount A − Principal P.

Application of compound interest

1. Increase in Growth:

Type 1: Population growth after n years:

Let P be the population of a city or state at the beginning of a certain year, and the population grows at a constant rate of r% per annum.

Then, the population after n years is given by A=P(1+r/100)n.

Type 2: Population grows at different rates:

Let P be the population of a city or state at the beginning of a certain year, and the population grows at a constant rate of r1% in the first year, r2% in the second year and so on. Then, the population after n years is given by:

A=P(1+r1/100)(1+r2/100)(1+r3/100)......(1+rn/100)

2. Depreciation:

Let P be the value of the product or an article at a certain time, and the value of the product depreciates at the rate of r% per annum.

Then, the depreciated value at n years is given by A=P(1−r/100)n.

Difference between simple interest and compound interest

Simple interest means calculating the interest over the period at the rate of interest per annum and principal.

But in compound interest, the interest of the first year will be added to the principal, which is considered as the principal for the following year.

So, we can find that there is no difference in S.I and C.I for the first conversion period.

Formula to calculate the difference in 2 years:

If the principal P and the rate of interest per annum r are given, we can use the following formula to calculate the difference in the second year between the C.I and the S.I.

C.I−S.I=P(r/100)2.

Formula to calculate the difference in 3 years:

If the principal P and the rate of interest per annum r are given, we can use the following formula to calculate the difference in the third year between the C.I and the S.I.

C.I−S.I=P(r/100)2 (3+r/100).

ReginaTagebücher

ReginaTagebücher