Guarantee of Profit

- In some cases, a partner may be admitted in the firm on a guarantee in respect of his minimum profit from the business.

- Such a guarantee may be given to an existing partner as well.

- Such a guarantee to the incoming partner is given ;

- All the old partners in agreed ratio

- Some of the old partners

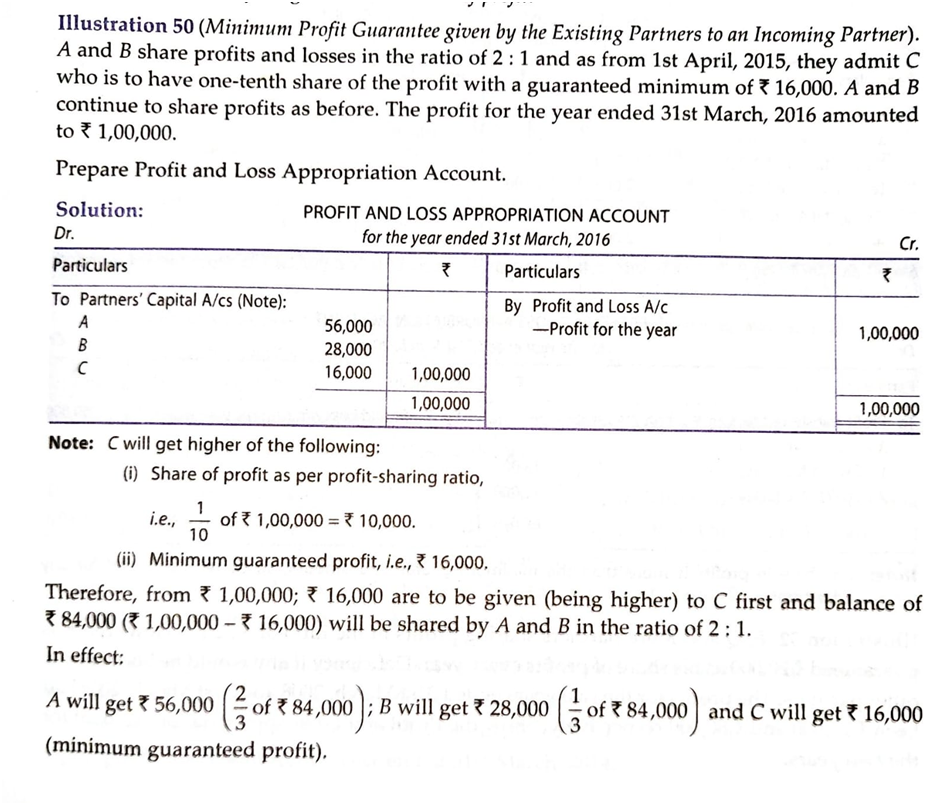

When all the partners guarantee that one of the partners shall be given a minimum amount of profit, the following amounts have to be calculated separately

- Share of profit as per profit sharing ratio

- Minimum Guaranteed Profit

- The minimum of the above two is given to that partner & the balance of profit (i.e. total profit – profit given to the guaranteed partner) is shared by the remaining partners in the profit-sharing ratio.

- If the partner’s actual share of profit turns out to be more than the guaranteed profit then in that case the partner will be given the actual amount instead of the guaranteed amount.

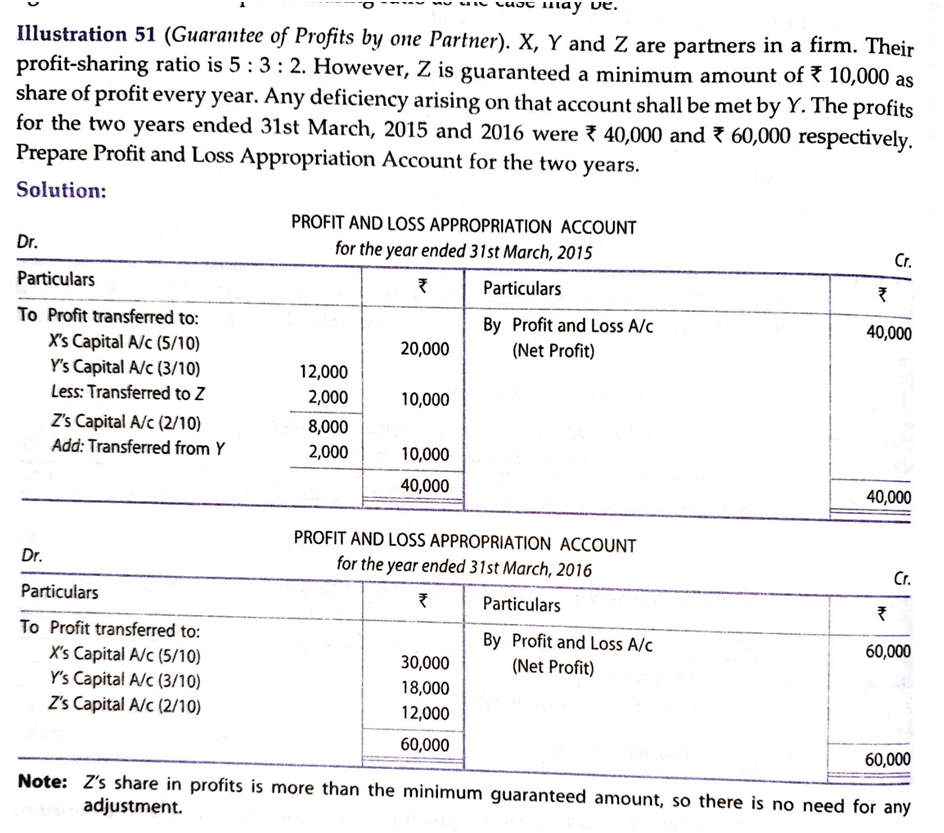

- When one or more than one partner guarantees a minimum profit, the adjustment is made through the partner’s capital accounts. The following steps are followed;

- Distribute the profit among the partners in their profit sharing ratio

- If the share of the guaranteed profit of the partner falls short of the minimum amount then the difference is deducted from the original share of profit of the partners who guarantee & it is added with the original share of profit of the guaranteed partner.

- When two or more partners give guarantee, the shortfall is shared by them in the agreed ratio or in their profit-sharing ration as the case may be.

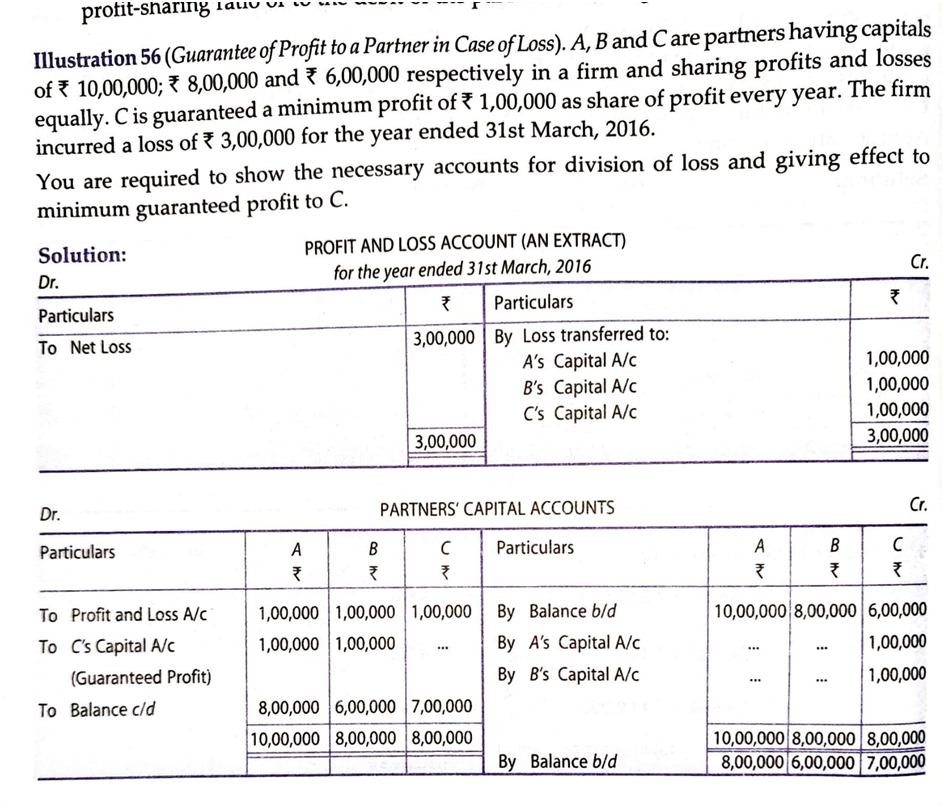

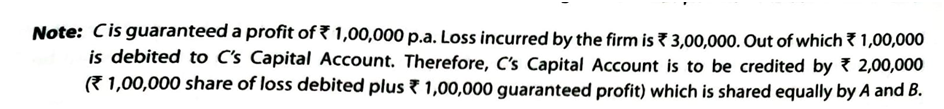

- Accounting Treatment of Guarantee of Profit in case of Loss

- Sometimes it is possible that the firm has incurred losses but the guaranteed profit is to be paid to the partner who has been guaranteed minimum profit. In such a case, the adjustment has to be made through partner’s capital A/c in the following manner;

- Distribute the loss among the partners in their profit sharing ratio

- Capital A/c of the guaranteed partner is credited with guaranteed minimum profit plus the amount of loss. This amount is debited to remaining partners in their profit sharing ratio or to the debit of the partner who has guaranteed minimum profit.

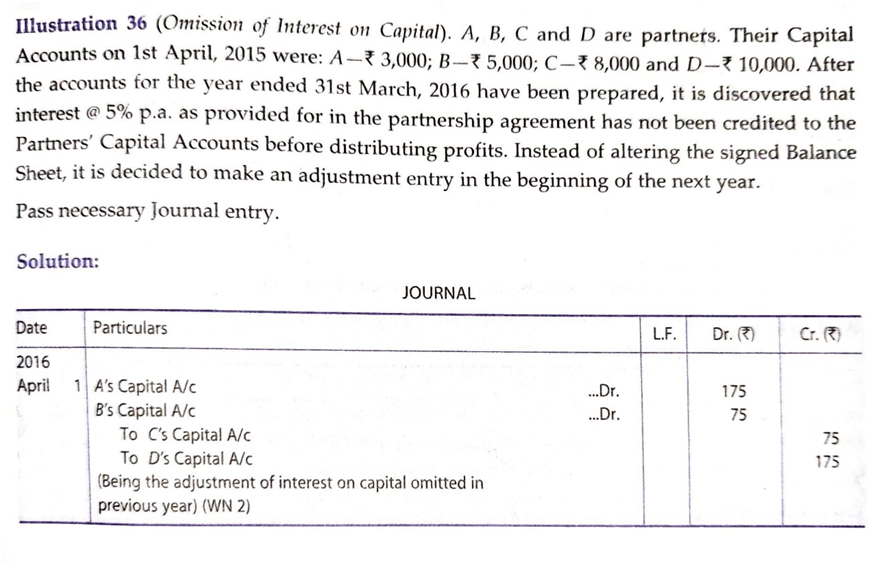

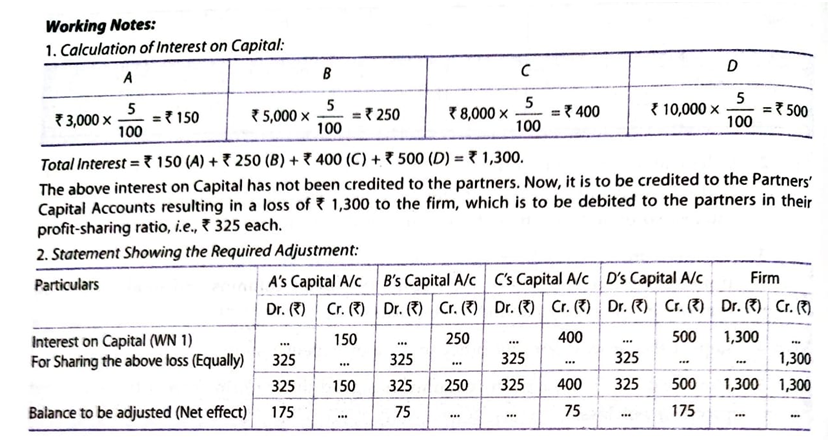

Past Adjustments

Sometimes, after the final accounts of a firm have been closed, it is found that certain matters have been left out by mistake. In such cases, instead of altering the final accounts which have already been closed, the firm rectifies the error or omission by passing an adjustment entry in the beginning of the financial year. Such adjustments are called past adjustments as they relate to the past.

Steps to pass adjusting journal entry:

Step 1 Calculate the amount already recorded.

Step 2 Calculate the amount which should have been recorded.

Step 3 Calculate the difference between Step 1 and Step 2.

Step 4 Find out the partner who received excess and the partner who received short.

Step 5 Pass the adjusting journal entry by debiting the partner who received excess and by crediting the partner who received short.

PREPARATION OF FINAL ACCOUNTS OF PARTNERSHIP FIRM

Final accounts of a partnership firm are prepared in the usual way in which they are prepared for a sole proprietorship concern except that the profits in the partnership have to be distributed among the various partners according to the terms of the partnership contract and the amount of profit may be arrived at after making adjustments for interest on capital, interest on drawings, salaries to partners, etc. for this another account “Profit & Loss Appropriation Account” is prepared after preparing Profit & Loss Account.

The final accounts prepared by partnership firms are:

a) Manufacturing account – if manufacturing activity is carried on

b) Trading and profit and loss account – to ascertain profitability

c) Profit and loss appropriation account – to show the disposal of profits and surplus

d) Balance sheet – to ascertain the financial status.

Vision classes

Vision classes