- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

Methods of calculating Depreciation

The depreciation depends on depreciable amount and the method of allocation. For this, two methods are mandated by law and enforced by professional accounting practice in India. These methods are straight line method and written down value method. There are other methods such as - annuity method, depreciation fund method, insurance policy method, sum of years digit method, double declining method, etc. which may be used for determining the amount of depreciation.

The selection of an appropriate method depends upon the following:

- Type of the asset;

- Nature of the use of such asset;

- Circumstances prevailing in the business;

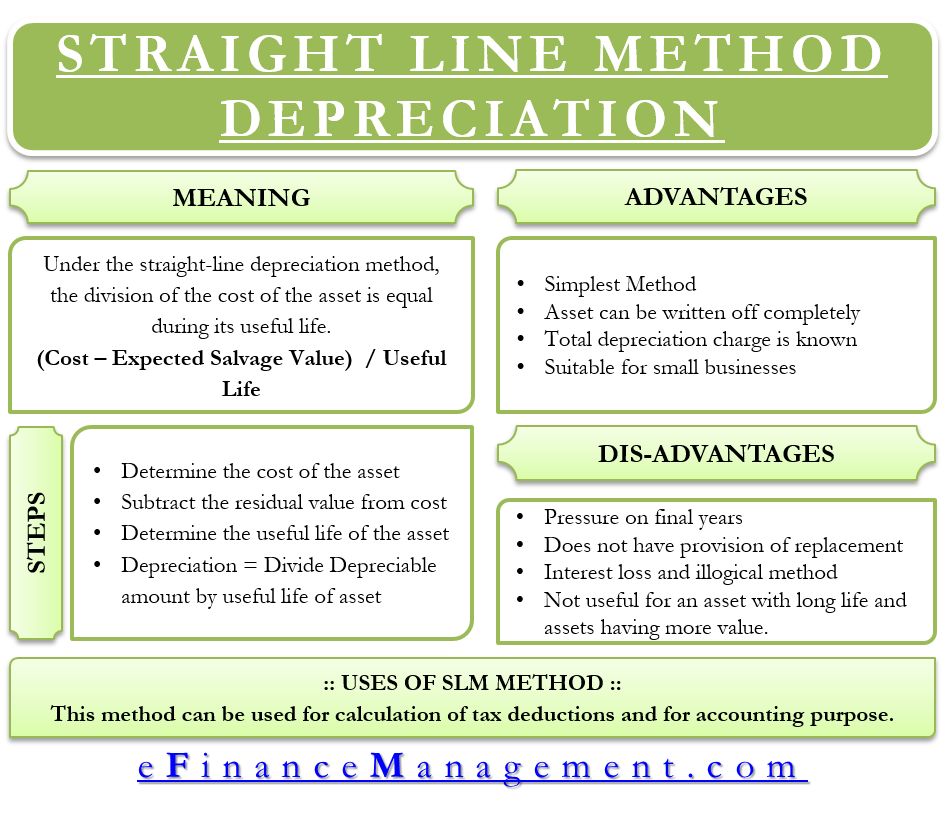

Straight Line Method

It is the widely used methods of providing depreciation. It is based on the assumption of equal usage of the asset over its entire useful life. It is called straight line for a reason that if the amount of depreciation and corresponding time period is plotted on a graph, it will result in a straight line. It is also called fixed installment method because the amount of depreciation remains constant from year to year over the useful life of the asset.

According to this method, a fixed and an equal amount is charged as depreciation in every accounting period during the lifetime of an asset. The amount annually charged as depreciation is such that it reduces the original cost of the asset to its scrap value, at the end of its useful life. This method is also known as fixed percentage on original cost method because same percentage of the original cost is written off as depreciation from year to year.

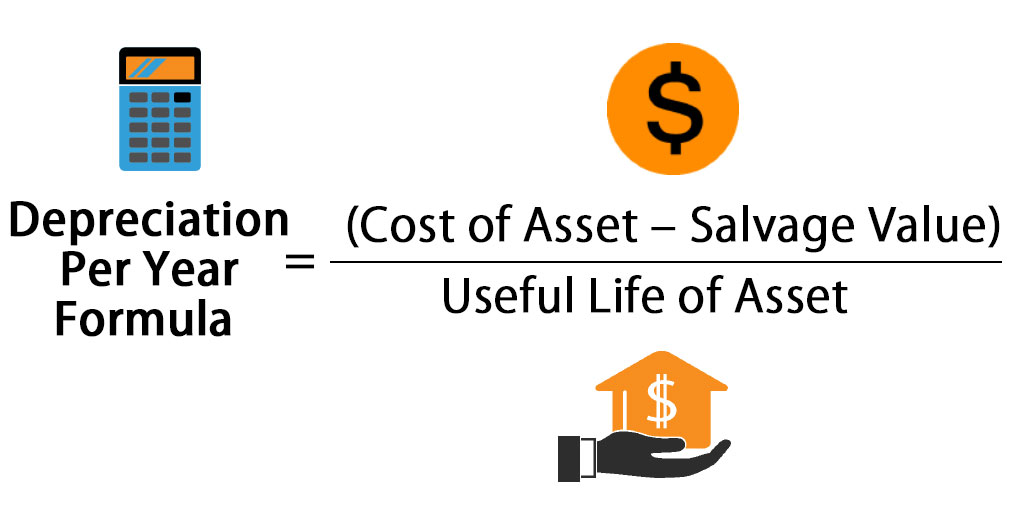

The depreciation amount is computed as -

Depreciation = ![]()

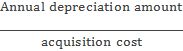

The rate of depreciation under straight line method is the percentage of the total cost of the asset to be charged as deprecation during the useful lifetime of the asset. Rate of depreciation is calculated as follows:

Rate of Depreciation =  * 100

* 100

Straight Line method has certain advantages which are –

- It is very simple, easy to understand and apply. Simplicity makes it a popular method in practice;

- Asset can be depreciated up to the net scrap value or zero value. Therefore, this method makes it possible to distribute full depreciable cost over useful life of the asset;

- Every year, same amount is charged as depreciation in profit and loss account.

- This makes comparison of profits for different years easy;

- This method is suitable for those assets whose useful life can be estimated accurately and where the use of the asset is consistent from year to year such as leasehold buildings.

There are certain limitations of straight line method which are-

- It is based on the faulty assumption of same amount of the utility of an asset in different accounting years;

- With the passage of time, work efficiency of the asset decreases and repair and maintenance expense increases. Hence, under this method, the total amount charged against profit on account of depreciation and repair taken together, will not be uniform throughout the life of the asset, rather it will keep on increasing from year to year.

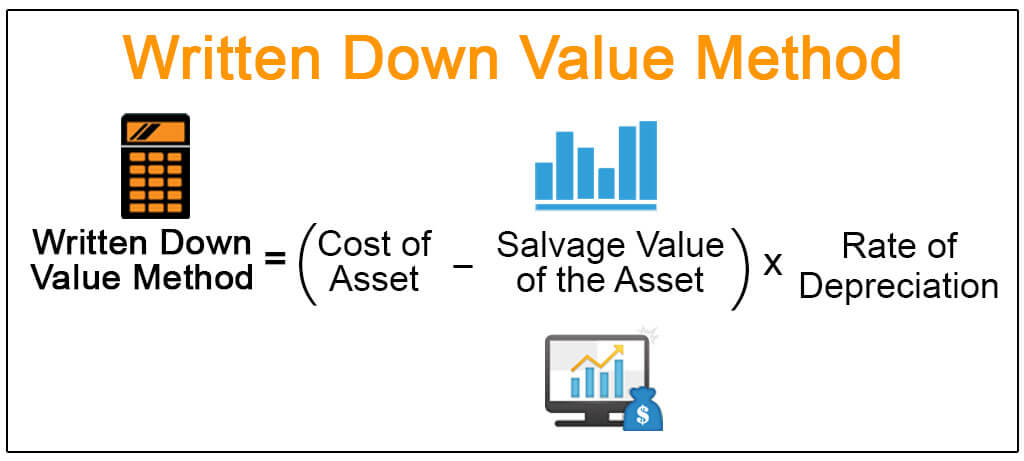

Written Down Value Method

The depreciation is charged on the book value of the asset in this method. It is also known as 'reducing balance method' because the book value keeps on reducing by the annual charge of depreciation. This method involves the application of a pre-determined proportion/percentage of the book value of the asset at the beginning of every accounting period, so as to calculate the amount of depreciation. The amount of depreciation reduces year after year.

Advantages of Written down Value Method are-

- It is based on a more realistic assumption that the benefits from asset go on diminishing (reducing) with the passage of time. Hence, it calls for proper allocation of cost because higher depreciation is charged in earlier years when asset's utility is higher as compared to later years when it becomes less effective.

- Results almost equal burden of depreciation and repair expenses taken together every year on profit and loss account.

- Income Tax Act accepts this method for tax purposes.

- As a large portion of cost is written-off in earlier years, loss due to obsolescence gets reduced.

- It is suitable for fixed assets which last for long and which require increased repair and maintenance expenses with passage of time. It can also be used where obsolescence rate is high.

Although this method is based upon a more realistic assumption it suffers from the following limitations.

- As depreciation is calculated at fixed percentage of written down value, depreciable cost of the asset cannot be fully written-off. The value of the asset can never be zero;

- It is difficult to ascertain a suitable rate of depreciation.

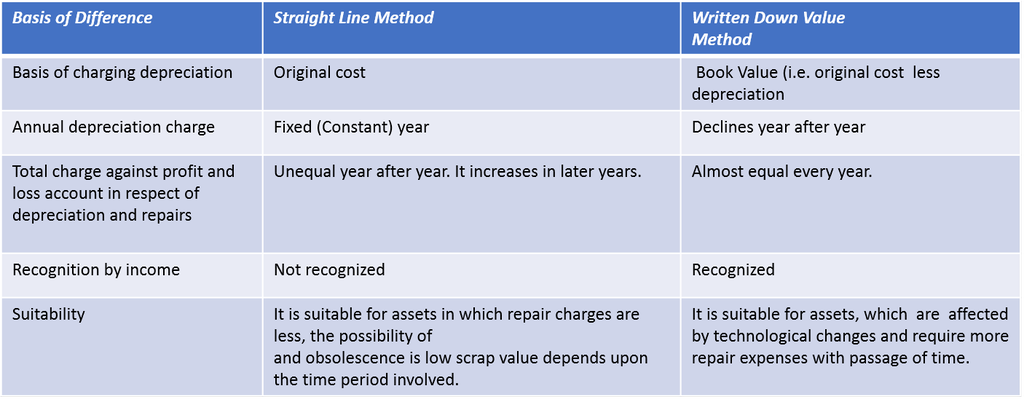

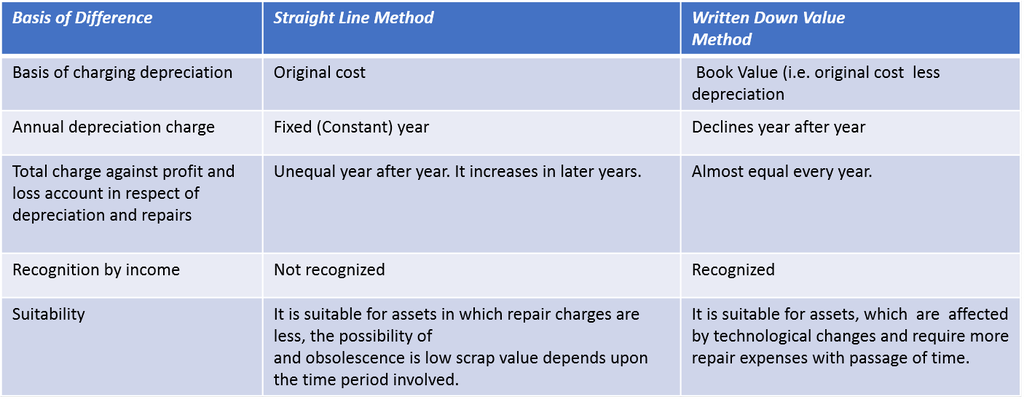

Difference between Straight Line method and Written down Value Method

Vision classes

Vision classes