- Books Name

- Vision classes Accountancy Book

- Publication

- Vision classes

- Course

- CBSE Class 11

- Subject

- Accountancy

System accounting

The systems of recording transactions in the book of accounts are generally classified into two types, viz. Double entry system and Single entry system. Double entry system is based on the principle of “Dual Aspect” which states that every transaction has two effects, viz. receiving of a benefit and giving of a benefit. Each transaction, therefore, involves two or more accounts and is recorded at different places in the ledger. The basic principle followed is that every debit must have a corresponding credit. Thus, one account is debited and the other is credited. Double entry system is a complete system as both the aspects of a transaction are recorded in the book of accounts. The system is accurate and more reliable as the possibilities of frauds and mis-appropriations are minimised. The arithmetic inaccuracies in records can mostly be checked by preparing the trial balance.

The system of double entry can be implemented by big as well as small organisations. Single entry system is not a complete system of maintaining records of financial transactions. It does not record two-fold effect of each and every transaction. Instead of maintaining all the accounts, only personal accounts and cash book are maintained under this system. In fact, this is not a system but a lack of system as no uniformity is maintained in the recording of transactions. For some transactions, only one aspect is recorded, for others, both the aspects are recorded. The accounts maintained under this system are incomplete and unsystematic and therefore, not reliable. The system is, however, followed by small business firms as it is very simple and flexible (you will study about them in detail later in this book).

Business Transactions

An exchange of goods or services for cash or on credit by the business with outsiders is called a transaction. In the words of L. C. Copper, “A person’s dealings in money or money’s worth are termed as transactions.”

Entity: - Business entity means a specific identifiable business enterprise like Tata, Reliance, Amul, Sony etc.

Transactions: - Exchange of goods and services for consideration.

Assets: - These are properties or economic resources of an enterprises which can be expressed in monetary terms it can be divided in two parts

(a) Non-Current Assets: Fixed assets: Tangible & Intangible (more than 1 year period)

- Tangible Assets

- Land and Building

- Plant and Machinery

- Furniture

- Office Equipments

- Intangible Assets

- Goodwill

- Patents

- Trademarks

- Copyright

- Computer software

(b) Current assets (less than 1 year period)

- Debtors

- Bills Receivable

- Cash in hand

- Cash at bank

- Cheque in hand

- Drafts in hand

- Stock

- Prepaid Expenses

Definition of Assets

“Assets are future economic benefits, the rights, which are owned or controlled by an organization or individual.” -- Finney and Miller “Assets are property or legal right owned by an individual or a company to which money value can be attached.” -- R. Brockington According to Institute of Certified Public Accountants, U.S.A; “Current Assets include cash and other assets or resources commonly identified as those which are reasonably expected to be realized in cash or sold or consumed during the normal operating cycle of the business.”

Liabilities:

These are certain obligations or dues which firm has to pay. Liabilities can be divided into two categories i.e.,Non-Current Liabilities and Current Liabilities.

Non-Current Liabilities

- Bank Loan

- Mortgage

- Loan from other financial institutions

- Other long-term liabilities

Current Liabilities

- Creditors

- Bills Payable

- Outstanding Expenses

- Bank overdraft

Trade Receivables: Debtors + Bills Receivables

Debtors: - There are persons who owe to an enterprise an amount for buying goods and services on credit.

Bills Receivables: Amount to be received againt B/R (from debtors).

Trade Payable: Creditors + Bills Payable.

Creditors: - These are persons who have to be paid by an enterprise an amount for providing the enterprise goods and services on credit.

Bills Payable: Amount payable against the bills (to the creditors).

Capital: It is an essential investment for commencement of every business.

Sales: It can be credit or cash, in which goods are delivered to customers: (a) Cash Sales (b) Credit Sales.

Revenues: -It is the amount which is earned by selling of products.

Expense: -It is known as cost of assets consumed or services which used.

Expenditure: -It means spending money for some benefit.

Profit: - Excess of revenues over expenses is called profit.

Gain: - It generates from incidental transaction such as sales of fixed asset, winning of court case.

Loss: - Excess of expenses over income is termed as loss.

Discount: -It is defined as concession or deduction in price of goods sold.

Voucher: -It is known as evidence in support of a transaction.

Goods: - It refers all the tangible goods (Raw material, work in progress, finished goods.)

Drawings: - Amount of goods or cash which is withdrawn from business for personal use.

Purchases: - It means of procurement of goods on credit or cash.

Stock: - It is a part of unsold goods. It can be divided into two categories.

1. Opening stock

2. Closing stock.

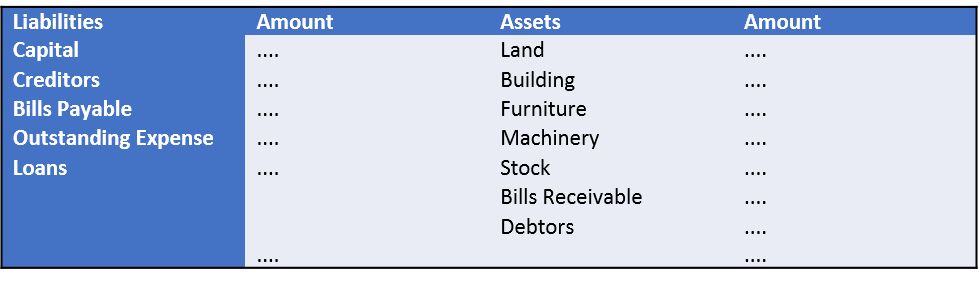

Balance Sheet: Balance Sheet is prepared at the end of each accounting period to ascertain the financial position of the business.

Format of Balance Sheet

Capital expenditure:

“Outlay resulting in the increase or acquisition of an asset or increase in the earning capacity of the business is capital expenses”. William pickles

Benefit of this expenditure we [business] enjoy for a long time. Capital expenditure is incurred for the purpose of enjoying long term advantage for the business.

This expenditure is mostly incurred for buying assets [tangible or intangible] which can later to be sold and converted into cash.

This expenditure is incurred to increase the earning capacity of the business.

Some examples of capital expenditure:

- Expenditure which are only for acquisition of fixed Assets

- Expenditure which are used for the extension or improvement in fixed Assets

- Legal charges incurred

- purchase of land, building,

- Purchase of furniture,

- Or any fixed asset for permanent use in the business.

Revenue expenditure: Mostly benefit of this expenditure we [business] enjoy only within the current year. Expenses of administration, manufacturing, selling expense, Office expense and all day to day expenses of the current year, are example of revenue expenditure.

According to Kohlar, it is “an expenditure charged against operation: a term used to contrast with capital expenditure.”

- Books Name

- CA Shivali kedia Accountancy Book

- Publication

- CA Shivali kedia

- Course

- CBSE Class 11

- Subject

- Accountancy

There are 2 systems of Accounting

- Double Entry System

Every transaction has 2 effects (Debit and Credit).

Eg 1: One person is receiving, another person is giving

Eg. 2: Suppose Ramesh purchases an office table by giving cash; the office table is coming in and cash is going out.

- Single Entry System

Because every transaction has 2 sides; maintaining accounts on the basis of a Single entry is not considered reliable under the Companies Act 2013. Although small businessmen adopt this method for ease of Accounting.

Vision classes

Vision classes