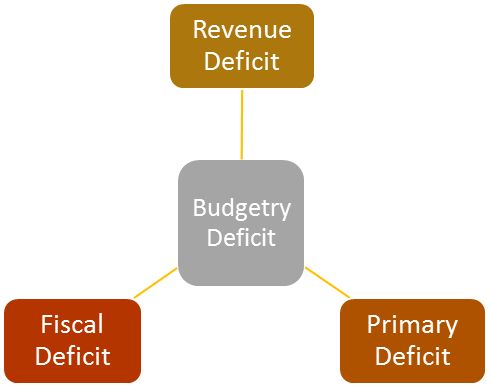

Measures of Government Deficit.

Definition: Budgetary Deficit is defined as the excess of total estimated expenditure.

Budget deficit:

- Budgetary deficit refers to the excess of total budgetary expenditure (both revenue expenditure and capital expenditure) over total budgetary receipts (both revenue receipt and capital receipt).

- In other words, when sum of revenue receipts and capital receipts fall short of the sum of revenue expenditure and capital expenditure, budgetary deficit is said to occur.

Symbolically, Budgetary Deficit = Total Expenditure – Total Receipts

Types:

- (i) Revenue deficit

- (ii) Fiscal deficit

- (iii) Primary deficit

1. Revenue deficit:

Meaning: Revenue deficit refers to the excess of revenue expenditure of the government over its revenue receipts.

Symbolically, Revenue Deficit = Total Revenue Expenditure – Total Revenue Receipts.

Implications of revenue deficit:

- Revenue deficit indicates dis-savings on government account because the government has to make up uncovered gap.

- Revenue deficit implies that the government has to cover this uncovered gap by drawing upon capital receipts either through borrowing or through sale of its assets.

- Since government is using capital receipts to generally meet consumption expenditure of the government, it leads to an inflationary situation in the economy.

Measures to reduce revenue deficit are:

- Government should reduce its unproductive or unnecessary expenditure.

- Government should increase its receipts from various sources of tax and non-tax revenue.

2. Fiscal deficit:

Meaning: Fiscal deficit is defined as excess of total expenditure over total receipts (revenue and capital receipts) excluding borrowing.

In the form of an equation,

Fiscal Deficit = Total Expenditure – Totoal receipts excluding borrowings

- Fiscal deficit is a measure of total borrowings required by the government.

- Fiscal deficit indicates capacity of a country to borrow in relation to what it produces. In other words, it shows the extent of government dependence on borrowing to meet its budget expenditure.

- Another point to be noted here is that as the government borrowing increases, its liability in future to repay loan with interest also increases leading to a higher revenue deficit. Therefore, fiscal deficit should be as low as possible.

Implications of fiscal deficit:

- Causes Inflation: An important component of government borrowing includes borrowing from the Reserve Bank of India. This invariably implies deficit financing or meeting deficit requirements of the government by way of printing more currency. This is a dangerous practice, though very convenient for the government. It increases circulation of money and causes inflation.

- Increase in Foreign Dependence: Government also borrows from rest of the world. It increases our dependence on other countries. Foreign borrowing is often associated with economic and political interference by the lender countries. It increases our economic slavery.

- Financial Burden for Future Generation: Borrowing implies accumulation of financial burdens for the future generations. It is for future generations to repay loans as well as the mounting interest thereon.

- Deficits Multiply Borrowings: Payment of interest increases revenue expenditure of the government, causing an increase in its revenue deficit. Thus, a vicious circle is set wherein the government takes more loans to repay earlier loans, which is called Debt Trap.

Sources of Financing Fiscal Deficit

- Borrowings: From internal sources(public, commercial banks) and external sources(foreign governments, international organisations)

- Deficit Financing: Government may borrow from RBI against its securities to meet the fiscal deficit. RBI issues new currency for this purpose, this is known as deficit financing.

Comparison between Fiscal Deficit and Revenue Deficit.

3. Primary deficit:

Meaning: Primary deficit is defined as fiscal deficit minus interest payments.

Primary Deficit = Fiscal Deficit – Interest Payments

Implications of primary deficit:

- While fiscal deficit shows borrowing requirement of the government for financing the expenditure inclusive of interest payments, primary deficit reflects the borrowing requirements of the government for meeting expenditures other than interest payments on earlier loans.

Comparison between Primary Deficit and Fiscal Deficit.

PathSet Publications

PathSet Publications