CIRCULAR FLOW OF INCOME - GENERAL

Circular Flow of Income

INTRODUCTION

The term macro is derived from the Greek word ‘makro’, which means “large”. It is a branch of economics concerned with the description and explanation of economic processes involving aggregates.

- An aggregate is a collection of economic subjects that have some characteristics in common.

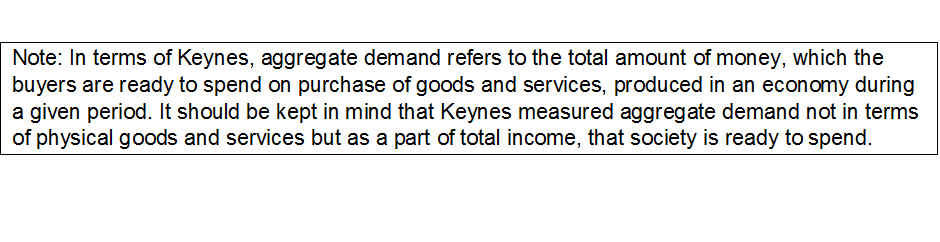

- Macroeconomics emerged after the publication of John Maynard Keynes' book, ‘The Theory of Employment, Interest, and Money’ in 1936. This branch investigates the economic relationships or issues that affect an economy as a whole, such as saving and total consumption.

- Macroeconomics is the part of economic theory that studies the economy as a whole, such as national income, aggregate employment, general price level, aggregate consumption, aggregate investment, etc. Its main instruments are aggregate demand and aggregate supply. It is also called the ‘Income Theory’ or ‘Employment Theory’

- Macroeconomics is concerned with economic problems at the level of an economy as a whole. Structure of Macroeconomics implies study of different sectors of the economy.

- Producer sector engaged in the production of goods and services.

- Household sector engaged in the consumption of goods and services.

- Note: Households are taken as the owners of factors of production.

- The government sector engaged in activities like taxation and subsidies

- Rest of the world sector engaged in exports and imports.

- Financial sector (or financial system) engaged in the activity of borrowing and lending.

CIRCULAR FLOW OF INCOME

It refers to the cycle of generation of income in the production process, its distribution between the factor of production namely Land, Labour, Capital and Enterprise and finally, its circulation from households to firms in the form of consumption expenditure on goods and services produced by them.

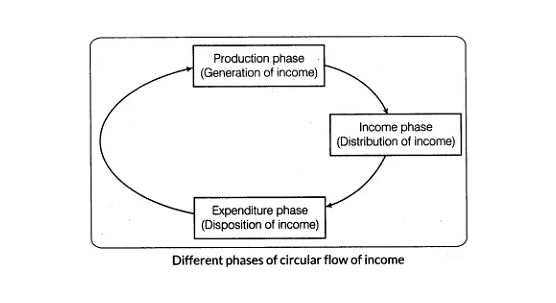

Phase in Circular Flow of Income

- Generation Phase: In this phase, the firm produces goods & services using factors of production (Land, Labour, capital and Enterprise).

- Distribution Phase: In the Second Phase, the firms make factor payments (Rent, wages, Interest & Profit) to the household for providing factor services.

- Disposition Phase: In this phase, the households spend the amount/income received by factors of production in purchasing good and services produced by firms.

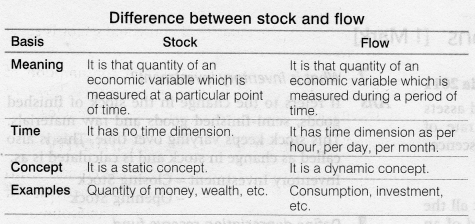

STOCK:

- Stock variable refers to that variable; which is measured at a particular point of time.

- It is static in nature, i.e., it does not change.

- There is no time dimension in stock variables.

- For eg. Distance, Amount of Money, National Wealth, National Capital, Money Supply, Water in Tank etc.

FLOW:

- Flow variable refers to that variable; which is measured over a period. The ‘period of time’ could be a day, a week, a year etc.

- It is dynamic in nature i.e. it can be changed.

- There is time dimension in flow variables

- For example, Speed, Spending of Money, Water in River, Exports, Imports, etc.

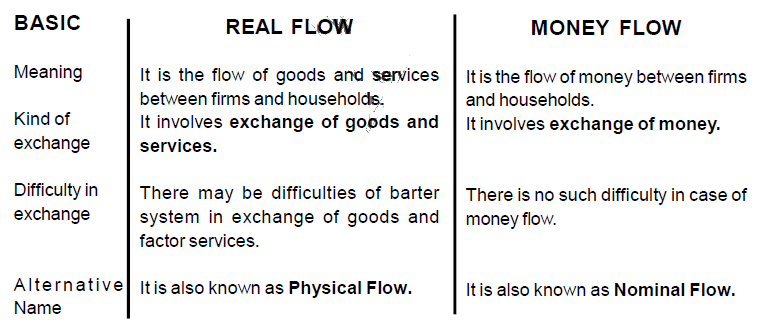

REAL & CASH FLOW

TYPES OF CIRCULAR FLOW

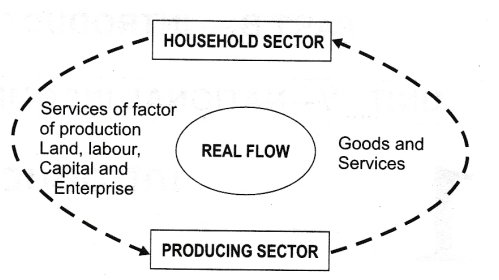

Real Flow: It refers to the flow of factor services (land, labour, capital, and enterprise) from household to firms and the corresponding flow of goods and services from firms to households. It is also known as ‘Physical Flow’.

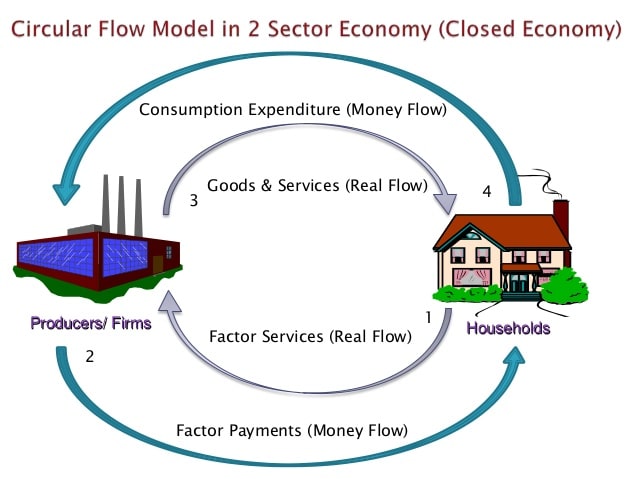

As seen in the above diagram, the households sector provides factor services to the producing sector i.e. firm which, in turn, provide goods and services to them as a reward for their productive services.

Real flow determines the magnitude of growth process in an economy. For example, when more factor services are offered to firms, then volume of production will be more and it speeds up the process of economic growth.

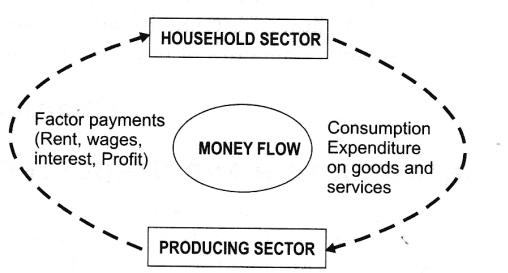

Money Flow: It refers to the flow of factor payments (Rent, wages, interest, and profit) from firms to households for providing factor services and corresponding flow of consumption expenditure from households to firm for purchase of goods and services produced by firm. It is also known as ‘Nominal flow’.

As seen in the above diagram, the producing sector makes factor payments to households for their factor services and households spend this income on purchase of goods and services produced by the firm.

CIRCULAR FLOW OF INCOME - TWO SECTOR ECONOMY MODEL

CIRCULAR FLOW IN A SIMPLE ECONOMY (TWO-SECTOR ECONOMY)

In a simple two-sector economy, there exist only two sectors i.e. household and firms, where households are the owners of factors of production (Land, Labour, Capital, and Enterprise) and consumers of goods & services. Firms produce goods and services and sell them to households.

In order to make our analysis simple, we can make some assumptions:-

- Only two sectors in an economy are there i.e. Households and firms. It means there is no government and foreign sector.

- Households provide factor services to firms only and firms hire factor services from household only.

- The amount received by the household from the firm for providing factor services is used entirely on consumption.

This brings us to the following conclusion.

- There are no savings in the economy, i.e. neither the household saves from their incomes, not the firm saves from their profits.

- In the given diagram, it can be seen that households are providing factor services in exchange for factor payment and firms are providing goods & services to households in exchange for consumption expenditure.

- Total Production = Total Consumption

- Factor Payment = Factor Income

- Consumption Expenditure = Factor Income

- Real Flow = Money Flow

Note: In a circular flow of income, production generates factor income, which is converted into expenditure. This flow of income continues, as production is a continuous activity due to never-ending human wants. It makes the flow of income circular.

Synonyms/Similar terms of this chapter

- Generation Phase - Production Phase

- Distribution Phase - Income Phase

- Disposition Phase - Expenditure Phase

- Real Flow – Physical Flow

- Money Flow – Nominal Flow

DOMESTIC TERRITORY, RESIDENTSHIP, CITIZENSHIP

DOMESTIC TERRITORY

In layman’s language, domestic territory means the political frontiers of a country. However, for national income accounting, it is used in a wider sense.

Definition: Domestic Territory is geographical territory administered by a government within which persons, goods and capital circular freely.

Let us first see what IS not included in a domestic territory:

The domestic territory DOES NOT include-

- Embassies, consulates and military establishment of a foreign country, for example- the American embassy in India is the domestic territory of America and not India

- An international organization like UNO, WHO located within the geographical boundaries of a country

What all is included?

Ship and aircraft owned and operated by normal residents between two countries.

- For example- Planes operated by Air India between London and Paris are part of the domestic territory of India. Similarly, planes operated by Singapore Airways between Indian and Japan are a part of domestic territory of Singapore.

Fishing Vessels, oil and natural gas rigs and floating platforms operated by the residents of a country in the international waters where they have exclusive rights of operation.

- For example, fishing boats operated by Indian anglers in international waters of Indian Ocean will be considered a part of domestic territory of India.

Embassies, consulates and military establishments of country located abroad.

- For example- Indian Embassy in Japan is a part of the domestic territory of India.

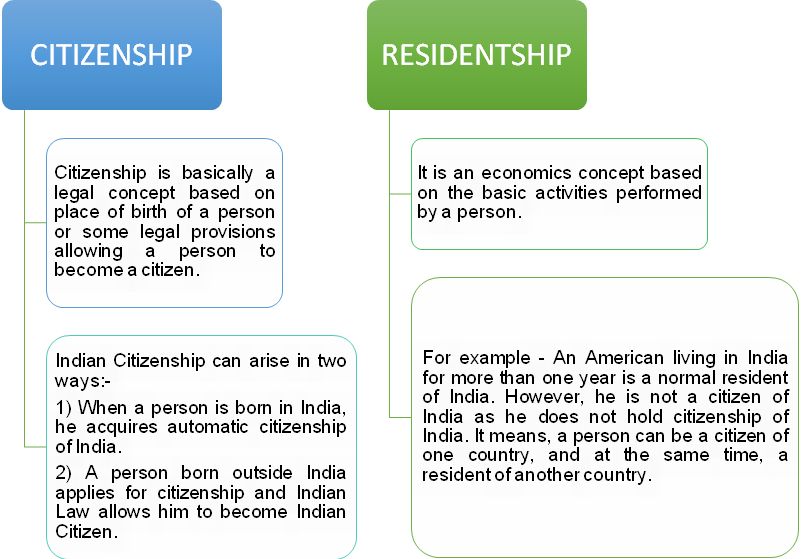

NORMAL RESIDENTS

Definition: Normal Residents of a country refers to an individual or institution who ordinarily resides in the country and whose centre of economic interest also lies in that country.

‘Centre of Economic Interest’ implies:

- The resident lives or is located within the domestic Territory.

- The resident carries out basic economic activities of earning, spending, and accumulation from that location.

Following are not included in Normal residents:-

- Foreign Tourists & Visitors

- Foreign staff of Embassies, officials, diplomats and members of the armed forces.

- International Organization like WHO, UNO etc.

- Employers of International Organizations.

- Crewmembers of foreign vessels, commercial travellers and seasonal workers, provided their stay is less than one year.

- Border workers, who cross borders on a regular basis to work in other countries.

CITIZENSHIP AND RESIDENTSHIP

FINAL GOODS & INTERMEDIATE GOODS

TYPES OF GOODS

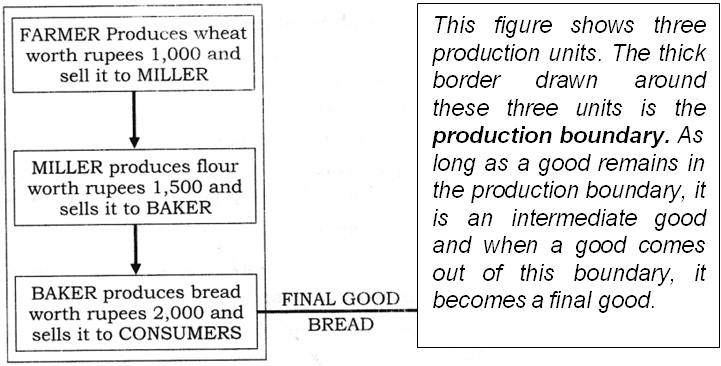

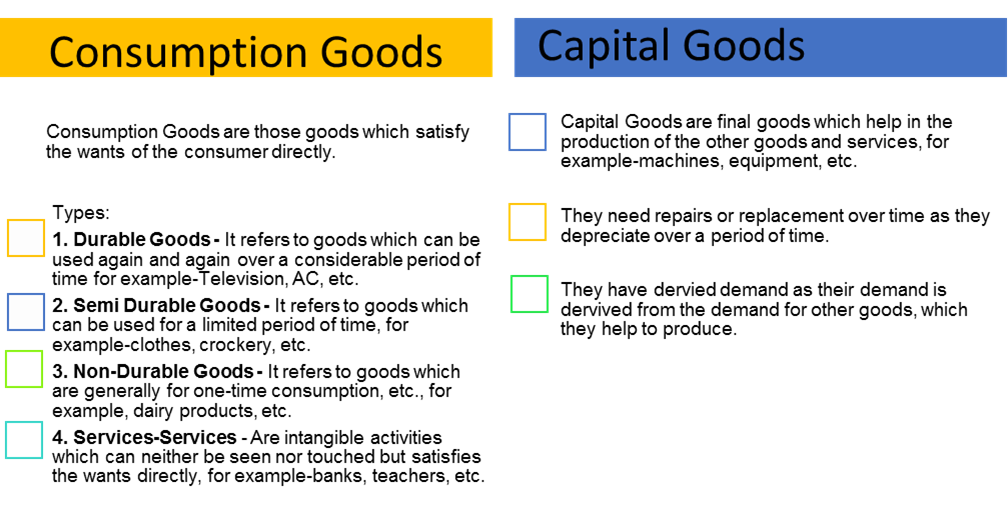

Final Goods: Final goods refer to those goods, which are used either for consumption or for investment.

For example,

- Goods purchased by consumer households as they are meant for final consumption.

- Goods purchased by firm for capital formation or investment like machinery purchased by a firm.

Intermediate Goods: Intermediate goods refer to those goods which are used either for resale or for further production in the same year.

For example,

- Goods purchased for resale like milk purchased by a dairy shop.

- Goods used for further production like milk used for making sweets.

NOTE: The distinction between intermediate goods and final goods is made based on the use of product and not on the basis of product itself. For example, sugar is an intermediate good when it is used by sweet shop for making sweets. However, if consumers use it, then it becomes a final good.

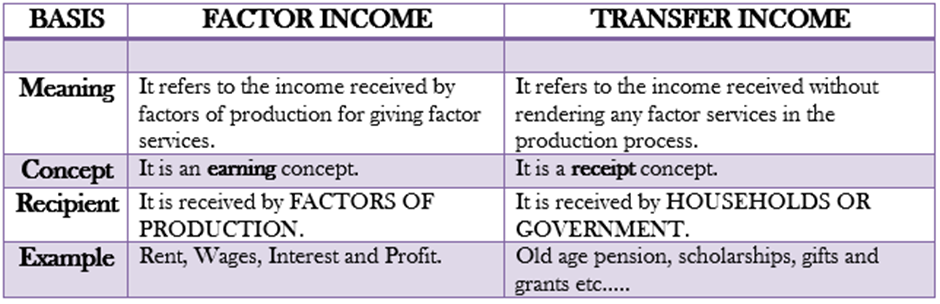

FACTOR INCOME & TRANSFER INCOME

FACTOR INCOME AND TRANSFER INCOME

Factor Income:

Definition: It refers to income received by factor of production (labour, Land, Capital and Enterprise) for rendering factor services in the production process.

- Factor Incomes of normal residents of a country is included in the National Income.

- For example-Rent, Wages, Interest and Profit.

Transfer Income:

Definition: Transfer Income refers to income received without rendering any productive service in return.

- It is unilateral (One-sided) concept.

- As there is no production of goods or services, it is not included in National Income.

- For example- Old age pension, pocket money, unemployment allowance, scholarship etc.

Note: Taxes received by the government are the transfer incomes of the government as they are received without providing any productive service in return. Similarly, subsidies paid by the government are transfer payments of the government.

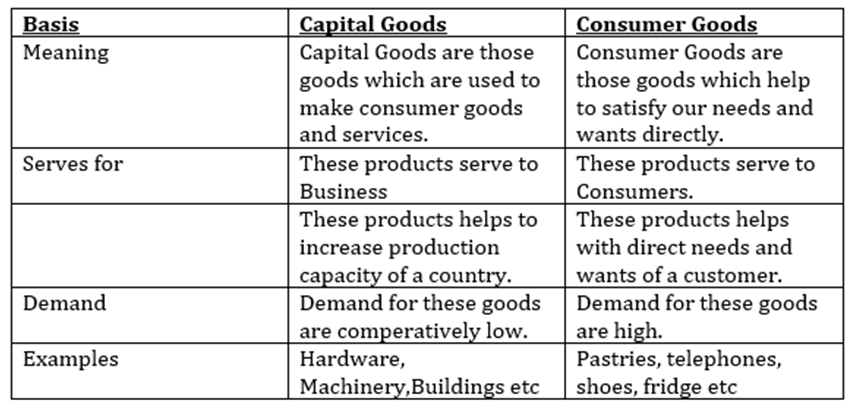

CONSUMPTION GOODS & CAPITAL GOODS

Final Goods can be further classified into two groups:

- Consumption Goods

- Capital Goods

NATIONAL INCOME AGGREGATES

INTRODUCTION

In an economy, different productive units produce various goods and services during a period of one year. Such goods and services cannot be added together in terms of quantity. Therefore, these are expressed in terms of money.

GROSS AND NET

- Gross means the value of product including depreciation.

- Net means the value of product excluding depreciation.

- The difference between these two terms is depreciation.

- Where depreciation is the expected decrease in the value of fixed capital assets due to its general use.

It is the result of production process.

Gross = Net + Depreciation Net = Gross – Depreciation

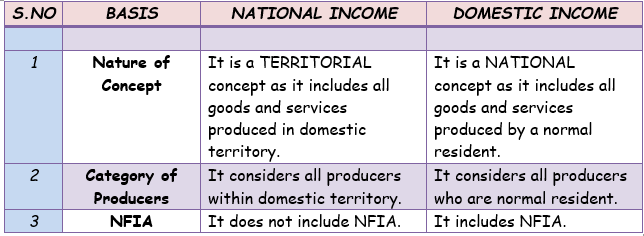

NATIONAL INCOME AND DOMESTIC INCOME

National Income refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

Domestic Income refers to a total factor income earned by the factor of production within the domestic territory of a country during an accounting year.

The difference between these two incomes is Net Factor Income from abroad (NFIA), which is included in National Income (NY) and excluded from Domestic Income (DY).

Where NFIA is the difference between income earned by normal residents from rest of the world and similar payments made to Non-residents within the domestic territory.

NFIA = Income earned by Residents from rest of the world (ROW) – Payments to

Non-Residents within Domestic territory.

NY = DY + NFIA DY = NY – NFIA

BASIC AGGREGATES OF NATIONAL INCOME

1. Gross Domestic Product at Market Price (GDPMP ):

GDPMP is defined as the gross market value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units.

- ‘Gross’ in GDPMP signifies that depreciation is included, i.e., no provision has been made for depreciation.

- ‘Domestic’ in GDPMP signifies that it includes all the final goods and services produced by all the production units located within the economic territory (irrespective of the fact whether produced by residents or non-residents).

- ‘Market Price’ in GDPMP signifies that indirect taxes are included and subsidies are excluded, i.e., it shows that Net Indirect Taxes (NIT) have been included.

- ‘Product’ in GDPMP signifies that only final goods and services have to be included and intermediate goods should not be included to avoid the double counting.

2. Gross Domestic Product at Factor Cost ( GDPFC):

GDPFC is defined as the gross factor value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units excluding Net Indirect Tax.

GDPFC = GDPMP – Net Indirect Taxes

3. Net Domestic Product at Market Price (NDPMP ).

NDPMP is defined as the net market value of all the final goods and services produced within the domestic territory of a country by its normal residents and non-residents during an accounting year.

NDPMP =GDPMP – Depreciation

4. Net Domestic Product at Factor Cost (NDPFC ).

NDPFC refers to a total factor income earned by the factor of production within the domestic territory of a country during an accounting year.

NDPFC = GDPMP – Depreciation – Net Indirect Taxes NDPFC is also known as Domestic Income or Domestic factor income.

5. Gross National Product at Market Price (GNPMP).

GNPMP refers to market value of all the final goods and services produced by the normal residents of a country during an accounting year.

GNPMP = GDPMP + Net factor income from abroad It must be noted that GNPMP can be less than GDPMP when NFIA is negative. However, GNPMP will be more than GDPMP when NFIA is positive.

6. Gross National Product at Factor Cost (GDPFC ) or Gross National Income

GNPFC refers to gross factor value of all the final goods and services produced by the normal residents of a country during an accounting year.

GDPFC = GNPMP – Net Indirect Taxes

7. Net National Product at Market Price (NNPMP ).

NNPMP refers to net market value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPMP = GNPMP – Depreciation

8. Net National Product at Factor Cost (NNPFC ) or National Income.

NNPFC refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPFC = GNPMP – Depreciation – Net Indirect Taxes It must be noted that NNPFC is also known as National Income.

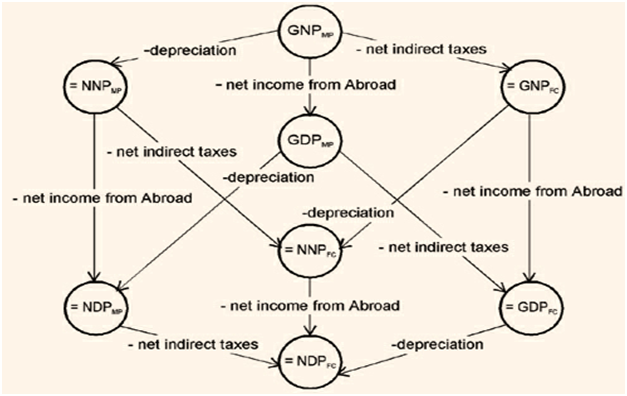

RELATIONSHIP BETWEEN ALL AGGREGATES:

THREE GOLDEN RULES

INVESTMENT

Investment or capital formation refers to addition to the capital stock of an economy. For example-Construction of roads, flyovers, Building, etc.

Investment can be of two forms:

Gross Investment

- Definition: It is an addition to the stock of capital before making allowance for depreciation

Net Investment

- Definition: Net Investment is an actual addition made to the capital stock of the economy in a given period.

- Net Investment = Gross Investment- Depreciation

DEPRECIATION (Consumption of fixed capital)

Definition: It refers to a fall in the value of an asset due to normal wear and tear ,the passage of time or expected obsolescence (change in technology).

NET INDIRECT TAXES (NIT)

- NIT refers to the difference between Indirect Tax and Subsidies.

- Net Indirect Taxes (NIT) = Indirect Tax-Subsidies

Indirect Tax

Definition: Indirect Taxes refers to those taxes, which are imposed by the government on production and sale of goods and services. For example- Goods and Services Tax (GST)

Subsidies

Definition: Subsidies are the ’economic assistance’ given by the government to the firms and households, with a motive of the general welfare. For Example- Subsidy on LPG Gas Cylinders.

Factor Cost

It refers to the amount paid to factors of production for their contribution to the production process.

Market Price

It refers to the Price at which product is actually sold in the market. For example- If price of the LPG cylinder is Rs.1000 and the tax rate is 10%, the price of the cylinder becomes Rs.1100 but a subsidy of Rs.50 is provided by the government hence the final price is Rs.1050.

Here Rs.1000 is factor cost, Rs.1050 is Market Price, Rs.100 is indirect Taxes and Rs.250 is a subsidy.

NET FACTOR INCOME FROM ABROAD (NFIA)

Definition: It refers to the difference between factor income received from the rest of the world and factor income paid to the rest of the world.

NFIA = Factor Income earned from Abroad-Factor Income paid Abroad.

Significance: NFIA is significant to differentiate between ‘domestic income’ and ‘national income’.

National Income= Domestic Income + NFIA.

Components of NFIA

- Net compensation of Employees- It is the difference between income from work received by resident workers living or employed abroad for less than one year & similar payments made to non-resident workers employed domestic territory of the country.

- Net Income from Property and entrepreneurship - It refers to the difference between income from property and entrepreneurship received by residents of the country and similar payments made to Non-residents

- Net Retained earnings - It refers to the difference between retained earnings of resident’s companies located abroad and retained earnings of non-resident companies located within the domestic territory of that country.

NFIA = Net Compensation of Employees + Net Income from Property and Entrepreneurship + Net Retained earnings

Synonyms/Similar terms of this chapter

VALUE ADDED METHOD

We have learnt that production gives rise to income, income results in expenditure, which in turn, generates income again.

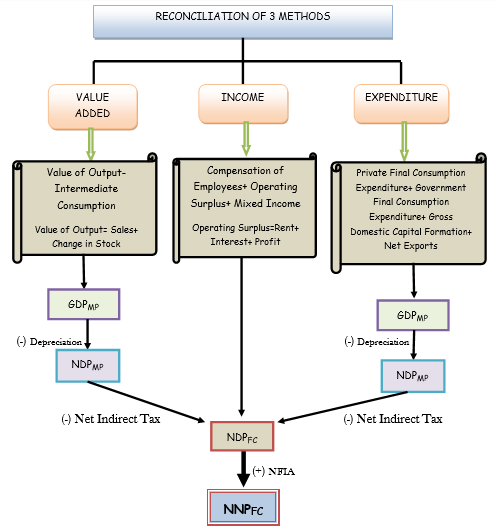

The National Income of a country can be measured in three different ways:

- Value Added Method

- Income Method

- Expenditure Method

It must be noted that all three methods give the same value of national income because they are used to measure the same physical output at three different phases.

VALUE-ADDED METHOD

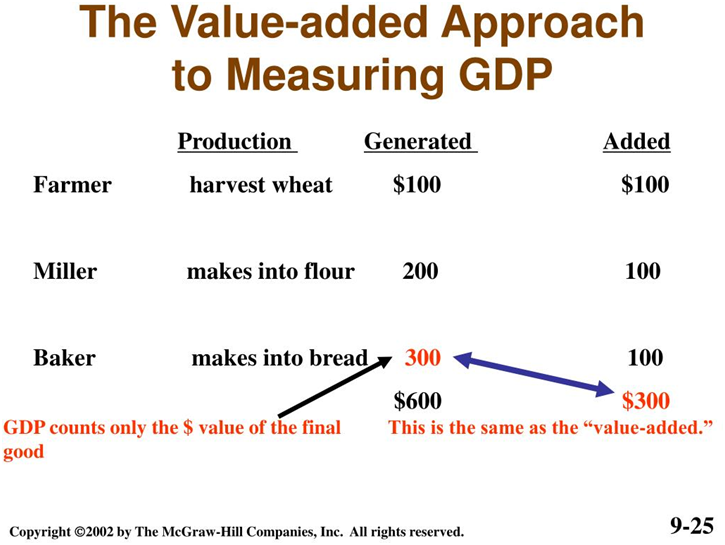

This method is used to measure national income in different phases of production in the circular flow. Every individual enterprise adds a certain value to the product when it purchases from some other firm as intermediate goods. When value-added by each and every firm is summed up, we get the value of national income.

- Value Added: Value added is the difference between the value of goods as they leave a stage of production and the cost of the goods as they entered that stage.

Value Added = Value of output - Intermediate consumption

For Example: Suppose a sweet shop owner buys milk worth ₹100 from the milkman. After processing the milk into sweets, he sells it for ₹250.

So, here the milk is intermediate consumption as it was used for making sweets. The sweets which are sold off are output and termed as the value of output.

The difference between this value of output and intermediate consumption is termed as ‘value-added’. Value added by each producing enterprise is known as the Gross Value Added (GVA mp).

Sum total of all GVAmp of all producing enterprises within the domestic territory of a country during one year is equal to GDPmp.

∴ ΣGVAmp = GDPmp

- If the value of intermediate consumption is given, then imports are not included separately as imports are already included in the value of intermediate consumption.

However, if domestic purchases are given, then imports will also be included.

For Example:

Case 1:

- Intermediate Consumption = ₹500

- Imports = ₹200

Here imports would not be included and the value of intermediate consumption is ₹500.

Case 2:

- Purchase of Raw Material from domestic firm=.₹700

- Imports =₹300

Here, the value of intermediate consumption = Purchase of Raw material from domestic firm + Imports =700+300

Intermediate consumption =₹1000

- Value of Output: Value of output refers to the market value of all goods and services produced during a period of one year.

How to calculate the value of output:

- When the entire output is used is sold in an accounting year then the value of output is equal to sales.

- When the entire output is not sold in an accounting year then the value of output is calculated as follows:

Value of output = Sales + change in stock

[Change in stock= Closing stock - Opening stock]

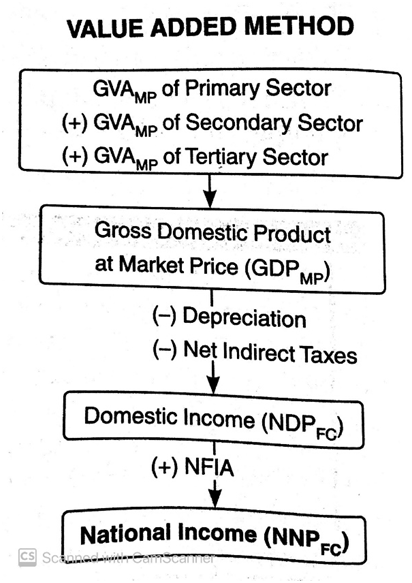

Steps to Calculate National Income by Value Added Method

Step 1- Identify and classify the production units:

The first step is to identify all the producing units into the primary, secondary and tertiary sector.

Step 2- Estimate Gross Domestic Product at Market Price:

Now gross value added to market price (GVAmp) of each sector calculated and the sum total of GVAmp of all sectors gives GDPmp i.e GDPmp= ΣGVA (of all sectors).

Step 3- Calculate Domestic Income (NDPFC)

Now, to calculate NDPFC from GDPmp, we need to subtract both depreciation as well as net indirect taxes i.e NDPFC = GDPmp – Depreciation – Net Indirect Taxes.

Step 4– Calculate National Income (NNPFC)

For calculating NNPFC from NDPFC, NFIA is to be added NNPFC= NDPFC +NFIA

Precautions of Value-Added Method

Intermediate goods are not to be included in National Income - If intermediate goods would be included in National Income it would lead to double-counting, as these are already included in final goods.

Sale and Purchase of Second Hand Goods are not included- Since these goods are already included in the year of manufacture, these are not included again. However, any brokerage or commission earned or paid is to be included while calculation.

Production of services for self-consumption (Domestic Services) are not included: Domestic services like services of Housewife, kitchen gardening etc. are not included in national income as these services never entered market place and it's difficult to find their market value.

Production of goods for self-consumption will be included - It is not included in national income as they contribute to current output. Their value is to be estimated or imputed, as they are not sold in the market.

Change in the stock of goods will be included - Net increase in the stock of inventories will be included in national income as part of capital formation.

The problem of Double Counting:

Double Counting refers to the counting of output more than once while passing through various stages of production.

While calculating national income, the only value of final goods is to be included. The problem of double counting arises when the value of intermediate goods are also included along.

How to avoid Double Counting:

Final Output Method – As per this method, the value of only the final output should be added to determine national income. For example, the value of sweets of Rs 250 sold to final customers should be taken in national income.

Value- Added Method – The value-added in every stage of production is included under this method for calculation of National Income.

INCOME METHOD

INCOME METHOD

As per this method, all the incomes that accrue to factors of production by way of wages, profits rent, interest, etc. are summed up to obtain the national income.

Components of Factor Income

The following are components of the Income Method. Sum of all the items given below is known as Domestic Income (NDP at FC)

1. Compensation of Employees (COE) –

Definition: COE is the amount paid to employees by employers for rendering productive services. It includes all the benefits received by employees from employers.

- Wages and Salaries in cash- It includes all the benefits, which are in monetary terms like wages, Salaries, bonus, commission, etc.

- Wages and Salaries in kind- it includes all the benefits in non-monetary terms like free house, car, medical facilities, etc.

- Employer’s Contribution to social security schemes – it includes contribution by an employer for social security schemas for Example- provident fund, gratuity, etc.

2. Rent and royalty-

Rent: is income from ownership of land and building. It includes both the actual rent (rent of left out land) as well as imputed rent (rent of self - occupied factors).

Royalty: refers to income received from granting leasing right of sub-soil assets. For example – Royalty from leasing of Iron mine, Gold mine, etc.

3. Interest –

Definition: Interest refers to the amount received from lending funds to a production unit. It involves both actual interest and imputed interest. For example, interest on loans taken for productive services only.

It does not include the following:

- Interest paid by the government on National Debt.

- Interest paid by consumers as such interest is paid on loans taken for consumption purposes.

- Interest paid by one firm to another firm.

4. Profits –

Definition: Profits are excess of revenues over the expenditure of any corporation. It is a residual income.

This profit earned by an entrepreneur can be used for three purposes:

- Corporate Tax – it is a tax paid by a corporate to a government on total profits. It is also known as ‘Profit Tax’ and ‘Business Tax’.

- Dividend – it is divided part of profit given to share - holders. It is also known as distributed profits.

- Retained Earnings – Out of total profit a part is distributed among shareholders and a part is retained in business in business, this is kept for future as Retained Earning. It is also known as undistributed profits, Savings of the Private sector and Reserve & Surplus.

5. Mixed Income –

Definition: It is income generated by people who are self-employed. For example- Barber, farmers, etc. or unincorporated enterprises like the retail trader, small shopkeeper.

Mixed income arises from productive services of self-employed persons, whose income includes wages, rent, interest and profit. These elements cannot be separated from each other. For Example: the income of a doctor running a clinic at his residence.

Steps of Income Method

Step-1 Identify and classify the production units.

All the producing units are classified in Primary, Secondary and tertiary sectors.

Step-2 Estimate the factor income paid by each sector.

Factor incomes paid by each factor are classified under:

- Compensation of Employees,

- Rent and Royalty

- Interest

- Profit

- Mixed income.

Step-3 Calculate Domestic Income (NDP at FC)

When all factor incomes are summed up, we get domestic income (NDP at FC) i.e. NDP at FC= Compensation of Employees + Rent and Royalty + interest +profit + mixed income of self-employed.

Step–4 Calculating National income from Domestic income.

In the final step, we need to add NFIA to domestic income to get National Income.

National Income (NNPFC) = Domestic Income (NDPFC) + NFIA.

PRECAUTIONS OF INCOME METHOD

Transfer Income – Transfer incomes are not included in National income as such incomes are not productive and there is no value addition.

Income from the sale of second-hand goods – Sale of second-hand goods are not included in national income as their sale are already recorded when these were first sold. However, commission, brokerage or any other income is to be recorded.

Income from the sale of shares, bonds and debentures are not included- Such items are not included in national income, as they do not contribute to the current flow of goods and services. However, any brokerage or commission is to be included in national income.

Windfall gains- These are gains like on lottery, horse race, etc are not included as there is no productive activity.

The imputed value of services provided by owners of production unit be the included- Imputed value of owner-occupied houses, interest on own capital, etc are included as it is a productive activity and add to flow of goods and services.

Payments out of past savings- These Payments like death duties, gift tax, interest tax, etc are not included in national income as they are paid out of past savings and do not add to the current flow of goods and services.

EXPENDITURE METHOD

EXPENDITURE METHOD

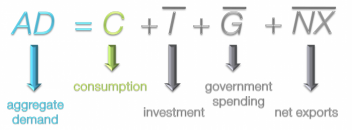

This method measures national income as the sum total of final expenditure incurred by households, business firms, governments, and foreigners.

This method is also known as ‘Income Disposable Method’.

Components of Final Expenditure:

1. Private final consumption expenditure-

As the name suggests, it is the expenditure made by households and private non –profit sharing institutions on all type of consumer goods.

It includes the following:

- Household final consumption expenditure.

- Private non-profit institutions serving household final consumption expenditure.

- Expenditure made by normal residents abroad during any tour and travel.

However, any expenditure made by foreign tourists in the domestic market would be deducted.

2. Government Final Consumption Expenditure-

It refers to expenditure made by the government on various administrative services like defence, law, and order, education, etc.

It includes the following:

- Intermediate consumption by government.

- Compensation paid by the government.

- Direct purchase from abroad for embassies and consulates located abroad.

However, it does not include the sale of goods and services produced by the general government.

3. Gross Domestic Capital Formation or Gross Investment-

Definition: It refers to the addition to the capital stock of the economy.

Following are components of GDCF:

- Gross fixed capital formation: it refers to expenditure made on purchase to a fixed asset. It includes the following Gross business fixed investment - (expenditure on new plants, machinery, equipment, etc).

- Gross Residential construction investment- (it includes expenditure on purchase of new houses by households).

- Gross public investment – (expenditure on construction of flyovers, bridges, etc by the government).

- Inventory Investment – it refers to the amount by which the firm’s inventories change during a period. it may include stock of raw material, semi-finished goods lying with producers.

It is calculated as the difference between closing stock and opening stock of the year.

- Change in Inventories = closing stock - opening stock.

- GDCF = Gross Fixed Capital Formation+ inventory Investment.

4. Net Exports:

It refers to the difference between exports and imports of a country, during a period of one year. Instead of taking Imports and exports separately, the difference between the two is taken as it is turned as Net Exports.

Net Exports=Export – Import

Steps in Calculating Net Exports

Following steps are involved in the calculation of national income by expenditure method:

Step-1 Identify the economic units incurring final expenditure-

All economic units, which incur final expenditure within the domestic territory, are classified under four groups:

- Households sector

- Govt. Sector

- Producing sector

- Rest of the world sector

Step-2 Classification of Final Expenditure –

Final expenditure by above economic units are estimated and classified under the following heads:

- Private Final Consumption Expenditure (PFCE)

- Government Final Consumption Expenditure (GFCE)

- Gross Domestic Capital Formation (GDCF)

- Net Exports (X-M)

Sum of all of the above components gives GDP.

GDP at MP = PFCE + GFCE + GDCF + (X-M)

Step-3 Calculate Domestic Income (NDPFC)-

Now to calculate NDP at FC from GDP at MP, we need to subtract depreciation and Net Indirect Taxes (NIT).

Step-4. Estimate net factor income from abroad to arrive at national income.

Finally, we add net factor income from abroad to NDPFC in order to get NNPFC (National Income).

Precautions of Expenditure Method

Expenditure on intermediate goods will not be included in national income: As intermediate goods are already included in the value of final expenditure, and if it is included again it will lead to double counting.

Transfer Payments are not included: As these payments are not connected with any productive activity, these are not added while calculating national income.

Purchase of second-hand goods will not be included: As the sale of second - hand goods are already included at the time when they were originally purchased. However, any brokerage or commission on such goods is included as it is the payment made for productive service.

Purchase of financial assets: Transactions relating shares, debentures, bonds etc. are not included, as they do not contribute to the current flow of goods and services. (Commission, brokerage on such transaction to be included)

Expenditure on own account production: Production for self - consumption, imputed value of owner occupied house, free services from general government and private non-profit institutions serving households will be included in national income since these are productive services.

TREATMENT OF DIFFERENT ITEMS IN NATIONAL INCOME

Treatments of different items in National Income

- National Income includes income earned by a normal resident of a country as a reward for their productive services in the current year.

The following items are not included while calculating national income:

Transfer Income and payments like Pension, Scholarship, gifts, etc.

Compulsory Transfer Payments like interest tax, capital gain tax, etc.

Sale and purchase of financial assets.

Windfall gains like lotteries, gambling, etc.

Non - market transactions like kitchen gardening, etc.

Intermediate consumption expenditure like the purchase of raw material by a firm, vegetables purchased by a dairy shop, etc.

Sale or purchase of second- hand goods like sale/purchase of an old house, etc.

Capital loss like the destruction of a building by earthquake or flood etc.

Capital gains like profit due to increase in the price of land, building, shares, etc.

National debt interest or interest paid by households to commercial banks.

Following items are included while calculation of National Income:

Brokerage/Commission on sale/purchase of second- hand goods.

Services provided by the owners of production units like imputed rent of owner’s occupied house interest on own capital etc.

Capital Formation (Investment) like the purchase of machinery by a firm, construction of flyover, bridges, etc.

Payment of bonus, contribution to provident fund by employer etc.

Payment of bus fare by households, examination fees paid by students, payment of telephone bills, etc.

Profit earned by an Indian company from its branches abroad, wages received by Indian employee working abroad, etc.

Free services, (Dispensary, education) by government, government expenditure on street lighting.

Interest on the loan paid by commercial banks.

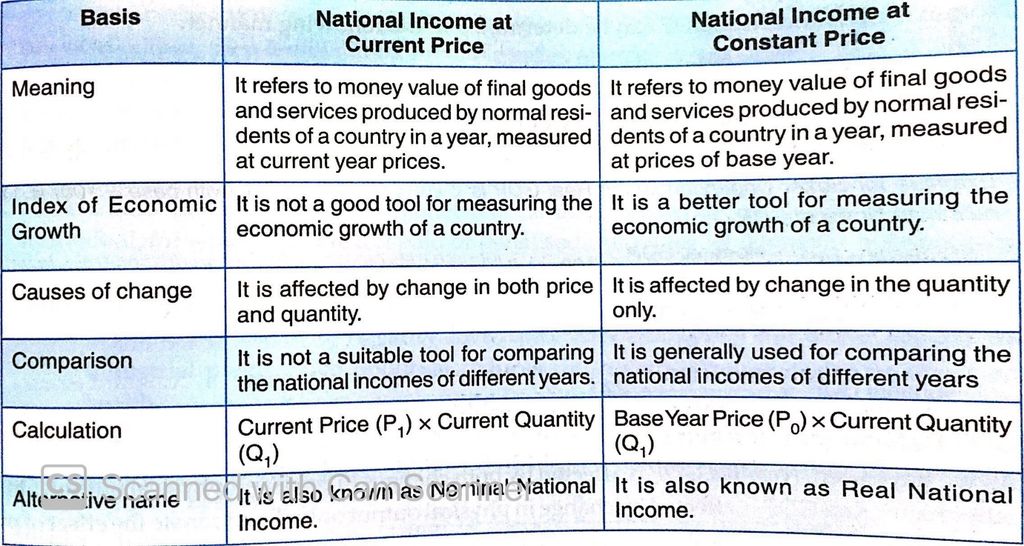

National Income at Current price and Constant price:

National Income at Current Price: It is the money value of final goods and services produced by normal residents of a country in a year, measured at prices of the current year.

It is also known as ‘Nominal National Income ’. For example – measuring India’s National Income of 2018-19 at prices of 2018-19 or measuring India’s National Income of 2017-18 at prices of 2017-18.

It does not show the true picture of the economic growth of a country as any increase in national income may be due to rise in price level without any change in physical output.

National Income at Constant Price: It is the money value of final goods and services produced by normal residents of a country in a year, measured at price of base - year. Base year is a normal year which is free from price fluctuations). Presently 2011-12 is taken as base year in India.

It is also known as ‘Real National Income’. It shows the true picture of the economic growth of a country as any increase in real national income is due to the increase in output only.

Numerical Example -

National Income at current price and at constant price.

- It can be seen that national income at current price is Rs22000 and at base price is Rs17000. The difference of Rs 5000 is not real. It does not give a true picture of economic growth as the increase is merely due to rise in prices.

Conversion of National income at current price into constant price.

- Conversion of national income at current into constant price can be done using price index, price index is an index number which shows the change in price level between two different time periods.

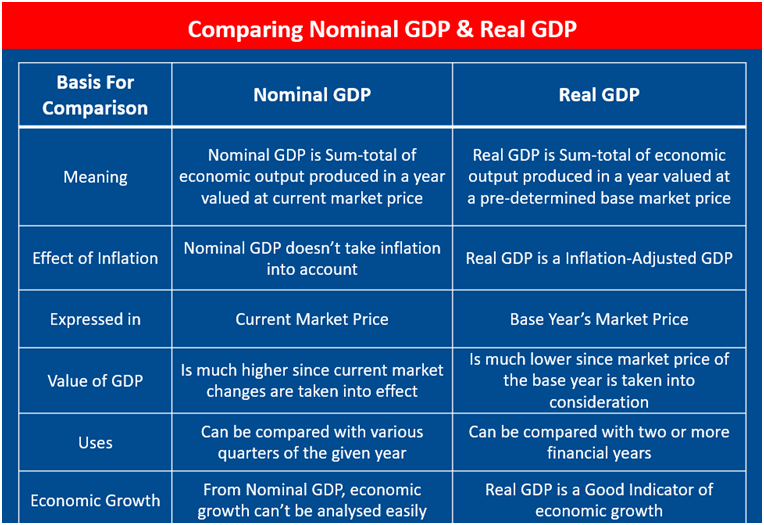

GDP DEFLATOR

Nominal GDP and Real GDP:

1. Nominal GDP or GDP at Current price – When GDP is estimated on the basis of price of the same year, it is called Nominal GDP.

2. Real GDP or GDP at Constant price – When GDP is estimated, based on the price of base year, it is called real GDP.

GDP deflator (Price Index)

Definition: GDP Deflator is one measure of overall price level. It measures the average level of prices of all the goods and services that make up GDP.

GDP Deflator or price index= Nominal GDP/Real GDP *100

Example:

If Nominal GDP is Rs 21000 Cr. and Real GDP is Rs 18000 Cr. Find GDP Deflator.

Ans: GNP Deflator = ₹116.67

Difference between Nominal GDP and Real GDP?

Which is better Nominal GDP or Real GDP?

Real GDP is better because:

- It helps in determining the effect of the increased production of goods and services as it is affected by change in physical output only. On the other hand, Nominal GDP can increase even without any increase in physical output.

- Real GDP is better measure to make periodic comparison in the physical output over different years.

- Real GDP facilitates international comparison of economic performance across the countries.

GDP and Welfare

We generally think that the increase in GDP is good. Increasing GDP is usually considered as one of the Chief goals of government's macroeconomics policy.

Because some serious problem arises when we try to use GDP as a measure of happiness or well-being, we now point out some of the limitations of GDP concept as a measure of welfare.

1. Distribution of GDP - GDP does not take into consideration the income distribution in an economy i.e. gap between rich and poor.

It may be possible that a large part of goods and services are consumed by rich. So, the welfare of the people may not rise as much as the rise in GDP.

2. Change in Price – If GDP is increasing due to increase in price rather than the increase in production, and then it will not be a reliable index of economic welfare.

3. Non-Monetary Exchange – GDP includes only those activities which are in direct monetary terms, so those activities like kitchen gardening which are non – monetary exchanges are not included in GDP due to non - availability of data. However, these activities contribute to economic welfare.

4. Externalities – Externalities refers to those harms or benefits for which a firm is not paid or penalised. It is of two types:

- Positive Externalities – These are the activities which result in benefits to others is termed as positive externalities. For example – Gurudwaras provide free langar for everyone. It increases the welfare of society.

- Negative Externalities – The activities which results in harm to others are termed as negative externalities. Smoking in public will make people smoke passively It reduces the welfare through a negative effect on health.

GDP does not take these externalities into account.

5. Rate of Population Growth – GDP also does not take into account the rate of growth of population i.e. if GDP is increasing due to increase in population. If the rate and growth of population are greater than the rate and growth of GDP, then it will decrease per - availability of goods and services which would adversely affect economic welfare.

BARTER EXCHANGE

INTRODUCTION:

This chapter is a detailed version of barter system and its difficulties, how money has overcome its drawbacks, money supply and its measures.

BARTER SYSTEM & ITS DIFFICULTIES

Barter system

Definition: Barter system refers to exchange of goods for goods. An economy, where there is a direct barter of goods and services, is called a barter economy.

For example, wheat may be exchanged for cloth; house for horses, etc., or a teacher may be paid wheat or rice as a payment for his/her services.

Such exchange exists in the C-C Economy (commodity-to-commodity exchange economy).

Note: In C-C Economy C stands for commodity. C-C economy is the one in which commodities are exchanged for commodities. C-C exchange refers to barter system of exchange. Hence, C-C Economy is an economy dominated by barter system of exchange

Limitations of Barter Exchange:

Lack of double coincidence of wants:

- Barter is possible only if goods produced by two persons are needed by each other, thus it is double coincidence of wants.

- Double coincidence of wants means that goods in possession of two different persons must be useful and needed by each other. It is the basis of barter system, however it is rare for this to happen.

- It is difficult to find such a person every time. In barter system, exchange becomes quite limited.

Lack of store of value:

- It is very difficult to store wealth for future use.

- Most of the goods like wheat, rice, cattle etc. are likely to deteriorate with the passage of time or involve heavy cost of storage.

- Further, the transfer of goods from one place to another place involves huge transport cost.

- Transfer of immovable commodities (such as house, farm, land, etc.) becomes almost impossible.

Absence of common measure of value:

Different commodities are of different values. The value of a good or service means the amount of other goods and services it can be exchanged for in the market. There is no common measure of value under barter system.

In this situation, it is difficult to decide in what proportions are the two goods to be exchanged.

Lack of standard of deferred payment:

- In a barter economy, future payments would have to be stated in terms of specific goods or services. This leads to following problems:

- There could be disagreement regarding the quality of the goods or services to be repaid.

- There would be disagreement regarding which specific commodities would be used for repayment.

Money has overcome the drawbacks of barter system in the following ways:

Barter system makes the exchange process very difficult and highly inefficient.

(a) Medium of exchange

- Under barter system, there is lack of double coincidence of wants.

- With money as a medium exchange individuals can exchange their goods and services for money and then use this money to buy other goods and services according to their needs and conveniences.

- A buyer can buy goods through money and a seller can sell goods for money.

(b) Measure of Value

- Under barter system, there was no common measure of value. Money has also solved this difficulty.

- As Geoffrey Crowther puts it, “Money acts as a standard measure of value to which all other things can be compared.” Money measures the value of economic goods.

- Money works as a common denominator into which the values of all goods and services are expressed.

- When we express the values of a commodity in terms of money, it is called price and by knowing prices of the various commodities, it is easy to calculate exchange ratios between them.

(c) Store of value

- Under barter system, it is very difficult to store wealth for future use.

- Most of the goods are perishable and their storage requires huge space and transportation cost.

- Wealth can be conveniently stored in the form of money.

- Money can be stored without loss in value.

- Money can easily be stored for future use.

(d) Standard of deferred payments

- Under barter system, transactions on deferred payments are not possible.

- With money, the debtors make a promise that they will make payments on some future dates. In these situations, money acts as a standard of deferred payments.

- It has become possible because money has general acceptability, its value is stable, and it is durable and homogeneous.

MONEY

MONEY

Definition: Money is something which is generally acceptable as a medium of exchange and can be converted into other assets without losing its time and value

Characteristics or Features of Money:

- Durability: Money must be durable and not likely to deteriorate rapidly with

frequent handling. Currency notes and coins are being used repeatedly and shall

continue to do so for many years. - Medium of exchange: Money is the thing that acts as a medium of exchange for the sale and purchase of goods and services.

- Weight: Money must be light in weight. Paper money is better than metal coins because it is light in weight.

- Measure of value: It not only serves as medium of exchange but also acts as a measure of value. The value of all the goods and services is expressed in terms of money.

Important points about money:

- Legal definition of money: Legally, money is anything proclaimed by law as a medium of exchange. Paper notes and coins (together called currency) is money as a matter of law.

- FIAT Money: It is defined as a money which is under the ‘FIAT’ (order/authority) of the government to act as a money.

- Functional definition of money: Functional definition of money refers to money as anything that performs four basic functions. (Medium of exchange, standard unit of value, standard of deferred payments, store of value)

- Narrow definition of money: Functional definition of money is a narrow definition of money. It includes only notes, coins and demand deposits as money.

- Broad definition of money: A broad definition of money also includes time deposits/ term deposits with the banks or post offices as a component of money.

MONEY SUPPLY

Money Supply & Measures of Money Supply

- Money supply:

Definition: The volume of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

- Measures of money supply:

On the recommendation of the second working group on money supply, the RBI presented four measures of money supply in its 1977 issues of RBI Bulletin, namely M1, M2, M3 and M4.

Measures of M1 include:

- Currency notes and coins with the public (excluding cash in hand of all commercial banks) [C]

- Demand deposits of all commercial and co-operative banks excluding inter-bank deposits. (DD)

- Where demand deposits are those deposits which can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- (c) Other deposits with RBI [O.D]

M1 = C + DD + OD

Where, Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi¬government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc.

Measures of M2:

- M1 [C + DD + OD]

- Post office saving deposits

Measures of M3:

- M1

- Time deposits of all commercial and co-operative banks.

Where, Time deposits are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

Measures of M4

- M3

- Total deposits with the post office saving organization (excluding national savings certificates).

- High-powered money: High-powered money is money produced by the RBI and the government. It consists of two things: (a) currency held by the public and (b) Cash reserves with the banks.

CONCLUSION

- Barter system: Barter system of exchange is a system in which goods are exchanged for goods.

- Double coincidence of wants: It means that goods in possession of two different persons must be useful and needed by each other.

- Money: Money is something which is generally acceptable as a medium of exchange and can be converted into other assets without loosing its time and value.

- Legal definition of money: Legally, money is anything proclaimed by law as a medium of exchange. Paper notes and coins (together called currency) is money as a matter of law.

- FIAT Money: It is defined as a money which is under the ‘FIAT’ (order/authority) of the government to act as a money.

- Functional definition of money: Functional definition of money refers to money as anything that performs four basic functions. (Medium of exchange, standard unit of value, standard of deferred payments, store of value)

- Narrow definition of money: Functional definition of money is a narrow definition of money. It includes only notes, coins and demand deposits as money.

- Broad definition of money: A broad definition of money also includes time deposits/ term deposits with the banks or post offices as a component of money.

- Money Supply: The stock of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

- High-powered money: It is money produced by the RBI and the government. It consists of two things: (i) currency held by the public and (ii) Cash reserves with the banks.

- Demand deposits: These are the deposits that can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- Time deposits: These are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

- Other deposit measures of M1: Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi-government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc

MONEY SUPPLY

Money Supply & Measures of Money Supply

Money supply:

Definition: The volume of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

Measures of money supply:

On the recommendation of the second working group on money supply, the RBI presented four measures of money supply in its 1977 issues of RBI Bulletin, namely M1, M2, M3 and M4.

Measures of M1 include:

Currency notes and coins with the public (excluding cash in hand of all commercial banks) [C]

Demand deposits of all commercial and co-operative banks excluding inter-bank deposits. (DD)

Where demand deposits are those deposits which can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

(c) Other deposits with RBI [O.D]

M1 = C + DD + OD

Where, Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi¬government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc.

Measures of M2:

- M1 [C + DD + OD]

- Post office saving deposits

Measures of M3:

- M1

- Time deposits of all commercial and co-operative banks.

Where, Time deposits are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

Measures of M4:

- M3

- Total deposits with the post office saving organization (excluding national savings certificates).

- High-powered money: High-powered money is money produced by the RBI and the government. It consists of two things: (a) currency held by the public and (b) Cash reserves with the banks

CONCLUSION

- Barter system: Barter system of exchange is a system in which goods are exchanged for goods.

- Double coincidence of wants: It means that goods in possession of two different persons must be useful and needed by each other.

- Money: Money is something which is generally acceptable as a medium of exchange and can be converted into other assets without loosing its time and value.

- Legal definition of money: Legally, money is anything proclaimed by law as a medium of exchange. Paper notes and coins (together called currency) is money as a matter of law.

- FIAT Money: It is defined as a money which is under the ‘FIAT’ (order/authority) of the government to act as a money.

- Functional definition of money: Functional definition of money refers to money as anything that performs four basic functions. (Medium of exchange, standard unit of value, standard of deferred payments, store of value)

- Narrow definition of money: Functional definition of money is a narrow definition of money. It includes only notes, coins and demand deposits as money.

- Broad definition of money: A broad definition of money also includes time deposits/ term deposits with the banks or post offices as a component of money.

- Money Supply: The stock of money held by the public at a point of time, in an economy, is referred to as the money supply. Money supply is a stock concept.

- High-powered money: It is money produced by the RBI and the government. It consists of two things: (i) currency held by the public and (ii) Cash reserves with the banks.

- Demand deposits: These are the deposits that can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- Time deposits: These are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

- Other deposit measures of M1: Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi-government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetary Fund, the World Bank, etc

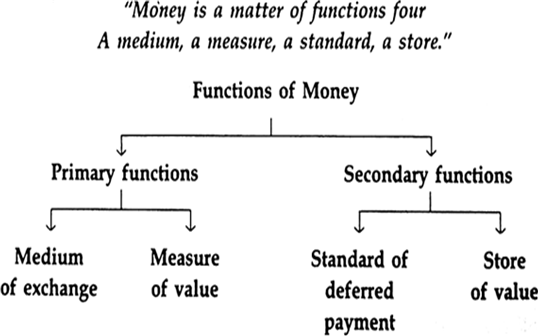

FUNCTIONS OF MONEY

Functions of Money:

We can conclude these four functions under the following two categories:

1 - Primary function

2 - Secondary function

Primary function or Main function:

The primary function includes the most important functions of money, which it must perform in an economic system irrespective of time and place. The following two functions are included under this category.

(i) Medium of exchange

- Money when used as a medium of exchange helps to eliminate the basic limitation of barter trade, that is, the lack of double coincidence of wants.

- Individuals can exchange their goods and services for money and then can use this money to buy other goods and services according to their needs and convenience.

- Thus, the process of exchange shall have two parts: a sale and a purchase.

- The ease at which money is converted into other goods and services is called “liquidity of money”.

(ii) Measure of value /unit of account

- Another important function of money is that it serves as a common measure of value or a unit of account.

- Under barter economy, there was no common measure of value in which the values of different goods could be measured and compared with each other. Money has also solved this difficulty.

- As Geoffrey Crowther puts it, “Money acts as a standard measure of value to which all other things can be compared.” Money measures the value of economic goods.

- Money works as a common denominator into which the values of all goods and services are expressed.

- When we express the values of a commodity in terms of money, it is called price and by knowing prices of the various commodities, it is easy to calculate exchange ratios between them.

Secondary Functions:

(i) Standard of deferred payments

- Credit has become the life and blood of a modern capitalist economy.

- In millions of transactions, instant payments are not made.

- The debtors make a promise that they will make payments on some future date. In those situations, money acts as a standard of deferred payments.

- It has become possible because money has general acceptability, its value is stable, it is durable and homogeneous.

(ii) Store of value

- Wealth can be conveniently stored in the form of money. Money can be stored without loss in value.

- Savings are secured and can be used whenever there is a need.

- In this way, money acts as a bridge between the present and the future.

- Money means goods and services. Thus, money serves as a store of value.

- It is also known as asset function of money.

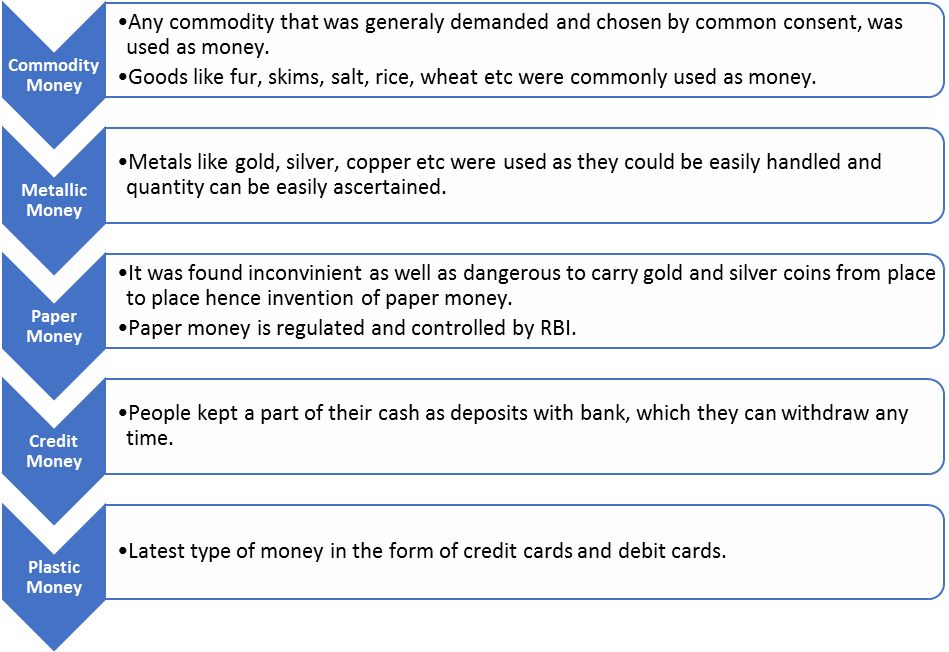

EVOLUTION OF MONEY

EVOLUTION OF MONEY

Money has evolved through different stages according to the time, place and circumstances. It developed through the following stages:

DEMAND FOR MONEY

DEMAND FOR MONEY

There are three main motives, for which money is wanted by the people:

Transaction Motive:

It refers to demand for money for conducting day-to-day transactions. This motive can be looked at from the perspective of consumers, who want income to meet their household expenditure (income motive) and from the perspective of businesspersons, who require money to carry on their business activities (business motive). The transaction motive relates to demand for money to meet the current transactions of individuals and business units.

Precautionary Motive:

It refers to the desire of people to hold cash balances for unforeseen contingencies. People wish to hold some money to provide for the risk of unforeseen events like sickness, accident, etc. The amount of money held under this motive, depends on the nature of individual and on the conditions in which he lives. The demand of money for precautionary balances is also closely related to the level of income. Higher the level of income, more will be the cash balances

Speculative Motive:

It refers to desire of the holder to keep cash balance as an alternative to financial assets like bonds. Under speculative motive, it is presumed that people can hold their wealth either in the form of bonds or in the form of cash balances. The decisions regarding holding of bonds or cash balances depend upon the expectations about changes in the rate of interest or capital value of assets (bonds) in future. The interest rate varies inversely with the market value of securities (bonds), i.e. when interest rate rises, market value of bonds falls. Hence, demand for money for speculative motive becomes less at high interest rates and becomes large at low interest rates.

COMMERCIAL BANK

COMMERCIAL BANK

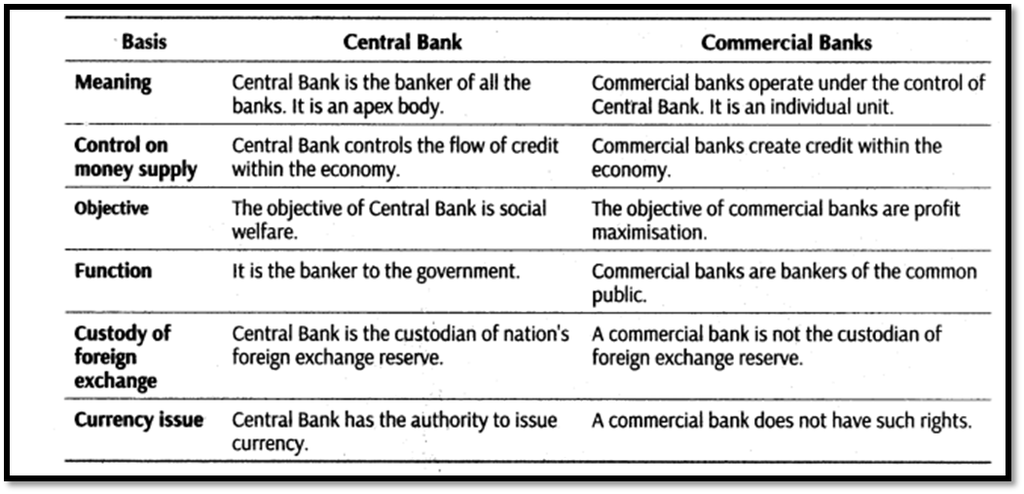

A commercial bank is a kind of financial institution that carries all the operations related to deposit and withdrawal of money for the general public, providing loans for investment, and other such activities. These banks are profit-making institutions and do business only to make a profit.

The two primary characteristics of a commercial bank are lending and borrowing. The bank receives the deposits and gives money to various projects to earn interest (profit). The rate of interest that a bank offers to the depositors is known as the borrowing rate, while the rate at which a bank lends money is known as the lending rate.

Function of Commercial Bank:

The functions of commercial banks are classified into two main divisions.

(a) Primary functions

Accepts deposit: The bank takes deposits in the form of saving, current, and fixed deposits. The surplus balances collected from the firm and individuals are lent to the temporary requirements of the commercial transactions.

Provides loan and advances: Another critical function of this bank is to offer loans and advances to the enterpreneurs and business people and collect interest. For every bank, it is the primary source of making profits. In this process, a bank retains a small number of deposits as a reserve and offers (lends) the remaining amount to the borrowers in demand loans, overdraft, cash credit, short-run loans, and more such banks.

Credit cash: When a customer is provided with credit or loan, they are not provided with liquid cash. First, a bank account is opened for the customer and then the money is transferred to the account. This process allows the bank to create money.

(b) Secondary functions

Discounting bills of exchange: It is a written agreement acknowledging the amount of money to be paid against the goods purchased at a given point of time in the future. The amount can also be cleared before the quoted time through a discounting method of a commercial bank.

Overdraft facility: It is an advance given to a customer by keeping the current account to overdraw up to the given limit.

Purchasing and selling of the securities: The bank offers you with the facility of selling and buying the securities.

Locker facilities: A bank provides locker facilities to the customers to keep their valuables or documents safely. The banks charge a minimum of an annual fee for this service.

Paying and gathering the credit: It uses different instruments like a promissory note, cheques, and bill of exchange.

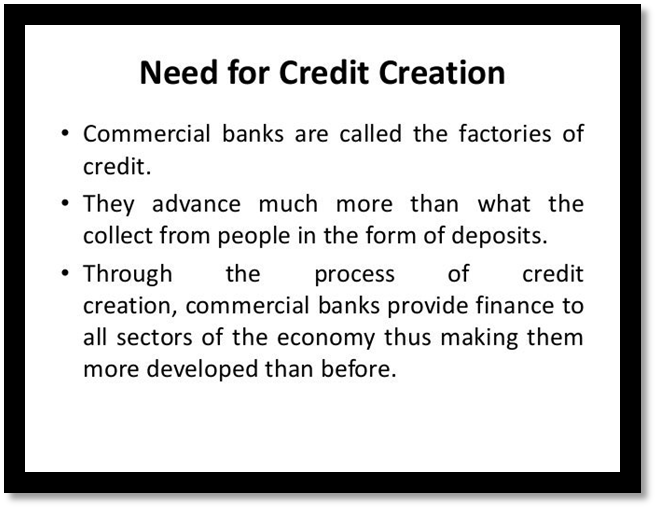

CREDIT CREATION

Money Creation / Credit Creation

Let us assume:

The entire commercial banking system is one unit. Let us call this one unit simply “banks’.

All receipts and payments in the economy are routed through the banks. One who makes payment does it by writing cheque. The one who receives payment deposits the same in his deposit account.

Suppose initially people deposit Rs.1000. The banks use this money for giving loans. But the banks cannot use the whole of deposit for this purpose. It is legally compulsory for the banks to keep a certain minimum fraction of these deposits as cash. The fraction is called the Legal Reserve Ratio (LRR). The LRR is fixed by the Central Bank. It has two components. A part of the LRR is to be kept with the Central bank and this part ratio is called the Cash Reserve Ratio (CRR). The other part is kept by the banks with themselves and is called the Statutory Liquidity Ratio.

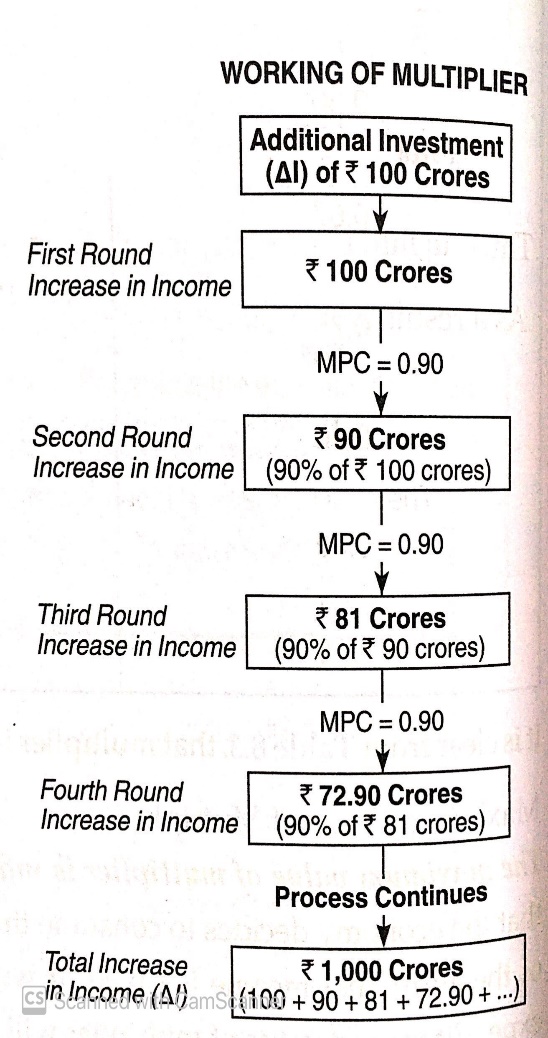

Let us now explain the process, suppose the initial deposits in banks is Rs.1000 and the LRR is 10 percent. Further, suppose that banks keep only the minimum required, i.e., Rs.100 as cash reserve, banks are now free to lend the remainder Rs.900. Suppose they lend Rs.900. What banks do to open deposit accounts in the names of the borrowers who are free to withdraw the amount whenever they like.

Let us now suppose they withdraw the whole of amount for making payments.

Now, since all the transactions are routed through the banks, the money spent by the borrowers comes back into the banks into the deposit accounts of those who have received this payment. This increases demand deposit in banks by 900. It is 90 per cent of the initial deposit. These deposits of Rs.900 have resulted on account of loans given by the banks. In this sense the banks are responsible for money creation. With this round, increased in total deposits are now Rs.1900 (1000 + 900).

When banks receive new deposit of Rs.900, they keep 10% of it as cash reserves and use the remaining Rs.810 for giving loans. The borrowers use these loans for making payments. The money comes back into the accounts of those who have received the payments. Bank deposits again rise, but by a smaller amount of Rs.810. It is 90 per cent of the last deposit creation. The total deposits now increase to Rs.2710 (=1000 + 900 + 810). The process does not end here.

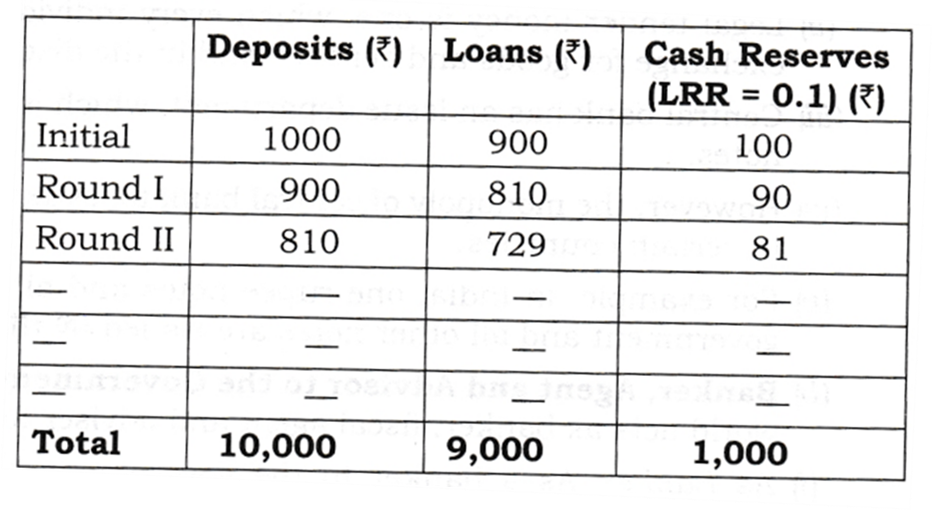

The deposit creation continues in the above manner. The deposits go on increasing round after round but Deposit Creation by Commercial Banks increases each time by only 90 per cent of the last round deposits. At the same time, cash reserves go on increasing, each time 90 per cent of the last cash reserve. The deposit creation comes to end when the total cash reserves become equal to the initial deposit. The total deposit creation comes to Rs.10000, ten times the initial deposit as shown in the table.

Deposit Creation By Commercial Banks

It can also be explained with the help of the following formula:

Money Multiplier = 1/LRR = 1/0.1 = 10

The total money creation thus,

Money creation = Initial deposit*1/LRR = 10,000

Note that lower the LRR, higher the money multiplier and more the money creation. If the LRR = 5% = 0.5, the money multiplier = 2(1/0.05). If the LRR = 20%, the money multiplier is

Banks are required to keep only a fraction of deposits as cash reserves because of the following two reasons:

First, the banking experience has revealed that not all depositors approach the banks for withdrawal of money at the same time and also that normally they withdraw a fraction of deposits.

Secondly, there is a constant flow of new deposits into the banks. Therefore to meet the daily demand for withdrawal of cash, it is sufficient for banks to keep only a fraction of deposits as a cash reserve.

When the primary cash deposit in the banking system leads to multiple expansion in the total deposits, it is known as money multiplier or credit multiplier.

CENTRAL BANK

CENTRAL BANK

Definition: The central bank is an apex body that controls, operates, regulates and directs the entire banking and monetary structure of the country.

It is known as apex as it occupies the top most position in the monetary and banking system of the country. India’s central bank is the Reserve Bank of India.

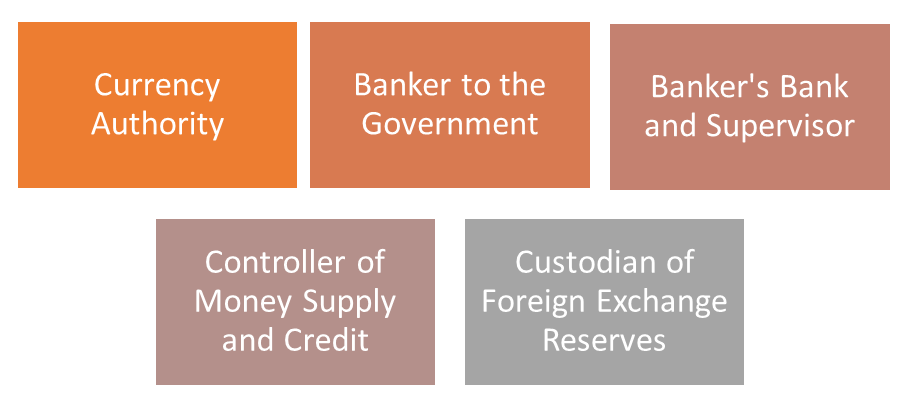

Functions of Central Bank:

1. Currency Authority:

- The central bank has the sole monopoly to issue currency notes. Commercial banks cannot issue currency notes. Currency notes issued by the central bank are the legal tender money.

- Legal tender money is one, which every individual is bound to accept by law in exchange for goods and services and in the discharge of debts.

- Central bank has an issue department, which is solely responsible for the issue of notes.

However, the monopoly of central bank to issue the currency notes may be partial in certain countries.

For example, in India, the government issues one-rupee notes and all types of coins and all other notes are issued by the Reserve Bank of India.

2. Banker to the Government:

- Central bank everywhere in the world acts as banker, fiscal agent and adviser to their respective government.

(I) As Banker:

As a banker to the government, the central bank performs same functions as performed by the commercial banks to their customers.

- It receives deposits from the government and collects cheques and drafts deposited in the government account.

- It provides cash to the government as resumed for payment of salaries and wages to their staff and other cash disbursements.

- It makes payments on behalf of the government.

- It also advances short-term loans to the government.

- It supplies foreign exchange to the government for repaying external debt or making other payments.

(ii) As Fiscal Agent:

- As a fiscal agent, it manages the public debt.

- It collects taxes and other payments on behalf of the government.

- It represents the government in the international financial institutions (such as World Bank, International Monetary Fund, etc.) and conferences.

(iii) As Adviser:

- The central bank also acts as the financial adviser to the government.

- It gives advice to the government on all financial and economic matters such as deficit financing, devaluation of currency, trade policy, foreign exchange policy, etc.

3. Banker’s Bank and Supervisor:

(a) Banker’s Bank: Central bank acts as the banker to the banks in three ways:

- Custodian of the cash reserves of the commercial banks;

- As the lender of the last resort; and

- As clearing agent.

(i) As a custodian of the cash reserves of the commercial banks, the central bank maintains the cash reserves of the commercial banks. Every commercial bank has to keep a certain percent of its cash reserves with the central bank by law.

(ii) As Lender of the Last Resort,

- As banker to the banks, the central bank acts as the lender of the last resort.

- In other words, in case the commercial banks fail to meet their financial requirements from other sources, they can, as a last resort, approach to the central bank for loans and advances.

- The central bank assists such banks through discounting of approved securities and bills of exchange.

(iii) As Clearing Agent,

- Since it is the custodian of the cash reserves of the commercial banks, the central bank can act as the clearinghouse for these banks.

- Since all banks have their accounts with the central bank, the central bank can easily settle the claims of various banks against each other simply by book entries of transfers from and to their accounts.

- This method of settling accounts is called the Clearing House Function of the central bank.

(b) Supervisor

- The Central Bank supervises, regulates and controls the commercial banks.

- The regulation of banks may be related to their licensing, branch expansion, liquidity of assets, management, amalgamation (merging of banks) and liquidation (the winding of banks).

- The control is exercised by periodic inspection of banks and the returns filed by them.

4. Controller of Money Supply and Credit:

Principal instruments of Monetary Policy or credit controls of the Central Bank of a country are broadly classified as:

- Quantitative Instruments or General Tools

- Qualitative Instruments or Selective Tools.

(a) Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy. These instruments do not direct or restrict the flow of credit to some specific sectors of the economy.

(i) Bank Rate (Discount Rate)

- Bank rate is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan). The thing, which has to be remembered, is that central bank lends to commercial banks and not to public.

- In a situation of excess demand leading to inflation,

- Central bank raises bank rate that discourages commercial banks in borrowing from central bank, as it will increase the cost of borrowing of commercial bank.

- It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

- Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

In a situation of deficient demand leading to deflation,

- Central bank decreases bank rate that encourages commercial banks in borrowing from the central bank as it will decrease the cost of borrowing of commercial bank.

- Decrease in bank rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

- Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

Thus, expenditure on investment and consumption increase, which will control the deficient demand.

(ii) Repo Rate

- Repo rate is the rate at which commercial bank borrow money from the central

- bank for short period by selling their financial securities to the central bank.

- These securities are pledged as a security for the loans.

- It is called Repurchase rate as this involves commercial bank selling securities

- to RBI to borrow the money with an agreement to repurchase them at a later

- date and at a predetermined price.

Therefore, keeping securities and borrowing is repo rate.

In a situation of excess demand leading to inflation,

- Central bank raises repo rate that discourages commercial banks in borrowing from central bank as it will increase the cost of borrowing of commercial bank.

- It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

- Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

In a situation of deficient demand leading to deflation,

- Central bank decreases Repo rate that encourages commercial banks in borrowing from central bank, as it will decrease the cost of borrowing of commercial bank.

- Decrease in Repo rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

- Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

Thus, expenditure on investment and consumption increase, which will control the deficient demand.

(iii) Reverse Repo Rate

- It is the rate at which the Central Bank (RBI) borrows money from commercial bank.

- In a situation of excess demand leading to inflation, Reverse repo rate is increased, it encourages the commercial bank to park their funds with the central bank to earn higher return on idle cash. It decreases the lending capability of commercial banks, which controls excess demand.

- In a situation of deficient demand leading to deflation, Reverse repo rate is decreased; it discourages the commercial bank to park their funds with the central bank. It increases the lending capability of commercial banks, which controls deficient demand.

(iv) Open Market Operations (OMO)

- It consists of buying and selling of government securities and bonds in the open market by Central Bank.

- In a situation of excess demand leading to inflation, central bank sells government securities and bonds to commercial bank. With the sale of these securities, the power of commercial bank of giving loans decreases, which will control excess demand.

- In a situation of deficient demand leading to deflation, central bank purchases.

- Government securities and bonds from commercial bank. With the purchase of these securities, the power of commercial bank of giving loans increases, which will control deficient demand.

(v) Varying Reserve Requirements

- Banks are obliged to maintain reserves with the central bank, which is known as legal reserve ratio. It has two components. One is the Cash Reserve Ratio or CRR and the other is the SLR or Statutory Liquidity Ratio.

- Cash Reserve Ratio: It refers to the minimum percentage of a bank’s total deposits, which it is required to keep with the central bank. Commercial banks have to keep with the central bank a certain percentage of their deposits in the form of cash reserves as a matter of law.

For example, if the minimum reserve ratio is 10% and total deposits of a certain bank is Rs. 100 crore, it will have to keep Rs. 10 crore with the Central Bank.

- In a situation of excess demand leading to inflation, Cash Reserve Ratio (CRR) is raised to 20 per cent, the bank will have to keep Rs.20 crore with the Central Bank, which will reduce the cash resources of commercial bank and reducing credit availability in the economy, which will control excess demand.

- In a situation of deficient demand leading to deflation, cash reserve ratio (CRR) falls to 5% the bank will have to keep Rs. 5 crore with the central bank, which will increase the cash resources of commercial bank and increasing credit availability in the economy, which will control deficient demand.

(vi) The Statutory Liquidity Ratio (SLR)

- It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

- In a situation of excess demand leading to inflation, the central bank increases statutory liquidity ratio (SLR), which will reduce the cash resources of commercial bank and reducing credit availability in the economy.

- In a situation of deficient demand leading to deflation, the central bank decreases statutory liquidity ratio (SLR), which will increase the cash resources of commercial bank and increases credit availability in the economy.

It may consist of:

(1) Excess reserves

(2) Unencumbered (are not acting as security for loans from the Central Bank) government and other approved securities (securities whose repayment is guaranteed by the government); and

(3) Current account balances with other banks.