LIBERALIZATION

Definition: Liberalization means the removal of entry and growth restrictions on the private sector.

- Liberalization involves deregulation and reduction of government controls and greater autonomy (freedom) of private investment, to make the economy more competitive.

- Under this process, business is given free hand and is allowed to run on commercial lines.

- The purpose of liberalization was:

- To unlock the economic potential of the country by encouraging private sector and multinational corporations to invest and expand.

- To introduce much more competition into the economy and create incentives for increasing efficiency of operations.

- The economic reforms taken by the Government under liberalization include the following

- Industrial Sector Reforms

- Financial Sector Reforms

- Tax Reforms

- Foreign Exchange Reforms

- Trade and Investment Policy Reforms

Industrial Sector Reforms

- Reduction in Industrial Licensing: The Monopolies new policy abolished industrial licensing and was Restrictive for all the projects, except for a shortlist of Trade Practices (MRTP) Act industries (like liquor, defence equipment’s, industrial explosives, etc.).

- No licences were needed (i) To set up new units; or (ii) Expand or diversify the existing line of manufacture.

- However, license is required for certain industries, related to security and a Decrease in strategic considerations.

- Decrease in role of Public Sector: One of Sector the striking features was the substantive reduction in the role of the public sector in the future industrial development of the country. The number of industries, exclusively reserved for the public sector, was reduced from 17 to the following 3 industries: (1) Defence equipment; (ii) Atomic energy generation; and (iii) Railway Transport

- De-reservation under small-scale industries: Many goods produced by small-scale industries have now been de-reserved.

- The investment ceiling on plant and machinery for small undertakings was enhanced to rupees one crore.

- In many industries, the market was allowed to determine the prices through forces of the market (and not by directive policy of the government).

- Monopolies and Restrictive Trade Practices (MRTP) Act: With the introduction of liberalization and expansion schemes, the requirement for large companies, to seek prior approval for expansion, establishment of new undertakings, mergers, amalgamations, etc. were eliminated.

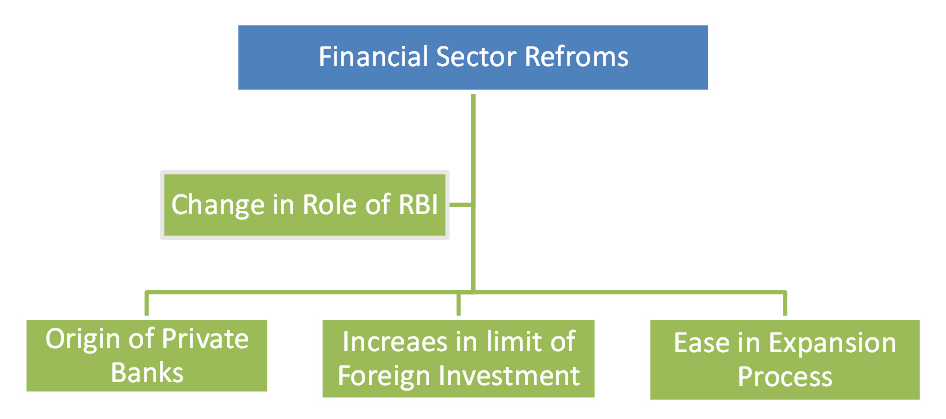

Financial Sector Reforms

- Change in Role of RBI: The role of RBI was reduced from regulator to facilitator of financial sector. As a result, financial sector was allowed to take decisions on many matters, without consulting the RBI.

- Origin of Private Banks: The reform policies led to the establishment of private sector banks, Indian as well as foreign. For example, Indian banks like ICICI and foreign banks like HSBC increased the competition and benefitted the consumers through lower interest rates and better services.

- Increase in limit of foreign investment: The limit of foreign investment in banks was raised to around 51%. Foreign Institutional Investors (FII) such as merchant bankers, mutual funds and pension funds were now allowed to invest in Indian financial markets.

- Ease in Expansion Process: Banks were given freedom to set up new branches after fulfillment of certain conditions) without the approval of the RBI.

Tax reforms

Definition: Tax reforms refer to reforms in government's taxation and public expenditure policies, which are collectively known as its 'Fiscal Policy'.

Taxes are of two types:

• Direct Taxes consist of taxes on incomes of individuals as well as profits of business enterprises. For Example, Income tax (taxes on individual incomes) and Corporate tax (taxes on profits of companies).

• Indirect Taxes refer to those taxes, which affect the income and property of persons through their consumption expenditure Indirect taxes are generally imposed on goods and services. For example, Goods and Services Tax (GST).

The major Tax Reforms made are:

1. Reduction in Taxes: Since 1991, there has been a continuous reduction in income and corporate tax as high tax rates were an important reason for tax evasion. It is now widely accepted that moderate rates of income tax encourage savings and voluntary disclosure of income

2. Reforms in Indirect Taxes. Considerable reforms have been made in indirect taxes to facilitate the establishment of the common national market for goods and commodities.

3. Simplification of Process: In order to encourage better compliance on the part of taxpayers many procedures have been simplified.

Foreign Exchange Reforms

- Devaluation of Rupee: Devaluation refers to a reduction in the value of the domestic currency by the government. To overcome the Balance of Payments crisis, the rupee was devalued again by foreign currencies. This led to an increase in the inflow of foreign exchange.

- Market Determination of Exchange Rate: The Government allowed rupee value to be free from its control. As a result, market forces of demand and supply determine the exchange value of the Indian rupee in terms of foreign currency.

Trade and Investment Policy Reforms

The reforms in the trade and investment policy were initiated:

- To increase the international competitiveness of industrial production

- To promote foreign investments and technology into the economy.

- To promote efficiency of local industries and adoption of modern technologies.

The important trade and investment policy reforms include:

- Removal of Quantitative restrictions on Imports and Exports: Under the New Economic Policy, quantitative restrictions on imports and exports were greatly reduced. For example, quantitative restrictions on imports of manufactured consumer goods and agricultural products were fully removed from April 2001.

- Removal of Export Duties: Export duties were removed to increase the competitive position of Indian goods in the international markets.

- Reduction in Import Duties: Import duties were reduced to improve the position of domestic goods in the foreign market.

- Relaxation in Import Licensing System: Import licensing was abolished, except in the case of hazardous and environmentally sensitive industries. This encouraged domestic industries to import raw materials at better prices, which raised their efficiency and made them more competitive.

PathSet Publications

PathSet Publications