- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

WORKING CAPITAL

Those funds needed for meeting day-to-day operations affect the liquidity and profitability of the business.

Formulae = current assets – current liability

Current Assets

- Converted into cash within a period of one year without a reduction in value.

- EXAMPLE Cash at Bank Marketable securities, Debtors

Current Liability

- The payment which is due for payment within one year; \

- Example bills payable, creditors, bank overdraft.

Types Working Capital

- Gross working capital: - total fund invested in the current assets.

- Gross working capital = current assets

- Networking capital: excess of current assets over current liabilities.= current assets – current liability

Major ingredients of working capital

- Cash management

- Inventories management

- Debtors management

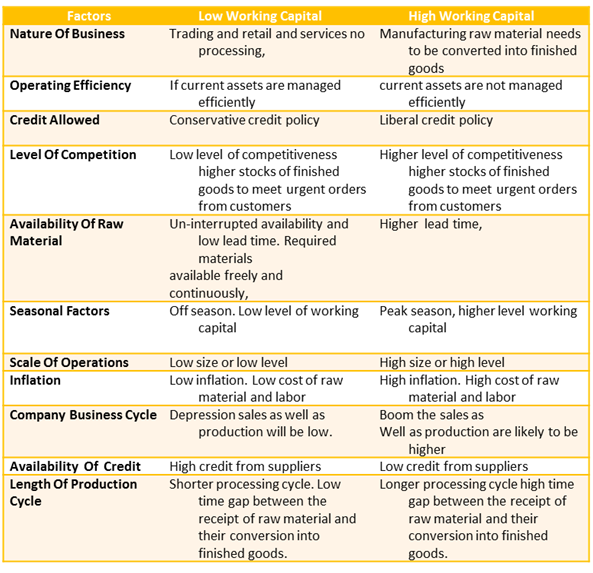

Factors affecting the working capital requirements:

- Nature of Business:

- In trading concerns, there is no processing that requires less working capital. Etc wholesale business

- Service industries do not have to maintain inventory and require less working capital. Example transportation, tourism, education, etc

- In manufacturing concern raw material is to convert into finished good requires more working capital. Steel, car manufacturing, cement, etc.

- Scale of Operations: Organizations operate on a higher scale of operation, the amount of inventory and debtors required is generally high and requires a large amount of working capital.

- Business Cycle: In case of a boom, the sales, as well as production, are higher and therefore, a higher amount of working capital is required and vice-versa

- Seasonal Factors: In peak season, a higher level of activity, and a higher amount of working capital are required. As against this, the level of activity, as well as the requirement for working capital, will be lower during the thin season.

- Production Cycle. Some businesses have a longer production cycle while some have a shorter one. Therefore, the working capital requirement is higher in firms with longer processing cycles and lower in firms with shorter processing cycles.

- Credit Allowed: Different firms allow different credit terms to their customers. A liberal credit policy results in a higher amount of debtors, increasing the requirement for working capital.

- Credit Availed: Just as a firm allows credit to its customers it also may get credit from its suppliers. To the extent, it avails the credit on its purchases; the working capital requirement is reduced.

- Operating Efficiency: Firms manage their operations with varying degrees of efficiency. Such efficiencies may reduce the level of raw materials, finished goods and debtors resulting in lower requirements for working capital.

- Availability of Raw Material: If the raw materials and other required materials are available freely and continuously, lower stock levels may be sufficient or vice-versa.

- Growth Prospects: For a firm with a growth prospect of concern is perceived to be higher, it will require a higher amount of working capital so that is able to meet higher production and sales target whenever required.

- Level of Competition: A higher level of competitiveness and liberal credit terms require a higher amount of working capital in a stock of finished goods, credit sales, advertisement

- Inflation: rising prices of input cost like labor, raw material, rent, and interest higher amounts of working capital is required to meet higher cost or vice-versa.

Factors affecting the working capital requirements:

ABCD CLASSES

ABCD CLASSES