Introduction

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CONCEPT & MEANING:

- Financial Markets: Concept, Functions, and types After going through this unit, the student/ learner would be able to:

- Understand the concept of the financial market.

- Understand the capital market and money market as types of financial markets.

- The money market and its instruments understand the concept of the money market.

- Describe the various money market instruments.

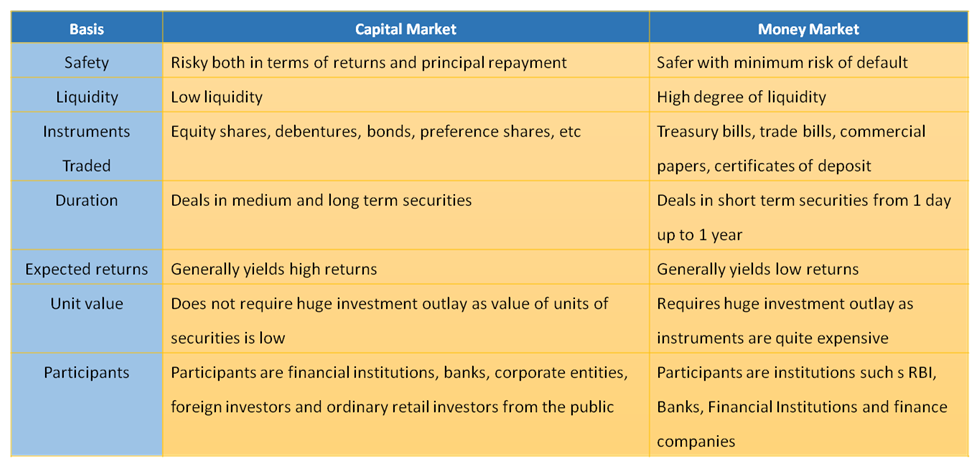

- Differentiate between capital market and money market

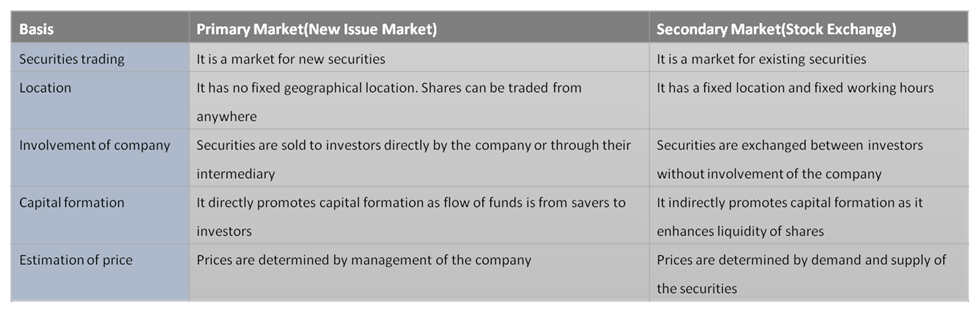

- Capital market and its types (primary and secondary) discuss the concept of the capital market.

- Explain primary and secondary markets as types of capital markets. Discuss the methods of floating new issues in the primary market.

- Distinguish between primary and secondary markets.

- Stock Exchange- Functions and trading procedures give the meaning of a stock exchange.

- Explain the functions of a stock exchange.

- Discuss the trading procedure in a stock exchange.

- Securities and Exchange Board of India (SEBI) - objectives and functions

- Give the meaning of depository services and demat account as used in the trading procedure of securities.

- State the objectives of SEBI.

- Explain the functions of SEBI.

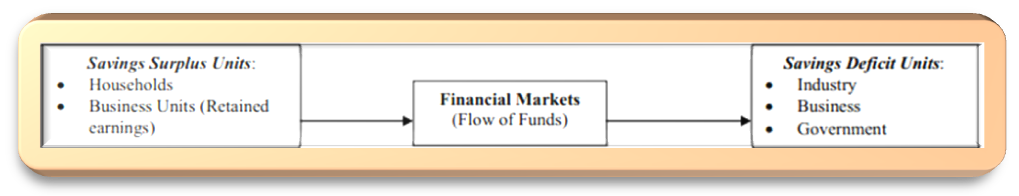

Financial Intermediation = process of allocating funds from saving surplus units (E.g. households) to saving deficit units (e.g. industries, government, etc). Alternatives = Banks or Financial markets.

Functions of financial market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

FINANCIAL MARKET

Bring together borrowers and lenders together, for the creation and exchange of financial assets

In to the most productive investment opportunity

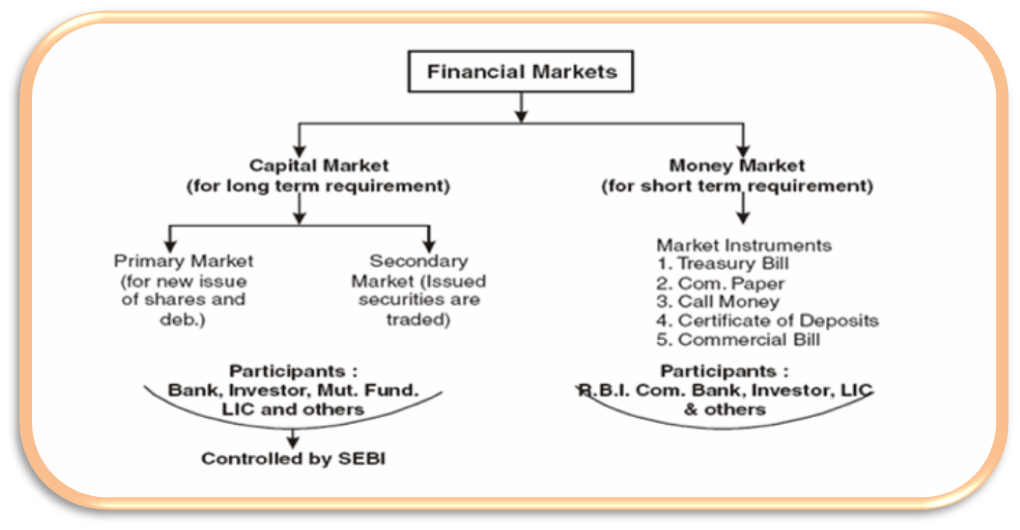

Classification of Financial Markets

- Capital markets

- Money markets

FUNCTIONS OF THE FINANCIAL MARKET

- Pricing of securities :

- The price of anything depends upon the demand and supply factors.

- Demand and supply of financial assets and securities in financial markets help in deciding the prices of various financial securities; where business firms represent the demand and the households represent the supply.

- Reduce the Cost of Transactions:

- By providing valuable information to buyers and sellers of financial assets, it helps to save time, effort, and money that would have been spent by them to find each other.

- Also, investors can buy/sell securities through brokers who charge a nominal commission for their services.

- This way financial market facilitates transactions at a very low cost.

- Add Liquidity to Financial Assets:

- Financial markets provide liquidity to financial instruments by providing a ready market for the sale and purchase of financial assets.

- Whenever the investors want, they can invest their savings into long term investments and

- Whenever they want, they can sell the investments/ instruments and convert them into cash.

- Mobilization of Savings into the most Productive Uses:

- Facilitates transfer of savings from the savers to the investors.

- Financial markets help people to invest their savings in various financial instruments and earn income and capital appreciation.

Types of Financial Markets

Money Market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

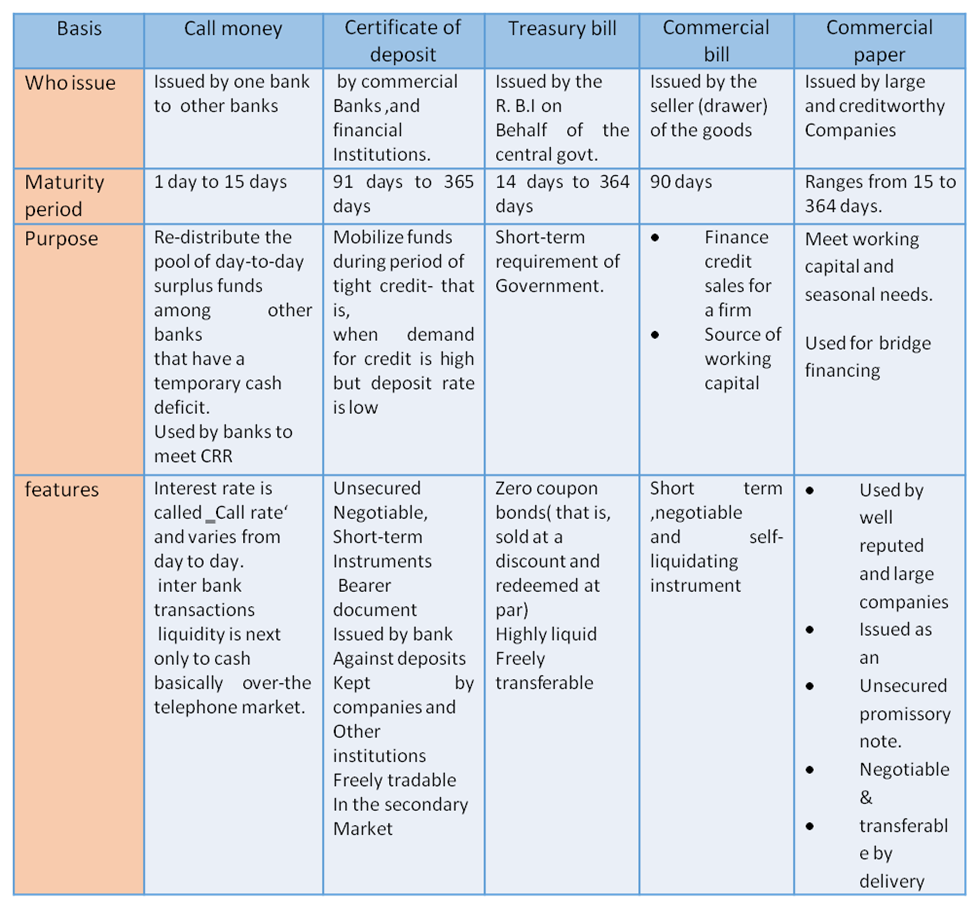

MONEY MARKET

- Provides funds for meeting short term requirements of cash ( one year or less)

- Enables the raising of short-term funds for meeting the temporary shortages of cash.

- Involves Institutions include the reserve bank, the state bank of India, LIC, GIC, UTI

Money Market Instruments:

Capital market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CAPITAL MARKET:

- Market for medium and long term funds to obtain finances for long term investments, such as buying plant, machinery, buildings, etc

- Includes Equity shares or ownership securities; Debentures, preference shares.

- Components of the capital market are

- The Primary or new issue market

- The secondary market or the Stock Exchange

Introduction and Marketing

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CONCEPT & MEANING

Market:-Refers to a set of actual and potential buyers of a product or service.

Marketer:-Who takes an active part in the process of exchange

- Seller examines the needs of the possible buyers, develops a market offering, and motivates the buyers to buy the product

- In situations of rare supply, the buyer may be taking extra efforts in persuading the seller to sell the product.

FUNCTIONS OF MARKETING

- Gathering and Analyzing Market Information:

- Begins with planning and designing a product for the consumers.

- Includes collecting and analyzing information regarding customer needs and buying habits, the nature of competition in the market, prevailing prices, distribution network, effectiveness of advertising media, etc

- Standardization and Grading:

- Refers to producing goods of fixed specifications, which helps in achieving consistency in the output. Increasing consumers’ confidence in the product quality.

- Process of classification of products into different groups such as quality, size, etc.

- packaging and Labeling:

- protects the product from leakages, spoilage, moisture, heat, and mishandling and adds value and life to the product

- Designing the label to be put on the package. The label may vary from simple tags to complex graphics.

- Branding:

- Name, term, symbol, or combination of all these which uniquely identify the products

- Creates a corporate brand identity for consumer

- Customer Support Services:

- Customer support services such as after-sales services, handling customer complaints, and obtaining credit services for the satisfaction of the customers.

- Pricing of Products:

- Generally, the lower the price, the higher would be the demand for the product and vice-versa.

- The marketers have to properly analyze the factors determining the price of a product and take several crucial decisions in this respect.

- Promotion:

- Promotion of products and services involves informing the customers about the firm’s product, its features, etc., and persuading them to purchase these products.

- Four important methods include advertising, Personal Selling, Publicity, and Sales Promotion.

- Physical Distribution

- Include decisions regarding channels of distribution or the marketing intermediaries (like wholesalers, retailers) to be used

- The physical movement of the product from where it is produced to a place where it is required by the customers for their consumption.

- Transportation:

- Involves physical movement of goods from one place to the other.

- On the basis of the nature of the product, the cost involved, urgency, nature of the goods, etc. suitable means of transportation can be selected

- Storage and Warehousing:

- Wide gap between the production and actual sale of goods.

- Involves making suitable arrangements for preserving the goods till they are bought by the consumers

- Finished goods may be required to be stored for a period when demand is expected to rise.

Marketing Management

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

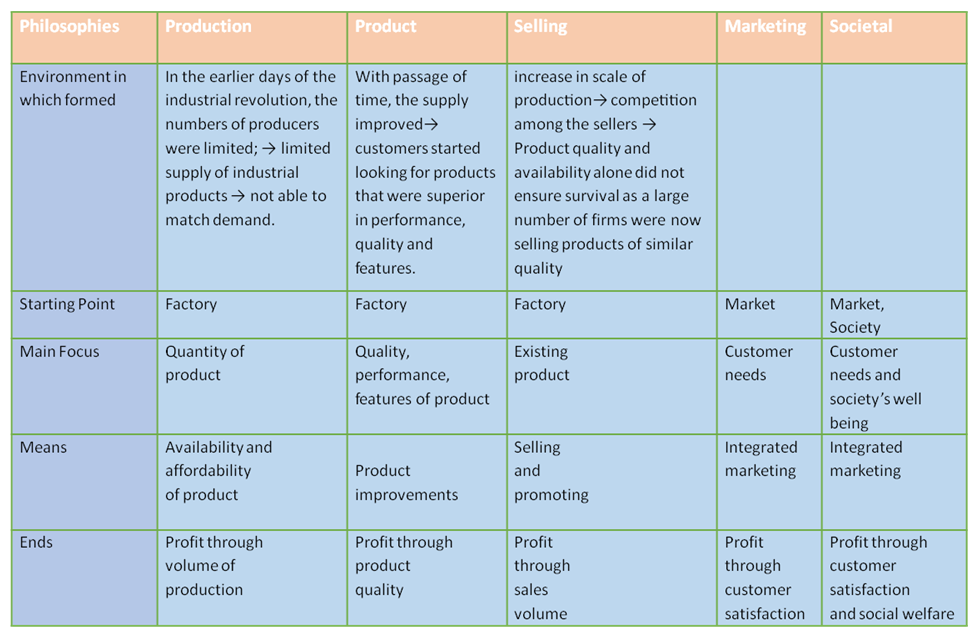

MARKETING MANAGEMENT

Marketing is finding out what people want and creating products, services, or ideas according to the needs of the consumers.

Market Management

- Is the art and science of choosing target markets and getting, keeping, and growing customers through creating, delivering, and communicating superior customer value?

PROCESS OF MARKETING

- Identification of Need to identify the needs of the target customers and develop products and services that satisfy such needs.

- Creating a Market Offering: Refers to a complete offer for a product having features like size, quality, taste, etc. at a certain price.

- Customer Value: Add value to the product so that the customers prefer it in relation to the competing products and decide to purchase it. Warranty, After-sale services, free home delivery

- Exchange Mechanism: Process through which two or more parties come together to obtain the desired product or service from someone giving something in return.

MARKETING AND SELLING

Marketing Mix

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

MARKETING MIX

Set of four controllable variables (Popularly known as, product price, place, and promotion) which marketer uses in the best possible manner to achieve its marketing objectives.

Introduction and Importance of Consumer protection

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CONCEPT & MEANING

Protecting consumers from unfair trade practices, adopted by the producers and sellers of goods and services is termed consumer protection. It not only includes educating consumers about their rights and responsibilities but also helps in getting their grievances redressed.

IMPORTANCE OF CONSUMER PROTECTION

From the Consumer’s point of view

- Innocent consumer

- Widespread ignorance About rights and relief’s available to it and it

- It has become necessary to educate them to achieve consumer awareness.

- Consumers Are Unorganized

- Consumers need to be organized in the form of consumer organizations to take care of their interests

- In India, consumer organizations are working to protect and promote the interests of consumers.

- Exploitation Of Consumers

- Consumers are exploited by unfair trade false and misleading advertising, hoarding, black marketing, etc.

- Consumers need protection against such malpractices of the sellers

Business Point of View:

- Social responsibility

- A business has social responsibilities towards various interest groups. Consumers form an important group among the many stakeholders of business and like other stakeholders; their interest has to be well taken care of.

- Moral Justification:

- It is the moral duty of any business to take care of consumer‘s interests and avoid any form of their exploitation.

- A business must avoid unscrupulous, exploitative and unfair trade practices like defective and unsafe products, adulteration, false and misleading advertising, hoarding, black marketing, etc.

- Intervention of Government:

- Businesses involved in any exploitative trade practices would invite the government

- Can damage the image of the company.

- Long-term Interest of Business:

- It is in the long-term interest of business to satisfy their customers.

- This leads to repeat sales and provides good feedback to prospective customers and thus, helps in increasing the customer base of business.

- It leads to long-term profit maximization through customer satisfaction

- Entrepreneur uses Society’s Resources:

- Business organizations use resources that belong to society.

- They, thus, have a responsibility to supply such products and render such services which are in the public interest and would not impair public confidence in them.

legal protection to consumers

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

LEGAL PROTECTION FOR CONSUMERS:

The Consumer Protection Act, 1986:

Meaning:-Was formed in 1986 to protect and promote the consumers’ interest through speedy and inexpensive redressal of their grievances.

Scope of consumer protection:

- Applicable to all types of undertakings, big and small,

- Whether in the private or public sector or in the co-operative sector,

- Whether a manufacturer or a trader,

- Whether supplying goods or providing services.

Consumer:

- A person who buys any goods for consideration or any user of such goods when such use is made with the approval of the buyer.

- A person who hires or avails of service for consideration or any beneficiary of such services when such use is made with the approval of the buyer.

- Consideration here means that the goods or services are either fully paid, partly paid or under a scheme of deferred payment such as an installment scheme.

- This definition does not include people who avail services for some commercial purpose or obtain goods for resale or for some commercial purpose.

Who can file a complaint?

A complaint before the appropriate consumer forum can be made by:

- Any consumer;

- Any registered consumers ‘association;

- The Central Government or any State Government;

- One or more consumers, on behalf of numerous consumers having the same interest; and

- A legal heir or representative of a deceased consumer.

Against whom a complaint can be filed?

Consumer Protection Act, 1986 is applicable to all types of undertakings, whether big or small, private or public, or in the co-operative sector, manufacturer or a trader, wholesaler or retailer, supplying goods or providing services. Thus, a complaint can be filed against:

- The seller, manufacturer, or dealer of defective goods. Defect means any fault, imperfection, or shortcoming in the quality, quantity, or purity of goods.

- The provider of services if they are deficient in any manner. Deficiency means any imperfection, shortcoming, or inadequacy in the quality, nature, and manner of performance of services.

Introduction and Role & Objectives of Financial Management

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

ROLE & OBJECTIVES OF FINANCIAL MANAGEMENT

- Financial Decisions: investment, financing and dividend- Meaning and factors affecting.

- Financial Planning- concept and importance.

- Capital Structure - Concept.

- Fixed and Working Capital - Concept and factors affecting their requirements.

- Factors affecting capital budgeting decisions- cash flows of the project, the rate of return, investment criteria involved.

- Factors affecting financing decision- cash flow position of the company, cost, risk, floatation costs, fixed operating costs, control considerations, state of the capital market, Return on investment, tax rate, flexibility, regulatory framework.

- Factors affecting dividend decision- the number of earnings, stability of earnings, stability of dividends, growth opportunities, cash flow position, shareholder's preference, taxation policy, stock market reaction, access to the capital market, legal constraints, contractual constraints.

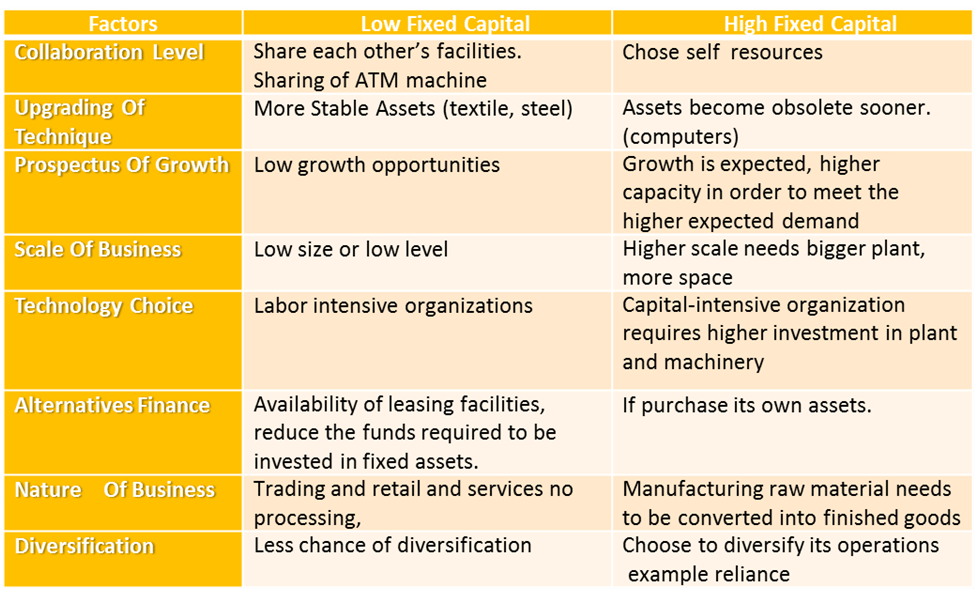

- Factors affecting fixed capital requirement- Nature of business, the scale of operations, choice of technique, technology up-gradation, growth prospects, diversification, financing alternatives, level of collaboration.

- Working capital- the concept of the operating cycle,

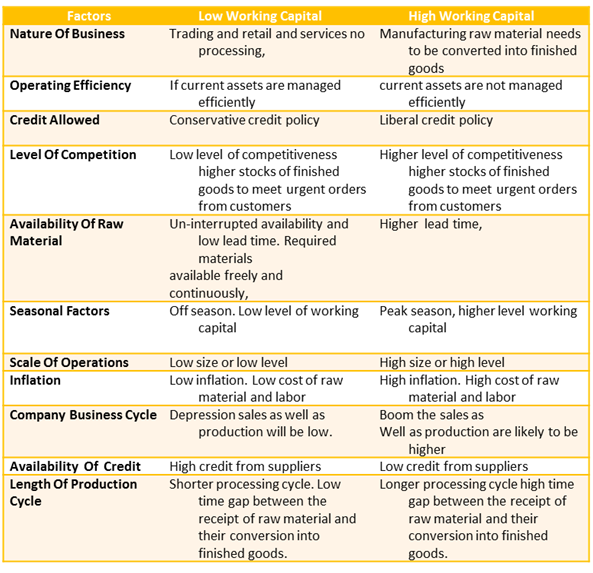

- Factors affecting working capital requirement- Nature of business, the scale of operations, business cycle, seasonal factors, production cycle, and credit allowed, the credit availed, availability of raw material.

Business Finance

Money required for carrying out business activities is called business finance. Required for

- Long term fixed assets , expansion, modernization and growth

- Short term working capital for meeting day to day working

Financial Management

Study of obtaining funds and their effective and careful utilization, to maximize the benefits to the owners of the funds

Objectives of financial management are as follows:-

Primary objective: To maximize the wealth of owners in the long run – Wealth Maximization concept.

- Owners‟ of a company are the shareholders.

- The term wealth refers to the wealth of owners as reflected by the market price of their shares.

- The goal of a firm should be to maximize the wealth of owners in the long run.

- An increase in the market price of shares is an indicator of the financial health of a firm.

Wealth of shareholders= number of shares * market price per share.

Other objectives that help a firm achieve the primary objective are:

- Ensure availability of funds at reasonable costs:

- Ensure effective utilization of funds:

- Ensure the safety of funds through the creation of reserves:

- Maintain liquidity and solvency:

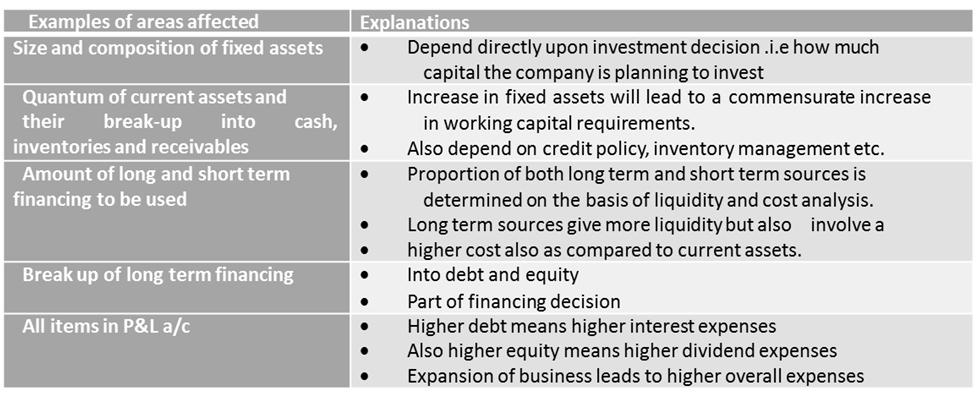

Role of Financial Management:

Financial Management has a direct bearing on the financial health of a company.

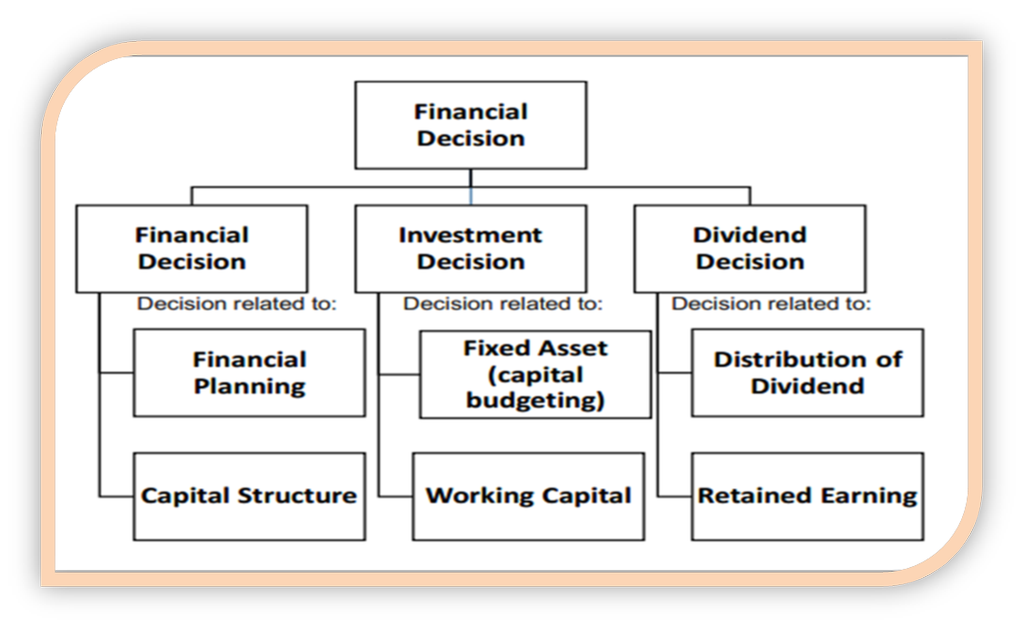

Financial Decisions

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

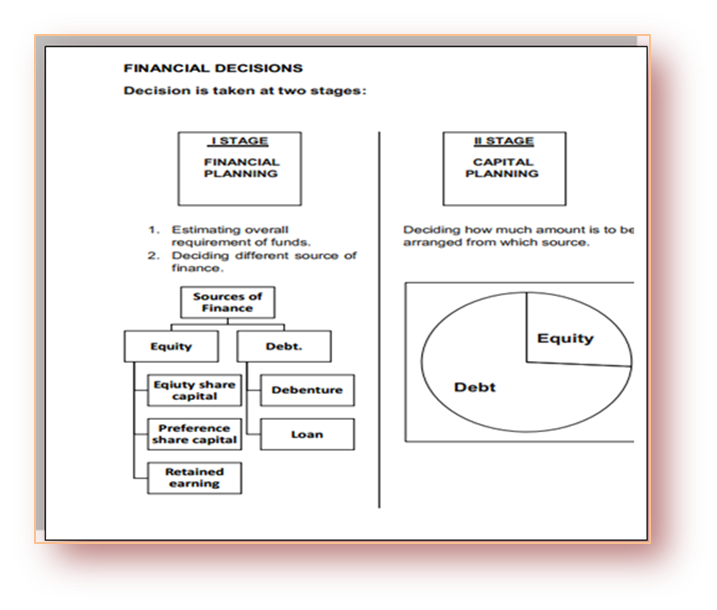

FINANCIAL DECISIONS

- Investment Decisions:

- Involves decision regarding short term (working capital) required for operational and day-to-day activities

- Long term (capital budgeting) investment in assets require funds for the setting up a new project or for expansion and modernization, machinery, building, etc

- Financing decisions:-

- Decision relates to various sources of finance i.e. equity shares, preference and debenture

- And relative proportion between them to form a capital structure

- Dividend decision: -

- Profit may either reinvest in the business for growth and expansion or it may distribute as dividends to the shareholder.

- Manager has to maintain the balance between the two.

Investment Decisions

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

INVESTMENT DECISIONS:

- Involves decision regarding short term (working capital) required for operational and day-to-day activities

- Long-term (capital budgeting) investment in assets requires funds for the setting of new projects or expansion and modernization.

Capital budgeting:

Refers to investment in long-term assets e.g. plant and machinery, furniture and fixture, land and building, expenditure on acquisition, expansion, modernization.

- Capital budgeting affects the growth, and profitability of the business in the long run.

- Must be financed through long-term sources of capital such as equity debentures, and long-term loans.

Why capital budgeting decision is considered a risky decision?

Capital budgeting decisions are important for the following reasons:

- Funds involved are large:

- Involves a large portion of funds

- Requires a lot of financial planning

- Irreversible decisions:

- Decisions once taken are not reversible without incurring heavy losses.

- Cancellation of a project is quite costly in terms of waste of funds.

- Returns/profits come in long run:

- The fixed assets are invested for the long term and earnings come after a long duration.

- It is difficult to measure the benefits as the future is uncertain due to political, legal, and technological changes.

- Effects on Long-term growth and profitability:

- The direction of growth depends on capital expenditure.

- If the decision goes in the right direction profitability increases.

- If goes wrong, it is harmful to growth and profitability.

Factors affecting capital budgeting decisions:

- Rate of return:-

- Expected rate of returns from each proposal should be compared with the risks associated with the projects before taking an investment decision.

- E.g If there are two investment proposals A and B with a rate of return of 10% and 12%, the project B should be selected.

- Investment criteria involved:

- All projects are to be considered based on the amount of investment, interest rate, cash flows and rate of return

- Ranking the projects, according to their profitability by using various capital budgeting techniques like;-Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period

- Cash Flows Of The Project:

- Cash is likely to generate when invest in fixed assets

- Company must analyze the duration in which the cash is likely to generate

- Projects like hydro-power, telecom longer time

- Eatables generate quick cash

Financing Decisions

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

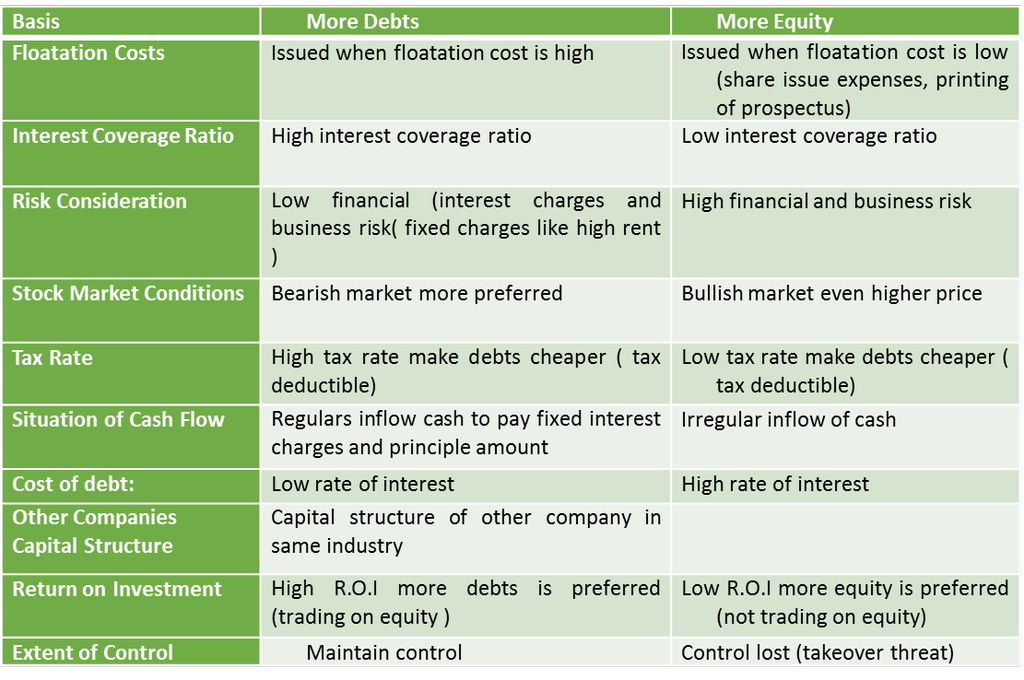

- This decision is about the amount of finance to be raised from various long-term sources

- Main sources of funds are shareholder's funds and borrowed funds

- A firm needs to have a careful mix of both debt and equity in making a capital structure

Factors Affecting Financing Decision:

- Cash Flow Position of the Business: a company having a stronger cash flow position may choose debt financing

- Higher Fixed Operating Costs: Already higher fixed operating costs (e.g., building rent, Insurance premium, Salaries, etc.), discourages the debt over equity

- Other Floatation Costs: Equity have a higher flotation cost in comparison to debts like prospectus, underwriter commission

- Issue of Cost: The costs of raising funds through different sources are different. The financial manager should have a cheaper source of finance.

- Control Considerations: Issues of more equity may lead to dilution of management’s control over the business. Debt does not let control dilution may be preferred

- Extent of Risk: Debts have more risk in comparison to equity.

- State of Capital Markets: During the boom period when the stock market is rising, more people invest in equity as a growing business will give more chances of higher-earning than investing in debts.

Rights & Responsibilities of Consumer

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

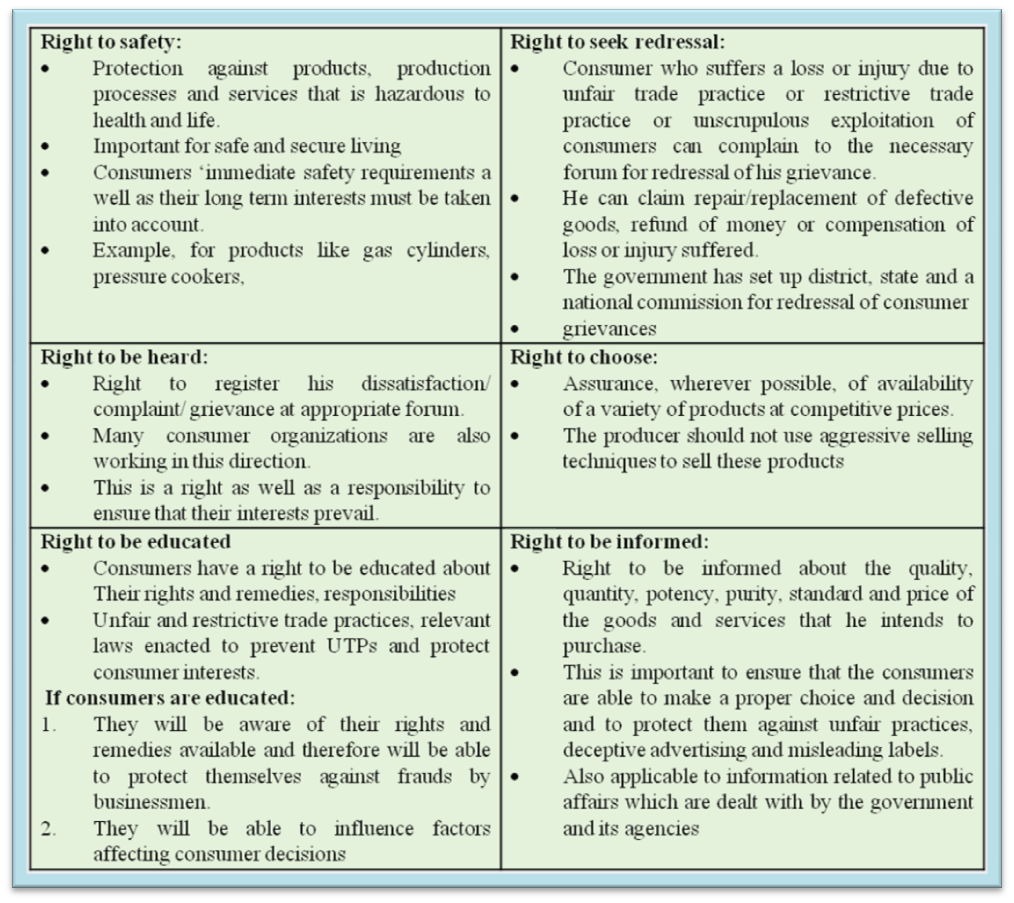

RIGHTS & RESPONSIBILITIES OF CONSUMERS:

Legal Redressal Forum

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

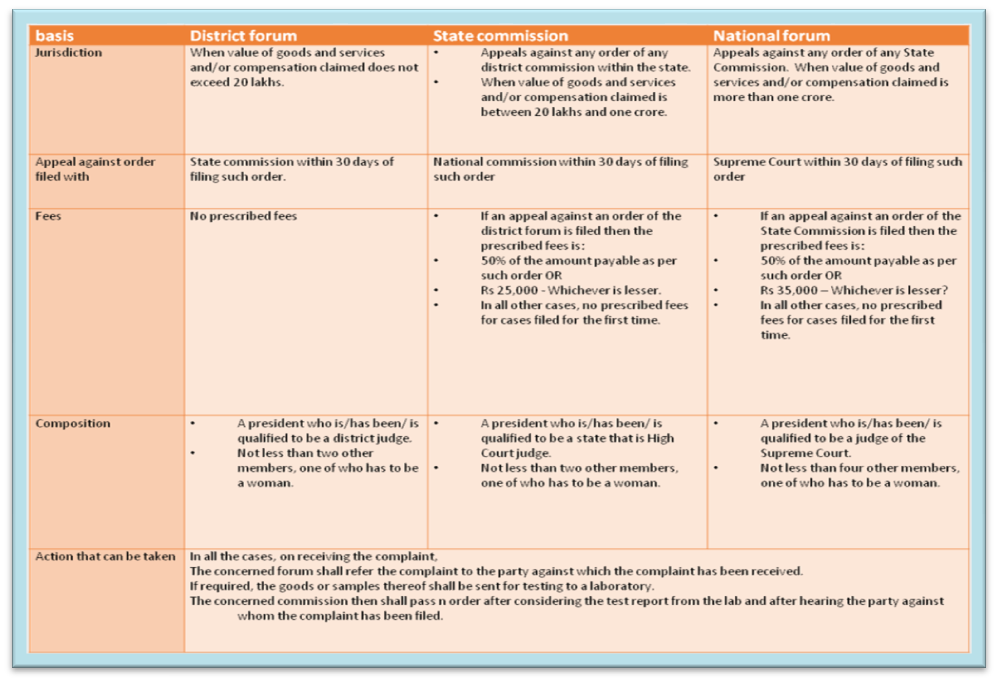

LEGAL REDRESSAL FORUM:

Redressal Agencies under Consumer Protect Act, 1986

Remedies/Relief Available

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

REMEDIES/RELIEFS AVAILABLE

Relief Available

- To remove the defect in goods or the deficiency in service.

- To replace the defective product with a new one, free from any defect.

- To refund the price paid for the product.

- To pay a reasonable amount of compensation for any loss or injury suffered by the consumer due to negligence of the opposite party.

- To pay punitive damages in appropriate circumstances.

- To discontinue the unfair/ restrictive trade practice and not repeat the same in the future.

- Not to offer hazardous goods for sale.

- To withdraw hazardous goods from sale.

- To cease manufacture of hazardous goods.

- To pay any amount (not less than 5% of the value of the defective goods to be credited to the Consumer Welfare Fund or any other organization/person, to be utilized in the prescribed manner.

- To issue corrective advertisements to neutralize the effect of misleading advertisements.

- To pay adequate costs to the appropriate party

Consumer Responsibilities

- Awareness: Aware of various goods and services available in the market to make an intelligent and wise decision.

- Follow instructions: Read labels carefully so as to have information about prices, net weight, manufacturing and expiry dates, etc, and the risks associated with products, and use the products safely

- Honest: be honest in dealings and choose only from legal goods and services and discourage dishonest practices like black-marketing, hoarding, etc.

- Cash memo: Ask for a cash memo on the purchase of goods or services for proof of the purchase made.

- Filing a complaint: File a complaint in an appropriate consumer forum in case of a shortcoming in the quality of goods purchased or services. Do not fail to take any action even when the amount involved is small.

- Environment friendly: Respect the environment. Avoid waste, littering and contributing to pollution.

- Form Consumer Awareness organizations: which can be represented the consumers for their welfare.

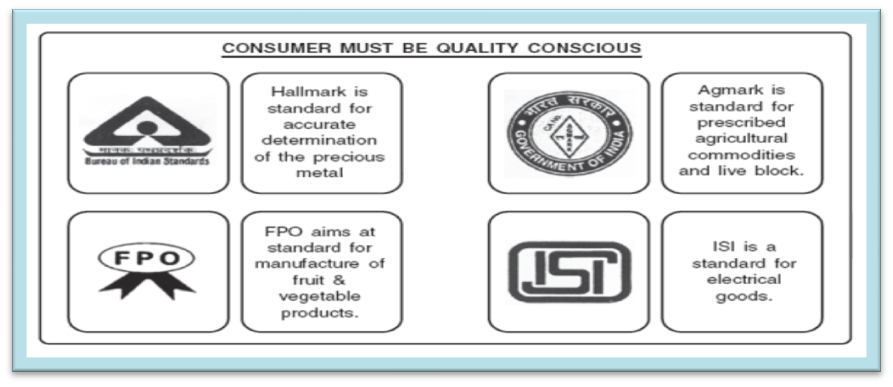

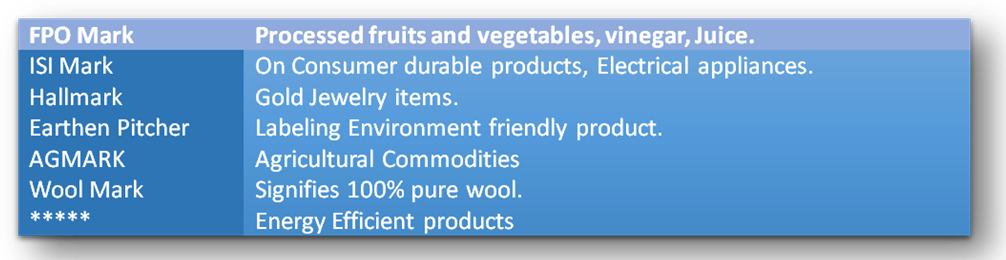

- Quality conscious: Buy only standardized goods as they provide quality assurance. ISI mark on electrical goods, FPO mark on food products, Hallmark on jewelry etc.

What kind of quality certification mark will you look for before buying products?

Role of Consumer Organisations & NGOs

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

ROLE OF CONSUMER ORGANISATIONS & NGOs:

- Publishing: periodicals and other publications to impart knowledge about consumer problems, legal reporting, and relief’s available and other matters of interest.

- Assist in Educating: the general public about consumer rights by organizing training programs, seminars and workshops

- Representing: the consumers by Filing complaints in appropriate consumer courts on their behalf

- Carrying: out comparative testing of consumer products in accredited laboratories to test the relative qualities of competing brands and publishing the test results for the benefit of consumers

- Encouraging: consumers to strongly protest and take an action against unscrupulous, exploitative and unfair trade practices of sellers.

- Legal assistance: to consumers by way of providing legal advice

Dividend Decisions

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

DIVIDEND DECISION

The dividend is that portion of the profit that is distributed to shareholders. Involved

- How much of the profit earned by the company (after paying tax) is to be distributed to the shareholders

- How much of it should be retained in the business for meeting the investment requirements

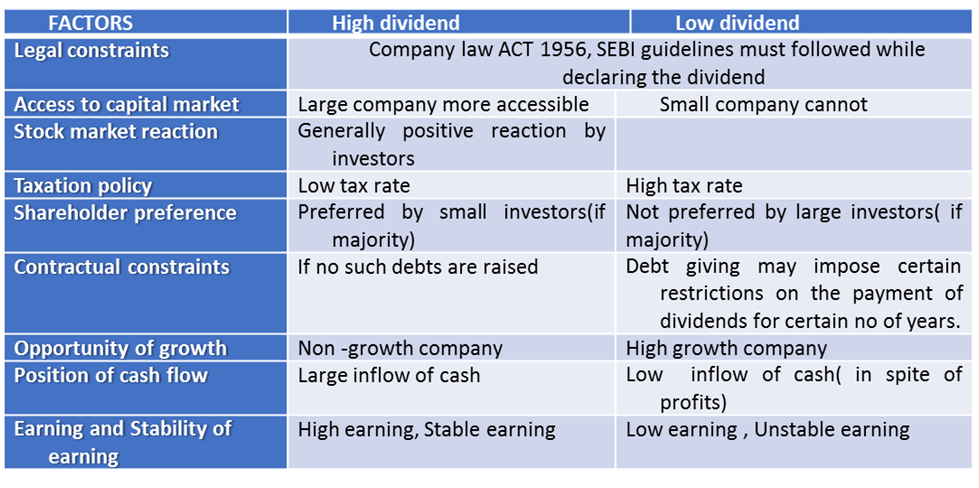

Explain Factors Affecting The Dividend Decision.

- Earnings: Dividends are paid out of the current and past earnings. Therefore, earnings are high then only the company can pay the dividend

- Stability of Earnings: Company having stable earnings is in a position to declare higher dividends than a company having unstable earnings.

- Stability of Dividends: some companies may pay a fixed rate of dividend irrespective of profit like the company may pay a dividend of Rs 3 per share for every share

- Growth Opportunities: Companies having good growth opportunities keep more money out of their earnings so as to invest in future projects. The dividend in growth companies is, therefore, smaller than that in the non–growth companies.

- Cash Flow Position: Dividends involve an outflow of cash. A company may be profitable but short on cash. The availability of enough cash in the company is necessary for the declaration of dividends by it.

- Shareholder Preference: If the shareholders, in general, want that at least a certain amount is paid as a dividend, the companies are likely to declare the same or vice -versa

- Taxation Policy. If the tax on dividends is higher it would be better to pay less by way of dividends. As compared to this, higher dividends may be declared if tax rates are relatively lower.

- Stock Market Reaction: Investors, in general, view an increase in dividends as good news and stock prices react positively to it. Similarly, a decrease in dividends may have a negative impact on the share prices in the stock market.

- Access to Capital Market: Large and reputed companies have easy access to the capital market and depend less on retained earnings growth to pay higher dividends.

- Legal Constraints: Certain provisions of the Company’s Act place restrictions on payouts as dividends. Such provisions must be adhered to while declaring the dividends.

- Contractual Constraints: While granting loans to a company, sometimes the lender may impose certain restrictions on the payment of dividends in the future. The companies are required to ensure that the dividends do not violate the terms of the loan agreement in this regard

Factors Affecting Dividend Decision:

Financial Planning

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

FINANCIAL PLANNING

Meaning - It involves the preparation of a financial blueprint for an organization. It is the process of estimating the fund requirement of a business and determining the possible sources from which it can be raised.

Objectives of Financial Planning:

- To ensure the availability of funds whenever they are required:

- Includes estimation of the funds required for different purposes (long term assets/wk cap requirement)

- Estimate the time at which these funds need to be made available.

- Specify sources of these funds.

- To see that the firm does not raise resources unnecessarily:

- Shortage of funds => firm cannot meet its payment obligations. o

- Surplus funds => do not earn returns but add to costs.

Importance of Financial Planning:

- Co-coordinating different functions: Financial Planning helps to coordinate the activities of the financial departments and other departments. Helps in co-coordinating various business functions e.g., sales and production functions, by providing clear policies and procedures.

- Avoiding business shocks and surprises: Financial Planning aims at studying various factors that have an impact on the business and helps in predicting the probability of their occurrence. Thus, Financial Planning helps to avoid shocks and surprises by predicting them in advance and developing plans to meet them.

- Makes the firm better prepared for the future: Financial Planning tries to forecast what may happen in the future and prepares alternative plans to meet different eventualities. Financial Planning would help to identify the sources from which funds can be raised to finance such a programm.

- Evaluation of performance easier: Financial Plans set standards against which actual performance is compared. The deviations that are identified can be corrected and necessary steps can be taken to prevent their re-occurrence.

- Links the present with the future: Financial Planning helps to estimate future requirements and prepares plans in the present to balance requirements of funds with the availability of funds.

Capital Structure

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CAPITAL STRUCTURE

Financial risk?

- The risk of default on the payment of debt.

- Higher use of debt increases the financial risk of a business

Capital Structure

- Refers to the mix of debt and equity

Optimum Capital Structure

- Proportion of debt and equity that results in an increase in the value of shareholders (higher E.P.S)

Factors affecting the Choice of Capital Structure:

- Cash Flow Position: Cash flows must not only cover fixed cash payment obligations but there must be sufficient safeguards also. It must be kept in mind that a company has cash payment obligations for normal business operations.

- Interest Coverage Ratio: refers to the number of times earnings before interest and taxes of a company cover the interest obligation. The higher the ratio, the lower is the risk of the company failing to meet its interest payment obligations.

- Formula for calculating ICR = EBIT/interest.

- Return on Investment: If the ROI of the company is higher, it can choose to use trading on equity to increase its EPS, i.e., its ability to use debt is greater.

- Cost of debt: A firm’s ability to borrow at a lower rate increases its capacity to employ higher debt. Thus, more debt can be used if the debt can be raised at a lower rate.

- Tax Rate: Since interest is a deductible expense, the cost of debt is affected by the tax rate makes debt relatively cheaper.

- Floatation Costs: Public issue of shares and debentures requires large expenditure. Getting a loan from a financial institution may not cost so much.

- Risk Consideration: Debt increases the financial risk to meet fixed interest payments and repayment obligations. If a firm’s business risk is lower, its capacity to use debt is higher and vice-versa.

- Flexibility: If a firm uses its debt potential to the full, it loses the flexibility to issue further debt. To maintain flexibility, it must maintain some borrowing power to take care of unforeseen circumstances.

- Control: A company that wants to retain control can use debts( up to a certain extent) . A public issue of equity may reduce the management holding in the company and may cause a takeover threat

- Regulatory Framework: Every company operates within a regulatory framework provided by the law e.g., public issues of shares and debentures have to be made under SEBI guidelines.

- Stock Market Conditions: If the stock markets are bullish, equity shares are more easily sold even at a higher price. During a bearish phase, a company may find rising equity capital more difficult and it may opt for debt.

- Capital Structure of other Companies: A useful guideline in capital structure planning is the debt-equity ratios of other companies in the same industry

SUMMARY:

Primary market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

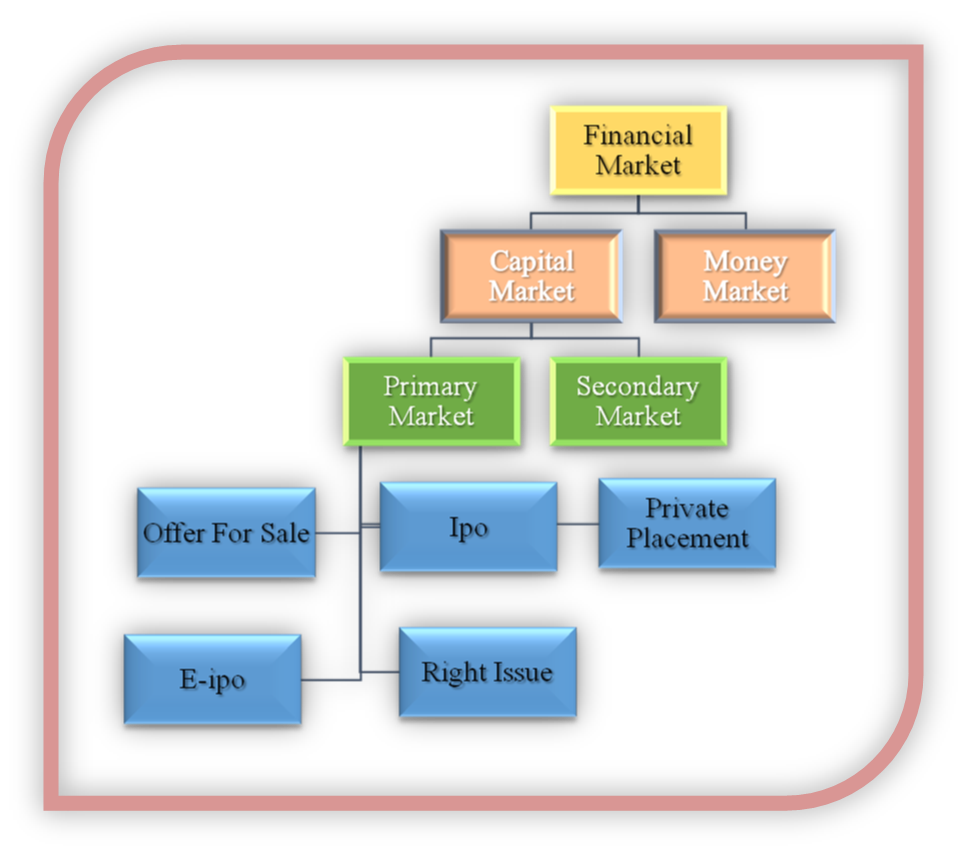

PRIMARY MARKET

- It deals with the issue of new or fresh capital also referred to as the New Issue Market (NIM).

- Securities are issued by the company directly to investors.

Methods of Floatation

1. Offer through Prospectus:

- Most popular method of raising funds is by public companies.

- Company issues a prospectus to inform and attract the investing public.

- Prospectus contains the financial performance of the company to let the public know about the risk factor in the likely investment.

2. Offer for Sale:

- First step: - The company sells securities at an agreed price to brokers.

- Second step: - Resell to the investing public at a higher price.

- Benefit: - Avoid the difficult procedure and minimize the floating cost.

3. Private Placement:

- A private placement is the allotment of securities by a company to institutional investors and some selected individuals.

- Benefit:-Cost-effective method for small companies to avoid expenses like underwriter commission and printing of prospectus etc.

4. Rights Issue:

- To maintain the control of the existing shareholder are offered the ‘right ‘to buy new shares in proportion to the number of shares they already possess.

- Shareholders may accept this offer or reject it.

5. e-IPOs:

- A company proposing to issue capital to the public through the online system of the stock exchange has to enter into an agreement with the stock exchange.

- SEBI registered brokers have to be appointed for the purpose of accepting applications and placing orders with the company.

- The issuer Company should also appoint a registrar to the issue having electronic connectivity with the exchange.

Secondary market and Stock Exchange

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

SECONDARY MARKET & STOCK EXCHANGE:

The market for the purchase and sale of existing securities within the regulatory framework prescribed by SEBI

Functions of a Stock Exchange

- Contributes to Economic Growth Instead of investing money in an unproductive sector like jewelry stock exchange provide avenues for investment in the securities market and help in capital formation and economic growth.

- Liquidity and Marketability to Existing Securities: By converting the securities into the cash stock exchange provide a ready market for the investors. This provides both liquidity and easy marketability to already existing securities in the market

- Allow Pricing of Securities: Share prices on a stock exchange are determined by the forces of demand and supply. Such a valuation provides important instant information to both buyers and sellers in the market.

- Scope for Speculation: Provides scope within the provisions of law for speculative activity in a restricted and controlled manner to ensure liquidity and price continuity in the stock market.

- Spreading of Equity Cult: Plays an essential role in ensuring wider share ownership by regulating new issues, better trading practices, and taking effective steps in educating the public about investments.

- Ensures better allocation of capital: - Reliable companies whose shares have high value can raise the additional fund in the capital market by gaining the faith of the investors

- Safety of Transaction: The membership of a stock exchange is well regulated and its dealings are well defined according to the existing legal framework. Investing public gets a safe and fair deal on the market.

DIFFERENCE:

Depository System

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

DEPOSITORY SYSTEM

Important terms related to the stock exchange

- Dematerialization: stocks are kept in electronic form instead of physical form (i.e. share certificates). It helps in overcoming the problem of theft, forgery, delays, misplaced certificates, and unnecessary paperwork.

Benefits of Demat Account

- Reduces paperwork.

- Elimination of problems with the transfer of shares such as loss, theft and delay.

- Exemption of stamp duty when the transfer of shares.

- The concept of odd-lot stands abolished.

- Increase liquidity through speedy settlement.

- Attract foreign investors and promote foreign investment.

Working on the Demat System

- A depository participant (DP), either a bank, broker or financial services company, may be identified.

- An account opening form and documentation (PAN card details, photograph, and power of attorney) may be completed.

- The physical certificate is to be given to the DP along with a dematerialization request form.

- If shares are applied in a public offer, simple details of the DP and Demat accounts are to be given and the shares on allotment would automatically be credited to the DEMAT account.

- If shares are to be sold through a broker, the DP is to be instructed to debit the account with the number of shares.

- The broker then gives instructions to his DP for the delivery of the shares to the stock exchange.

- The brokers then receive payment and pay the person for the shares sold.

- All these transactions are to be completed within 2 days, i.e., delivery of shares and payment received from the buyer is on T+2 bases, settlement period.

Advantages of Electronic trading systems or screen-based trading has certain

- Ensures Transparency

- It allows participants to see the prices of all securities in the market while business is being transacted.

- They are able to see the full market in real-time.

- Increases Efficiency

- It increases the efficiency of operations since there is a reduction in time, cost, and risk of error.

- Improving the liquidity of the market

- People from all over the country and even abroad who wish to participate in the stock market can brokers or members without knowing each other.

- This system has enabled a large number of participants to trade with each other, thereby improving the liquidity of the market.

- Single trading platform:-

- A single trading platform has been provided as a business is transacted at the same time in all the trading centers.

Now, screen-based trading or online trading is the only way in which you can buy or sell shares.

Important terms

- Demutualization: Process that separates the trading rights of members or brokers in a stock exchange from its ownership and control.

- Depository: - Organisation that holds securities (like shares, debentures, bonds, government securities, mutual fund units, etc.) of investors in electronic forms through a registered Depository Participant. Two Depositories viz. National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) are registered with SEBI

- Depository Participant: -agent of the depository through which it interfaces with the investor and provides depository services. Commercial banks, foreign banks operating in India with the approval of the Reserve Bank of India.

TRADING PROCEDURE

The procedure for the purchase and sale of securities in a stock exchange involves the following steps:

- Selection of a Broker:

- The first step is to select a broker who will buy/sell securities on behalf of the speculator/ investor.

- The investor has to sign a broker-client agreement and a client registration form before placing an order to buy or sell securities.

- He has also to provide certain other details and information such as PAN number (mandatory), Bank account details, Depository account details, etc.

- The broker then opens a trading account in the name of the investor

- Opening Demat Account With Depository:

- The investor has to open a Demat account or beneficial owner‘(BO) account with a depository participant (DP) for holding and transferring securities in the Demat form.

- He will also have to open a bank account for cash transactions in the securities market.

- Placing the order:

- The order can be communicated to the broker and should specify the securities to be bought or sold and the price range within which the order is to be executed.

- The broker will then go ahead with the deal at the above-mentioned price or the best price available.

- An order confirmation slip is issued to the investor by the broker. Only the securities of listed companies can be traded on the stock exchange.

- Execution of order:-

- The broker goes online and connects to the main stock exchange and matches the share and best price available.

- Issuing a trade confirmation slip

- When the shares can be bought or sold at the price mentioned, it will be communicated to the broker‘s terminal and the order will be executed electronically.

- The broker will issue a trade confirmation slip to the investor.

- Contract Note

- After the trade has been executed, within 24 hours the broker issues a Contract Note.

- A Unique Order Code number is assigned to each transaction and is printed on the contract note.

- Settlement:

- This is the last stage in the trading of securities done by the brokers on behalf of their clients.

- The investor has to deliver the shares/or pay cash for the shares bought.

Cash in cash-out day

- Cash in day: - Cash is paid or securities are delivered on the pay-in day, which is before the T+2 day as the deal has to be settled and finalized on the T+2 day. The settlement cycle is on T+2 days on a rolling settlement basis.

- Cash-out day: -On the T+2 day, the exchange will deliver the share or make payment to the other broker. This is called the pay-out day. The broker then has to make payment to the investor within 24 hours of the payout day since he has already received payment from the exchange.

Contract note:-

- This note contains details of the number of shares bought or sold, the price, the date and time of the deal, and the brokerage charges.

- This is an important document as it is legally enforceable and helps to settle disputes/claims between the investor and the broker.

SEBI

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

SEBI

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India was established by the Government of India on 12 April 1988as an interim administrative body to Protect the interests of investors To promote the development of the securities market And regulate the securities market

Purpose and Role of SEBI

• To the issuers: To provide a market to raise the finances in an EasyFair Efficient manner.

• To the investors: Provide protection of their rights and interests through Adequate Accurate and Authentic information on a continuous basis.

• To the intermediaries: Offer a competitive professionalized with adequate and efficient infrastructure. So that they are able to deliver better service to the investors and issuers.

Objectives of SEBI

- Regulate stock exchanges and the securities industry to promote their orderly functioning.

- Protect the rights and interests of investors and guide and educate them.

- Prevent trading malpractices and achieve a balance between self-regulation by the securities industry and its statutory regulation.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers.

Functions of SEBI

Protective functions

- Controlling insider trading: It prevents insiders such as directors, and promoters who have access to price-sensitive information regarding securities of the company (which is not available to the public) to make individual profits through the trading of securities.

- Undertaking steps for investment or protection.

- Promotes fair practices and code of conduct in the securities market.

- Stops fraudulent and unfair trade practices in the security market: - like making misleading statements and price rigging. (Manipulating with the sole intention of inflating or deflating the market price of securities is termed as “price rigging)

Developmental functions

- Conducting research & publish information useful to all market participants.

- Undertakes measures to develop the capital markets by adopting a flexible and adaptable approach.

- Training of intermediaries of the securities market.

Regulatory functions

- Conducts inquiries and audits of the stock exchanges.

- Register and regulates the working of stockbrokers, sub-brokers, and share transfer agents.

- Registers and regulates the working of mutual funds etc.

- Regulation of stockbroker, portfolio exchanges, underwriters & merchant bankers

- Regulation of tasks over bids by companies.

- Levying fee or other charges as per the act.

- Performing and exercising such power under Securities Contracts (Regulation) Act 1956, as may be delegated by the Government of India.

Place

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

PLACE MIX

Concerned with transferring the goods and services available at the right place and right time so that customers can purchase the same.

Includes

- Physical Distribution

- Channels of Distribution`

Refers to a team of merchants, agents and business institutions that combine physical movement and title movement of products to reach the producers to the consumers.

Product Mix

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

PRODUCT mix:

- Product is a mixture of tangible and intangible attributes, which are capable of being exchanged for a value, with the ability to satisfy customer needs.

Include services, ideas, persons, and places.

Three types of benefits for a customer from the product

- Functional benefits

Car provides the functional utility of transportation

- Psychological benefits

Satisfies the need for prestige and esteem

- Social benefits.

Acceptance from a group

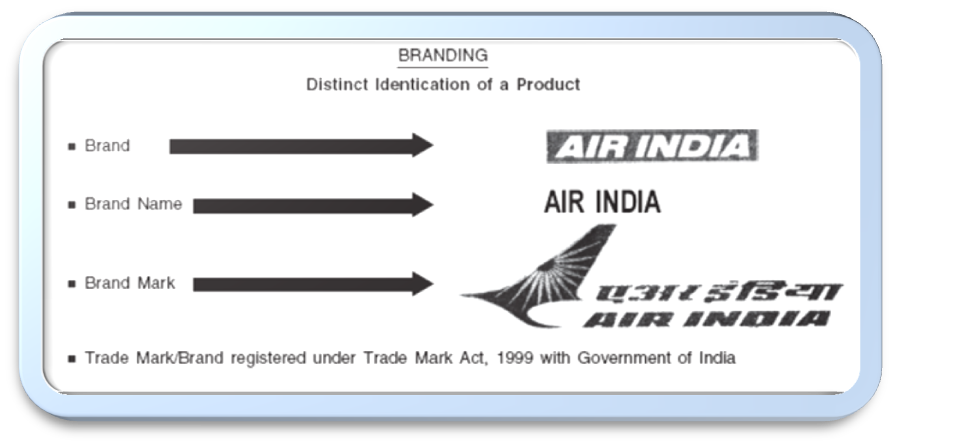

Branding: Branding is a name, term, symbol, or combination of all these which uniquely identify the products and create a corporate brand identity for the consumer. Two components—brand name and brand mark.

-

- Brand Name: Part of a brand, which can be spoken, is called a brand name. For example, Asian Paints, SONY Maggie.

- Brand Mark: Part of a brand that can be recognized but which is not able to express. Appears in the form of a symbol, design, for Example, the tiger on Britannia biscuits

Trade Mark: A brand or part of a brand that is given legal protection is called a trademark.

Advantages to the Marketers

- Product Differentiation: Helps a firm in differentiating its product from that of its competitors. This enables the firm to secure and control the market for its products. Example Sony, Samsung, Nokia.

- Advertising and Display Programmers: Without a brand name, the advertiser can only create awareness for the product and branding increases the sale of the product.

- Introduction of New Product becomes easy: If a new product is introduced under a known brand, it enjoys goodwill and can get a good start.

- Differential Pricing: enables a firm to charge a higher price for its products than its competitors. Nokia, Sony charge higher prices than their competitors

Advantages to Customers

- Status Symbol: Some brands have become status symbols because of their quality. The consumers feel proud and improve their satisfaction level. Like Puma, Nokia

- Ease in shopping: Satisfied customer with a particular brand of a product, customer need not make a close check every time.

- Ensures Quality: Branding means quality. Customer is always confident about the quality McDonald's, Haldiram

Characteristics of Good Brand

- Suggestive it should suggest the product’s benefits and qualities. It should be appropriate to the product’s function. E.g. Boost. Sunsilk, Hajmola.

- Continuing Chosen name should have staying power i.e., it should not get out of date. Lifebuoy( more than 125 years)

- Adaptable should be suitably flexible to hold new products, which are added to the product line e.g., nestle, Samsung.

- Registration should be capable of being registered and protected legally.

- Easy to spell should be short, easy to pronounce, spell, recognize and remember e.g., Ponds, VIP, Rin, Vim, etc

- Disincentive A brand name should be distinctive e.g., GOOGLE, Sprit, MICROSOFT,LG

Packaging: - anything which protects the product from leakages, spoilage, moisture, heat, and mishandling and adds value and life to the product

Levels of Packaging

- Primary Package:

- Refers to the product’s immediate container.

- Ready to use the product (e.g., plastic packet for socks);

- Used throughout the entire life of the product (e.g., toothpaste tube, a matchbox, etc.).

- Secondary Packaging:

- additional layers of protection that are kept till the product are ready for use, e.g., a tube of shaving cream

- Transportation Packaging:

- Further packaging components are necessary for storage, identification, or transportation. For example toothpaste in cardboard boxes containing 10, 20, or 100 units.

Importance of Packaging

- Self-Service Outlets: Self-service retail outlets are becoming very popular, particularly in major cities and towns. Example reliance fresh, easy day, etc.

- Increasing Standards of Health and Sanitation: standards of living in the country are increasing, and more and more people have started purchasing packed goods as the chances of adulteration in such goods are less.

- Innovational Opportunity: packaging has completely changed the marketing scene in the country. milk can now be stored for 4-5 days, traveling pouches of paste, tea, sugar, coffee, canned juices

- Product Differentiation, by looking at the package of a product customers can guess about the quality of the product contained in it.

Functions of Packaging

- Product usage: The size and shape of the package should be such that it should be convenient to open, handle and use for the consumers.

- Identification: Colgate in red color or Ponds cream jar can be easily identified by its package.

- Promotion: color schemes, photographs, or typeface may be used to attract the attention of the people at the point of purchase. In self-service stores, this role of packaging becomes all the more important.

- Enables Protection: protects the contents of a product from spoilage, breakage, leakage, pilferage, damage, climatic effect, etc. This kind of protection is required during storing, distribution, and transportation of the product.

Labeling: - Part of the product that carries information about the product, its contents, method of use, seller, etc.

Functions

- Promotion of Products: Attractive labels can attract customers and can increase sales. For example the label on the soft drink‘20% Extra Free.

- Required Information By Law: For example, the statutory warning on the package of Cigarettes or Pan Masala, ‘Smoking is Injurious to Health’

- Identification of the Product: Labels help to identify the product or brand on its package from many products also including the name and address of the manufacturer.

- Describe the Product and Specify its Contents. Describe the product, its usage, cautions in use, etc. and specify its contents, MRP, expiry date, manufacturing date, batch number, etc.

- Enables grading of products: Grading the products into different categories. Different type of milk is sold by Amul brands under Red( full cream), blue (single tone) yellow(double tone)

Price Mix

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

PRICE mix

Price is the monetary sacrifice of a product. Price mix refers to the decisions relating to the price charged for the product.

Determination of the Price of a Product is influenced by many factors.

- Pricing Objectives:

- Competitive Market: to survive at competitive market prices has to keep low

- Attaining Product Quality Leadership: normally higher prices are charged to cover high quality and high cost of Research and Development.

- Obtaining Market Share Leadership: If a firm's objective is to obtain a larger share of the market; it will keep the price of its products at a lower

- The extent of Competition: Apart from these internal considerations, external factors such as prices of similar products in the market, govt.-policy, etc. should also be considered

- Total Cost of production: Sales price = total costs + desired profit. No firm likes to sell its product below the total cost of the product.

- Demand for the product: If there is less demand for the product, it will not sell at a very high price. Demand should be predicted correctly before setting the price.

- Other marketing methods Used: The price fixation process is also affected by other elements of marketing such as distribution system, quality of salesmen employed, quality and amount of advertising, sales promotion efforts, the type of packaging, credit facility, and customer services provided.

- Government and Legal Regulations: to protect the interest of the public against unfair practices Government can declare certain products as essential products and regulate their price.(petrol, diesel, LPG)

Channels of Distribution

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CHANNELS OF DISTRIBUTION

Types of Channels

Direct Channel (Zero Level)

- Most simple and shortest mode of distribution

- Goods are made directly available by the manufacturers to customers, without involving any intermediary

- Mail order selling, internet selling and selling through own sales force, (e.g., Eureka Forbes).

Indirect Channels

When a manufacturer employs one or more intermediaries to move goods from the point of production to the point of consumption

- Manufacturer-Retailer Consumer(One Level Channel):

-

- One intermediary i.e., retailers is used between the manufacturers and the customers.

- Maruti Udyog

-

- Manufacturer-Wholesaler-Retailer-Consumer (Two-Level Channel):

-

- Wholesalers and retailers act as connecting links between the manufacturer and consumer.

- Consumer goods like soaps, clothes, rice,

-

- Manufacturer-Agent-Wholesaler-Retailer-Consumer (Three Level Channels):

-

- Manufacturers use their selling agents or brokers who connect them with wholesalers and then the retailers.

-

Factors Determining Choice of Channels

1. Product Related Factors:

- Industrial products/consumer product is

- Usually technical, made on order, and expensive products purchased by few buyers. short channels

- Consumer products usually standardized, less expensive, frequently bought products. by long channels

- Unit value

- Value of a product is low long channels

- High-value products, shorter channels

- Nature of products

- Complex products require technical details as in the case of most industrial or engineering products, short channels

- Simple Products sold through a long channel

- Related to Company’s

Financial strength

-

- Direct selling involves a lot of funds in fixed assets that can be used only by the financial sound company (reliance on the fresh, easy day)

Degree of Control

-

- Greater control on the channel members, short channels are used (Bata India)

- Less control over the middlemen longer channel (Colgate, nestle)

3. Issue Regarding Competitors

- Go In line with the competitors (Maruti, Tata Motors, Hyundai)

- Use Different lines from competitors( dell laptop sales through direct selling)

- Market Factors:

- No of buyers

- Number of buyers is small, industrial products, short channels

- Number of buyers is large, soft drinks, toothpaste etc., longer channels

- Size of order

- Order is small, for example consumer products, longer channels

- Size of the order is large, with short channels.

5. Environmental Factors:

- Economic condition

- Depressed economy marketers use shorter channels to reduce the cost due to limited sales

- Legal constraints:-Govt may fix certain channels(petrol pumps)

Physical Distribution: - Activities required to physically move goods from manufacturers to the customers.

Creates place utility and time utility by the provision of goods at the appropriate place and at the appropriate time

Activities involved in physical distribution

- Transportation (movement of goods):

- Helps in the movement of goods from the place of production to the place of consumption

- There are various means of transportation i.e., rail, road, air, pipeline, water transport, etc.

- Modes are evaluated and compared based on speed, frequency, flexibility, and cost, and the best-suited mode is selected by the company.

- Stock/Inventory:

- Inventory refers to the maintenance of a stock of goods. The inventory needs to be maintained so that goods can be supplied whenever demanded.

- The firm must consider the benefits of inventory and the cost involved and accordingly, the optimum level of inventory should be maintained.

- Warehousing:

- Whatever is produced is not sold off immediately. Therefore every company needs to store the finished goods until they are sold in the market.

- Storage of goods is necessary because some goods like crops are seasonal in production.

- Order processing:

- The time and steps involved between taking order from customer and delivery of goods as per order.

- There is a direct relationship between the time taken in order processing and the satisfaction of customers.

- Fast order processing gives more satisfaction to customers (Dominos 30 minutes home delivery)

Promotion Mix

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

PROMOTION MIX

An Element marketing mix Refers to a combination of promotional tools

-

-

- Sales Promotion

- Advertising,

- Personal Selling,

- Public relations

-

Can be used in different combinations, to achieve its communication objectives of

- Reminding is used for mature products since it keeps consumers thinking about the product

- Informing potential customers used to inform consumers about a new product

- Persuading them to buy, to tell the superiority of the product over its competitors

Advertising:-Impersonal, paid form of communication by the identified sponsor to promote some goods or service through common modes of some channels like ‘newspapers’, ‘magazines’, ‘television’, and ‘radio’.

FEATURES OF ADVERTISING

- Paid Form: sponsor has to bear the cost to be paid to various channels of communications

- Information: informs the buyers about the benefits they get when they purchase a particular product.

- Identified Sponsor: A sponsor may be an individual or a firm that pays for the advertisement. The name of a reputed company may increase sales of products

- Non-Personal Presentation: advertising is non-personal. There is the absence of personal appeal in advertising.

Role of Advertising in Business

- Research: Motivates firm for research and development activities to find new products and or add value to the existing products. Example mobile firm keeps on adding new features.

- Ease in Introduction of New Product: A firm can introduce itself and its product to the public through advertising. A new enterprise can't make an impact on possible customers without the help of advertising.

- Provide employment: Advertising provides direct employment to a large number of people engaged in both electronic and print media

- Enables Mass Production: Mass production reduces the cost of production per unit by the economical use of various factors of production.

- Advance standard of living: Convince people to consume the latest things and thereby improves their standard of living.

- To Promotion Sales: Promotes the sale of products by informing and persuading the people to buy them and helps in winning new customers and maintaining existing customers

- Support to media: Provides an important source of revenue to the publishers and magazines. It enables them to increase the circulation of their publication by selling them at lower rates.

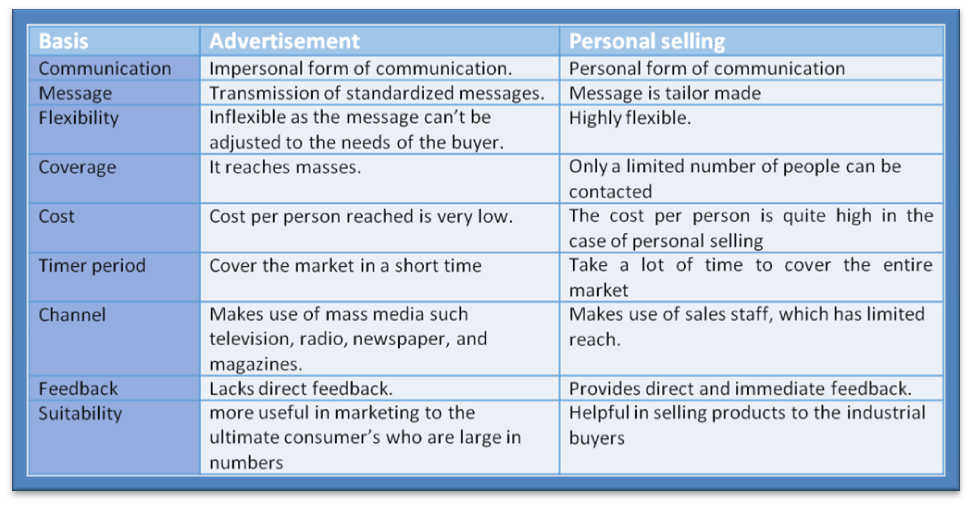

Personal selling: - Face-to-face communication between a seller and buyer. It involves an oral presentation by salespersons to one or more prospective buyers to make sales.

Features of Personal Selling

- Personal Form: direct face-to-face dialogue takes place that involves an interactive relationship between the seller and the buyer.

- Development of Relationship: this allows a salesperson to develop personal relationships with the likely customers.

Qualities of good salesmen

- Mentally healthy: Should possess certain mental qualities like imagination, initiative, self-confidence, sharp memory, alertness, etc. able to understand the needs and preferences of customers.

- Understanding: Should have a sense of understanding to convince the customers to buy. He must persuade the customer to finalize the purchase with a sense of satisfaction.

- Flexibility in approach: Should interact with customers with a flexible approach i.e., try to persuade different types of customers for different reasons.

- Full Knowledge of the product and the company: should have full knowledge of the product and the company he is representing. He should be able to explain every feature of the product.

- Inspired to trust: Should be co-operative and courteous. He should not feel irritated if the buyer puts up many questions even if the questions are irrelevant.

- Notable personality and sound health: Should have a good build and be well dressed. Customers will be impressed by the salesman’s pleasing personality. He is to travel therefore should have good health.

- Superior communication skills: Should be good in conversations and able to convince customers and create the need in his mind of the customer.

Difference

PROMOTION

Sales promotion

Refers to short-term incentives, which are designed to encourage the buyers to make immediate purchases of a product or service to boost the sales of a firm.

Methods of sales promotion

- Rebate:

- Under it to clear the excess stock, products are offered at some reduced price.

- For example, giving a rebate by a car manufacturer to the tune of 12,000/- for a limited period.

- Discount:

- Under this method, the customers are offered products at less than the listed price.

- For example, giving a discount of 30% on the sale of Liberty Shoes. Similarly giving a discount of 50% + 40% by the KOUTONS.

- Refunds:

- Under this method, some part of the price of an article is refunded to the customer on showing proof of purchase.

- This is commonly used by food product companies, to boost their sales.

- For example, refunding an amount of 5/- on showing the empty packet of the product price 100/-.

- Product Combination: Under this method, along with the main product some other product is offered to the customer as a gift. The following are some examples:

- Offer of a pack of ½ kg of rice with the purchase of a bag of Atta (wheat flour),

- Get 128 KB Memory Card Free with a Digi cam’ or Buy a TV of 25+ and Get a Vacuum Cleaner Free

- Quantity Gift:

- Under this method, some extra quantity of the main product is passed on as a gift to the customers.

- For example, 25% extra toothpaste in a packet of 200 gm toothpaste. Similarly, a gift of one RICH LOOK shirt on the purchase of two shirts.

- Instant Draw and Assigned Gift:

- Under this method, a customer is asked to scratch a card on the purchase of a product and the name of the product is inscribed thereupon which is immediately offered to the customer as a gift.

- For example, on buying a car when the card is scratched such gifts are offered – TV, Refrigerator, Computer, Mixer, Dinner Set, Wristwatch, T-shirt, Iron Press, etc.

- Lucky Draw:

- Under this method, the customers of a particular product are offered gifts on a fixed date and the winners are decided by the draw of lots.

- While purchasing the product, the customers are given a coupon with a specific number printed on it. Based on this number alone, the buyer claims to have won the gift.

- For example, the ‘Buy a bathing soap and get a gold coin’ offer can be used under this method.

- Usable Benefits:

- Under this method, coupons are distributed among the consumers on behalf of the producer. A coupon is a kind of certificate telling that the product mentioned therein can be obtained at a special discount.

- It means that if a customer has a coupon for some product he will get the discount mentioned therein whenever he buys it. Possession of a coupon motivates the consumer to buy the product, even when he does not need it.

-

- Such coupons are published in newspapers and magazines.

- Full Finance @ 0%:-

- Under this method, the product is sold and money is received in installments at a 0% rate of interest.

- The seller determines the number of installments in which the price of the product will be recovered from the customer.

- No interest is charged on these installments.

- Samples or Sampling:-

- Under this method, the producer distributes free samples of his product among the consumers. This method is used mostly in the case of products of daily use, e.g., Washing Powder, Tea, Toothpaste, etc.

- Thus, the consumers willy-nilly make use of the free sample. If it satisfies them, they buy it and in this way, sales are increased.

- Contests:

- Some producers organize contests with a view to popularizing their products.

- Consumers taking part in the contest are asked to answer some very simple questions on a form and forward the same to the company.

- Result is declared on the basis of all the forms received by a particular date

Public Relations Tools

Meaning - involves a variety of programs to promote and protect a company’s image or its products to strengthen relations with various stakeholders like customers, shareholders, employees, suppliers, investors, etc.

Public relations help in achieving the following marketing objectives:

- Building awareness: Public relations department can place stories and dramatize the product in the media. This will build marketplace excitement before the product reaches the market or media advertising takes place. This usually creates a favorable impression on the target customer.

- Building credibility: If news about a product comes in the media whether print or electronic it always lends credibility and people believe in the product since it is in the news.

- Stimulates sales force: It becomes easier for the sales force to deal with the retailers and convince dealers if they have already heard about the product in the news before it is launched. Retailers and dealers also feel it is easier to sell the product to the ultimate consumer.

- Lowers promotion costs: Maintaining good public relations costs much less than advertising and direct mail. However, it requires a lot of communication and interpersonal skills to convince the media to give space or time for the organization and its product.

The public relations department performs five functions:

- Press relations:

- Information about the organization needs to be presented in a positive manner in the press.

- Generating news requires skill in developing and researching a story and getting the media to accept press releases is a difficult task.

- The public relations department is in contact with the media to present facts and a correct picture of the company.

- Product publicity:

- New products require special effort to publicize and the company has to sponsor such programs.

- The public relations department manages the sponsoring of such events.

- The company can draw attention to new products by arranging sports and cultural events like news conferences, seminars, and exhibitions.

- Corporate Communication:

- The image of the organization needs to be promoted through communicating with the public and the employees within the organization.

- This is usually done with the help of a newsletter, annual reports, brochures, articles and audio-visual materials. Companies rely on these materials to reach and influence their target markets.

- Speeches by the company’s executives at a meeting of trade associations or trade fairs can boost the company’s image.

- Lobbying:

- The organization has to deal with government officials and different ministers in charge of corporate affairs, industry, and finance with respect to policies relating to business and the economy.

- The government also wants to maintain a healthy relationship with associations of commerce and industry while formulating industrial, telecom, taxation policies, etc.

- The public relations department then has to be positive in promoting regulations that affect them.

- Counseling:

- The company can build goodwill by contributing money and time to certain causes like the environment, wildlife, children’s rights, education, etc.

- Such cause-related activities help in promoting public relations and building goodwill.

Financial Leverage

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

Trading On Equity /Financial Leverage

How are the shareholders of a company likely to gain with a debt component in the capital employed?

Explain with the help of an example.

What do you mean by Trading on equity/financial leverage?

Financial leverage = proportion of debt in the overall capital structure. Also called - Trading on Equity or

Capital Gearing.

- Cost of funds = cost of debt + cost of equity.

- As financial leverage increases, the cost of funds declines as debt is a cheaper source of funds.

The reasons for higher EPS with debt are:

- Rate of return on investment is more than the cost of debt

- Interest paid on debt is tax-deductible and so there is a saving on the amount of income tax that the company will be required to pay.

- Number of shares is lesser when funds are raised as debt and so divisible profits (EAT) will have to be distributed among a lesser number of shares.

Use of Financial Leverage, however, involves a risk to equity holders because even a small change in EBIT will cause a great change in EPS and return on Equity as we can see in example II. Thus, the benefits of trading on Equity are available only when the following conditions are satisfied:

- The rate of earning is higher than the rate of interest on the debt.

- The company‘s earnings are stable and are regular to pay at least the interest on debentures.

- There are sufficient fixed assets to offer as security to lenders.

Numerical

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

NUMERICAL

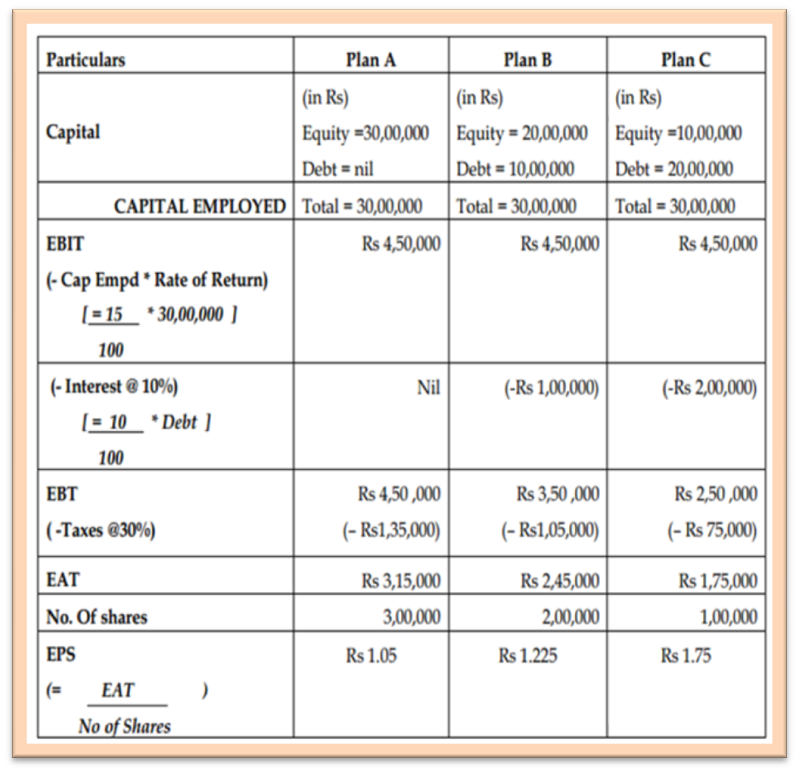

Example I: A company requires Rs 30, 00,000 to finance its operations. The expected rate of return is 15% and the tax rate is 30%. Financing options are:

- Equity shares @ Rs 10 per share OR

- Equity @ Rs 10 per share and debt @ 10% per annum.

The calculations of EBT (Earnings before Tax), EAT (Earnings after taxes), and EPS (Earning per

Share) under the above three alternatives can be given as:

In the above example, we see that Plan C has a higher EPS as:

- Tax paid is least in Plan C as compared with tax paid in Plans A and B.

- The rate of return on investment (=15%) is more than the cost of debt (10%)

- The number of shareholders under Plan C = 1, 00,000 which is much lesser than that under plan A (3, 00,000) or B (2, 00,000).

Que. Sahil Industries needs to raise funds of Rs.30,00,000. Its expected earnings before interest and taxes (EBIT) are Rs. 2,00,000. The company wishes to use more debt content as compared to equity to raise earnings per share (EPS) of equity shareholders. The debt is available at an interest of 10%. As finance Manager, advise whether the company should prefer more debt or more equity to have higher EPS. Give reasons to support your answer.

Ans. Sahil Industries should use less debt (preferably no debt) to have higher EPS because the current return on investment (ROI) is less than the cost of debt. The prevailing ROI is only 6.66% (=2,00,000/30,00,000 * 100) against the interest rate of 10%. When ROI is less than the interest rate on debt, then EPS falls with rising in use of debt. So, the company should prefer more equity to have higher EPS.

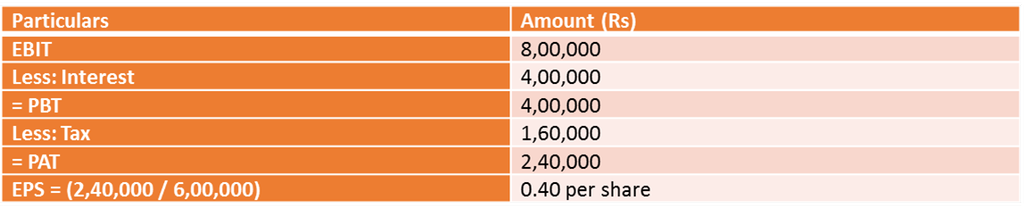

Que. Viyo Ltd.’ is a company manufacturing textiles. It has a share capital of ` 60 lakhs. The earnings per share in the previous year was ` 0.50. For diversification, the company required additional capital of ` 40 lakhs. The company raised funds by issuing 10% debentures for the same. During the current year, the company earned a profit of ` 8 lakhs on capital employed. It paid tax @40%.

(a) State whether the shareholders gained or lost, in respect of earning per share on diversification. Show your calculations clearly.

(b) Also, state any three factors that favor the issue of debentures by the company as part of its capital structure.

Answer:- Statement showing the calculation of earnings for shareholders

Thus the shareholders have lost wealth as earnings per share have decreased. Assuming the face value of a share is Rs 10.

Cost of Debt: As external sources of finance are always cheaper than internal sources of finance, debt helps in producing the overall cost.

- Tax Rate: Interest paid on debt is tax-deductible expenses. Due to this real cost of debt is much lower than the nominal one.

- Control: By rising debt, the control of shareholders is not diluted