- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

FINANCIAL MARKET

Bring together borrowers and lenders together, for the creation and exchange of financial assets

In to the most productive investment opportunity

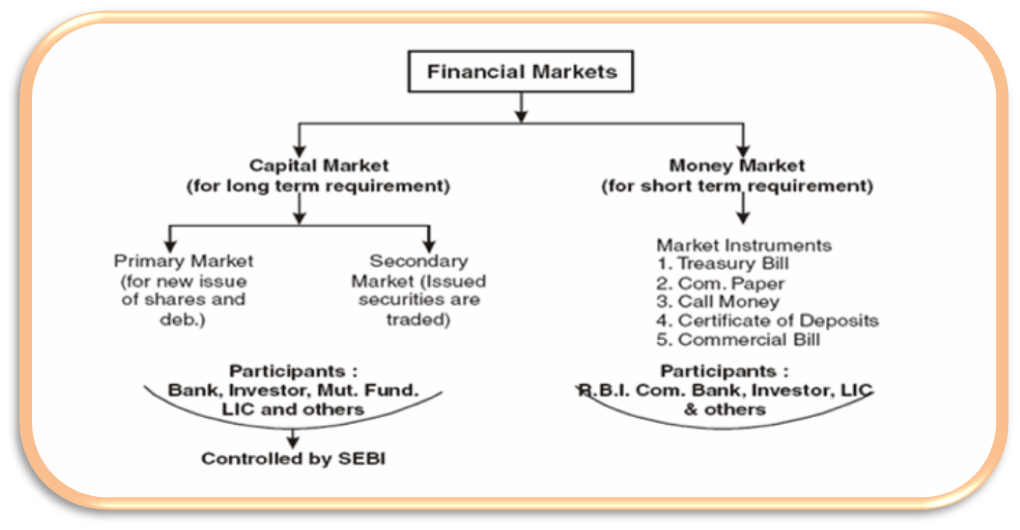

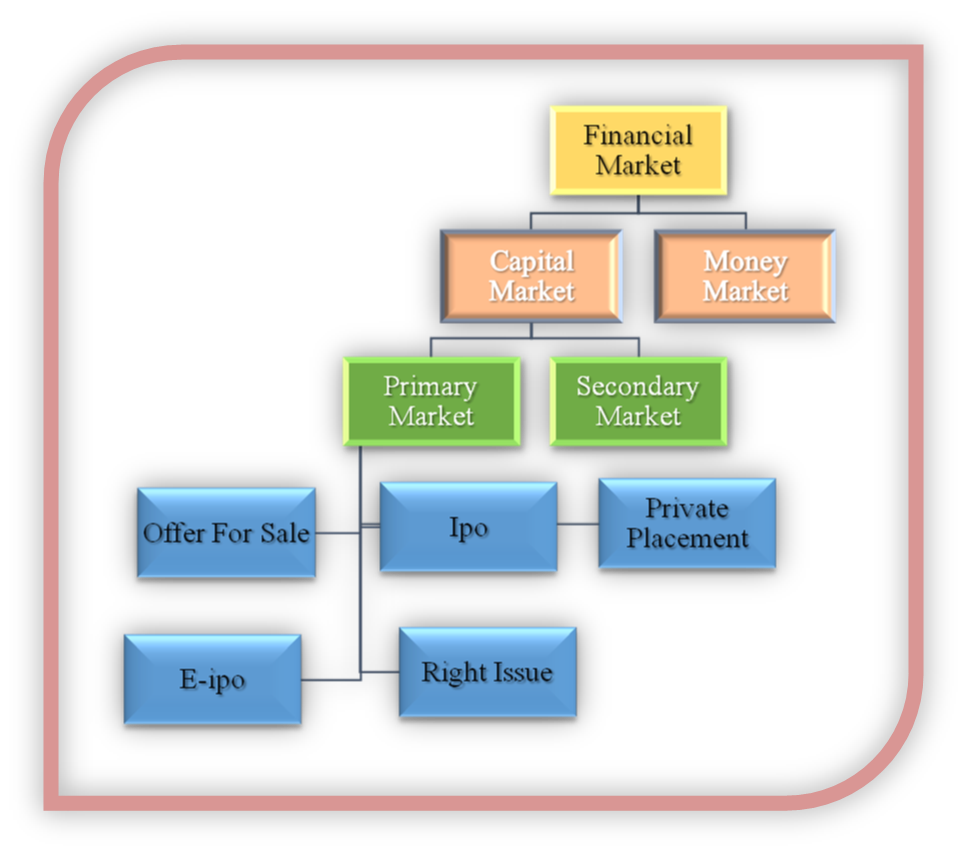

Classification of Financial Markets

- Capital markets

- Money markets

FUNCTIONS OF THE FINANCIAL MARKET

- Pricing of securities :

- The price of anything depends upon the demand and supply factors.

- Demand and supply of financial assets and securities in financial markets help in deciding the prices of various financial securities; where business firms represent the demand and the households represent the supply.

- Reduce the Cost of Transactions:

- By providing valuable information to buyers and sellers of financial assets, it helps to save time, effort, and money that would have been spent by them to find each other.

- Also, investors can buy/sell securities through brokers who charge a nominal commission for their services.

- This way financial market facilitates transactions at a very low cost.

- Add Liquidity to Financial Assets:

- Financial markets provide liquidity to financial instruments by providing a ready market for the sale and purchase of financial assets.

- Whenever the investors want, they can invest their savings into long term investments and

- Whenever they want, they can sell the investments/ instruments and convert them into cash.

- Mobilization of Savings into the most Productive Uses:

- Facilitates transfer of savings from the savers to the investors.

- Financial markets help people to invest their savings in various financial instruments and earn income and capital appreciation.

Types of Financial Markets

ABCD CLASSES

ABCD CLASSES