- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

FIXED CAPITAL

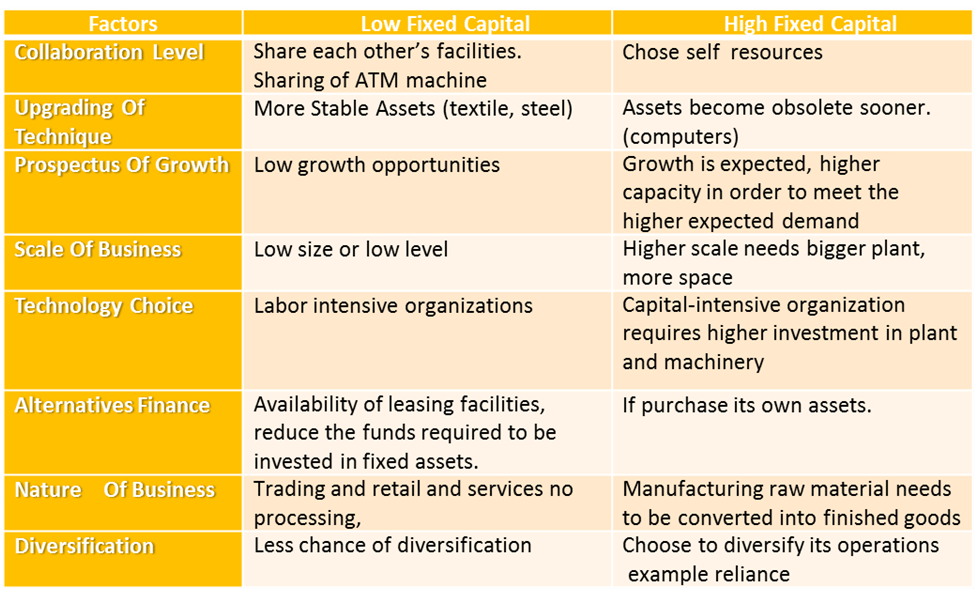

Factors affecting the Requirement of Fixed Capital:

- Collaboration Level:

If business organizations share each other’s facilities such collaboration reduces the level of investment in fixed assets. For example, a bank may use another’s ATM, or telecom companies share a common TOWER.

- Upgrading Of Technique:

- If assets become obsolete sooner. For example, computers become obsolete faster and are replaced much sooner. Require higher fixed capital.

- Other business like steel and textile has stable assets and can be used for a longer period.

- Prospectus Of Growth:

- An organization generally aiming for higher growth requires higher investment in fixed assets in order to meet the expected order quickly.

- Scale Of Business:

- A larger organization operating at a higher scale needs a bigger plant, more space, etc. and therefore, requires higher investment in fixed assets when compared with a small organization.

- Technology Choice:

- A capital-intensive organization requires higher investment in plants and machinery as it relies less on manual labor. Labor-intensive organizations on the other hand require less investment in fixed assets.

- Alternatives of Finance:

- Availability of leasing facilities may reduce the funds required to be invested in fixed assets, thereby reducing the fixed capital requirements.

- Nature of Business:

- A trading concern needs lower investment in fixed assets compared with a manufacturing organization; since it does not require purchasing plant and machinery etc.

- Diversification:

- A firm chooses to enter into other sectors/businesses With diversification, fixed capital requirements increase e.g., a textile company is diversifying

Factors affecting fixed assets requirements are:

ABCD CLASSES

ABCD CLASSES