- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

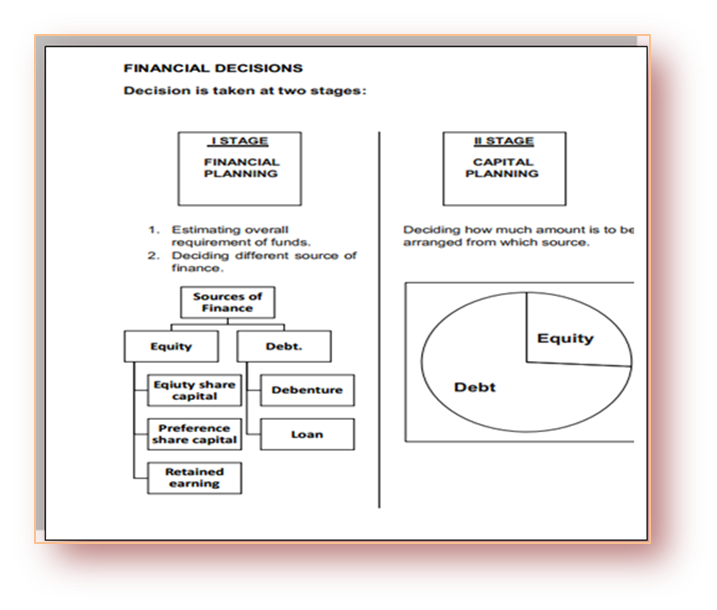

- This decision is about the amount of finance to be raised from various long-term sources

- Main sources of funds are shareholder's funds and borrowed funds

- A firm needs to have a careful mix of both debt and equity in making a capital structure

Factors Affecting Financing Decision:

- Cash Flow Position of the Business: a company having a stronger cash flow position may choose debt financing

- Higher Fixed Operating Costs: Already higher fixed operating costs (e.g., building rent, Insurance premium, Salaries, etc.), discourages the debt over equity

- Other Floatation Costs: Equity have a higher flotation cost in comparison to debts like prospectus, underwriter commission

- Issue of Cost: The costs of raising funds through different sources are different. The financial manager should have a cheaper source of finance.

- Control Considerations: Issues of more equity may lead to dilution of management’s control over the business. Debt does not let control dilution may be preferred

- Extent of Risk: Debts have more risk in comparison to equity.

- State of Capital Markets: During the boom period when the stock market is rising, more people invest in equity as a growing business will give more chances of higher-earning than investing in debts.

ABCD CLASSES

ABCD CLASSES