- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

ROLE & OBJECTIVES OF FINANCIAL MANAGEMENT

- Financial Decisions: investment, financing and dividend- Meaning and factors affecting.

- Financial Planning- concept and importance.

- Capital Structure - Concept.

- Fixed and Working Capital - Concept and factors affecting their requirements.

- Factors affecting capital budgeting decisions- cash flows of the project, the rate of return, investment criteria involved.

- Factors affecting financing decision- cash flow position of the company, cost, risk, floatation costs, fixed operating costs, control considerations, state of the capital market, Return on investment, tax rate, flexibility, regulatory framework.

- Factors affecting dividend decision- the number of earnings, stability of earnings, stability of dividends, growth opportunities, cash flow position, shareholder's preference, taxation policy, stock market reaction, access to the capital market, legal constraints, contractual constraints.

- Factors affecting fixed capital requirement- Nature of business, the scale of operations, choice of technique, technology up-gradation, growth prospects, diversification, financing alternatives, level of collaboration.

- Working capital- the concept of the operating cycle,

- Factors affecting working capital requirement- Nature of business, the scale of operations, business cycle, seasonal factors, production cycle, and credit allowed, the credit availed, availability of raw material.

Business Finance

Money required for carrying out business activities is called business finance. Required for

- Long term fixed assets , expansion, modernization and growth

- Short term working capital for meeting day to day working

Financial Management

Study of obtaining funds and their effective and careful utilization, to maximize the benefits to the owners of the funds

Objectives of financial management are as follows:-

Primary objective: To maximize the wealth of owners in the long run – Wealth Maximization concept.

- Owners‟ of a company are the shareholders.

- The term wealth refers to the wealth of owners as reflected by the market price of their shares.

- The goal of a firm should be to maximize the wealth of owners in the long run.

- An increase in the market price of shares is an indicator of the financial health of a firm.

Wealth of shareholders= number of shares * market price per share.

Other objectives that help a firm achieve the primary objective are:

- Ensure availability of funds at reasonable costs:

- Ensure effective utilization of funds:

- Ensure the safety of funds through the creation of reserves:

- Maintain liquidity and solvency:

Role of Financial Management:

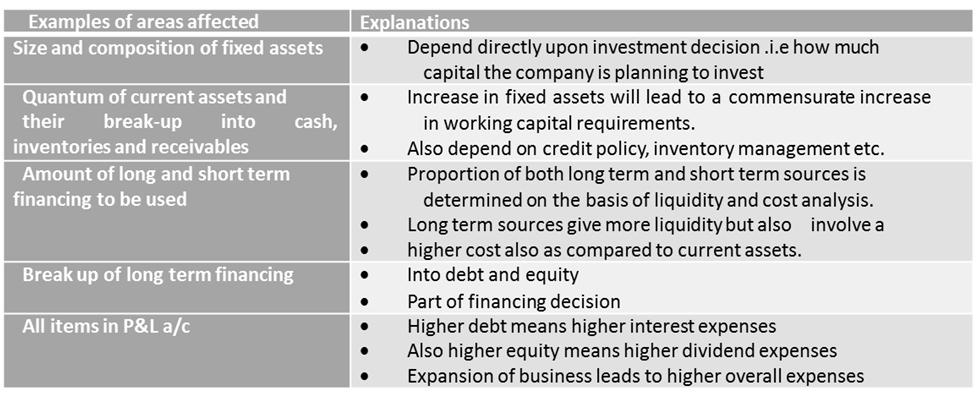

Financial Management has a direct bearing on the financial health of a company.

ABCD CLASSES

ABCD CLASSES