- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

Demonetization:

- The Government of India, made an announcement on November 8, 2016 with thoughtful implications for the Indian economy.

- The two largest denomination notes, Rs 500 Rs 1,000, were ‘demonetized’ with immediate effect, ceasing to be legal tender except for a few specified purposes such as paying utility bills.

- This led to eighty six per cent of the money in circulation invalid. The people of India had to deposit the invalid currency in the banks which came along with the restrictions placed on cash withdrawals.

Aim of demonetization

- To curb corruption,

- Counterfeit the use of high denomination notes for illegal activities; and especially the accumulation of ‘black money’ generated by income that has not been declared to the tax authorities.

Features

- Tax administration measure. Cash holdings arising from declared income was readily deposited in banks and exchanged for new notes. But those with black money had to declare their unaccounted wealth and pay taxes at a penalty rate.

- Check on tax evasion: - Demonetization is also interpreted as a shift on the part of the government indicating that tax evasion will no longer be tolerated or accepted.

- Channelizing savings into the formal financial system. Though, much of the cash that has been deposited in the banking system is bound to be withdrawn but some of the new deposits schemes offered by the banks will continue to provide a base loan, at lower interest rates.

- Create a less-cash or cash-lite economy:- channeling more savings through the formal financial system and improving tax compliance. Though there are arguments against this as digital transactions require use of cell phones for customers and Point-of-Sale (PoS) machines for merchants, which will only work if there is internet connectivity.

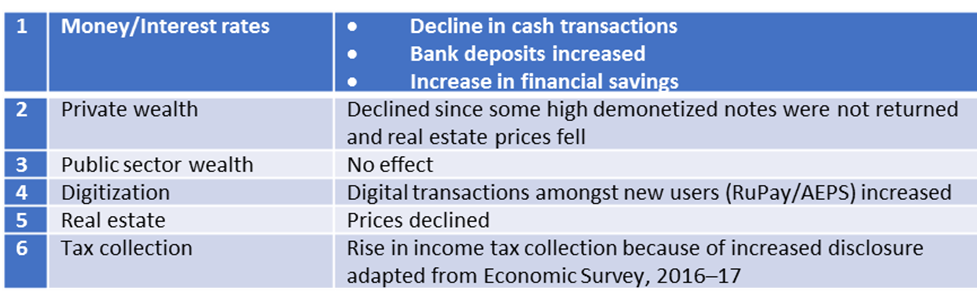

Impact of demonetization

ABCD CLASSES

ABCD CLASSES