Introduction

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CONCEPT & MEANING:

- Financial Markets: Concept, Functions, and types After going through this unit, the student/ learner would be able to:

- Understand the concept of the financial market.

- Understand the capital market and money market as types of financial markets.

- The money market and its instruments understand the concept of the money market.

- Describe the various money market instruments.

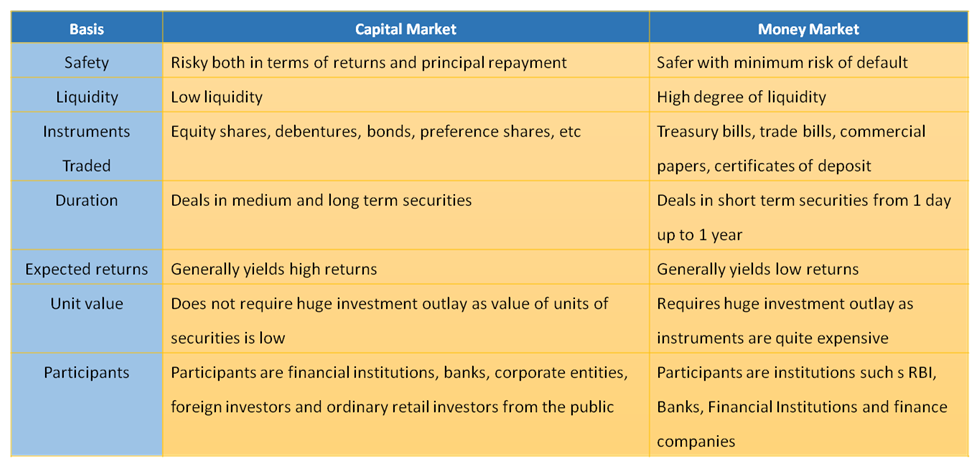

- Differentiate between capital market and money market

- Capital market and its types (primary and secondary) discuss the concept of the capital market.

- Explain primary and secondary markets as types of capital markets. Discuss the methods of floating new issues in the primary market.

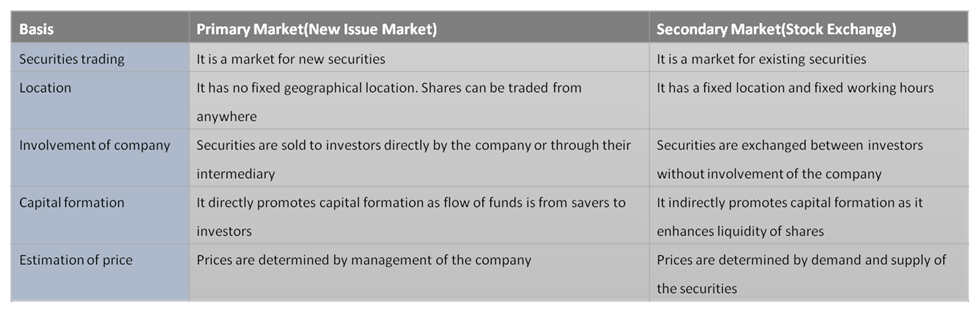

- Distinguish between primary and secondary markets.

- Stock Exchange- Functions and trading procedures give the meaning of a stock exchange.

- Explain the functions of a stock exchange.

- Discuss the trading procedure in a stock exchange.

- Securities and Exchange Board of India (SEBI) - objectives and functions

- Give the meaning of depository services and demat account as used in the trading procedure of securities.

- State the objectives of SEBI.

- Explain the functions of SEBI.

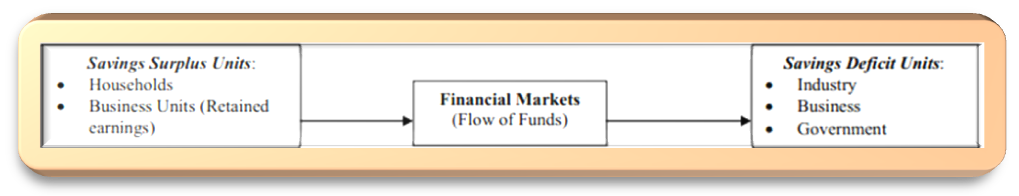

Financial Intermediation = process of allocating funds from saving surplus units (E.g. households) to saving deficit units (e.g. industries, government, etc). Alternatives = Banks or Financial markets.

Functions of financial market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

FINANCIAL MARKET

Bring together borrowers and lenders together, for the creation and exchange of financial assets

In to the most productive investment opportunity

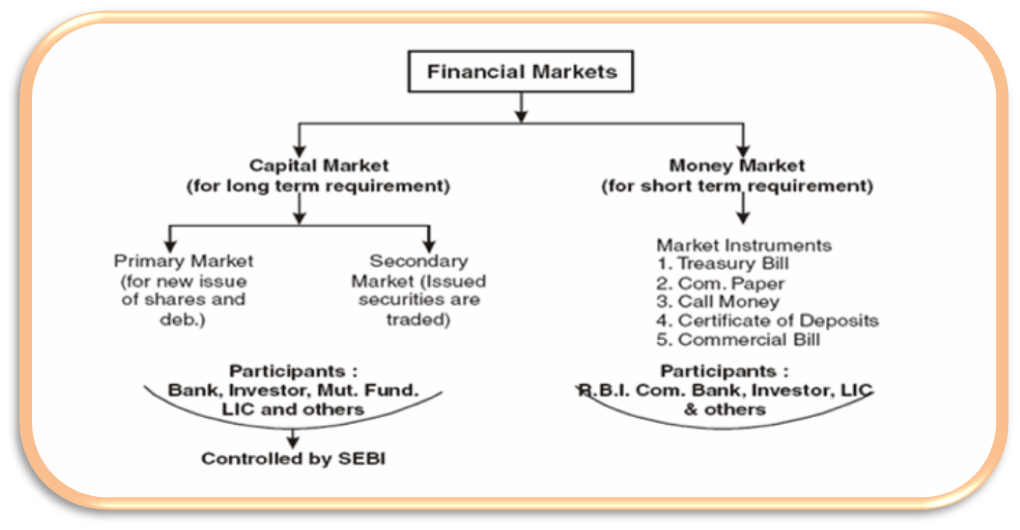

Classification of Financial Markets

- Capital markets

- Money markets

FUNCTIONS OF THE FINANCIAL MARKET

- Pricing of securities :

- The price of anything depends upon the demand and supply factors.

- Demand and supply of financial assets and securities in financial markets help in deciding the prices of various financial securities; where business firms represent the demand and the households represent the supply.

- Reduce the Cost of Transactions:

- By providing valuable information to buyers and sellers of financial assets, it helps to save time, effort, and money that would have been spent by them to find each other.

- Also, investors can buy/sell securities through brokers who charge a nominal commission for their services.

- This way financial market facilitates transactions at a very low cost.

- Add Liquidity to Financial Assets:

- Financial markets provide liquidity to financial instruments by providing a ready market for the sale and purchase of financial assets.

- Whenever the investors want, they can invest their savings into long term investments and

- Whenever they want, they can sell the investments/ instruments and convert them into cash.

- Mobilization of Savings into the most Productive Uses:

- Facilitates transfer of savings from the savers to the investors.

- Financial markets help people to invest their savings in various financial instruments and earn income and capital appreciation.

Types of Financial Markets

Money Market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

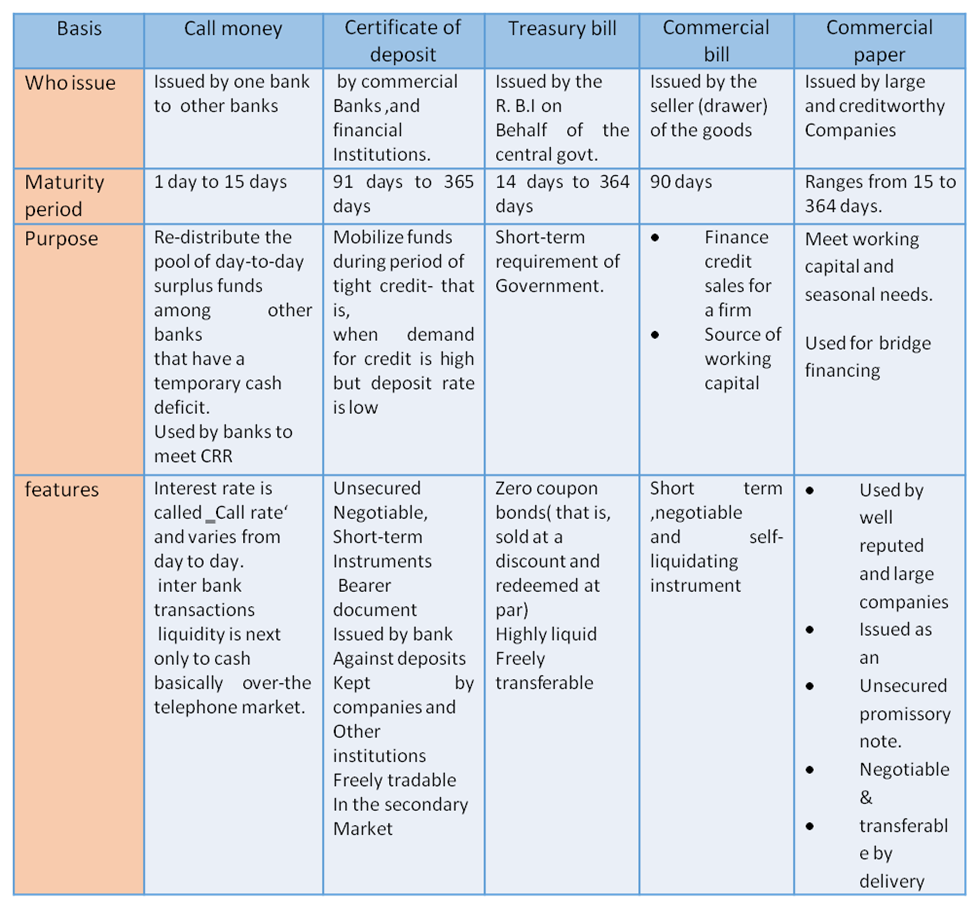

MONEY MARKET

- Provides funds for meeting short term requirements of cash ( one year or less)

- Enables the raising of short-term funds for meeting the temporary shortages of cash.

- Involves Institutions include the reserve bank, the state bank of India, LIC, GIC, UTI

Money Market Instruments:

Capital market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

CAPITAL MARKET:

- Market for medium and long term funds to obtain finances for long term investments, such as buying plant, machinery, buildings, etc

- Includes Equity shares or ownership securities; Debentures, preference shares.

- Components of the capital market are

- The Primary or new issue market

- The secondary market or the Stock Exchange

Primary market

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

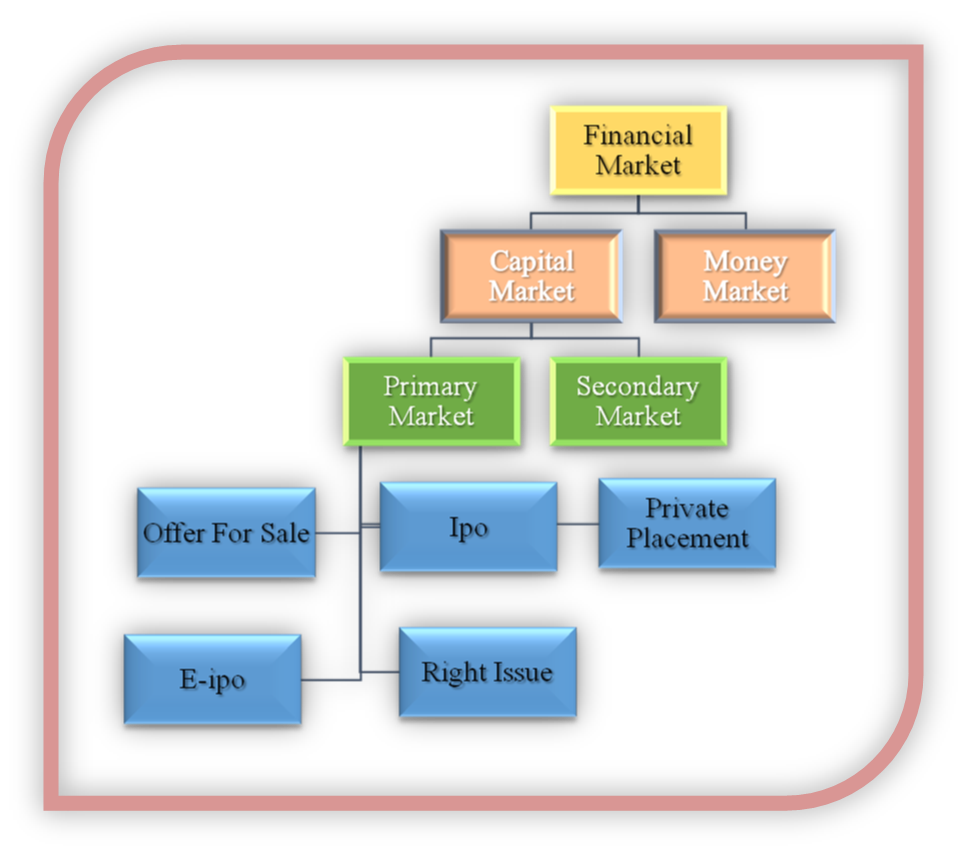

PRIMARY MARKET

- It deals with the issue of new or fresh capital also referred to as the New Issue Market (NIM).

- Securities are issued by the company directly to investors.

Methods of Floatation

1. Offer through Prospectus:

- Most popular method of raising funds is by public companies.

- Company issues a prospectus to inform and attract the investing public.

- Prospectus contains the financial performance of the company to let the public know about the risk factor in the likely investment.

2. Offer for Sale:

- First step: - The company sells securities at an agreed price to brokers.

- Second step: - Resell to the investing public at a higher price.

- Benefit: - Avoid the difficult procedure and minimize the floating cost.

3. Private Placement:

- A private placement is the allotment of securities by a company to institutional investors and some selected individuals.

- Benefit:-Cost-effective method for small companies to avoid expenses like underwriter commission and printing of prospectus etc.

4. Rights Issue:

- To maintain the control of the existing shareholder are offered the ‘right ‘to buy new shares in proportion to the number of shares they already possess.

- Shareholders may accept this offer or reject it.

5. e-IPOs:

- A company proposing to issue capital to the public through the online system of the stock exchange has to enter into an agreement with the stock exchange.

- SEBI registered brokers have to be appointed for the purpose of accepting applications and placing orders with the company.

- The issuer Company should also appoint a registrar to the issue having electronic connectivity with the exchange.

Secondary market and Stock Exchange

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

SECONDARY MARKET & STOCK EXCHANGE:

The market for the purchase and sale of existing securities within the regulatory framework prescribed by SEBI

Functions of a Stock Exchange

- Contributes to Economic Growth Instead of investing money in an unproductive sector like jewelry stock exchange provide avenues for investment in the securities market and help in capital formation and economic growth.

- Liquidity and Marketability to Existing Securities: By converting the securities into the cash stock exchange provide a ready market for the investors. This provides both liquidity and easy marketability to already existing securities in the market

- Allow Pricing of Securities: Share prices on a stock exchange are determined by the forces of demand and supply. Such a valuation provides important instant information to both buyers and sellers in the market.

- Scope for Speculation: Provides scope within the provisions of law for speculative activity in a restricted and controlled manner to ensure liquidity and price continuity in the stock market.

- Spreading of Equity Cult: Plays an essential role in ensuring wider share ownership by regulating new issues, better trading practices, and taking effective steps in educating the public about investments.

- Ensures better allocation of capital: - Reliable companies whose shares have high value can raise the additional fund in the capital market by gaining the faith of the investors

- Safety of Transaction: The membership of a stock exchange is well regulated and its dealings are well defined according to the existing legal framework. Investing public gets a safe and fair deal on the market.

DIFFERENCE:

Depository System

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

DEPOSITORY SYSTEM

Important terms related to the stock exchange

- Dematerialization: stocks are kept in electronic form instead of physical form (i.e. share certificates). It helps in overcoming the problem of theft, forgery, delays, misplaced certificates, and unnecessary paperwork.

Benefits of Demat Account

- Reduces paperwork.

- Elimination of problems with the transfer of shares such as loss, theft and delay.

- Exemption of stamp duty when the transfer of shares.

- The concept of odd-lot stands abolished.

- Increase liquidity through speedy settlement.

- Attract foreign investors and promote foreign investment.

Working on the Demat System

- A depository participant (DP), either a bank, broker or financial services company, may be identified.

- An account opening form and documentation (PAN card details, photograph, and power of attorney) may be completed.

- The physical certificate is to be given to the DP along with a dematerialization request form.

- If shares are applied in a public offer, simple details of the DP and Demat accounts are to be given and the shares on allotment would automatically be credited to the DEMAT account.

- If shares are to be sold through a broker, the DP is to be instructed to debit the account with the number of shares.

- The broker then gives instructions to his DP for the delivery of the shares to the stock exchange.

- The brokers then receive payment and pay the person for the shares sold.

- All these transactions are to be completed within 2 days, i.e., delivery of shares and payment received from the buyer is on T+2 bases, settlement period.

Advantages of Electronic trading systems or screen-based trading has certain

- Ensures Transparency

- It allows participants to see the prices of all securities in the market while business is being transacted.

- They are able to see the full market in real-time.

- Increases Efficiency

- It increases the efficiency of operations since there is a reduction in time, cost, and risk of error.

- Improving the liquidity of the market

- People from all over the country and even abroad who wish to participate in the stock market can brokers or members without knowing each other.

- This system has enabled a large number of participants to trade with each other, thereby improving the liquidity of the market.

- Single trading platform:-

- A single trading platform has been provided as a business is transacted at the same time in all the trading centers.

Now, screen-based trading or online trading is the only way in which you can buy or sell shares.

Important terms

- Demutualization: Process that separates the trading rights of members or brokers in a stock exchange from its ownership and control.

- Depository: - Organisation that holds securities (like shares, debentures, bonds, government securities, mutual fund units, etc.) of investors in electronic forms through a registered Depository Participant. Two Depositories viz. National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) are registered with SEBI

- Depository Participant: -agent of the depository through which it interfaces with the investor and provides depository services. Commercial banks, foreign banks operating in India with the approval of the Reserve Bank of India.

TRADING PROCEDURE

The procedure for the purchase and sale of securities in a stock exchange involves the following steps:

- Selection of a Broker:

- The first step is to select a broker who will buy/sell securities on behalf of the speculator/ investor.

- The investor has to sign a broker-client agreement and a client registration form before placing an order to buy or sell securities.

- He has also to provide certain other details and information such as PAN number (mandatory), Bank account details, Depository account details, etc.

- The broker then opens a trading account in the name of the investor

- Opening Demat Account With Depository:

- The investor has to open a Demat account or beneficial owner‘(BO) account with a depository participant (DP) for holding and transferring securities in the Demat form.

- He will also have to open a bank account for cash transactions in the securities market.

- Placing the order:

- The order can be communicated to the broker and should specify the securities to be bought or sold and the price range within which the order is to be executed.

- The broker will then go ahead with the deal at the above-mentioned price or the best price available.

- An order confirmation slip is issued to the investor by the broker. Only the securities of listed companies can be traded on the stock exchange.

- Execution of order:-

- The broker goes online and connects to the main stock exchange and matches the share and best price available.

- Issuing a trade confirmation slip

- When the shares can be bought or sold at the price mentioned, it will be communicated to the broker‘s terminal and the order will be executed electronically.

- The broker will issue a trade confirmation slip to the investor.

- Contract Note

- After the trade has been executed, within 24 hours the broker issues a Contract Note.

- A Unique Order Code number is assigned to each transaction and is printed on the contract note.

- Settlement:

- This is the last stage in the trading of securities done by the brokers on behalf of their clients.

- The investor has to deliver the shares/or pay cash for the shares bought.

Cash in cash-out day

- Cash in day: - Cash is paid or securities are delivered on the pay-in day, which is before the T+2 day as the deal has to be settled and finalized on the T+2 day. The settlement cycle is on T+2 days on a rolling settlement basis.

- Cash-out day: -On the T+2 day, the exchange will deliver the share or make payment to the other broker. This is called the pay-out day. The broker then has to make payment to the investor within 24 hours of the payout day since he has already received payment from the exchange.

Contract note:-

- This note contains details of the number of shares bought or sold, the price, the date and time of the deal, and the brokerage charges.

- This is an important document as it is legally enforceable and helps to settle disputes/claims between the investor and the broker.

SEBI

- Books Name

- BUSINESS STUDIES-XII

- Publication

- ABCD CLASSES

- Course

- CBSE Class 12

- Subject

- Business Studies

SEBI

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India was established by the Government of India on 12 April 1988as an interim administrative body to Protect the interests of investors To promote the development of the securities market And regulate the securities market

Purpose and Role of SEBI

• To the issuers: To provide a market to raise the finances in an EasyFair Efficient manner.

• To the investors: Provide protection of their rights and interests through Adequate Accurate and Authentic information on a continuous basis.

• To the intermediaries: Offer a competitive professionalized with adequate and efficient infrastructure. So that they are able to deliver better service to the investors and issuers.

Objectives of SEBI

- Regulate stock exchanges and the securities industry to promote their orderly functioning.

- Protect the rights and interests of investors and guide and educate them.

- Prevent trading malpractices and achieve a balance between self-regulation by the securities industry and its statutory regulation.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers.

Functions of SEBI

Protective functions

- Controlling insider trading: It prevents insiders such as directors, and promoters who have access to price-sensitive information regarding securities of the company (which is not available to the public) to make individual profits through the trading of securities.

- Undertaking steps for investment or protection.

- Promotes fair practices and code of conduct in the securities market.

- Stops fraudulent and unfair trade practices in the security market: - like making misleading statements and price rigging. (Manipulating with the sole intention of inflating or deflating the market price of securities is termed as “price rigging)

Developmental functions

- Conducting research & publish information useful to all market participants.

- Undertakes measures to develop the capital markets by adopting a flexible and adaptable approach.

- Training of intermediaries of the securities market.

Regulatory functions

- Conducts inquiries and audits of the stock exchanges.

- Register and regulates the working of stockbrokers, sub-brokers, and share transfer agents.

- Registers and regulates the working of mutual funds etc.

- Regulation of stockbroker, portfolio exchanges, underwriters & merchant bankers

- Regulation of tasks over bids by companies.

- Levying fee or other charges as per the act.

- Performing and exercising such power under Securities Contracts (Regulation) Act 1956, as may be delegated by the Government of India.

ABCD CLASSES

ABCD CLASSES