financial statements of non-profit making organizations

Like trading organizations, non-profit making organizations also prepare their financial statements at the end of each accounting period. Their financial statements comprise the following:

1. Receipts and Payments Account (Cash Book)

2. Income and Expenditure Account (Profit & Loss A/c)

3. Balance Sheet.

1. Receipts and Payments ACCOUNT:

The following points are noteworthy relating to Receipts and Payments A/C:

a. Receipts and Payments Account is a summary of cash transactions.

b. It shows the opening and closing balance of cash and bank, receipts and payments (both cash and cheque) and the closing cash and bank balance at the end of the accounting period.

c. The left-hand side records all receipts and the right-hand side all payments (whether revenue or capital or relating to current years past or future accounting years).

d. It shows a classified summary of cash transactions during a given period.

For example, fees may be received from the members of a club on different dates and appear on different pages of the Cash Book as it is a chronological record. But the total fees received during the accounting period is shown in the Receipts and Payments Account.

Keypoints OF RECEIPTS and Payments Account

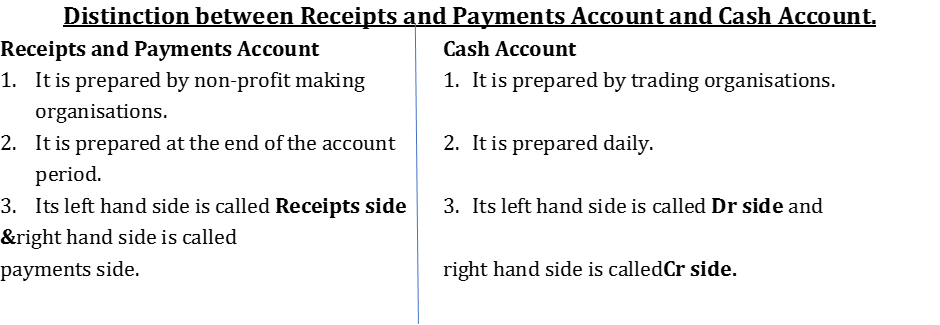

1. It is similar to a Cash Book of a trading concern.

2. It is a real account. Receipts are recorded on the receipt side and payments are recorded on the payment side.

3. It starts with the opening cash and bank balance and closes with the closing cash and bank balance.

4. Both cash and bank transactions are merged in the same column.

5. All types of receipts are recorded on its receipts side irrespective of the nature of receipts (i.e. both capital and revenue receipts and receipts relating to past, present and future years).

6. All types of payments are recorded on the credit side irrespective of the nature of payments (i.e. both capital and revenue payments and payments relating to past, present and future years).

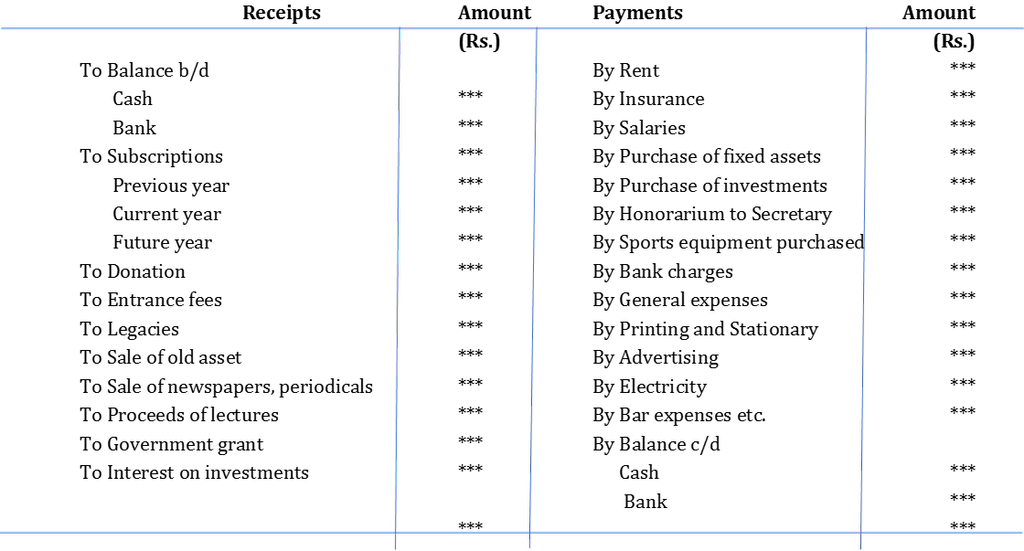

Format of Receipts and Payments Account:

Name of the Non-Profit Making Organisation:-

Receipts and Payments Account for the year ended **********

Income and Expenditure Account

Important Facts about Income & Expenditure A/C:

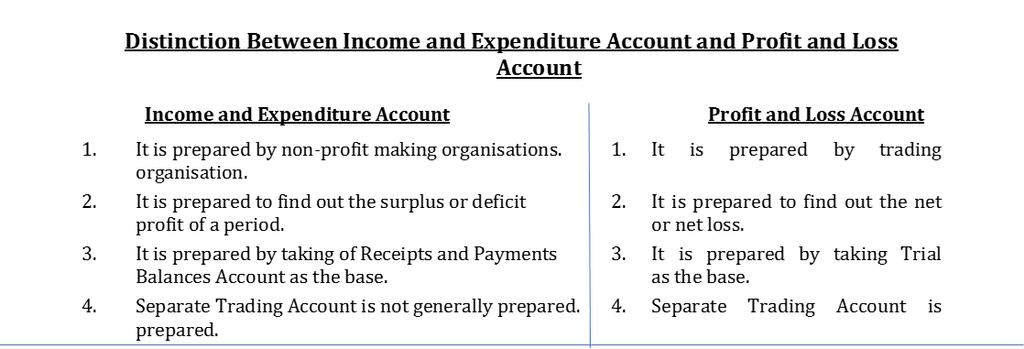

- Income and Expenditure Account is similar to Profit and Loss Account of a trading concern

- Since non-profit making organizations do not operate on profit objectives, income and Expenditure Account is prepared instead of preparing Profit and Loss Account.

- On the debit side, it shows all revenue expenses relating to the current year whether paid or not.

- On the credit side, it shows all revenue incomes and gains relating to the current year whether received or not.

- It is a nominal account and its preparation procedure is the same as that of a Profit and Loss Account of a trading concern.

- The balancing figure of this account is called surplus/excess of income over expenditure or deficit/excess of expenditure over income.

Key points of Income and Expenditure Account

1. It is similar to the Profit and Loss Account of a trading concern.

2. It is a nominal account. Expenses and losses are recorded on the debit side and incomes and gains are recorded on the credit side. The expenses are matched with revenues of the concerned period.

3. All revenue incomes relating to the current year whether received or due are recorded on the credit side.

4. All revenue expenses relating to the current year whether paid or outstanding are recorded on the debit side.

5. Capital expenditures and capital receipts are not recorded in this account.

6. It records both cash and non-cash items such as depreciation.

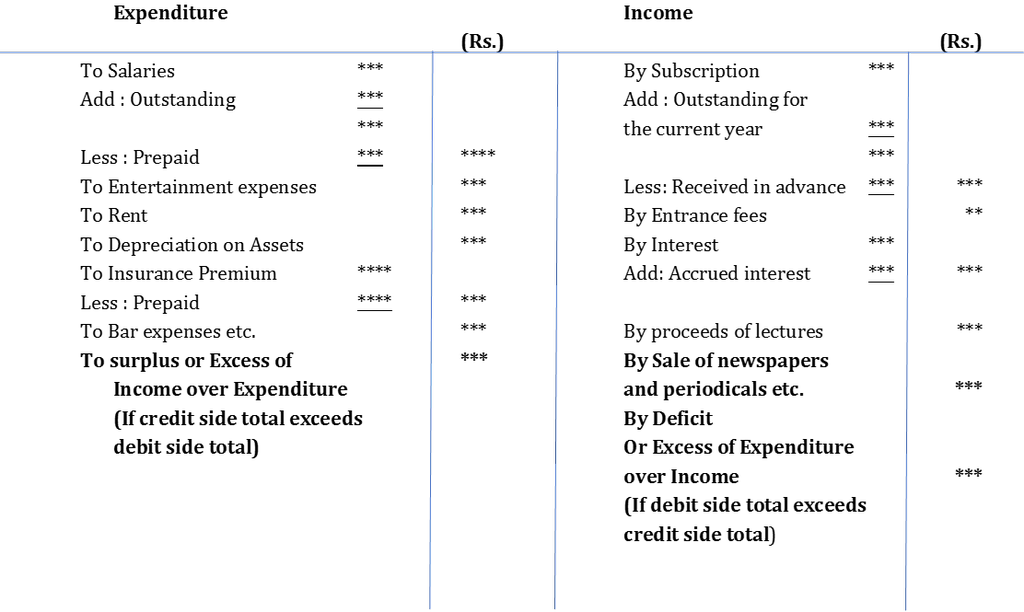

Format of Income and Expenditure Account

(Name of the Non-Profit Making Organisation)

Income and Expenditure Account

For the year ended on *********

3. Balance Sheet

The balance sheet of a non-profit making organization is prepared on the same line as that of a trading concern. Assets including accrued income and prepaid expenses are shown on the assets side and the liabilities side shows all liabilities including outstanding expenses. Capital Fund (same as Capital Account in case of trading concerns) appears on the liabilities side. The surplus during the period is added to the Capital Fund and the deficit is subtracted.

Note: When no information regarding Capital Fund is available, it can be ascertained by preparing the Balance Sheet at the beginning of the year i.e. Opening Balance Sheet.

Vision classes

Vision classes