1. Concept & process

ACCOUNTING FOR SHARE CAPITAL – CONCEPT & PROCESS

One of the alternatives before him is to raise money by issuing shares to the general public.

All the steps have been discussed as under:

1. Issue of prospectus: A prospectus is a document that may be a notice, circular or advertisement issued for inviting deposits from the public for the subscription of any shares or debentures of a company. It is properly dated and signed by every director of the company, a copy of which is also filed with the Registrar of Companies. Each prospectus contains a printed application form and also specifies the amount per share payable on application, on the allotment and on calls. It also specifies the amount of minimum subscriptions.

The issue of shares starts with the issue of a prospectus and ends with the receipt of calls from the shareholders. The detailed procedure for the issue of shares consists of the following five steps:

The minimum subscription is the minimum amount which, in the opinion of directors, must be raised in cash by the issue of shares to provide for:

(i) The purchase of any property

(ii) Any preliminary or formation expenses/commission.

(iii) The repayment of any borrowings

(iv) Working Capital

2. Receipt of Application Money: After the publication of the prospectus, all investors who want to be the shareholders of a company have to fill in the prescribed application form and send it to the banker of the company with an Account Payee cheque for the amount payable on application. The application money per share cannot be less than 5% of the nominal / face value of a share. All money received on the application are kept deposited in a scheduled bank until the certificate of commencement (required for a public company) is received or until the receipt of the minimum subscription stated in the prospectus. If the minimum subscription is not received within 120 days of the issue of the prospectus, all the application money received must be refunded without interest to the applicants within the next 10 days.

3. Allotment of Shares: After the last date of application, the company’s banker forward all the applications to the company. Then the Board of Directors starts the process of allotment.

- Allotment is the act of accepting those applications which are genuine and fulfill the conditions laid down in the prospectus.

- A letter of allotment is sent to all those applicants whose applications are accepted by the Board of Directors.

- An applicant who receives the letter of allotment becomes a member/ shareholder of the company from the date of posting of the letter.

- On the other hand, a letter of regret is sent to those applicants whose applications are rejected. The application money received from such applicants are also refunded.

- Here it is to be noted that, no shares can be allotted unless the minimum subscription stated in the prospectus has been received in full.

- Besides a company cannot allot more shares than those stated in the prospectus.

- On allotment, a shareholder is also required to pay the allotment money due on allotted shares.

4. Issue of Share Certificate: A share certificate is issued to each person whose name appears in the Register of Members. It is issued under the seal of the company and specifies the name, address and occupation of the holder along with the number of shares held and the amount paid-up thereon. It is prima facie evidence that its holder is a shareholder of the company.

Note: The company must issue a share certificate within three months of the allotment of shares.

5. Calls on Shares: After the payment of application and allotment money the balance amount due from the shareholder may be demanded by the company in the form of calls. A call is simply an installment of payment. Generally, the prospectus specifies the number, dates and amount of calls to be made by a company. In case the prospectus is silent, the directors have the discretion to decide the number and date of calls and the amount payable in each call.

Note (1): Usually calls are numbered as a first call, second call, third call etc. The last call is named as final call. For example, if the second call is the last call, then it is termed as “Second and Final call”.

Note (2): A call is a demand by a company on its shareholders to pay the whole or part of the balance remaining unpaid on each share. It may be made at any time during the lifetime of the company or during its winding-up.

2. Journal Entries

JOURNAL ENTRIES - ISSUE OF SHARES

A company may issue shares for different purposes such as the purchase of properties, meeting preliminary expenses, repayment of a loan, and fulfilling its working capital requirement. The purposes of the issue are mostly divided into two parts:

1. For cash

2. For consideration other than cash (i.e. purchase of properties etc.)

If the company is in immediate need of the entire proceeds (i.e. no. of shares issued * market price per share) of the issue, it may ask the investors to pay the full amount (i.e. market price) in one installment i.e. on application.

Where the entire proceeds are not required immediately, the company usually requests the investors to pay in 3 or 4 installments i.e. on application, on the allotment and on calls. Further calls may be divided into two or three parts e.g. first call, second call and third call etc. The last call is called the final call.

Thus, the issue of shares has been discussed in four parts as follows :

A. Issue of shares for cash at par

B. Issue of shares for cash at a premium

C. Issue shares for cash at a discount

D. Issue of shares for consideration other than cash by Rs.2. Thus the shares are issued at a premium of Rs.2 per share.

ACCOUNTING PROCEDURE:

The entire accounting procedure relating to the issue of shares usually consists of the following :

1. Journalising the transactions.

2. Preparation of ledger accounts.

3. Preparations of the cash books (Bank Column only).

4. Presentation of Balance Sheet.

STAGES IN SHARE ACCOUNTING:

The entire accounting procedures are to be maintained at five-stage of share accounting. These five stages are (a) Application (b) Allotment, (c) Calls, (d) Forfeiture, (e) Re-issue.

Note: If the company receives in full all its dues on application, allotment and calls, the questions of the last two stages i.e. forfeiture and re-issue do not arise. Thus, there will be three stages only.

SHARES MAY BE ISSUED AT PAR OR PREMIUM. LET US HAVE A LOOK AT BOTH THE CASES

(A) ISSUE OF SHARE FOR CASH AT PAR :

1. Journal: When shares are issued for cash at par value i.e. at nominal/ face value of a share, the following entries are passed at each stage of accounting.

(a) On Application:

Bank A/c Dr.

To Share Application A/c.

(Being application money received for…..shares @ Rs……each)

Note: The application money received will remain in the Share Application Account till the allotment of shares by the Board of Directors.

TREATMENT OF APPLICATION MONEY :

On allotment, it is the discretion of the directors to allot in full or in part the number of shares applied. Even some applications may be rejected by sending them a letter of regret.

there are four possibilities:

(i) Transfer of application money on allotted shares to share capital account. The entry is:

Share Application A/c. Dr.

To share capital A/c.

(Being application money on………….shares @ Rs….each transferred to share capital account as per Director’s resolution No……dated………)

(ii) Adjustment of excess application money against money due on allotment if Directors allot less number of shares than applied for. The entry is :

Share Application A/c. Dr.

To Share Allotment A/c.

(Being the excess application money adjusted against allotment)

For example, Mr. X had applied for 200 shares in a company but only 100 shares were allotted to him. If he is required to pay Rs.2 on the application, Rs.5 on the allotment and Rs.3 on calls, then out of Rs.400 ( i.e. Rs.2 * 200) application money Rs.200 (i.e. 100 * Rs.2)will be transferred to share capital account, and Rs.200 (i.e. excess application money) will be adjusted against his dues on allotment of Rs.500 (i.e. Rs.100 * 5)

(iii) Transfer of surplus application money after adjustment against allotment to calls-in-advance account. The entry is:

Share Application A/c. Dr.

To Calls-in-advance A/c.

(Being the surplus after adjustment against dues on allotment transferred to the calls-in-advance account.)

For example, Mr. Y had applied for 300 shares in X Ltd to whom only 100 shares were allotted. If he is required to pay Rs.3 on the application, Rs.4 on the allotment and Rs.3 on calls then out of Rs.900 (Rs.3 * 300) application money, Rs.300 (i.e. 100 * 3) will be transferred to share capital account, Rs.400 (i.e. 100 * 4) will be adjusted in share allotment account and Rs.200, the surplus money, will be transferred to the calls-in-advance account.

Note: If there is no provision in the prospectus for the transfer of surplus money to the calls-in advance account, then it should be refunded.

(iv)Refund of application money on rejected applications. The entry will be:

Share Application A/c. Dr.

To Bank A/c.

(Being application money on…………….shares @ Rs……………..each refunded as per Director’s Resolution No……….dated…………)

Alternatively: We can pass one compound journal entry against the four simple entries discussed above. The entry will be:

Share Application A/c. Dr.

To share capital A/c. (application money on allotted shares)

To share allotment A/c. (adjusted in allotment)

To calls-in-advance (adjusted in call)

To Bank A/c. (refunded)

( Being the transfer of application money to share capital, share allotment and calls in advance account and the refund of the balance on the allotment of shares as per Director’s Resolution No………..dated……….)

TREATMENT OF ALLOTMENT MONEY :

When shares are allotted, the applications to whom shares are allotted are sent the Letter of Allotment with a request to pay the allotment money due.

Some shareholders may pay the allotment money whereas some others may fail to pay it in time.

There are three possibilities.

(i) Amount due on the allotment: The amount due on the allotment is equal to the product of the number of shares allotted and the allotment money per share. The entry will be :

Share Allotment A/c. Dr

To Share Capital A/c.

(Being the allotment money due on..... shares @ Rs.....each as per Director’s Resolution No.... dated......)

(ii) Amount received on the allotment: On receipt of the allotment money the following entry is passed :

Bank A/c. Dr

To Share Allotment A/c.

(Being allotment money received on....shares @ Rs.....each)

(iii) Amount not received on the allotment: This amount will be equal to the total amount due on an allotment less the amount adjusted against the allotment. It will be transferred to the calls-in-arrear account by passing the following entry.

Calls-in-Arrear A/c. Dr.

To share allotment A/c

(Being the allotment money not received transferred to calls-in-arrear account)

Treatment of Call money :

After allotment of shares, the balance due from shareholders is demanded by the company by making calls. A company may demand the remaining amount due in one call or in two or more calls.

On each call, entries are made in respect of the following four aspects :

(i) Amount due on the call.

(ii) Amount received on the call.

(iii) Adjustment of calls in advance.

(iv) Amount not received on the call.

(i) Amount due/receivable on the call: This amount is equal to the product of no. of shares allotted and the call money per share. The entry will be.

Share Call A/c. Dr

To share capital A/c

(Being call money due on.....shares @ Rs.......per share as per Director’s Resolution No......dated.........)

(ii) Amount received on the call: Whatever amount is received, the bank account is debited and the share call account is credited. The entry will be :

Bank A/c Dr.

To Share Call A/c

(Being call money on......shares @Rs........each received)

(iii) On adjustment of call-in-advance: The amount received in advance on the application or on an allotment in respect of the particular call is now transferred from the calls-in-advance account to the share call account. The entry will be :

Calls-in-advance. Dr.

To Share Call A/c

(Being the amount received in advance transferred to share call account)

(iv) Amount not received on the call: This amount can be calculated as follows :

Amount not received on the call = Amount due on the call minus Amount received on the call minus calls – in–advance.

The entry will be :

Calls-in-Arrear A/c. Dr.

To Share Call A/c

(Being call money due on.....shares @Rs......each transferred to the calls-in-arrear account, for non-payment)

UNDER SUBSCRIPTION AND OVER SUBSCRIPTION:

Where the number of applications received from the public is less than the number of shares to be issued, it is called under subscription. In this case, the company will allow only that number of shares applied by the public.

For example: If 1000 shares are to be issued but the public applied for only 900 shares, not 1000 shares, then the company can allot only 900 shares, not 1000 shares.

On the other hand, the issue is said to be oversubscribed if the number of applications received is more than the number of shares to be issued. In this case, the company will allow the number of shares which are to be issued.

For example: If 1,200 applications are received against 1000 shares to be issued, then only 1000 shares will be allotted.

OVERSUBSCRIPTION AND METHODS OF ALLOTMENT :

When a particular issue is oversubscribed, the Board of Directors of the Company may decide to allot the shares in different ways according to their discretion.

Mostly, there are three methods of allotment in case of oversubscription: These are :

(a) Simple Allotment: Where the issue is not oversubscribed to a large extent, the Board may allow the required number of shares by rejecting the applications to the extent it is oversubscribed, It is called a simple allotment.

For example, A company is to issue 10,000 shares for which 10,500 applications were received. In this case, the company may allot 10,000 shares by rejecting applications for 500 shares. In this case, the question of excess application money and calls-in-advance does not arise.

(b) Categorized Allotment: Where the issue is oversubscribed to a large extent and the minimum number of shares to be applied has been fixed in the prospectus, the Directors may decide to satisfy an unequally a maximum number of applicants. Here, they divide the total applications into two / three categories.

For example, the categories may be :

(a) Applicants for more than 5000 shares.

(b) Applicants for more than 2000 but less than 5000 shares

(c) Applicants for more than 1000 but less than2000 shares

(d) Applicants for less than 1000 shares.

Each category is satisfied by allotting some shares except the applicants for less number of shares. Usually, more shares are allotted to the applicants applying for a maximum number of shares.

Example : X Ltd. issued 1,00,000 shares of Rs.10 each. The public applied for 1, 60,000 shares. The allotment was made as follows :

(a) Applicants for 50,000 shares (in respect of applications for 2000 shares or more) were allotted 50,000 shares.

(b) Applicants for 70,000 shares (in respect of applications for 1000 shares or more) were allotted 30,000 shares.

(c) Applicants for 35,000 shares (in respect of applications for less than 1000 shares) were allotted 20,000 shares.

(d) 5,000 applications were rejected.

The above allotment can be put under the following four categories.

Category No. of Applications No. of shares allotted

1 50,000 50,000

2 70,000 30,000

3 35,000 20,000

4 5,000 NIL

TOTAL 1,60,000 1,00,000

In this type of allotment, it is necessary to calculate excess application money under each category allotted and the amount to be adjusted on allotment and calls. Suppose the above issue is payable as Rs.5 on applications, Rs.3 on the allotment and Rs.2 on the final call, then the excess application money under each category and its adjustment on allotment and calls will be calculated.

(c) Pro-rata Allotment: When the shares are oversubscribed to a very large extent, the company is unable to satisfy all the applicants. In such a situation the company has the following alternatives.

(i) It may allot proportionately to all the applicants.

(ii) Reject some applications and allot proportionately to the rest of the applicants.

Such an allotment is called “pro-rata allotment”. It means allotment in proportion to the shares applied for.

For example: If the applicants for 60,000 shares are allotted 20,000 shares (i.e. in the ratio of 3: 1), then an application for 3 shares will get one share.

The proportion in which the shares are allotted is very much essential to determine excess application money and the amount not paid in case of a defaulting shareholder.

For example, the Issue price of a share is Rs.10 payable as Rs.5 on the application; Rs.3 on the allotment and Rs.2 on calls, Mr. X, a shareholder who had been allotted 300 shares in the ratio of 5 : 3, could not pay his dues on final call. This case will be analyzed as follows :

(i) No. of shares applied = 300 shares × 5/3 = 500

(ii) Application Money paid = 500 shares × Rs.5 = Rs.2,500

(iii) Application money required = 300 shares × Rs.5 = Rs.1,500

(iv) Excess Application money received = Rs.2,500 – Rs.1500 = Rs.1,000

(v) Amount due on allotment = 300 shares × Rs.3 = Rs. 900

(vi) Amount adjusted on allotment = Rs.900

(vii) Calls-in-advance = (Rs.1000 – Rs.900) Rs.100

(viii) Amount due on call = 300 shares × Rs.2 = Rs.600

(ix) Amount unpaid on final call = (Rs.600–Rs.100) Rs.500

(B) ISSUE OF SHARES FOR CASH AT A PREMIUM :

When shares are issued at a price higher than their nominal or face value, it is said to be issued at a premium.

The aggregate amount received as premium shall be transferred to an account called “Share Premium Account”. It is in the nature of a “Capital Reserve”. It cannot be distributed as a dividend in cash.

Application/Utilisation of Share Premium ACCOUNT:

The share premium account can be utilized/ applied in the manner prescribed in Section 78 as follows :

(a) For the issue of fully paid bonus shares

(b) For writing off the preliminary / formation expenses of the company.

(c) for writing off the (i) expenses or (ii) commission paid or (iii) discount allowed on any issue of shares or debentures of the company.

(d) For providing for the premium payable on the redemption of (i) redeemable preference shares or (ii) debentures of the company.

The accounting procedure for recording the premium on the issue of shares depends on the stage of its collection. Premium may be collected with application money or with allotment money.

Note: When nothing is mentioned, it is presumed to have been collected along with the allotment money.

I. When it is collected along with application money.

(a) Bank A/c. Dr.

To share application A/c (Total amount received on the application including premium)

(Being application money received on.....shares @ Rs........each including premium of Rs.....)

(b) When the premium is transferred to share capital account along with application money.

Share application A/c. Dr.

To share Capital

To share Premium A/c.

(Being application money on.....shares @Rs....... each transferred to share capital account and share premium account as per Director’s Resolution No.....dated......)

II. When the premium is received along with allotment money: Here, the premium is included with the amount due on allotment. The following entry will be passed.

Share Allotment A/c. Dr.

To share capital A/c.

To share premium A/c.

(Being allotment money due on.....shares @Rs......each including premium Rs...... each as per Director’s Resolution No......date......)

CALLS-IN-ARREAR:

The amount which remains unpaid on the allotment and /or calls are called calls-in-arrear. When the shareholders fail to pay their dues on the allotment and /or calls, then the allotment account and calls account show a debit balance which is transferred to the calls-in-arrear account by means of the following entry:

Calls-in-Arrear A/c. Dr.

To share allotment A/c.

To share call A/c.

(Being the amount unpaid on the allotment and call transferred to calls-in-arrear account)

If money is collected from such defaulting shareholders, then it is credited to calls-in-arrear accounts as follows:

Bank A/c. Dr.

To calls-in-Arrear A/c

(Being the amount collected from defaulting shareholders)

Note: Call-in-Arrear is the amount called up by the company at the allotment or call but not paid by the Shareholder.

Whatever balance remains in the “Calls-in-Arrear Account” at the end of the year, is shown as a deduction from the share capital account on the liabilities side of the Balance sheet. The company can charge interest on the calls-in-arrear if there is a provision in the Articles of Association. However, the rate of interest cannot exceed 5% per annum. The interest on calls-in-arrear is credited to the profit and loss account as an income.

When shares are issued at a discount, the entry for discount is generally made along with the amount due on allotment. The entry will be revised as follows :

Share Allotment A/c. Dr.

Discount on Issue of Shares A/c/ Dr.

To share Capital A/c.

(Being allotment due on.......shares @Rs......each as per

Director’s Resolution No......dated.........)

Note. A separate account entitled “Discount on issue of Shares Account” is opened in the ledger the balance of which is shown under the head Miscellaneous Expenditure on the asset side of the Balance sheet.

The following entries are made in case of calls in advance.

(a) For transferring excess application money

Share Application A/c. Dr

To Calls-in-Advance A/c.

(Being excess application money transferred to calls-in-advance account)

(b) For Calls-in-advance received along with allotment money.

Bank A/c. Dr.

To call-in-Advance A/c.

(Being call money for.....shares@ Rs.....each received in advance)

(c) For adjusting calls in advance with the calls (s)

Call-in-advance A/c. Dr.

To Call A/c.

(Being calls received in advance adjusted with call)

If it is necessary to provide interest on calls in advance, the entries will be made as follows :

(a) For interest due.

Interest in calls-in-advance A/c.. Dr.

To shareholder A/c

(Being interest due on calls-in-advance@....%p.a.)

(b) For payment of interest.

Shareholders A/c. Dr.

To bank A/c.

(Being interested on calls-in-advance paid)

(c) For transferring interest on calls-in-advance to the profit and loss account.

Profit and Loss A/c. Dr.

To Interest on Calls-in-Advance A/c.

(Being interest on calls-in-advance transferred to profit and loss account)

3. Forfeiture of shares

FORFEITURE OF SHARES :

Forfeiture means cancellation of share capital and membership of the shareholder of a company due to non-payment of premium or dues on allotment and/or calls. If some of the shareholders fail to pay their dues on the allotment and/or calls, the Board of Directors may forfeit such shares according to the provisions of the Articles of Association by passing a resolution to that effect.

Causes of Forfeiture: The shares may be forfeited due to :

(i) Non-payment of the allotment money.

(ii) Non-payment of the call money.

(iii) Non-payment of premium in case of issue of shares at a premium.

(iv) Non-payment of any other amount due from the shareholder.

Effects of forfeiture: When the shares are forfeited, it results in the following :

(i) The holder of the shares ceases to be a member/shareholder of the company.

(ii) The amount paid to date is not refunded to the shareholder. It becomes the property of the company.

(iii) The share capital account is canceled to the extent called up to date.

(iv) The amount so forfeited is kept in a separate account called “Forfeited Share.

Account”. This account is added to the share capital account in the Balance Sheet.

(v) The share premium account is debited to the extent unpaid in case forfeited shares were issued at a premium.

(vi) The discount, if any, allowed at the time of issue is also canceled to the extent of shares forfeited by crediting to Discount on Issue of Shares A/c.

JOURNAL ENTRIES

(a) If the unpaid amount has not been transferred to the calls-in-arrear account.

Share Capital A/c Dr.

(i.e. No of shares forfeited × called up value per share)

Share Premium A/c Dr.

(Unpaid premium on forfeited shares)

To Share allotment A/c. (Unpaid amount on allotment)

To Share First Call A/c. (Unpaid amount on 1st call)

To Share Final Call A/c. (Unpaid amount on final call)

To Discount on Issue of Shares A/c.

(Discount originally allowed on the issue of shares)

To Forfeited Shares A/c. (Amount received)

(Being the forfeiture of......Shares for non-payment of allotment/calls/premium as per Director’s Resolution No......dated......)

(b) If the unpaid amount has been transferred to the calls-in-arrear account.

Share Capital A/c. Dr.

(No. of shares forfeited × called-up value per share)

Share Premium A/c. Dr.

(Unpaid premium, if any)

To Call-in-Arrear A/c. (Total amount unpaid)

To Discount on Issue of Shares A/c. (Discount allowed if any)

To Forfeited Shares A/c. (Amount received)

(Being forfeiture of.....shares for non-payment of dues as per Director’s Resolution No.... date......)

RE-ISSUE OF FORFEITED SHARES :

As we know that on forfeiture, the share capital is canceled and the defaulter ceases to be a member/shareholder of the company. It means such forfeited shares can be offered to a new shareholder at a new price. It is called the re-issue of forfeited shares.

The company can re-issue these forfeited shares at any price, i.e. at par, at a premium, or at a discount. But they are usually offered at a discount.

If forfeited shares are re-issued at a discount, then the company has to fulfill a condition. The condition is that the discount allowed at the time of re-issue cannot exceed the forfeited amount. In other words, the discount on re-issue must be less than the amount forfeited.

In case a part of the total shares forfeited is re-issued, then this condition must be satisfied for that part of shares re-issued.

For example, A company forfeited 300 shares of Rs.10 each, Rs.7 called up and the forfeited amount was Rs.600 (i.e. Rs.2 per share). It means the company can re-issue these shares at a maximum discount of Rs.2 per share i.e. at Rs.5 per share. The discount allowed on the re-issue of these shares cannot be more than Rs.600. If the company re-issued a part, say 100 shares, at a discount, then the discount on re-issue cannot be more than Rs.200 (i.e. 1/3 of Rs.600).

PROFIT ON RE-ISSUE:

If the discount on the re-issue of forfeited shares is less than the amount forfeited, then there is a profit. This profit is in the nature of capital profit. Hence, it is transferred to the “Capital Reserve Account”. The Capital Reserve Account is shown under the head“Reserves and Surplus” on the Liabilities side of the Balance Sheet.

For example: If 300 shares were re-issued at a discount of Rs.1.50 per share. The share forfeited account shows a balance of Rs.600. Then the capital profit of Rs.150 [i.e. Rs.600 – (300 shares × Rs.1.50)] is to be transferred to Capital Reserve Account.

The entry will be :

Forfeited shares A/c. Dr.

To Capital Reserve A/c.

(Being the profit on re-issue transferred to capital reserve)

So we have the following four alternatives for the re-issue of forfeited shares.

JOURNAL :

1. On Re-issue :

(a) If forfeited shares were re-issued at par.

Bank A/c. Dr.

To share capital A/c.

(Being the re-issue of....shares @Rs....each as per Director’s Resolution No.....dated.....)

(b) If forfeited shares are re-issued at a premium.

Bank A/c. Dr. .......)

To Share Capital A/c.

To Share Premium A/c.

(Being the re-issue of.......shares @ Rs......each as per Director’s Resolution No.....dated

(c) If forfeited shares are re-issued at a discount.

Bank A/c. Dr. (Actual amount received)

Forfeited Shares A/c. Dr. (Discount on re-issue)

To Share Capital A/c.

(Being the re-issue of.....shares @ Rs....... each as per Director’s Resolution No.......dated)

(d) If shares originally issued at a discount are re-issued at a discount also :

Bank A/c. Dr.

Discount on Issue of Shares A/c. Dr. (Original Discount)

Forfeited Shares A/c. Dr. (Discount on re-issue)

To Share Capital A/c.

(Being the re-issue of......shares of Rs.........each @Rs......each as per Director’s Resolution No.....dated......)

Note: Where a part of the forfeited shares are re-issued, the capital profit to be transferred to capital reserve may be calculated as Capital Reserve = (Forfeited amount per share – Discount on re-issue per share) × No. of shares re-issued.

FORFEITURE AND RE-ISSUE IN CASE OF PRO-RATA ALLOTMENT :

In such a case, it is essential to know the amount paid and not paid for recording the forfeiture of shares. In the case of categorized allotment and pro-rata allotment, it is, therefore, necessary to determine the number of shares applied by the defaulting shareholder on the basis of which the amount paid and not paid can be calculated. It means the excess amount adjusted at a particular stage of the issue can help to determine the net amount not paid at that stage.

D. ISSUE OF SHARES FOR CONSIDERATION OTHER THAN CASH :

Sometimes, a company can issue shares to buy various assets such as land, building, machinery etc. needed at the time of formation.

Sometimes, it may be necessary to issue shares to the promoters, lawyers, etc. for their services rendered in the formation of the company.

The consideration for such shares is not cash but it is other than cash i.e. assets or services. When such shares are issued, those are shown separately under the head “Issued Capital” on the liabilities side of the Balance Sheet with prior information to the Registrar of Companies.

(a) Where the shares are issued for the purchase of Assets

Assets A/c. Dr.

To Share Capital A/c.

(Being an issue of.....shares @Rs......each in exchange of assets purchased as per Director’s Resolution No......dated......)

(b) Where the Shares are issued to promoters

Goodwill A/c.

To share Capital A/c.

(Being an issue of......shares of Rs.......each to promoters as per agreement as per Director Resolution No.....dated.......)

SUMMARY OF JOURNAL ENTRIES

1. For application money received

Bank A/c. Dr.

To Share Application A/c.

2. For the transfer of application money

Share Application A/c. Dr.

To Share Capital A/c.

To Share Allotment A/c.

To Calls-in-advance A/c.

To Bank A/c.

3. For allotment money due

Share Allotment A/c. Dr.

Discount on Issue of Shares A/c. Dr.

To Share Capital A/c.

To Share Premium A/c.

4. For allotment money received

Bank A/c. Dr.

To Share Allotment A/c.

5. For call money due

Share Call A/c. Dr.

To Share Capital A/c.

6. For adjustment of calls-in-advance

Calls-in-advance A/c. Dr.

To Share Call A/c.

7. For call money received

Bank A/c. Dr.

To Share Call A/c.

8. For the amount not received on allotment and calls

Calls-in-arrear A/c. Dr

To Share Allotment A/c.

To Share Call A/c.

9. For the Calls-in-arrear received

Bank A/c. Dr.

To Calls-in-Arrear A/c.

10. For interest received on Calls-in arrear

Bank A/c. Dr.

To Interest on Calls-in-arrear A/c.

11. For Interest paid on Calls-in-Advance

Interest on Calls-in-Advance A/c. Dr.

To Bank A/c

12. For the shares forfeited

Share capital A/c. Dr.

Share Premium A/c. Dr.

To Share Allotment A/c.

To Share Call A/c.

To Discount on Issue of Shares A/c

To Forfeited Shares A/c.

13. For the re-issue of forfeited shares

Bank A/c. Dr.

Discount on Issue of Shares A/c. Dr.

Forfeited Shares A/c. Dr.

To Share Capital A/c.

To Share Premium A/c.

PREPARATION OF CASHBOOK :

In case of issue share for cash, all transactions are made through the bank. Hence, a cash book will be prepared taking bank columns only. It is debited with cash received at various stages of the issue and credited with the payment of cash in case of a refund. It is balanced to find out the net cash received from the issue of shares which is shown on the asset side of the Balance Sheet.

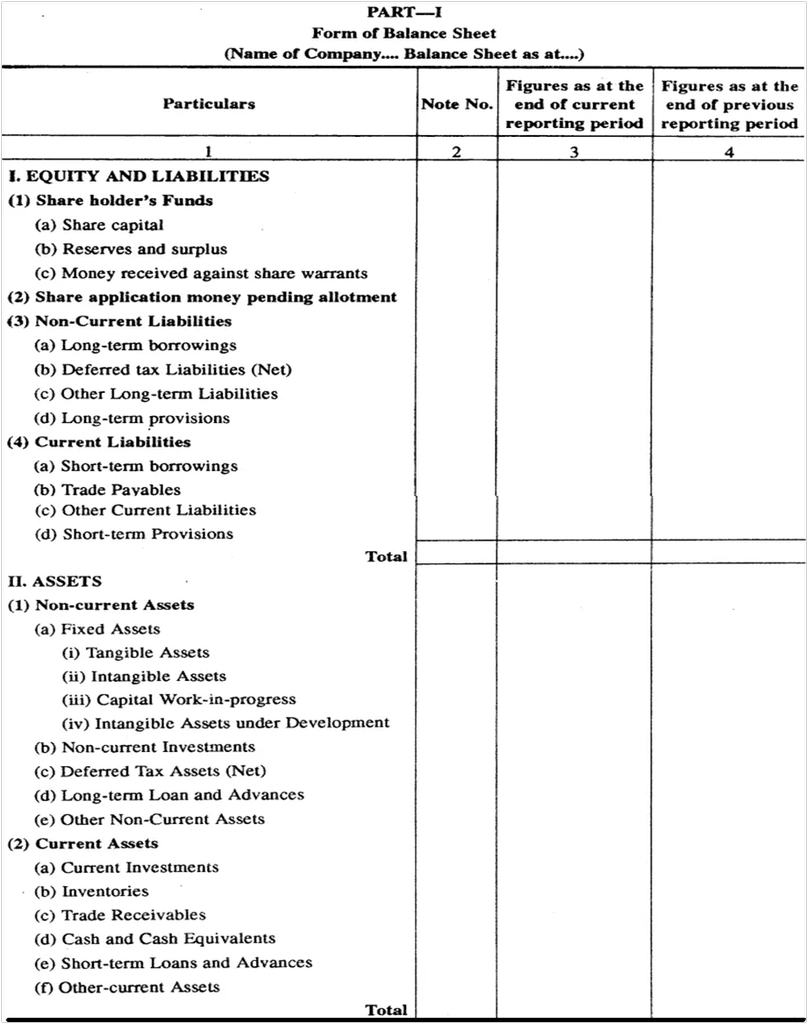

PRESENTATION IN THE BALANCE SHEET :

While preparing the Balance Sheet, the various components of the capital such as authorized capital, issued capital, subscribed capital, etc. are shown on the liabilities side of the Balance sheet under the head ‘share capital’ describing the number of shares and their amounts under each category. The balance of the share capital account in the ledger is put under the head “paid-up share capital” after deducting the amount of calls-in-arrear from subscribed capital. The amount of bank balance (in cash book) is shown under the head “current asset” on the asset side of the Balance Sheet. The calls-in-advance are shown under current liabilities till they are adjusted.

SUDIP CHAKRABORTY

SUDIP CHAKRABORTY